The New Frontier: Greening Middle East Chemicals

The Middle East’s petrochemical giants are racing to decarbonize in step with global climate goals. Gulf states have announced net-zero targets (Saudi Arabia by 2060, UAE by 2050) and are expanding renewables and nuclear power. To meet these ambitions and comply with new export rules (e.g. the EU’s Carbon Border Adjustment Mechanism on carbon-intensive imports), the region’s chemical industry is embracing three major trends: green chemical production, carbon capture and utilization (CCUS), and sustainability finance. Taken together, these trends reshape strategy and investment. For example, S&P notes that 67 low-carbon hydrogen and ammonia projects (9 million tonnes/year capacity) are under development in the Middle East, powered by cheap solar and wind. These projects align the region with the decarbonization of fertilizer, shipping fuel and power markets. At the same time, Gulf producers are deploying CCUS to cut emissions in petrochemicals, and are tapping green bonds to finance the transition.

Green Chemical Production: Exporting Decarbonized Feedstocks

Abu Dhabi’s TA’ZIZ consortium (ADNOC/ADQ) is building the UAE’s first large-scale green methanol/ammonia complex at Al Ruwais. This $1.7 billion plant (EPC awarded to Samsung) will produce 1.8 Mt/year of methanol (plus low-carbon ammonia, PVC and other chemicals) using electricity from clean sources. It exemplifies the region’s pivot toward renewables-powered chemical manufacturing. Other headline projects include:

-

Saudi Arabia (Neom and Yanbu): The 2.2-GW Neom Green Hydrogen project (a joint NEOM/ACWA/Air Products venture) is set to start producing 240 kt/year of renewable hydrogen by 2026 and ~1.2 Mt/year of green ammonia (from water electrolysis). A new Yanbu Green Hydrogen Hub (led by ACWA Power and in partnership with Germany’s EnBW) is under development, targeting over 4 GW of electrolyzers yielding 400 kt H₂/year (2.2 Mt ammonia). Both plants include captive solar/wind power and export terminals for ammonia.

-

Oman (Dhofar/Salalah): In Dhofar, a 2.5 GW electrolyzer cluster (4.5 GW renewables) will generate ~178 kt H₂/year, fed via pipeline to a Salalah Free Zone ammonia plant targeting 1.0 Mt/year of green ammonia by 2030. This project (led by EDF Renewables, J-Power and others) was a winner of Oman’s hydrogen tender.

-

Other initiatives: Abu Dhabi’s Masdar is in early discussions on green hydrogen/ammonia exports, and Egypt (Fertiglobe) is expanding renewable ammonia at Ain Sokhna. Regional consortiums (e.g. InterContinental Energy in Oman) are carving out additional export corridors.

These megaprojects position the Gulf as a low-cost supplier of sustainable chemicals. S&P Commodity Insights reports that Middle Eastern projects have among the world’s lowest renewable hydrogen costs (with long-term forecasts as low as $1.50-$2.50/kg H₂ vs initial estimates closer to $8/kg in Japan/EU). Export markets are emerging: for instance, Germany’s H2Global tender awarded 397 kt of blue/green ammonia to Fertiglobe (Egypt) at roughly €1,000/ton for delivery by 2033, and Japan and Korea are seeking long-term clean hydrogen supplies. Major fertilizer and fuel users (like Yara and shipping lines) are lining up offtake agreements with Gulf projects.

-

Strategic implications: By leveraging desert solar and wind, Middle Eastern producers can export “green” feedstocks while burning domestic gas at home. This diversifies economies and creates a new export commodity (green hydrogen derivatives). It also aligns the fertilizer and methanol industries with global decarbonization: clean ammonia can replace conventional ammonia for fertilizer and as a shipping fuel.

-

Investment landscape: Most projects are joint ventures between Gulf NOCs and foreign partners (e.g. Air Products, Yara, Scatec). They require massive capital — NEOM alone secured $8.4 billion of financing in Q1 2023. Equity and export credit agencies are engaged, and some facilities (e.g. Oman’s ACME project) have already closed debt funding.

-

Opportunities: Middle Eastern producers may undercut higher-cost green hydrogen projects in the US or Australia. There is a first-mover advantage in building scale and securing offtake contracts in Europe and Asia (e.g. COP29’s Hydrogen Declaration and new subsidies).

-

Challenges: Without new demand, ammonia output could flood the market. Analysts warn that an extra ~4.6 Mt/year of ammonia (including green/blue) is set to come on line by 2026. “Unless substantial demand for new low-carbon uses (e.g. marine fuels or power) materialises in the next 4–5 years,” industry players fear a price crash. Green hydrogen projects also face execution risk: prolonged lead times, grid integration of renewables, and competition from blue (CCS-based) ammonia.

Despite the risks, the green chemicals trend is clear: Gulf producers are rewriting the fertilizer and fuel-export playbook to align with net-zero. The chart of global hydrogen megaprojects now lists the Middle East at the top, and commodity buyers are taking notice.

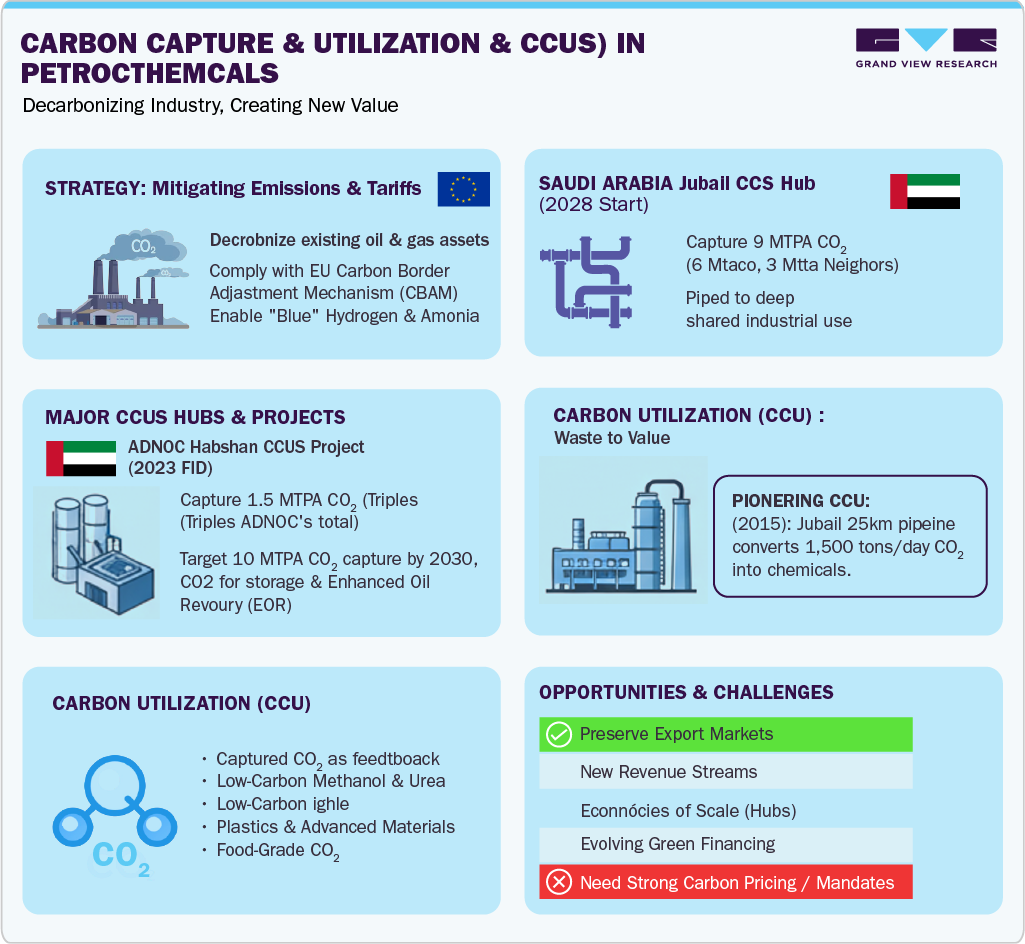

Carbon Capture and Utilization (CCUS) in Petrochemicals

To decarbonize existing oil-and-gas complexes and avoid import penalties, Middle Eastern chemical producers are rapidly scaling up CCUS. As Clean Air Task Force (CATF) observes, “Carbon capture and storage (CCS) must play a key role in reaching [net-zero] climate targets,” especially to cut hard-to-abate emissions from petrochemicals. The EU’s Carbon Border Adjustment Mechanism further incentivizes Gulf exporters to reduce embedded carbon. Gulf NOCs have responded with major CCUS projects and strategic partnerships:

-

Saudi Arabia (Jubail CCS Hub): Aramco is co-developing one of the world’s largest CCS hubs in Jubail, Eastern Province. Starting in 2028, the facility will capture up to 9 MtCO₂/year (6 Mt from Aramco alone, 3 Mt from neighboring plants). The concept is to pipe captured CO₂ from gas processing and petchem units to deep saline aquifers. This hub is designed to be expandable and shared among petrochemical, refining and power plants.

-

UAE (Abu Dhabi – Habshan): ADNOC’s flagship Habshan CCUS project (final investment decision in 2023) will capture 1.5 MtCO₂/year from gas processing. This triples ADNOC’s capture capacity and is part of a $15 billion low-carbon investment plan. In parallel, ADNOC aims to reach 10 MtCO₂/yr of capture by 2030 through additional plants. Captured CO₂ at Habshan is planned for deep storage and enhanced oil recovery, and can also feed low-carbon hydrogen production. Abu Dhabi’s Al Reyadah (800 kt/yr) was an early pilot for using steel plant CO₂ for EOR.

-

Saudi Aramco & SABIC (Jubail pipeline): Starting 2015, Saudi Aramco and SABIC built a 25 km CO₂ pipeline in Jubail. It captures 1,500 t/day of CO₂ from an ethylene glycol plant and delivers it to adjacent methanol, urea and polycarbonate facilities. This project, touted as the world’s largest CCU effort, converts “waste” CO₂ into chemical feedstocks (including food-grade CO₂). In doing so, Sabic provides low-carbon methanol and urea, reducing the carbon footprint of its outputs.

-

Emerging CCU partnerships: Gulf companies are also exploring novel uses of CO₂. For example, Oman’s OQ (Fertiglobe) and petroleum firms are studying mineralization and concrete markets. Aramco has R&D centers for carbon-to-plastic technologies. International alliances are forming: Aramco‑Linde‑SLB in Jubail, or ADNOC with Occidental for DAC and advanced CCUS.

The result is a CCUS ecosystem that underpins low-carbon hydrogen and petrochemicals. The captured carbon not only reduces emissions but also helps meet global demand for cleaner fuels. For example, Masdar has built a partnership with Germany’s BASF to convert CO₂ into methanol and SAF in the UAE. These “carbon-to-products” schemes turn a waste stream into value.

Opportunities: By integrating CCUS, Gulf petchem producers preserve export markets and comply with future EU and U.S. carbon rules. Captured CO₂ becomes an asset (e.g. for urea or methanol feedstock) instead of a liability. Large-scale hubs achieve economies of scale and attract international financing. Going first also gives Gulf players leverage to sell blue ammonia to Asia (e.g. ADNOC’s recent certified blue ammonia cargo to Japan).

Challenges: CCUS is capital-intensive and technologically complex. Injecting millions of tonnes of CO₂ requires careful reservoir management. Regulatory frameworks (e.g. CO₂ transport laws) are still evolving. And critically, additional revenues must justify the investment. Without strong carbon prices or mandates, companies risk underutilized capture capacity. Still, the prevailing view is that CCUS is indispensable for petrochemicals’ future: SABIC and Aramco cite climate targets and customer demand for low-carbon products as drivers of their CCUS plans.

Sustainability Finance: Funding the Transition

Decarbonizing chemicals requires vast investment, and financing follows opportunity. Gulf states have been tapping the green bond market aggressively. According to S&P, Middle East sustainable bond issuance (green, social, sukuk) quadrupled in 9M 2023 versus a year earlier (to $19.4 billion), albeit from a low base. Saudi Arabia and the UAE together accounted for ~83% of that. In absolute terms, this volume still represents <1% of regional GDP, but the trend is clear. Notably, about 86% of these new bonds are “pure green” issues (financing renewable energy, green transport, etc.), reflecting the region’s emphasis on climate mitigation projects.

Chemical and energy groups are now looking to these markets. chemical companies issued approximately $4.4 billion of climate-aligned debt in early 2023 (81% green). For example, U.S.-listed LyondellBasell raised $500 million of green bonds (2019) to fund renewable energy and circular-economy projects. Industry experts believe Middle East peers could do likewise. Masdar (Abu Dhabi’s renewables champion) already pioneered this in 2023 with a $750 million green bond (10-year) to expand solar/wind capacity. Other state-linked entities – from NEOM to ADNOC subsidiaries – are establishing green financing frameworks.

Key factors shaping this finance boom include:

-

Government leadership: UAE and Saudi net-zero commitments and renewable targets create large pipeline projects. Sovereign bonds (often via PIF or ADIA) have shouldered much issuance so far, but private GREs and corporates (banks, utilities, developers) are increasingly entering the market.

-

Investor demand: Global demand for ESG assets is strong. Green bonds tend to attract a broader investor base, often with slightly lower yields. In this year’s Gulf issuances, green tranches were easily absorbed even as conventional issues were more constrained.

-

Project focus: Use-of-proceeds trends show heavy emphasis on renewables and hydrogen. S&P notes recent Middle East green bonds funded solar PV farms (e.g. Ar Rass in KSA) and planned hydrogen trains (Neom). We expect future bonds to finance green ammonia plants, blue hydrogen (with CCUS), and retrofits of refineries and crackers.

A bullet summary of recent developments:

-

Middle East green/sustainability bonds hit $19.4 B in 9M 2023 (4× prior year), still only ~0.1% of GDP.

-

Saudi & UAE dominate issuance: 43% and 40% of 2023 volume. In KSA, most issues were sovereign (via PIF); in UAE, GREs and corporates led (e.g. Masdar, FAB, TAQA).

-

Green share: ~86% of regional sustainable issues were green, well above the global average.

-

Biggest deals: Masdar’s $750m (2023) was followed by banks (FAB, ADIB) and export-finance entities. Even DP World issued a $100m “blue” bond for port projects.

-

Future chemical issuers: SABIC, Borouge or ADNOC’s chemical units are expected to tap the market. Credit agencies highlight that “hard-to-abate” sectors (chemicals, oil & gas, metals) will need more green financing if they are to meet net-zero goals.

-

Headwinds: High oil prices and rising interest rates can slow the green transition. S&P cautions that Gulf issuers may prioritize brown expansions if oil revenues jump. Also, clear taxonomy rules (“what counts as green”) will be needed to sustain investor confidence.

In summary, the Middle East chemical industry is pivoting rapidly toward a low-carbon future. Massive green ammonia and methanol plants are under construction to monetize cheap solar/wind power in export markets. CCUS projects are proliferating to shield legacy petrochemical exports from carbon tariffs and to enable new “blue” products. And financial markets are gearing up to fund this transformation, from green bond frameworks to sustainability-linked debt. The strategy is bold: by exporting decarbonized commodities and technologies, Gulf producers aim to reinforce their global market share and revenue base even as the world phases out fossil emissions. Yet success will depend on market growth (in shipping fuels, clean power, and agriculture), on technology execution, and on attracting sufficient capital. If all goes as planned, the Middle East could become a textbook example of an oil economy redirecting its petrochemical expertise and capital into the next generation of energy products.