Transforming Regional Trade: The Middle East’s Path to Sustainable Logistics Leadership

For decades, the Middle East’s role in global trade was defined by what it produced such as oil, gas, and energy wealth. Today, that definition is shifting toward how it moves. From digital customs corridors to solar-powered warehouses, the region is quietly re-engineering the pathways of global commerce. The new competitive frontier isn’t about volume moved but efficiency, sustainability, and resilience and the Middle East is positioning itself to lead on all three.

From Energy Exports to Smart Trade Ecosystems

What ports like Jebel Ali, Khalifa, and Dammam represent today is more than throughput. They represent a regional transformation from energy exporter to smart trade orchestrator. With Vision 2030 in Saudi Arabia and the UAE’s “We the UAE 2031” blueprint, logistics has become a central pillar of diversification.

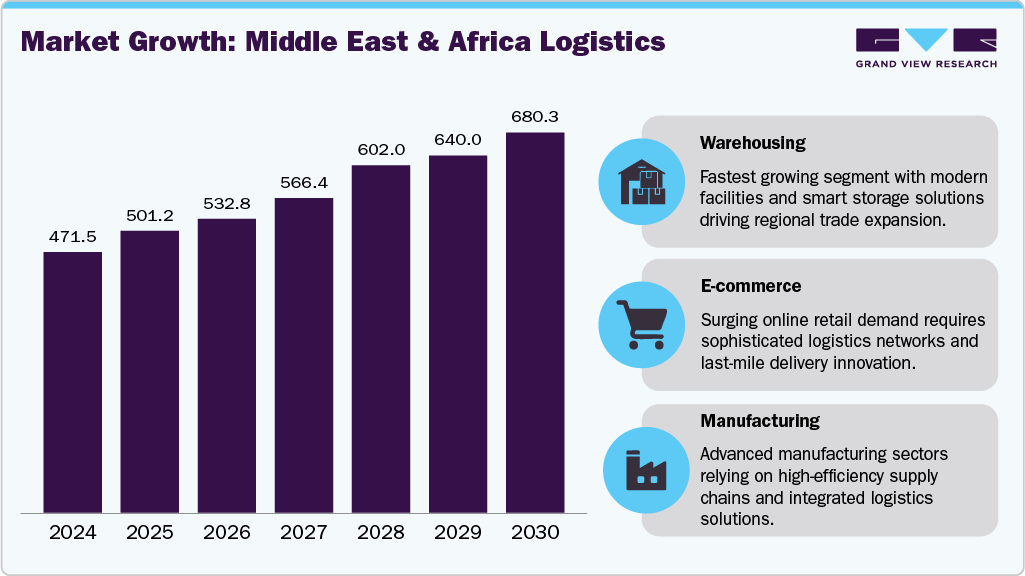

According to Grand View Research, the Middle East & Africa logistics market is projected to reach USD 680.3 billion by 2030, growing at a 6.8% CAGR. That growth is driven not only by traditional trade but by surging e-commerce, food security initiatives, and advanced manufacturing sectors that depend on logistics speed and sustainability in equal measure.

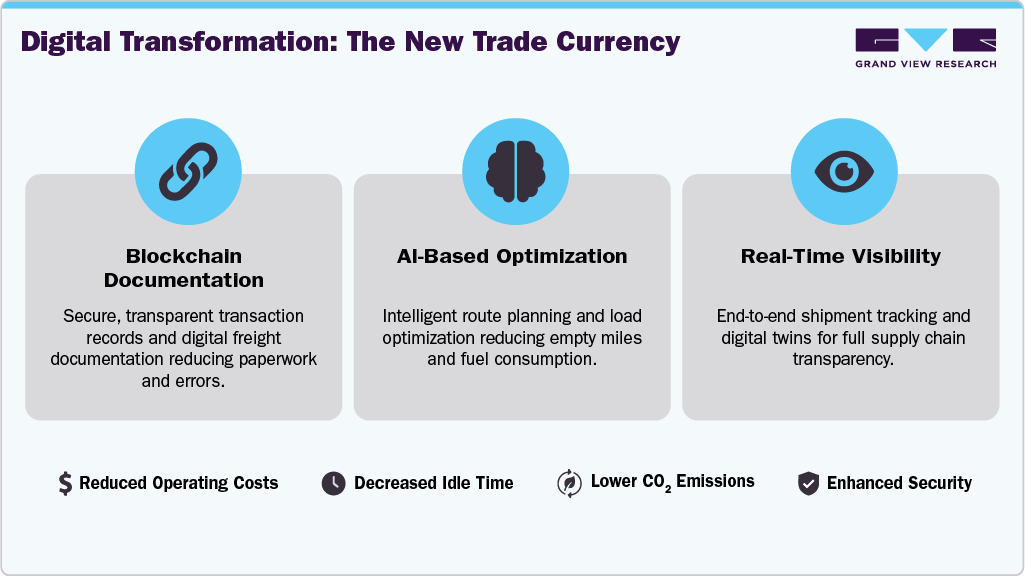

Digitalization: The New Trade Currency

Every shipment now carries a digital twin. Blockchain documentation, real-time visibility dashboards, and AI-based route optimization are becoming baseline expectations. The digital logistics market in the MEA region valued at USD 1.41 billion in 2024 and forecast to expand nearly 19% annually reflects a growing belief that bytes, not barrels, will power trade efficiency (Grand View Research).

This digitization wave is not just about cutting costs. By reducing empty miles, optimizing load factors, and slashing idle time at ports, digital systems directly reduce CO₂ intensity across supply chains turning operational efficiency into measurable climate impact.

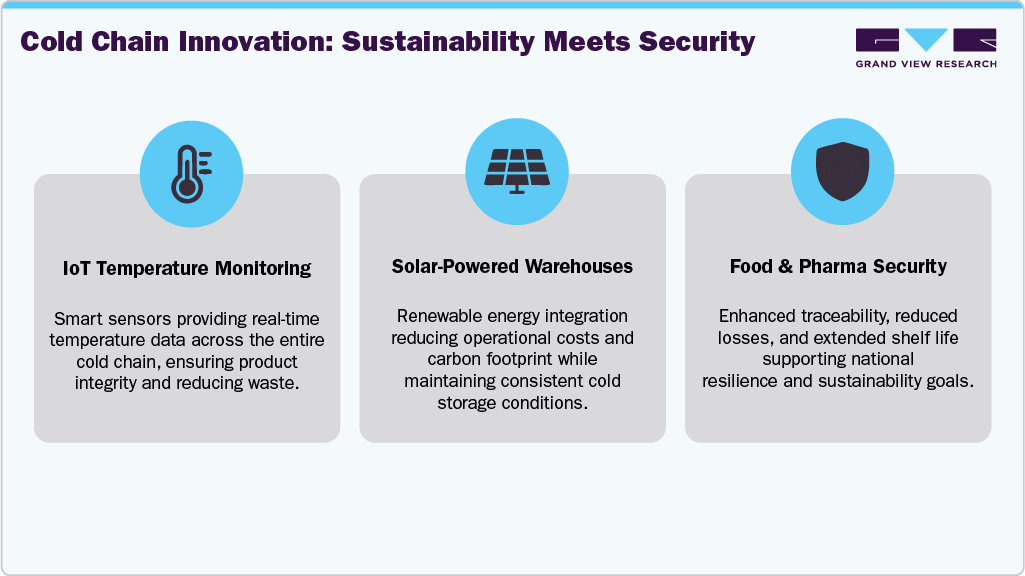

Cold Chain: Sustainability Meets Security

Food and pharma supply chains are becoming the litmus test for logistics modernization. Rising temperatures and growing imports of perishables have forced the region to invest in MEA cold-chain market which is projected at USD 35.9 billion (2024) and growing rapidly through the decade (Grand View Research).

Cold chain isn’t just about keeping lettuce crisp or vaccines viable. It’s about national resilience. A modern cold-chain grid means fewer losses, better traceability, and lower energy consumption through smart refrigeration and renewables integration. The Gulf’s adoption of solar-cooled warehouses and IoT-enabled temperature monitoring is now setting benchmarks for sustainable food security.

The Last-Mile Revolution

If ports are the lungs of trade, last-mile delivery is its heartbeat. In a region where urban populations are soaring and e-commerce carts never sleep, sustainability will hinge on rethinking the final leg of logistics.

The MEA last-mile delivery market, worth USD 15.6 billion in 2023, is transforming through micro-fulfillment centers, route-sharing platforms, and electrified fleets (Grand View Research). The UAE and Saudi Arabia are experimenting with cargo bikes, autonomous vans, and green-delivery incentives. These aren’t pilot projects; they’re blueprints for low-carbon urban logistics at scale.

Infrastructure + Incentives: Building the Green Spine

Hardware and policy are moving in tandem. Across the GCC, free zones and logistics cities are embedding sustainability requirements into land-use and operator licenses. Hydrogen-powered trucking corridors are on the table. Dubai’s Green Logistics Strategy aims to cut logistics emissions by 30% by 2030 through electrification and smart routing.

Governments are also wielding policy as a market signal. Tax breaks for electric fleets, carbon-credit frameworks for warehouse retrofits, and ESG-linked port financing are creating an ecosystem where green choices become financially rational ones.

Financing the Transition

Sustainability in logistics doesn’t come cheap but it pays in resilience. Public-private partnerships and blended-finance vehicles are now de-risking investment in low-carbon assets. Sovereign wealth funds across the Gulf are pivoting toward logistics decarbonization as part of broader green-investment mandates.

At the corporate level, shippers and 3PLs are turning to green bonds and sustainability-linked loans to fund EV fleets and energy-efficient infrastructure. As banks and investors begin pricing carbon exposure into credit decisions, sustainability will soon influence not just how cargo moves, but who gets funded to move it.

The Data Imperative

Behind every warehouse upgrade and fleet electrification lies one shared dependency data interoperability. Without it, carbon accounting, customs clearance, and multimodal synchronization break down.

Regional collaboration initiatives like the Digital Freight Alliance and Arab Digital Economy Vision are steps toward seamless trade corridors, where electronic bills of lading, automated customs, and emissions tracking move together. The region’s competitive edge will depend on how quickly it can unify those standards across borders.

Leadership Through Sustainability

The world’s trade hubs from Rotterdam to Singapore are watching the Middle East’s next move closely. The region’s unique position at the intersection of Asia, Africa, and Europe gives it a rare opportunity: to prove that growth and sustainability can coexist at scale.

Sustainability, once a checkbox, is fast becoming the currency of trust in trade. Multinationals selecting logistics partners in the Gulf are weighing carbon transparency alongside cost and speed. The players that lead on sustainability will own the narrative and the contracts of the next decade.

What Forward-Looking Leaders Should Be Doing Now

-

Digitize at the core. Make real-time visibility and carbon measurement part of every logistics contract.

-

Green the last mile. Shift urban fleets toward electric, hybrid, and shared-route models.

-

Invest in resilience. Build cold-chain redundancy and renewable-powered warehousing.

-

Align finance and sustainability. Leverage ESG capital to lower logistics borrowing costs.

- Collaborate regionally. Push for interoperable data and unified emissions reporting standards.

The Bottom Line: Trade Leadership Through Sustainability

The Middle East’s logistics transformation isn’t just about moving goods faster it’s about moving them smarter and cleaner. What began as a diversification agenda is evolving into a global case study in sustainable trade leadership.

The region that once powered the world with hydrocarbons is now teaching it how to move goods with hydrogen, electrons, and data. The world’s trade future may still pass through the Gulf but this time, it will do so with a smaller carbon footprint and a larger purpose.