- Home

- »

- Animal Health

- »

-

Aquaculture Vaccines Market Size, Industry Report, 2033GVR Report cover

![Aquaculture Vaccines Market Size, Share & Trends Report]()

Aquaculture Vaccines Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Attenuated Live Vaccines, Inactivated Vaccines), By Route Of Administration, By Application, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-544-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Aquaculture Vaccines Market Summary

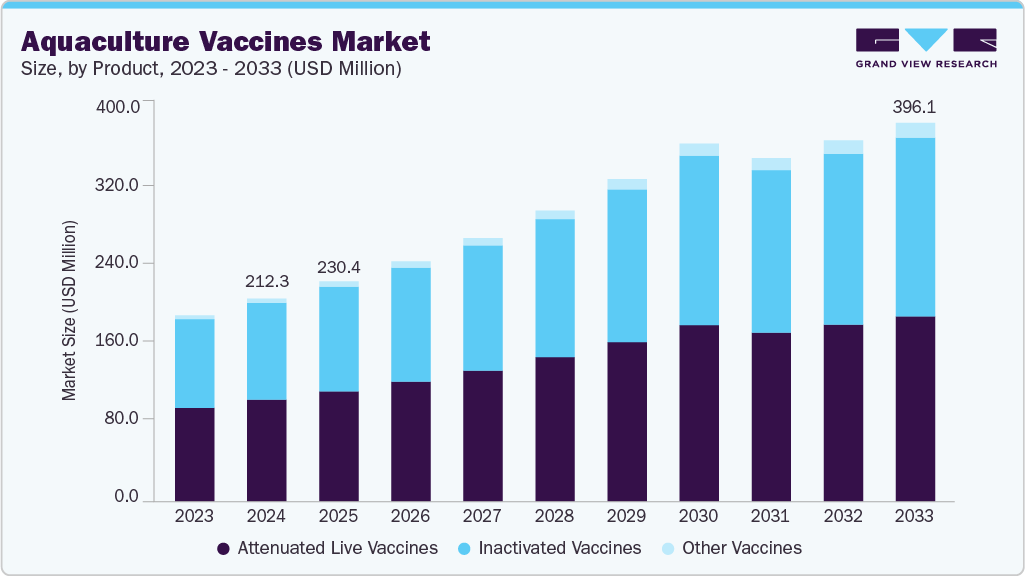

The global aquaculture vaccines market size was estimated at USD 212.3 million in 2024 and is projected to reach USD 396.1 million by 2033, growing at a CAGR of 7.01% from 2025 to 2033. The market is experiencing significant growth, driven by rising disease incidence in aquaculture, increasing government support and regulatory initiatives, as well as advancements in vaccine development technology.

Key Market Trends & Insights

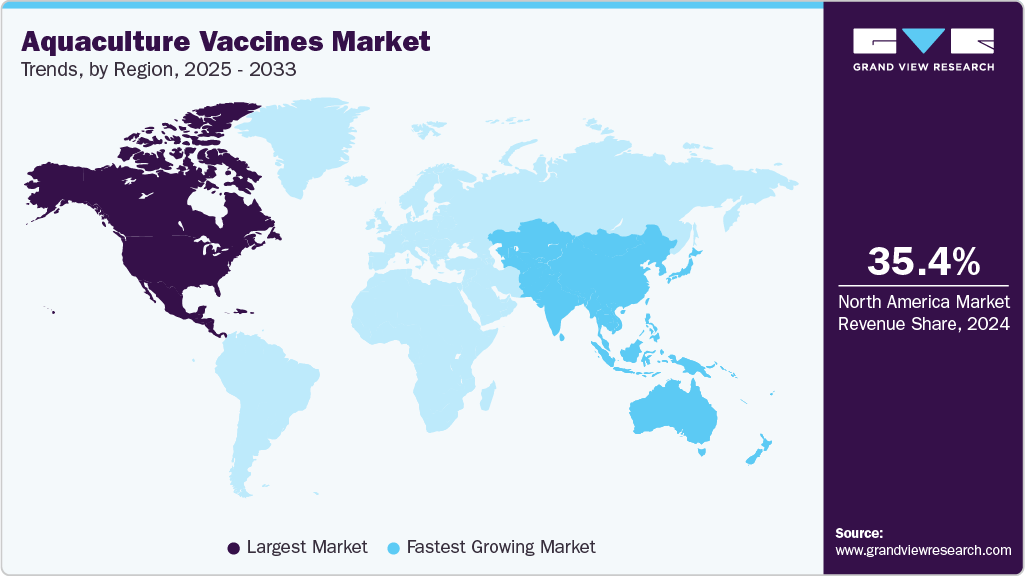

- North America dominated the global aquaculture vaccines market with the largest revenue share of 35.42% in 2024.

- The aquaculture vaccines market in the U.S. accounted for the largest market revenue share in North America in 2024.

- By product, the attenuated live vaccines segment led the market with the largest revenue share of 50.13% in 2024.

- By route of administration, the injected segment accounted for the largest market revenue share in 2024.

- Based on application, the bacterial segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 212.3 Million

- 2033 Projected Market Size: USD 396.1 Million

- CAGR (2025-2033): 7.01%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing in the market

Rising disease incidences in aquaculture are boosting market growth. According to a study published in October 2025, in countries such as China, India, and Vietnam, disease outbreaks are responsible for over 30% of total aquaculture production losses. In addition, about 50% of global aquaculture losses are caused by disease, with a greater impact observed in developing nations. The increasing adoption of aquaculture practices, high-density fish farming, and global trade have led to increased exposure to pathogens and outbreaks of viral, bacterial, and parasitic infections.A rise in fish mortality rates results in significant economic losses for producers. Thus, farmers rely on vaccines to prevent disease, ensure consistent production, and reduce dependency on antibiotics. The growing recognition of vaccination as a cost-effective preventive measure is driving the global adoption of aquaculture vaccines. Vaccines play a crucial role in mitigating losses and enhancing yield, improving fish health, welfare, and profitability, making them essential tools in sustainable aquaculture operations across multiple species and regions.

In addition, governments and regulatory authorities all around the globe are implementing policies promoting sustainable aquaculture and stricter biosecurity measures to curb antibiotic usage and disease outbreaks. Moreover, incentives, funding programs, and streamlined approvals encourage the development and adoption of fish vaccines.

For instance, in February 2024, the Government of Canada invested over USD 3.5 million in 18 clean technology projects to help fisheries and aquaculture reduce their environmental impact, enhance sustainability, and strengthen the sector’s long-term competitiveness. In addition, according to the October 2025 report, India’s Marine & Aquaculture Biotechnology (MAB) program utilizes aquatic resources to enhance sustainability and health by developing fish vaccines and discovering marine bioactive compounds for novel therapeutics.

Moreover, regulatory frameworks, such as USDA approvals in the U.S., EU GMP certifications, and India’s draft fish vaccine guidelines, assure quality, safety, and market acceptance. Producers are motivated to integrate vaccines into health management protocols, reducing disease-related risks. This proactive regulatory support fosters innovation, encourages private sector investment, and accelerates market growth by making vaccines more accessible and standardized across global aquaculture operations.

Furthermore, innovations in biotechnology, such as recombinant DNA, yeast expression platforms, and multivalent vaccines, allow the production of highly effective, species-specific vaccines with minimal environmental impact. The fish mortality is reduced, preventing disease spread and ensuring higher production yields by improving vaccine efficacy. In addition, technological advancements also facilitate oral or immersion administration, simplifying mass vaccination in large-scale operations.

For instance, in July 2024, UVAXX developed the first epitope-based vaccine protecting barramundi from Scale Drop Disease Virus, introducing advanced immunotechnology to combat severe aquaculture losses in Southeast Asia. As technology evolves, the aquaculture vaccine industry experiences rapid product diversification, expanded applications, and wider adoption.

Challenges And Limitations In Fish Vaccine Development

Vaccine Type / Factor

Challenges / Limitations

Impact / Notes

Oral Vaccines

Oral tolerance due to the route of entry; suppression of humoral and cellular immune responses.

Limits effectiveness; the mechanism in fish is poorly understood compared to mammals.

Mucosal Vaccines

Lack of immunostimulants in non-replicating vaccines; prolonged exposure risk; difficulty in dosing via bath administration.

Vaccine performance can be suboptimal; functional testing of mucosal T cells is challenging.

Bath / Immersion Vaccines

Denaturation of antigens crossing barriers; variability in results; difficulty measuring improvement.

Reduces reliability; requires more research for standardized protocols.

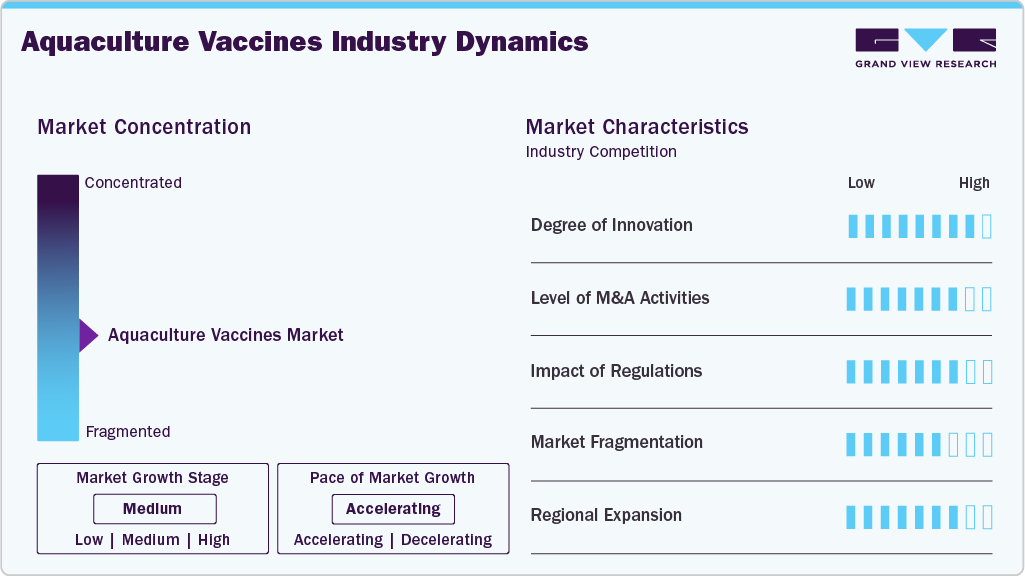

Market Concentration & Characteristics

The aquaculture vaccine industry is moderately concentrated, dominated by key global players, including Zoetis, Merck Animal Health, PHARMAQ (a subsidiary of Zoetis), Virbac, and HIPRA. These companies leverage strong R&D capabilities, global distribution networks, and partnerships with aquaculture institutes, while regional players focus on autogenous and species-specific vaccines to meet local disease challenges.

The aquaculture vaccine industry demonstrates a high degree of innovation, with advancements in recombinant, DNA, and oral vaccine technologies improving disease prevention and fish welfare. For instance, in July 2025, Scientists at the University of Bergen, supported by FHF, achieved promising progress toward developing a DNA vaccine against sea lice, aiming to enhance fish welfare and reduce harmful delicing methods in aquaculture.

Mergers and acquisitions are moderate but strategic in the aquaculture vaccine industry. Leading animal health companies acquire smaller biotech firms to expand aquatic vaccine portfolios and geographic presence. For instance, in February 2025, MSD Animal Health acquired Elanco’s aqua business, expanding its aquaculture portfolio with innovative vaccines, therapeutics, and facilities across Canada, Vietnam, and Chile to strengthen fish health, sustainability, and global reach.

Regulations play a critical role in ensuring vaccine safety, efficacy, and environmental sustainability. Stringent approval processes by authorities like EMA, USDA, and regional fishery departments influence product timelines. Harmonization efforts aim to streamline licensing, while growing biosecurity and antimicrobial resistance concerns push governments to promote vaccination as a sustainable disease control strategy in aquaculture operations.

The aquaculture vaccine industry remains moderately fragmented, with both global leaders, such as Zoetis, HIPRA, and PHARMAQ, and regional players, including Indian Immunologicals and Aquatreck, contributing to innovation. Diverse fish species, varying disease profiles, and distinct regulatory frameworks across regions create opportunities for niche manufacturers, resulting in a competitive yet collaborative ecosystem promoting localized vaccine development.

The aquaculture vaccine industry is rapidly expanding across Asia-Pacific, Latin America, and the Middle East, driven by government investments in sustainable aquaculture and rising seafood demand. Companies are establishing regional production hubs and collaborations with local research institutes to tailor vaccines for endemic diseases, enhance accessibility, and ensure compliance with regional aquaculture health regulations.

Product Insights

The attenuated live vaccines segment led the market with the largest revenue share of 50.13% in 2024, owing to their superior ability to induce long-lasting, robust immune responses in fish. These vaccines contain weakened pathogens that mimic natural infections, effectively stimulating both humoral and cellular immunity. They offer enhanced protection with minimal booster requirements, making them cost-effective for large-scale aquaculture operations. Their efficiency in controlling bacterial and viral diseases such as vibriosis and furunculosis further boosts their adoption.

The other vaccines segment, comprising DNA, recombinant, subunit, and peptide-based vaccines, is anticipated to grow at the fastest CAGR over the forecast period. The growth of this segment is driven by rising demand for next-generation, targeted immunization technologies that offer enhanced safety, stability, and efficacy. DNA and recombinant vaccines, particularly, provide precise antigen expression, long-term immunity, and no risk of pathogen reversion. In addition, growing R&D investments, supported by government and industry collaborations, are accelerating their development against complex pathogens such as sea lice and viral nervous necrosis.

Route Of Administration Insights

The injected segment accounted for the largest market revenue share in 2024, due to its proven efficacy and ability to provide long-lasting, robust immunity in fish. Intraperitoneal injection ensures precise dosage and direct immune response activation, making it the preferred method for high-value species such as salmon and trout. For instance, in September 2025, ICAR announced that commercially produced injectable vaccines for imported fish will be available within a year, following draft regulatory approval. In addition, the widespread adoption by commercial fish farms in developed markets, such as Norway, Chile, and Canada, further drives segment dominance.

The oral vaccines segment is anticipated to grow at the fastest CAGR over the forecast period, driven by its ease of administration, cost-effectiveness, and suitability for large-scale fish farming. Oral delivery eliminates the need for manual handling and reduces injection stress, thereby improving fish welfare and lowering labor costs. This method allows efficient mass immunization through feed, making it ideal for small and juvenile fish. In addition, the process is non-invasive, does not require handling of the fish, and is easy to administer, making it suited for mass immunization. This aids in the growth of the segment.

Application Insights

The bacterial segment accounted for the largest market revenue share in 2024, primarily due to the high prevalence of bacterial infections in farmed fish, including species such as Aeromonas, Vibrio, and Edwardsiella. These infections cause significant mortality, reduce growth rates, and result in substantial economic losses in aquaculture operations worldwide. Bacterial vaccines, available in forms such as inactivated, attenuated, or recombinant vaccines, provide effective prevention, improve fish health, and enhance production efficiency.

The viral vaccine segment is anticipated to grow at the fastest CAGR during the forecast period, due to the increasing incidence of viral diseases, such as Infectious Salmon Anaemia (ISA), Viral Nervous Necrosis (VNN), and Koi Herpesvirus (KHV), which cause severe mortality and economic losses. Growing awareness among aquaculture producers about biosecurity, coupled with advancements in recombinant DNA and subunit vaccine technologies, is driving the adoption of these practices.

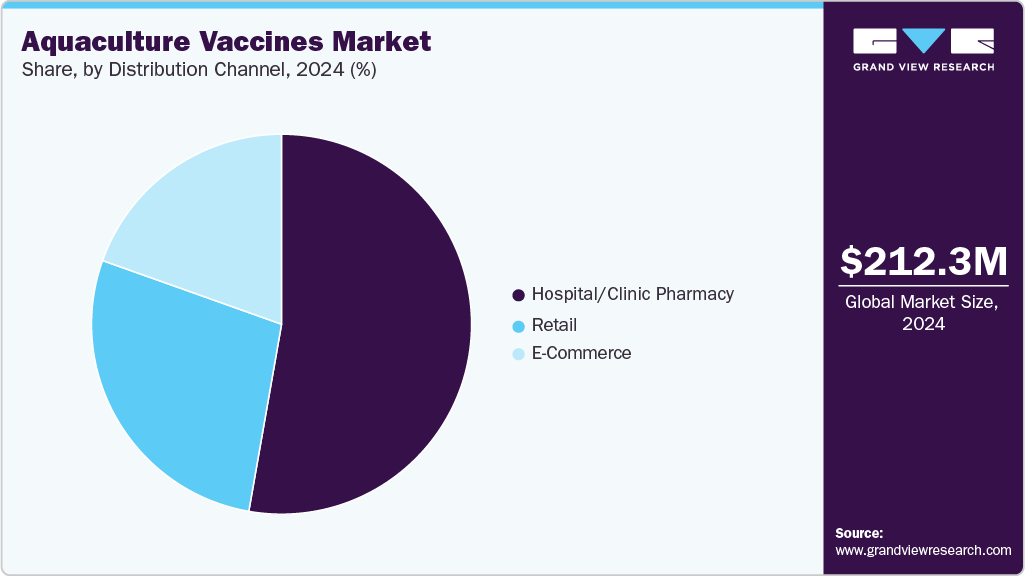

Distribution Channel Insights

The hospital/clinic pharmacy segment accounted for the largest market revenue share in 2024. The market is expanding due to its established distribution networks, direct access to veterinary professionals, and ability to provide timely and specialized vaccines. Aquaculture hospitals and clinics serve as centralized points for vaccination, disease diagnosis, and fish health management, ensuring proper administration and monitoring. Their expertise allows them to handle complex vaccines, such as DNA-based or multivalent formulations, and provide guidance on biosecurity practices.

The e-commerce segment is anticipated to grow at the fastest CAGR over the forecast period, due to increasing digital adoption among fish farmers and aquaculture businesses. Online platforms offer convenience, wider product availability, and competitive pricing, enabling small and remote farms to access vaccines and health products without geographic limitations. E-commerce portals also provide detailed product information, peer reviews, and support for ordering and logistics, enhancing buyer confidence. The growth of mobile technology, improved payment systems, and reliable cold-chain logistics further facilitates online vaccine sales.

Regional Insights

North America dominated the global aquaculture vaccines market with the largest revenue share of 35.42% in 2024.The market is driven by rising seafood consumption, increasing aquaculture production, and growing awareness of disease prevention to ensure fish health and yield. Some of the technological advancements in recombinant DNA and oral vaccines further fuel market growth. Key players, including Zoetis, Benchmark, and MSD Animal Health, compete through product innovation, strategic collaborations, and expanded distribution networks. Regulatory oversight by the U.S. FDA Center for Veterinary Medicine and the Canadian Food Inspection Agency ensures safety, efficacy, and environmental compliance of vaccines.

U.S. Aquaculture Vaccines Market Trends

The aquaculture vaccines market in the U.S. accounted for the largest market revenue share in North America in 2024, owing to the rising prevalence of fish diseases, increasing technological advancements, and rising consumer demand for safe seafood. The market exhibits moderate consolidation, with both global and regional companies competing for market share. For instance, in March 2025, AquaTactics, Bimeda’s Washington-based aquaculture division, entered the autogenous fish vaccine sector after USDA approval, offering development, customer support, and comprehensive fish health services, including vaccination protocols and pathology.

The Canada aquaculture vaccines market is expected to grow at a significant CAGR during the forecast period,propelled by rising emphasis on sustainable practices, reducing antibiotic use, and increasing government support and funding. Additionally, regulatory surveillance is overseen by the Canadian Food Inspection Agency (CFIA), which ensures the safety, efficacy, and environmental compliance of vaccines. The stringent approval processes, post-market monitoring, and adherence to federal aquaculture and animal health standards shape market growth and commercialization. For instance, in May 2023, CATC expanded its Canadian lab services, earning OECD GLP recognition and EU GMP certification. This enabled high-quality aquatic safety studies and batch release testing, ensuring regulatory compliance and international market acceptance.

Europe Aquaculture Vaccines Market Trends

The aquaculture vaccines market in Europe is growing due to Norway’s leading salmon exports, government and private sector support, growing concerns over antimicrobial resistance, and the presence of key players. The regulatory agency of Norwegian Medicines ensures that autogenous vaccines are used only when commercial vaccines are insufficient. In addition, the European Commission funded a large-scale collaborative project under the 7th Framework Programme to advance the aquaculture industry, thereby further strengthening market growth and innovation across the region. Increasing government funding has also boosted the market growth. For instance, in November 2022, the EU launched the Cure4Aqua project, aiming to enhance aquaculture welfare through vaccines, selective breeding, AI-driven health monitoring, and the development of sustainable alternatives to antibiotics.

The UK aquaculture vaccines market is expected to grow at a significant CAGR over the forecast period. The market is characterized by rising consumer demand for sustainable seafood and the need to reduce antibiotic usage in fish farming. Some of the disease challenges, such as Tenacibaculum and sea lice, spur the adoption of effective vaccines. For instance, in October 2025, Onda expanded its Tenacibaculum study models to include T. dicentrarchi and T. finnmarkense, offering aquaculture producers reliable, science-driven tools to combat bacterial diseases and accelerate vaccine development globally.

The aquaculture vaccines market in Germany held a significant share in 2024. The country’s growth is influenced by rising government support & subsidies, as well as growing consumer awareness. The presence of major pharmaceutical and biotech companies, along with investments in R&D for novel vaccines, enhances competitiveness. Key players focus on developing species-specific vaccines and advanced delivery methods, intensifying market rivalry.

Asia Pacific Aquaculture Vaccines Market Trends

The aquaculture vaccines market in Asia Pacific is expected to grow at the fastest CAGR over the forecast period.The region's growth can be attributed to rising demand, a booming aquaculture industry, supportive government initiatives, abundant water resources, and increasing adoption of sustainable aquaculture practices. The region also leads global production of key aquatic species, including tilapia.

The Japan aquaculture vaccines market is witnessing new growth opportunities due to rising demand for high-value fish species and government support for sustainable fish farming practices. In addition, technological advancements in vaccine development, including autogenous and multivalent vaccines, are enhancing disease prevention efficiency. For instance, in October 2025, Kyoritsu Seiyaku launched the world’s first trivalent oil-adjuvant vaccine preventing all serotypes of α-hemolytic lactococcosis in yellowtail, addressing the newly identified Type III strain and supporting sustainable aquaculture.

The aquaculture vaccines market in India is expected to emerge as the fastest and most competitive in the Asia Pacific region, supported by rising aquaculture production, increasing disease-related losses, growing adoption of sustainable and environmentally safe vaccination over antibiotics, and government initiatives supporting fish health research. India ranks as the world’s third-largest fish producer, with inland fisheries contributing more than 65% of output, creating strong demand for disease prevention. Some of the competitive players, such as Indian Immunologicals Limited, ICAR-CIFA partnerships announced in March 2023, and emerging biotech startups focusing on vaccines for freshwater and marine species. Companies are innovating oral and injectable vaccines for pathogens such as Aeromonas hydrophila and developing vaccines for exotic species.

Latin America Aquaculture Vaccines Market Trends

The aquaculture vaccines market in Latin America is driven by the region’s large-scale fish and shrimp farming, rising disease outbreaks, growing export demand, and increasing investment in sustainable aquaculture practices. Countries such as Brazil, Chile, and Mexico are leading in salmon, tilapia, and shrimp production, highlighting the need for effective vaccines to mitigate losses and ensure food safety. Some of the key competitors include AquaGen, Bimeda’s AquaTactics, and regional biotech firms providing species-specific and autogenous vaccines. Companies are focusing on developing vaccines for bacterial and viral pathogens, improving delivery methods, and expanding cold-chain distribution networks.

The Brazil aquaculture vaccines market is gaining momentum, supported by rising export-oriented aquaculture and increasing sustainability and reduced antibiotic use. The regulatory decisions are governed by Brazil’s Ministry of Agriculture, Livestock, and Supply (MAPA), requiring vaccine registration, field trials, GMP compliance, and adherence to international aquatic animal health standards.

Middle East & Africa Aquaculture Vaccines Market Trends

The aquaculture vaccines market in MEA has grown over the forecasted years, attributable to strategic government support, rising technological adoption and increasing aquaculture production. Competitive intensity is moderate, with both global multinationals and regional manufacturers vying to provide tailored solutions for local species and conditions. Regulatory frameworks vary by country, with approvals overseen by national veterinary authorities, emphasizing the importance of safety, efficacy, and compliance with international standards for aquatic animal health.

The South Africa aquaculture vaccines market is expanding, fueled by rising seafood consumption and disease management needs. Government initiatives supporting sustainable aquaculture and biosecurity measures further encourage vaccine adoption. The market is moderately competitive, with domestic players and multinational companies offering bacterial and viral vaccines through direct sales and distributor networks.

Key Aquaculture Vaccine Company Insights

The global aquaculture vaccine industry is dominated by key players, including Bayer Animal Health, Zoetis, HIPRA, Indian Immunologicals Limited, CAVAC, and KBNP. These companies leverage R&D, strategic partnerships, and regional distribution networks to maintain market share, drive innovation, and address disease challenges in aquaculture worldwide. For instance, in August 2024, Indian Immunologicals Limited partnered with ICAR-CIBA to develop a recombinant viral nervous necrosis (VNN) vaccine for finfish, advancing India’s aquaculture sector amid disease-related global losses exceeding USD 10 billion annually.

Key Aquaculture Vaccine Companies:

The following are the leading companies in the aquaculture vaccine market. These companies collectively hold the largest market share and dictate industry trends.

- Zoetis

- Phibro Animal Health Corporation

- Elanco

- Merck & Co., Inc.

- KBNP

- CAVAC

- Kyoto Biken Laboratories, Inc.

- Nisseiken Co., Ltd.

- Vaxxinova International BV

- HIPRA

Recent Developments

-

In July 2025,FHF and the University of Bergen advanced DNA-vaccine research against sea lice, offering a sustainable, welfare-friendly solution to reduce stress and mortality in farmed fish, enhancing global aquaculture health.

-

In March 2025, Aquatreck Animal Health, backed by SAIC and partnered, is progressing its yeast-based sea lice vaccine, creating recombinant proteins to trigger immunity, aiming to improve fish welfare and reduce economic losses in salmon farming.

-

In March 2025, AquaTactics, following USDA approval, entered the autogenous fish vaccine market, offering customized vaccines, veterinary services, and pathology support to enhance fish health and productivity across U.S. aquaculture operations.

Aquaculture Vaccines Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 230.4 million

Revenue forecast in 2033

USD 396.1 million

Growth rate

CAGR of 7.01% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, route of administration, distribution channel, regional

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Saudi Arabia; Kuwait; Qatar; Oman

Key companies profiled

Zoetis; Phibro Animal Health Corporation; Elanco; Merck & Co., Inc.; KBNP; CAVAC; Kyoto Biken Laboratories, Inc.; Nisseiken Co., Ltd.; Vaxxinova International BV; HIPRA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aquaculture Vaccine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global aquaculture vaccines market report based on product, application, route of administration, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Attenuated Live Vaccines

-

Inactivated Vaccines

-

Other Vaccines

-

-

Route of Administration Outlook (Revenue, USD Million, 2021 - 2033)

-

Oral

-

Injected

-

Immersion & Spray

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Bacterial

-

Viral

-

Parasitic

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Retail

-

E-Commerce

-

Hospital/Clinic Pharmacy

-

-

Region Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The global aquaculture vaccines market size was estimated at USD 212.3 million in 2024 and is expected to reach USD 230.4 million in 2025.

b. The global aquaculture vaccines market is expected to grow at a compound annual growth rate of 7.01% from 2025 to 2033 to reach USD 396.1 million by 2033.

b. Asia Pacific is expected to grow at a fastest CAGR over the forecast period. The region's growth can be attributed to rising demand, a booming aquaculture industry, supportive government initiatives, abundant water resources, and increasing adoption of sustainable aquaculture practices.

b. Some key players operating in the aquaculture vaccines market include Zoetis; Phibro Animal Health Corporation; Elanco; Merck & Co., Inc.; KBNP; CAVAC; Kyoto Biken Laboratories, Inc.; Nisseiken Co., Ltd.; Vaxxinova International BV; and HIPRA.

b. Key factors that are driving the market growth include rising disease incidence in aquaculture, increasing government support and regulatory initiatives and growing technological advancements in vaccine development.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.