- Home

- »

- Green Building Materials

- »

-

Asbestos Abatement Services Market Size Report, 2033GVR Report cover

![Asbestos Abatement Services Market Size, Share & Trends Report]()

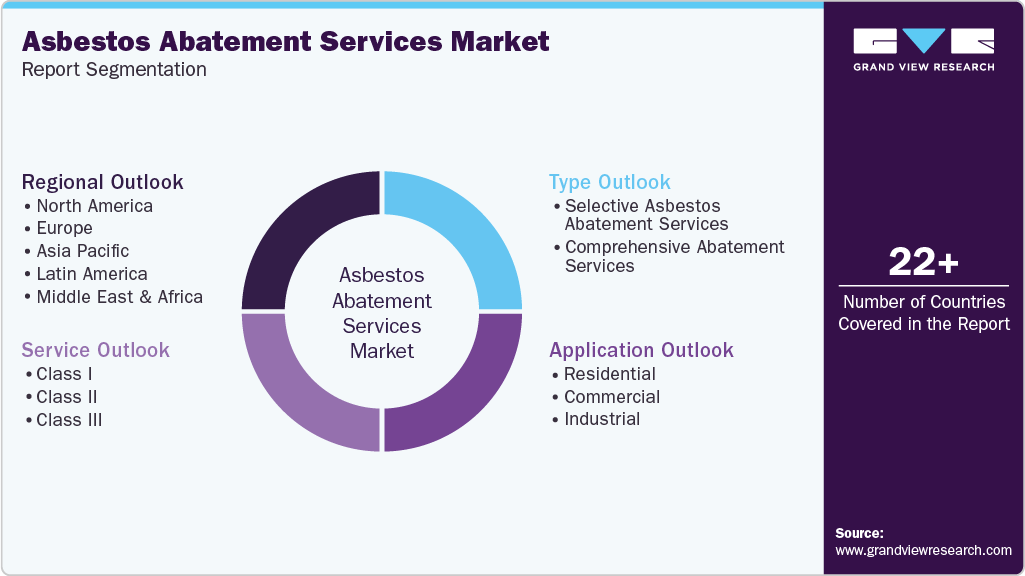

Asbestos Abatement Services Market (2025 - 2033) Size, Share & Trends Analysis Report By Service (Class I, Class II, Class III), By Application (Residential, Commercial, Industrial), By Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-780-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Asbestos Abatement Services Market Summary

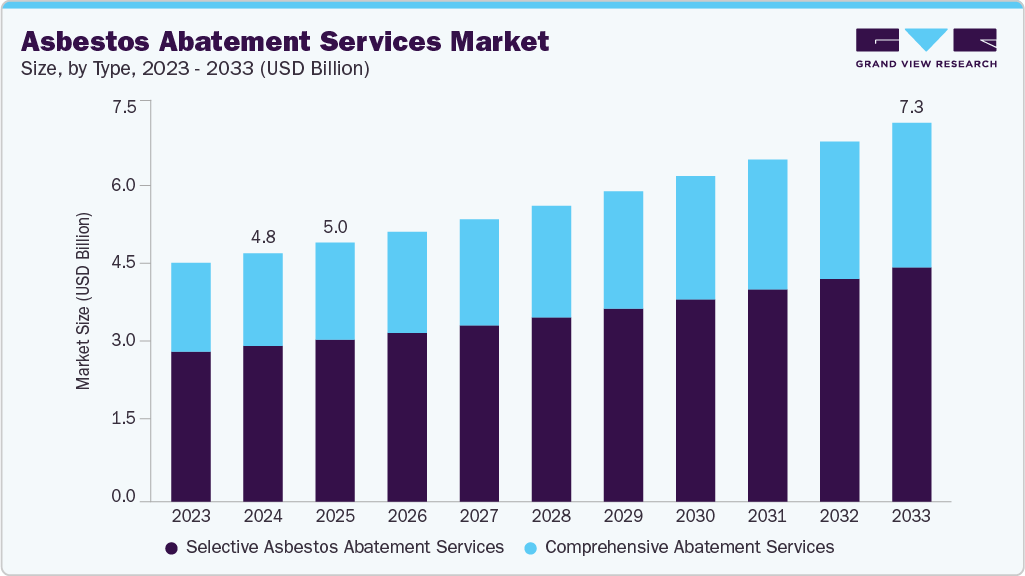

The global asbestos abatement services market size was estimated at USD 4,808.0 million in 2024 and is projected to reach USD 7,336.6 million by 2033, growing at a CAGR of 4.9% from 2025 to 2033. The growing awareness of the health risks associated with asbestos exposure is a major market driver.

Key Market Trends & Insights

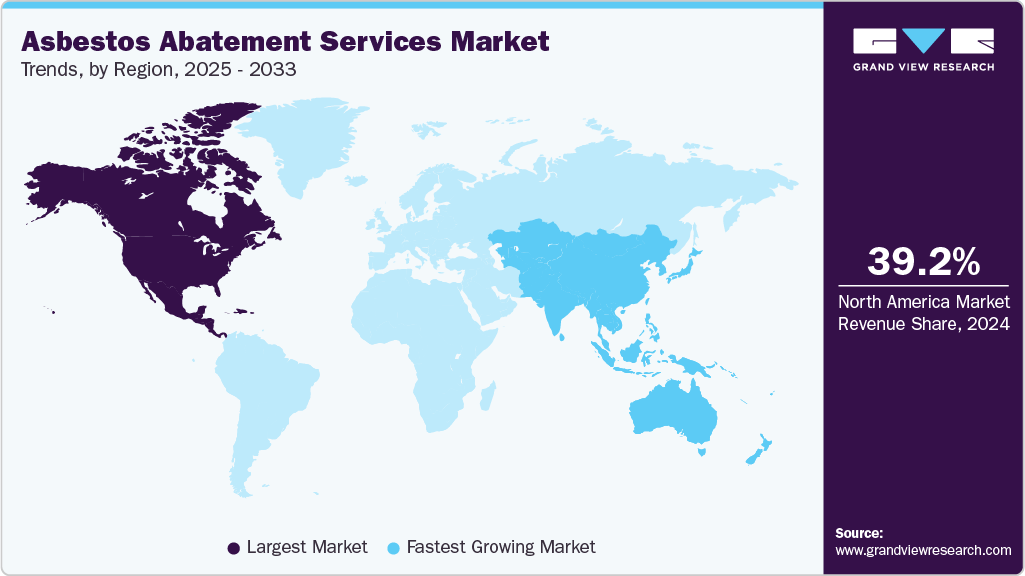

- North America dominated the asbestos abatement services market with the largest revenue share of 39.2% in 2024.

- The asbestos abatement services market in the U.S. is expected to grow at a substantial CAGR of 4.0% from 2025 to 2033.

- By type, comprehensive abatement services segment is expected to grow at a considerable CAGR of 5.2% from 2025 to 2033 in terms of revenue.

- By service, class I segment is expected to grow at a considerable CAGR of 5.3% from 2025 to 2033 in terms of revenue.

- By application, industrial segment is expected to grow at a considerable CAGR of 5.5% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 4,808.0 Million

- 2030 Projected Market Size: USD 7,336.6 Million

- CAGR (2025-2030): 4.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest-growing region

Governments and regulatory bodies enforce strict safety regulations for asbestos handling and removal. This has increased demand for professional abatement services across residential, commercial, and industrial sectors. The rising construction and renovation activities in developing regions contribute to market growth. Older buildings often contain asbestos materials, making safe removal and disposal services essential. The increasing emphasis on occupational safety and environmental protection also drives demand. Furthermore, advancements in safe abatement technologies enable efficient and cost-effective asbestos removal solutions globally.

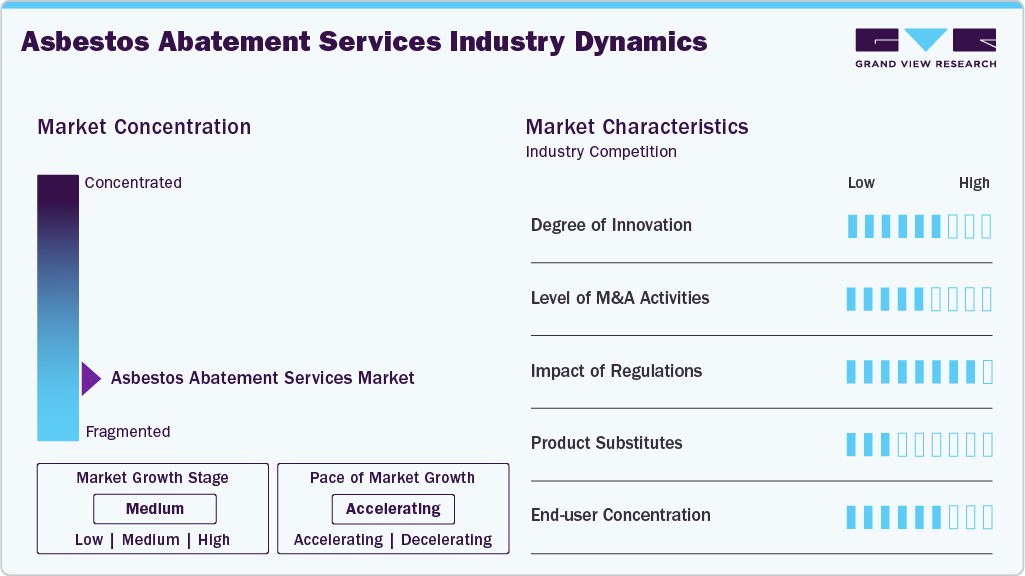

Industry Concentration & Characteristics

The global asbestos abatement services industry is highly fragmented, with numerous small and medium-sized service providers operating regionally. Few large companies hold a significant share, but local players dominate many markets due to specialized expertise and regulatory compliance. Intense competition drives companies to adopt advanced technologies and safety practices to differentiate themselves. Overall, the market structure encourages innovation and service diversification across different regions.

The asbestos abatement services industry shows a moderate level of innovation, focusing on developing safer and more efficient removal techniques. Companies invest in advanced equipment and protective solutions to reduce risks during abatement. Waste handling and disposal methods are also continuously improved to meet environmental standards. Safety concerns and regulatory compliance requirements largely drive innovation.

The industry is heavily influenced by government regulations and safety standards, which dictate how asbestos can be handled and removed. Strict compliance is mandatory, shaping operational processes and service offerings. Non-compliance can result in severe penalties, making regulation a key factor in market participation. As a result, companies continuously update their practices to adhere to evolving legal requirements.

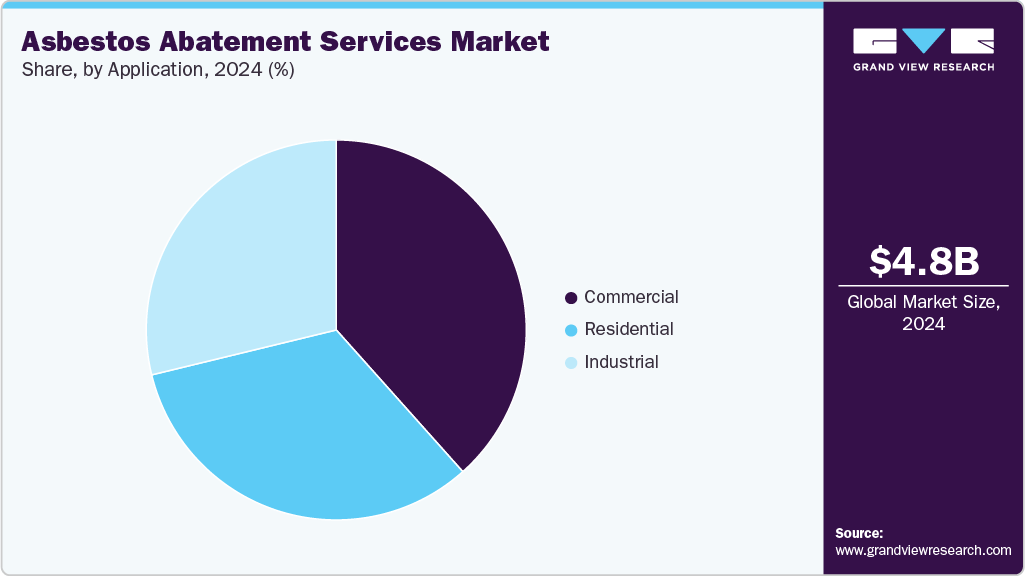

The market serves a diverse range of end users, including residential, commercial, and industrial sectors. No single end-user dominates, although the construction and renovation segments account for a significant share. Service providers must adapt to the specific needs of different clients, from large industrial facilities to small residential projects. This diversity reduces dependency on any single customer group while ensuring steady demand across sectors.

Drivers, Opportunities & Restraints

A key market driver is growing awareness of the health risks associated with asbestos exposure. Strict government regulations and safety standards increase the demand for professional abatement services. Aging buildings and infrastructure in developing countries require safe asbestos removal. Rising construction and renovation activities further fuel the need for certified asbestos management solutions.

Expanding urbanization and industrialization in emerging economies create new growth opportunities for asbestos abatement services. Companies can leverage advanced removal technologies and eco-friendly disposal methods to attract clients. Partnerships with construction and renovation firms offer additional business channels. Increasing focus on workplace safety and environmental compliance opens avenues for specialized service offerings.

High operational costs and the need for specialized training limit entry for smaller players. Strict regulations increase compliance burdens, affecting profit margins. Public reluctance or low awareness in some regions slows market adoption. In addition, the hazardous nature of asbestos handling poses risks that can impact workforce availability and operational efficiency.

Type Insights

Selective asbestos abatement services dominate the market and accounted for a share of 62.7% in 2024 due to their targeted approach in removing only hazardous materials. These services are preferred in renovation and partial demolition projects where minimal disruption is needed. They are cost-effective and allow buildings to remain partially operational during abatement. Strong demand from residential and commercial sectors reinforces their market leadership.

Comprehensive abatement services are the fastest-growing segment, driven by large-scale construction and industrial projects. These services involve the complete removal and safe disposal of all asbestos-containing materials, ensuring full compliance with regulations. Increasing awareness of health risks and stricter safety standards encourages clients to opt for complete solutions. The segment’s growth is also supported by technological advancements that make full abatement more efficient and safer.

Service Insights

Class I services dominate the market and accounted for a share of 46.8% in 2024 because they involve the removal of asbestos in insulation and thermal system materials, which are commonly found in older buildings. These services are highly sought after in residential and commercial renovations. Their targeted approach makes them cost-effective and less disruptive during projects. Strong regulatory compliance requirements also contribute to their widespread adoption.

Class II services are growing significantly due to increased demand for removing asbestos-containing materials in non-thermal products, such as walls, ceilings, and flooring. Growing construction and remodeling activities drive the need for these services. Strict safety regulations encourage clients to opt for professional abatement. Technological improvements in efficient removal and waste management further support market growth.

Application Insights

The commercial segment dominates the market and accounted for a share of 38.4% in 2024 due to high demand from offices, schools, and public buildings. Older commercial structures often contain asbestos in insulation, flooring, and ceilings, requiring professional removal. Regulatory mandates for workplace safety further drive service adoption. Frequent renovations and retrofits in commercial properties maintain steady market demand.

The industrial segment is the fastest growing, driven by large-scale manufacturing plants, warehouses, and factories requiring full asbestos removal. Strict occupational health and safety regulations push industries to adopt professional abatement solutions. Expansion of industrial infrastructure in developing regions also fuels growth. Advanced technologies in handling and disposing of asbestos improve efficiency and safety in industrial projects.

Regional Insights

North America dominates the asbestos abatement services market and accounted for 39.2% share, due to strict regulatory frameworks and strong enforcement of safety standards. High awareness of health risks associated with asbestos drives demand across residential, commercial, and industrial sectors. Aging infrastructure requires frequent inspections and removal services. The presence of established service providers further strengthens market leadership in the region.

U.S. Asbestos Abatement Services Market Trends

The asbestos abatement services market in the U.S. is dominated the North American market due to strict federal and state regulations on asbestos handling and removal. High awareness of health risks drives demand across residential, commercial, and industrial sectors. Aging buildings require frequent inspections and professional abatement. Established service providers with advanced technologies strengthen the U.S.

The Canada asbestos abatement services marketis growing steadily, driven by increasing construction, renovation, and industrial projects. Rising regulatory focus on workplace safety and asbestos management fuels service adoption. Public awareness campaigns encourage property owners to opt for professional removal. Entry of experienced service providers enhances efficiency and compliance in the market.

Europe Asbestos Abatement Services Market Trends

The asbestos abatement services market in Europe shows steady growth due to stringent environmental regulations and safety standards. Renovation of older buildings and industrial facilities creates a continuous demand for abatement services. High awareness among building owners and contractors drives adoption. The presence of technologically advanced service providers enhances market efficiency and compliance.

Germany asbestos abatement services market dominates the European market due to strict national regulations and strong enforcement of asbestos handling and disposal. High awareness of health hazards in residential, commercial, and industrial sectors drives demand. Aging infrastructure and renovation projects create continuous opportunities for service providers. Advanced technologies and experienced companies further strengthen Germany’s market leadership.

The asbestos abatement services market in the UK is growing steadily, supported by increasing construction and refurbishment activities across commercial and residential sectors. Regulatory compliance and safety standards encourage professional asbestos removal services. Public awareness of asbestos-related health risks boosts adoption. Emerging service providers with modern abatement solutions are expanding market reach and efficiency.

Asia Pacific Asbestos Abatement Services Market Trends

The asbestos abatement services market in the Asia Pacific is the fastest-growing region, with a CAGR of 6.2%, fueled by rapid urbanization, industrial expansion, and large-scale construction projects. Increasing awareness of occupational safety and regulatory adoption encourages professional asbestos removal. Developing economies are investing heavily in infrastructure renovation. Growth is also supported by the entry of global service providers offering advanced abatement solutions.

China asbestos abatement services market dominated the Asia Pacific market due to rapid urbanization and large-scale industrial and construction projects. Strict government regulations on workplace safety and asbestos handling drive demand. Aging commercial and residential infrastructure requires professional removal services. The entry of global and local service providers with advanced technologies strengthens China’s market leadership.

The asbestos abatement services market in India is the fastest-growing market in the region, fueled by expanding construction, industrialization, and infrastructure development. Increasing awareness of health risks and regulatory adoption encourages professional asbestos abatement. Renovation of older buildings and industrial facilities drives market growth. Technological advancements and a trained workforce support efficient and safe asbestos removal services.

Middle East & Africa Asbestos Abatement Services Market Trends

The asbestos abatement services market in the Middle East and Africa is witnessing gradual growth due to urban development and industrialization in key countries. Regulatory frameworks are being strengthened to ensure safe handling and disposal of asbestos. Infrastructure modernization projects drive demand for professional services. Awareness campaigns and government initiatives further support market adoption in the region.

South Africa asbestos abatement services market dominated the MEA market due to stringent national regulations and enforcement on asbestos handling and removal. High awareness of health hazards drives demand across residential, commercial, and industrial sectors. Aging infrastructure and ongoing construction projects create continuous opportunities for service providers. The presence of experienced companies with advanced technologies further strengthens South Africa’s market leadership.

Latin America Asbestos Abatement Services Market Trends

The asbestos abatement services market in Latin America is growing as governments implement regulations to manage asbestos risks in public and private structures. Aging commercial and industrial facilities require professional removal services. Rising construction and renovation activities support market expansion. Increasing awareness of health hazards is encouraging the adoption of certified abatement services.

Brazil asbestos abatement services market is the dominating market for asbestos abatement services in Latin America due to increasing construction, renovation, and industrial activities. The growing regulatory focus on workplace safety and asbestos management drives the adoption of professional services. Awareness of health hazards among property owners encourages safe removal practices. The entry of certified service providers with advanced technologies supports efficient and compliant asbestos abatement solutions.

Key Asbestos Abatement Services Company Insights

Some key players operating in the market include KION Group AG, Toyota Industries Corporation, and Jungheinrich AG.

-

Based in Los Angeles, Nielsen Environmental specializes in asbestos abatement, lead remediation, and demolition services. The company uses advanced safety measures, including Class 1 containment and multi-chamber decontamination units, to comply with all federal and state regulations. It provides detailed project documentation from start to finish, ensuring regulatory transparency. Serving residential, commercial, and industrial clients, Nielsen is known for reliability and professional execution. Fully insured and bonded, the firm maintains multiple certifications that highlight its focus on safety and quality. Their approach emphasizes precision in hazardous material handling and thorough client support throughout each project.

-

Precision Environmental Company offers asbestos and lead abatement, mold remediation, and selective demolition services. The firm works across healthcare, education, government, and industrial sectors, providing both emergency and planned services. It handles complex projects such as historic building renovations and large industrial cleanups. A team of certified professionals maintains a strong emphasis on safety and compliance. The company also invests in employee training and community initiatives to improve service quality. Precision Environmental is recognized for delivering reliable, efficient, and fully compliant environmental solutions.

Key Asbestos Abatement Services Companies:

The following are the leading companies in the asbestos abatement services market. These companies collectively hold the largest market share and dictate industry trends.

- Nielsen Environmental

- Precision Environmental Company

- Abatement & Demolition Services

- MG Scaffolding (Oxford) Limited

- Lloyd D. Nabors Demolition

- San Diego Abatement Services

- DRYmedic Restoration Services

- O'Rourke Wrecking Company

- Abatement Services, Inc

- Select Demo Services

- Superior Abatement Services

- Belfor Property Restoration

- Penhall Company

- Paul Davis Restoration

- SERVPRO

Recent Developments

-

In September 2025, MG Scaffolding introduced a new Asbestos Division after receiving approval from the Health & Safety Executive (HSE). The division focuses on safe and compliant asbestos removal under expert supervision. Led by experienced professionals, it ensures adherence to strict safety standards. This launch strengthens the company’s position in specialist environmental and scaffolding services.

-

In January 2025, ICV Partners acquired a major stake in Environmental Remedies, LLC (ERI), California's leading residential asbestos abatement company. ERI provides professional asbestos removal services to homeowners, restoration firms, and insurance companies nationwide. The acquisition is intended to support ERI’s growth through enhanced operations, leadership, and infrastructure. With ICV’s backing, ERI aims to expand its market presence and pursue new growth opportunities.

Asbestos Abatement Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5,013.6 million

Revenue forecast in 2033

USD 7,336.6 million

Growth rate

CAGR of 4.9% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, service, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Nielsen Environmental; Precision Environmental Company; Abatement & Demolition Services; MG Scaffolding (Oxford) Limited; Lloyd D. Nabors Demolition; San Diego Abatement Services; DRYmedic Restoration Services; O'Rourke Wrecking Company; Abatement Services, Inc.; Select Demo Services; Superior Abatement Services; Belfor Property Restoration; Penhall Company; Paul Davis Restoration; SERVPRO

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Asbestos Abatement Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global asbestos abatement services market report based on type, service, application, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Selective Asbestos Abatement Services

-

Comprehensive Abatement Services

-

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Class I

-

Class II

-

Class III

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global asbestos abatement services market size was estimated at USD 4,808.0 million in 2024 and is expected to be USD 5,013.6 million in 2025.

b. The global asbestos abatement services market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.9% from 2025 to 2033 to reach USD 7,336.6 million by 2033.

b. Selective asbestos abatement services dominate the market and accounted for a share of 62.7% in 2024 due to their targeted approach in removing only hazardous materials. These services are preferred in renovation and partial demolition projects where minimal disruption is needed.

b. Some of the key players operating in the global asbestos abatement services market include Nielsen Environmental, Precision Environmental Company, Abatement & Demolition Services, MG Scaffolding (Oxford) Limited, Lloyd D. Nabors Demolition, San Diego Abatement Services, DRYmedic Restoration Services, O'Rourke Wrecking Company, Abatement Services, Inc, Select Demo Services, Superior Abatement Services, Belfor Property Restoration, Penhall Company, Paul Davis Restoration, and SERVPRO.

b. The global asbestos abatement services market is driven by growing awareness of health risks associated with asbestos exposure. Strict government regulations and safety standards increase demand for professional removal services. Additionally, aging infrastructure and rising construction and renovation activities boost the need for certified asbestos abatement solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.