- Home

- »

- Clothing, Footwear & Accessories

- »

-

Asia Pacific Jewelry Market Size, Industry Report, 2033GVR Report cover

![Asia Pacific Jewelry Market Size, Share & Trends Report]()

Asia Pacific Jewelry Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Necklace, Ring), By Material (Platinum, Gold), By Distribution Channel (Offline Retail Stores, Online Retail Stores), By End-user (Men, Women), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-654-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Asia Pacific Jewelry Market Summary

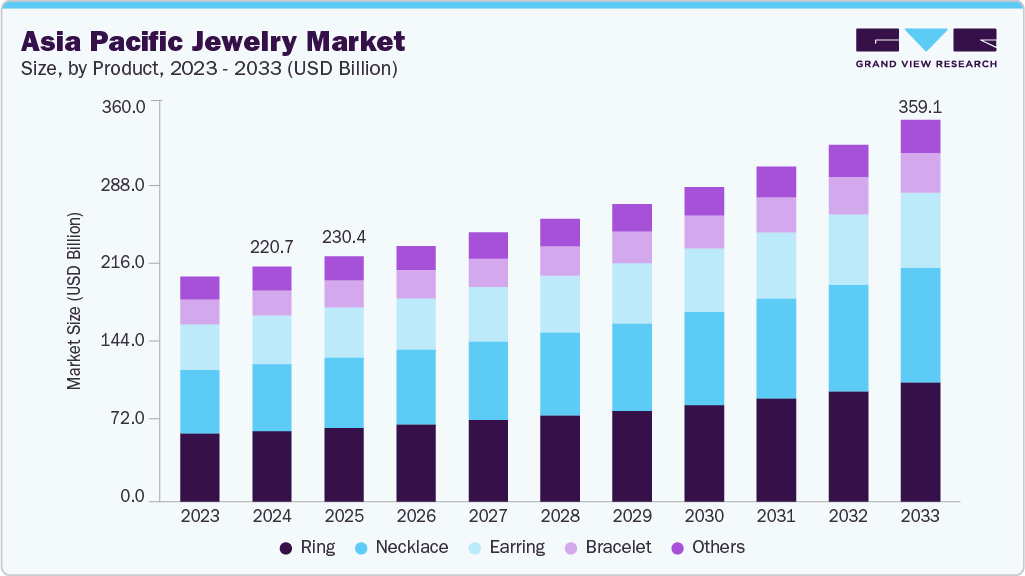

The Asia Pacific jewelry market size was estimated at USD 220.67 billion in 2024, and is projected to reach USD 359.09 billion by 2033, growing at a CAGR of 5.7% from 2025 to 2033. Rising disposable incomes and increasing demand for luxury and culturally significant jewelry are key drivers of the Asia Pacific jewelry market.

Key Market Trends & Insights

- The jewelry market in China held the largest market share of 40.8% in 2024.

- By product, the ring segment held the largest share of 30.1% in 2024.

- By material, the gold jewelry market held the largest share, 68.4% in 2024.

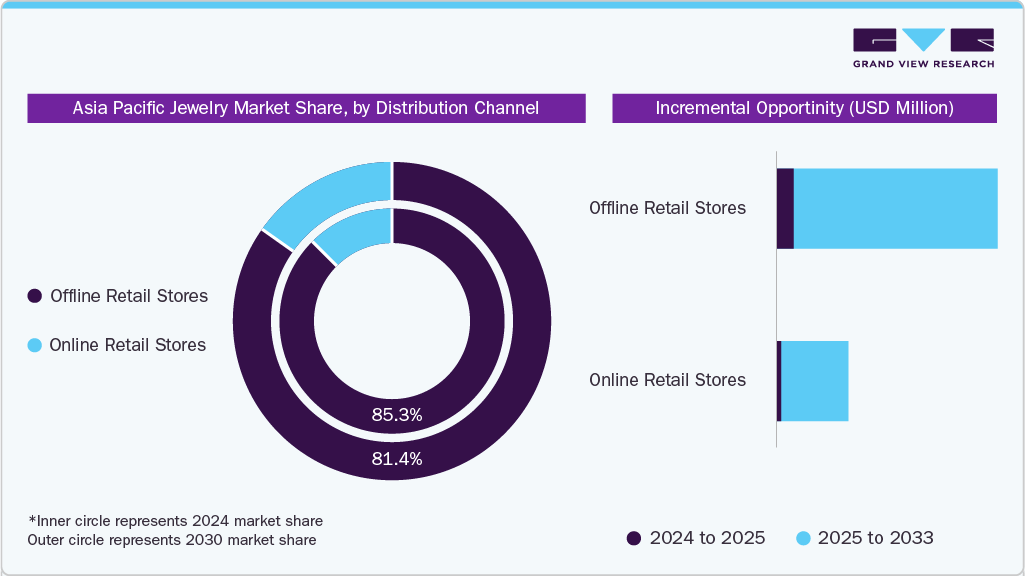

- By distribution channel, offline retail stores held the largest share, 85.3% in 2024.

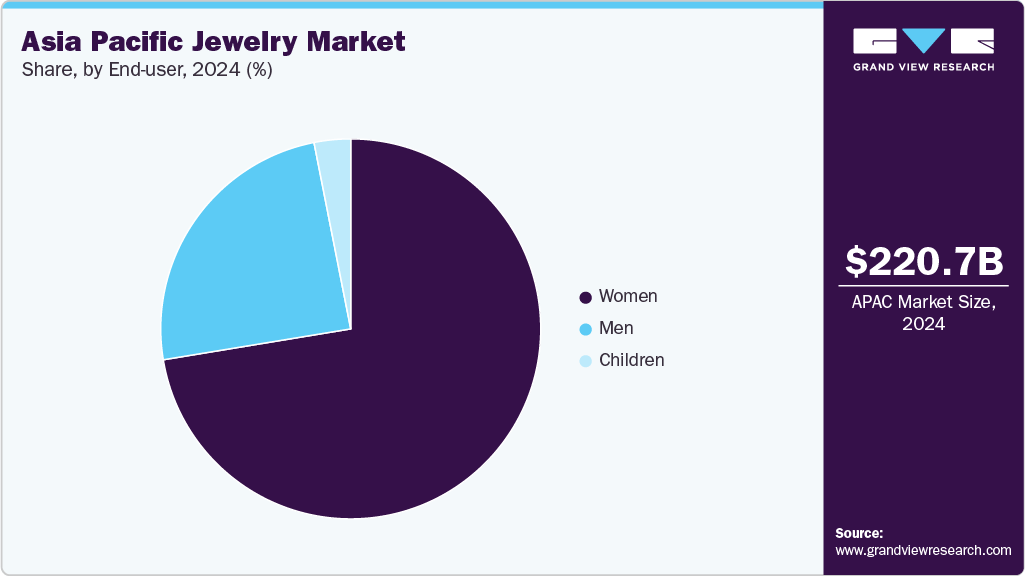

- By end use, women held the largest share of 72.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 220.67 Billion

- 2033 Projected Market Size: USD 359.09 Billion

- CAGR (2025-2033): 5.7%

The Asia Pacific jewelry industry is propelled by rapid urbanization and the expanding influence of global fashion trends. Technological advancements in jewelry manufacturing, such as 3D printing and lab-grown gemstones, enhance product variety and appeal. Companies such as Rapid 3D, based in India, offer 3D printing services for jewelry at an affordable price. E-commerce growth has made jewelry more accessible to a broader consumer base, especially in tier-2 and tier-3 cities. Additionally, rising interest in personalized and ethically sourced jewelry shapes purchasing decisions across the region.

The increasing participation of women in the workforce is boosting demand for contemporary and work-appropriate jewelry. Celebrity endorsements and the influence of social media platforms are significantly shaping consumer preferences and brand visibility. Government initiatives supporting small-scale artisans and exports are also contributing to market expansion. According to the data published by India Brand Equity Foundation, in 2022, India ranked first among top exporters of cut & polished diamonds, while second in gold jewelry. Furthermore, the rise in gifting culture during festivals and special occasions fuels consistent jewelry sales across the region.

Source: YouGov PLC., Printline Media Pvt. Ltd.

Product Insights

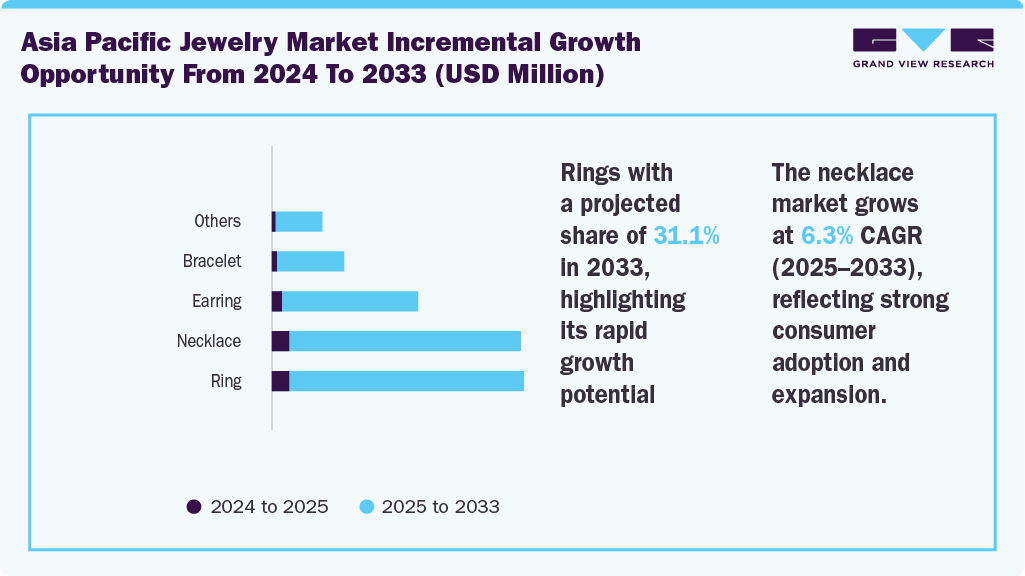

The Asia Pacific rings market accounted for the largest share of 30.1% of the revenue in 2024. Rings in the Asia Pacific jewelry market are witnessing increased demand due to the rise of gender-neutral designs, appealing to a broader audience beyond traditional buyers. The influence of pop culture and K-dramas has sparked interest in unique, stackable, and couple rings. Urban consumers favor versatile ring styles suitable for casual and formal wear. The emergence of boutique and designer brands also offers niche, limited-edition collections that drive exclusivity. Furthermore, virtual try-on technology advancements enhance customer engagement and boost online ring purchases. For instance, in September 2023, Perfect Corp, based in Taiwan, introduced a virtual try-on feature for jewelry products, including stacking rings and bracelets, enhancing the user experience.

The necklace market is projected to grow at the fastest CAGR of 6.3% from 2025 to 2033. Necklaces are thriving in the region due to a renewed focus on cultural revival and traditional craftsmanship in modern formats. High demand during festive seasons, where gold and gemstone necklaces symbolize prosperity, significantly boosts sales. Collaborations between local artisans and global designers are introducing fusion pieces catering to heritage and fashion-conscious consumers. Rising tourism in countries such as Thailand and India is also driving souvenir necklace purchases. Additionally, sustainability trends encourage interest in recycled metals and ethically sourced materials in necklace production.

Material Insights

The gold jewelry material market in Asia Pacific accounted for the largest share of 68.4% of the revenue in 2024. Gold holds the largest market share due to its deep-rooted cultural and religious significance, especially in India, China, and Indonesia. For instance, according to the data published in May 2022, about 80% of Indians have gifted gold jewelry to their loved ones at least once. Fluctuations in global economic conditions often push consumers toward gold as a form of wealth preservation. The rise in digital gold investments also increases consumer trust and familiarity with the material. Additionally, government policies around hallmarking and purity certification enhance transparency and encourage more purchases.

The diamond jewelry market is expected to grow significantly during the forecast period. Diamond jewelry is gaining traction in the region, driven by rising aspirational lifestyles and the perception of diamonds as symbols of success and individuality. The availability of certified and conflict-free diamonds is appealing to ethically conscious buyers. Increased marketing targeting millennials and Gen Z, especially through social media influencers, is reshaping diamond jewelry consumption. Moreover, the growth of lab-grown diamonds offers affordable luxury, expanding the consumer base significantly.

Distribution Channel Insights

The jewelry sales through the offline retail stores accounted for the largest share of around 85.3% of the Asia Pacific revenue in 2024. Offline retail stores remain vital in the Asia Pacific jewelry market due to the cultural importance of physically inspecting and trying on jewelry before purchase. Trusted local jewelers and brand outlets offer personalized customer service and after-sales support, which builds strong consumer confidence. Festivals and wedding seasons also drive high foot traffic to physical stores. Additionally, many consumers prefer the tactile experience and instant gratification that offline stores provide. For instance, according to the data published in July 2024, Tanishq, primarily an offline jewelry retailer, ranked first in YouGov's recommendation rankings in India.

The jewelry sales through the offline retail stores are projected to grow at the fastest CAGR of 8.5% from 2025 to 2033. Online retail stores rapidly expand their presence by offering convenience, wider product selections, and competitive pricing. Advanced virtual try-on technologies and detailed product visuals help bridge the gap between online and in-store experiences. The growing penetration of smartphones and improved internet infrastructure in rural and urban areas boosts accessibility. Moreover, online platforms provide personalized recommendations and seamless payment options, enhancing customer engagement.

End-user Insights

Asia Pacific women’s jewelry Market accounted for the largest share of around 72.4% of the revenue in 2024. Women are the primary end users driving the Asia Pacific jewelry market, fueled by increasing financial independence and a desire for self-expression through accessories. Rising participation in professional and social spheres motivates demand for versatile, fashion-forward pieces. Additionally, evolving cultural norms encourage women to invest in fine jewelry for special occasions and everyday wear. The influence of social media and celebrity trends further shapes their purchasing decisions.

The Asia Pacific children’s jewelry Market is projected to grow at the fastest CAGR of 5.3% from 2025 to 2033. Children represent a growing segment as parents increasingly purchase jewelry for special milestones such as naming ceremonies, birthdays, festivals, and religious ceremonies. For instance, Cambodian parents make jewelry pieces for children, such as silver strings with bells to tie on their ankles to protect them from evil. Safety-focused designs using hypoallergenic materials and lightweight styles appeal to this market. Rising disposable incomes and the desire to pass down family heirlooms as sentimental gifts also contribute. Moreover, expanding customizable and playful jewelry options attracts younger buyers and their families.

Country Insights

The Asia Pacific jewelry market is driven by rapid economic growth and increasing urbanization, which elevate consumer purchasing power and lifestyle aspirations. A growing youth population with heightened fashion consciousness fuels demand for trendy and personalized jewelry. Additionally, integrating advanced technologies in design and retail enhances accessibility and customer experience. Finally, expanding cross-border trade and tourism broadens market reach and diversity in consumer preferences.

China Jewelry Market Trends

The jewelry market in China held the largest market share of 40.8%, driven by the country’s strong economic growth and increasing urban middle class with rising disposable incomes. A shift toward premiumization fuels a growing appreciation for luxury goods and branded jewelry. Government initiatives promoting domestic consumption and e-commerce expansion have enhanced market accessibility. Additionally, cultural festivals and gifting traditions significantly boost demand. According to data published by the World Gold Council, gold will continue to lead China’s jewelry market in 2024. The influence of digital marketing and celebrity endorsements further drives consumer interest in fine jewelry.

India Jewelry Market Trends

The India jewelry market is the fastest-growing market, projecting a CAGR of 6.3%, driven by deep-rooted cultural and religious traditions where gold holds immense symbolic value. The country experiences robust demand during wedding seasons and festivals such as Diwali, which are key sales drivers. Increasing affordability and availability of diverse designs cater to traditional and modern tastes. According to the YouGov plc data published in April 2023, about 36% of Indians planned to purchase luxury products such as jewelry the following year. The rise of organized retail and online platforms is improving reach and convenience. Furthermore, younger consumers are growing in preference for branded and lightweight jewelry options.

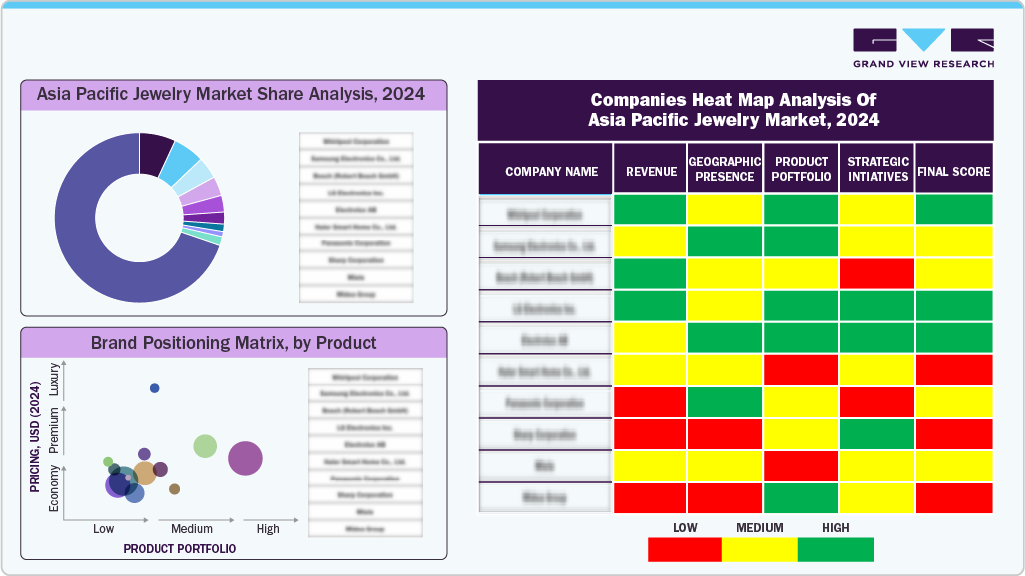

Key Asia Pacific Jewelry Company Insights

The Asia Pacific jewelry market is rapidly growing and transforming, with major players focusing on innovation and customization to meet diverse consumer preferences. Companies are investing in advanced manufacturing technologies, including lab-grown gemstones and 3D printing, to offer unique and affordable designs. Digital transformation, especially through e-commerce platforms and virtual try-on tools, is enhancing customer experience and expanding reach into tier-2 and tier-3 cities. Brands are also leveraging local cultural festivals and partnering with regional artisans to create authentic collections that resonate with varied markets. This multi-faceted strategy helps strengthen market presence and drive sustained regional growth.

Key Asia Pacific Jewelry Companies:

- Titan Company Limited

- Malabar Gold & Diamonds

- Chow Tai Fook Jewellery Company Limited

- Kalyan Jewellers

- PCJeweller

- SENCO GOLD LTD

- De Beers Group

- Tiffany & Co.

- Damas Jewellery

- Swarovski

Recent Developments

-

In May 2025, Shanghai inaugurated the International Jewelry Fashion Functional Zone in Huangpu District, aiming to establish the city as a global jewelry and fashion hub. The initiative includes a comprehensive three-year development plan featuring 24 strategic tasks across six key categories, such as brand incubation, designer talent cultivation, and immersive retail experiences.

-

In January 2025, POP MART launched its jewelry brand, POPOP, introducing a high-street-to-premium collection featuring sterling silver, cubic zirconia, and artificial pearl pieces.

Asia Pacific Jewelry Market Report Scope

Report Attribute

Details

Market value size in 2025

USD 230.36 billion

Revenue Forecast in 2033

USD 359.09 billion

Growth rate

CAGR of 5.7% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, distribution channel, end-user, country

Country scope

China; India; Japan; South Korea; Australia & New Zealand

Key companies profiled

Titan Company Limited; Malabar Gold & Diamonds; Chow Tai Fook Jewellery Company Limited; Kalyan Jewellers; PCJeweller; SENCO GOLD LTD; De Beers Group; Tiffany & Co.; Damas Jewellery; Swarovski

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Jewelry Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the Asia Pacific jewelry market report on the basis of product, material, distribution channel, end-user, and country.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Necklace

-

Ring

-

Earring

-

Bracelet

-

Others

-

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Platinum

-

Gold

-

Diamond

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline Retail Stores

-

Supermarkets & Hypermarkets

-

Jewelry Stores

-

-

Online Retail Stores

-

-

End-user Outlook (Revenue, USD Million, 2021 - 2033)

-

Men

-

Women

-

Children

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia & New Zealand

-

-

Frequently Asked Questions About This Report

b. The Asia Pacific jewelry market size was estimated at USD 220.7 billion in 2024 and is expected to reach USD 230.4 billion in 2025.

b. The Asia Pacific jewelry market is expected to grow at a compound annual growth rate (CAGR) of 5.7 % from 2025 to 2033 to reach USD 359.1 billion by 2033.

b. The ring market accounted for a revenue share of 30.1% in 2024, driven by rising disposable incomes, a growing middle-class population, the cultural significance of jewelry in weddings, and increasing demand for branded and customized designs.

b. Some key players operating in the Asia Pacific Jewelry market include Titan Company Limited, Malabar Gold & Diamonds, Kalyan Jewellers, De Beers Group, Tiffany & Co., and Swarovski.

b. Key factors driving market growth in the Asia Pacific Jewelry market is fueled by deep-rooted cultural traditions, significant demand for gold and gemstones in ceremonies, and a long-standing heritage of artisanal craftsmanship. Market growth is further enhanced by rising disposable incomes, urbanization, digital retail expansion, and increasing global demand for luxury, customized, and sustainable jewelry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.