- Home

- »

- Animal Feed and Feed Additives

- »

-

Asia Pacific Pet Food Texture Ingredients Market, 2030GVR Report cover

![Asia Pacific Pet Food Texture Ingredients Market Size, Share & Trends Report]()

Asia Pacific Pet Food Texture Ingredients Market (2025 - 2030) Size, Share & Trends Analysis Report By Category (Dog Food, Cat Food), By Form (Wet, Dry), By Texture Ingredient (Modified Starch, Gums & Hydrocolloids), By Other Ingredient, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-794-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Asia Pacific Pet Food Texture Ingredients Market Summary

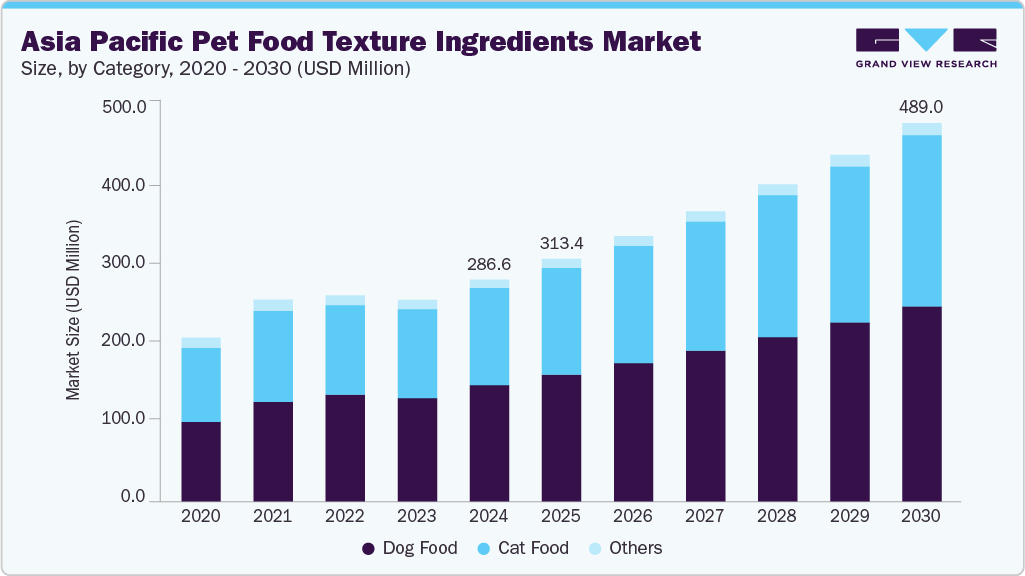

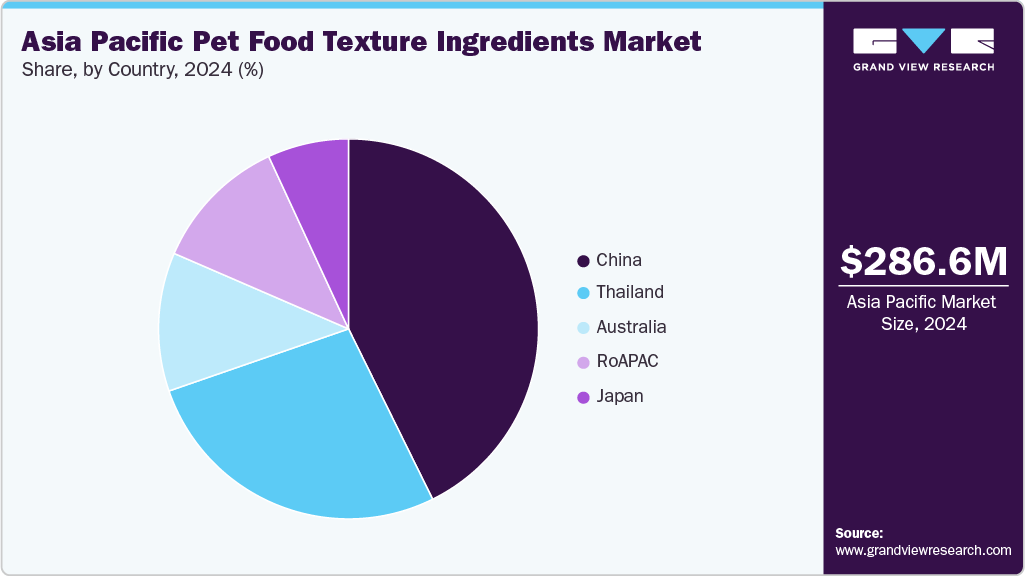

The Asia Pacific pet food texture ingredients market size was estimated at USD 286.6 million in 2024 and is projected to reach USD 489.0 million by 2030, growing at a CAGR of 9.3% from 2025 to 2030. The industry is driven by rising pet humanization and growing demand for premium, palatable pet foods.

Key Market Trends & Insights

- Thailand is expected to grow with the fastest CAGR of 9.9%, in terms of revenue, from 2025 to 2030.

- By category, the dog food segment dominated the market with a 52.5% revenue share in 2024.

- Based on dog food by form, treats are expected to grow with the fastest CAGR of 9.9%, in terms of revenue, from 2025 to 2030.

Market Size & Forecasts

- 2024 Market Size: USD 286.6 Million

- 2030 Projected Market Size: USD 489.0 Million

- CAGR (2025-2030): 9.3%

Increasing disposable incomes and a focus on enhanced texture and nutrition are prompting manufacturers to use advanced ingredients, boosting market growth. Another key driver for the market is the rapid expansion of the regional pet food manufacturing sector. Local producers are investing in innovative formulations to improve texture stability and shelf life. The growing adoption of wet and semi-moist pet food products further increases the demand for texture-modifying ingredients, strengthening market growth.

An emerging opportunity in the industry lies in the rising demand for natural and clean-label formulations. Consumers are increasingly seeking products free from artificial additives, driving innovation in plant-based and sustainable texture ingredients. This trend opens avenues for ingredient suppliers to develop eco-friendly, functional solutions that align with evolving consumer preferences.

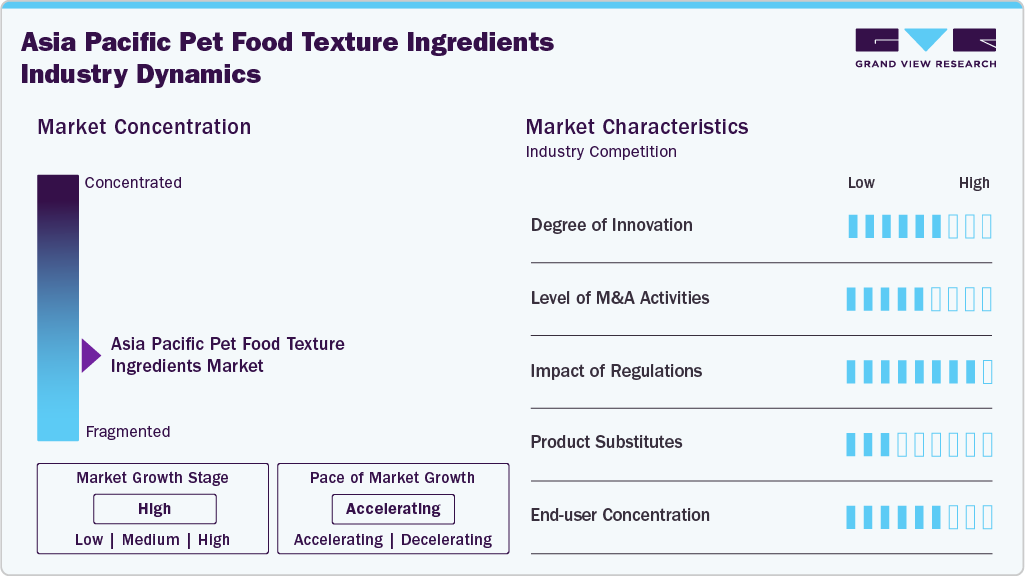

Market Concentration & Characteristics

The industry is moderately concentrated, with a mix of ingredient suppliers and strong regional players competing for market share. Key companies focus on product innovation, strategic partnerships, and capacity expansion to differentiate themselves in a competitive landscape. Market participants are leveraging advanced technologies to enhance ingredient functionality, such as improving texture, stability, and palatability in pet foods. The competitive environment encourages continuous R&D investment to meet evolving consumer preferences and regulatory standards.

Market characteristics are shaped by the growing demand for premium and functional pet foods across emerging economies like China. Manufacturers prioritize versatile ingredients that can be used in wet, dry, and semi-moist formulations, enhancing their appeal to pet owners. Price sensitivity varies by region, with premium segments driving innovation while value segments emphasize cost-effective solutions. Overall, the market demonstrates steady growth driven by urbanization, pet humanization trends, and increasing awareness of pet nutrition.

Category Insights

The dog food segment held the dominant position in the market, accounting for around 52.5% of the revenue share in 2024, driven by the high ownership rates of dogs across key countries such as China, Japan, and Australia. Strong demand for premium, palatable, and nutritionally balanced dog foods is encouraging manufacturers to incorporate advanced texture ingredients that enhance mouthfeel and product appeal. The segment benefits from established distribution channels and consistent consumer spending, reinforcing its leading market position.

The cat food segment is the fastest-growing category in the region with a CAGR of 9.9%, fueled by increasing cat ownership and a rising preference for specialized, high-quality formulations. Pet owners are increasingly investing in products that offer improved texture, palatability, and functional benefits such as hairball control and digestive support. This growth is prompting manufacturers to innovate with tailored texture ingredients, positioning the segment for strong revenue expansion over the forecast period.

Form Insights

Dog Dry Food

Under dog food, dry food dominated with a revenue share of 47.3% in 2024, due to its convenience, longer shelf life, and cost-effectiveness. Busy urban lifestyles and the preference for easy-to-store, ready-to-serve options are driving strong consumer adoption. Manufacturers are enhancing dry dog food with texture-improving ingredients to maintain palatability and nutritional quality. The combination of practicality and product innovation solidifies dry food as the leading form segment in the region.

Cat Treat Food

Under cat food, treats are the fastest-growing segment with a revenue CAGR of 11.7 %, driven by increasing consumer focus on pet bonding and indulgence. Cat owners are seeking convenient, portion-controlled snack options that provide both enjoyment and functional benefits, such as dental care and nutritional supplementation. This rising demand is encouraging manufacturers to develop innovative texture ingredients that enhance taste, crunchiness, and overall sensory appeal. The combination of premiumization and functional innovation positions treats for robust growth in the region.

Texture Ingredient Insights

Within the texture ingredient segment comprising modified starch, gums & hydrocolloids, and others, modified starch holds the dominant share, driven by its multifunctional properties that enhance texture performance, formulation stability, and product appeal in premium pet food applications.

Dog Wet Food by Texture Ingredient

Within the dog wet food segment by texture ingredient, modified starch is the fastest-growing segment with a revenue CAGR of 8.9%, driven by rising demand for smooth, palatable, and stable wet dog food products that maintain quality during storage and serving. Manufacturers are increasingly incorporating modified starch to enhance texture and overall product appeal. This trend is fueling the rapid growth of the segment in the region.

Cat Wet Food by Texture Ingredients

Gums and hydrocolloids are expected to see strong growth in the wet cat food segment, with a projected CAGR of 9.5%. This growth is driven by rising demand for wet cat foods that are smooth, cohesive, and easy to digest. Manufacturers are increasingly using gums to enhance texture, stability, and overall product quality. The trend toward premium, palatable formulations is supporting the rapid adoption of gums across the region.

Other Ingredient Insights

Dog Wet Food

Within the dry dog food segment by other Ingredients, native starch is the fastest-growing segment with a revenue CAGR of 9.6%. Its adoption is driven by rising demand for natural, clean-label ingredients that enhance kibble structure, texture consistency, and shelf life. Manufacturers are increasingly using native starch to deliver high-quality, palatable, and stable products. This trend is supporting the rapid growth of the segment across the region.

Cat Wet Food

Within the dry cat food segment by other ingredients, corn gluten meal is a significant segment, registering a revenue CAGR of 9.3%. Its growth is driven by demand for high-protein, functional ingredients that improve kibble texture and nutritional value. Manufacturers are incorporating corn gluten meal to enhance firmness, palatability, and overall product quality. This focus on functional, protein-rich formulations is supporting strong adoption in the region.

Country Insights

China Pet Food Texture Ingredients Market Trends

China dominated the market, accounting for a 42.7% revenue share in 2024, driven by rapid urbanization and rising disposable incomes, which have fueled growth in pet ownership and increased demand for premium, high-quality pet foods. This trend is encouraging local manufacturers to focus on improving product texture, palatability, and stability through innovative ingredients and advanced processing technologies. A clear example is the 2025 launch of TastePepAI, an artificial intelligence platform designed to optimize taste and texture in pet food formulations, enabling manufacturers to create more appealing and functional products. Similarly, international brands like ZIWI are expanding in China, introducing texture-enhanced, premium offerings that meet evolving consumer expectations. These developments highlight how innovation in texture ingredients and formulation strategies is central to sustaining China’s leading position in the market.

Thailand Pet Food Texture Ingredients Market Trends

The pet food texture ingredients market in Thailand is witnessing the fastest growth in the Asia Pacific, with a revenue CAGR of 9.9%, driven by the expanding demand for innovative and high-quality pet food products. Pet owners are increasingly seeking foods with enhanced texture, palatability, and functional benefits. This is prompting manufacturers to invest in advanced ingredient solutions to meet evolving consumer expectations.

Australia Pet Food Texture Ingredients Market Trends

The pet food texture ingredients market in Australia is fueled by a strong focus on natural and clean-label products. Consumers are increasingly prioritizing transparency, sustainability, and high-quality ingredients in pet nutrition. This trend is driving manufacturers to develop plant-based and functional texture solutions that align with health-conscious preferences. The emphasis on premium, eco-friendly formulations is supporting steady market expansion in the country.

Japan Pet Food Texture Ingredients Market Trends

The pet food texture ingredients market in Japan is primarily driven by the country’s strong preference for high-safety and scientifically formulated pet products. Strict regulatory standards and consumer focus on product reliability are pushing manufacturers to adopt advanced, high-quality texture ingredients. This emphasis on safety and precision in formulation positions Japan as a key market in the region.

Key Asia Pacific Pet Food Texture Ingredients Company Insights

Key players operating in the pet food texture ingredients market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

-

Cargill is a leading manufacturer and supplier of functional ingredients, including starches, gums, and other texture-enhancing solutions for wet and dry pet food. The company leverages its strong R&D capabilities and regional production facilities to develop ingredients that improve palatability, consistency, and shelf stability. With a robust presence across key markets such as China, Japan, and Australia, Cargill supports manufacturers in delivering high-quality, innovative pet food formulations that meet evolving consumer preferences.

-

Mars Incorporated is a major player known for its premium pet food brands and focus on product innovation. The company invests in advanced ingredient technologies to enhance texture, palatability, and nutritional quality across both wet and dry pet food formulations. With a strong presence in key markets such as China, Japan, and Australia, Mars leverages regional production and R&D capabilities to cater to the growing demand for high-quality, functional, and consumer-preferred pet food products.

Key Asia Pacific Pet Food Texture Ingredients Companies:

- Mars Incorporated

- Cargill, Incorporated

- Ingredion Incorporated

- Kemin Industries, Inc.

- Roquette Frères

- Tate & Lyle

- ADM

Recent Developments

-

In June 2025, Mars Petcare and Big Idea Ventures launched the 2025 Global Pet Food Innovation Program, partnering with AAK, Bühler, and Givaudan. The program is designed to drive sustainability in the pet food industry by supporting startups focused on innovative ingredients, eco-friendly fats and proteins, and cutting-edge processing methods.

-

In July 2025, WH Group acquired Poland-based pet food company Pupil Foods via its European arm, Morliny Foods, to diversify its portfolio and strengthen its presence in Europe’s growing Pet Food Texture Ingredient Market. Pupil Foods produces wet and dry pet food under brands like Pupil and Teo, operating two facilities in Poland and exporting to Europe, Asia, and the Middle East.

Asia Pacific Pet Food Texture Ingredients Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 313.4 million

Revenue forecast in 2030

USD 489.0 million

Growth rate

CAGR of 9.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Category, form, texture ingredients, other ingredients, country

Regional scope

Asia Pacific

Country scope

China, Japan, Thailand, Australia

Key companies profiled

Mars Incorporated; Cargill; Incorporated; Ingredion Incorporated; Kemin Industries, Inc.; Roquette Frères; Tate & Lyle; ADM

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Pet Food Texture Ingredients Market Report Segmentation

This report forecasts volume & revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific pet food texture ingredients market report based on category, form, texture ingredients, other ingredients, and country:

-

Category Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Dog Food

-

Cat Food

-

Other Pet Food

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Wet Food

-

Dry Food

-

Treats

-

-

Texture Ingredient Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Modified Starch

-

Gums & Hydrocolloids

-

-

Other Ingredient Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Native Starch

-

Corn Gluten Meal

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

China

-

Japan

-

Thailand

-

Australia

-

Frequently Asked Questions About This Report

b. The Asia Pacific food texture ingredients market size was estimated at USD 286.6 million in 2024 and is expected to reach USD 313.4 million in 2025.

b. The Asia Pacific food texture ingredients market is expected to grow at a compound annual growth rate of 9.3% from 2025 to 2030 to reach USD 489.0 million by 2030.

b. China dominated the Asia Pacific food texture ingredients market with a share of 42.7% in 2024, driven by rapid urbanization and rising disposable incomes, which have fueled growth in pet ownership and increased demand for premium, high-quality pet foods.

b. Some key players operating in the Asia Pacific food texture ingredients market include Mars Incorporated, Cargill, Incorporated, Ingredion Incorporated, Kemin Industries, Inc. , Roquette Frères, Tate & Lyle, ADM.

b. The market is driven by rising pet humanization and growing demand for premium, palatable pet foods. Increasing disposable incomes and focus on enhanced texture and nutrition are prompting manufacturers to use advanced ingredients, boosting market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.