- Home

- »

- Automotive & Transportation

- »

-

Automatic Number Plate Recognition System Market Report 2033GVR Report cover

![Automatic Number Plate Recognition System Market Size, Share & Trends Report]()

Automatic Number Plate Recognition System Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Hardware, Software), By End-use (Government, Commercial), By Application, By Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-075-0

- Number of Report Pages: 149

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automatic Number Plate Recognition System Market Summary

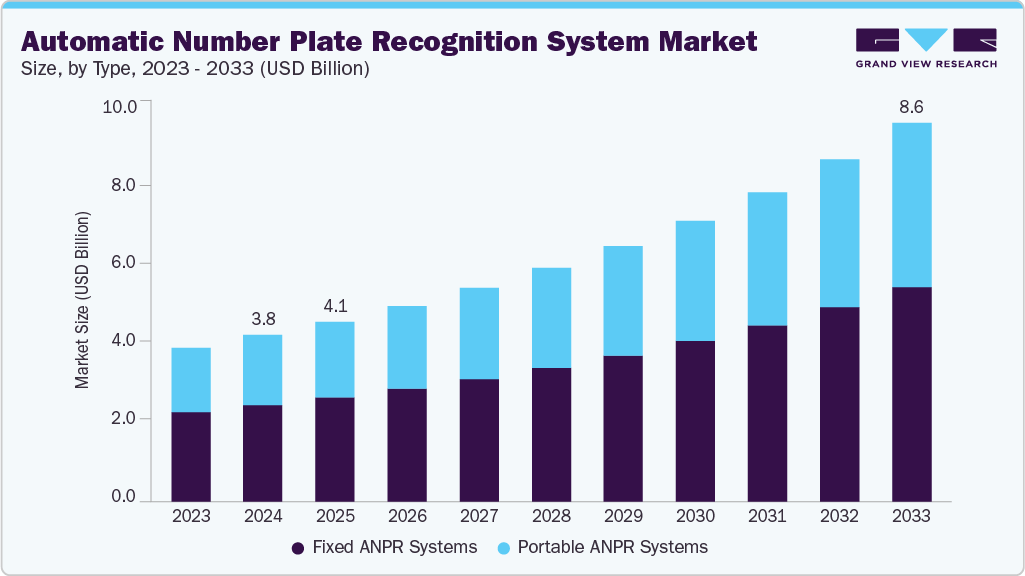

The global automatic number plate recognition system market size was estimated at USD 3.77 billion in 2024 and is projected to reach USD 8.59 billion by 2033, growing at a CAGR of 9.7% from 2025 to 2033. The market growth is driven by the adoption of advanced security measures across regions, the increasing demand for efficient traffic management in major cities worldwide, heightened concerns over national security, and a significant rise in vehicle theft and related criminal activities.

Key Market Trends & Insights

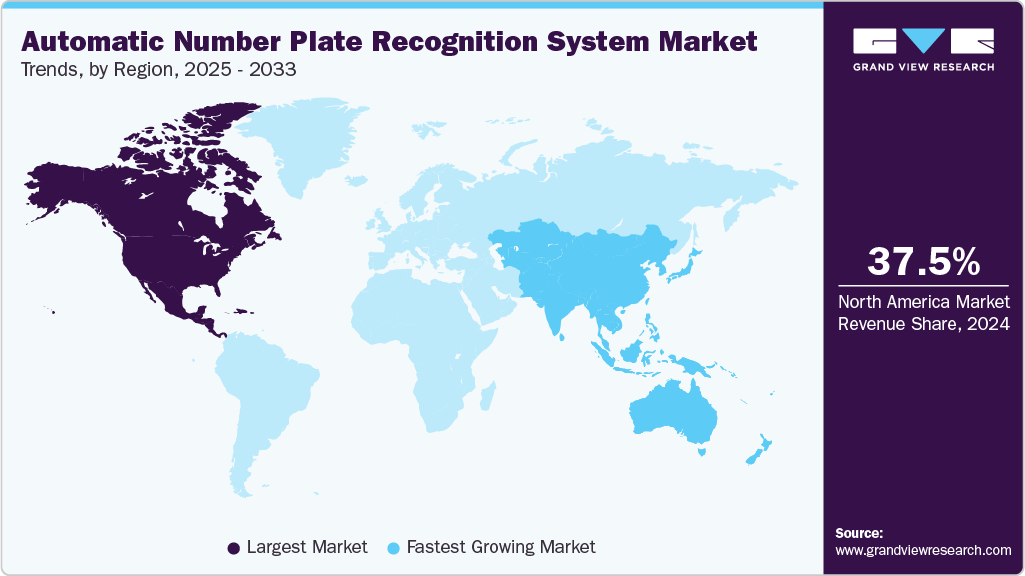

- North America dominated the automatic number plate recognition system industry and accounted for a share of 37.5% in 2024.

- The automatic number plate recognition system market in the U.S. held a dominant position in the region in 2024.

- By type, the fixed ANPR systems segment dominated the market in 2024 and accounted for the largest share of 57.9%.

- By component, the hardware segment held the largest market in 2024.

- By application, the traffic management segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.77 Billion

- 2033 Projected Market Size: USD 8.59 Billion

- CAGR (2025-2033): 9.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Advancements in surveillance technologies, innovations in imaging techniques, the easy availability and accessibility of camera-powered compact devices, and increasing concerns regarding public and critical infrastructure security are driving growth opportunities for the automatic number plate recognition system (ANPR) market. The rise in vehicle theft incidents and crimes committed using stolen vehicles generates an increased demand for automatic number plate recognition systems. The specific nature of the information associated with vehicle owners, linked to vehicle registration numbers displayed on number plates, makes these systems a preferred choice for multiple government agencies and security organizations. Automatic number plate recognition systems are also deployed on toll plazas and integrated with smart parking assistance systems in commercial buildings in numerous countries.The growing demand for stolen-vehicle tracking and crime prevention solutions is driving market expansion. Law enforcement agencies are increasingly adopting ANPR technology to strengthen surveillance and improve crime detection outcomes. These systems automatically capture and analyze vehicle license plate information, enabling rapid identification of stolen or suspicious vehicles. By cross-referencing plate data with real-time criminal databases, ANPR solutions allow authorities to monitor suspect movements and respond more effectively to potential threats.

The increasing adoption by multiple government agencies, including road transportation authorities, law enforcement divisions, and other relevant organizations, is anticipated to drive significant growth for the ANPR market in the coming years. For instance, in August 2024, Calsoft.Inc., a prominent technology company, partnered with NVIDIA Corporation to implement tollbooth automation and integrate advanced NVIDIA technologies with India’s significant digital payment system, the Unified Payments Interface. The solution delivered by the two is used to automatically read the number plates and collect toll charges from the UPI account of associated drivers. As part of the pilot, this newly designed solution is being deployed in multiple metropolitan areas nationwide.

One of the most significant challenges facing the ANPR market is ensuring data privacy and compliance with relevant regulations. ANPR systems collect and store sensitive information about vehicles and drivers, which is subject to stringent privacy laws and regulations in various regions. Compliance with frameworks such as the GDPR in Europe, the CCPA in the U.S., and other local data protection regulations requires careful handling of data, secure storage, and strict access protocols. Failure to comply can result in heavy penalties, legal liabilities, and reputational damage for vendors and end-users. Addressing these concerns is critical for market players to gain trust, ensure compliance, and facilitate widespread adoption of ANPR solutions.

Type Insights

The fixed ANPR systems segment dominated the market in 2024, accounting for the largest share of 57.9%. Extensively used fixed ANPR systems are characterized by advanced imaging technology permanently installed in a particular location for tracking & monitoring, data collection, real-time data analysis, and sharing of insights. The type of ANPR is often installed on border crossings where road traffic passes through territories of two or more nations, toll collection plazas for automated processes, advanced parking spaces, and surveillance points for public security and commercial premises. The growth in demand from government agencies, commercial buildings, the military & defense industry, security services companies, the facility management sector, and the hospitality industry is expected to drive the growth of this segment during the forecast period.

The portable ANPR systems segment is expected to grow at the fastest CAGR over the forecast period. Portable ANPR systems are primarily used by law enforcement agencies and specific security department vehicle fleets to enhance surveillance and security. Advancements such as the ability to scan multiple number plates per second, the capacity to perform in low-light or visibility conditions, and more are contributing to the growth potential. Increasing security patrol deployments in urban areas, rising concerns regarding commercial premises' security, and the growing adoption by multiple military and defense departments are contributing to the growth of this segment.

Component Insights

The hardware segment held the largest market share in 2024. High-performance hardware components support the use of advanced imaging technology and smart sensors, including an ANPR computer/processor, camera, frame grabber, and relay cards. The abilities of hardware components directly influence the imaging quality, speed, efficacy, range, reliability, and other aspects of the ANPR system. With growing demand from multiple commercial buildings in metro cities, public security surveillance systems and other industries are likely to experience growth for this segment. Furthermore, continuous upgrades, reinstallations, and repairs contribute to the demand.

The software segment is expected to grow at the fastest CAGR of 10.9% during the forecast period. ANPR software is central to processing, analyzing, and managing vehicle and license plate data, enabling applications in traffic monitoring, toll management, parking enforcement, and logistics yard management. This growth can be attributed to the growing requirement for sophisticated software solutions that can integrate with modern technologies such as the Internet of Things (IoT), Artificial Intelligence (AI), Machine Learning (ML), and the emergence of advanced solutions, the launch of innovation-backed software offerings by key players, and need for a robust system to address diversified nature of number plate displays.

Application Insights

The traffic management segment dominated the market in 2024. Traffic management applications of ANPR systems focus on monitoring and optimizing vehicular flow, reducing congestion, and enhancing road safety. The segment’s growth can be attributed to the increasing use of ANPR systems in automated processes, such as toll collections, speed limit violation detection, and other incidents related to enforcing traffic rules and regulations. The rise in road traffic in urban areas of both developed and developing countries, the increasing number of vehicle theft incidents, and the demand from facility management organizations and municipal authorities for enhanced traffic management are key growth-driving factors for this market.

The security and surveillance segment is expected to grow at the fastest CAGR during the forecast period. The security and surveillance application of ANPR systems focuses on monitoring public spaces, critical infrastructure, and other sensitive areas to enhance safety. These systems play a key role in preventing criminal and terrorist activities by providing real-time vehicle identification and tracking capabilities. Growing incidents of vehicle-related crimes and rising public security concerns are driving the greater adoption of this technology by law enforcement agencies. As a result, ANPR technology is increasingly being utilized to support surveillance operations, enhance crime investigation processes, and facilitate effective preventive security measures.

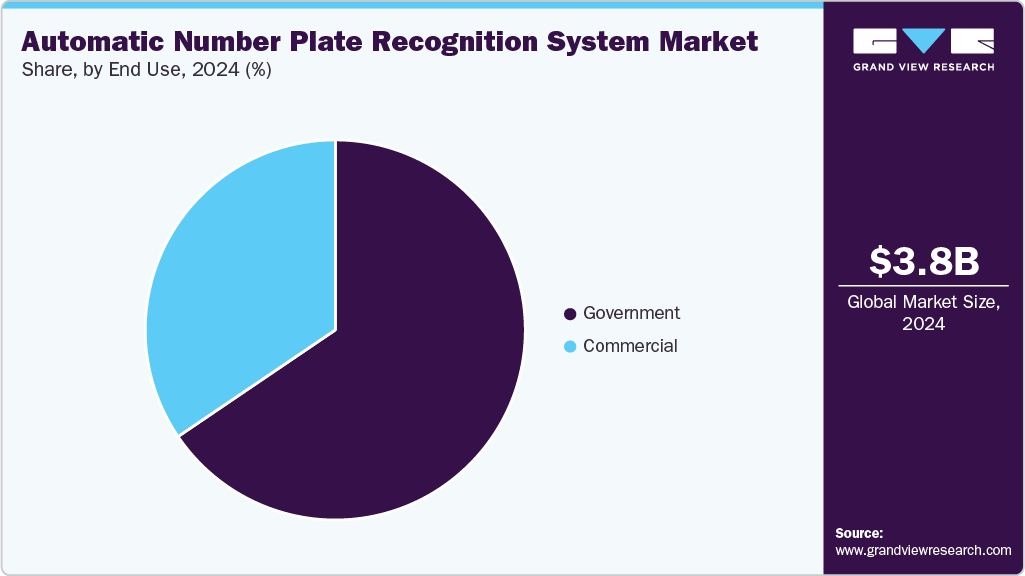

End Use Insights

The government segment dominated the market in 2024. Multiple agencies in countries including the U.S., European nations, India, China, Japan, and others have trusted advanced ANPR systems as a valuable aid in implementing their traffic management and security surveillance initiatives. Law enforcement patrol vehicles, toll collection plazas, traffic signals, crowded urban spaces, tourist attraction points, critical infrastructure properties, entry and exit points of federal buildings, facilities used for official government operations, and other areas are common locations where governments worldwide utilize ANPR systems.

The commercial segment is expected to witness the fastest CAGR over the forecast period. Advanced ANPR systems are widely used across commercial buildings, smart parking facilities, and other secured private sites. Key adopters include data centers, banks, financial institutions, and large manufacturing plants where controlled access and monitoring are critical. The systems are also deployed at vendor and supplier sites supporting the military and defense sector, as well as in hospitals and healthcare environments. In addition, research and development institutions working in sensitive areas, such as clinical testing, scientific innovation, weapons development, and AI, rely on ANPR solutions to strengthen security and ensure restricted access.

Regional Insights

North America dominated the automatic number plate recognition system industry, accounting for a 37.5% share in 2024, driven by high adoption across law enforcement, commercial, and critical infrastructure applications. Advanced surveillance requirements, rising security threats, and stringent regulatory frameworks are driving investment in ANPR technology. The region benefits from well-established technology infrastructure and strong R&D capabilities, facilitating innovation in AI-enabled ANPR solutions.

U.S. Automatic Number Plate Recognition System Market Trends

The automatic number plate recognition system market in the U.S. held a dominant position in the region in 2024. The U.S. is one of the largest ANPR markets globally, with widespread adoption by federal, state, and local law enforcement agencies. ANPR technology is widely deployed for detecting stolen vehicles, enforcing traffic laws, and monitoring public safety. The presence of advanced technology vendors and ongoing investments in smart city initiatives, intelligent transportation systems, and AI-based surveillance are key drivers of growth behind the country’s development.

Europe Automatic Number Plate Recognition System Market Trends

The automatic number plate recognition system market in Europe is expected to register a moderate CAGR from 2025 to 2033. Regulatory requirements for traffic monitoring, public safety, and border control drive the regional growth. Government initiatives aimed at reducing vehicle-related crimes and improving road safety are supporting market expansion. Technological advancements, such as AI-powered recognition and cloud-based analytics, are further strengthening the market’s potential.

The UK automatic number plate recognition system market is expected to grow at a significant CAGR from 2025 to 2033. The UK has emerged as a significant ANPR market in Europe, with widespread deployment by law enforcement agencies and transportation authorities. The technology is extensively used for traffic monitoring, congestion management, and crime prevention initiatives. Public safety programs, coupled with government investment in smart city infrastructure, are driving market growth. In addition, private sector adoption in commercial buildings, parking facilities, and critical infrastructure further contributes to demand.

The automatic number plate recognition system market in Germany held a substantial market share in 2024, driven by its focus on intelligent transportation systems, traffic safety, and urban mobility solutions. Law enforcement agencies rely on ANPR systems for vehicle tracking, crime prevention, and highway monitoring. Investments in smart city projects, as well as the integration of AI and IoT technologies into surveillance solutions, are further driving market growth.

Asia Pacific Automatic Number Plate Recognition System Market Trends

The automatic number plate recognition system market in the Asia Pacific is expected to grow at a fastest CAGR of 11.3% during the forecast period, driven by increasing urbanization, rising vehicle ownership, and growing investments in smart city initiatives. Governments across the region are adopting ANPR technology to enhance traffic management, strengthen law enforcement capabilities, and improve public safety.

India automatic number plate recognition system market is expected to grow at a notable rate during the forecast period due to its rapidly expanding urban population and increasing vehicle density. Law enforcement agencies are increasingly deploying ANPR technology to track stolen vehicles, enforce traffic regulations, and enhance public security. The government's focus on smart city projects, highway modernization, and intelligent transportation systems (ITS) is boosting market adoption.

The automatic number plate recognition system market in China held a substantial market share in 2024, supported by extensive government initiatives in traffic management, smart city development, and surveillance infrastructure expansion. The country is witnessing widespread deployment of ANPR systems for toll collection, urban traffic monitoring, and public security enforcement.

Key Automatic Number Plate Recognition System Company Insights

Some of the key companies in the automatic number plate recognition system industry include Genetec Inc., Kapsch TrafficCom AG, and Siemens AG, among others. Strategic partnerships and new product launches have become a key competitive strategy to accelerate integration into new vehicle models.

-

Genetec Inc. is a technology company that provides a unified platform for physical security, public safety, and operations solutions. Their flagship product, Security Center, integrates IP video surveillance, access control, and automatic license plate recognition into a single, open-architecture system. The company offers cloud-based services and solutions for various industries, including retail, transportation, and government, through a global network of resellers and partners.

-

Kapsch TrafficCom AG is a global provider of intelligent transportation systems, providing innovative solutions that promote sustainable mobility. The company develops and delivers electronic toll collection and traffic management technologies designed to create a future free from congestion. Operating in over 50 countries across the Americas, Europe, the Middle East, and the Asia-Pacific region, the company offers end-to-end ITS solutions, ranging from system components to full-scale operations. With a mission to advance sustainable mobility, the company helps city authorities and highway operators enhance road efficiency, reduce emissions, and optimize urban infrastructure through cutting-edge ITS innovations.

Key Automatic Number Plate Recognition System Companies:

The following are the leading companies in the automatic number plate recognition system market. These companies collectively hold the largest market share and dictate industry trends.

- Adaptive Recognition Inc.

- Axis Communications AB

- Genetec Inc.

- Kapsch TrafficCom AG

- Robert Bosch GmbH

- Leonardo US Cyber and Security Solutions, LLC

- Tattile s.r.l.

- Siemens AG

- Vaxtor Ltd

- NDI Recognition System

Recent Developments

-

In July 2025, Adaptive Recognition Inc. expanded its Einar camera family with the Einar Super Tele, a long-range ANPR+MMR camera capable of recognizing vehicle make, color, model, category, body type, and generation. Designed for modern, infrastructure-sensitive environments, it delivers powerful performance while supporting seamless, frictionless operations.

-

In February 2025, Kapsch TrafficCom AG, a major player in tolling systems across North America, launched its latest automatic number plate recognition engine. This advanced technology is designed to deliver enhanced performance, greater versatility, and improved cost efficiency, establishing a new standard in license plate recognition.

Automatic Number Plate Recognition System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.09 billion

Revenue forecast in 2033

USD 8.59 billion

Growth rate

CAGR of 9.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, component, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Adaptive Recognition Inc.; Axis Communications AB; Genetec Inc.; Kapsch TrafficCom AG; Robert Bosch GmbH; Leonardo US Cyber and Security Solutions, LLC; Tattile s.r.l.; Siemens AG; Vaxtor Ltd; NDI Recognition System

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automatic Number Plate Recognition System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global automatic number plate recognition system market report based on type, component, application, end use, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Fixed ANPR Systems

-

Portable ANPR Systems

-

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Software

-

Service

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Security & Surveillance

-

Toll Management

-

Parking Management

-

Traffic Management

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Government

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automatic number plate recognition system market size was estimated at USD 3.77 billion in 2024 and is expected to reach USD 4.09 billion in 2025.

b. The global automatic number plate recognition system market is expected to grow at a compound annual growth rate of 9.7% from 2025 to 2033 to reach USD 8.59 billion by 2033.

b. The fixed ANPR systems segment dominated the market in 2024 and accounted for the largest share of 57.9%. The growth in demand from government agencies, commercial buildings, the military & defense industry, security services companies, the facility management sector, and the hospitality industry is expected to drive the growth of this segment during the forecast period.

b. Some key players operating in the automatic number plate recognition system market include Adaptive Recognition Inc., Axis Communications AB, Genetec Inc., Kapsch TrafficCom AG, Robert Bosch GmbH, Leonardo US Cyber and Security Solutions, LLC, Tattile s.r.l., Siemens AG, Vaxtor Ltd, and NDI Recognition System

b. Key factors that are driving the market growth include growing public-private partnerships for the development of smart cities, increasing number of parking facilities, and rising adoption of Electronic Toll Collection (ETC) systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.