- Home

- »

- Next Generation Technologies

- »

-

Automotive Operating System Market, Industry Report, 2033GVR Report cover

![Automotive Operating System Market Size, Share & Trends Report]()

Automotive Operating System Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Android, Linux, QNX, Windows), By Vehicle Type (Passenger Cars, Commercial Vehicles), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-334-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Operating System Market Summary

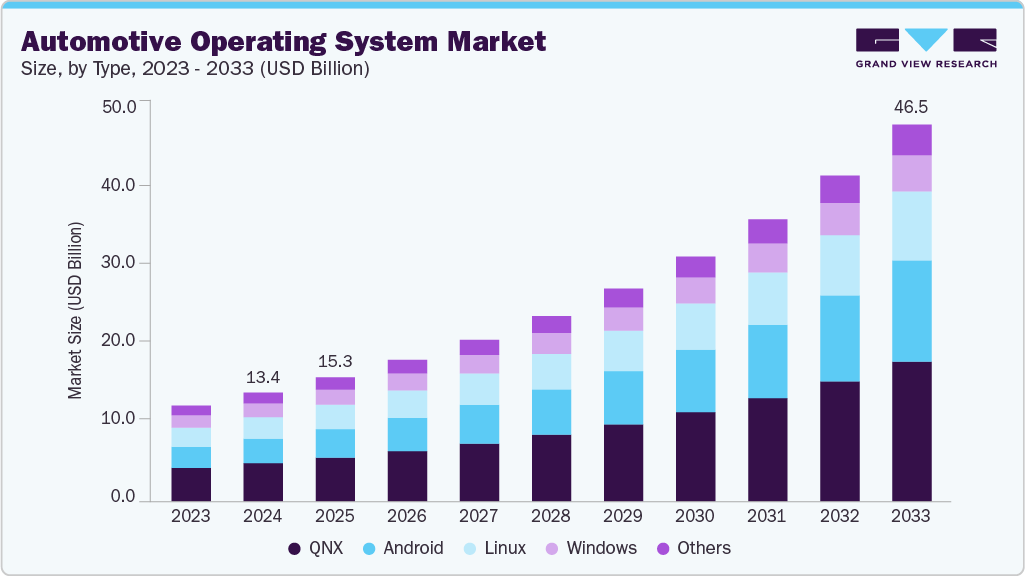

The global automotive operating system market size was estimated at USD 13.44 billion in 2024 and is projected to reach USD 46.53 billion by 2033, growing at a CAGR of 14.9% from 2025 to 2033. The industry is being driven by several key factors.

Key Market Trends & Insights

- North America dominated the global automotive operating system market with the largest revenue share of 30.2% in 2024.

- The automotive operating system market in the U.S. led the North America market and held the largest revenue share in 2024.

- By type, QNX led the market, holding the largest revenue share of 35.1% in 2024.

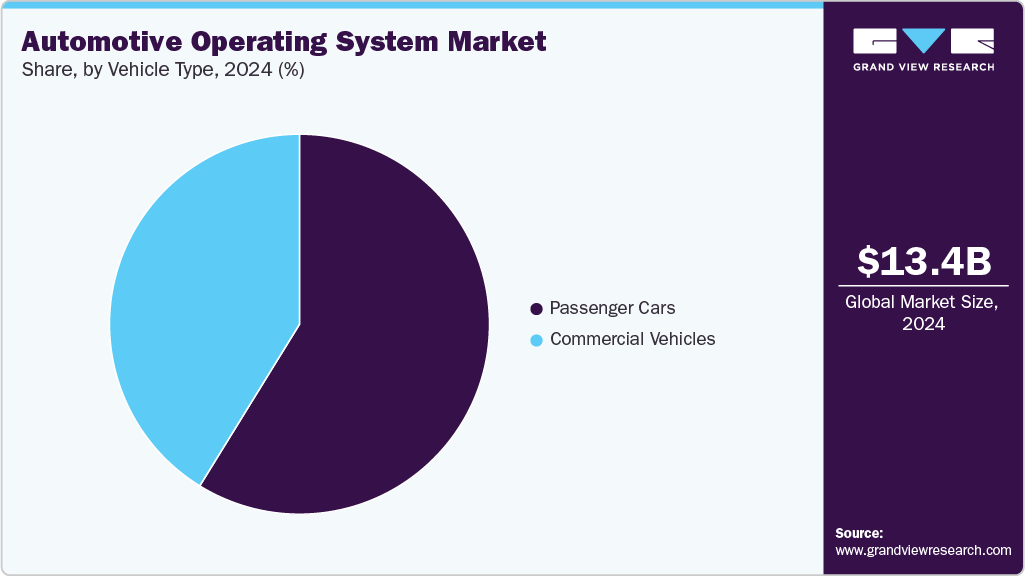

- By vehicle type, passenger cars held the dominant position in the market.

- By application, the ADAS & safety system segment held the dominant position in the market.

Market Size & Forecast

- 2024 Market Size: USD 13.44 Billion

- 2033 Projected Market Size: USD 46.53 Billion

- CAGR (2025-2033): 14.9%

- North America: Largest Market in 2024

- Asia Pacific: Fastest Growing Market

Increasing vehicle connectivity is at the forefront, with growing demand for connected car services and integration with personal devices. The rise of autonomous driving technologies necessitates advanced operating systems capable of handling complex algorithms and real-time decision-making.Consumers' expectations for advanced in-vehicle infotainment, mirroring smartphone-like experiences, are also pushing innovation. Additionally, the need for improved safety features, including advanced driver assistance systems and real-time monitoring, is a significant driver. The ongoing electrification of vehicles is another crucial factor, requiring specialized operating systems to manage battery systems, optimize energy consumption, and support EV-specific features.

There's a notable shift toward open-source platforms such as Android Automotive OS, fostering increased collaboration between automakers and tech companies. This move is enabling faster development cycles and greater customization options. The integration of AI and machine learning is becoming more prevalent, enhancing everything from voice assistants to autonomous driving capabilities. Cloud connectivity and over-the-air updates are increasingly important, allowing for remote software updates and opening new revenue streams through subscription-based services.

Cybersecurity has become a critical focus area, with increased emphasis on protecting connected vehicles from cyber threats and implementing secure communication protocols. Lastly, standardization efforts are gaining momentum, with initiatives such as AUTOSAR and industry-wide collaborations aimed at creating common platforms and standards for autonomous driving and vehicle data communication. These trends are collectively driving the development of more advanced, connected, and feature-rich vehicles, pushing the automotive industry towards more powerful and flexible operating systems that can meet the demands of modern and future vehicles.

Type Insights

The QNX segment dominated the market with a share of over 35.1% in 2024. This growth can be attributed to several factors, such as real-time capabilities, microkernel architecture, and robust safety certifications. These characteristics make the QNX operating system particularly well-suited for critical automotive systems, including advanced driver assistance systems (ADAS) and autonomous driving features. QNX's long-standing presence in the automotive industry, coupled with its proven track record in safety-critical environments, has led many automakers to trust and implement this operating system in their vehicles. Additionally, QNX's ability to support a wide range of hardware platforms and its optimization for low-latency operations have contributed to its significant market share.

The Android segment is expected to register a significant CAGR over the forecast period. The increasing consumer demand for seamless integration between vehicles and mobile devices aligns well with Android's ecosystem and familiarity. Google's introduction of Android Automotive OS, a full-stack, open-source platform designed specifically for in-vehicle infotainment systems, has garnered significant interest from automakers. This platform offers a more customizable and feature-rich environment compared to traditional automotive operating systems. The vast Android app ecosystem and the ease of app development for this platform are attractive to both automakers and third-party developers, potentially leading to a more diverse and rapidly evolving in-car software landscape. Furthermore, Android's strong position in the mobile market and Google's continued investment in automotive technologies, including autonomous driving and connected car services, are likely to fuel its adoption and growth in the automotive sector over the forecast period.

Application Insights

The ADAS & Safety System segment dominated the market in 2024. The dominance of these systems reflects the industry's growing focus on vehicle safety and the progression toward autonomous driving. This segment's prominence is driven by stringent safety regulations, increasing consumer demand for advanced safety features, and the automotive industry's push toward higher levels of vehicle autonomy. ADAS features such as adaptive cruise control, lane departure warnings, automatic emergency braking, and parking assistance have become increasingly common in modern vehicles, necessitating robust operating systems capable of real-time processing and decision-making. The complexity and critical nature of these systems require highly reliable, secure, and fast-responding operating systems, contributing to the segment's significant market share.

The connected services segment is expected to register a significant CAGR over the forecast period. The growth of connected services in the automotive operating system market is driven by increasing demand for real-time vehicle data analytics, over-the-air (OTA) updates, and enhanced in-vehicle connectivity for infotainment, navigation, and telematics. Automakers are integrating cloud-based platforms and 5G connectivity to enable personalized user experiences, predictive maintenance, and seamless integration with digital ecosystems.

Vehicle Type Insights

Passenger cars dominated the market in 2024 as they represent the largest volume of vehicles produced and sold globally, providing a vast market for automotive OS implementation. The consumer demand for advanced infotainment systems, connectivity features, and driver assistance technologies in personal vehicles has been a significant driver. Automakers have been quick to adopt advanced operating systems in passenger cars to meet these expectations and differentiate their products in a competitive market. Additionally, the rapid advancement of electric and hybrid passenger vehicles has necessitated more complex operating systems to manage power distribution, battery systems, and related features, further boosting the segment's market share.

The commercial vehicle segment is expected to register the highest CAGR over the forecast period. The commercial vehicle segment in the automotive operating system market is driven by the growing demand for connected fleet management, predictive maintenance, and autonomous driving capabilities. Increasing adoption of telematics, real-time diagnostics, and over-the-air (OTA) software updates enhances operational efficiency and vehicle uptime. Moreover, regulatory mandates for emission monitoring and driver safety further accelerate OS integration in commercial fleets.

Regional Insights

North America automotive operating system industry dominated with a revenue share of over 30.0% in 2024. The North American market is characterized by rapid technological adoption and a strong focus on connectivity and autonomous driving. The region's well-developed automotive industry, coupled with the presence of major tech companies, is driving innovation in vehicle software platforms. Additionally, the region is witnessing increased investment in electric vehicle technologies, which is driving the need for specialized operating systems to manage battery performance and charging infrastructure. Subsequently, fostering market growth over the coming years.

U.S. Automotive Operating System Market Trends

The automotive operating system industry in the U.S. is expected to grow significantly. The U.S., as a leader in both automotive and technology sectors, is at the forefront of automotive operating system innovation. There's a strong emphasis on AI and machine learning integration, particularly for enhancing voice recognition, predictive maintenance, and autonomous driving capabilities. There's a growing trend towards open-source solutions, with many automakers adopting Android Automotive OS or developing their own Linux-based systems to offer customizable user experiences and subscription-based services.

Europe Automotive Operating System Market Trends

The automotive operating system market in Europe is expected to grow significantly over the forecast period. Europe's automotive operating system market is characterized by a strong focus on standardization, interoperability, and compliance with stringent regulatory requirements. The region is seeing a significant push towards open-source platforms, with various initiatives such as GENIVI and AUTOSAR gaining traction. There's a significant increase in prominence in the development of software-defined vehicles, with European automakers investing heavily in proprietary OS development to maintain control over the user experience and data. Additionally, there's a strong trend toward seamless integration of mobility services and public transportation information within vehicle infotainment systems, reflecting Europe's integrated approach to transportation.

Asia Pacific Automotive Operating System Market Trends

The automotive operating system industry in the Asia Pacific region is anticipated to be at the fastest CAGR over the forecast period. The Asia Pacific region's automotive operating system market is characterized by rapid growth and technological innovation, driven largely by China's booming automotive sector and Japan's advanced manufacturing capabilities. There's a strong focus on developing localized solutions, with domestic tech giants such as Baidu and Alibaba creating their own automotive OS platforms. There's also a growing emphasis on connected car technologies and smart city integration, with V2X (Vehicle-to-Everything) communication becoming increasingly important. The region is also witnessing increased collaboration between automakers and tech companies, fostering innovation in areas such as autonomous driving and AI-powered user interfaces. Additionally, the diverse market conditions across the region are driving the development of scalable OS solutions that can cater to both premium and budget vehicle segments.

Key Automotive Operating System Company Insights

Key players operating in the automotive operating system market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth. Some key companies in the Automotive Operating System market are BlackBerry Limited, and NVIDIA Corporation

-

BlackBerry Limited dominates the automotive operating system landscape, powering over 235 million vehicles globally. Its QNX Neutrino RTOS and QNX Hypervisor are industry standards for functional safety (ISO 26262 ASIL-D), cybersecurity, and real-time performance. QNX is widely adopted by major OEMs such as Volkswagen, BMW AG, Ford Motor Company, Toyota Motor Corporation, and Hyundai Motor Company, and is integrated into ADAS, digital cockpit, and infotainment systems. The company’s consistent collaborations with semiconductor companies such as Qualcomm Incorporated and NXP Semiconductors N.V. further strengthen its embedded software position.

-

NVIDIA Corporation is a key player in the Automotive Operating System market. through its NVIDIA DRIVE OS, a foundational platform for autonomous driving, AI-based perception, and infotainment. DRIVE OS provides a unified software stack integrating CUDA, TensorRT, and Vulkan APIs, supporting real-time compute for Level 2-4 autonomous systems. Partnerships with Mercedes-Benz Group AG, Volvo Car Corporation, and BYD Company Limited reinforce its strategic positioning in next-generation software-defined vehicles. NVIDIA Corporation’s integration of AI, digital twins, and simulation environments makes it a pivotal player in the shift toward software-centric automotive architectures.

Key Automotive Operating System Companies:

The following are the leading companies in the automotive operating system market. These companies collectively hold the largest Market share and dictate industry trends.

- BlackBerry Limited

- Microsoft

- Alphabet

- Apple Inc.

- NVIDIA Corporation

- Green Hills Software

- Elektrobit

- Robert Bosch GmbH

- Wind River Systems, Inc.

- Baidu, Inc.

Recent Developments

-

In June 2025, NXP Semiconductors N.V. announced the acquisition of TTTech Auto GmbH, to strengthen its position in the automotive operating system market. The deal aims to accelerate software-defined vehicle development by combining NXP Semiconductors N.V.’s high-performance processors with TTTech Auto GmbH’s expertise in safety-critical automotive middleware and real-time networking solutions.

-

In May 2025, Volvo Cars and Google LLC expanded their strategic partnership to integrate Google’s Gemini AI into Volvo vehicles equipped with Android Automotive OS. This collaboration enhances in-car intelligence, enabling natural voice interaction, predictive navigation, and personalized driver assistance, reinforcing Volvo’s focus on connected, AI-driven mobility experiences.

-

In January 2024, BlackBerry Limited introduced QNX Sound, a novel platform that decouples acoustics software and audio from vehicle hardware. This new technology gives audio designers and engineers unprecedented creative flexibility to craft unique in-vehicle sound experiences. QNX Sound is pre-integrated with BlackBerry's QNX Hypervisor and QNX Real-Time Operating System (RTOS). A key feature of the platform is its audio extension system, which allows third-party signal processing providers to assemble and deploy their C-code algorithms directly. This development represents a significant advancement in automotive audio technology, potentially transforming how manufacturers approach sound design in vehicles.

Automotive Operating System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.30 billion

Revenue forecast in 2033

USD 46.53 billion

Growth rate

CAGR of 14.9% from 2025 to 2033

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, vehicle type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

BlackBerry Limited; Microsoft; Alphabet; Apple Inc.; NVIDIA Corporation; Green Hills Software ; Elektrobit; Robert Bosch GmbH; Wind River Systems, Inc.; Baidu, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Automotive Operating System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global automotive operating system market report based on type, vehicle type, application, and region:

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Android

-

Linux

-

QNX

-

Windows

-

Others

-

-

Vehicle Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Passenger Cars

-

Commercial Vehicles

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Infotainment System

-

ADAS & Safety System

-

Connected Services

-

Body Control & Comfort System

-

Engine Management & Powertrain Control

-

Communication & Telematics

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive operating system market size was estimated at USD 11.83 billion in 2023 and is expected to reach USD 13.44 billion in 2024.

b. The global automotive operating system market is expected to grow at a compound annual growth rate of 14.5% from 2024 to 2030 to reach USD 30.21 billion by 2030.

b. North America dominated the automotive operating system market with a share of 30.3% in 2023. This is attributable to the region's well-developed automotive industry, coupled with the presence of major tech companies, and increased investment in electric vehicle technologies

b. Some key players operating in the automotive operating system market include BlackBerry Limited, Microsoft Corporation, Alphabet Inc., Apple Inc., Wind River Systems, Inc., Hitex GmbH, Bayerische Motoren Werke AG, Baidu, Inc., NVIDIA Corporation, Green Hills Software

b. Key factors that are driving the market growth include increasing vehicle connectivity, growth of autonomous driving technologies, rising demand for in-vehicle infotainment, and need for improved safety features

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.