- Home

- »

- Animal Health

- »

-

Ayurveda Veterinary Medicine Market, Industry Report, 2033GVR Report cover

![Ayurveda Veterinary Medicine Market Size, Share & Trends Report]()

Ayurveda Veterinary Medicine Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Pharmaceuticals, Nutritional Supplements), By Animal (Companion Animals, Production Animals), By Route of Administration (Oral, Topical), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-790-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ayurveda Veterinary Medicine Market Summary

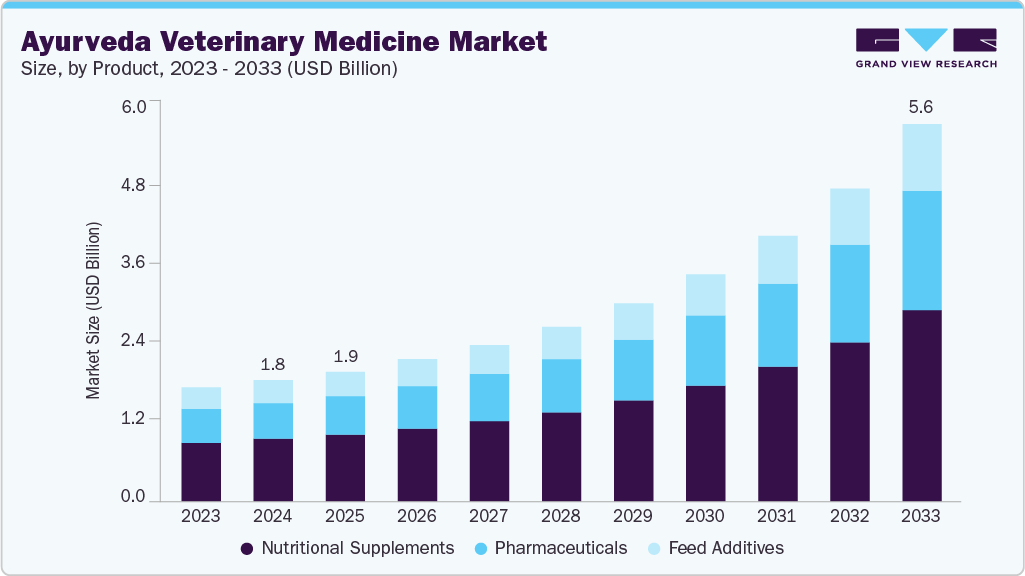

The global Ayurveda veterinary medicine market size was estimated at USD 1.80 billion in 2024 and is projected to reach USD 5.61 billion by 2033, growing at a CAGR of 14.30% from 2025 to 2033. The market growth is driven by rising preference for natural and holistic animal care, increasing concerns over antimicrobial resistance (AMR) and supportive regulatory approvals and government initiatives.

Key Market Trends & Insights

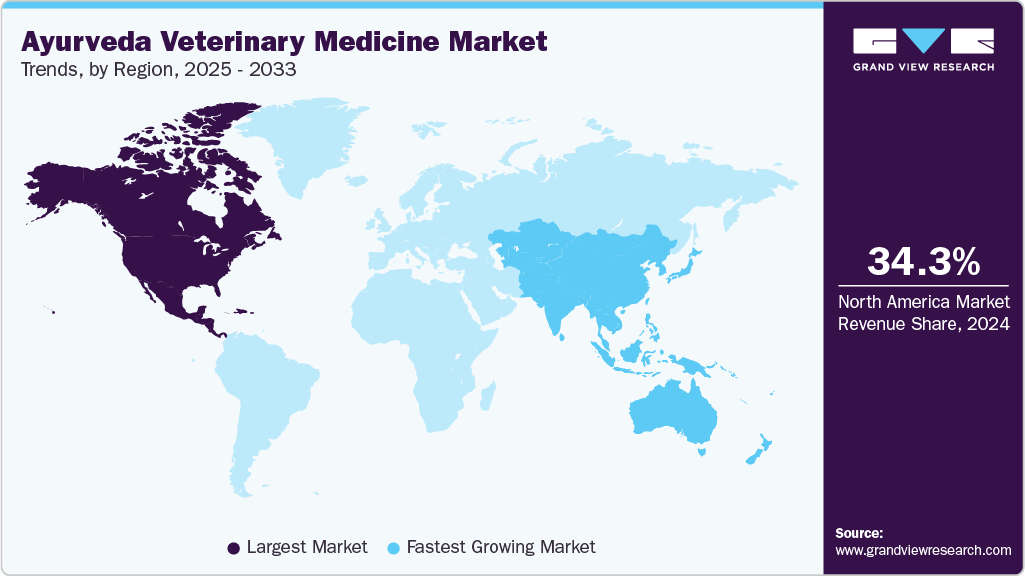

- North America market for Ayurveda veterinary medicine held the largest revenue share of 34.29% in 2024 in the global market.

- U.S. dominated the North America region with the largest revenue share in 2024.

- By product, the nutritional supplements segment held the largest revenue share of 51.39% of the market in 2024.

- By animal, the production animals segment held the largest revenue share in the market in 2024.

- Based on route of administration, the oral segment held the largest market share in 2024.

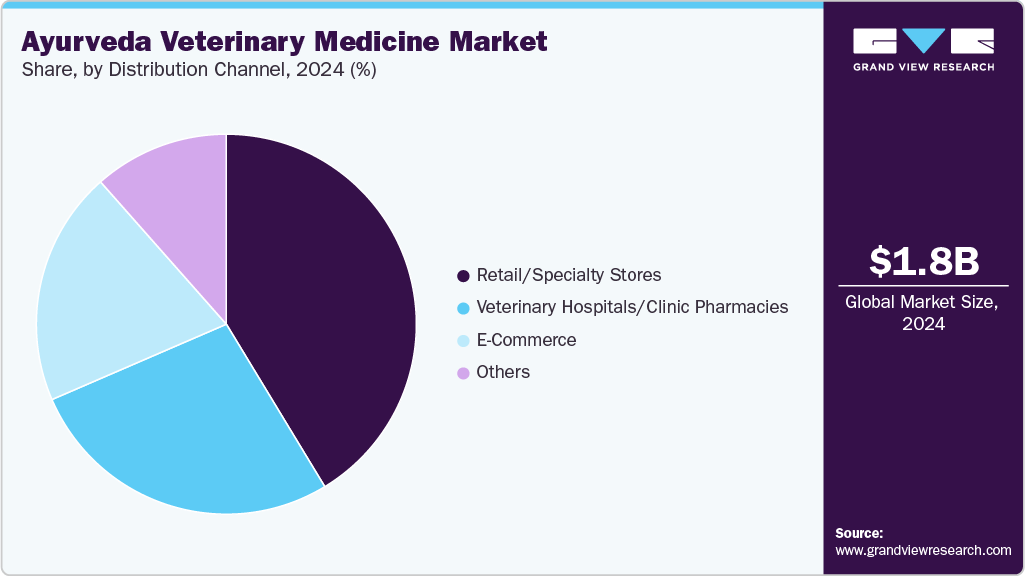

- By distribution channel, the retail/specialty stores held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.80 Billion

- 2033 Projected Market Size: USD 5.61 Billion

- CAGR (2025-2033): 14.30%

- North America region: Largest market in 2024

- Asia Pacific region: Fastest growing market

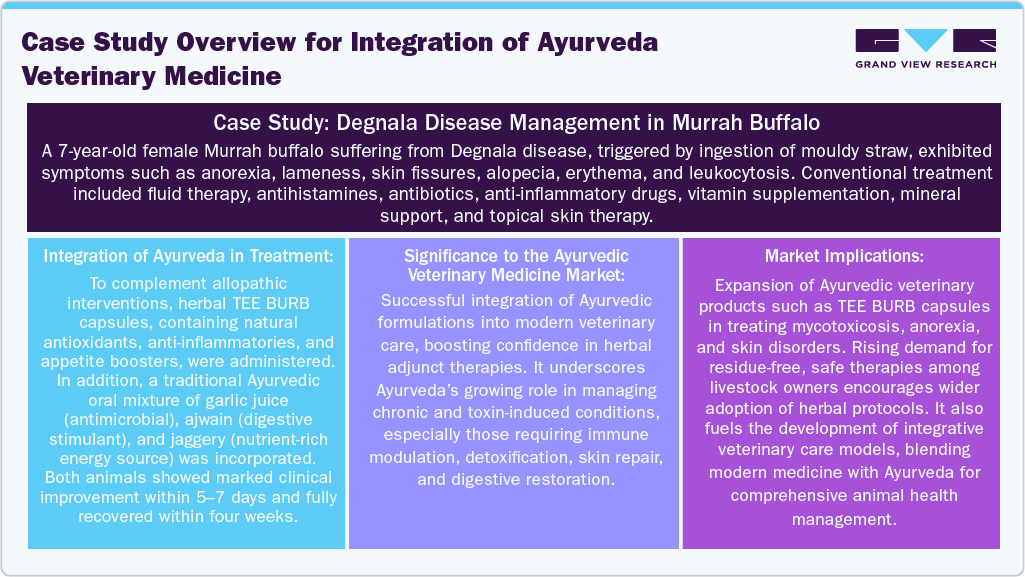

Growing awareness among pet owners and livestock farmers about the potential side effects of chemical-based veterinary drugs is creating a strong inclination toward natural, safe, and holistic treatments. Global trends in wellness and herbal therapy are influencing animal healthcare purchasing decisions, especially in emerging economies. For instance, in June 2025, experts of Agrovet highlighted Veterinary Ayurveda as a sustainable, observation-based science offering eco-friendly solutions, zoonotic threats, and industrial farming fatigue, advocating its integration in modern animal healthcare. This demonstrated increasing preference for nature-derived, holistic animal wellness solutions over synthetic chemical treatments. This shift encourages higher demand for Ayurveda veterinary medicines that are plant-based, free from antibiotics, and focus on overall animal wellness. It boosts adoption among veterinarians, increases retail shelf presence of herbal veterinary supplements, and drives new product development for immunity boosters, skin care, digestion enhancers, and stress management solutions.

In addition, excessive use of antibiotics in livestock and pets has led to a global rise in antimicrobial resistance (AMR), which poses a major threat to both animal and human health. Governments, veterinary associations, and regulatory bodies are promoting reductions in antibiotic usage, especially in preventive care and feed supplements. For instance, in September 2025, Department of Animal Husbandry and Dairying (DAHD) hosted a nationwide virtual awareness program on Ethno Veterinary Medicine (EVM), emphasizing Ayurveda-based livestock care to one lakh farmers. Officials highlighted EVM’s role in treating diseases sustainably and reducing antibiotic dependence. This aligns with growing concerns over AMR, emphasizing the demand for Ayurveda veterinary solutions as safer alternatives to conventional antibiotics. Ayurvedic formulations, which are known for their anti-inflammatory and antimicrobial properties, are increasingly used as natural substitutes, particularly in poultry, dairy, and companion animal care, thus accelerating market penetration and increasing investments in herbal veterinary R&D.

Furthermore, some of the countries are promoting herbal veterinary healthcare through supportive regulatory frameworks, subsidies for herbal product development, and incentives for sustainable livestock management. Traditional medicine authorities, such as India’s AYUSH Ministry, are actively encouraging Ayurvedic integration in veterinary healthcare systems. For instance, in October 2024, Union Ministry of Animal Husbandry released new Standard Veterinary Treatment Guidelines (SVTG) to regulate antibiotic usage and formally integrate Ayurvedic drugs for livestock and poultry treatment, ensuring safer, standardized care. In addition, regulatory validation increases consumer trust, accelerates product registrations, and opens new global export opportunities for Ayurveda veterinary products. This creates a favorable platform for investments, cross-border partnerships, and expansion of herbal animal health brands. Hence, local manufacturers scale operations for global players to enter space, for accelerated commercialization and structured growth.

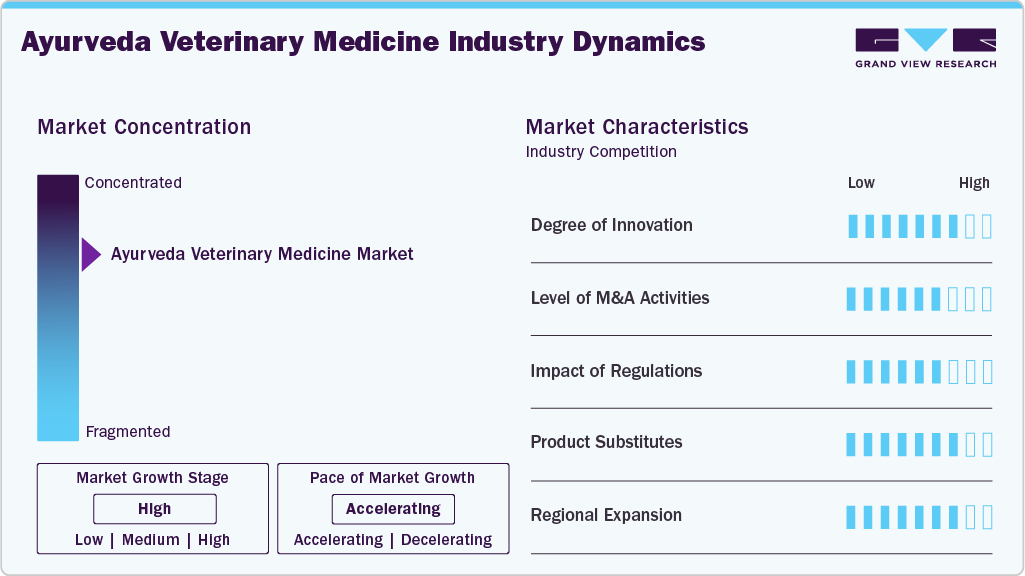

Market Concentration & Characteristics

The Ayurveda veterinary medicine industry is moderately concentrated, and the pace is accelerating, with a mix of established Ayurvedic healthcare firms and emerging animal health startups. Leading players focus on herbal formulations, R&D, and regional expansion. Strategic collaborations with veterinary clinics and government-backed initiatives enhance market positioning, while niche brands target livestock-specific conditions, gradually intensifying competition within the sector.

The market is witnessing a gradual but steady rise in innovation, driven by the development of polyherbal formulations targeting immunity, digestion, skin repair, and detoxification in livestock. Innovation is also driven by demand for residue-free, safe alternatives to antibiotics, motivating R&D investment in standardized herbal veterinary products. For instance, in September 2025, Ayurvedic medicine manufacturers in India are exploring legal routes to access ‘bhasmam’ (major component of Ayurvedic medicines) derived from incinerated animal horns and tusks.

Mergers and acquisitions remain limited but are expected to increase as Ayurveda veterinary firms seek scalability and global reach. Larger herbal healthcare companies are witnessing veterinary segments to diversify their portfolios, and international nutraceutical players may collaborate with Indian Ayurveda brands. For instance, in December 2023, Zenex acquired Ayurvet to integrate herbal and Ayurvedic products into its global animal health portfolio, enhancing product diversity, geographic reach, and export growth, particularly in the EU region.

Government regulations promoting antibiotic stewardship and encouraging herbal alternatives are accelerating Ayurveda veterinary adoption. Standard Veterinary Treatment Guidelines (SVTG) in India and residue-free compliance norms globally enhance market access. However, the lack of standardized approval frameworks and inconsistent international licensing regulations poses challenges.Conventional allopathic veterinary drugs, nutraceuticals, probiotics, and homeopathic treatments act as substitutes to Ayurveda veterinary products. Farmers often prefer antibiotics due to faster results, although residues and resistance concerns are shifting demand toward herbal alternatives.

Regional expansion strategies are escalating, with Indian Ayurveda veterinary brands expanding across South Asia, the Middle East, Africa, and Latin America due to rising demand for natural livestock care solutions. Companies are forming export partnerships, tapping into dairy-intensive markets, and aligning formulations with regional livestock diseases.

Product Insights

On the basis of product, the nutritional supplements segment held the largest revenue share of 51.39% in 2024, owing to rising awareness of livestock and companion animal health through conduction of virtual programs. For instance, in September 2025, DAHD conducted a virtual program promoting Ayurveda-based veterinary practices to over one lakh farmers, supporting sustainable livestock care and reducing antibiotic dependence. Furthermore, nutritional supplements, including herbal immunity boosters, vitamins, minerals, and digestive enhancers, address malnutrition, improve productivity, and support overall wellness. Integration of Ayurvedic formulations with conventional feeding practices, coupled with government support for sustainable livestock management, reinforces the segment’s growth.

The pharmaceuticals segment is projected to be the fastest growing segment over the forecast period, driven by increasing demand for safe, effective, and natural alternatives to conventional drugs. This segment includes herbal formulations, anti-inflammatory agents, antimicrobial treatments, and immunity boosters designed for both livestock and companion animals. Rising awareness of antibiotic resistance, regulatory support for herbal veterinary solutions, and growing adoption of preventive healthcare practices accelerate pharmaceutical uptake. Rising product innovation, clinical validation, and expansion into urban and rural veterinary networks further propel market growth.

Animal Insights

On the basis of animal, the production animals segment dominated the market with largest revenue share in 2024, This segment includes cattle, poultry, swine and other production animals. The growth of this segment is contributing to high demand by farmers for natural solutions to enhance productivity, immunity, and general animal health. Ayurvedic formulations such as herbal feed supplements, immunity boosters, and digestive aids help improve milk yield, egg production, and growth rates while reducing reliance on synthetic drugs. Government initiatives supporting sustainable livestock practices and rising awareness of herbal alternatives further strengthen adoption.

Companion animals, including dogs, cats, horses and others are projected to register the fastest CAGR during the forecast period. Rising pet ownership, urbanization, and the humanization of pets drive demand for safe, natural, and holistic treatments. Growing awareness of preventive healthcare, chronic disease management, and wellness-focused pet care, coupled with e-commerce and veterinary clinic distribution, accelerates market growth.

Route of Administration Insights

On the basis of route of administration, the oral segment dominated with the largest revenue share in 2024 and is projected to be the fastest growing during the period 2025-2033. The oral route is preferred due to ease of administration, cost-effectiveness, and proven efficacy in improving overall health, productivity, and immunity. Growing awareness among farmers and pet owners about natural, residue-free alternatives, coupled with government initiatives promoting sustainable animal care, further fuels adoption. Moreover, most of the of herbal feed supplements, immunity boosters, digestive aids, and vitamin-mineral formulations are consumed orally and are used widely for both livestock and companion animals.

Topical formulations are projected to be the second-fastest growing segment over the forecast period, driven by their ease of application, quick local action, and rising preference for non-invasive treatments. Pet owners and livestock farmers are increasingly opting for herbal ointments, sprays, and gels to manage skin infections, wounds, inflammations, and parasitic conditions.

Distribution Channel Insights

On the basis of distribution channel, the retail and specialty stores constituted the largest revenue segment in 2024. The market is expanding due to widespread accessibility and consumer preference for direct, in-person purchases. These outlets provide a diverse range of herbal supplements, feed additives, topical formulations, and preventive care products for livestock and companion animals. The segment benefits from growing awareness of natural, residue-free treatments, personalized customer guidance, and promotional campaigns. Expanding networks of veterinary pharmacies, Ayurvedic wellness centers and rural retail chains further enhance reach, making retail and specialty stores the primary channel generating maximum revenue.

E-commerce represents the fastest growing segment in the market, fueled by increasing digital adoption, convenience, and wider product availability. Online platforms enable farmers and pet owners to access herbal supplements, feed additives, immunity boosters, and topical treatments with doorstep delivery. Personalized recommendations, subscription models, and competitive pricing enhance customer engagement.

Regional Insights

North America Ayurveda veterinary medicine industry dominated globally with the largest revenue share of 34.29% in 2024. The market is driven by rising competition as demand surged due to growing preference for natural and holistic animal care. Startups promoting herbal formulations are entering alongside global Ayurvedic brands expanding regionally. Established animal healthcare firms are exploring partnerships and product diversification into herbal therapeutics to meet growing demand, driving innovation and competitive differentiation.

U.S. Ayurveda Veterinary Medicine Market Trends

The ayurveda veterinary medicine industry in the U.S. accounted for the largest market share in the North America market, owing to rising pet humanization, growing demand for natural and plant-based treatments, and increased awareness of holistic pet wellness. Companies expanded portfolios with plant-based nutraceuticals and holistic remedies. For instance, in February 2023, Bioved Pharmaceuticals’ launched its Shwan Ayurved line, featuring clinically validated human-grade products adapted for dogs, intensified market competition.

The Canada ayurveda veterinary medicine industry is expected to grow at a significant CAGR during the forecast periodpropelled by increasing distrust of chemical-based treatments, increasing veterinary openness to integrative medicine and growing influence of immigrant communities’ familiar with Ayurveda. Companies are expanding its distribution through e-commerce and specialty pet health channels.

Europe Ayurveda Veterinary Medicine Market Trends

The Ayurveda veterinary medicine industry in Europe is projected to grow over the forecast period due to expansion of e-commerce platforms and shift toward preventive healthcare. Some of the key players such as Bioved Pharmaceuticals, Ayurvet Ltd., and Himalaya Wellness expanded their presence through partnerships, clinical validation, and distribution collaborations across European countries. In addition, companies focus on R&D, clinical validation, and organic certifications to gain trust, particularly in Germany, France, and UK.

The Ayurveda veterinary medicine industry in the UK is expected to grow significantly over the forecast period. The market is characterized by government push toward ayurveda integration, humanization of pets and growing awareness of side effects of synthetic drugs. Regulatory support strengthened, as witnessed in September 2024 of the UK’s APPG on Indian Traditional Sciences advocated for integrating Ayurvedic principles into mainstream healthcare systems, indirectly increasing acceptance of Ayurveda veterinary applications.

The Germany ayurveda veterinary medicine industry held a significant market share in 2024. The country’s growth is influenced by rising cases of chronic conditions in companion animals and increased availability of online retail platforms offering imported Ayurvedic pet supplements. Companies compete by offering herbal supplements focused on immunity, digestion, and joint care. Partnerships with veterinary clinics and e-commerce expansion enhanced market penetration.

Asia Pacific Ayurveda Veterinary Medicine Market Trends

Asia Pacific Ayurveda veterinary medicine industry is expected to grow at the fastest CAGR over the forecast period. The region's growth can be attributed to strong traditional medicine roots in India, Sri Lanka, and Nepal. Some of the major players such as Himalaya Wellness, Ayurvet, Indian Herbs Specialities, Bioved Pharmaceuticals, and Dabur expand their regional distribution. Rising pet ownership, government promotion of AYUSH, and increased awareness of herbal animal care boosted market competitiveness.

The Ayurveda veterinary medicine industry in China is witnessing new growth opportunities due to growing interest in holistic pet and livestock care intersected with the rising influence of Indian herbal brands. Traditional Chinese Medicine (TCM) dominated the market, and major companies expand their presence through partnerships, e-commerce platforms, and cross-border trade. The market demand is driven by urban pet humanization, increasing livestock health awareness, and awareness to alternative therapies complementing existing TCM-based veterinary care.

The India Ayurveda veterinary medicine market is emerged as the largest and most competitive, supported by strong governmental initiatives. The 2021 MoU between Department of Animal Husbandry and Dairying (DAHD) and the Ministry of AYUSH accelerated R&D, new herbal formulations, and policy-led integration into veterinary practice. Some of the major players competed through product innovation, nationwide distribution, and targeted solutions for livestock, pets, and nomadic animal health.

Latin America Ayurveda Veterinary Medicine Market Trends

The ayurveda veterinary medicine industry in Latin America is driven by the expansion of veterinary services. The market is driven by expansion of herbal medicine market and supportive regulatory environment. The region focuses on product innovation, partnerships with veterinary clinics, and distribution expansion to capture growing demand for natural animal care. Companies increasingly utilize digital marketing and e-commerce channels to enhance reach and brand recognition.

Brazil ayurveda veterinary medicine industry is gaining momentum, supported by several key factors, such as e-commerce and online veterinary platforms and rising livestock health awareness. Increasing regulatory support for alternative medicine and cultural acceptance of herbal treatments further intensifies competition among market participants in Brazil.

Middle East & Africa Ayurveda Veterinary Medicine Market Trends

The Ayurveda veterinary medicine industry in MEA is anticipated to grow over the forecast period, attributed to moderate competition among regional distributors and global herbal medicine companies. The region’s growth is also driven by increasing pet ownership, rising awareness of natural treatments, and demand for preventive livestock care. Regulatory support for alternative therapies and expanding veterinary healthcare infrastructure further intensify competition across markets such as UAE, Saudi Arabia, South Africa, and Egypt.

South Africa ayurveda veterinary medicine industry is expanding, fueled with moderate competition among local herbal product manufacturers and a few international players. Key strategies include product innovation, collaborations with veterinary clinics, and expanding distribution channels. Cultural acceptance of herbal remedies and growing regulatory support for alternative veterinary solutions further intensify competition in the market.

UAE Ayurveda veterinary medicine industry is experiencing growth due to growing awareness of animal wellness and government support and regulations. Strong consumer preference for high-quality, natural products, coupled with supportive regulations for alternative veterinary medicines, intensifies market competition in the UAE.

Key Ayurveda Veterinary Medicine Company Insights

The Ayurveda veterinary medicine industry is characterized by a blend of traditional Ayurvedic companies and global animal health firms expanding into herbal segments. These companies focus on product innovation, strategic partnerships, and expanding distribution channels to capture the growing demand for Ayurveda veterinary medicines. For instance, in September 2025, Arya Vaidya Sala (AVS), Kottakkal, one of the known institution in India partnered with the National Dairy Development Board to promote Ayurveda veterinary medicines for livestock health. This collaboration supports wider adoption of natural, residue-free treatments.

Key Ayurveda Veterinary Medicine Companies:

The following are the leading companies in the ayurveda veterinary medicine market. These companies collectively hold the largest market share and dictate industry trends.

- Himalaya Wellness Company

- AYURSUN PHARMA

- Vetraise Remedies

- Garuda Trade Kft.

- Zenex Health Animal Health

- Bioved

- Curafyt

- Euro Herbals

- SaluVet GmbH

- Natural Remedies

- Shelter Pharma

- Indian Herbs

Recent Developments

-

In October 2025, CKK Eduveda and Fur Ball Story introduced the world’s first Ayurveda veterinary course series, aimed at educating veterinarians and pet owners worldwide. The initiative promotes holistic animal care and global Ayurveda adoption.

-

In October 2025, Uniray Lifesciences highlighted strong growth of Ayurvedic Propaganda Cum Distribution (PCD) and third-party manufacturing models due to low investment, rising herbal demand, and healthcare expansion. This model supports rapid Ayurveda veterinary market entry.

-

In September 2025, CCRAS and Telangana Veterinary University signed a MoU to merge Ayurveda with veterinary science through collaborative research in livestock health, nutrition, and diagnostics. The alliance boosts evidence-based Ayurveda veterinary solutions.

Ayurveda Veterinary Medicine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.93 billion

Revenue forecast in 2033

USD 5.61 billion

Growth rate

CAGR of 14.30% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, animal, route of administration, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Saudi Arabia; Kuwait; Qatar; Oman

Key companies profiled

Himalaya Wellness Company; AYURSUN PHARMA; Vetraise Remedies; Garuda Trade Kft.; Zenex Health; Animal Health Bioved; Curafyt; Euro Herbals; SaluVet GmbH; Natural Remedies; Shelter Pharma; Indian Herbs

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ayurveda Veterinary Medicine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Ayurveda veterinary medicine market report based on product, animal, route of administration, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceuticals

-

Antimicrobial

-

Anti-inflammatory

-

Analgesics

-

Others

-

-

Nutritional Supplements

-

Feed Additives

-

-

Animal Outlook (Revenue, USD Million, 2021 - 2033)

-

Companion Animals

-

Dogs

-

Cats

-

Horses

-

Other Companion Animals

-

-

Production Animals

-

Cattle

-

Poultry

-

Swine

-

Other Production Animals

-

-

-

Route of Administration Outlook (Revenue, USD Million, 2021 - 2033)

-

Oral

-

Topical

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Veterinary Hospitals/Clinic Pharmacies

-

Retail/Specialty Stores

-

E-Commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The global ayurveda veterinary medicine market size was estimated at USD 1.80 billion in 2024 and is expected to reach USD 1.93 billion in 2025.

b. The global ayurveda veterinary medicine market is expected to grow at a compound annual growth rate of 14.30% from 2025 to 2033 to reach USD 5.61 billion by 2033.

b. North America held dominated with largest revenue share of 34.29% in 2024 in ayurveda veterinary medicine market. The market is driven by rising competition as demand surged due to growing preference for natural and holistic animal care. Startups promoting herbal formulations are entering alongside global Ayurvedic brands expanding regionally.

b. Some key players operating in the ayurveda veterinary medicine market include Himalaya Wellness Company, AYURSUN PHARMA, Vetraise Remedies, Garuda Trade Kft., Zenex Health, Animal Health Bioved, Curafyt, Euro Herbals, SaluVet GmbH, Natural Remedies, Shelter Pharma, Indian Herbs.

b. Key factors that are driving the market growth include rising preference for natural and holistic animal care, increasing concerns over antimicrobial resistance (AMR) and supportive regulatory approvals and government initiatives.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.