- Home

- »

- Power Generation & Storage

- »

-

Battery Energy Storage Systems Market Size Report, 2033GVR Report cover

![Battery Energy Storage Systems Market Size, Share & Trends Report]()

Battery Energy Storage Systems Market (2025 - 2033) Size, Share & Trends Analysis Report By Battery Type (Flywheel Battery, Lead Acid Battery, Lithium-ion Battery), By Application (Telecommunication, Data Center, Medical, Industrial, Marine), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-642-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Battery Energy Storage Systems Market Summary

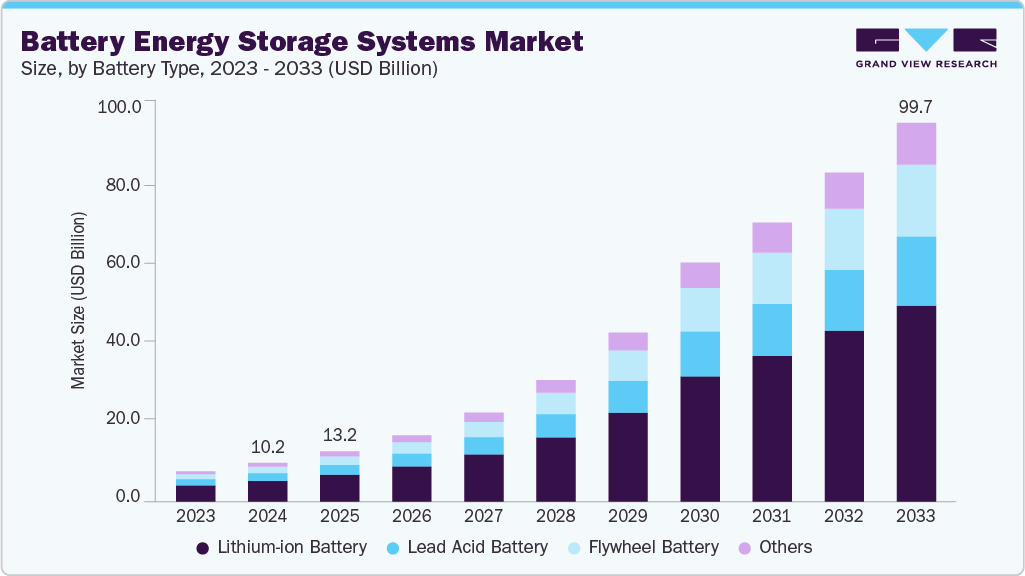

The global battery energy storage systems market size was estimated at USD 10.17 billion in 2024 and is projected to reach USD 99.67 billion by 2033, growing at a CAGR of 28.8% from 2025 to 2033. The market growth is driven by the rapid electrification of energy systems, increasing renewable power integration, and global push toward net-zero emissions.

Key Market Trends & Insights

- Asia Pacific battery energy storage systems market held the largest share of 44.1% of the global market in 2024.

- The battery energy storage systems market in the U.S. is expected to grow significantly over the forecast period.

- By battery type, lithium-ion battery held the highest market share of 53.8% in 2024.

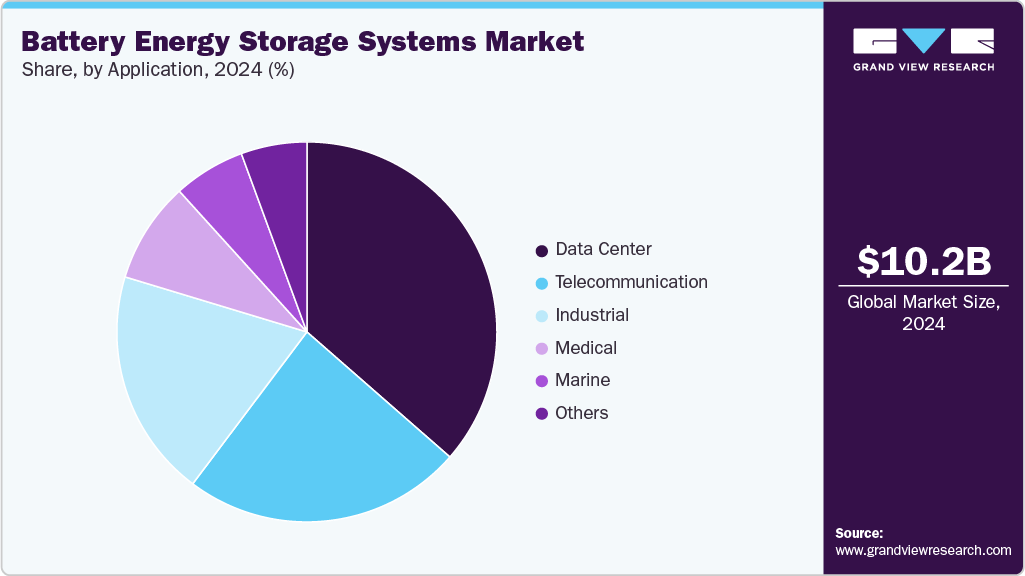

- By application, the data center segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 10.17 Billion

- 2033 Projected Market Size: USD 99.67 Billion

- CAGR (2025-2033): 28.8%

- Asia Pacific: Largest market in 2024

- Latin America: Fastest growing market

The expansion of solar and wind capacity, coupled with the increasing demand for grid flexibility, is driving the need for advanced energy storage solutions that can deliver both short- and long-duration storage.Government incentives, policy frameworks that promote the adoption of renewable energy, and increasing investment in sustainable infrastructure are accelerating the deployment of lithium-ion, flow, and emerging battery technologies. Continuous improvements in battery energy density, cost reduction, and efficiency, alongside the scaling of pilot projects to commercial operations, are further strengthening market adoption. The growing emphasis on grid stability, renewable energy firming, and peak-shaving solutions continues to make battery energy storage systems (BESS) critical for utility, commercial, and industrial applications worldwide.

In North America, market expansion is primarily driven by federal clean energy mandates, state-level renewable portfolio standards, and grid modernization programs. The United States is at the forefront, with significant investments in utility-scale solar and wind projects complemented by large-scale battery storage deployments to replace peaker plants and enhance grid resilience. Incentive programs, such as the Investment Tax Credit (ITC) and Department of Energy demonstration projects, as well as state-level resilience procurement initiatives, are accelerating the commercial adoption of renewable energy. In addition, corporate sustainability commitments from sectors such as data centers, manufacturing, and logistics are boosting demand for energy storage systems. Canada is also witnessing growing interest, particularly in provinces that aim to reduce diesel reliance in remote and off-grid communities, supported by provincial clean energy targets and incentive programs.

Europe represents another substantial market, supported by aggressive decarbonization agendas, the rapid expansion of renewable energy, and integrated energy storage policy frameworks. Countries such as Germany, the United Kingdom, France, Spain, and the Netherlands are actively piloting large-scale energy storage projects as part of their grid modernization and renewable energy integration strategies. EU directives facilitating clean energy financing, cross-border electricity trade, and the phasing out of fossil fuel generation provide strong momentum for the adoption of battery storage. Collaborations among utilities, technology developers, and research institutions are accelerating commercialization, while industrial decarbonization initiatives and growing demand for flexible grid-balancing solutions further reinforce the region’s growth. As Europe continues to transition from coal- and gas-fired power generation, battery energy storage systems are increasingly seen as vital for maintaining reliability, supporting the deployment of renewable energy, and enabling a low-carbon energy transition.

Drivers, Opportunities & Restraints

The increasing emphasis on grid decarbonization, renewable energy integration, and the growing demand for flexible and long-duration energy storage solutions primarily drive the global battery energy storage systems (BESS) market. As utilities transition from coal- and gas-fired generation to solar, wind, and other renewable sources, storage systems capable of delivering reliable power over hours to days have become increasingly critical. BESS technologies, including lithium-ion, flow, and emerging chemistries, provide scalable and cost-effective solutions for utility-scale, commercial, and industrial applications. Government incentives supporting grid modernization, carbon reduction mandates, and funding for energy storage demonstration projects, particularly in North America, Europe, and parts of the Asia-Pacific region, are strengthening market adoption. Increased investment from energy developers, industrial users, and large corporate power consumers seeking improved energy resilience, peak shaving, and operational cost reductions further accelerates deployment. Moreover, advancements in battery technology, improved safety profiles, and declining system costs enhance the attractiveness of BESS solutions.

Market opportunities are expanding as power systems increasingly contend with challenges arising from the intermittency of renewable energy, fluctuations in peak demand, and the growing need for grid stability. BESS offers strong potential for applications in remote microgrids, islanded systems, commercial and industrial facilities, and critical infrastructure where reliability and energy cost management are priorities. Hybrid storage solutions, co-location with solar and wind plants, and integration with emerging technologies such as green hydrogen and vehicle-to-grid systems present new avenues for optimization and value creation. Partnerships between utilities, renewable energy project developers, and energy storage technology firms are expected to accelerate large-scale commercial deployments, while innovative financing mechanisms and service models, such as energy-as-a-service, are opening new market channels globally.

However, the market faces several restraints, including high upfront capital costs, uncertainties around long-term battery degradation, and extended payback periods for large-scale deployments compared to conventional generation or mature energy storage technologies. Regulatory complexities, grid interconnection approvals, and gaps in energy storage procurement frameworks can also impede deployment. Technical challenges, such as round-trip efficiency, thermal management, and the recycling or second-life usage of battery components, remain areas of ongoing development. Competition from alternative storage solutions, including pumped hydro, compressed air energy storage, thermal storage, and emerging flow battery technologies, may affect market positioning. Continued policy support, standardization, financing innovations, and technological advancements likely to be critical to unlock the full potential of BESS within global energy transition strategies.

Battery Type Insights

The lithium-ion battery segment held the largest revenue share of 53.8%, in 2024, supported by its high energy density, long operational life, and rapidly declining system costs. Its widespread adoption across utility-scale renewable energy storage, commercial and industrial backup systems, microgrids, and EV charging infrastructure reflects the maturity and scalability of lithium-ion technology. Advancements in chemistries such as LFP and NMC have improved safety, thermal stability, and performance efficiency, reinforcing their dominance for short- to medium-duration storage applications. A well-established global supply chain and continued policy support for renewable integration further strengthen the segment’s leadership in the Battery Energy Storage Systems market.

The flywheel battery segment is expected to record the fastest CAGR of around 30.7% over the forecast period, driven by rising demand for high-power, rapid-response storage solutions. Flywheel systems offer exceptionally fast charge-discharge rates, high cycle durability, and minimal performance degradation, making them ideal for grid frequency regulation, industrial power quality management, and mission-critical backup applications. Technological improvements in rotor materials, magnetic bearings, and control systems are enhancing efficiency and reliability. While flywheels are not typically used for long-duration storage, their advantages in instantaneous response and high cycling frequency are increasingly valuable in modern power systems with high renewable penetration.

Application Insights

The data center segment held the largest revenue share of 36.4%, in 2024, driven by the rapid expansion of global cloud computing, hyperscale facilities, and AI-driven digital workloads that require highly reliable and uninterrupted power. Battery energy storage systems are being increasingly deployed in data centers to provide backup power, enhance power quality, reduce reliance on diesel generators, and support peak load management. The growing focus on achieving carbon-neutral operations, along with corporate sustainability targets, has further accelerated the use of BESS to integrate on-site renewable energy sources and optimize energy usage. As data center operators prioritize resilience, operational efficiency, and energy cost control, particularly in regions with rising electricity costs and grid constraints, the adoption of BESS in this segment continues to strengthen, establishing its position as the leading application area in the global market.

The industrial segment is expected to record the fastest CAGR of 29.8% over the forecast period, driven by the increasing electrification of industrial processes, growing emphasis on energy efficiency, and the need for continuous and stable power supply in manufacturing environments. Industries such as mining, chemicals, automotive, food processing, and heavy manufacturing are adopting BESS to reduce peak demand charges, integrate distributed renewable resources, and ensure operational continuity during grid disturbances. The rising implementation of microgrids and hybrid energy systems, alongside growing corporate commitments to carbon reduction, is further driving uptake. As industrial facilities increasingly shift toward automation and electric-driven production lines, the role of BESS in managing load variability, improving energy stability, and reducing operational costs is expected to expand rapidly.

Regional Insights

The Asia-Pacific battery energy storage systems market held the largest share, approximately 44.8% of the global Battery Energy Storage Systems market in 2024, driven by the rapid deployment of renewable energy, large-scale grid modernization programs, and expanding electrification initiatives. China leads the region with a strong domestic manufacturing capacity, ambitious solar and wind installation plans, and policy support for integrating energy storage across utility-scale and distributed energy networks.

Countries such as Japan, South Korea, and Australia are also accelerating the adoption of storage to enhance grid flexibility, enable peak shifting, and support the development of clean hydrogen pathways. Meanwhile, India is scaling up battery storage to stabilize grids that are increasingly dominated by renewable energy sources and expanding microgrids across remote and rural regions. The growing demand for grid reliability, rising expansion of digital infrastructure, and increasing private and public investment in clean energy continue to position the Asia-Pacific region at the forefront of BESS capacity additions globally.

North America Battery Energy Storage Systems Market Trends

North America remains a major hub for BESS deployment, supported by strong federal and state-level renewable energy policies, large-scale energy storage procurement programs, and growing investments in grid resilience. The U.S. leads market activity, bolstered by incentives such as the Investment Tax Credit (ITC) for standalone storage, Department of Energy (DOE) demonstration funding, and state mandates encouraging utilities to install multi-hour storage to replace gas peaker plants. Adoption is also rising across commercial and industrial facilities, data centers, and microgrids for resilience and cost optimization. Canada is expanding its storage applications to support remote communities, renewable energy integration, and the decarbonization of provincial grids. Increasing corporate sustainability targets and the electrification of critical infrastructure further reinforce the region’s strong growth trajectory.

Europe Battery Energy Storage Systems Market Trends

Europe represents a policy-driven and innovation-focused market for BESS, supported by aggressive decarbonization targets, renewable integration frameworks, and national energy storage deployment strategies. Countries such as Germany, the United Kingdom, Spain, France, and the Netherlands are prioritizing storage to support variable renewable energy resources and ensure grid stability. EU directives, such as the Fit for 55 and Renewable Energy Directive (RED III), are encouraging utilities and grid operators to incorporate flexible storage assets into their transmission and distribution systems. Collaborative efforts among energy developers, technology providers, and research institutions are accelerating the commercial deployment of grid-scale storage technologies. The region is increasingly focused on enhancing energy independence and reducing reliance on fossil-fueled backup generation.

U.S. Battery Energy Storage Systems Market Trends

The U.S. market is one of the fastest-expanding globally, driven by large-scale solar-plus-storage and wind-plus-storage projects, corporate clean energy procurement, and grid resilience initiatives. Federal policy support, as outlined in the Inflation Reduction Act (IRA) and DOE storage innovation funding, has catalyzed the development of multi-hour and long-duration energy storage projects. The commercial and industrial sectors are also adopting BESS to manage peak loads, improve power quality, and support backup power needs, especially in data centers and manufacturing hubs. State procurement mandates in California, New York, Texas, and the Midwest are further accelerating utility-scale storage deployments, which aim to replace natural gas peaker plants and reduce renewable curtailment.

Latin America Battery Energy Storage Systems Market Trends

Latin America is expected to witness the fastest CAGR of 31.7% over the forecast period, driven by increasing renewable energy integration, grid modernization initiatives, and energy access programs. Countries such as Chile, Brazil, and Mexico are deploying BESS alongside the expansion of solar and wind capacity to stabilize grids and mitigate intermittency. The rising focus on energy diversification, industrial decarbonization, and the electrification of remote communities is supporting the need for scalable and cost-efficient storage systems. Collaborations among regional utilities, global project developers, and financing institutions are accelerating the demonstration and utility-scale deployment of renewable energy sources. Growing emphasis on resilience and reliability is positioning Latin America as a high-growth market for battery storage solutions.

Middle East & Africa Battery Energy Storage Systems Market Trends

The Middle East & Africa region remains in an early but dynamic phase of BESS adoption, driven by increasing investment in renewable megaprojects, national energy diversification plans, and emerging green hydrogen strategies. Gulf countries are leading the development of large-scale solar and wind projects, paired with storage, to reduce their dependence on natural gas for power generation. In Sub-Saharan Africa, BESS is gaining traction in remote microgrids, off-grid electrification, mining operations, and critical infrastructure backup, where reliable and long-life storage solutions are essential. While regulatory frameworks and financing remain developing areas, public-private partnerships and international clean energy funding are expected to accelerate market growth across the region.

Key Battery Energy Storage Systems Company Insights

Some of the key players operating in the global Battery Energy Storage Systems (BESS) market include Fluence Energy, Inc., and Tesla, Inc., among others.

-

Fluence Energy, Inc. is a U.S.-based global leader in grid-scale energy storage technology and digital optimization solutions. Headquartered in Virginia, Fluence was formed as a joint venture between Siemens and AES Corporation and has established a strong presence across more than 40 countries. The company provides fully integrated BESS platforms, power conversion systems, and energy management software designed for utility-scale renewable integration, grid modernization, and peak shaving applications. Fluence has deployed over 7 GW of energy storage capacity globally and maintains an active pipeline of multi-gigawatt projects across the United States, Europe, and the Asia-Pacific region. The company continues to advance modular storage architectures and AI-driven optimization through its Fluence IQ platform, helping grid operators enhance flexibility, reduce curtailment, and lower operational costs. Recent expansions in manufacturing partnerships and supply chain localization strategies are enabling Fluence to scale production and support accelerating global demand for long-duration and grid-forming storage solutions.

-

Tesla, Inc. is a key innovator in the battery energy storage market, leveraging its leadership in lithium-ion cell technology, automotive-scale manufacturing, and power electronics. Headquartered in Texas, Tesla offers a portfolio of storage systems, including Powerwall (residential), Powerpack (commercial), and Megapack (utility-scale), which are widely deployed to support grid stabilization, smooth renewable power, and backup power applications. The company has commissioned landmark BESS installations such as the Hornsdale Power Reserve in Australia and large-scale storage farms across California and Texas. Tesla continues to expand its global footprint through Gigafactory production facilities in North America, Europe, and Asia, with a focus on high-volume battery cell manufacturing and LFP-based architectures to reduce system-level costs. In parallel, Tesla's Autobidder energy trading and optimization platform enables real-time market participation, enhancing revenue generation for asset owners. The company's integrated approach, spanning cell development, system engineering, software optimization, and global manufacturing, positions it as a dominant driver of cost reduction and scalability in the BESS industry.

Key Battery Energy Storage Systems Companies:

The following are the leading companies in the battery energy storage systems market. These companies collectively hold the largest Market share and dictate industry trends.

- BYD Company Ltd.

- Contemporary Amperex Technology Co., Ltd. (CATL)

- EVE Energy Co., Ltd.

- Fluence Energy, Inc.

- Hitachi Energy Ltd.

- LG Energy Solution

- NEC Energy Solutions, Inc.

- Panasonic Holdings Corporation

- Samsung SDI Co., Ltd.

- Tesla, Inc.

Recent Developments

- In September 2025, Fluence Energy announced the opening of a new grid-scale battery manufacturing and integration facility in Ohio, aimed at expanding domestic production capacity for utility-scale energy storage systems. The facility was developed in collaboration with Siemens and supported through federal clean energy manufacturing incentives designed to strengthen U.S. energy supply chains. Spanning over 500,000 square feet, the plant is dedicated to producing standardized Megawatt-scale storage modules and advanced digital control systems used for renewable integration and grid stability services.

Battery Energy Storage Systems Market Report Scope

Report Attribute

Details

Market Definition

The market size represents the total capital expenditure spending associated with the manufacturing, integration, deployment of battery energy storage systems used across utility, commercial, industrial, and residential applications.

Market size value in 2025

USD 13.19 billion

Revenue forecast in 2033

USD 99.67 billion

Growth rate

CAGR of 28.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Revenue in USD Million/Billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Battery type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE

Key companies profiled

Tesla, Inc.; LG Energy Solution; Samsung SDI Co., Ltd.; Contemporary Amperex Technology Co., Ltd. (CATL); BYD Company Ltd.; Fluence Energy, Inc.; Panasonic Holdings Corporation; EVE Energy Co., Ltd.; Hitachi Energy Ltd.; NEC Energy Solutions, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Battery Energy Storage Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global battery energy storage systems market report based on battery type, application, and region.

-

Battery type Outlook (Revenue, USD Million, 2021 - 2033)

-

Flywheel battery

-

Lead acid battery

-

Lithium-ion Battery

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Telecommunication

-

Data Center

-

Medical

-

Industrial

-

Marine

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global battery energy storage systems market size was estimated at USD 10.17 billion in 2024 and is expected to reach USD 13.19 billion in 2025.

b. The global battery energy storage systems market is expected to grow at a compound annual growth rate of 28.8% from 2025 to 2033 to reach USD 99.67 billion by 2033.

b. Based on the battery type segment, lithium-ion battery held the largest revenue share of more than 53.8% in 2024.

b. Some of the key players operating in the global battery energy storage systems (BESS) market include Tesla, Inc.; LG Energy Solution; Samsung SDI Co., Ltd.; Contemporary Amperex Technology Co., Ltd. (CATL); BYD Company Ltd.; Fluence Energy, Inc.; Panasonic Energy Co., Ltd.; Hitachi Energy Ltd.; EVE Energy Co., Ltd.; and NEC Energy Solutions, Inc.

b. The battery energy storage systems (BESS) market is primarily driven by the rapid expansion of renewable energy generation, growing demand for grid flexibility and stability, and increasing adoption of storage solutions to support peak load management, frequency regulation, and enhanced energy resilience across utility, commercial, and residential sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.