- Home

- »

- Personal Care & Cosmetics

- »

-

Betulin Market Size, Share & Growth, Industry Report, 2033GVR Report cover

![Betulin Market Size, Share & Trends Report]()

Betulin Market (2025 - 2033) Size, Share & Trends Analysis Report By Source (Birch Trees, Others), By Application (Personal Care & Cosmetics, Pharmaceuticals, Nutraceuticals), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-798-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Betulin Market Summary

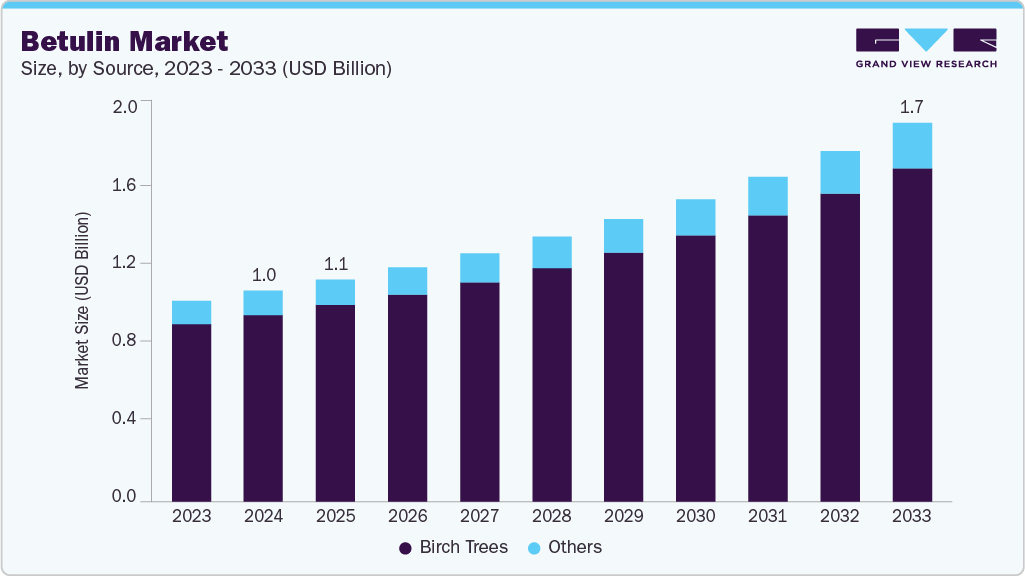

The global betulin market size was estimated at USD 964.4 million in 2024 and is projected to reach USD 1,733.8 million by 2033, growing at a CAGR of 6.9% from 2025 to 2033. The betulin industry is growing steadily, driven by rising demand for natural, plant-based ingredients in pharmaceuticals and cosmetics.

Key Market Trends & Insights

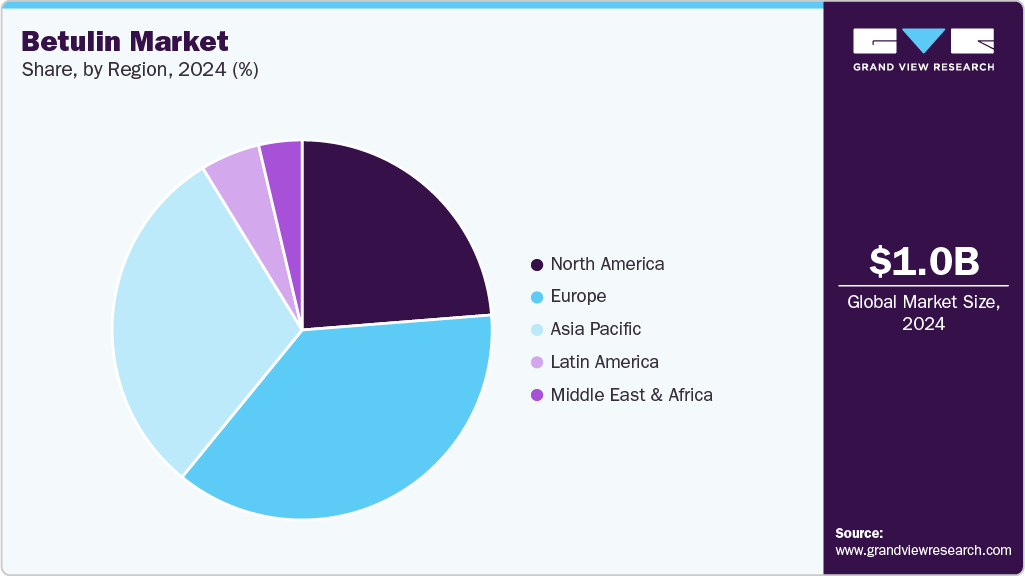

- Europe dominated the global betulin market with the largest revenue share of 37.15% in 2024.

- By source, the birch trees segment led the market with the largest revenue share of 88.5% in 2024.

- By application, the pharmaceuticals segment is expected to grow at the fastest CAGR of 7.3% during the forecast period.

- Asia Pacific region is expected to grow at the fastest CAGR of 7.2% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 964.4 Million

- 2033 Projected Market Size: USD 1,733.8 Million

- CAGR (2025-2033): 6.9%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

Its strong anti-inflammatory and antioxidant properties, along with the global shift toward sustainable products, are key factors supporting market expansion. Growing R&D activities in biotechnology and pharmaceuticals are driving the demand for betulin and its derivatives. Ongoing studies highlighting its anticancer, antiviral, and anti-inflammatory properties are fostering new formulation developments and clinical applications. In addition, rising investments in natural compound-based drug discovery are enhancing betulin’s commercial potential across therapeutic and healthcare segments.

The growing focus on green and sustainable extraction technologies offers a major opportunity for the botulin industry. Utilizing eco-friendly methods to extract betulin from birch bark can reduce costs and appeal to environmentally conscious brands. This approach also helps companies meet clean-label and sustainability standards. As industries shift toward natural sourcing, demand for eco-extracted betulin is expected to increase.

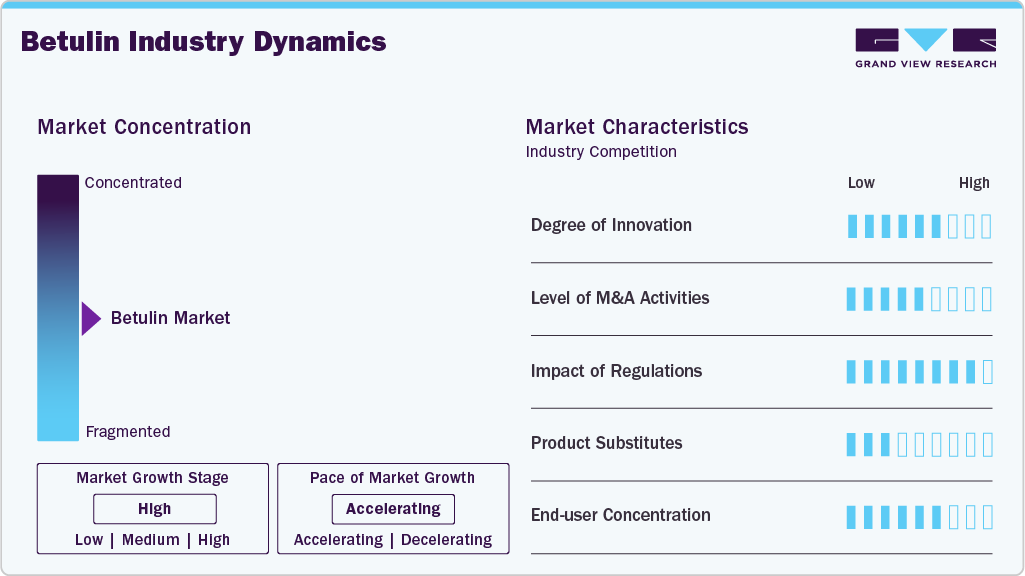

Market Concentration & Characteristics

The botulin industry is moderately concentrated, with a few key players in Europe and Asia dominating production and supply. These companies have access to abundant birch resources and advanced extraction technologies, giving them a strong competitive edge. Smaller firms and startups are entering through specialized, sustainable extraction solutions, adding innovation to the market landscape.

The botulin industry is driven by innovation and sustainability, shaped by growing demand for natural bioactive compounds in cosmetics and pharmaceuticals. It features steady growth potential, supported by R&D activities and eco-friendly manufacturing trends. However, regulatory challenges and limited large-scale production still define the industry’s development stage.

Source Insights

The birch trees segment led the market with the largest revenue share of 88.5% in 2024, due to their exceptionally high betulin content compared to other plant sources. This natural abundance allows for cost-effective extraction and large-scale production. Their consistent availability across major regions further strengthens their role as the primary and most reliable source of raw materials.

The others segment is anticipated to grow at the fastest CAGR of 7.5% during the forecast period, driven by increasing research on alternative botanical sources with comparable betulin yields. Rising focus on diversifying raw material sources and reducing supply dependency on birch trees is encouraging adoption. In addition, the growing interest in sourcing localized, sustainable ingredients support the segment’s accelerated expansion.

Application Insights

The personal care and cosmetics segment led the market with the largest revenue share of 33.8% in 2024, primarily due to its extensive use in skincare, haircare, and anti-aging formulations. Betulin’s antioxidant and skin-repairing properties make it a preferred ingredient in premium natural cosmetic products. Growing consumer preference for clean-label and plant-based formulations further strengthens its dominance in this segment.

The pharmaceutical segment is anticipated to grow at the fastest CAGR of 7.3% during the forecast period. This segment is expanding rapidly as ongoing research continues to reveal betulin’s therapeutic potential in treating inflammation, viral infections, and cancer. The increasing number of clinical trials and formulation development using betulin derivatives is accelerating the adoption of this compound. This growing scientific validation is positioning betulin as a promising bioactive compound in modern drug discovery.

Regional Insights

The botulin market in North America is driven by the region’s growing investments in botanical drug research. Pharmaceutical companies are focusing on developing natural compounds with proven therapeutic efficacy, positioning betulin as a valuable bioactive ingredient. This science-driven demand supports long-term market stability and innovation.

U.S. Betulin Market Trends

The betulin market in the U.S. is propelled by growing clinical research of betulin’s potential in anti-cancer and anti-inflammatory therapies. Academic and commercial research collaborations are accelerating product development using betulin derivatives. This focus on evidence-based applications enhances its credibility and market acceptance in the healthcare sector.

Europe Betulin Market Trends

Europe dominated the global betulin market with the largest revenue share of 37.15% in 2024, driven by the region’s growing emphasis on sustainability and the replacement of synthetic ingredients with bio-based alternatives. Regulatory frameworks supporting natural formulations have encouraged manufacturers to incorporate betulin into pharmaceutical and cosmetic products. This alignment with the EU’s green chemistry goals continues to strengthen its market position across the region.

The betulin market in Germany serves as a key consumer in the European market, primarily driven by its robust pharmaceutical and biotechnology sector. The country’s strong focus on research and clinical innovation encourages the adoption of betulin in advanced drug and skincare formulations, supporting steady market growth.

Asia Pacific Betulin Market Trends

The betulin market in Asia Pacific is anticipated to grow at the fastest CAGR of 7.2% during the forecast period, fueled by rapid industrial expansion in pharmaceuticals and nutraceuticals, alongside rising government focus on herbal product standardization. Countries in the region are investing heavily in plant-based research to develop safe, effective natural ingredients. This structured approach to innovation continues to accelerate betulin’s adoption in health and wellness applications.

The China betulin market accounted for the largest market revenue share of 42.2% in Asis Pacific in 2024, influenced by the modernization of traditional Chinese medicine (TCM). The integration of betulin into modern formulations reflects the country’s strategic shift toward scientifically validated plant-derived therapeutics. This modernization trend is expanding the commercial scope of betulin in both healthcare and personal care sectors.

Latin America Betulin Market Trends

The betulin market in Latin America is expanding with the growing use of native plant resources in natural ingredient production. Local manufacturers are adding betulin to herbal cosmetics and supplements, boosting both domestic and export demand. This focus on regional biodiversity is enhancing Latin America’s global market presence.

Middle East & Africa Betulin Market Trends

The betulin market in Middle East and Africa is driven by the region’s expanding pharmaceutical and cosmetic manufacturing sectors. Growing industrial diversification and rising demand for locally produced plant-based ingredients are fostering betulin adoption. This manufacturing shift toward value-added natural products is creating new growth opportunities across the region.

Key Betulin Company Insights

Otto Chemie Pvt. Ltd. and SimSon Pharma Limited dominated the global betulin industry, due to their strong manufacturing capabilities and high-quality product standards. Their well-established distribution networks and focus on consistent supply for pharmaceutical and cosmetic applications further strengthen their market presence.

-

Otto Chemie Pvt. Ltd. holds a strong position in the betulin market with its advanced extraction technologies and focus on high-purity natural compounds. The company caters to pharmaceutical, cosmetics, and research industries by ensuring consistent product quality and regulatory compliance. Its global distribution reach and customer-focused approach have helped establish it as a trusted supplier in the natural ingredients segment.

-

SimSon Pharma Limited is recognized for its extensive portfolio of plant-based bioactives and laboratory-tested ingredients. The company’s emphasis on innovation, product standardization, and purity assurance supports its strong market credibility. By serving both domestic and international clients, SimSon Pharma continues to expand its footprint in the pharmaceutical and cosmetic ingredient markets.

Key Betulin Companies:

The following are the leading companies in the betulin market. These companies collectively hold the largest Market share and dictate industry trends.

- Otto Chemie Pvt. Ltd.

- SimSon Pharma Limited

- ChemFaces

- Aktin Chemicals, Inc.

- Hovane Phytochemicals

- Betulin Lab (Latvijas Finieris Group)

- Tianjin NWS Biotechnology and Medicine Co. Ltd.

Recent Developments

- In May 2022, Betulin Lab, a subsidiary of Latvijas Finieris Group, inaugurated its pilot plant for betulin extraction in Latvia. This facility represents a significant step toward industrial-scale production of high-purity betulin from birch bark byproducts, supporting the sustainable and value-added use of forest resources.

Betulin Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,016.8 million

Revenue forecast in 2033

USD 1,733.8 million

Growth rate

CAGR of 6.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Source, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Otto Chemie Pvt. Ltd.; SimSon Pharma Limited; ChemFaces; Aktin Chemicals, Inc.; Hovane Phytochemicals; Betulin Lab (Latvijas Finieris Group); Tianjin NWS Biotechnology and Medicine Co. Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to the country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

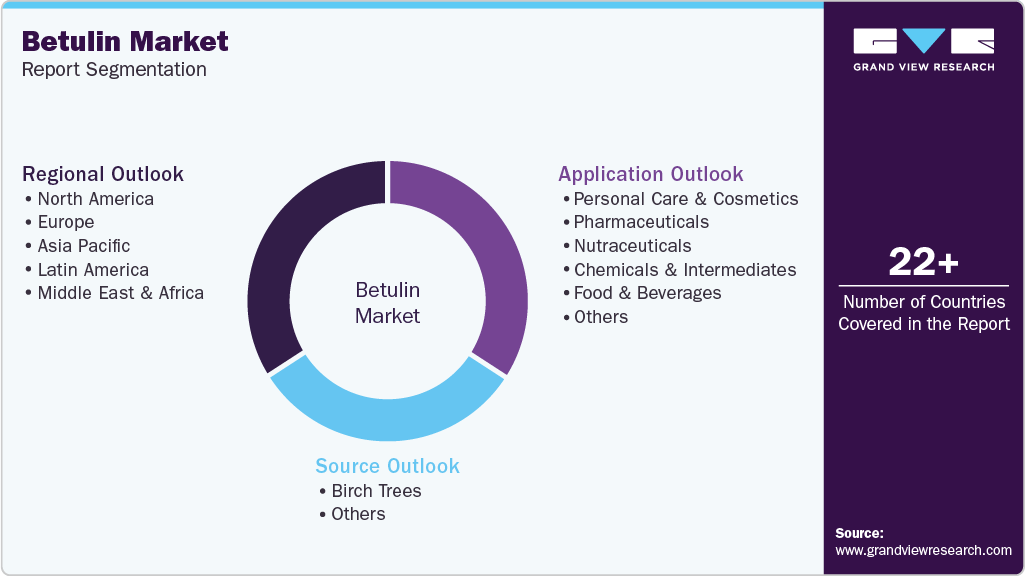

Global Betulin Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global betulin market report based on source, application, and region

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Birch Trees

-

Others (Hazel bark, calendula, alder cordial)

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Personal Care & Cosmetics

-

Pharmaceuticals

-

Nutraceuticals

-

Chemicals & Intermediates

-

Food & Beverages

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global betulin market size was estimated at USD 964.4 million in 2024 and is expected to reach USD 1,016.8 million in 2025

b. The global betulin market is expected to grow at a compound annual growth rate of 6.9% from 2025 to 2033 to reach USD 1,733.8 million by 2033.

b. Europe dominated the betulin market with a share of 37.1% in 2024, driven by the region’s growing emphasis on sustainability and the replacement of synthetic ingredients with bio-based alternatives.

b. Some key players operating in the betulin market include Otto Chemie Pvt. Ltd., SimSon Pharma Limited, ChemFaces, Aktin Chemicals,Inc., Hovane Phytochemicals, Betulin Lab (Latvijas Finieris Group), Tianjin NWS Biotechnology and Medicine Co. Ltd.

b. The market is growing steadily, driven by rising demand for natural, plant-based ingredients in pharmaceuticals and cosmetics. Its strong anti-inflammatory and antioxidant properties, along with the global shift toward sustainable products, are key factors supporting market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.