- Home

- »

- Medical Devices

- »

-

Blood Viscometer Market Size, Share, Industry Report, 2033GVR Report cover

![Blood Viscometer Market Size, Share & Trends Report]()

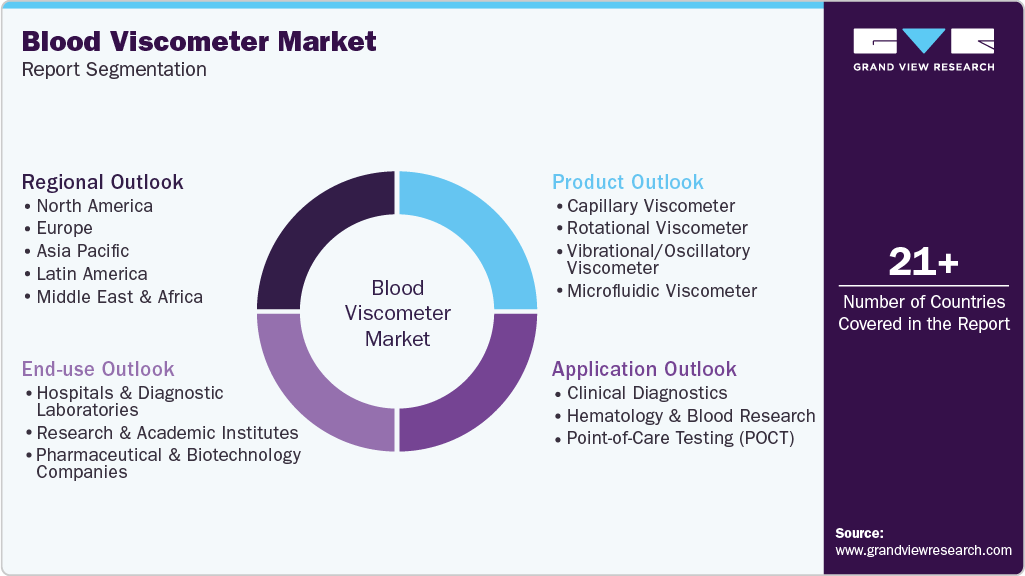

Blood Viscometer Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Capillary Viscometers, Rotational Viscometers, Microfluidic Viscometers), By Application (Clinical Diagnostics, Point-of-Care Testing (POCT), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-818-2

- Number of Report Pages: 105

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Blood Viscometer Market Summary

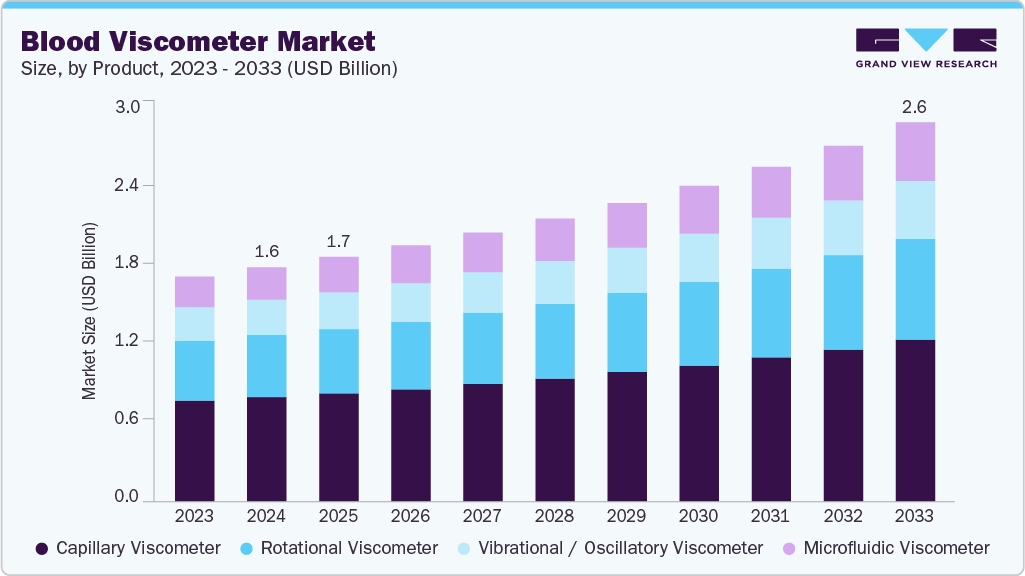

The global blood viscometer market size was estimated at USD 1.62 billion in 2024 and is projected to reach USD 2.63 billion by 2033, growing at a CAGR of 5.63% from 2025 to 2033. The growth outlook by advancements in clinical diagnostics, the increasing prevalence of cardiovascular and hematological disorders, and the growing adoption of point-of-care testing technologies.

Key Market Trends & Insights

- The North America blood viscometer market held the largest share of 43.46% of the global market in 2024.

- The blood viscometer industry in the Canada is expected to grow notably over the forecast period.

- By product, the capillary viscometers segment held the largest market share of 44.50% in 2024.

- Based on application, the clinical diagnostics segment held the largest market share in 2024.

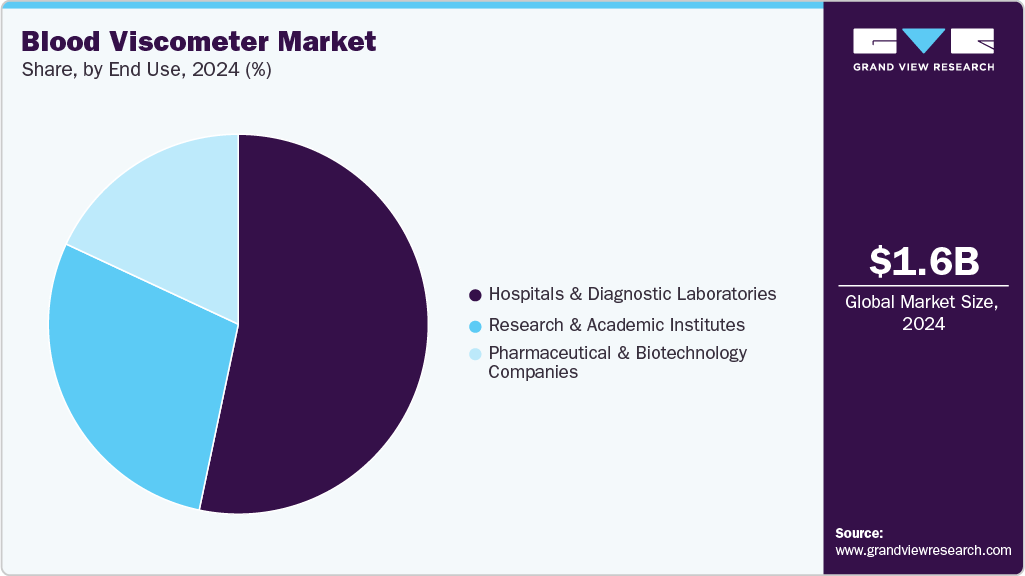

- Based on end use, the hospitals & diagnostic laboratories segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.62 Billion

- 2033 Projected Market Size: USD 2.63 Billion

- CAGR (2025-2033): 5.63%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In April 2023, a study published in Clinical Hemorheology and Microcirculation examined blood rheology and nitric oxide levels in coronary artery disease patients. The findings showed that higher erythrocyte aggregation and lower NO levels were linked to poorer collateral vessel development in the heart. Innovation in blood viscometry is increasing, with modern instruments offering real-time measurement, minimal sample volume requirements, and enhanced sensitivity for non-Newtonian fluids. These advancements enable more precise rheology assessments, improve diagnostic accuracy in conditions such as diabetes, hyperviscosity syndromes, and thrombosis, and expand use in routine clinical testing.In December 2022, an article in the Biomedical Journal discussed how grounding, or direct contact with the Earth’s surface, helps lower inflammation, stabilize heart rate, and improve flow. The study noted measurable improvements in zeta potential, suggesting reduced red blood cell aggregation, a factor directly linked to viscosity and its monitoring in clinical research.

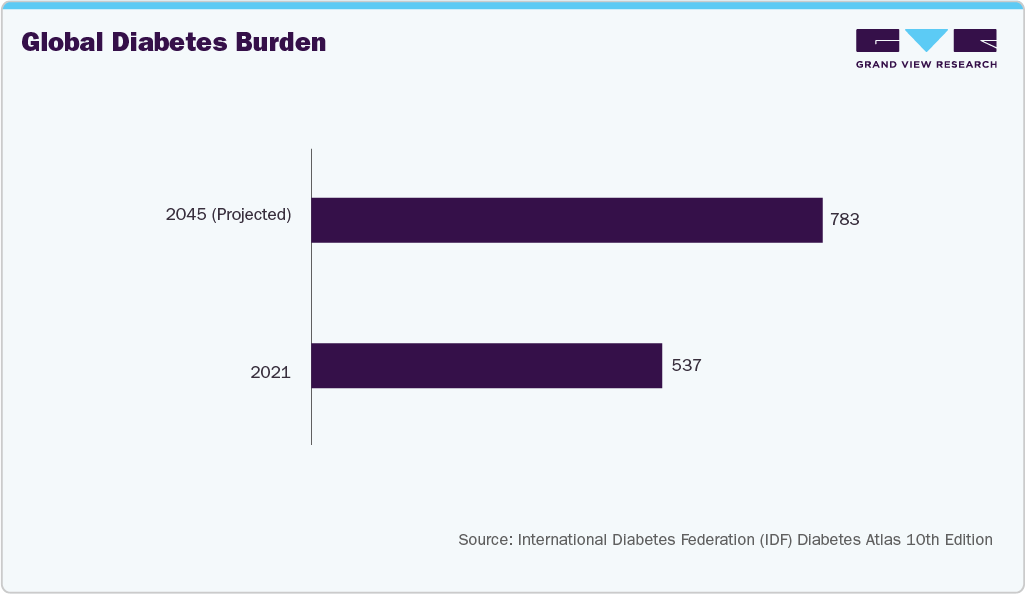

The rising incidence of cardiovascular diseases, anemia, and coagulation disorders is fueling demand for accurate viscosity measurement tools. As these disorders often involve changes in blood flow properties, viscometers are increasingly used for patient risk assessment, treatment monitoring, and therapy optimization.In February 2025, the World Health Organization (WHO) reported that anemia affects 40% of young children, 37% of pregnant women, and 30% of women of reproductive age worldwide.

The shift toward decentralized, rapid diagnostic solutions is driving demand for compact, user-friendly viscometers that deliver instant results in point-of-care settings, such as ICUs and outpatient clinics. This trend supports early disease detection, aligns with personalized medicine, and promotes cost-efficient healthcare delivery, sustaining market growth. In October 2023, a study in the Journal of Applied Physics presented a magnetic falling-sphere viscometer that employs a magnetized sphere and fluxgate magnetometers to track its motion through fluid. The system requires only 15 ml of sample and determines viscosities from 200 to 3000 cP within seconds, achieving 3% precision.

Clinical Relevance of Blood Viscosity Testing in Diabetes Care

In December 2023, research published in Pathology in Practice highlighted the vital role clinical viscosity testing can play in diabetes management and complication prevention. Since diabetes affects circulation, understanding haemorheology, the study of flow properties, has become critical for early diagnosis and risk monitoring.

Key Insight

Blood viscosity parameters such as plasma viscosity, whole blood viscosity, red cell deformability, and aggregation directly influence cardiovascular complications in diabetic patients. Elevated plasma viscosity, particularly in Type 2 diabetes, correlates with increased blood pressure and cardiovascular risk, indicating a major diagnostic opportunity for viscometers.

Expanding Role of Viscometers in Clinical Research

-

Plasma viscosity testing is increasingly being used over erythrocyte sedimentation rate (ESR) for its precision and clinical interpretability.

-

Whole blood viscosity measurements, especially when taken at multiple shear rates, offer deeper insights into early vascular changes in prediabetic or microangiopathic patients.

-

Red cell deformability and aggregation studies are emerging as predictive indicators for vascular plaque formation and impaired microcirculation in diabetic populations.

This multi parameter utility positions viscometers as essential instruments in both clinical laboratories and academic research settings.

Market Implication

-

The findings underscore a shift from pure research use to applied clinical diagnostics, aligning with the high projected growth of the research and academic institutes segment.

-

The integration of rheology profiling could become a routine lab practice, opening up recurring demand for advanced viscometers.

-

The move towards early detection and prediabetic screening suggests that hospitals and diagnostic labs will increasingly collaborate with research institutes to develop standardized viscosity-based diabetic risk models.

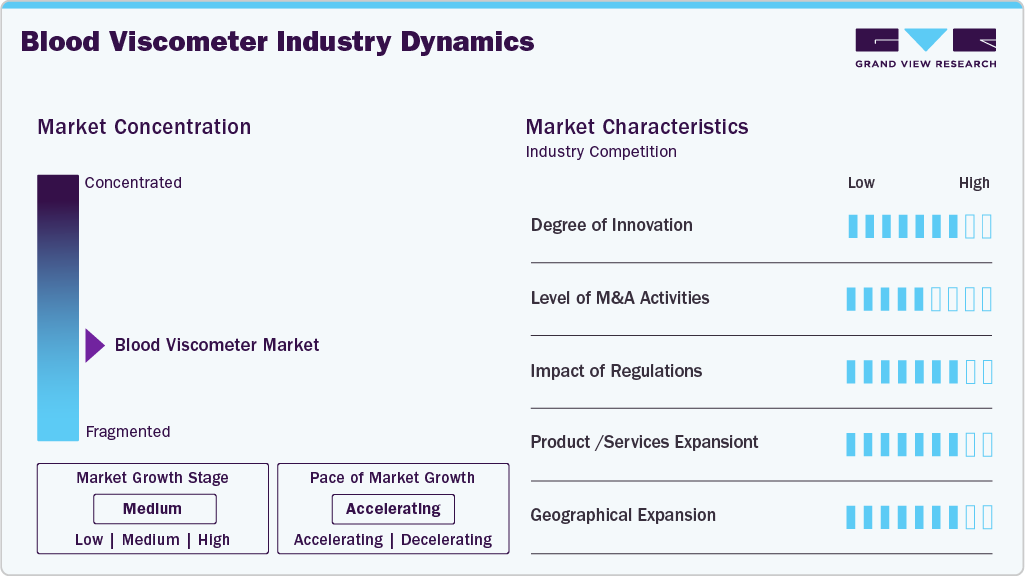

Market Concentration & Characteristics

The degree of innovation in the blood viscometer industry is currently high, driven by advancements in sensor accuracy, miniaturization, and digital integration. Newer models incorporate real-time viscosity monitoring, non-Newtonian fluid profiling, and wireless connectivity, enhancing both clinical precision and research efficiency. Continuous R&D investments, especially from companies leveraging vibrational and microfluidic technologies, are reshaping the competitive landscape and enabling faster, more reliable diagnostics.

The level of merger and acquisition activities is medium, reflecting a mix of consolidation among niche manufacturers and strategic alliances for technology acquisition. While the market is not dominated by large-scale takeovers, selective M&A deals are occurring to integrate advanced sensor technologies, expand product portfolios, and strengthen distribution networks. Most transactions are driven by access to innovation rather than market dominance, keeping activity steady but measured.

The impact of regulations on the blood viscometer industry is high, as products must comply with stringent standards for clinical accuracy, patient safety, and device calibration. Regulatory bodies such as the FDA and EMA require extensive validation for medical use, creating significant entry barriers but also ensuring high product reliability. In March 2024, the Journal of Agriculture and Life Sciences published a study from Cuba proposing the use of viscometers to guide pharmacological treatment for arterial hypertension. The research detailed how microviscometers can help identify whether elevated pressure is due to increased viscosity or arterial stiffness, offering a new precision-based approach for hypertension management.

Product expansion is high in the industry, supported by the introduction of portable, automated, and multi-parameter viscometers tailored for diverse applications from hematology labs to point-of-care testing. Manufacturers are increasingly focusing on customization and modular design, expanding product lines to serve clinical diagnostics, research, and industrial viscosity testing. This diversification is strengthening brand positioning and broadening adoption across both developed and emerging markets.

The blood viscometer industry's regional expansion is moderate, as growth remains concentrated in North America, Europe, and East Asia, while penetration in Latin America, the Middle East, and Africa remains limited. Expansion efforts are ongoing through distributor partnerships, localized manufacturing, and regulatory approvals; however, infrastructure gaps and pricing sensitivity in emerging markets temper the rapid scaling. As awareness of viscosity testing’s clinical value rises, regional expansion is expected to accelerate gradually but unevenly.

Product Insights

The capillary viscometers segment registered the largest market share of 44.50% in 2024,due to their widespread use in hospitals, diagnostic laboratories, and research settings for precise measurement of whole blood and plasma viscosity. Their advantages, including simple operation, high accuracy, and reliable correlation with standard reference methods, make them the preferred choice for routine diagnostic and clinical testing. In August 2024, the International Journal of Recent Surgical and Medical Sciences published a study on blood viscosity in patients with bilateral primary varicose and reticular veins, measuring viscosity using a capillary viscometer; results showed no significant differences between study groups.

The microfluidic viscometer segment is anticipated to grow at the fastest CAGR over the forecast period due to the increasing demand for compact, low sample volume, and rapid diagnostic solutions. These devices leverage microchannel technology to provide real time viscosity measurements, enabling integration into point of care and portable diagnostic platforms. The rising focus on personalized medicine, decentralized testing, and miniaturized lab-on-chip systems further accelerates the adoption of microfluidic viscometers. In May 2022, ACS Sensors published a study introducing a droplet-based microfluidic viscometer for point-of-care blood coagulation testing, enabling real-time monitoring of viscosity through color changes in droplets and offering a low-cost alternative to conventional lab assays.

Application Insights

The clinical diagnostics segment held the largest market share of 48.16% in 2024. The segment is driven by the widespread adoption of viscometers in hospitals and diagnostic laboratories for routine viscosity analysis related to cardiovascular, diabetic, and rheological disorders. Increasing awareness of the role of blood viscosity in disease monitoring, combined with advancements in analytical precision and integration with automated laboratory systems, further supports its strong market position.In August 2024, an article in Applied Physics Letters introduced a rapid, non-contact viscometry method based on optical coherence tomography for measuring viscosity. The technique shows strong potential for clinical diagnostics, enabling fast assessment of rheology changes relevant to cardiovascular and hematologic disorders.

The point-of-care testing (POCT) segment is anticipated to grow at the fastest CAGR over the forecast period due to the rising demand for portable and rapid diagnostic devices that enable viscosity testing outside traditional laboratory settings. The development of compact, user-friendly, and cost-effective viscometers tailored for emergency rooms, outpatient clinics, and home care applications is accelerating adoption. In April 2025, the University of Waterloo’s Capstone Design Symposia featured biomedical innovations, such as HemoTrek, a compact point-of-care blood viscometer designed for the rapid detection of Hyperviscosity Syndrome, showcasing the growing academic focus on portable and microfluidic-based viscometry technologies.

End Use Insights

The market is categorized by end use into hospitals & diagnostic laboratories, research & academic institutes, and pharmaceutical & biotechnology companies. In 2024, the hospitals & diagnostic laboratories segment held the largest market share of 53.30%. This is attributed to the extensive use of blood viscometers in clinical diagnostics and patient monitoring. These facilities rely on viscosity measurement for assessing flow properties in conditions such as cardiovascular diseases, diabetes, and hyperviscosity syndromes. In September 2024, a Sensing and Bio-Sensing Research study introduced a rapid capillary-based blood viscometry method utilizing longitudinal guided waves, enabling quick and low-volume measurements for hospital diagnostics and point-of-care use.

The research & academic institutes segment is poised to grow at the fastest CAGR over the forecast period, driven by increasing research activities in hematology, biomaterials, and hemodynamics. Rising funding for biomedical research and the growing use of viscometers to study blood rheology, drug formulation, and microfluidic applications are key contributors to this growth. In September 2023, Microsystem Technologies announced a micropillar-enabled acoustic wave (μPAW) viscometer, offering 20 times higher sensitivity than conventional quartz devices. This enables real-time viscosity measurement, with potential applications in biomedical testing.

Regional Insights

The North America blood viscometer industry dominated the market with a 43.46% market share in 2024. High volumes of diagnostic testing, the reliable presence of sophisticated healthcare infrastructure, and the extensive use of precision analytical tools in clinical and research settings are the main factors driving the market. In January 2023, Biophysics Reviews published a NIST study on microfluidic techniques for measuring mechanical properties of biological samples. It highlighted how microfluidic rheometry enables high-throughput, droplet-scale viscosity testing of biofluids, with potential diagnostic relevance.

U.S. Blood Viscometer Market Trends

The U.S. blood viscometer industry is characterized by high clinical adoption supported by advanced diagnostic infrastructure, strong research funding, and a well-established network of hospitals and laboratories. The market benefits from early technology adoption, the presence of leading manufacturers, and growing recognition of viscosity as a biomarker in cardiovascular and metabolic disorders. In April 2022, Clinical Hemorheology and Microcirculation published a study using a scanning capillary viscometer, which showed that patients with acute and recent COVID-19 had significantly higher whole blood viscosity at both high and low shear rates, highlighting hyperviscosity as a key factor in thrombotic risk.

Europe Blood Viscometer Market Trends

The blood viscometer industry in Europe is anticipated to grow significantly over the forecast period due to its strong academic research environments, robust healthcare systems, and increasing incorporation of viscosity testing into diagnostic protocols. Regional growth is also being supported by the rising incidence of chronic illnesses and the growing focus on early-stage diagnosis.In July 2025, Eurostat reported that 35.3% of EU residents aged 16 and above had a long-term illness or chronic health issue in 2024, with the condition more common among women (37.4%) than men (33.1%) and rising notably with age.

The UK blood viscometer industry has grown significantly due to government initiatives supporting healthcare innovation, the adoption of precision diagnostic tools, and the expansion of clinical research programs. In February 2022, Analytical Chemistry introduced a machine learning-aided microfluidic rheometer capable of rapidly measuring temperature-dependent viscosity of non-Newtonian biofluids such as blood plasma.

The blood viscometer industry in France is expanding due to government-funded initiatives promoting biomedical innovation. The need for advanced viscometry technologies is being driven by growing cooperation between private diagnostic firms and public health organizations. In June 2021, researchers at TotalEnergies’ Platform for Experimental Research in Lacq (PERL) developed a low-cost, hospital-suited viscometer prototype in collaboration with the Hemovis association and Bicêtre Hospital in Paris, adapting oil and gas viscosity measurement technology for healthcare applications.

Asia Pacific Blood Viscometer Market Trends

The Asia Pacific blood viscometer industry is experiencing significant growth driven by expanding healthcare infrastructure, rising investments in medical research, and a growing burden of chronic diseases. The availability of affordable diagnostic tools and growing awareness of rheology testing are driving rapid technology adoption in nations such as China, Japan, and India.In June 2023, an article in Scientific Reports examined the link between viscosity and stroke outcomes in patients with middle cerebral artery atherosclerosis.

The blood viscometer industry in China has gained ground from technological innovation, significant government support for biomedical research, and an aging population with an increase in metabolic and cardiovascular diseases. Adoption in both clinical and research applications is being accelerated by local manufacturers' focus on small, high-precision instruments. In August 2024, Applied Physics Letters published a study introducing a rapid, non-contact viscosity measurement technique using optical coherence tomography, which measured viscosity across varying hematocrit levels and showed strong potential for advancing hemodynamic and disorder diagnostics.

The India blood viscometer industry is experiencing robust growth, driven by rising healthcare expenditure, increasing awareness of advanced diagnostic testing, and the growing adoption of automated laboratory equipment. In May 2023, researchers at the Indian Institute of Technology (BHU) developed a low-cost, disposable paper-based capillary sensor that measures plasma viscosity using a smartphone app, as published in Microfluidics and Nanofluidics. The device uses only 50 µL of plasma and showed excellent correlation (R² = 0.9644) with Brookfield viscometer results, offering a portable and affordable point-of-care diagnostic tool.

Latin America Blood Viscometer Market Trends

The blood viscometer industry in Latin America is experiencing a notable shift driven by improving healthcare infrastructure, expanding diagnostic laboratory capacity, and growing investments in clinical research.In 2024, the International Diabetes Federation noted that Argentina recorded a 14% diabetes prevalence among adults, representing around 4.34 million cases. The South and Central America (SACA) region, which includes Argentina, had 35 million adults with diabetes, projected to rise to 52 million by 2050.

The Brazil blood viscometer industry has witnessed an increased use of viscometers in private labs and research facilities, bolstered by healthcare modernization programs. Viscometers are being used more frequently to measure rheology due to the rising prevalence of chronic illnesses such as diabetes, obesity, cardiovascular disease, and inflammatory disorders.In 2024, according to the International Diabetes Federation, Brazil recorded around 16.6 million adults aged 20-79 living with diabetes, making it one of the top ten countries globally with the highest diabetic population.

Middle East & Africa Blood Viscometer Market Trends

The blood viscometer industry in the Middle East and Africa is expanding steadily owing to rising healthcare spending, updated diagnostic labs, and an increase in the frequency of chronic illnesses, including diabetes and cardiovascular conditions. It is anticipated that regional adoption will be accelerated by government initiatives supporting advanced diagnostic technology.In November 2025, the International Diabetes Federation (IDF) reported that the Middle East and North Africa region had 84.7 million adults (aged 20-79) living with diabetes, projected to nearly double to 162.6 million by 2050, marking one of the highest global prevalence rates at 17.6%.

Saudi Arabia Blood Viscometer Market Trends

The Saudi Arabia blood viscometer industry is witnessing the rising prevalence of diabetes, a key factor driving demand for blood viscometers. Tools that allow for accurate viscosity monitoring to support diagnosis, therapy optimization, and early detection of problems are becoming increasingly important as the nation focuses on better care for metabolic and cardiovascular disorders.In 2024, the International Diabetes Federation (IDF) reported that Saudi Arabia had 5.3 million adults living with diabetes, with a 23.1% prevalence rate, one of the highest in the Middle East and North Africa region.

Key Blood Viscometer Company Insights

Key companies in the blood viscometer industry are actively pursuing various strategic initiatives to enhance their market presence. These initiatives include investing in research and development to innovate and improve the properties of the viscometer, which aims to achieve better clinical outcomes and enhance patient comfort.

Key Blood Viscometer Companies:

The following are the leading companies in the blood viscometer market. These companies collectively hold the largest market share and dictate industry trends.

- Anton Paar GmbH

- RheoSense, Inc.

- Benson Viscometers - Clinical Viscometers

- Beijing Steellex Scientific Instrument Co., Ltd.

- Health Onvector

- KYOTO ELECTRONICS MANUFACTURING CO., LTD.

- A&D Company, Limited

- AMETEK.Inc.

- Cannon Instrument Company.

- CSC Scientific Company, Inc.

Recent Developments

-

In July 2025, Biorheologics Co. Ltd. received a U.S. patent for a small blood viscosity measurement kit using a disposable U-shaped capillary viscometer, designed for accurate, infection-free viscosity testing across a wide shear rate range.

-

In January 2023, RheoSense, Inc., a manufacturer of viscometers, launched the m-VROC II, a high-precision small-sample viscometer capable of measuring viscosity in volumes as small as 15 microliters.

Blood Viscometer Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.70 billion

Revenue forecast in 2033

USD 2.63 billion

Growth Rate

CAGR of 5.63% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/ billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Anton Paar GmbH; RheoSense, Inc..; Benson Viscometers - Clinical Viscometers; Beijing Steellex Scientific Instrument Co., Ltd.; Health Onvector; KYOTO ELECTRONICS MANUFACTURING CO., LTD.; A&D Company, Limited; AMETEK.Inc.; Cannon Instrument Company; CSC Scientific Company, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Blood Viscometer Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global blood viscometer market report based on product, application, end use, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Capillary Viscometer

-

Rotational Viscometer

-

Vibrational / Oscillatory Viscometer

-

Microfluidic Viscometer

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Clinical Diagnostics

-

Hematology & Blood Research

-

Point-of-Care Testing (POCT)

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals & Diagnostic Laboratories

-

Research & Academic Institutes

-

Pharmaceutical & Biotechnology Companies

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.