- Home

- »

- Conventional Energy

- »

-

Canada Diesel Fuel Market Size, Industry Report, 2033GVR Report cover

![Canada Diesel Fuel Market Size, Share & Trends Report]()

Canada Diesel Fuel Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Petroleum Diesel, Biodiesel, Renewable Diesel), By Application (Automotive, Construction, Mining), And Segment Forecasts

- Report ID: GVR-4-68040-803-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Canada Diesel Fuel Market Summary

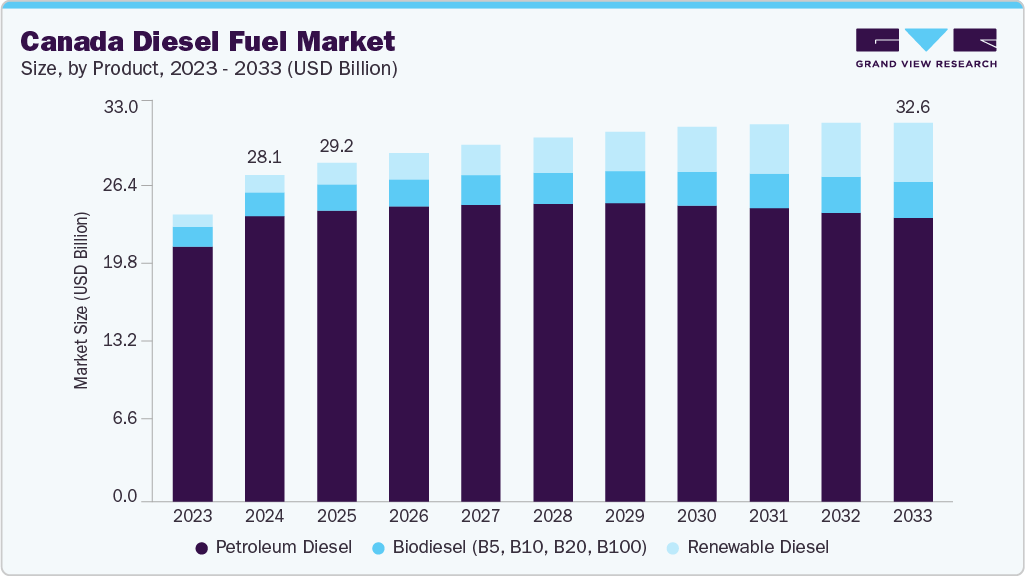

The Canada diesel fuel market size was estimated at approximately USD 28.10 billion in 2024 and is projected to reach USD 32.62 billion by 2033, growing at a CAGR of 1.4% from 2025 to 2033. Market growth is primarily driven by the steady demand from the transportation, mining, and industrial sectors, which remain key consumers of diesel fuel across Canada.

Key Market Trends & Insights

- By product, petroleum diesel held the highest market share of 87.4% in 2024.

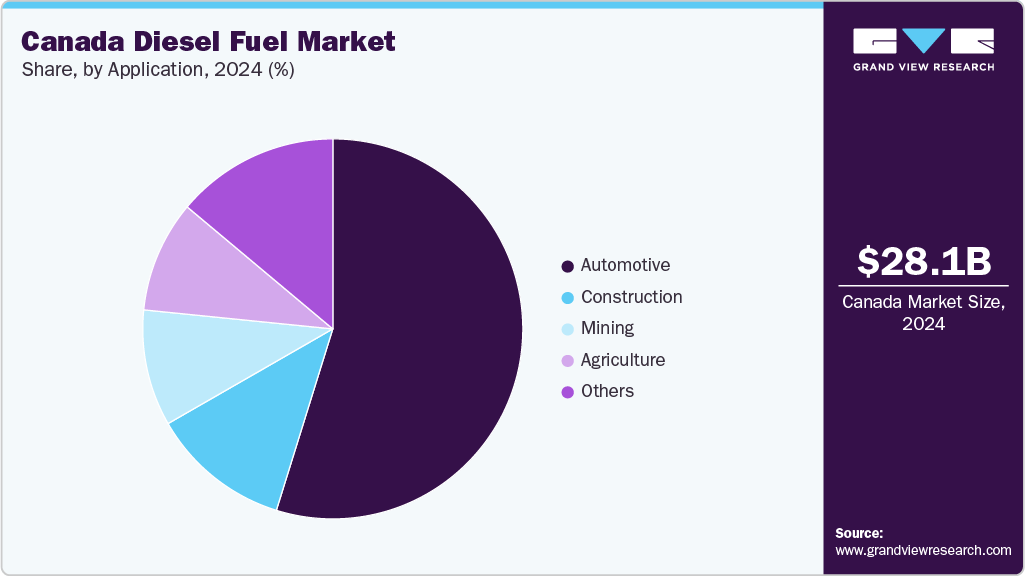

- Based on the application, the automotive segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 28.10 Billion

- 2033 Projected Market Size: USD 32.62 Billion

- CAGR (2025-2033): 1.4%

The ongoing expansion of freight and logistics activities, coupled with the continued reliance on heavy-duty vehicles in remote and industrial regions, supports sustained consumption. In addition, the Canadian government’s infrastructure investments, particularly in road transport and construction, are fueling diesel demand. While decarbonization policies gradually influence the market, the essential role of diesel in backup power generation, marine operations, and agriculture continues to underpin its importance in Canada’s energy mix.

In Western Canada, provinces such as Alberta, Saskatchewan, and British Columbia account for a significant portion of diesel fuel consumption, largely due to their extensive industrial and energy operations. The oil sands sector, mining activities, and rural transport networks significantly contribute to regional demand. Meanwhile, Eastern Canada, including Ontario and Quebec, is witnessing steady consumption driven by freight mobility, urban construction, and agricultural applications. The increasing adoption of low-sulfur diesel (ULSD) and biodiesel blends in compliance with federal clean fuel regulations is reshaping market dynamics.

Moreover, the emergence of renewable diesel and ongoing efforts to modernize refining capacity by leading suppliers such as Shell Canada, Imperial Oil, and Suncor Energy are expected to enhance supply stability and product quality. Overall, the market is poised for moderate yet stable growth, striking a balance between the country’s energy security goals and its long-term transition toward cleaner fuel alternatives.

Drivers, Opportunities & Restraints

The Canada diesel fuel industry is primarily driven by robust demand across transportation, construction, mining, and agricultural sectors, which collectively form the backbone of the nation’s energy consumption. Diesel remains an essential fuel for freight logistics, heavy-duty trucks, and off-road machinery, particularly in remote and industrial regions where electrification alternatives are limited. In addition, the expansion of Canada’s infrastructure projects and increasing investments in resource extraction and road transportation continue to sustain diesel consumption. The reliability, energy density, and cost-effectiveness of diesel fuel make it indispensable in sectors where continuous and high-power output is required. Moreover, federal clean fuel regulations and efficiency standards are encouraging refiners to produce low-sulfur and biodiesel blends, supporting both compliance and sustainable growth in the domestic fuel market.

Opportunities in the Canada diesel fuel industry are emerging through the development of renewable and low-carbon diesel alternatives, which align with national decarbonization targets. The growing integration of biodiesel and renewable diesel (R100) into the fuel supply chain presents a key growth avenue, as refiners and distributors invest in cleaner production technologies. Companies such as Suncor Energy, Imperial Oil, and Parkland Fuel Corporation are increasingly exploring renewable feedstocks and advanced refining processes to meet the rising demand for sustainable fuels. In addition, the electrification gap in heavy transportation and remote industries ensures long-term relevance for diesel, particularly in the marine, rail, and mining sectors. With government incentives supporting cleaner fuel transitions, the market is likely to witness increased collaboration between fuel producers, logistics providers, and regulatory agencies to expand renewable diesel infrastructure.

However, the market faces restraints due to stringent environmental regulations, volatile crude oil prices, and the gradual transition toward electrification and hydrogen-based transport systems. High carbon emissions from conventional diesel combustion are prompting policymakers to tighten emission norms, increasing pressure on producers and distributors. The growing competitiveness of electric vehicles (EVs) and hybrid fleets, especially in urban centers, could gradually curb diesel demand in the light-duty vehicle segment. Furthermore, fluctuating global oil supply dynamics and refinery maintenance cycles occasionally disrupt pricing stability. Despite these challenges, market adaptability, supported by advancements in cleaner fuel technologies and efficiency-driven consumption patterns, will be critical in maintaining its strategic importance within Canada’s evolving energy landscape.

Product Insights

The petroleum diesel segment accounted for the largest revenue share of 87.4% in 2024, dominating the market's product landscape. This dominance stems from its widespread utilization across the transportation, mining, agriculture, and industrial sectors, where high energy density and reliability are critical. Petroleum diesel remains the most accessible and cost-effective fuel option, powering freight trucks, heavy machinery, marine vessels, and backup generators nationwide. Despite growing environmental concerns, the extensive availability of refining infrastructure and well-established distribution networks by leading suppliers such as Imperial Oil, Shell Canada, and Suncor Energy have sustained petroleum diesel's market leadership. Furthermore, its compatibility with existing engines and fueling systems ensures continued preference among consumers and industrial users seeking efficiency and durability in fuel performance.

The renewable diesel segment is expected to record the highest CAGR of 13.2% over the forecast period, supported by Canada's ongoing energy transition and policy-driven emphasis on low-carbon transportation fuels. Renewable diesel's compatibility with existing engines and fueling systems positions it as a practical decarbonization option for commercial fleets, freight operators, and industrial users seeking to reduce emissions without equipment upgrades. Federal and provincial initiatives, including the Clean Fuel Regulations and low-carbon fuel standards led by British Columbia, are driving demand growth and encouraging capacity expansion. Major fuel suppliers and refiners such as Parkland Corporation, Shell, and Federated Co-operatives Ltd. are increasingly investing in renewable diesel production and co-processing capabilities to align with national emission reduction targets. As sustainability commitments strengthen across the public and private sectors, the adoption of renewable diesel is set to accelerate, contributing to a gradual shift in Canada's diesel fuel portfolio.

Application Insights

Based on application, the automotive segment accounted for the largest market share of 54.8% in 2024. This dominance is primarily attributed to the extensive use of diesel in commercial vehicles, freight trucks, buses, and off-road transportation equipment, which form the backbone of Canada’s logistics and supply chain network. Diesel engines are preferred for their superior torque, fuel efficiency, and durability, making them ideal for long-haul transportation and heavy-duty applications. The segment’s growth is also supported by the expansion of Canada’s e-commerce and logistics sectors, which have increased freight movement and diesel consumption. Moreover, continued investments in road infrastructure and cross-provincial transportation corridors are reinforcing diesel demand within the automotive industry.

The mining application segment is projected to record the highest CAGR of 1.6% during the forecast period, supported by ongoing resource extraction activities across regions such as Alberta, British Columbia, Saskatchewan, and the Northern territories. Diesel remains essential in mining operations due to its suitability for powering high-capacity haul trucks, drilling rigs, excavators, and other heavy-duty machinery operating in remote and rugged environments where alternative fuel infrastructure is limited. Growth in mineral and metal demand, particularly for copper, nickel, lithium, and potash, driven by global energy transition supply chains, is encouraging continued mining expansion and sustaining diesel consumption. In addition, developments in ultra-low-sulfur diesel (ULSD) supply, along with gradual integration of renewable diesel blends, are helping mining companies meet environmental compliance targets without compromising performance. As large-scale mining projects advance and remote industrial operations continue to rely on high-load diesel equipment, the mining application segment is expected to maintain steady growth and remain a vital contributor to Canada’s market through 2033.

Key Canada Diesel Fuel Company Insights

Some of the key players operating in the market include BacTech Environmental Corporation, Anglo American plc, and others.

-

Anglo American plc is a leading global mining company headquartered in London, with a diverse portfolio spanning copper, diamonds, platinum, and other essential metals. The company is at the forefront of integrating innovative technologies to enhance the sustainability and efficiency of its operations. Anglo American's commitment to reducing environmental impact is evident in its development of the SandLix heap leaching process, which utilizes microorganisms to extract metals from low-grade ores. This method not only increases resource utilization by economically processing previously uneconomical materials but also reduces water and energy consumption and minimizes the volume of wet tailings requiring storage.

-

BacTech Environmental Corporation is a Canadian cleantech company specializing in the application of bioleaching to remediate toxic mining sites and recover valuable metals. The company employs naturally occurring bacteria to oxidize sulfides in mine tailings, a process that neutralizes toxic substances like arsenic and converts them into environmentally benign compounds. This bioremediation approach not only recovers metals but also addresses long-standing environmental hazards associated with historic mining activities.

Key Canada Diesel Fuel Companies:

- Canadian Clean Fuels Corporation

- Cenovus Energy Inc.

- Gibson Energy Inc.

- Greenergy Canada

- Husky Energy (Cenovus Energy)

- Imperial Oil Ltd. (Esso)

- Irving Oil Ltd.

- Parkland Corporation

- Shell Canada Ltd.

- Suncor Energy Inc. (Petro-Canada)

Recent Developments

-

In April 2025, Suncor Energy Inc. announced the successful expansion of its diesel production and renewable fuel blending capacity at the Edmonton Refinery in Alberta, aimed at strengthening Canada’s clean fuel supply chain. The project involves integrating renewable diesel production capabilities and enhancing ultra-low-sulfur diesel (ULSD) output to meet the growing demand from the transportation, mining, and industrial sectors.

Canada Diesel Fuel Market Report Scope

Report Attribute

Details

Market Definition

The market size represents the total revenue generated from the production, distribution, and sale of diesel fuel across transportation, industrial, mining, agricultural, and commercial applications within Canada.

Market size value in 2025

USD 29.20 billion

Revenue forecast in 2033

USD 32.62 billion

Growth rate

CAGR of 1.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Volume in billion gallon, revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Volume & revenue forecast, Volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application

Country scope

Canada

Key companies profiled

Suncor Energy Inc. (Petro-Canada); Imperial Oil Ltd. (Esso); Parkland Corporation; Irving Oil Ltd.; Gibson Energy Inc.; Greenergy Canada; Husky Energy (Cenovus Energy); Shell Canada Ltd.; Cenovus Energy Inc.; Canadian Clean Fuels Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Canada Diesel Fuel Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Canada diesel fuel market report based on product, and application:

-

Product Outlook (Volume, Billion Gallon; Revenue, USD Billion, 2021 - 2033)

-

Petroleum Diesel

-

Biodiesel (B5, B10, B20, B100)

-

Renewable Diesel

-

-

Application Outlook (Volume, Billion Gallon; Revenue, USD Billion, 2021 - 2033)

-

Automotive

-

Construction

-

Mining

-

Agriculture

-

Others

-

Frequently Asked Questions About This Report

b. The Canada diesel fuel market size was estimated at USD 28.10 billion in 2024 and is expected to reach USD 29.20 billion in 2025.

b. The Canada diesel fuel market is expected to grow at a compound annual growth rate of 1.4% from 2025 to 2033 to reach USD 32.62 billion by 2033.

b. Based on the product segment, petroleum diesel held the largest revenue share of more than 87.40% in 2024.

b. Some of the key players operating in the Canada diesel fuel market include Suncor Energy Inc. (Petro-Canada), Imperial Oil Ltd. (Esso), Parkland Corporation, Irving Oil Ltd., Gibson Energy Inc., Greenergy Canada, Husky Energy (Cenovus Energy), Shell Canada Ltd., Cenovus Energy Inc., and Canadian Clean Fuels Corporation.

b. The key factors driving the Canada diesel fuel market include the rising demand from transportation, mining, construction, and agricultural sectors, which continue to rely heavily on diesel for high-performance and long-haul operations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.