- Home

- »

- Conventional Energy

- »

-

Canada Gasoline Fuel Market Size, Industry Report, 2033GVR Report cover

![Canada Gasoline Fuel Market Size, Share & Trends Report]()

Canada Gasoline Fuel Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Regular Gasoline, Mid-Grade Gasoline, Premium Gasoline, Ethanol-Blended Gasoline), By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-804-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Canada Gasoline Fuel Market Summary

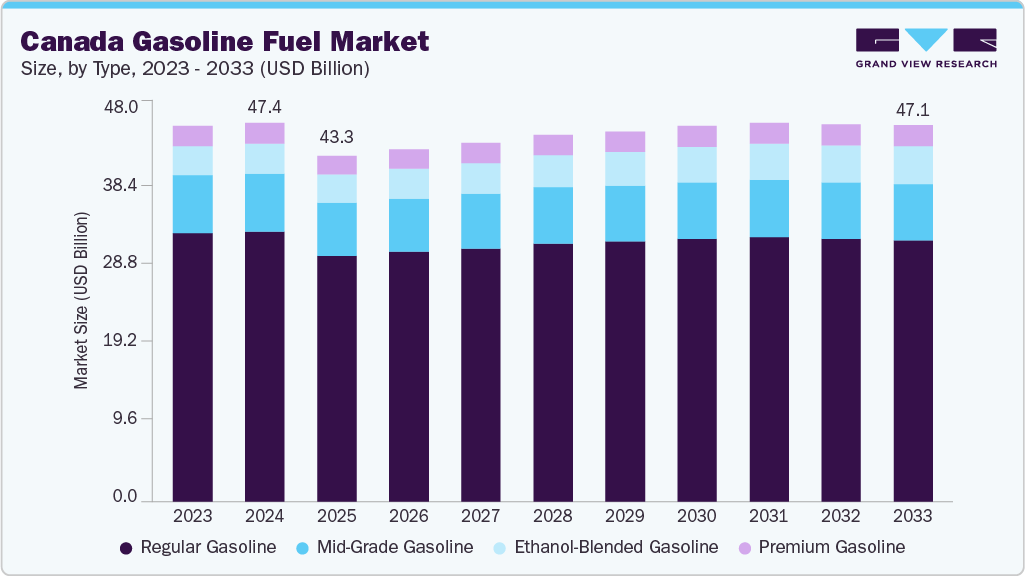

The Canada gasoline fuel market size was estimated at USD 47.42 billion in 2024 and is projected to reach USD 47.12 billion by 2033, growing at a CAGR of 1.1% from 2025 to 2033. Market growth is primarily supported by the country’s strong mobility trends, with gasoline remaining the dominant fuel for passenger vehicles across both urban and rural regions.

Key Market Trends & Insights

- By type, regular gasoline held the highest market share of 71.2% in 2024.

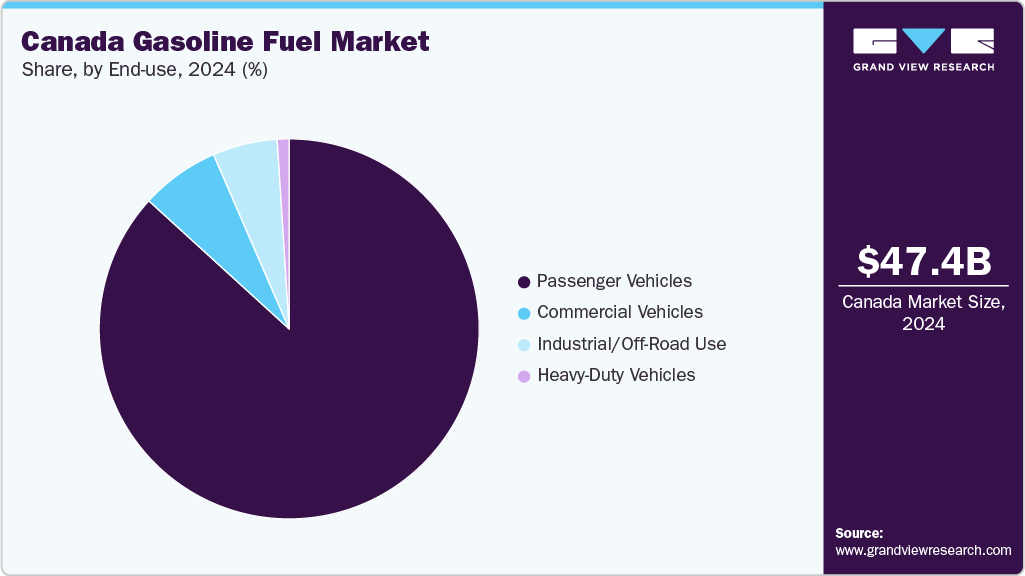

- By end use, passenger vehicles held the highest market share in 2024.

- By type, the ethanol-blended gasoline segment is projected to register the fastest CAGR of 3.9% over the forecast periodd.

Market Size & Forecast

- 2024 Market Size: USD 47.42 Billion

- 2033 Projected Market Size: USD 47.12 Billion

- CAGR (2025-2033): 1.1%

Despite the gradual increase in the adoption of hybrid and electric vehicles, internal combustion engine (ICE) cars and light-duty trucks continue to comprise a large share of Canada’s vehicle fleet. Steady economic activity, population growth in major metropolitan areas, and continued consumer preference for SUVs and light trucks sustain gasoline demand. Additionally, ongoing improvements in retail fuel distribution networks, convenience store expansions, and competitive pricing strategies by major fuel marketers are expected to reinforce stable market performance over the forecast period.

Regionally, gasoline consumption is highest in Ontario, Quebec, Alberta, and British Columbia, driven by dense commuting networks, suburban transportation patterns, and robust commercial activity. Provincial fuel standards and federal carbon pricing policies are gradually influencing the shift toward cleaner-burning gasoline and higher biofuel blending mandates. The market is witnessing increasing availability of E10 and E15 ethanol-blended gasoline, supported by agricultural producers and biofuel refiners. Meanwhile, key companies such as Suncor Energy (Petro-Canada), Imperial Oil (Esso), Parkland Corporation, Shell Canada, and Irving Oil continue to modernize refining operations and optimize supply chains to ensure reliable distribution across retail fueling stations. While the long-term electrification of transport will shape future fuel demand, gasoline is expected to remain a key component of Canada’s energy and mobility infrastructure in the medium term, balancing regulatory pressures with the persistent need for accessible and affordable liquid transportation fuels.

Drivers, Opportunities & Restraints

The Canada gasoline fuel industry’s growth is primarily driven by strong demand from the passenger transportation sector, where gasoline-powered vehicles continue to account for the majority of the national vehicle fleet. Despite rising interest in electric and hybrid vehicles, internal combustion engine (ICE) cars, SUVs, and light-duty trucks remain the preferred choice for many consumers due to affordability, convenience, and widespread refueling infrastructure. Growing urbanization, commuter travel between suburban and metropolitan regions, and steady post-pandemic recovery in road mobility further support gasoline consumption. Additionally, investments in retail fuel networks, service stations, and convenience store expansions have strengthened distribution accessibility. The introduction of improved fuel formulations and higher-efficiency engine standards is also contributing to sustained gasoline usage across both personal and commercial transportation segments.

Opportunities in the Canada gasoline fuel market are emerging through increased adoption of biofuel blending and advancements in cleaner-burning gasoline formulations. The expansion of ethanol-blended gasoline, including E10 and E15, is driven by federal and provincial policies aimed at reducing life-cycle carbon emissions. Fuel suppliers, including Petro-Canada (Suncor Energy), Esso (Imperial Oil), Shell Canada, and Parkland Corporation, are actively investing in supply chain modernization and blending infrastructure to support the greater integration of renewable fuel components. Opportunities also lie in optimizing retail station networks in remote and rural regions, where mobility needs remain high and adoption of electrification is slower. Moreover, consumer demand trends toward fuel-efficient and hybrid vehicles create space for premium and performance-oriented gasoline grades, presenting scope for differentiated product offerings.

However, the market faces restraints linked to tightening environmental regulations, shifting consumer preferences, and the gradual transition toward the adoption of electric vehicles (EVs). Federal carbon pricing mechanisms and provincial clean fuel standards are increasing compliance costs for gasoline suppliers, prompting the market to shift toward lower-emission alternatives. The growing availability of EV charging infrastructure and government incentives for EV purchase are expected to gradually reduce gasoline demand in the passenger vehicle segment, particularly in densely populated urban regions. Additionally, fluctuations in global crude oil prices and seasonal variations in driving behavior influence pricing and demand stability. Despite these challenges, gasoline is expected to maintain a significant role in Canada’s energy and transportation landscape in the medium term, supported by its entrenched infrastructure, broad accessibility, and continued reliance on ICE-based mobility.

Type Insights

The regular gasoline segment accounted for the largest revenue share of 71.2% in 2024, dominating the type landscape of the Canadian gasoline fuel market. Its market leadership is driven by widespread use in passenger vehicles, light-duty trucks, and everyday personal transportation, which collectively make up the majority of Canada’s on-road mobility. Regular gasoline remains the most accessible and cost-effective fuel alternative for consumers across both urban and rural regions, supported by a well-established retail fueling network. Major suppliers, including Suncor Energy (Petro-Canada), Imperial Oil (Esso), Parkland Corporation, and Shell Canada, continue to ensure a stable supply through their extensive refining and distribution capabilities. Additionally, the familiarity of regular gasoline among consumers, coupled with its compatibility with the existing national vehicle fleet, reinforces its continued dominance in the market, particularly as commuting, logistics, and personal vehicle usage remain central to everyday mobility.

The ethanol-blended gasoline segment is projected to register the fastest CAGR of 3.9% over the forecast period, driven by Canada’s increasing emphasis on reducing greenhouse gas emissions and enhancing fuel sustainability. Blends such as E10 and E15 are gaining traction, supported by federal Clean Fuel Regulations and provincial renewable fuel standards that encourage the greater integration of biofuels. Ethanol-blended gasoline offers improved environmental performance by lowering the carbon intensity of transportation fuels, making it an attractive choice for both regulators and consumers seeking cleaner mobility solutions. Fuel producers and distributors are expanding blending infrastructure and forming partnerships with agricultural suppliers to enhance supply consistency. As national and regional policies continue to push for decarbonization, and as awareness surrounding low-emission gasoline alternatives grows, the adoption of ethanol-blended gasoline is expected to accelerate, reshaping the composition of Canada’s gasoline fuel portfolio over the coming decade.

End Use Insights

The passenger vehicle segment led the Canada gasoline fuel industry, accounting forthe largest share of 86.6% in 2024. This dominance is driven by the continued reliance on gasoline-powered cars, SUVs, and light-duty trucks across urban, suburban, and rural regions. Internal combustion engine (ICE) vehicles still make up the majority of Canada’s on-road fleet, supported by a well-established gasoline retail infrastructure and strong consumer familiarity with gasoline-based mobility. Commuting patterns between suburban communities and major metropolitan centers, combined with lifestyle preferences toward larger vehicle models, reinforce gasoline demand. Furthermore, gasoline engines are widely recognized for their smooth operation, lower upfront vehicle cost compared to diesel or electric alternatives, and extensive service accessibility across the country. As daily travel, personal mobility, and family vehicle ownership remain central to Canadian transportation habits, the Passenger Vehicles segment retains its strong leadership position in the gasoline fuel market.

The heavy-duty vehicles segment is projected to record the fastest CAGR of 4.6% over the forecast period. The growth is supported by expanding freight transportation, construction activities, and regional logistics operations that rely on gasoline-powered light commercial trucks, delivery vans, and municipal service fleets. The rise of e-commerce and last-mile delivery networks is contributing to increased gasoline consumption among medium-duty and fleet-operated vehicles, particularly in urban centers. Additionally, municipalities and private fleet operators seeking lower upfront vehicle acquisition costs, compared to diesel or electric alternatives, continue to adopt gasoline-powered commercial vehicles. As fleet modernization programs evolve and service-oriented industries expand, gasoline demand within the Heavy-Duty Vehicles segment is expected to increase steadily. While long-term transportation electrification may influence future trends, gasoline-powered commercial mobility will remain a critical component of Canada’s logistics and service sectors in the near to medium term.

Key Canada Gasoline Fuel Company Insights

Some of the key players operating in the market include Suncor Energy Inc. and Parkland Corporation.

-

Suncor Energy Inc. is one of Canada’s largest integrated energy companies, operating across oil sands development, refining, and retail fuel distribution. Headquartered in Calgary, Suncor markets gasoline primarily under the Petro-Canada brand, which maintains one of the most extensive retail station networks nationwide. The company continues to modernize its refining operations to enhance fuel efficiency, reduce emissions, and expand the availability of ethanol-blended gasoline options in accordance with federal clean fuel regulations. Suncor is also investing in decarbonization initiatives, including research on renewable fuels, carbon capture technologies, and energy efficiency upgrades, across its downstream operations. These efforts reinforce its commitment to balancing fuel supply reliability with Canada’s long-term sustainability goals.

-

Parkland Corporation is a leading fuel distributor, marketer, and retail convenience operator in Canada, managing gasoline supply through brands such as Chevron, Ultramar, On the Run, and Fas Gas+. The company leverages a diversified supply chain, including terminals, blending facilities, and refinery partnerships, to ensure consistent fuel availability across urban centers and remote regions. Parkland is increasingly expanding its renewable and low-carbon fuel offerings, including ethanol-blended gasoline, to comply with provincial and federal clean fuel standards. Additionally, the company is investing in network optimization, digital retail engagement, and the integration of EV charging solutions at select service stations, positioning itself to serve both conventional fuel consumers and emerging alternative mobility markets.

Key Canada Gasoline Fuel Companies:

- 7-Eleven Canada

- Canadian Tire Corporation

- Cenovus Energy Inc.

- Costco Wholesale Canada

- Husky Energy

- Imperial Oil Limited

- Irving Oil Ltd.

- Parkland Corporation

- Shell Canada Limited

- Suncor Energy Inc.

Recent Developments

-

In April 2025, Parkland Corporation announced enhancements to its gasoline blending and distribution capabilities at its Burnaby Refinery in British Columbia, supporting the increased supply of ethanol-blended gasoline across Western Canada. The upgrade focuses on expanding E10 and E15 blending capacity, improving storage infrastructure for bioethanol, and streamlining logistics to retail fueling stations.

Canada Gasoline Fuel Market Report Scope

Report Attribute

Details

Market Definition

The market size represents the total revenue generated from the production, distribution, and sale of gasoline fuel across passenger transportation, commercial fleets, retail fueling networks, and municipal or small-scale industrial applications within Canada.

Market size value in 2025

USD 43.34 billion

Revenue forecast in 2033

USD 47.12 billion

Growth Rate

CAGR of 1.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Revenue in USD billion, volume in billion gallon, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Type, end use

Country scope

Canada

Key companies profiled

Suncor Energy Inc.; Imperial Oil Limited; Shell Canada Limited; Parkland Corporation; Irving Oil Ltd.; Cenovus Energy Inc.; Husky Energy; Canadian Tire Corporation; Costco Wholesale Canada; 7-Eleven Canada

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Canada Gasoline Fuel Market Report Segmentation

This report forecasts volume & revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Canada gasoline fuel market report based on type and end use:

-

Type Outlook (Volume, Billion Gallon; Revenue, USD Billion, 2021 - 2033)

-

Regular Gasoline

-

Mid-Grade Gasoline

-

Premium Gasoline

-

Ethanol-Blended Gasoline

-

-

End Use Outlook (Volume, Billion Gallon; Revenue, USD Billion, 2021 - 2033)

-

Passenger Vehicles

-

Commercial Vehicles

-

Heavy-Duty Vehicles

-

Industrial / Off-Road Use

-

Frequently Asked Questions About This Report

b. The Canada gasoline fuel market size was estimated at USD 47.42 billion in 2024 and is expected to reach USD 43.34 billion in 2025.

b. The Canada gasoline fuel market is expected to grow at a compound annual growth rate of 1.1% from 2025 to 2033 to reach USD 47.12 billion by 2033.

b. Based on the type segment, regular gasoline held the largest revenue share of more than 71.22% in 2024.

b. Some of the key players operating in the Canada gasoline fuel market include Suncor Energy Inc., Imperial Oil Limited, Shell Canada Limited, Parkland Corporation, Irving Oil Ltd., Cenovus Energy Inc., Husky Energy, Canadian Tire Corporation, Costco Wholesale Canada, and 7-Eleven Canada.

b. The key factors driving the Canada gasoline fuel market include the sustained reliance on gasoline-powered passenger vehicles and light-duty trucks for daily commuting, personal mobility, and commercial transportation activities across urban and suburban regions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.