- Home

- »

- Biotechnology

- »

-

Cell Signaling Market Size And Share, Industry Report, 2033GVR Report cover

![Cell Signaling Market Size, Share & Trends Report]()

Cell Signaling Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Endocrine Signaling, Paracrine Signaling), By Product, By Technology, By Pathway, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-190-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cell Signaling Market Summary

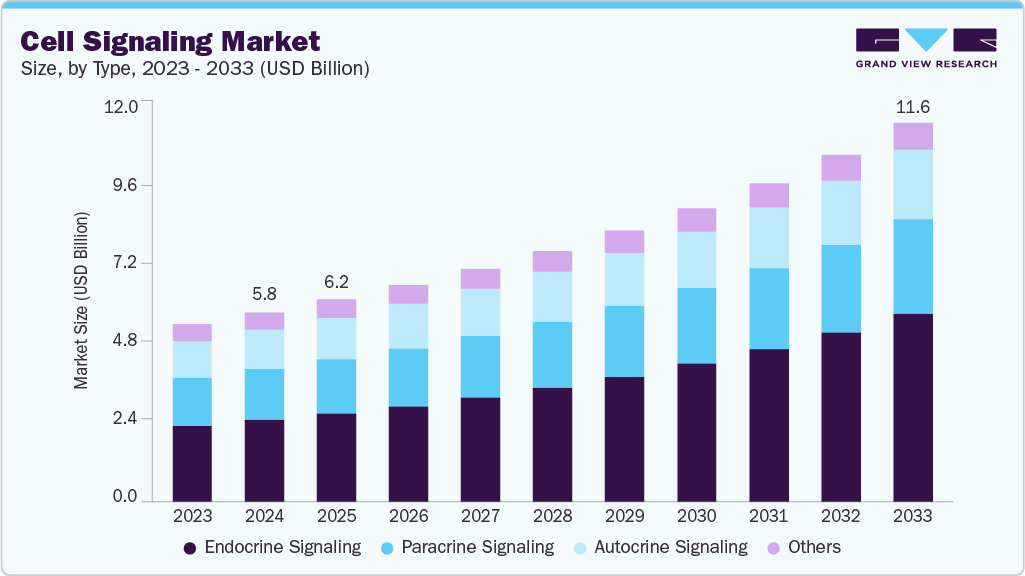

The global cell signaling market size was estimated at USD 5.77 billion in 2024 and is projected to reach USD 11.55 billion by 2033, growing at a CAGR of 8.14% from 2025 to 2033. An increasing prevalence of chronic diseases such as cancer, cardiovascular diseases, and neurological disorders globally, as well as growing advancements in cell signaling research, are the prime factors driving market growth.

Key Market Trends & Insights

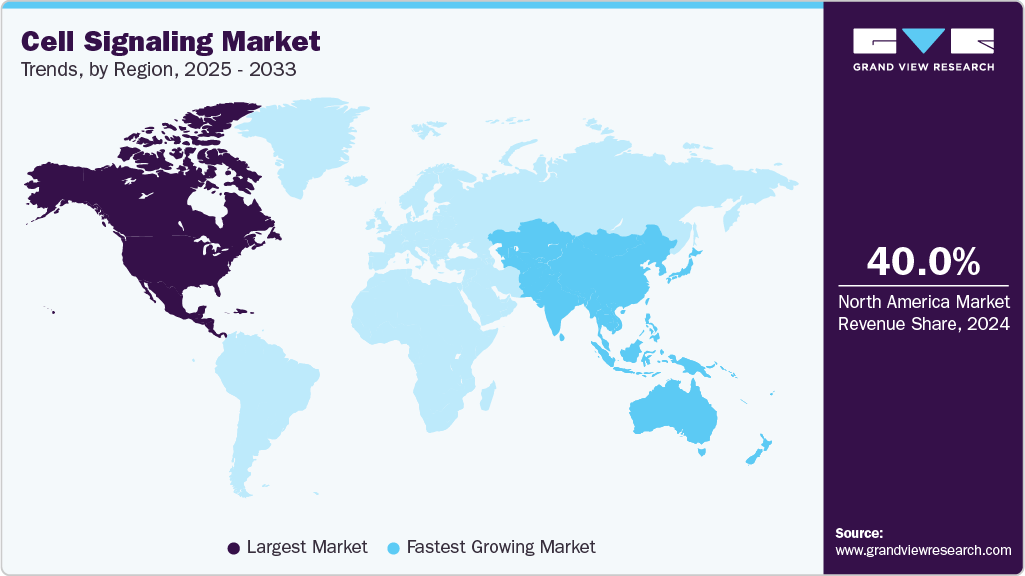

- The North America cell signaling market held the largest share of 40.13% of the global market in 2024.

- The cell signaling industry in the U.S. is expected to grow significantly over the forecast period.

- By type, the endocrine signaling segment held the highest market share of 43.21% in 2024.

- Based on product, the consumables segment held the highest market share in 2024.

- By technology, the microscopy segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.77 Billion

- 2033 Projected Market Size: USD 11.55 Billion

- CAGR (2025-2033): 8.14%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Growing Focus on Precision & Targeted Therapies

The increasing focus on precision and targeted therapies is driving strong demand in the cell signaling market. Diseases, such as cancer, autoimmune disease, and neurodegenerative disorders, are linked with aberrant signaling pathways, and researchers and biopharmaceutical companies have invested in pathway-level analysis to identify more selective and efficacious drugs.

Major Signaling Pathways & Targeted Therapeutic Areas

Cell Signaling Pathway

Therapeutic Focus / Key Application Areas

AKT Signaling Pathway

Cancer, metabolic disorders, inflammation, neurodegenerative diseases; focus on tumor growth inhibition, apoptosis regulation & metabolic pathway targeting

AMPK Signaling Pathway

Metabolic diseases (diabetes, obesity), cardiovascular disorders, aging & mitochondrial dysfunction; therapies promoting cellular energy balance & metabolic regulation

ErbB / HER Signaling Pathway

Oncology (breast, lung, GI cancers), targeted biologics & small-molecule inhibitors; major focus on HER2-positive cancers & growth factor-driven tumor signaling

Other Signaling Pathways (e.g., Wnt, Notch, Hedgehog, JAK-STAT, NF-κB)

Cancer, stem-cell and regenerative therapies, autoimmune & inflammatory disorders, developmental biology-driven therapies; immune modulation, tissue repair & targeted pathway inhibitors

Source: Secondary Research, Grand View Research

At the same time, clinical research is utilizing signaling biomarkers to stratify patients, monitor treatment responses, and provide insight into the mechanisms of drug resistance, thereby reinforcing the need for sophisticated cell-based functional systems and data-driven platforms.

Advances in Molecular Biology & Omics Technologies

Advances in molecular biology and multi-omics platforms are significantly boosting demand in the cell signaling market. The integration of genomics, proteomics, transcriptomics, and metabolomics is enabling researchers to map signaling pathways more accurately and uncover disease-specific molecular drivers. As a result, demand will also rise for high-quality signaling reagents, pathway-specific antibodies, assay kits, and analytical platforms used by academic labs, biotech companies, and pharmaceutical R&D programs.

Meanwhile, next-generation technologies are booming, including high-content imaging, spatial biology, single-cell sequencing, and advanced flow cytometry. Drug therapy, antibodies, lights in the sky, miR imaging, and personalized medicine techniques are being integrated into tech platforms. Software computing, live-cell imaging devices, and multiparameter tests are becoming increasingly necessary every day. By encouraging funding for cell signaling research, the partnership between these technologies is bolstering market expansion.

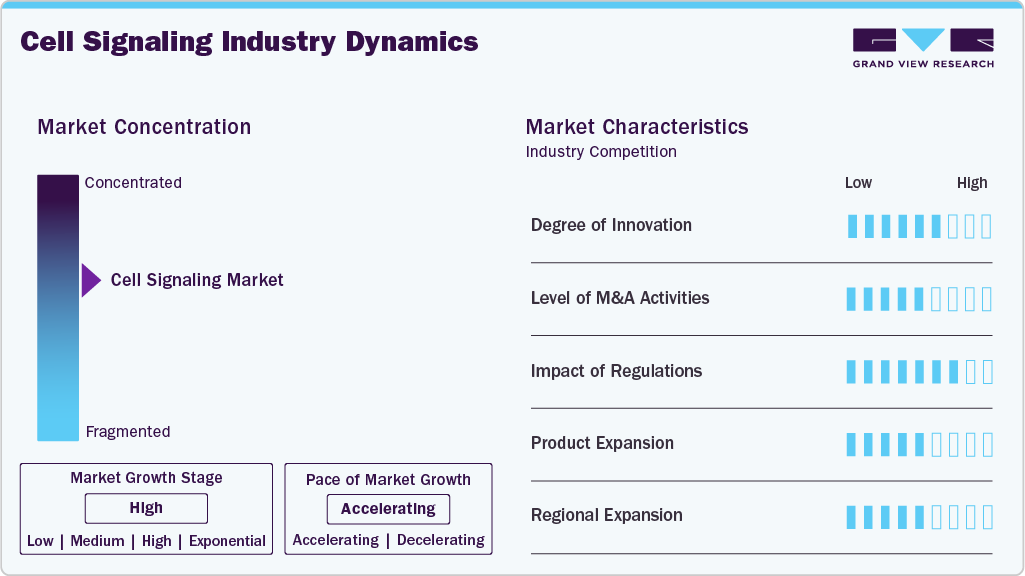

Market Concentration & Characteristics

The cell signaling industry is growing at a moderate rate, and this growth is accelerating. The adoption of cutting-edge medical technologies, rising R&D program investments, the rising incidence of chronic illnesses, and other factors have all contributed to the cell signaling industry's moderate to high rate of growth.

M&A activity in the cell signaling industry is rising as major life science companies seek to expand their capabilities in precision medicine, oncology, and advanced cell analysis. To boost portfolios and spur innovation, businesses are acquiring suppliers of signaling reagents, assay platforms, and single-cell or multi-omics technologies, thereby facilitating further industry consolidation.

Regulations significantly impact the cell signaling market by enforcing stringent standards for quality, validation, and the ethical use of biological tools. Regulatory requirements enhance credibility and promote the wider adoption of compliant, clinically aligned cell signaling technologies, even though they can increase development costs.

Companies are constantly launching new pathway-specific reagents, assays, and sophisticated analytical tools, such as single-cell and multi-omics solutions, to facilitate in-depth signaling research. For instance, in September 2023, CST introduced SignalStar Multiplex IHC in the US and a few European markets, enabling high-throughput tissue-microenvironment analysis, shorter optimization times, and quick, flexible 8-plex spatial IHC with validated antibodies.

The geographical distribution of cell signaling is slowly shifting from developed nations to emerging countries. These economies also exhibit greater disease variation compared to countries in North America and Western Europe, where traditional diseases are on the rise.

Type Insights

Endocrine signaling accounted for the largest revenue share of 43.21% in 2024 and is anticipated to witness the fastest growth through 2033, driven by its critical role in regulating long-distance hormonal communication across physiological systems, as well as expanding research in metabolic disorders, cancer, and endocrine-related diseases.

The paracrine signaling segment is expected to register a significant CAGR over the forecast period, driven by its expanding role in cell-to-cell communication studies, therapeutic development, and advanced tissue engineering applications.

Product Insights

Consumables accounted for the largest revenue share in 2024 and expected to grow with the fastest CAGR over the forecast period. This share is due to repurchasing of consumables. Furthermore, the expanding number of advances in genomes and proteomics, as well as the growing emphasis on customized medicine and targeted therapies, are accelerating this segment's growth rate.

Instruments segment is estimated to register a substantial CAGR over the forecast period. Factors such as technological advancements, growing demand for automated systems, and expanding PoC diagnostics demand are contributing to segment growth. Furthermore, rising prevalence of chronic diseases, increase of fund grants for cell-based research and others are driving segment expansion.

Technology Insights

The microscopy segment dominated the market in 2024, with a share of 35.81%. This leadership is driven by the increasing adoption of advanced imaging platforms, including fluorescence, confocal, and live-cell microscopy, which enable the visualization of dynamic cell signaling events with high spatial and temporal resolution. Factors linked to technological breakthroughs in recent years have accelerated the development of light microscopy, which is boosting demand for this segment.

Flow cytometry is anticipated to grow at the fastest rate during the forecast period, as it is a technique that efficiently and precisely analyzes single cells in solutions. It is highly useful for studying the immune system and how it responds to infectious diseases, as well as cancer. Researchers can utilize this technique to track live movements, thereby increasing demand for flow cytometry and driving market growth.

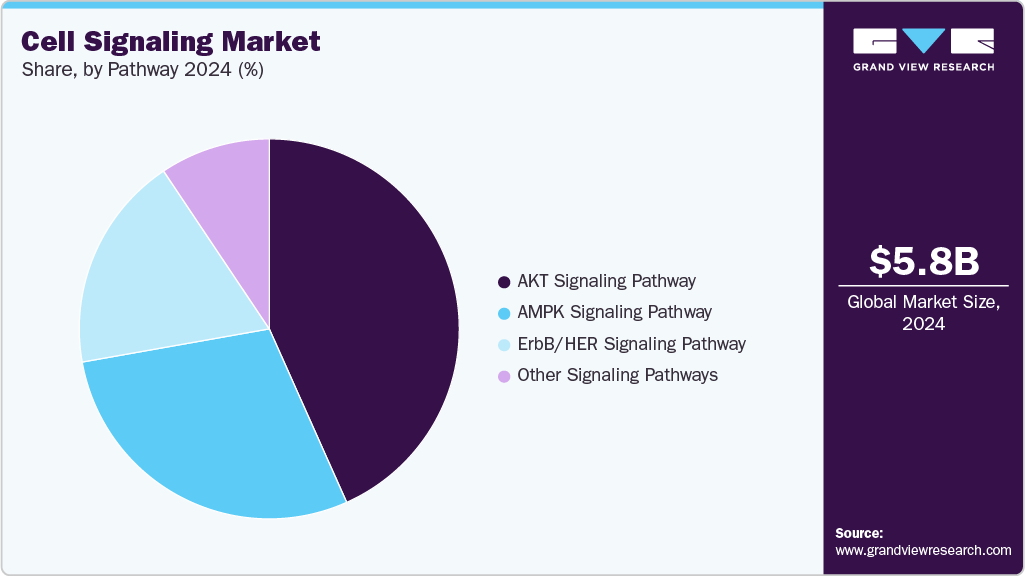

Pathway Insights

The AKT signaling pathway dominated the market in 2024, accounting for a share of 43.32%. The AKT signaling pathway, commonly referred to as the survival pathway, regulates cell development, apoptotic signals, and cell proliferation. This signaling pathway is the most frequently dysregulated in the most common types of cancer. The anticipated growth of commercial diagnostic tests, driven by the downregulation of the AKT pathway, will propel the cell signaling sector to grow over the expected timeframe.

In 2024, the AMPK signaling pathway segment also had a sizable market share. This is primarily owing to an increase in the prevalence of cancer and tumors globally. Depending on the tissue-specific tumor microenvironment, the AMPK pathway exhibits both oncogene and tumor suppressor effects, which further supports the market expansion.

Regional Insights

North America dominated the overall cell signaling market in 2024, accounting for a share of 40.13% Factors such as the local presence of a substantial number of key players such as Thermo Fisher Scientific, Merck KGaA, and Cell Signaling Technology Inc., among others, coupled with an upsurge in research and development spending by key players to develop innovative and advanced products, are attributed for the regional cell signaling industry growth.

U.S. Cell Signaling Market Trends

The U.S. held a significant share of the industry in cell signaling in 2024, driven by substantial R&D expenditures and the presence of key industry players. In addition, the focus on cytokine pathway targeting better patient outcomes increased interest in signaling-based treatments and research instruments, which had a favorable impact on the region's market expansion.

Europe Cell Signaling Market Trends

The Europe cell signaling industry is set to grow steadily, supported by a strong biotechnology ecosystem, government-backed research programs, and active academic-industry collaborations in oncology, immunology, and regenerative medicine.

The UK cell-signaling industry is poised for growth driven by strong biomedical investment, robust biopharma R&D, and national cancer and immunology initiatives.

Germany's cell-signaling industry is poised for strong growth, driven by its advanced biotech sector, robust clinical research networks, and the government's focus on molecular medicine. Investments in proteomics, single-cell analysis, and AI-enabled pathway platforms are reinforcing its leadership in life-science innovation and commercial expansion.

Asia Pacific Cell Signaling Market Trends

The Asia Pacific is expected to record the fastest CAGR of 9.88% in the cell-signaling market, driven by expanding biotech infrastructure, increasing research spending, and a strong focus on cancer and infectious disease studies. Growing cross-border partnerships are accelerating the adoption of advanced signaling tools in the region.

China is rapidly strengthening its role in the cell-signaling market, supported by major government investment in precision medicine, synthetic biology, and immuno-oncology. Advances in lab automation, bioinformatics, and pathway-targeted drug discovery continue to accelerate growth.

The Japan cell signaling market is projected to grow significantly due to strong academic research output, technological innovation, and a strong focus on neuroscience, regenerative medicine, and cell therapy development.

MEA Cell Signaling Market Trends

The Middle East & Africa cell signaling market is expected to grow steadily, driven by increasing life-science investments, a rising burden of cancer & immune-mediated disorders, and strategic collaborations with global biotechnology companies.

The Kuwait cell signaling industry remains nascent but shows growing potential as the country accelerates biomedical research and precision-medicine initiatives. Investments in research infrastructure and biosciences education are expected to increase market traction over the forecast period.

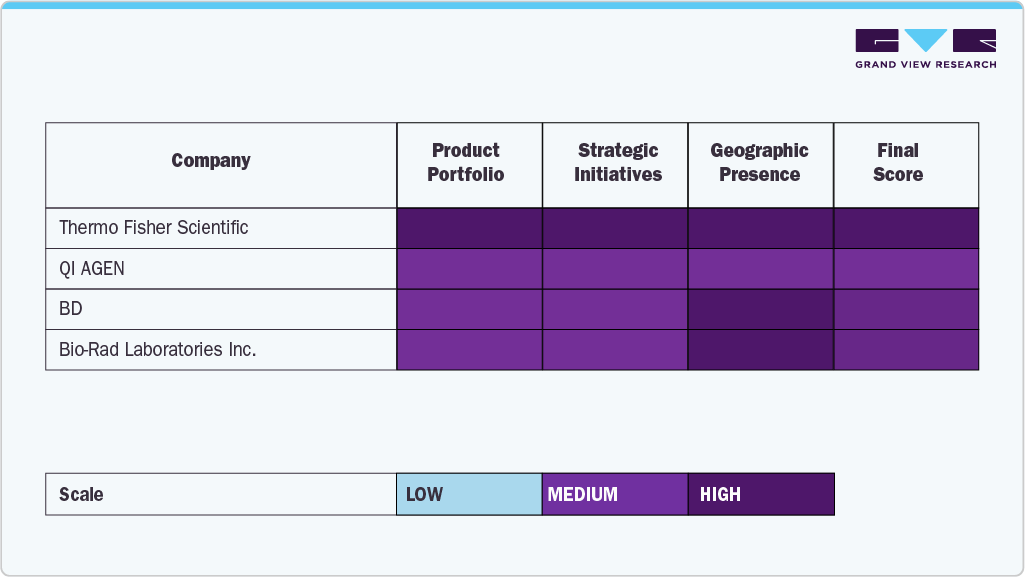

Key Cell Signaling Company Insights

The cell signaling market is characterized by several established players who maintain leadership through robust product portfolios, extensive assay platforms, and continuous investment in research and development. Leading companies, such as Thermo Fisher Scientific, QIAGEN, Becton Dickinson and Company, Bio-Rad Laboratories, Bio-Techne, Cell Signaling Technology, Danaher, Merck KGaA, PerkinElmer, and Promega Corporation, have secured substantial market share through advanced signaling pathway tools, high-quality antibodies, innovative detection technologies, and strong global distribution networks.

Organizations such as Cell Signaling Technology and Bio-Techne continue to expand their offerings with next-generation reagents, multiplex signaling detection platforms, and precision-engineered antibodies tailored for research in oncology, immunology, and regenerative medicine.

The cell signaling market is witnessing a dynamic mix of established powerhouses and emerging innovators, with mergers, acquisitions, and technological advancements fostering heightened competition.

Key Cell Signaling Companies:

The following are the leading companies in the cell signaling market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc.

- QIAGEN

- Becton, Dickinson and Company

- Bio-Rad Laboratories Inc.

- Bio-Techne Corporation

- Cell Signaling Technology Inc.

- Danaher

- Merck KGaA

- PerkinElmer Inc.

- Promega Corporation

Recent Developments

-

In March 2025, Leveragen partnered with Cell Signaling Technology to leverage its Singularity Musculus nanobody platform, accelerating development of high-performance reagent antibodies for research applications.

-

In January 2025, BD partnered with Biosero to integrate robotic automation with BD flow cytometry systems, enabling automated high-throughput workflows and accelerating drug discovery and cell therapy development.

-

In February 2023, Bio-Techne partnered with Cell Signaling Technology to validate CST antibodies on the Simple Western platform, enabling faster, automated, and more reproducible signaling-protein analysis for researchers.

Cell Signaling Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.17 billion

Revenue forecast in 2033

USD 11.55 billion

Growth rate

CAGR of 8.14% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, technology, pathway, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc.; QIAGEN; Becton, Dickinson and Company; Bio-Rad Laboratories Inc.; Bio-Techne Corporation; Cell Signaling Technology Inc.; Danaher; Merck KGaA; PerkinElmer Inc.; Promega Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Cell Signaling Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global cell signaling market on the basis of type, product, technology, pathway, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Endocrine Signaling

-

Paracrine Signaling

-

Autocrine Signaling

-

Others

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Consumables

-

Instruments

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Flow Cytometry

-

Microscopy

-

Western Blotting

-

ELISA

-

Others

-

-

Pathway Outlook (Revenue, USD Million, 2021 - 2033)

-

AKT Signaling Pathway

-

AMPK Signaling Pathway

-

ErbB/HER Signaling Pathway

-

Other Signaling Pathway

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cell signaling market is expected to witness a compound annual growth rate of 8.14% from 2025 to 2033 to reach USD 11.55 billion by 2033.

b. The global cell signaling market size was estimated at USD 5.77 billion in 2024 and is expected to reach USD 6.17 billion in 2025.

b. The consumables segment dominated the 2024 market with a revenue share of 58.35% owing to the recurring usage of consumables and high commercial demand.

b. Some key players in the cell signaling market are Merck KgaA; Thermo Fisher Scientific, Inc.; Horizon Discovery Ltd.; QIAGEN; GeneCopoeia, Inc.; New England Biolabs; NanoString; and BioGenex.

b. Key drivers of the cell signaling market are rising incidence of chronic diseases and technological advancement in cell based signaling research.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.