- Home

- »

- Consumer F&B

- »

-

China Avocado Market Size & Share, Industry Report, 2033GVR Report cover

![China Avocado Market Size, Share & Trends Report]()

China Avocado Market (2025 - 2033) Size, Share & Trends Analysis Report By Form (Fresh, Processed), By Distribution Channel (B2B, B2C), And Segment Forecasts

- Report ID: GVR-4-68040-786-7

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

China Avocado Market Summary

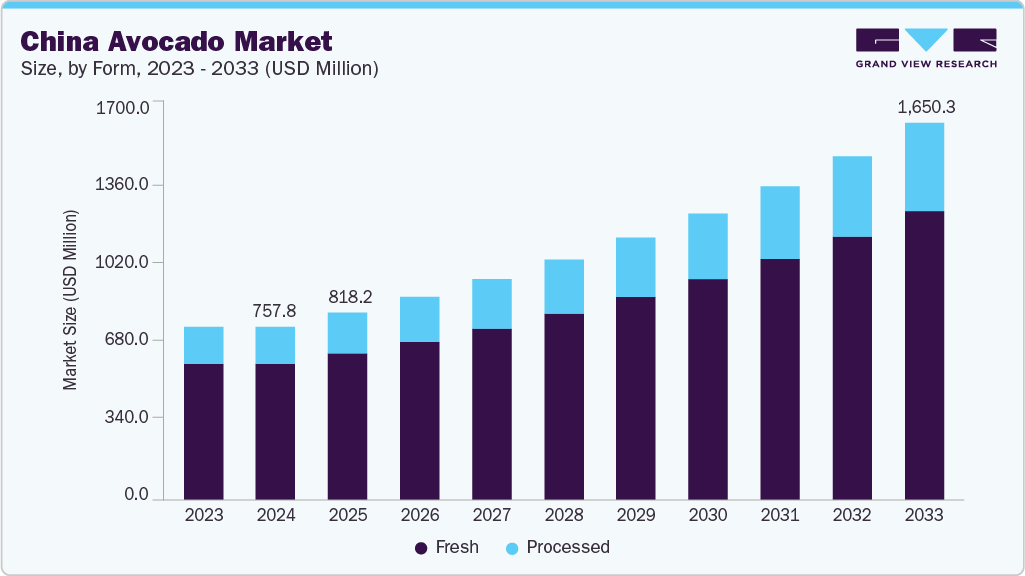

The China avocado market size was estimated at USD 757.8 million in 2024 and is projected to reach USD 1,650.3 million by 2033, growing at a CAGR of 8.9% from 2025 to 2033. The growing emphasis on health and wellness among Chinese consumers has become a key driver of avocado consumption in recent years. Avocados are marketed as a superfood, rich in healthy fats and nutrients.

Key Market Trends & Insights

- By form, the China fresh avocado market held the largest share of 78.4% in 2024.

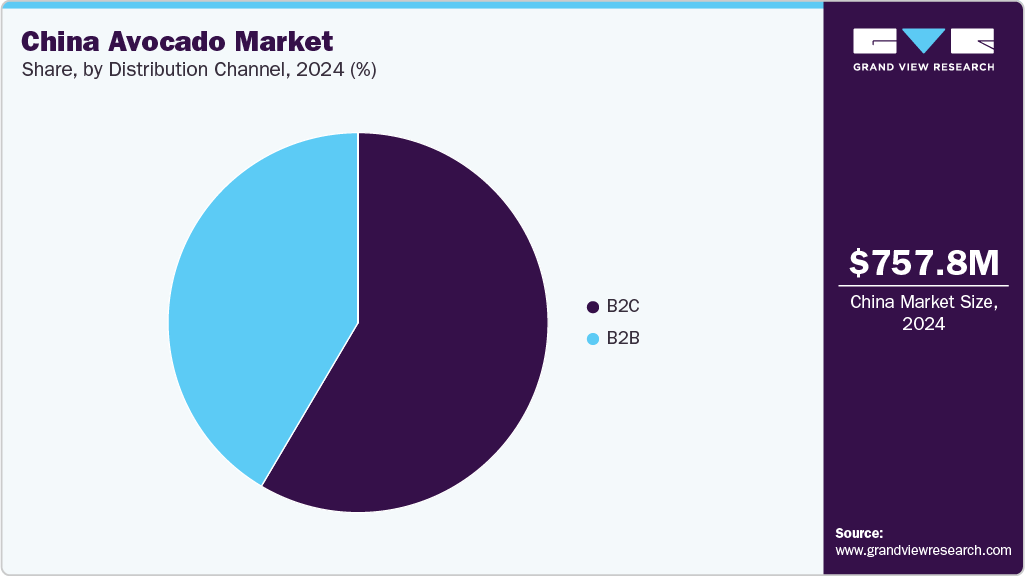

- By distribution channel, the B2C channel segment held the largest market share of 58.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 757.8 Million

- 2033 Projected Market Size: USD 1,650.3 Million

- CAGR (2025-2033): 8.9%

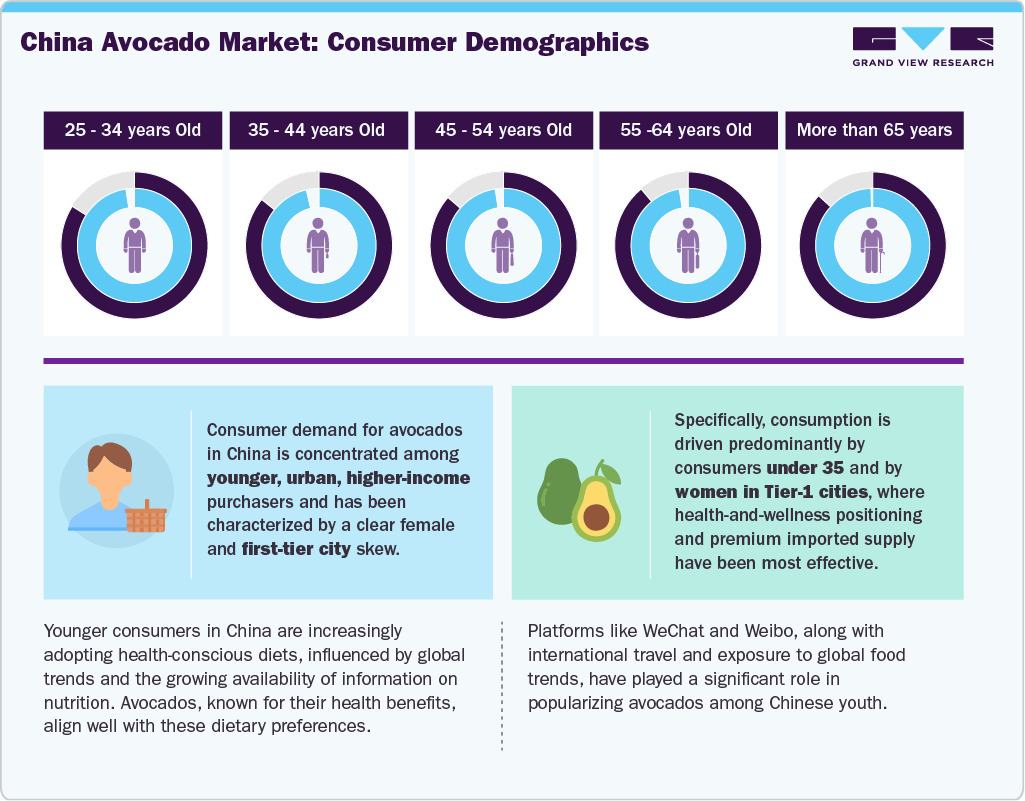

Avocados are increasingly favored for their high content of heart-healthy monounsaturated fats, fiber, essential vitamins, and antioxidants, which support cardiovascular health and boost immunity. This aligns with the rising trend of choosing nutrient-dense foods to promote active lifestyles and reduce the risk of chronic illnesses. A survey further revealed that 53.55% of Chinese consumers now have a scientific approach to health. In comparison, 28.85% are aware of chronic disease prevention and treatment, and 28.16% understand the importance of infectious disease prevention. These insights reflect a broader shift in the public mindset toward preventive healthcare and wellness-driven food choices.

A significant portion of Chinese consumers are willing to invest in healthier options, and 73% are ready to pay more for food products considered beneficial for health. In addition, 58% of the Chinese middle-class population aged between 20 and 49 prefer ethical brands, indicating that their purchasing decisions are influenced not only by nutritional value but also by brands' social and environmental responsibility.

A reliable and diverse international supply chain largely supports the steady availability of avocados in China. Major exporters such as Peru, Chile, and Kenya have become critical partners in meeting China’s growing demand, offering avocados during different seasonal windows to ensure a consistent year-round supply. These countries have developed strong trade relationships with Chinese distributors and retailers, backed by investments in advanced cold-chain logistics, which help maintain product freshness during long-distance shipping. This seamless coordination has played a crucial role in reducing post-harvest losses and improving the overall quality of avocados reaching Chinese consumers.

Moreover, the dependable supply from these nations has enabled the expansion of fresh and processed avocado segments in China. While fresh avocados are prominently sold through supermarkets, online platforms, and specialty fruit stores, processed products like avocado oil, frozen cubes, guacamole, and spreads are gaining traction in the B2B and B2C channels.

Form Insights

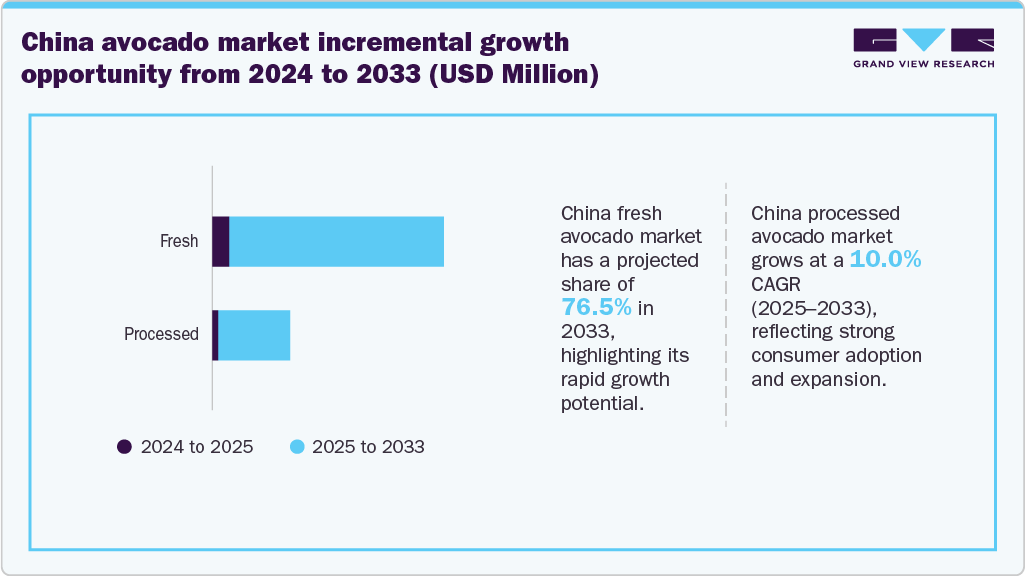

The China fresh avocado market accounted for the largest share of 78.4% of the revenue in 2024. China's fresh avocado industry is primarily driven by consumer preference for whole, unprocessed avocados, particularly among health-conscious urban populations who associate freshness with higher nutritional value. Fresh avocados are widely consumed in salads and breakfast dishes, and increasingly in fusion cuisine at high-end restaurants and cafes.

Due to limited domestic production, the growth of the fresh segment is heavily reliant on imports, with countries like Peru, Chile, Kenya, and Mexico serving as major suppliers. For instance, according to World Integrated Trade Solutions, China imported 65,558,000 kg of fresh and dried avocados from these countries in 2023. Technological advancements in cold chain logistics and ripening facilities have significantly improved the quality and shelf life of imported avocados, ensuring better availability across China’s Tier-1 and Tier-2 cities.

The China processed avocado market is projected to grow at the fastest CAGR of 10.0% from 2025 to 2033. The processed avocado segment is gaining significant traction in China, driven by evolving dietary preferences, increased product innovation, and greater convenience demand. Although it currently holds a smaller share than fresh avocados, this segment is witnessing faster growth, especially among younger consumers and urban populations. Processed forms such as pulp, guacamole, and ready-to-use spreads align well with fast-paced lifestyles, offering easy use without compromising nutrition. These products are increasingly featured in restaurants, cafes, and quick-service food chains, contributing to broader market exposure and acceptance.

Distribution Channel Insights

The China avocado market through B2C channels accounted for the largest revenue share of around 58.5% in 2024. The B2C segment in China is witnessing strong growth, driven by rising health consciousness, increasing disposable incomes, and shifting dietary preferences among urban consumers. Avocados are increasingly perceived as a superfood rich in healthy fats, fiber, and essential nutrients, making them popular among millennials, fitness enthusiasts, and wellness-focused households. To grab the opportunities of such rising demand among consumers in China, Aldi China and Mr. Avocado partnered to launch ready-to-eat avocados in China to enhance consumer convenience and meet increasing demand for fresh, ripened produce. Social media trends, fitness influencers, and nutrition awareness campaigns have further boosted avocado’s appeal as part of a modern, balanced diet.

The China avocado industry through the B2B channel is projected to grow at a significant CAGR of 10.0% from 2025 to 2033. The foodservice and processing industries primarily lead the B2B segment. Restaurants, hotels, cafes, and catering services in Tier 1 and Tier 2 cities are major buyers, sourcing avocado pulp, guacamole, and frozen chunks to meet the demand for Western, fusion, and health-focused cuisines. These formats offer convenience, consistency, and minimal wastage, making avocados an essential ingredient in modern foodservice menus. With rising health awareness and improved cold-chain logistics, companies invest in infrastructure to expand their B2B presence. This includes ripening centers and storage facilities to maintain product quality and supply efficiency.

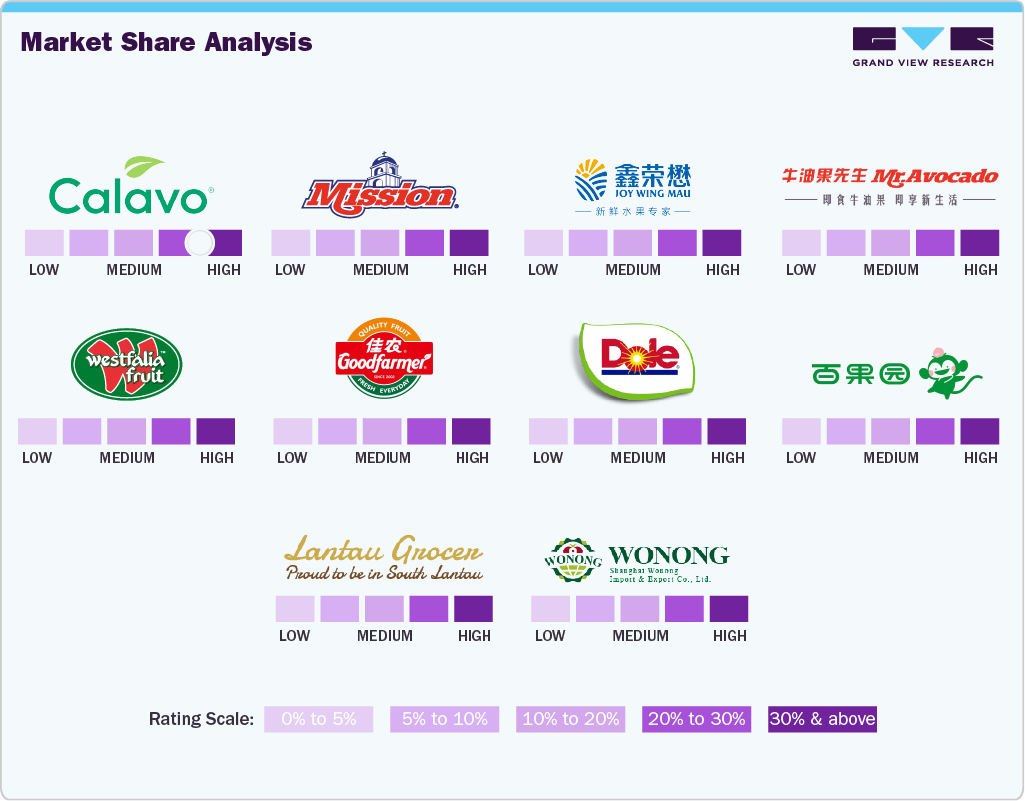

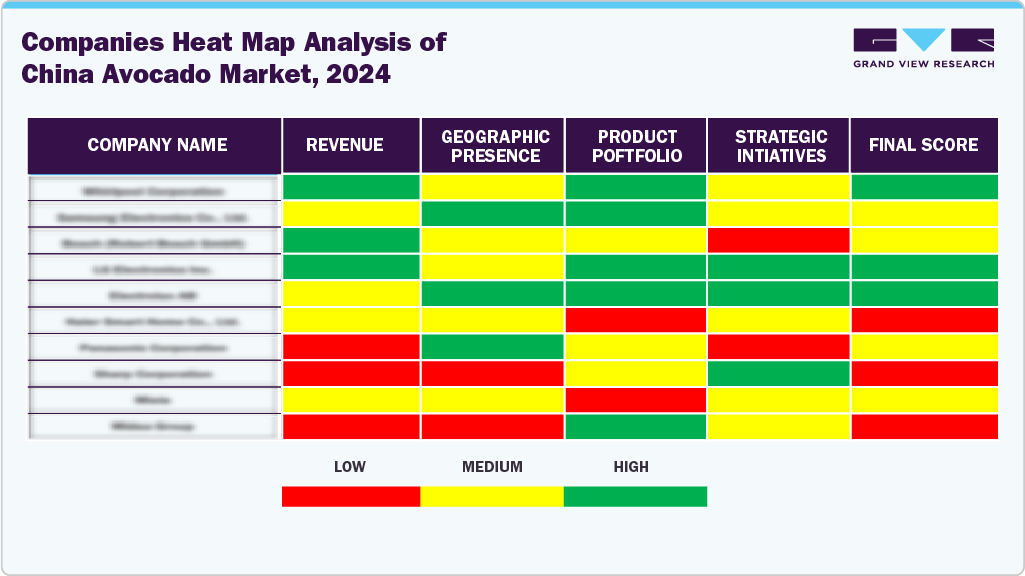

Key China Avocado Company Insights

The China avocado market is import-led and characterized by fragmented supply chains and concentrated urban demand (first- and new-first-tier cities). Import dependence and channel fragmentation create margin pressure and require investors to optimize cold-chain logistics, ripening control, and inventory turnover to protect freshness and reduce spoilage. Market access is controlled by a mix of specialized fruit importers, multinational fresh-produce traders, and vertically integrated groups. Multinationals and specialized traders are being leveraged for airfreight and cold-chain solutions to meet retailer quality specifications; this dynamic has increased bargaining power for large importers versus smaller local buyers.

Key China Avocado Companies:

- Shenzhen Pagoda Industrial Group Corp Ltd

- Shanghai Wonong Import & Export Co., Ltd.

- Calavo Growers

- Mission Produce Inc.

- Joy Wing Mau Group

- Mr. Avocado

- Westfalia Fruit

- Goodfarmer Foods Holding (Group) Limited Company

- Lantau Grocer

- Dole China

Recent Developments

-

In June 2025, a New ripening capacity was opened in East China by Mr. Avocado (Shanghai) to scale ready-to-eat supply and improve distribution efficiency. This facility was described as equipped with advanced ripening technology and positioned to serve the Yangtze Delta and surrounding provinces.

-

In June 2025, Mission Produce (global grower-processor and shareholder in Mr. Avocado) further invested in China operations, including on-the-ground ripening/packing capacity, to secure year-round, branded supply for retail and foodservice. The strategic facility investments and partnership activity were highlighted as efforts to capture China’s growing per-capita demand.

China Avocado Market Report Scope

Report Attribute

Details

Market value size in 2025

USD 818.2 million

Revenue Forecast in 2033

USD 1,650.3 million

Growth rate

CAGR of 8.9% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative (Revenue) units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, distribution channel

Country scope

China

Key companies profiled

Shenzhen Pagoda Industrial Group Corp Ltd, Shanghai Wonong Import & Export Co., Ltd., Calavo Growers, Mission Produce Inc., Joy Wing Mau Group, Mr. Avocado, Westfalia Fruit, Goodfarmer Foods Holding (Group) Limited Company, Lantau Grocer, Dole China

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

China Avocado Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the China avocado market report based on form, and distribution channel:

-

Form Outlook (Revenue, USD Million, 2021 - 2033)

-

Fresh

-

Processed

-

Pulp

-

Guacamole

-

Others

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

B2B

-

Processing Industry

-

Foodservice Industry

-

-

B2C

-

Frequently Asked Questions About This Report

b. The China avocado market size was estimated at USD 757.8 million in 2024 and is expected to reach USD 818.2 million in 2025.

b. The China avocado market is expected to grow at a compounded growth rate of 8.9% from 2025 to 2030 to reach USD 1,650.3 million by 2033.

b. The fresh avocado market accounted for the largest share of 78.4% of the revenue in 2024. Fresh avocado is primarily driven by consumer preference for whole, unprocessed avocados, particularly among health-conscious urban populations who associate freshness with higher nutritional value. Fresh avocados are widely consumed in salads and breakfast dishes, and increasingly in fusion cuisine at high-end restaurants and cafes.

b. Some key players operating in China avocado market include Shenzhen Pagoda Industrial Group Corp Ltd, Shanghai Wonong Import & Export Co., Ltd., Calavo Growers, Mission Produce Inc., Joy Wing Mau Group, Mr. Avocado and others

b. Key factors that are driving the market growth include changing dietary preferences and urbanization and retail expansion

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.