- Home

- »

- Alcohol & Tobacco

- »

-

China Baijiu Market Size And Share, Industry Report, 2033GVR Report cover

![China Baijiu Market Size, Share & Trends Report]()

China Baijiu Market (2025 - 2033) Size, Share & Trends Analysis Report By Price Point (Economy, Ultra-Premium, Mid-Premium), By Distribution Channel (On-Trade, Off-Trade), By Price Point - Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-807-6

- Number of Report Pages: 115

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

China Baijiu Market Summary

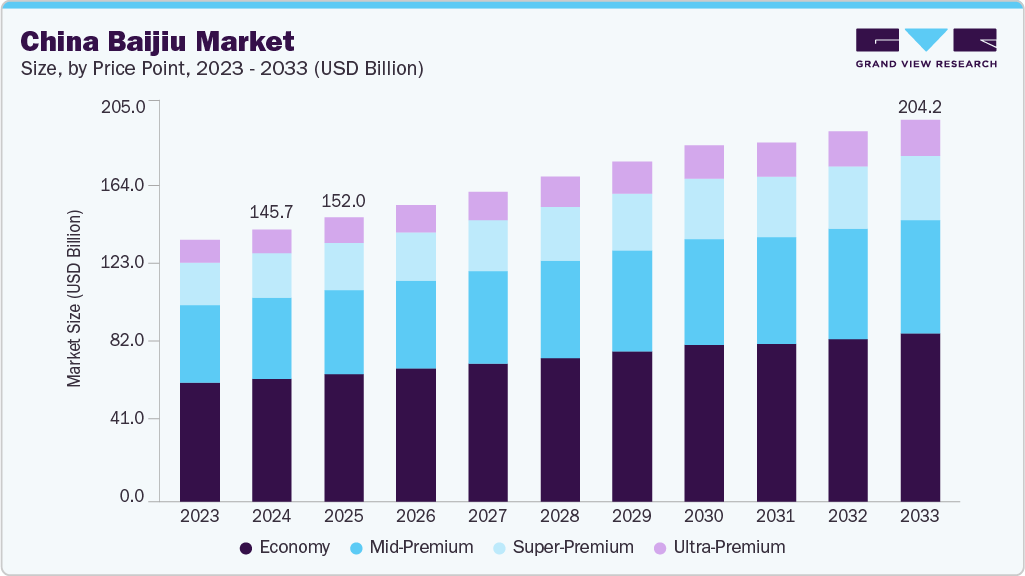

The China baijiu market size was estimated at USD 145.7 billion in 2024 and is expected to reach USD 204.2 billion by 2033, growing at a CAGR of 3.8% from 2025 to 2033. Rising disposable incomes primarily drive market growth, as well as the cultural significance of baijiu and increasing premiumization.

Key Market Trends & Insights

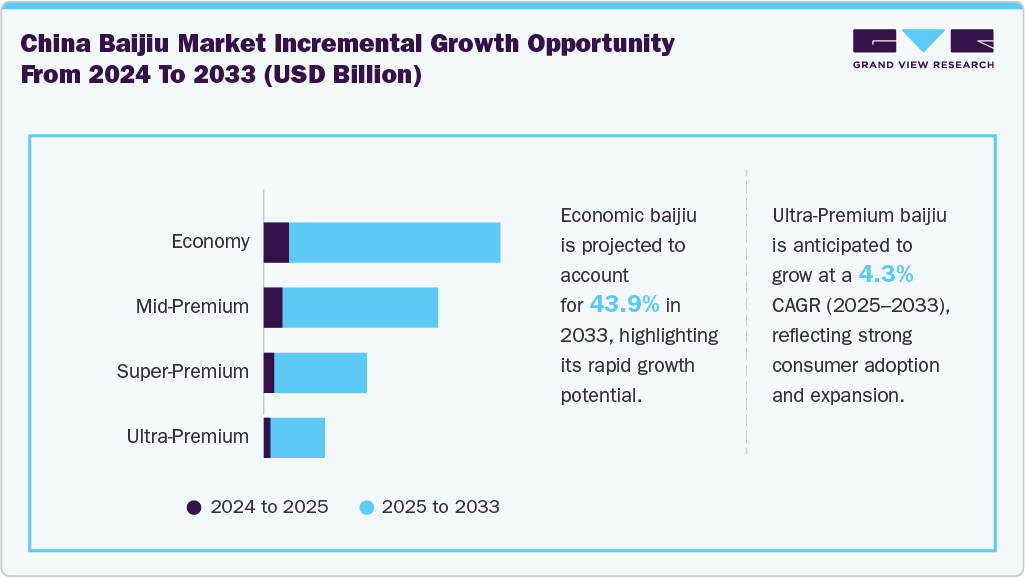

- By price point, economic baijiu led the China baijiu market and accounted for a share of 45.1% in 2024.

- By distribution channel, the off-trade channel accounted for a share of 62.2% in the China baijiu market in 2024.

- By price point, ultra-premium baijiu is anticipated to witness a CAGR of 4.3% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 145.7 Billion

- 2033 Projected Market Size: USD 204.2 Billion

- CAGR (2025-2033): 3.8%

As China’s middle and upper-middle classes expand, consumers are spending more on high-quality spirits for gifting and personal enjoyment, fueling demand for premium and ultra-premium baijiu. Deeply rooted in Chinese traditions, baijiu remains central to social gatherings, business banquets, and festivals, ensuring consistent consumption across demographics.A major trend in the market is the strong shift toward premium and super-premium segments, driven by growing consumer affluence and a desire for exclusivity. Consumers increasingly associate high-end baijiu with social status and gifting prestige, prompting brands to focus on aged varieties, refined brewing techniques, and artistic packaging. For instance, Kweichow Moutai’s premium lines, such as Moutai Bulao and Moutai Prince, have seen strong sales growth, reflecting the rising demand for collectible and luxury spirits among affluent consumers.

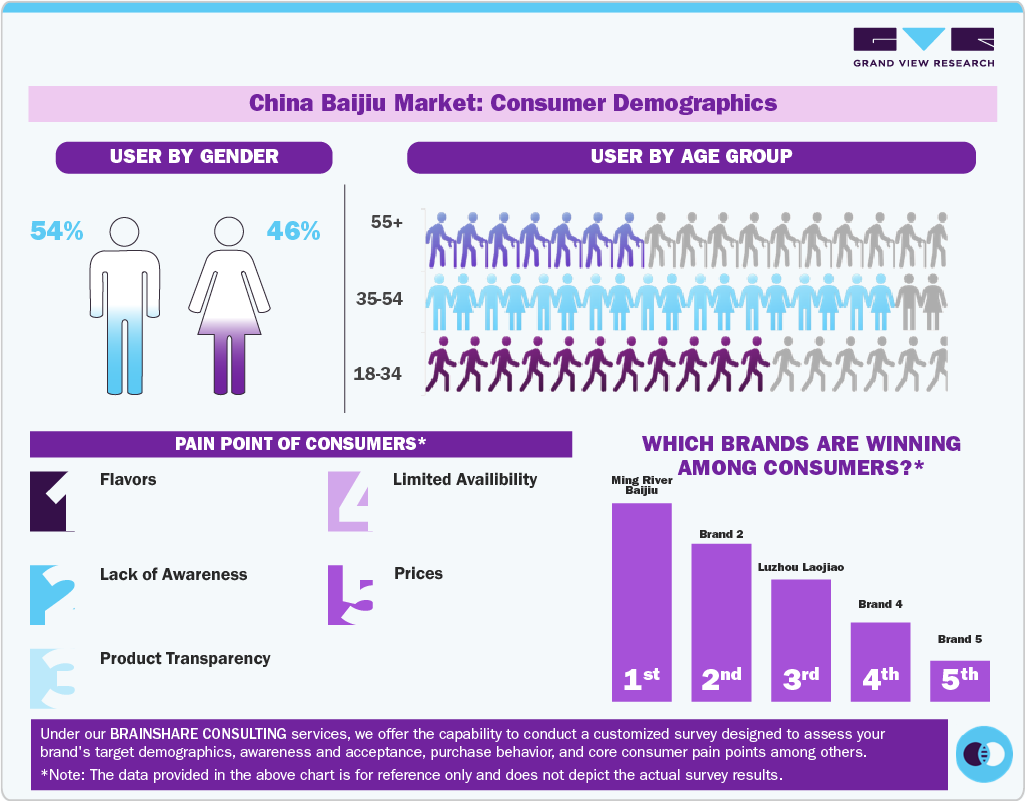

Another significant development is the changing consumer demographics and evolving taste preferences, particularly among younger generations. Millennials and Gen Z consumers are moving away from the strong traditional flavours and seeking lighter, more approachable variants suitable for casual drinking or cocktails. In response, brands like Jiangxiaobai have introduced low-alcohol, fruit-infused baijiu, targeting younger drinkers and marketing it through social media, effectively modernizing the category’s image and making it more appealing to new audiences.

Consumer Insights

The market is undergoing significant transformations driven by evolving consumer insights, moving beyond its traditional confines of formal banquets and high-status gifting. While an established demographic still values premium baijiu for business and ceremonial occasions, there's a discernible shift towards individual and private consumption, particularly among emerging affluent and younger demographics. These consumers are increasingly seeking products that align with modern lifestyles, emphasizing factors like quality, unique brand narratives, and a desire for more approachable drinking experiences. This includes a growing interest in lower alcohol content, innovative packaging designs, and novel consumption methods, such as baijiu cocktails or pairings that challenge traditional perceptions.

To capture these evolving preferences, baijiu brands must leverage insights into consumer values beyond mere price or prestige. Opportunities lie in premiumization strategies that focus on craftsmanship, heritage, and unique cultural storytelling, appealing to a sophisticated consumer base that appreciates authenticity and origin. For younger generations, success hinges on rebranding and product innovation that redefines baijiu's image, perhaps through engaging digital marketing, experiential events, or collaborations that introduce it in new, fashionable contexts. Furthermore, a growing health consciousness and demand for transparency mean brands must also consider messaging around ingredients and responsible consumption, tailoring their offerings to a diverse mosaic of evolving tastes, occasions, and demographic preferences across China's vast and dynamic market.

Price Point Insights

The economic baijiu segment held the largest revenue share, accounting for a share of 45.1% in 2024. It caters to the country’s vast base of price-sensitive consumers who value affordability and tradition in everyday drinking occasions. Widely consumed across lower-tier cities and rural regions, it remains integral to family gatherings, festivals, and local celebrations. Brands such as Luzhou Laojiao’s Erqu Jiu and Fenjiu’s Qinghua series have built strong loyalty through consistent quality and accessible pricing, making them household staples.

Ultra-premium baijiu is anticipated to witness a CAGR of 4.3% from 2025 to 2033. Consumers seek products that symbolize status, heritage, and exclusivity. With rising disposable incomes and the growth of high-net-worth individuals, baijiu has evolved from a traditional drink into a luxury item often associated with prestige and social standing. Ultra-premium variants are favored for gifting, business banquets, and special occasions, where brand reputation and packaging sophistication are key factors. For instance, Kweichow Moutai’s premium lines, such as Moutai Flying Fairy and Moutai Zodiac Editions, are highly sought after for their exceptional craftsmanship and limited availability, often appreciating over time.

Distribution Channel Insights

The sales of baijiu through off-trade channels held the largest share, accounting for 62.2% in 2024. Consumers often buy baijiu in bulk or as gift sets from supermarkets, specialty liquor stores, and online platforms, which offer a wider variety, promotional discounts, and convenient access. The cultural practice of gifting baijiu during festivals, weddings, and business occasions further strengthens off-trade sales.

On-trade channels are expected to grow at a CAGR of 3.5% from 2025 to 2033. Bars, restaurants, and high-end hotels are becoming key venues for baijiu consumption, shifting the consumption of this spirit from traditional banquets to more casual, experience-driven settings. Premium and modern baijiu brands are leveraging this trend by promoting cocktail-based baijiu drinks and hosting tasting events to appeal to younger, urban audiences.

Key China Baijiu Company Insights

Leading players in the market include Jiannanchun Group Co., Ltd., Wuliangye Yibin Co., Ltd., Luzhou Laojiao Co., Ltd, and Ming River Baijiu. The market is witnessing intense competition as major players focus on strengthening their distribution networks and enhancing brand visibility across both online and offline channels. Leading distilleries are prioritizing innovation in product formulation, packaging, and distillation techniques to cater to changing consumer tastes and attract younger demographics.

Key China Baijiu Companies:

- Kweichow Moutai Co., Ltd.

- Wuliangye Yibin Co., Ltd.

- Luzhou Laojiao Co., Ltd.

- Jiannanchun Group Co., Ltd.

- Shui Jing Fang Co., Ltd.

- Ming River Baijiu

- Fenjiu Group Co., Ltd.

- Gujing Group Co., Ltd.

- Shede Spirits Co., Ltd.

- Shui Jing Fang Co., Ltd.

Recent Developments

-

In October 2025, China’s second-largest liquor brand, Wuliangye, launched a new 29% ABV spirit called Wuliangye · Crush On as it entered the growing low-alcohol market. The move aimed to attract younger consumers and modernize the brand’s image amid shifting drinking preferences toward lighter, more lifestyle-oriented beverages.

-

In August 2025, Chinese liquor giants such as Wuliangye Group and Yanghe Brewery introduced lower-alcohol versions of their traditional baijiu spirits (such as 29% and 33.8% ABV variants) to attract younger, health-conscious consumers who were shifting away from strong spirits toward lighter, flavored, or low-ABV drinks. This move reflected growing concerns about declining demand among younger drinkers.

China Baijiu Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 152.0 billion

Revenue forecast in 2033

USD 204.2 billion

Growth rate (Revenue)

CAGR of 3.8% from 2025 to 2033

Market size volume in 2025

1,695.2 million 9-liter cases

Volume forecast in 2033

1,997.6 million 9-liter cases

Growth rate (Volume)

CAGR of 2.1% from 2025 to 2033

Actual

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in million 9-liter cases, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Price point, distribution channel, price point-distribution channel

Key companies profiled

Kweichow Moutai Co., Ltd.; Wuliangye Yibin Co., Ltd.; Luzhou Laojiao Co., Ltd.; Jiannanchun Group Co., Ltd.; Shui Jing Fang Co., Ltd.; Ming River Baijiu; Fenjiu Group Co., Ltd.; Gujing Group Co., Ltd.; Shede Spirits Co., Ltd.; Shui Jing Fang Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

China Baijiu Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest trends and opportunities in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the China baijiu market by price point, distribution channel, and price point-distribution channel:

-

Price Point Outlook (Volume, Million 9-Liter Cases; Revenue, USD Million, 2021 - 2033)

-

Economy

-

Mid-Premium

-

Super-Premium

-

Ultra-Premium

-

-

Distribution Channel Outlook (Volume, Million 9-Liter Cases; Revenue, USD Million, 2021 - 2033)

-

On-trade

-

Off-trade

-

-

Price Point-Distribution Channel Outlook (Volume, Million 9-Liter Cases; Revenue, USD Million, 2021 - 2033)

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

Frequently Asked Questions About This Report

b. The China baijiu market was estimated at USD 145.74 billion in 2024 and is expected to reach USD 151.96 billion in 2025.

b. The China baijiu market is expected to grow at a compound annual growth rate of 3.8% from 2025 to 2033 to reach USD 204.24 billion by 2033.

b. Economic baijiu is the largest segment, accounting for a share of 45.11% in 2024. It caters to the country’s vast base of price-sensitive consumers who value affordability and tradition in everyday drinking occasions. Widely consumed across lower-tier cities and rural regions, it remains integral to family gatherings, festivals, and local celebrations.

b. Some of the key players in the China baijiu market is Kweichow Moutai Co., Ltd.; Wuliangye Yibin Co., Ltd.; Luzhou Laojiao Co., Ltd.; Jiannanchun Group Co., Ltd.; Shui Jing Fang Co., Ltd.; Ming River Baijiu; Fenjiu Group Co., Ltd.; Gujing Group Co., Ltd.; Shede Spirits Co., Ltd.; Shui Jing Fang Co., Ltd.

b. The growth of the China baijiu market is primarily driven by rising disposable incomes, the cultural significance of baijiu, and increasing premiumization. As China’s middle and upper-middle classes expand, consumers are spending more on high-quality spirits for gifting and personal enjoyment, fueling demand for premium and ultra-premium baijiu.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.