China Milk Protein Market Summary

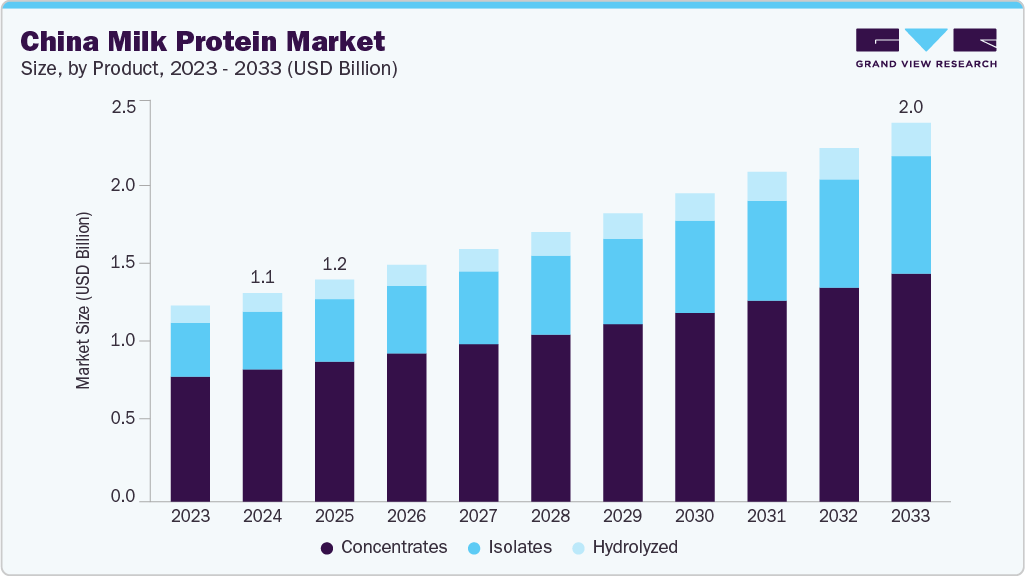

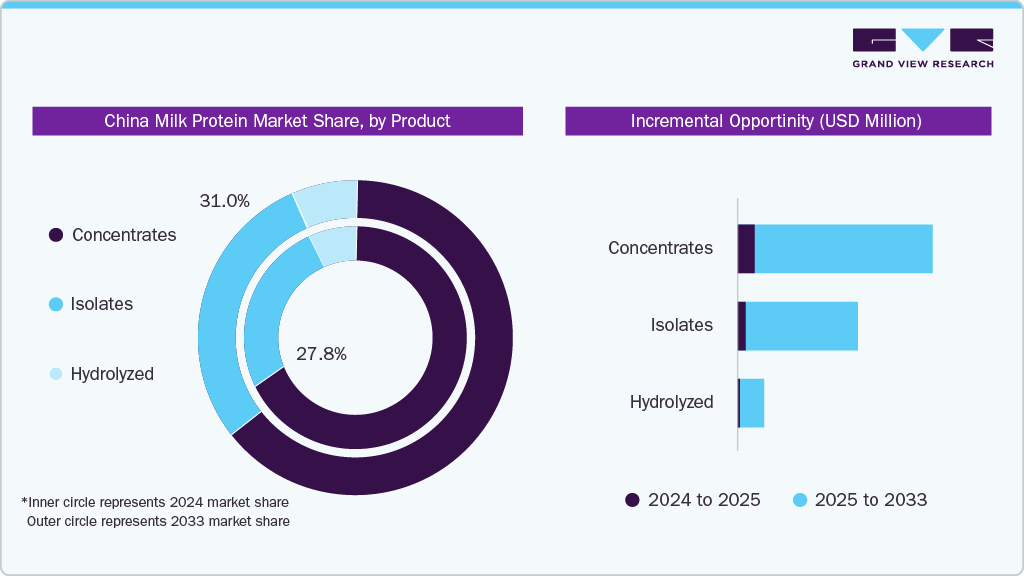

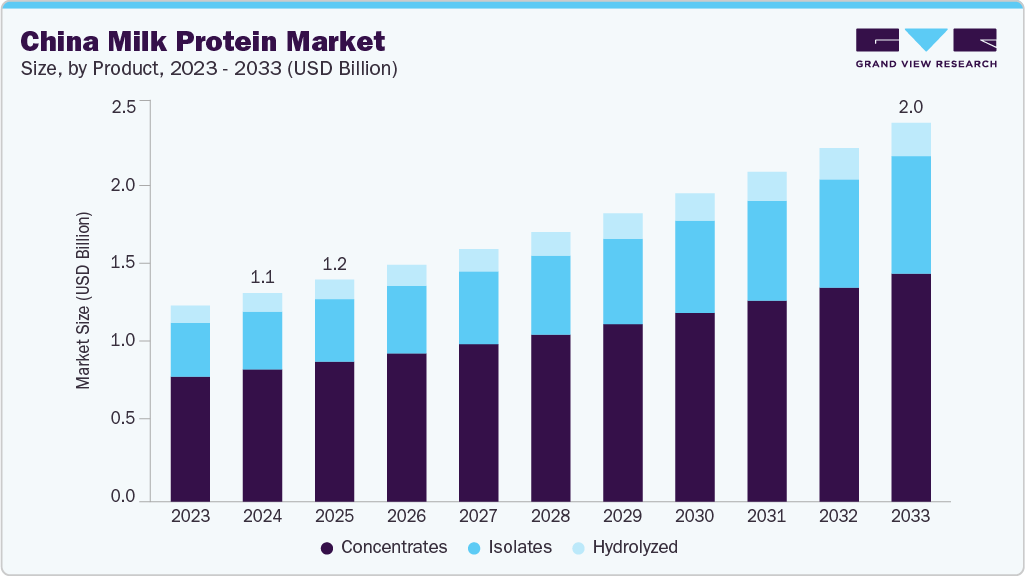

The China milk protein market size was estimated at USD 1.11 billion in 2024 and is projected to reach USD 2.02 billion by 2033, growing at a CAGR of 6.9% from 2025 to 2033. The market is primarily driven by rising health awareness and increasing demand for functional food, personalized nutrition, and product innovation.

Key Market Trends & Insights

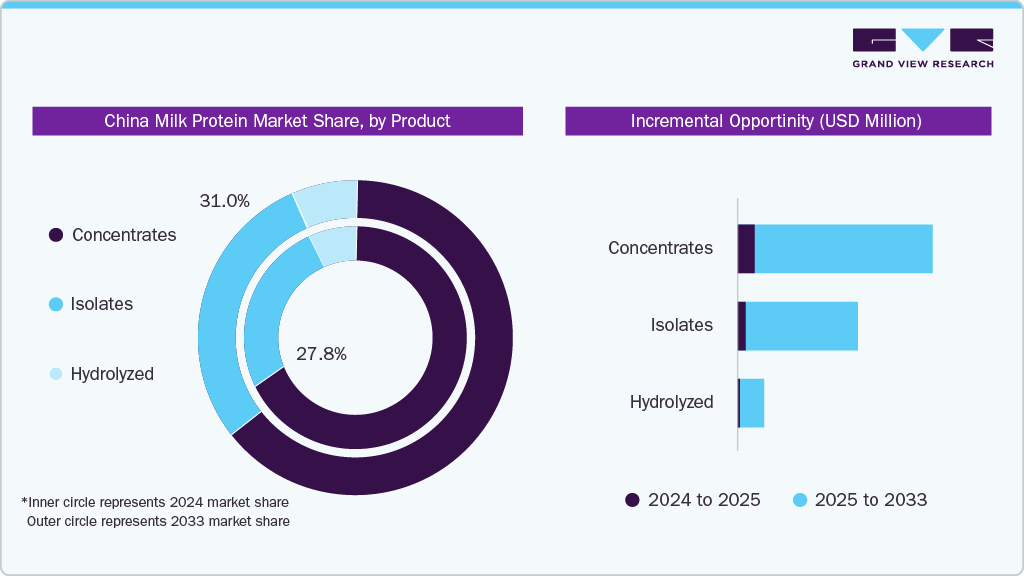

- By product, the concentrates segment held the largest market share of 63.4% in 2024.

- By form, the powder segment held the largest market share in 2024.

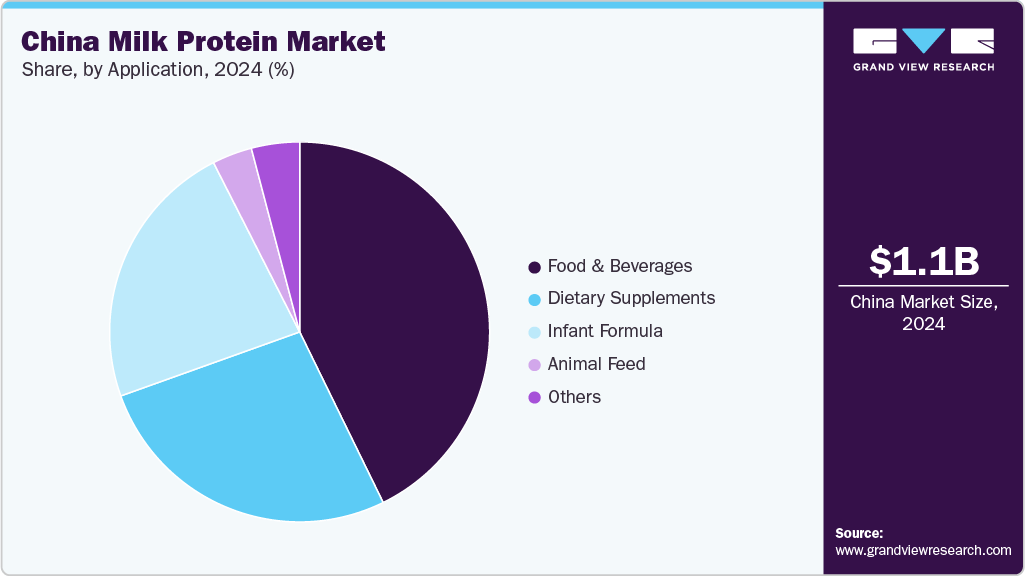

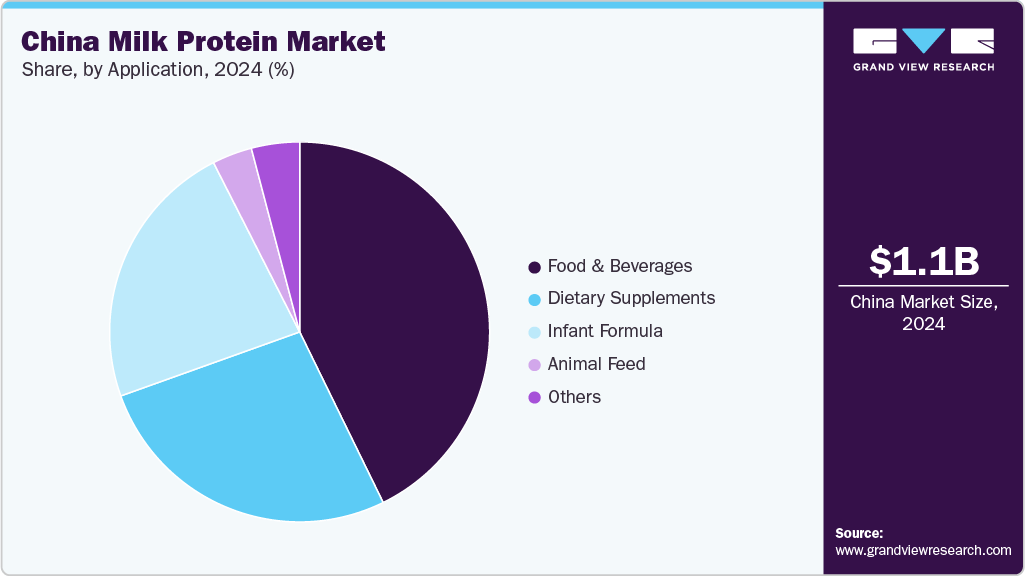

- By application, the food & beverages segment accounted for the largest market share of 42.8% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.11 Billion

- 2033 Projected Market Size: USD 2.02 Billion

- CAGR (2025-2033): 6.9%

The demand for milk protein is expected to grow in the country as the aging population seeks protein-rich nutrition to slow muscle loss, support healthy aging, and maintain vitality. The growth of the milk protein industry in China is expected to be driven by rising urbanization and demand for convenience food, with an increasing number of people living fast-paced lifestyles. This is leading to evolving food preferences, such as on-the-go nutritional products, that align with busy lifestyles. Milk protein infused snacks, Ready-to-Drink (RTD) beverages, and meal replacement options fit well with this demand, providing satiety and energy in compact formats.

In addition, the rise of fitness culture in urban China has enhanced the popularity of sports nutrition. Protein powders, shakes, and high-protein yogurts are in high demand, particularly among the middle class and younger individuals. According to a study published by BMC Public Health in June 2025, between September and November 2024, a large-scale survey of over 176,000 college students (aged 19-22) in Shandong Province found a 92.0% physical fitness qualified rate, with female and urban students slightly outperforming males and rural students, respectively.

The study confirmed that frequent and intense exercise, sufficient sleep, and regular breakfast significantly improved fitness outcomes. At the same time, excessive screen time, smoking, alcohol use, and fast food intake were linked to poor performance. Parental encouragement and involvement in physical activity also played a positive role in fitness levels of students. This directly supports the growing market demand for sports and functional nutrition products, including milk protein-based shakes, powders, and fortified snacks, which fitness-oriented students and young professionals in China increasingly favor.

Government support and regulatory push for maintaining quality of the milk protein ingredients are also expected to drive the growth of the market. The government of China continues to promote domestic dairy development, protein fortification, and higher nutrition standards. This has encouraged companies to innovate with cleaner labels and higher-quality milk protein ingredients. Furthermore, the expansion of online platforms and cross-border e-commerce has made it easier for consumers to access premium milk protein products, including those from international brands.

Product Insights

The concentrates segment accounted for a revenue share of 63.4% in 2024. The market has gained significant momentum due to national nutritional initiatives and technological drivers such as innovations in dairy science and processing, and innovations in RTD protein beverages. Government initiatives, such as tariff reductions under WTO commitments and strengthened food safety reforms, have fostered a more secure and competitive environment for Milk Protein Concentrates (MPCs). In addition, the growing focus on weight management as China is witnessing a rapid rise in obesity and metabolic health issues due to urban lifestyles, sedentary habits, and processed food consumption is expected to surge the demand for milk protein in the country. According to a report published by NutraIngredients in June 2025, Synutra, a Qingdao-based infant formula company, launched its Xianfeng meal-replacement drink, marking its entry into China’s rapidly expanding weight management market. Formulated with milk protein concentrates, 10 vitamins, 4 minerals, maltodextrin as dietary fiber, and Medium Chain Triglycerides (MCTs), the product is designed to offer a convenient, nutritionally balanced alternative.

The isolates segment is projected to experience the fastest CAGR of 8.2%, in terms of revenue, from 2025 to 2033. The market is experiencing growth due to increasing demand for high-purity, low-lactose proteins in clinical nutrition, muscle recovery, and clean-label functional foods. As health awareness increases and dietary preferences shift toward high-protein and low-fat options, milk protein isolates are expected to become essential ingredients in ready-to-drink products, bars, and elderly nutrition formulas.

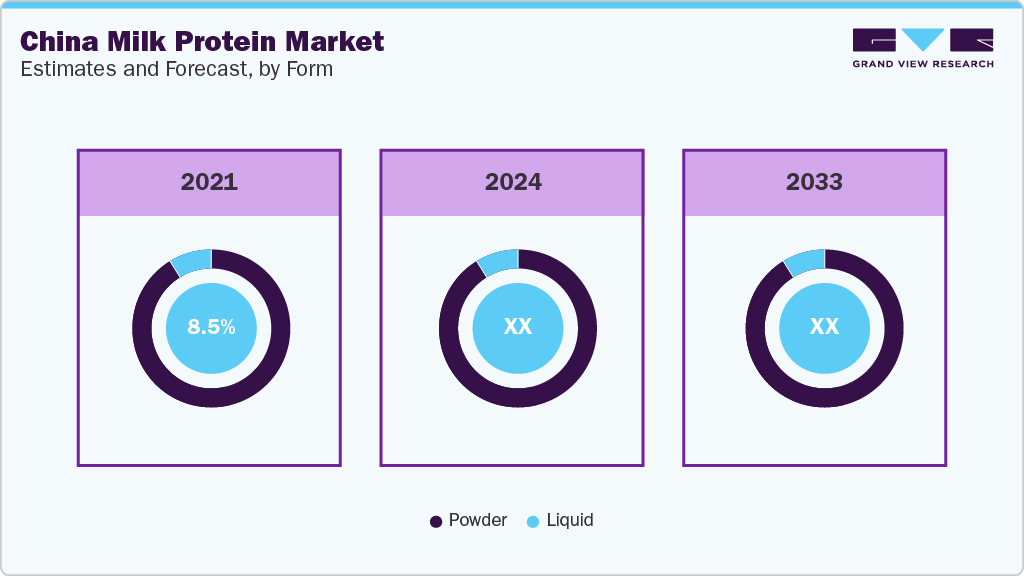

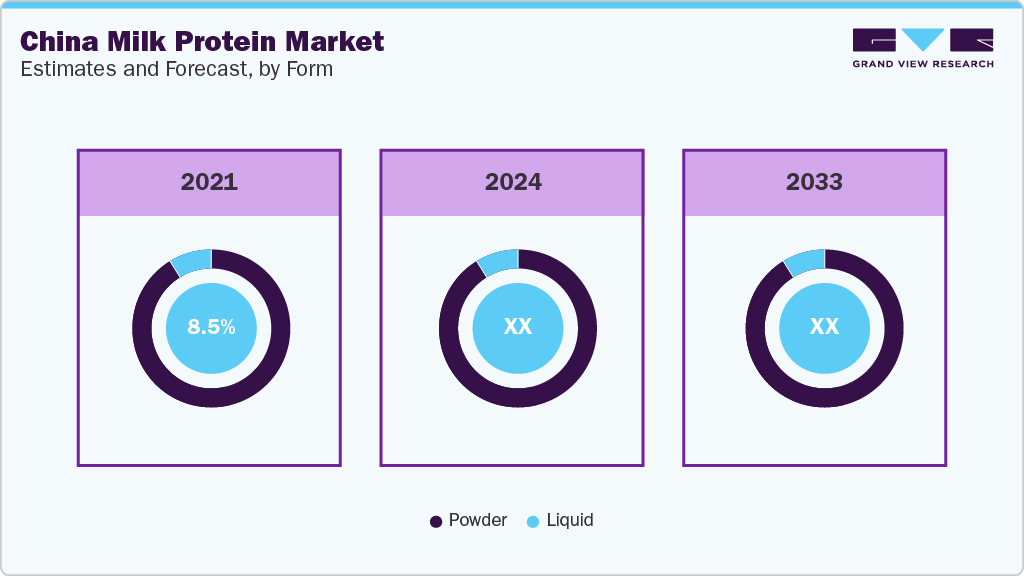

Form Insights

The powder segment accounted for the largest revenue share of the market in 2024. Long shelf life, ease of storage, and transportation are driving the growth of the powder milk protein segment. Powder milk protein is used in infant formula, sports nutrition, clinical foods, bakery, dairy products, and meal replacements, making it a highly versatile and scalable product. In addition, high reconstitution and functional use are driving the growth of China milk protein industry. Milk protein powders are designed for high solubility and rehydration, making them ideal for RTD mixes, food blends, and clinical feeds. Many manufacturers prefer powder because it offers customizable concentrations, allowing more control over taste, viscosity, and nutritional value.

The liquid segment is anticipated to record the fastest CAGR from 2025 to 2033. The market is driven by rising demand for RTD functional beverages and an increasing aging population in the country. A report published by ENGLISH.GOV.CN in October 2024 stated that China’s population aged 60 and above reached nearly 297 million in 2023, accounting for 21.1% of the total population. Meanwhile, those aged 65 and over made up 15.4% of the total population in the same year, highlighting the country's rapidly aging society. The demand for easily digestible, nutrient-dense protein products to support muscle maintenance, bone health, and immunity, especially for the aging population, is surging. This is expected to favor the growth of the liquid milk protein segment over the coming years.

Application Insights

The food & beverages segment accounted for the largest revenue share of the market in 2024. A rapid shift in consumer preferences toward health, convenience, and wellness is increasing the demand for milk proteins. Integration of these products into daily consumer lifestyles and the sheer scale of the global food supply chain are driving the growth of the market. Functional ingredients such as probiotics, plant proteins, fibers, and antioxidants are increasingly incorporated into mainstream food products such as dairy, snacks, beverages, and baked goods to meet consumer demand for enhanced nutrition.

The dietary supplements segment is anticipated to experience the fastest CAGR from 2025 to 2033. The market is driven by demographic shifts, increasing health awareness, and evolving consumer lifestyles. Furthermore, younger generations, especially urban millennials and Gen Z, are adopting supplements as part of their daily wellness routines, often for beauty, energy, stress relief, or general health maintenance.

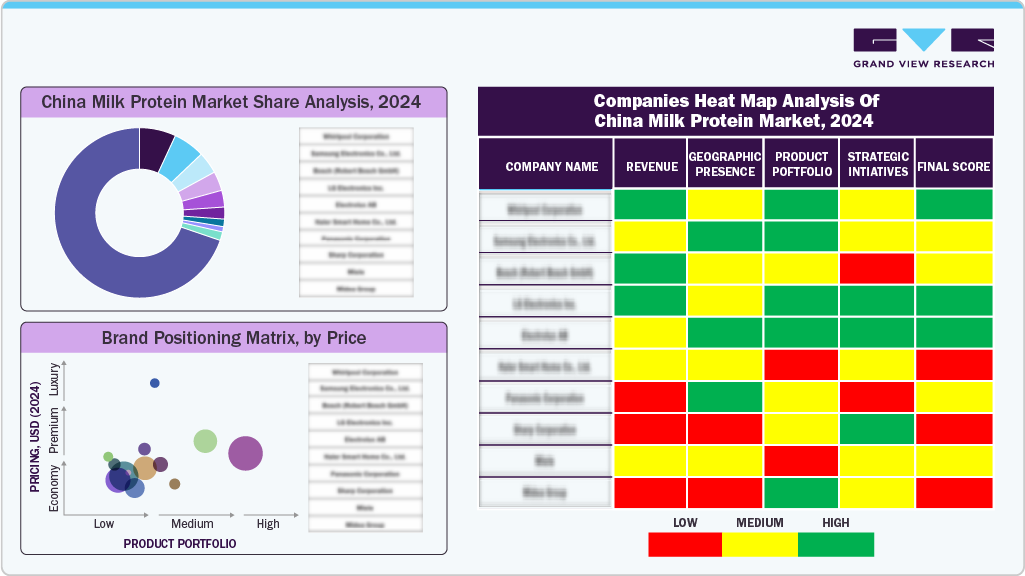

Key China Milk Protein Company Insights

Some key players in the China milk protein market include Saputo Inc., Fonterra Co-operative Group Limited, and LACTALIS Ingredients.

- Saputo Inc. is engaged in the production and marketing of cheese, milk, extended shelf‑life cream, yogurt, sour cream, dairy mixes, dips, dairy ingredients, such as milk powder, whey powder, lactose, and whey protein concentrates, and a range of plant‑based alternative cheeses and beverages offered under branded and private‑label lines. It operates in several countries, including China, supplying high-quality dairy for retail, foodservice, and industrial use.

Key China Milk Protein Companies:

- Saputo Inc.

- Fonterra Co-operative Group Limited

- Arla Foods Ingredients Group

- LACTALIS Ingredients

- FrieslandCampina

- China Mengniu Dairy Company Limited.

Recent Developments

- In May 2024, Fonterra announced that it worked with Mengniu, a China-based dairy manufacturer, to develop six ready-to-drink beverages using its milk protein concentrate, whey protein concentrate, and calcium caseinate. Through this collaboration, the two players aim to meet the rising demand for nutritious ready-to-drink beverages in China.

China Milk Protein Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 1.19 billion

|

|

Revenue forecast in 2033

|

USD 2.02 billion

|

|

Growth rate

|

CAGR of 6.9% from 2025 to 2033

|

|

Actuals

|

2021 - 2024

|

|

Forecast period

|

2025 - 2033

|

|

Quantitative units

|

Revenue in USD Million, Volume in Kilo Tons, and CAGR from 2025 to 2033

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, trends

|

|

Segments covered

|

Product, form, application

|

|

Key companies profiled

|

Saputo Inc.; Fonterra Co-operative Group Limited; Arla Foods Ingredients Group; LACTALIS Ingredients; FrieslandCampina ; China Mengniu Dairy Company Limited.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

China Milk Protein Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the China milk protein market report based on product, form, and application:

-

Product Outlook (Revenue, USD Million, Volume, Kilo Tons, 2021 - 2033)

-

Concentrates

-

Isolates

-

Hydrolyzed

-

Form Outlook (Revenue, USD Million, Volume, Kilo Tons, 2021 - 2033)

-

Application Outlook (Revenue, USD Million, Volume, Kilo Tons, 2021 - 2033)

-

Food & Beverages

-

Infant Formula

-

Dietary Supplements

-

Animal Feed

-

Others