- Home

- »

- Consumer F&B

- »

-

Chocolate Market Size To Reach $156.74 Billion By 2033GVR Report cover

![Chocolate Market Size, Share & Trends Report]()

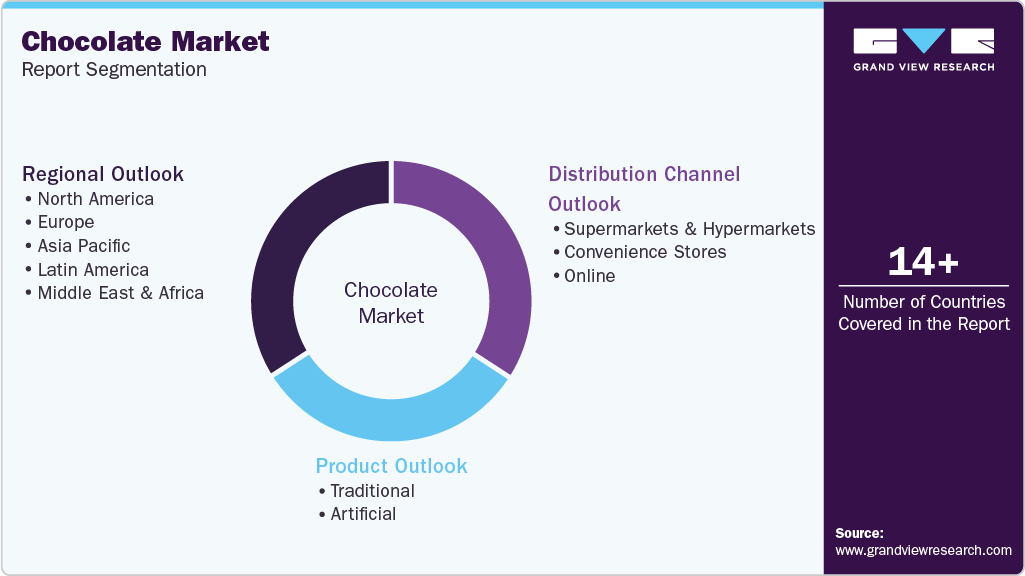

Chocolate Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Traditional, Artificial), By Distribution Channel (Supermarket & Hypermarket, Convenience Store, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-221-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Chocolate Market Summary

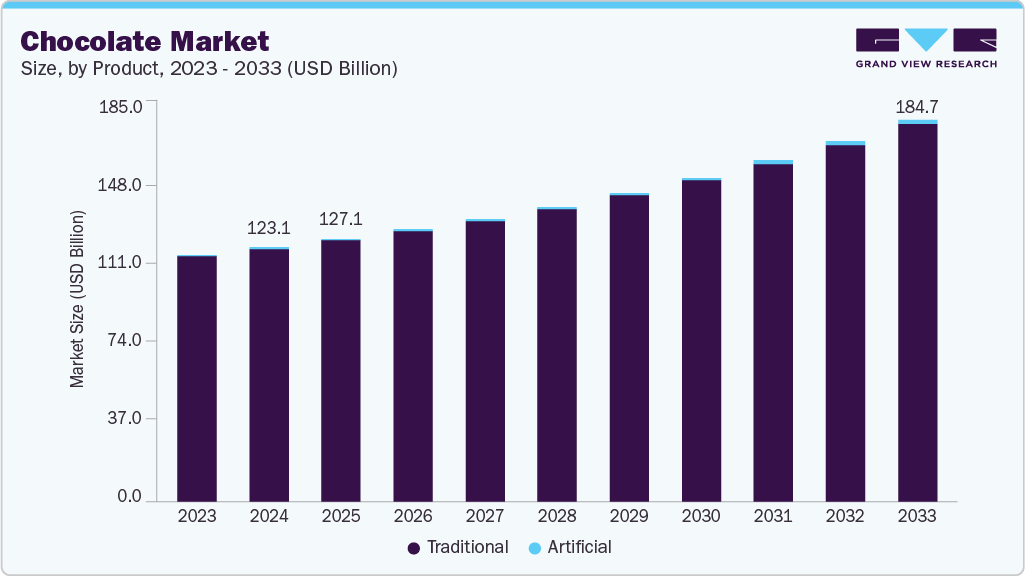

The global chocolate market size was valued at USD 123.05 billion in 2024 and is projected to reach USD 184.69 billion in 2033, growing at a CAGR of 4.8% from 2025 to 2033. Consumer consciousness regarding the health benefits of eating high-quality chocolate remains the key driver of the market.

Key Market Trends & Insights

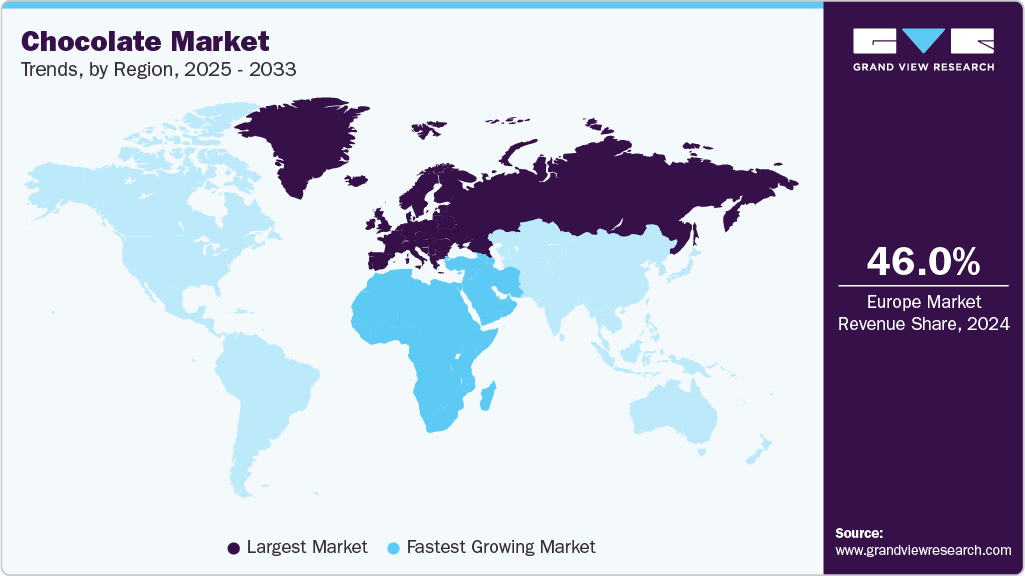

- The European chocolate market dominated and accounted for the largest market revenue share of around 46.0% in 2024.

- The UK chocolate market is expected to grow rapidly in the coming years.

- By product, the traditional chocolate segment dominated the market and accounted for a revenue share of over 99% in 2024.

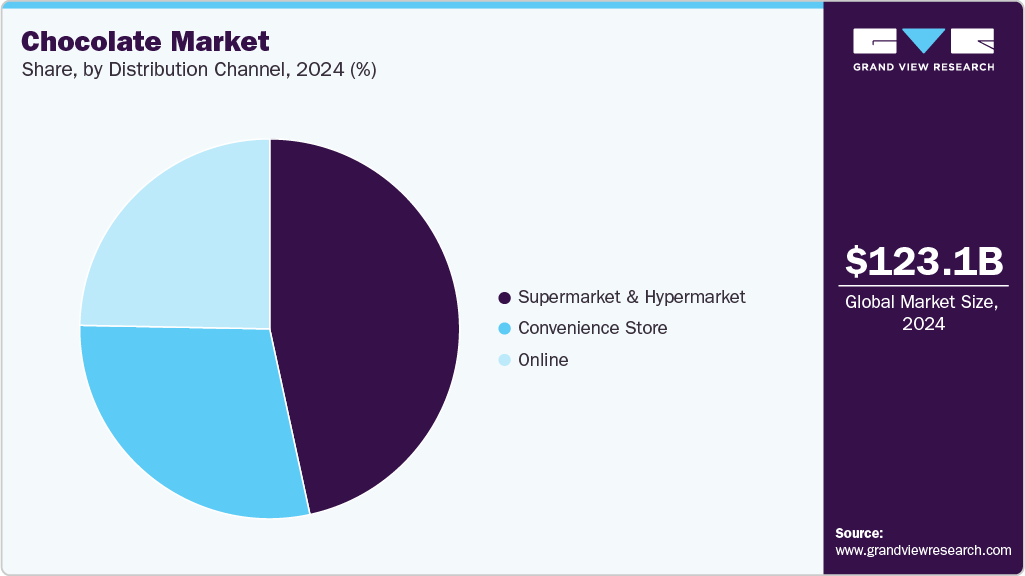

- By distribution channel, sales of chocolate through supermarkets and hypermarkets accounted for a revenue share of around 46% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 123.05 Billion

- 2033 Projected Market Size: USD 184.69 Billion

- CAGR (2025-2033): 4.8%

- Europe: Largest market in 2024

- Middle East & Africa: Fastest growing market

Moreover, the marketing of chocolate also plays a crucial role in shaping consumer perceptions and driving demand globally. Another factor driving product demand in the coming years is the growing demand for vegan, organic, gluten-free, and sugar-free chocolates. The COVID-19 pandemic moderately impacted the global market. Governments across the globe were forced to impose lockdowns due to the rapid spread of infection, forcing many businesses and production facilities to shut down temporarily. This affected the global supply and distribution chain, thereby negatively impacting the market growth. However, the demand for chocolates increased during the pandemic as people stocked up on packaged and processed foods. According to the State of Treating Report 2021 by the National Confectioners Association (NCA), chocolate rose by 4.2% during the pandemic period in 2020.Moreover, consumers preferred eating these during the pandemic to reduce stress and elevate their mood. This ensured a stable demand for chocolates during the pandemic. Consumers' increased belief in the superiority of bean and single-origin chocolates over bar chocolates is anticipated to motivate market participants to invest in the trend to increase their profits. The growing emphasis on the bean-to-bar concept has resulted in a significant increase in demand for premium and specialty chocolate products in recent years. The single-origin cocoa trend is still fueling new product development and innovation. This is expected to contribute to the overall market growth in the coming years.

According to health experts, moderate chocolate consumption increases serotonin, which calms the brain and works as an antidepressant. It also causes the release of endorphins in the body, which quickly improves mood. As per World Population Review data, almost 3.4% or 251-310 million of the global population suffers from depression. Therefore, the rising prevalence of mental illnesses such as anxiety and depression may promote product demand during the forecast period.

Chocolate consumption also reduces the release of the stress hormone cortisol. Regular inclusion of these elements in a regular diet can mitigate health issues and help avoid reliance on medication. Chocolate sales are expected to increase in the coming years due to its ability to relax the mind and induce happiness. Increasing awareness regarding preventive healthcare is anticipated to further fuel market growth during the projected timeframe.

Another factor influencing the global market is the growing awareness of the health benefits of dark chocolate consumption. According to the Cleveland Clinic, dark chocolate is known to enhance blood circulation in the body, reduce blood pressure, improve brain function, and lower the risk of heart disease when consumed in moderation, as it has vital minerals such as zinc, magnesium, phosphorus, copper, and iron. Moreover, some of the factors expected to drive the market growth include the premiumization of chocolate-based products and the use of visually appealing packaging to attract consumers' attention.

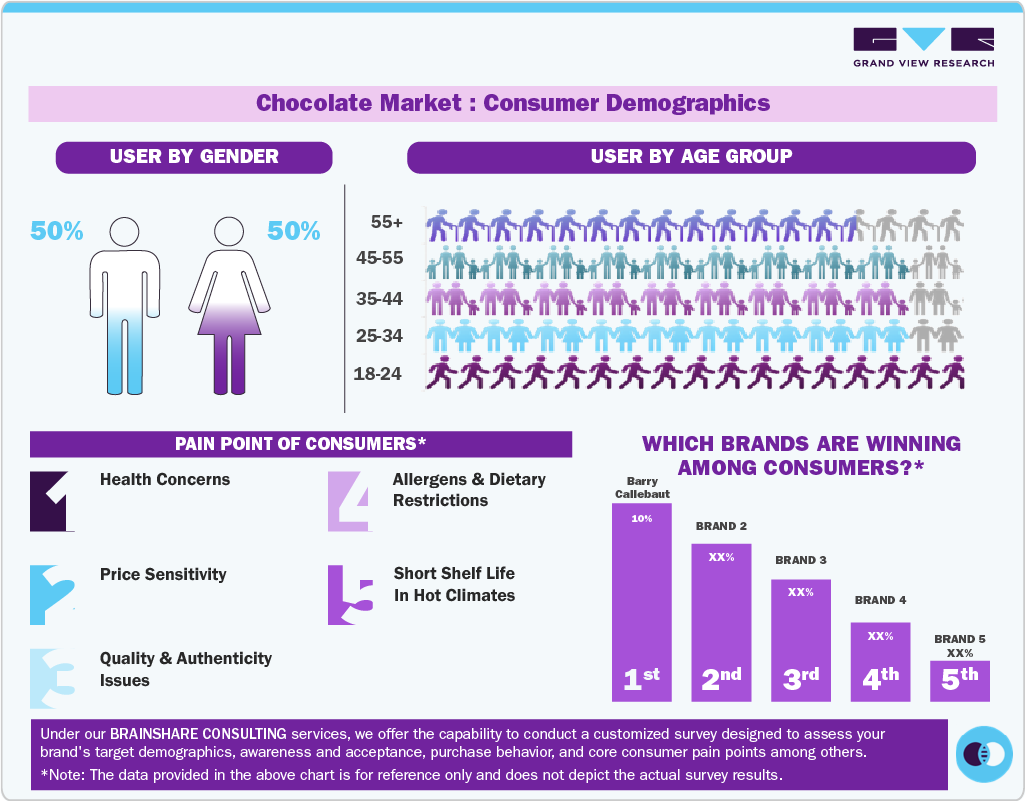

Consumer Insights for Chocolate

Global consumer demand for chocolate is increasingly shaped by shifting lifestyles, evolving taste preferences, and rising health consciousness. Traditional milk and dark chocolates continue to dominate due to their familiarity and indulgence factor, but premiumization and artisanal varieties are gaining strong traction, particularly in urban markets. Consumers are more interested in chocolates with higher cocoa content, reduced sugar, and functional ingredients such as nuts, fruits, or added proteins. Health-driven choices are influencing demand in North America and Europe, while affordability and accessibility remain central in emerging markets. Seasonal gifting, emotional appeal, and convenience packaging further drive consumer purchasing patterns worldwide. Alongside these trends, the marketing of chocolate increasingly emphasizes health, indulgence, and sustainability.

Another key consumer insight is the growing preference for sustainable and ethically sourced chocolates. Increasing awareness of fair trade practices, deforestation, and child labor in cocoa farming has led many buyers, especially in developed economies, to seek brands emphasizing transparency and ethical sourcing. Younger demographics, including millennials and Gen Z, strongly associate chocolate purchases with values such as sustainability, premium quality, and brand authenticity. In parallel, digital channels and e-commerce platforms are becoming crucial for reaching consumers, particularly in the Asia-Pacific region, where online shopping and social media influence purchasing decisions. Chocolate consumption is moving beyond indulgence to encompass health, ethics, and experiential value.

Product Insights

The traditional chocolate segment dominated the market and accounted for a revenue share of over 99% in 2024. This can be attributed to cocoa's greater popularity, ease of availability, and penetration when compared to carob, which is the raw material for artificial chocolate. The milk chocolate segment held the largest share in the traditional segment. It contains a high concentration of flavonoids, which are antioxidants that remove free radicals from the bloodstream and improve blood flow. The demand for milk chocolate has increased globally as a result of these advantages, as well as rising consumer purchasing power.

The artificial chocolate segment is anticipated to register the fastest CAGR of 9.6% during the forecast period 2025 to 2033. Carob confectionery is caffeine-free, making it ideal for caffeine-intolerant consumers. According to Caffeine Informer, almost 10% of the global population has hyposensitivity towards caffeine. Furthermore, the calcium composition of carob is almost three times that of cocoa. This makes it especially prevalent among women and people suffering from calcium deficiency.

Despite having to be imported, Nutella from Ferrero India continues to dominate the Indian chocolate spreads market. Globally, they continue to pursue a dominant position in the chocolate confectionery market, as indicated by their launch of Nutella biscuits in 2020, witnessing sales of over 45 million.

Distribution Channel Insights

Sales of chocolate through supermarkets and hypermarkets accounted for a revenue share of around 46% in 2024. Higher brand and product availability in such stores is a key factor in the segment's growth. Furthermore, consumers prefer physical stores to get immediate access to the product and select the products in person for a better experience. Additionally, due to increasing consumer demand, manufacturers are opening stores in malls, which will increase sales of chocolate in supermarkets and hypermarkets in the upcoming years.

The online distribution channel is expected to register the fastest CAGR of 5.6% during the forecast period from 2025 to 2033. The online channel has gained traction in the last few years due to increased internet penetration in countries globally. The growing internet user population, availability of a variety of brands, and convenience of buying from home are the major factors promoting the use of online distribution channels. Furthermore, features provided by online retailers, including cash on delivery, discounts, and cashback, are anticipated to boost the growth of online distribution channels. Digital platforms and social media have also revolutionized the marketing of chocolate, creating more direct connections with consumers.

Regional Insights

North America chocolate market accounted for a revenue share of 17.3% in 2024, characterized by strong consumer demand for premium, artisanal, and health-focused chocolate products. With high disposable incomes and evolving dietary preferences, consumers are increasingly shifting toward dark chocolate and low-sugar variants. Seasonal gifting occasions such as Valentine’s Day, Halloween, and Christmas remain major sales drivers, alongside everyday indulgence. The region also witnesses the growing popularity of organic, fair-trade, and sustainably sourced chocolates, as ethical consumption becomes more mainstream. Innovation in flavors, packaging, and product formats, including protein-enriched and plant-based chocolates, is fueling growth. Digital channels and e-commerce platforms are expanding the reach of both established and niche chocolate brands.

U.S. Chocolate Market Trends

The chocolate market in the U.S. is anticipated to grow significantly over the forecast period from 2025 to 2033, driven by both mass-market and premium consumption. American consumers value indulgence, convenience, and variety, with chocolate bars, truffles, and seasonal assortments being highly popular. Rising health awareness is influencing demand for dark chocolate, sugar-free options, and products fortified with functional ingredients. Sustainability and transparency are increasingly important, with consumers preferring brands that emphasize ethical sourcing and eco-friendly packaging. E-commerce channels are significantly boosting chocolate sales, particularly for gift sets and specialty chocolates. Innovation in flavor profiles, such as salted caramel, exotic fruits, and nut blends, further supports market expansion across demographics.

Europe Chocolate Market Trends

The chocolate market in Europe dominated with the largest market revenue share of 46.0% in 2024. Rising consumer demand for dark chocolate in the region is a major driver of regional market growth. According to the ITC Trade Map 2020 data, Europe imported almost 1,521 thousand tons of chocolate products. Furthermore, Europe was also the largest chocolate-producing region with the highest per capita consumption estimated to be 5.0 kilograms, as per the CBI, Ministry of Foreign Affairs. These factors are predicted to boost the regional market in the coming years.

The UK chocolate market is expected to grow rapidly in the coming years. The market is driven by a blend of traditional consumption patterns and evolving premiumization trends. British consumers maintain strong loyalty to heritage brands while showing rising interest in artisanal and organic chocolates. Dark chocolate and low-sugar variants are increasingly popular, reflecting health-conscious behavior. Seasonal occasions, such as Easter and Christmas, remain important consumption periods, but everyday snacking and gifting are also major drivers. Growing concerns over obesity and sugar intake have prompted demand for healthier options, including reduced-calorie chocolates and plant-based alternatives. Sustainability and ethical sourcing are crucial, with U.K. buyers seeking products aligned with fair-trade and eco-friendly values.

Asia Pacific Chocolate Market Trends

The chocolate market in Asia Pacific is anticipated to register a significant CAGR of 6.9% over the forecast period from 2025 to 2033, fueled by rising disposable incomes, urbanization, and Western lifestyle influence. While chocolate consumption in the region has historically been lower than in Western markets, increasing exposure and marketing campaigns are expanding consumer acceptance. This reflects how the marketing of chocolate in the Asia Pacific is tailored to cultural gifting traditions and aspirational lifestyles. Gifting remains a major driver, especially during festivals and special occasions in India, China, and Japan. Premium and innovative flavors are particularly attractive to younger consumers. E-commerce and modern retail channels are crucial in improving product accessibility. Health-oriented chocolates, such as low-sugar, dark chocolate, and functional products, are gaining momentum as awareness of nutrition and wellness increases.

China chocolate market is growing significantly, driven by urbanization, rising incomes, and the influence of Western culture. Unlike traditional sweet preferences, chocolate is often associated with gifting, status, and special occasions rather than daily indulgence. Premium chocolate brands enjoy strong demand in urban areas, while affordability remains key in smaller cities. Health-conscious trends are reshaping demand, with consumers interested in dark chocolate, sugar-free, and natural ingredient-based options. E-commerce platforms are pivotal, as online sales channels drive accessibility and brand visibility nationwide. Marketing campaigns highlighting luxury, exclusivity, and lifestyle appeal are central to market expansion.

Latin America Chocolate Market Trends

The chocolate market in Latin America is expected to grow significantly over the forecast period, as the region is unique, having both a major cocoa producer and consumer. While affordability and mass-market products dominate demand, premium and artisanal chocolates are gaining popularity in urban centers. Traditional flavors blended with local ingredients, such as chili, coffee, and tropical fruits, create distinct consumer appeal. Seasonal demand during holidays, coupled with impulse purchases, sustains steady sales. However, economic disparities across countries make price sensitivity a significant factor. Rising awareness about health and ethical sourcing is gradually influencing consumer choices. E-commerce platforms are expanding, although brick-and-mortar stores remain the leading channel for chocolate distribution.

Brazil is one of the largest chocolate consumers in Latin America, with demand strongly tied to cultural traditions, seasonal gifting, and everyday indulgence. Affordable mass-market chocolates dominate sales, but there is growing interest in premium, gourmet, and healthier alternatives among middle- and upper-income consumers. Local flavors and exotic ingredients are often integrated into product innovation, appealing to domestic tastes. Rising concerns over obesity and sugar intake are influencing demand for sugar-free and dark chocolate varieties. Brazil’s role as a cocoa producer further supports the growth of artisanal and origin-based chocolates. E-commerce penetration is increasing, but supermarkets remain the dominant retail channel.

Middle East & Africa Chocolate Market Trends

The chocolate market in the Middle East & Africa is anticipated to register the fastest CAGR of 7.5% over the forecast period from 2025 to 2033, driven by rising incomes, urbanization, and increasing exposure to Western brands. In the Middle East, chocolate is often associated with gifting, hospitality, and celebrations, while in Africa, affordability and accessibility remain critical factors. Premium and luxury chocolates have strong demand in countries like Saudi Arabia and South Africa, while mass-market products drive consumption in price-sensitive regions. Heat-sensitive storage and distribution challenges impact product quality in some markets. Growing interest in sugar-free and health-oriented chocolates is noticeable, particularly in affluent consumer segments. Retail modernization and e-commerce channels are further supporting market growth.

The UAE chocolate market has grown significantly over the forecast period. The country has a strong retail infrastructure, a multicultural population, and high disposable incomes. Chocolates are deeply linked to gifting traditions, weddings, and festive occasions, driving steady demand throughout the year. Premium and luxury brands dominate, with consumers willing to pay for exclusivity, quality, and imported products. Health trends are also shaping demand, with sugar-free, dark, and organic chocolates gaining popularity among affluent and health-conscious buyers. The strong presence of duty-free retail, modern supermarkets, and e-commerce platforms ensures wide product accessibility. Innovative packaging, seasonal collections, and personalized chocolates further enhance consumer engagement in the UAE.

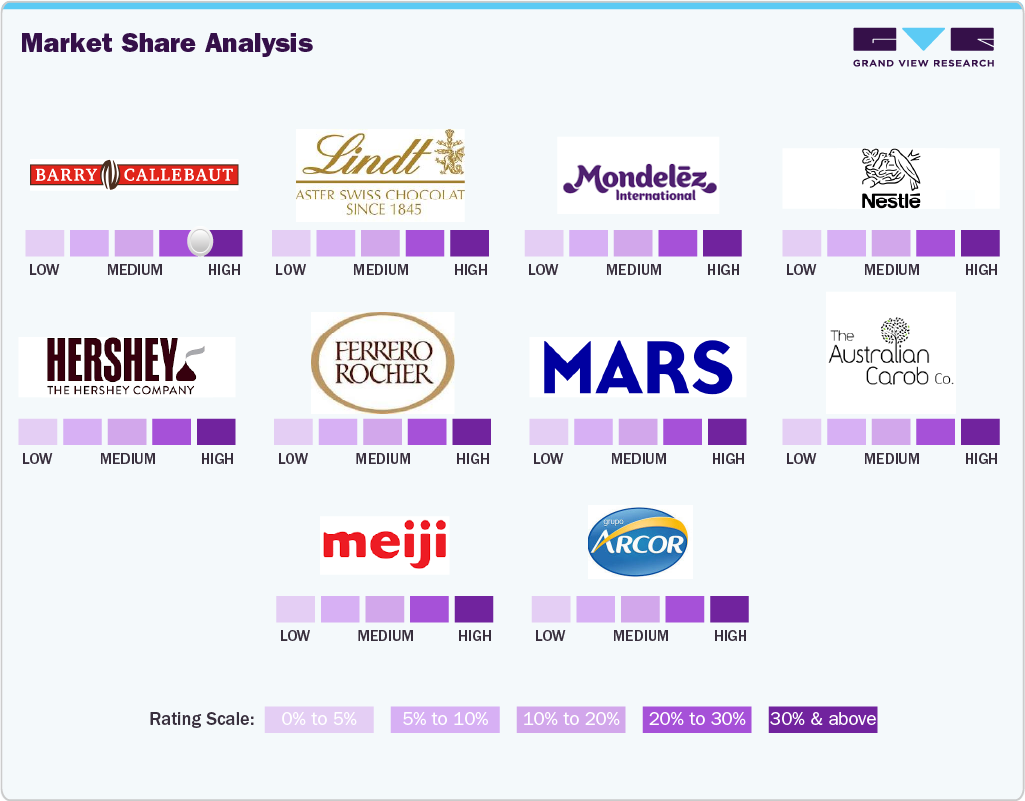

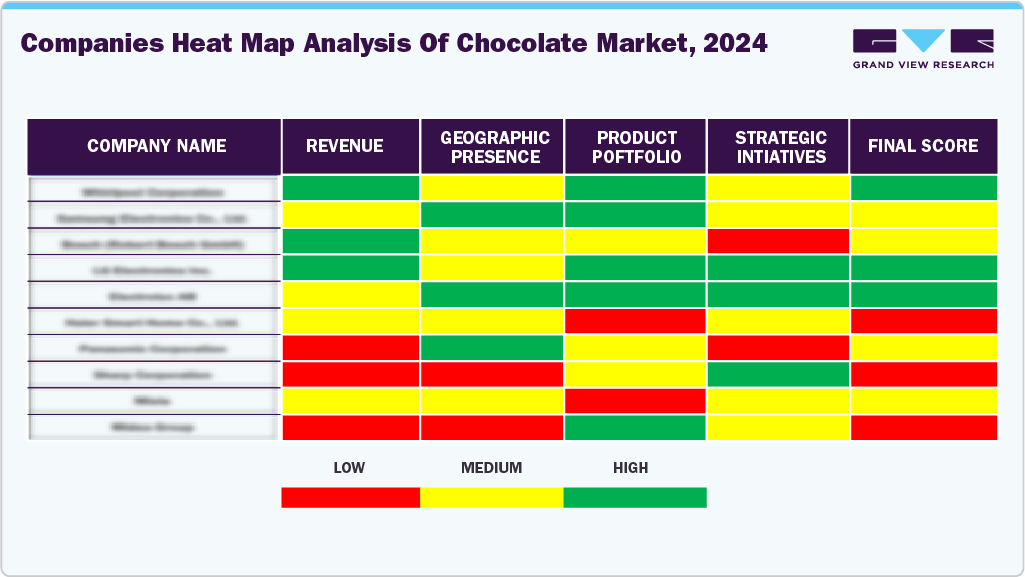

Key Chocolate Company Insights

Key players operating in the chocolate market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Chocolate Companies:

The following are the leading companies in the chocolate market. These companies collectively hold the largest market share and dictate industry trends.

- Barry Callebaut

- Chocoladefabriken Lindt & Sprüngli AG

- Mondelēz International

- Nestlé S.A.

- THE HERSHEY COMPANY

- Ferrero

- Mars, Incorporated

- The Australian Carob Co.

- Meiji Holdings Co., Ltd.

- Arcor

Recent Developments

-

In January 2024, Justin’s expanded its portfolio by introducing USDA-certified organic dark chocolate candy pieces. Offered in Dark Chocolate Peanut and Dark Chocolate Peanut Butter flavors, the products carried Non-GMO Project Verification, featured Rainforest Alliance-certified cocoa, and excluded any artificial sweeteners.

-

In October 2023, Mondelēz International repositioned the Toblerone chocolate brand as a premium chocolate with its "Never Square" campaign. The campaign takes inspiration from luxury brands and positions Toblerone as a unique and high-quality chocolate. To support the new brand positioning, Toblerone is introducing innovative formats and gifting options, including Toblerone Truffles with a velvety smooth truffle center and a unique diamond shape. The brand is also expanding its Tiny Toblerone packs to U.S. retailers, making the chocolate more accessible. These smaller sizes and shareable packs align with the company's goal of providing a variety of portion sizes and mindful snacking options.

-

In August 2023, Mondelēz launched two new Cadbury chocolate bars: Cadbury Darkmilk Praline, part of the Darkmilk line with 40% cocoa and a creamy hazelnut filling, and Cadbury Caramilk Crispy, a white-chocolate blend with light crisped rice.

-

In October 2022, Barry Callebaut, a leading manufacturer of high-quality chocolate and cocoa products, announced the development of the second generation of chocolate. This new chocolate places a greater emphasis on cocoa and reduces the amount of sugar used. The Cocoa Cultivation & Craft principle is employed in creating this new generation of chocolate, which aims to highlight the unique flavors of each cocoa bean. The result is chocolate that contains 60-80% more cocoa and 50% less sugar, making it a healthier option for those looking for a mindful indulgence.

Chocolate Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 127.05 billion

Revenue forecast in 2033

USD 184.69 billion

Growth rate

CAGR of 4.8% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Switzerland; China; India; Japan; Australia & New Zealand; South Korea; Brazil; UAE

Key companies profiled

Barry Callebaut; Chocoladefabriken Lindt & Sprüngli AG; Mondelēz International; Nestlé S.A.; THE HERSHEY COMPANY; Ferrero; Mars, Incorporated; The Australian Carob Co.; Meiji Holdings Co., Ltd.; Arcor

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Chocolate Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global chocolate market report on the basis of product, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Traditional

-

Dark

-

Milk

-

White

-

Artificial

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2021 - 2033)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Switzerland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global chocolate market size was estimated at USD 123.05 billion in 2024 and is expected to reach USD 127.05 billion in 2025.

b. The global chocolate market is expected to grow at a compound annual growth rate of 4.8% from 2025 to 2033 to reach USD 184.69 billion by 2033.

b. Europe dominated the chocolate market with a share of 46.0% in 2024. Rising consumer demand for dark chocolate in the region is a major driver of the regional market growth.

b. Key players in the chocolate market include Barry Callebaut; Chocoladefabriken Lindt & Sprüngli AG; Mondelēz International; Nestlé S.A.; THE HERSHEY COMPANY; Ferrero; Mars, Incorporated; The Australian Carob Co.; Meiji Holdings Co., Ltd.; and Arcor.

b. Consumer consciousness regarding the health benefits of eating high-quality chocolate remains the key driver of the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.