- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Clothing Fibers Market Size & Share, Industry Report, 2033GVR Report cover

![Clothing Fibers Market Size, Share & Trends Report]()

Clothing Fibers Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Cotton, Synthetic, Animal-based, Others), By End Use (Women’s Wear, Men’s Wear, Kid's Wear), By Region, And Segment Forecasts

- Report ID: 978-1-68038-779-7

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Clothing Fibers Market Summary

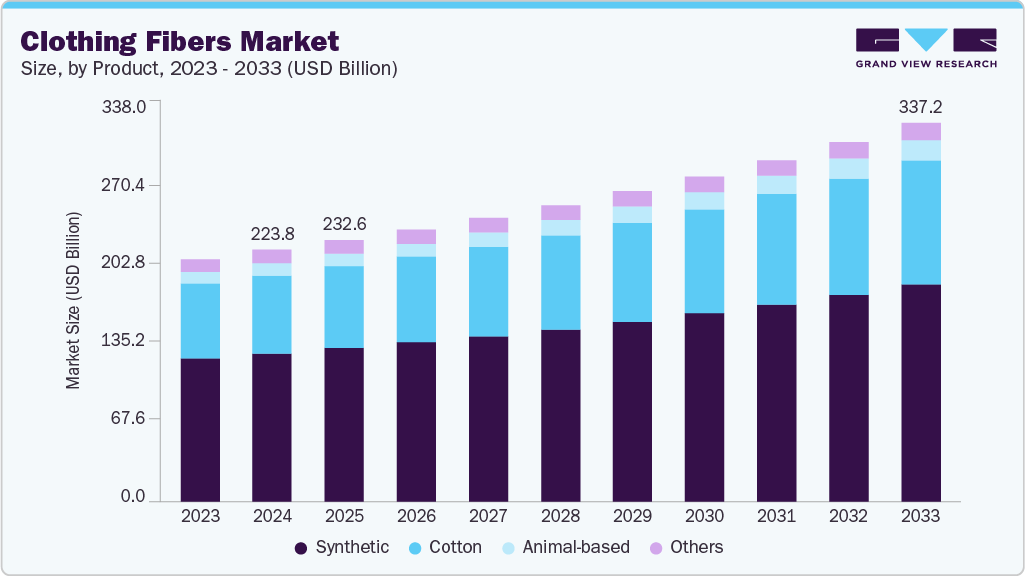

The global clothing fibers market size was estimated at USD 223.8 billion in 2024 and is projected to reach USD 337.2 billion by 2033, growing at a CAGR of 4.8% from 2025 to 2033. The demand for clothing fibers is rising steadily due to the expanding global population and increasing urbanization, which drive greater apparel consumption.

Key Market Trends & Insights

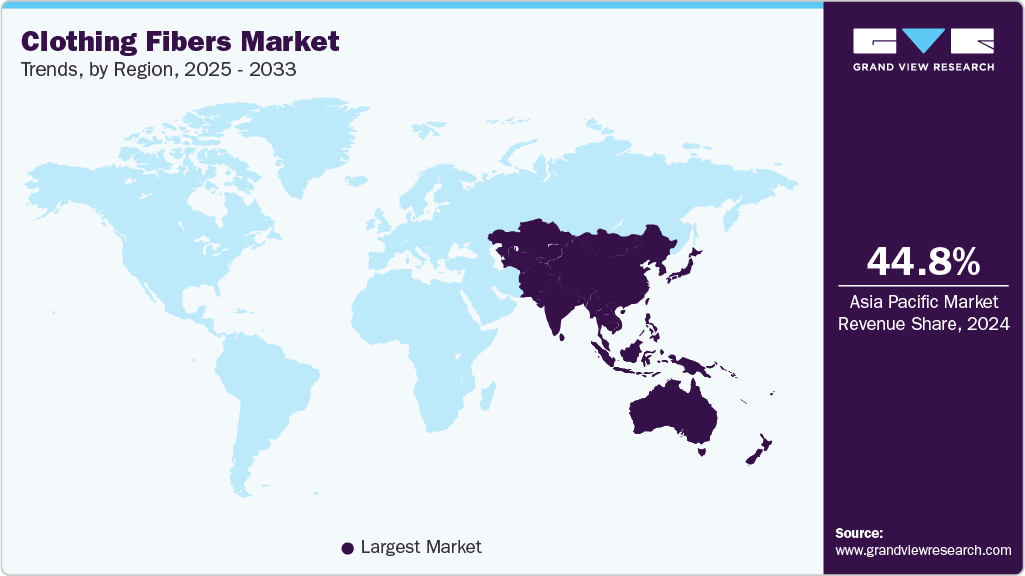

- Asia Pacific dominated the clothing fibers market with the largest revenue share of 44.8% in 2024.

- By product, the animal-based segment is expected to grow at the fastest CAGR of 6.6% over the forecast period.

- By end use, the kid’s wear segment is expected to grow at the fastest CAGR of 5.4% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 223.8 Billion

- 2033 Projected Market Size: USD 337.2 Billion

- CAGR (2025-2033): 4.8%

- Asia Pacific: Largest market in 2024

The rising disposable income levels, especially in emerging economies, have led to a surge in demand for fashion and comfort-oriented clothing. E-commerce growth has made clothing more accessible, further accelerating fiber demand. Consumers are also increasingly prioritizing sustainable and eco-friendly fashion, which boosts demand for natural and regenerated fibers. Seasonal fashion cycles and fast fashion trends contribute to high turnover rates in apparel, requiring constant fiber production. The shift toward performance wear and functional textiles is fueling specialized fiber segments.

Key growth drivers for the clothing fibers industry include the increasing inclination toward sustainable textiles, the growth of technical textiles, and innovation in fiber blends. Demand for natural fibers like organic cotton, hemp, and bamboo is expanding due to environmental concerns. Synthetic fibers like polyester and nylon continue to dominate due to their low cost, durability, and versatility in different weather conditions. Additionally, advancements in fiber engineering have led to high-performance blends catering to specific use cases such as sportswear, casual wear, and formalwear. A robust global textile and apparel industry, coupled with trade liberalization and favorable sourcing practices, is sustaining fiber demand. The rapid emergence of textile recycling technologies is also reshaping how fibers are produced and consumed.

A notable trend is the rising use of bio-based and biodegradable fibers, such as lyocell and polylactic acid (PLA), in sustainable fashion. The integration of nanotechnology and smart fibers in clothing is gaining ground, especially in functional and wearable technology segments. Companies are also exploring recycled polyester (rPET) and circular design models to reduce fiber waste. Blended fabrics combining natural and synthetic fibers for improved comfort, elasticity, and durability are becoming more popular. Digital fashion trends and 3D knitting technologies are reshaping fiber usage by minimizing waste and enabling on-demand production. There’s also a growing focus on traceability and certification, with consumers preferring brands that ensure fiber origin transparency.

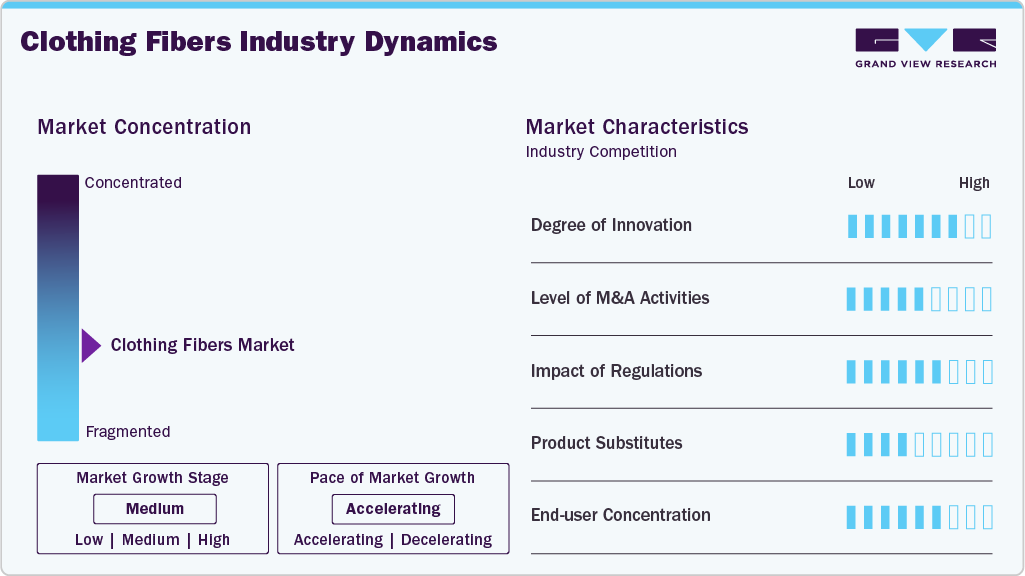

Market Concentration & Characteristics

The clothing fibers market is moderately fragmented, with a mix of large-scale chemical corporations dominating the synthetic fiber space and various regional players catering to natural and specialty fibers. The presence of integrated companies with in-house fiber-to-garment capabilities gives them a competitive edge. Meanwhile, startups and small firms are disrupting the market with sustainable fiber innovations. Consolidation is seen in segments like polyester and viscose due to economies of scale, while eco-fiber niches remain open to new entrants. The global nature of sourcing and production also dilutes market concentration across geographies, although vertical integration is a growing trend among top players.

The threat of substitutes in the clothing fibers industry is moderate, as each fiber type has specific properties suited for different applications. However, innovations in lab-grown fibers and leather alternatives pose future threats. Natural fibers may be substituted with synthetic or regenerated alternatives for cost or performance reasons. Similarly, the rise of second-hand clothing, rental fashion, and digital wearables could indirectly reduce demand for virgin fibers. Yet, due to the deeply embedded use of traditional fibers in garment manufacturing, immediate substitution remains unlikely. However, increasing consumer consciousness about fiber origin and sustainability may cause market shifts over time.

Product Insights

The synthetic fibers segment led the clothing fibers industry with the highest revenue share of 58.9% in 2024, due to their cost-effectiveness, durability, and versatility across various apparel segments. Fibers such as polyester, nylon, and acrylic are widely used for their resistance to shrinkage, high tensile strength, and ability to retain colors and shapes, making them ideal for both casual and performance wear. Their compatibility with advanced manufacturing techniques and ease of mass production have given them a competitive edge, particularly in fast fashion. Moreover, innovations in recycled synthetic fibers like rPET are helping brands align with sustainability goals while maintaining performance, further reinforcing the dominance of synthetics in the global market.

The cotton segment is expected to grow at a significant CAGR of 5.3% over the forecast period, driven by rising consumer preference for breathable, skin-friendly, and biodegradable fabrics. Growing awareness of sustainable fashion and the harmful environmental impact of synthetic fibers has accelerated demand for organic and responsibly sourced cotton. Cotton's versatility in both luxury and everyday wear also boosts its appeal across demographics. Government support for cotton farming, including subsidies and organic certification programs, has further improved its production and global trade. Additionally, fashion brands are increasingly incorporating cotton into their collections to meet eco-conscious consumer expectations and ESG commitments.

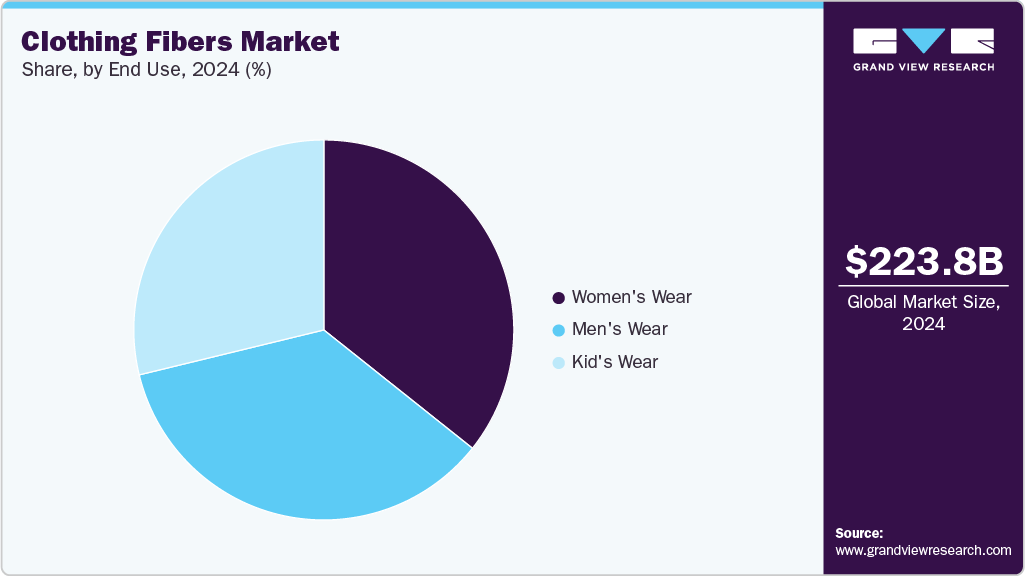

End Use Insights

The women’s wear segment held the highest revenue share of 35.7% in 2024, driven by evolving fashion trends, higher garment variety, and increasing purchasing frequency among female consumers. The segment exhibits strong demand for both natural fibers like cotton and premium options such as silk and viscose, used in dresses, tops, and athleisure. The rise of fashion-conscious and digitally active female shoppers is pushing brands to frequently update collections, resulting in higher fiber usage. Moreover, growing awareness around sustainability and body-inclusive fashion has led to increased use of innovative and comfortable fibers tailored to diverse needs. This dynamic consumer base is accelerating fiber innovation and demand in women's wear.

The kid’s wear segment is expected to grow at the fastest CAGR of 5.4% over the forecast period, due to increasing demand for comfortable, safe, and sustainable materials. Parents are showing a strong preference for organic and skin-friendly fabrics such as cotton, bamboo, and Tencel, driving innovation and diversification in fiber usage. The rise of children's activewear has also pushed demand for performance-enhancing fibers like spandex and polyester blends that offer flexibility and durability. Additionally, growing awareness around eco-conscious fashion and ethical manufacturing is accelerating the adoption of natural and regenerated fibers in children's clothing.

Regional Insights

Asia Pacific dominated the global clothing fibers market and accounted for the largest revenue share of about 44.8% in 2024, owing to its vast textile manufacturing ecosystem, cost-effective labor, and abundant availability of raw materials like cotton, jute, and viscose. China, India, Bangladesh, and Vietnam are key contributors to both fiber production and apparel exports. Government schemes supporting textile parks and man-made fiber clusters have strengthened the industry. The region is also witnessing rising domestic consumption driven by a growing middle class and urbanization. Technological advancements in spinning and dyeing, along with increased focus on eco-friendly production methods, are enhancing competitiveness. The rising participation of regional manufacturers in global supply chains positions Asia Pacific as a dominant force in both volume and innovation.

China Clothing Fibers Market Trends

China remains the world’s leading producer of polyester, viscose, and nylon, supported by a strong petrochemical base and vertically integrated manufacturing. It is also increasing its focus on sustainability, with domestic brands and manufacturers adopting recycled polyester and cleaner fiber processing technologies. The Chinese government is encouraging green production through subsidies and emission regulations. Moreover, the country is shifting towards high-end textile exports and investing in automation and AI for fiber processing. Its growing domestic fashion market, driven by young consumers and digital platforms, is further boosting fiber demand. Partnerships with international apparel brands are driving innovation in high-performance and functional clothing fibers.

North America Clothing Fibers Market Trends

The North America clothing fibers industry is evolving with increased adoption of eco-conscious textiles and support for reshoring fiber and textile manufacturing. Manufacturers are investing in advanced fiber technologies such as moisture-wicking, temperature-regulating, and anti-microbial fabrics, especially for sportswear and outdoor clothing. The rise of slow fashion, local sourcing, and consumer demand for organic and traceable fibers is transforming the market landscape. U.S. and Canadian companies are also exploring innovative blends combining natural and synthetic fibers to improve comfort and longevity. Recycling infrastructure for polyester and post-consumer textile waste is gaining traction, promoting circular economy models.

U.S. Clothing Fibers Market Trends

The U.S. is focusing on high-performance fibers used in sports, outdoor wear, and technical apparel. There is a growing push towards sustainability, with consumer awareness encouraging the adoption of organic cotton, hemp, and rPET. U.S.-based brands are increasingly partnering with textile recyclers and sustainable fiber innovators. Government support for domestic textile manufacturing, including recent incentives for reshoring and clean energy adoption, is improving local competitiveness. Demand for traceable and certified clothing fibers has also surged due to ESG considerations. Innovation in fiber biotechnology is another area of growth, with several startups working on lab-grown and carbon-negative fibers.

Europe Clothing Fibers Market Trends

Europe is leading in sustainable fiber innovation, driven by stringent EU regulations and an environmentally conscious consumer base. The region is highly focused on circular fashion, with brands emphasizing fiber traceability, recyclability, and lifecycle impact. Countries like Italy, France, and the Netherlands are investing in next-generation materials such as regenerated cellulosics and biodegradable synthetics. Extended Producer Responsibility (EPR) regulations are pushing fiber producers to innovate in end-of-life solutions. The rise of ethical fashion movements, combined with pressure from NGOs and consumer advocacy groups, is reshaping fiber choices in apparel. The region also supports textile R&D hubs and academic-industry collaborations.

The Germany clothing fibers market is expected to grow during the forecast period. Germany stands out for its leadership in technical and functional fibers, driven by advanced R&D capabilities and a strong machinery sector. The country emphasizes high-quality synthetic and performance fibers used in sportswear, medical textiles, and protective clothing. Its focus on sustainability has led to significant investments in fiber recycling technologies, bio-based polymers, and energy-efficient manufacturing. German consumers show high awareness of environmental impact, which is pushing retailers to adopt certified and traceable fiber inputs. The country’s well-regulated textile supply chain, along with EU funding for green technologies, makes it a key hub for sustainable fiber development.

Central & South America Clothing Fibers Market Trends

Central & South America is showing growth potential in natural clothing fibers, particularly in cotton and alpaca wool. Countries like Brazil, Peru, and Colombia are increasing investments in textile production, driven by both export and domestic demand. Rising incomes and fashion consciousness are pushing consumers toward diverse apparel choices, thereby increasing fiber demand. However, the region faces challenges in large-scale synthetic fiber production due to limited petrochemical infrastructure. Governments are supporting the development of sustainable fiber value chains, particularly in organic farming and indigenous fiber crafts. Regional players are also exploring export opportunities for niche and luxury fibers in global markets.

Middle East & Africa Clothing Fibers Market Trends

The Middle East & Africa region is gradually expanding its footprint in the clothing fibers industry, driven by investments in textile zones, trade partnerships, and increasing consumer demand. Countries like Egypt and Ethiopia are gaining attention as emerging textile hubs due to their cotton-growing potential and labor availability. Gulf countries are investing in synthetic fiber production and downstream textile industries as part of their diversification strategies. In Africa, donor-backed programs are supporting sustainable cotton farming and local fiber processing. While infrastructural limitations exist, increasing urbanization and demand for affordable clothing are pushing growth. Export-driven fiber development is gaining ground, especially in East Africa.

Key Clothing Fibers Company Insights

Some of the key players operating in the market include Eastman Chemical Company and Asahi Kasei Corporation.

-

Eastman Chemical Company is a U.S.-based specialty materials manufacturer known for producing innovative, sustainable fiber solutions for textiles and apparel. Its Naia cellulosic fiber is gaining popularity in the fashion industry for being eco-friendly, soft, and biodegradable. The company leverages closed-loop production and sustainable sourcing to support circular fashion initiatives.

-

Asahi Kasei is a Japanese multinational that produces a range of synthetic and regenerated fibers. It is best known for Bemberg, a premium cupro fiber made from cotton linter, and Roica, a high-performance stretch fiber (spandex). Asahi Kasei focuses heavily on sustainable innovation and technical performance in the fashion and sportswear sectors.

Toray Industries, Inc. and Indorama Ventures Public Company Limited are some of the emerging participants in the clothing fibers market.

-

Toray Industries is a leading Japanese manufacturer of synthetic fibers such as polyester and nylon, widely used in apparel, sportswear, and industrial textiles. It is known for its proprietary technologies in ultra-microfiber and recycled fiber production. Toray plays a major role in promoting sustainability through advanced materials like ECOSUEDE and &+ (And Plus) fibers.

-

Headquartered in Thailand, Indorama Ventures is one of the world’s largest producers of polyester fibers, yarns, and PET resins used in clothing, home textiles, and industrial fabrics. The company emphasizes recycling and circular economy practices, with a strong presence in post-consumer PET recycling for fiber applications, particularly through its DEJA brand.

Key Clothing Fibers Companies:

The following are the leading companies in the clothing fibers market. These companies collectively hold the largest market share and dictate industry trends.

- Eastman Chemical Company

- Teijin Ltd.

- Toray Industries, Inc.

- Asahi Kasei Corporation

- The Bombay Dyeing and Manufacturing Co. Ltd.

- Reliance Industries Limited

- Indorama Ventures Public Company Limited

- Invista

- Hyosung TNC Corporation

- Lenzing AG

Recent Developments

-

In May 2025, Teijin Frontier introduced a high-performance recycled polyester fabric that mimics the look and feel of natural fibers through proprietary spinning and finishing. The fabric features cooling touch, UV protection, anti-stick and quick-dry properties, and is made from 100% recycled polyester, with a commercial launch planned for spring/summer 2026.

-

In February 2025, Hyosung, Loop Industries, and Pleatsmama collaborated to pioneer circular fashion with infinite Loop textile-to-textile recycling technology. This collaboration highlights the potential of circular fashion and innovative recycling technologies to drive sustainability across industries.

Clothing Fibers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 232.6 billion

Revenue forecast in 2033

USD 337.2 billion

Growth rate

CAGR of 4.8% from 2025 to 2033

Base year for estimation

2024

Actual estimates/Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2023 to 2033

Report coverage

Volume and Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; China; Japan; India; South Korea; Brazil; South Africa; Morocco

Key companies profiled

Eastman Chemical Company; Teijin Ltd.; Toray Industries, Inc.; Asahi Kasei Corporation; The Bombay Dyeing and Manufacturing Co. Ltd.; Reliance Industries Limited; Indorama Ventures Public Company Limited; Invista; Hyosung TNC Corporation; Lenzing AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Clothing Fibers Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the clothing fibers market report based on product, end use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Cotton

-

Synthetic

-

Animal-based

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Women’s Wear

-

Men’s Wear

-

Kid's Wear

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Morocco

-

-

Frequently Asked Questions About This Report

b. The global clothing fibers market size was estimated at USD 223.8 billion in 2024 and is expected to reach USD 232.6 billion in 2025

b. The global clothing fibers market is expected to grow at a compound annual growth rate of 4.8% from 2025 to 2033 to reach USD 337.2 billion by 2033.

b. The synthetic fibers segment held the highest revenue market share of 58.9% in 2024, due to their cost-effectiveness, durability, and versatility across various apparel segments.

b. Some of the key players operating in the clothing fibers market include Eastman Chemical Company, Teijin Ltd., Toray Industries, Inc., Asahi Kasei Corporation, The Bombay Dyeing and Manufacturing Co. Ltd., Reliance Industries Limited, Indorama Ventures Public Company Limited, Invista, Hyosung TNC Corporation, and Lenzing AG.

b. Rising demand for sustainable, functional, and comfortable apparel across diverse consumer segments is driving the clothing fibers market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.