- Home

- »

- Electronic Devices

- »

-

Commercial Lighting Market Size, Industry Report, 2033GVR Report cover

![Commercial Lighting Market Size, Share & Trends Report]()

Commercial Lighting Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (CFL, Fluorescent Lighting), By Installation (New Installations, Retrofit), By Distribution Channel (Online, Offline), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-713-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Commercial Lighting Market Summary

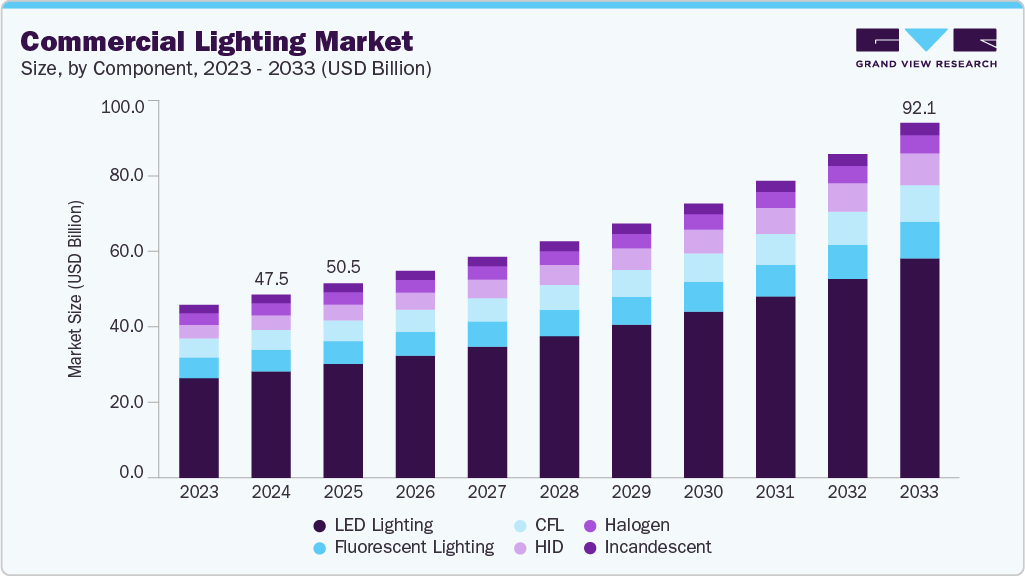

The global commercial lighting market size was estimated at USD 47.54 billion in 2024 and is projected to reach USD 92.14 billion by 2033, growing at a CAGR of 7.8% from 2025 to 2033. The growing prevalence of green building certifications, such as LEED, BREEAM, and WELL is driving the market growth.

Key Market Trends & Insights

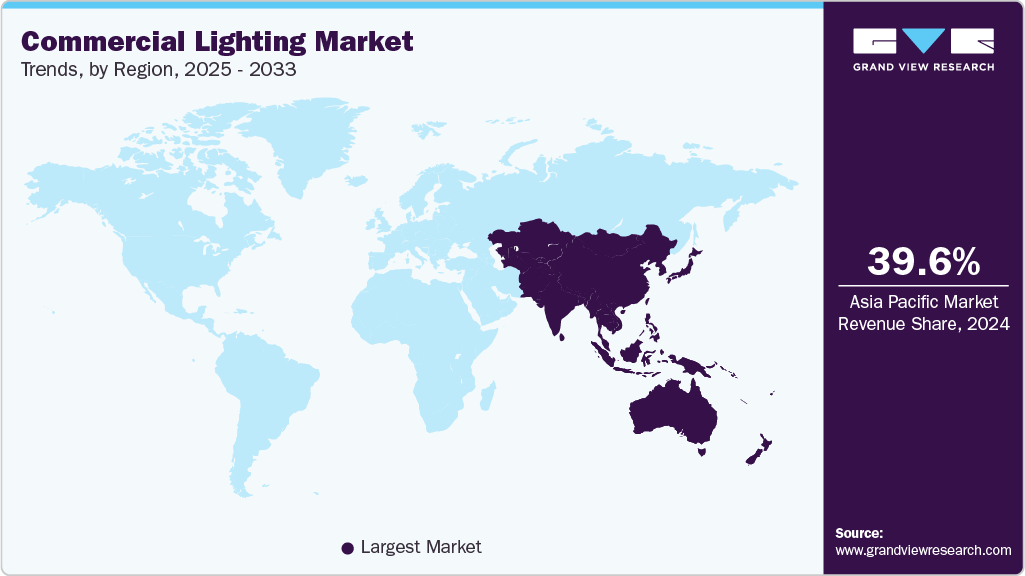

- Asia Pacific held a 39.6% revenue share of the global commercial lighting market in 2024.

- In the U.S., the rapid expansion of sectors such as warehousing, logistics, and data centers is accelerating the demand for commercial lighting systems.

- By product, the LED lighting segment held the largest revenue share of 58.1% in 2024.

- By installation, the new installations segment held the largest revenue share in 2024.

- By distribution channel, the offline segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 47.54 Billion

- 2033 Projected Market Size: USD 92.14 Billion

- CAGR (2025-2033): 7.8%

- Asia Pacific: Largest market in 2024

Urbanization and infrastructure development are fueling the demand for commercial lighting globally. The expansion of commercial real estate, such as new office complexes, shopping malls, hotels, airports, and metro stations, directly translates to increased demand for diverse lighting applications, including ambient lighting, architectural facade lighting, task lighting, and emergency systems. Emerging economies in Asia, the Middle East, and parts of Africa are witnessing a construction boom, with developers prioritizing modern lighting solutions that align with aesthetic, functional, and regulatory standards. In addition, renovation projects in mature markets like North America and Europe are triggering retrofitting activities, where outdated lighting systems are being replaced with smarter, greener alternatives.

Workplace wellness and human-centric lighting are driving the market growth. Research has shown that lighting impacts employee productivity, mood, and overall well-being. As companies prioritize creating healthier work environments, there is growing adoption of tunable lighting systems that mimic natural daylight cycles, helping to regulate circadian rhythms and reduce eye strain. These systems are particularly valued in commercial offices and healthcare settings where long hours under artificial lighting are common. This growing awareness of lighting’s influence on human behavior and health is reshaping how lighting is designed and deployed across commercial sectors.

The modernization of commercial infrastructure and the expansion of new commercial spaces contribute to the growth of the lighting market. Across developing and developed economies, there is a growing pipeline of office complexes, malls, airports, educational institutions, and healthcare facilities. Each of these spaces requires specialized lighting solutions tailored to specific functional, aesthetic, and safety needs. Architectural and façade lighting, ambient interior lighting, and emergency lighting are becoming integral parts of design specifications, with architects and engineers prioritizing both performance and visual impact. As commercial construction surges globally, lighting becomes a critical part of capital expenditure planning.

Furthermore, branding and visual merchandising strategies play an important role in driving the market for commercial lighting, particularly in retail, entertainment, and hospitality industries. Businesses are using dynamic and color-tunable lighting to create immersive environments, highlight products, and build emotional connections with customers. Lighting is not just seen as a utility, but as an experience-enhancing tool that adds value to the space. This trend is encouraging the adoption of digitally controlled, programmable lighting systems that allow for customized ambiance and interactive design elements, opening up new avenues for innovation in commercial lighting solutions.

Product Insights

The LED segment dominated the market in 2024. The growing adoption of lighting-as-a-service (LaaS) models is enabling wider uptake of LED solutions in commercial markets. This business model allows commercial clients to install and use advanced LED systems without large upfront investments, instead paying a monthly or usage-based fee that includes installation, maintenance, and upgrades. LaaS is particularly appealing to small and medium enterprises that may not have the capital to invest in a full lighting overhaul but want to benefit from the performance and savings that LEDs offer. This shift toward service-oriented procurement further incentivizes lighting providers to offer LED-based solutions due to their lower maintenance needs and longer operational life, reinforcing the segment’s dominance in the evolving commercial lighting landscape.

The HID segment is projected to be the fastest-growing segment from 2025 to 2033. In certain specialized commercial applications, HID lighting is favored for its specific color characteristics and brightness levels. For instance, metal halide HID lamps are often used in retail and sports facilities because of their bright white light and good color rendering, which help showcase products and enhance visual clarity in performance environments. High-pressure sodium lamps, on the other hand, are valued for their energy efficiency and long lifespan in outdoor commercial lighting applications. These characteristics make HIDs a continuing choice for specific lighting needs where extreme brightness, durability, and wide coverage outweigh the benefits of newer, more efficient technologies.

Installation Insights

The new installations segment dominated the market in 2024. The rapid expansion of infrastructure projects and commercial construction activities across urban and semi-urban areas is driving the market growth. As new commercial buildings, retail spaces, educational institutions, healthcare centers, hospitality establishments, and industrial facilities are being developed, the demand for modern, efficient, and aesthetically appealing lighting solutions has surged. Lighting is no longer seen as a purely functional component. Still, as an integral aspect of architecture and design, and therefore, lighting systems are increasingly integrated during the planning and construction phases. This shift is contributing significantly to the growth of the new installations segment, where lighting plays a critical role in both visual appeal and energy management strategies.

The retrofit segment is projected to be the fastest-growing segment from 2025 to 2033. The rise of smart building technologies is contributing to the retrofit segment’s growth. As more commercial buildings seek to become part of the smart infrastructure ecosystem, upgrading lighting systems becomes a natural entry point. Many retrofitting projects involve the integration of smart controls, motion sensors, daylight harvesting systems, and connectivity to building management systems. These features enhance the operational efficiency and user comfort of commercial spaces and provide valuable data insights into usage patterns and energy optimization. Retrofitting existing commercial buildings with such intelligent lighting solutions is helping to bridge the gap between old infrastructure and next-generation smart environments, making the retrofit segment one of the most dynamic areas of growth within the commercial lighting industry.

Distribution Channel Insights

The online segment dominated the market in 2024. The growing emphasis on data-driven procurement and digital records management in enterprise operations is driving online sales of commercial lighting systems. Online platforms offer detailed purchase histories, warranty information, and automated documentation, which aid in asset tracking and compliance. With many commercial organizations adopting enterprise resource planning (ERP) systems and digital procurement software, integrating lighting purchases through online channels aligns with their broader IT and operational strategies. This seamless integration between procurement systems and online lighting vendors is expected to further drive the growth of the online segment in the market during the forecast period.

The offline segment is projected to grow at a significant CAGR from 2025 to 2033. Brick-and-mortar lighting showrooms increasingly incorporate digital tools such as in-store configuration software, digital catalogs, and interactive kiosks to offer a richer customer experience. Some also provide extended services such as installation, after-sales maintenance, and warranty support, which further incentivizes businesses to choose offline vendors for comprehensive lighting solutions. This hybridization of offline engagement with value-added services is helping traditional players remain competitive in the digital age, thereby sustaining the momentum of the offline segment within the market.

Application Insights

The outdoor lighting segment dominated the market in 2024 in terms of revenue share. The rise of commercial logistics and 24/7 operations in sectors such as warehousing, manufacturing, and transportation is also contributing significantly to the outdoor lighting market. Facilities such as distribution centers, freight terminals, and industrial parks require extensive outdoor lighting to maintain productivity and safety around the clock. With the growing e-commerce economy, the need for well-illuminated loading bays, parking lots, and perimeter zones has become more urgent, especially as operations extend into night hours. Commercial stakeholders are thus opting for high-intensity, weather-resistant, and low-maintenance outdoor lighting systems that can ensure visibility while minimizing operational costs through energy-saving technology.

The smart lighting segment is projected to be the fastest-growing segment from 2025 to 2033. The increasing adoption of Internet of Things (IoT) technologies and the rising demand for intelligent infrastructure in commercial environments are driving segment growth. Businesses and facility managers are prioritizing lighting systems that can be remotely monitored, programmed, and automated to optimize energy consumption and enhance operational efficiency. Smart lighting solutions, embedded with sensors and connected via wireless or wired networks, enable dynamic adjustments based on occupancy, daylight availability, and time of day, thereby significantly reducing electricity usage and maintenance costs. This is particularly appealing in commercial settings such as office buildings, hotels, shopping malls, and hospitals, where lighting accounts for a substantial portion of energy expenditures.

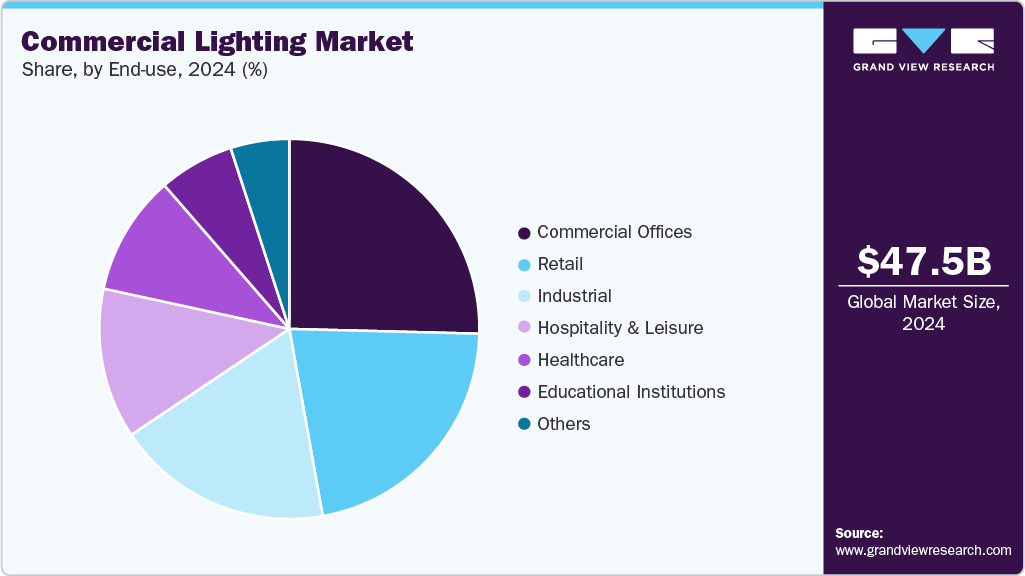

End Use Insights

The commercial offices segment dominated the market in 2024 in terms of revenue share. The trend toward smart offices is also significantly influencing the demand for advanced lighting solutions in the commercial office segment. With the integration of IoT-based lighting systems, offices can now implement occupancy-based lighting control, daylight harvesting, and remote monitoring through centralized building management systems. These smart capabilities not only reduce unnecessary energy usage but also contribute to a more dynamic and adaptable office environment. Such systems also provide insights through data analytics, enabling facility managers to optimize space usage and maintenance schedules based on actual usage patterns.

The healthcare segment is projected to be the fastest-growing segment from 2025 to 2033. The rise of outpatient care facilities, diagnostic centers, and medical wellness hubs is driving the market growth. As healthcare delivery becomes decentralized to improve accessibility and cost-effectiveness, smaller satellite clinics and specialty care centers are being set up in urban and semi-urban areas. These facilities still require sophisticated lighting systems for diagnostics, patient safety, and brand consistency. As these facilities often operate with limited space and budget constraints, there’s an amplified demand for compact, energy-efficient, and easily installed lighting solutions. This trend is expanding the market footprint beyond tertiary hospitals, driving volume growth in both new installations and retrofits of lighting products and systems.

Regional Insights

The Asia Pacific commercial lighting industry dominated globally with a market share of 39.6% in 2024. The increasing adoption of smart and connected lighting technologies across the region drives market growth. With rising internet penetration and advances in wireless communication infrastructure, Asia Pacific’s commercial sector is increasingly integrating IoT-enabled lighting systems. These smart solutions allow for centralized control, remote monitoring, adaptive brightness, and predictive maintenance, enhancing operational efficiency in commercial spaces such as IT parks, educational institutions, and industrial facilities. Moreover, the data analytics capabilities of smart lighting systems are enabling businesses to optimize energy use and improve building management strategies, making them particularly attractive in countries where energy security and grid reliability are ongoing concerns.

India Commercial Lighting Market Trends

The commercial lighting industry in India is projected to grow during the forecast period. The growth of India’s retail, hospitality, and healthcare industries drives market growth. These sectors are increasingly investing in modern lighting solutions that ensure energy efficiency and enhance the customer and visitor experience. In retail and hospitality spaces, lighting plays a pivotal role in visual merchandising and ambiance creation, while in healthcare environments, it contributes to comfort, safety, and staff performance. As these sectors expand into Tier 2 and Tier 3 cities, the demand for advanced lighting, particularly LED and smart lighting systems, is extending beyond metropolitan regions, resulting in broader market penetration across the country.

Europe Commercial Lighting Market Trends

The commercial lighting industry in Europe is expected to grow during the forecast period. The digital transformation of commercial environments across Europe is contributing to the growth of the lighting market. Businesses are increasingly investing in smart lighting technologies integrated with IoT platforms to gain real-time control over lighting conditions, energy usage, and maintenance schedules. These systems are particularly attractive for large commercial facilities such as shopping centers, office parks, airports, and healthcare institutions, where operational efficiency and user experience are paramount. The rise of flexible working models and hybrid offices has further increased the need for adaptable lighting systems that can respond to occupancy changes and enhance the comfort and wellness of employees.

The commercial lighting industry in Germany is expected to grow during the forecast period. Germany’s thriving renewable energy ecosystem indirectly supports the commercial lighting industry. With a growing share of electricity derived from solar, wind, and other renewables, many commercial buildings are being designed or retrofitted to function as energy-efficient ecosystems. Lighting systems form a core part of this infrastructure, particularly when paired with renewable power generation and energy storage. For example, commercial facilities with rooftop solar arrays are increasingly outfitted with LED lighting and smart controls to ensure that energy generated onsite is utilized as efficiently as possible. This synergy between sustainable energy production and consumption is contributing to the wider adoption of energy-saving lighting systems across German cities.

North America Commercial Lighting Market Trends

The commercial lighting industry in North America is expected to grow during the forecast period. An increase in commercial construction and renovation projects is driving the market in North America. As commercial real estate development regains momentum, particularly in urban centers like New York, Toronto, Chicago, and Los Angeles, new lighting installations are a fundamental part of building design and tenant fit-outs. Additionally, many building owners are leveraging lighting upgrades as part of post-COVID facility overhauls that focus on creating safer, healthier, and more adaptive workplaces. These renovations frequently include the installation of UV-C lighting for sanitization, tunable white lighting to support circadian rhythms, and touchless lighting controls, all of which align with evolving health and wellness standards in North American workplaces.

The U.S. commercial lighting industry is projected to grow during the forecast period. The rapid expansion of sectors such as warehousing, logistics, and data centers in the U.S. is boosting demand for high-performance lighting solutions. These facilities operate around the clock and require consistent, reliable illumination that enhances worker safety and operational efficiency. High-bay LED lighting and motion-sensor-based controls are being widely installed in such industrial-commercial spaces, where energy savings and durability are paramount. As e-commerce continues to drive growth in logistics infrastructure and digital services fuel new data center construction, the demand for sophisticated lighting systems tailored to these environments is set to expand significantly. This industrial-commercial overlap further strengthens the U.S. market outlook for commercial lighting during the forecast period.

Key Commercial Lighting Company Insights

Some of the key companies operating in the market, include Signify Holding and Lithonia Lighting, among others are leading participants in the commercial lighting industry.

-

Signify Holding is a multinational company specializing in lighting products, systems, and services, with a strong presence in the market. Signify offers an expansive commercial lighting portfolio that includes conventional lighting, LED lighting, and connected lighting systems. Its LED-based product lines are at the core of its commercial strategy, providing high-lumen output, energy-saving benefits, and long product lifespans. These are used in indoor environments such as corporate offices and educational institutions, as well as in outdoor applications like parking lots, architectural façades, and public lighting projects.

-

Lithonia Lighting, a brand under Acuity Brands Inc. In the commercial lighting segment, Lithonia Lighting offers an expansive and diverse product portfolio that caters to nearly every application, ranging from interior office spaces and retail environments to warehouses, educational institutions, and healthcare facilities. The company specializes in LED lighting technologies that combine energy efficiency with long operational lifespans, making them suitable for commercial clients seeking reduced maintenance and operating costs.

Amerlux, LLC and Kichler Lighting LLC are some of the emerging market participants in the commercial lighting industry.

-

Amerlux, LLC is a U.S.-based commercial lighting manufacturer specializing in architectural-grade, energy-efficient lighting solutions tailored to the needs of commercial, retail, and urban infrastructure markets. Its signature product families, such as the Linea, Gravitas, and Essenza series, offer extensive configuration options in terms of size, optics, beam angles, finishes, and control compatibility. This flexibility enables lighting designers to achieve precise light distribution and mood-setting effects in a range of commercial applications, including corporate boardrooms, hospitality lounges, and retail showrooms.

-

Kichler Lighting LLC is a prominent lighting manufacturer. Kichler offers a curated selection of decorative and architectural-grade fixtures that cater to offices, multi-use buildings, hotels, restaurants, and public spaces. Its commercial indoor lighting solutions focus primarily on pendant lights, wall sconces, linear suspensions, flush mounts, chandeliers, and ceiling fans with integrated lighting, all of which are designed to combine aesthetic appeal with durable construction.

Key Commercial Lighting Companies:

The following are the leading companies in the commercial lighting market. These companies collectively hold the largest market share and dictate industry trends.

- Alcon Lighting

- Amerlux, LLC

- Axis Lighting

- FES Lighting

- Intense Lighting

- Kichler Lighting LLC

- Litetronics

- Lithonia Lighting

- Pro Lighting Group Inc.

- RAB Lighting

- SAL Commercial

- Signify Holding

- TCP Lighting

- VONN Lighting

- WAC Lighting

Recent Developments

-

In June 2025, Axis Lighting acquired Picasso Lighting Industries in a strategic move that establishes a U.S.-based manufacturing platform for the company. This development allows Axis Lighting to produce and distribute its wide array of innovative and customizable architectural lighting solutions directly within the United States. The acquisition also strengthens Axis Lighting’s standing as a leading choice among North America’s architectural lighting professionals, with Picasso Lighting’s product portfolio serving as a strong complement to its own offerings.

-

In September 2024, Kingswood Capital Management, LP, acquired Kichler Lighting, LLC, and plans to merge it with its existing portfolio company, Progress Lighting, LLC. This strategic combination will form one of North America’s leading residential lighting platforms, uniting two well-established and complementary brands. The newly formed entity will leverage enhanced distribution and service capabilities, along with a diverse and comprehensive product portfolio, to better serve customers across various channels, including homebuilders, trade professionals, showrooms, retail, and ecommerce.

-

In May 2024, Intense Lighting launched the GX Adapt luminaire. This versatile fixture features an adjustable multi-head accent system, offering between one to four powerful 2-inch aperture heads housed within a compact rectangular extrusion. Designed with flexibility in mind, the GX Adapt is available in both pendant and surface mount configurations, making it suitable for a wide variety of environments.

Global Commercial Lighting Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 50.47 billion

Revenue forecast in 2033

USD 92.14 billion

Growth rate

CAGR of 7.8% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product, installation, distribution channel, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Alcon Lighting; Amerlux, LLC; Axis Lighting; WAC Lighting; FES Lighting; Intense Lighting; Kichler Lighting LLC; Litetronics; Lithonia Lighting; Pro Lighting Group Inc.; RAB Lighting; SAL Commercial; Signify Holding; TCP Lighting; VONN Lighting; WAC Lighting

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Commercial Lighting Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global commercial lighting market report based on product, installation, distribution channel, application, end use, and region:

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

CFL

-

Fluorescent

-

Halogen

-

HID

-

Incandescent

-

LED

-

-

Installation Outlook (Revenue, USD Billion, 2021 - 2033)

-

New Installations

-

Retrofit

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2021 - 2033)

-

Online

-

Offline

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Indoor Lighting

-

Outdoor Lighting

-

Smart Lighting

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Commercial Offices

-

Retail

-

Hospitality & Leisure

-

Healthcare

-

Educational Institutions

-

Industrial

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global commercial lighting market size was estimated at USD 47.54 billion in 2024 and is expected to reach USD 50.47 billion in 2025.

b. The global commercial lighting market is expected to grow at a compound annual growth rate of 7.8% from 2025 to 2033 to reach USD 92.14 billion by 2033.

b. The LED segment dominated the commercial lighting market in 2024. The growing adoption of lighting-as-a-service (LaaS) models is enabling wider uptake of LED solutions in commercial markets.

b. Some key players operating in the market include Alcon Lighting, Amerlux, LLC, Axis Lighting, WAC Lighting, FES Lighting, Intense Lighting, Kichler Lighting LLC, Litetronics, Lithonia Lighting, Pro Lighting Group Inc., RAB Lighting, SAL Commercial, Signify Holding, TCP Lighting, VONN Lighting, WAC Lighting.

b. Factors such as the growing prevalence of green building certifications, such as LEED, BREEAM, and WELL and the rapid expansion of sectors such as warehousing, logistics, and data centers are the key factors driving the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.