- Home

- »

- Processed & Frozen Foods

- »

-

Consumer Packaged Goods Market, Industry Report, 2033GVR Report cover

![Consumer Packaged Goods Market Size, Share & Trends Report]()

Consumer Packaged Goods Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Personal Care, Home Care), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-763-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Consumer Packaged Goods Market Summary

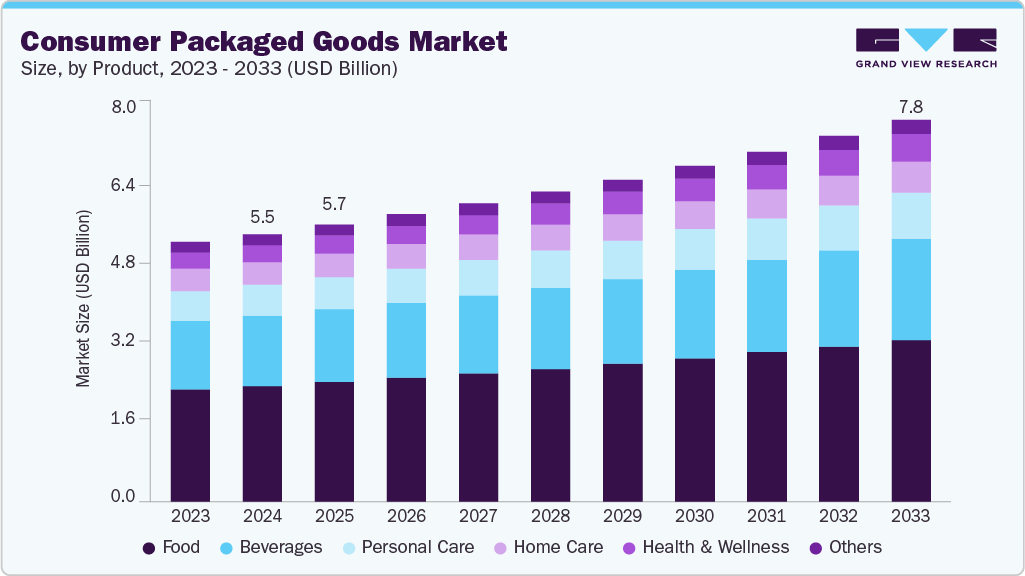

The global consumer packaged goods market size was estimated at USD 5,467.51 billion in 2024 and is projected to reach USD 7,799.43 billion by 2033, at a CAGR of 4.1% from 2025 to 2033. The rising consumer demand, urbanization, and disposable incomes worldwide drive this growth.

Key Market Trends & Insights

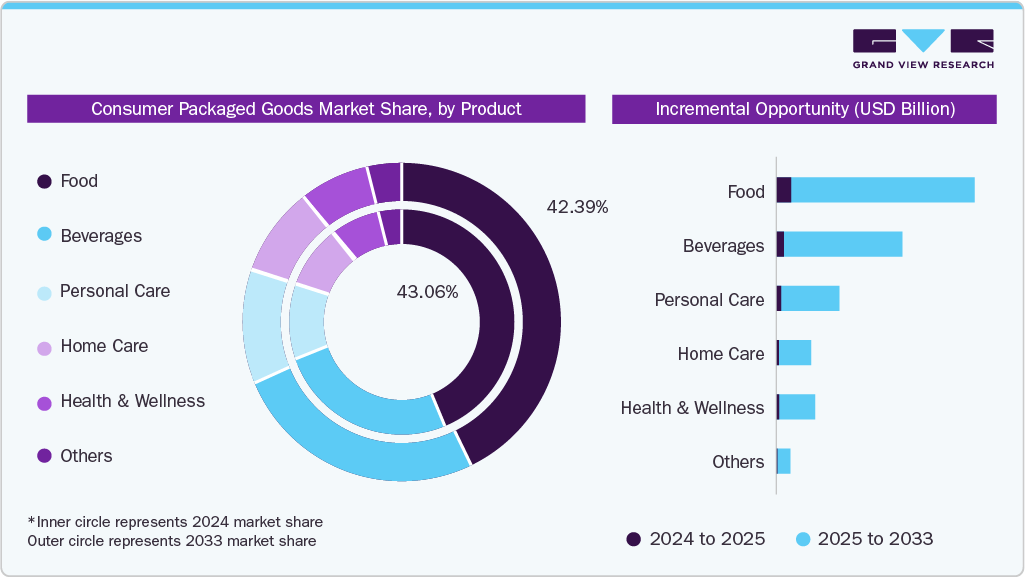

- By product, the food segment led the market with a revenue share of 43.06% in 2024.

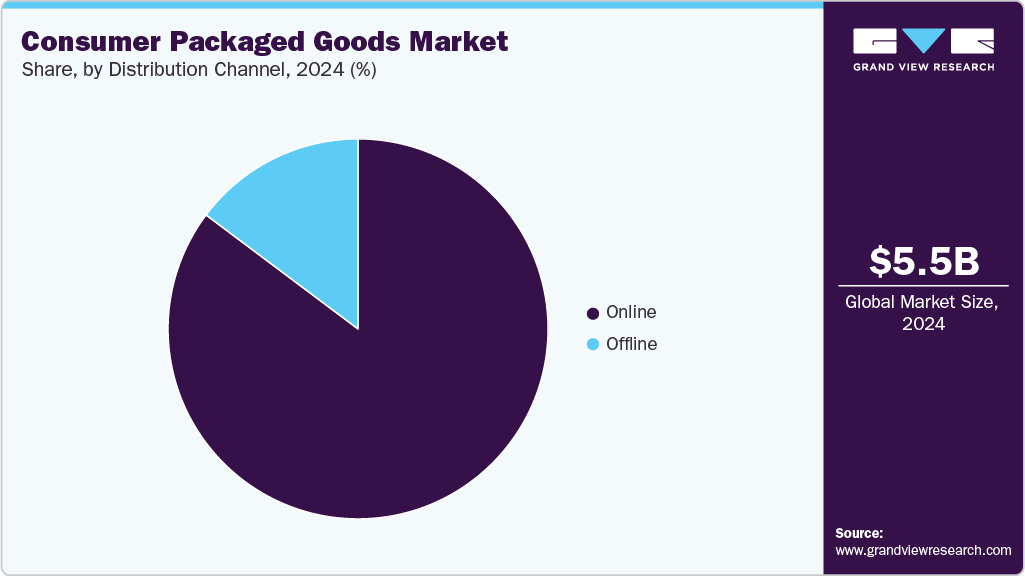

- By distribution channel, the offline sales segment held the highest market share of 85.22% in 2024.

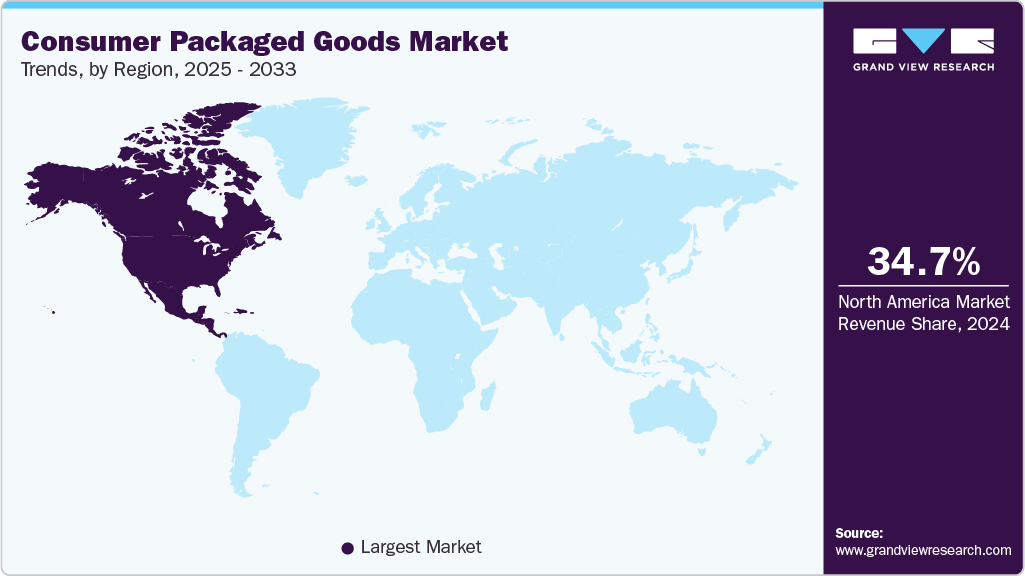

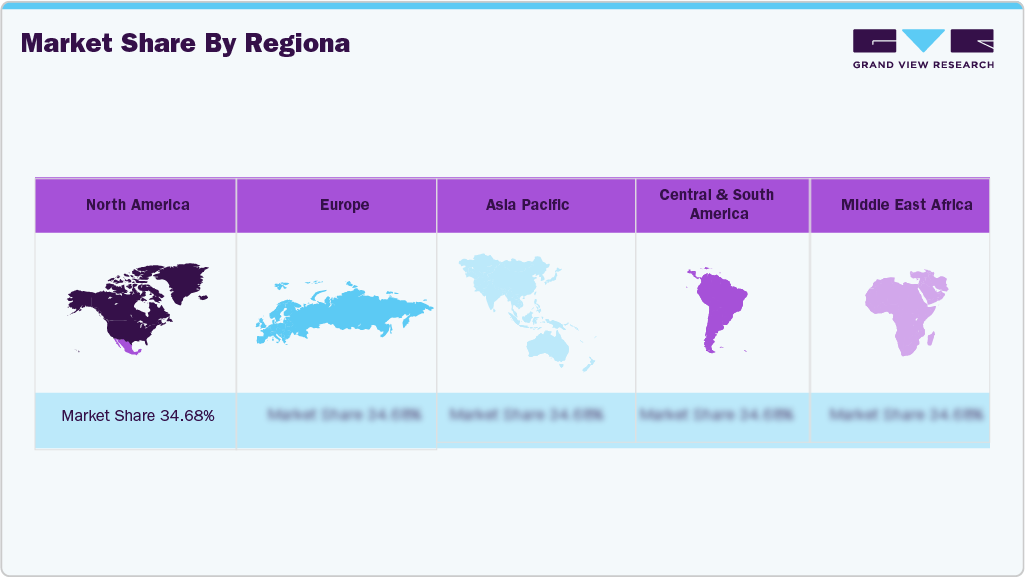

- By region, North America held the largest market share of 34.68% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5,467.51 Billion

- 2033 Projected Market Size: USD 7,799.43 Billion

- CAGR (2025-2033): 4.1%

- North America: Largest market in 2024

One notable trend in the Consumer Packaged Goods (CPG) industry is the growing shift toward health-conscious and sustainable products. Consumers are increasingly seeking items with natural ingredients, low sugar, and eco-friendly packaging. This shift is driven by rising awareness about personal well-being and environmental impact, as well as social media influence and transparency from brands. Companies that adapt by offering organic, plant-based, or recyclable options are seeing stronger engagement and loyalty, making sustainability and health-focused innovation a key driver in shaping the CPG market.

As urbanization accelerates, particularly in emerging markets, more consumers are entering the middle class, leading to increased disposable incomes. For instance, according to an article by The Economic Times, published in September 2025, India's rural areas have recently surpassed urban centers in the consumption of affordable premium FMCG products, accounting for 51% of the volume share in 2025, up from 45% in 2021. This shift indicates a growing aspiration among rural consumers for higher-quality products, fueling demand in the CPG sector.

Another key growth driver for the consumer packaged goods market is the rising awareness of health, wellness, and sustainability. Consumers are increasingly looking for products with natural ingredients, lower sugar or fat content, and eco-friendly packaging. This shift encourages companies to innovate, introducing organic, plant-based, or recyclable options, which helps them capture new customer segments while maintaining loyalty among existing buyers.

Several companies are actively pursuing sustainable packaging initiatives. PepsiCo has announced that by 2025, 98% of its packaging will be recyclable, compostable, biodegradable, or reusable (RCBR). Similarly, Nestlé aims to ensure all of its packaging is recyclable or reusable by 2025, and as of late 2023, approximately 82% of its plastic packaging was already designed to be recyclable.

This trend aligns with broader shifts in consumer behavior, as highlighted by the 2024 Food & Beverage Trends survey from Matter Communications, which found that 44% of respondents are likely to incorporate healthier beverages such as gut-health sodas, sparkling drinks, or enhanced water with electrolytes into their daily routines. When evaluating nutritional attributes, consumers prioritized low sugar (64%), high protein content (58%), and low carbohydrate levels (52%), underscoring the growing importance of health-conscious choices in everyday consumption.

Another key factor shaping the Consumer Packaged Goods (CPG) industry includes the ongoing growth of e-commerce and direct-to-consumer channels, greater investment in digital advertising and marketing technologies, and a rising consumer preference for sustainable and purpose-driven brands. In addition, artificial intelligence (AI) is increasingly transforming the value chain, with leading companies applying it across product development, supply chain optimization, and hyper-personalized marketing, enabling more efficient operations and closer consumer engagement. According to the CPG Industry Outlook 2024, by Infosys Knowledge Institute, spending on generative AI by companies increased from USD 441 million in 2023 to USD 726 million in 2024.

Consumer Insights

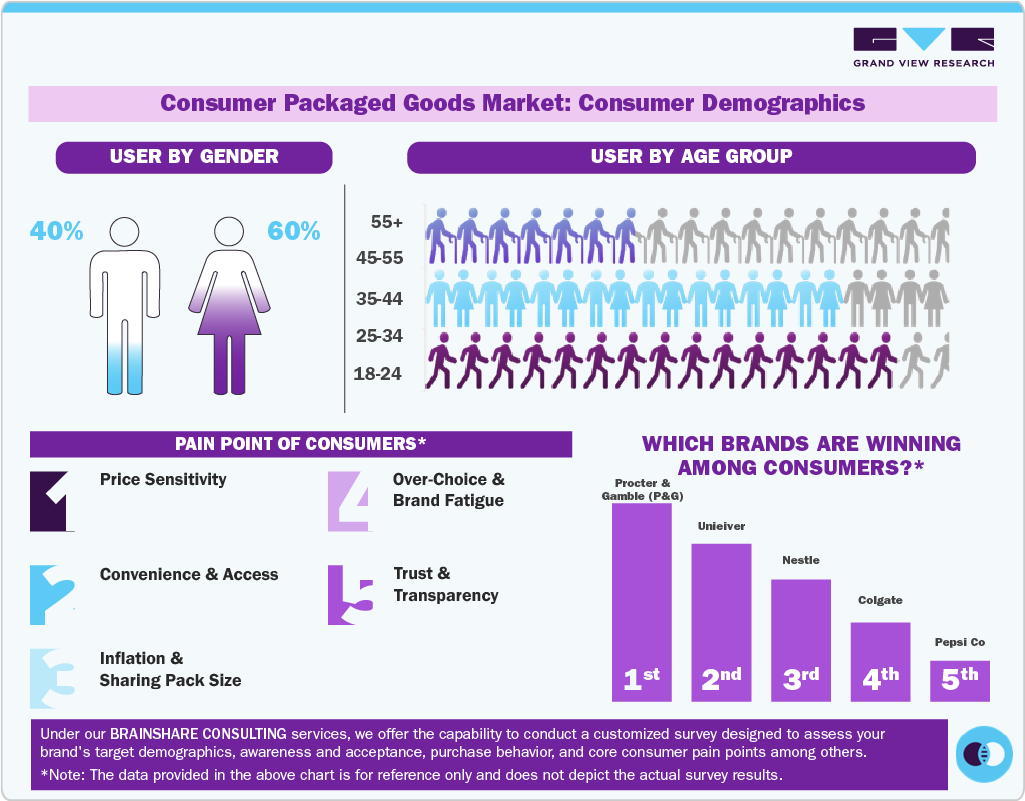

Consumer demographics in the U.S. CPG market are strongly influenced by both gender and age. Women make up around 60% of buyers, reflecting their role as the primary decision-makers for groceries, household items, and personal care. Men, who account for roughly 40%, are becoming more active in areas such as grooming, fitness-focused nutrition, and convenient packaged products. This split helps explain why major CPG companies often focus marketing efforts on women while developing specific lines for men, particularly in grooming, sports nutrition, and supplements.

Age also plays a key role in shaping purchasing behavior. The 18-34 segment leads in trying out online shopping, D2C brands, sustainable packaging, and functional foods, driven by their comfort with digital platforms and openness to new products. Consumers aged 35-54 form the backbone of household spending, buying staples in food, cleaning, and over-the-counter health products while balancing value and occasional premium upgrades. Meanwhile, those 55 and older tend to stick with familiar, trusted brands, especially in categories like oral care, OTC medicines, and nutrition, favoring consistency and reliability. These differences give brands clear cues on positioning: younger shoppers look for novelty and eco-friendly credentials, middle-aged buyers want value without compromising quality, and older consumers prioritize trust and dependability.

Consumers also face several challenges that shape market dynamics. Price pressures and shrinkflation, where pack sizes shrink but prices stay the same, are top frustrations. Convenience issues, such as out-of-stock items or delivery delays, also create friction. With so many product variants available-like multiple types of toothpaste or shampoo-shoppers can feel overwhelmed, increasing the demand for simplified choices and clear guidance. Above all, trust and transparency remain crucial; vague claims like “all natural” or “organic” are often questioned, pushing brands to provide verifiable labels and authentic messaging.

Despite these hurdles, a few global leaders continue to dominate. Procter & Gamble remains strong with household and personal care brands like Tide, Pampers, and Gillette. Unilever leverages products such as Dove, Ben & Jerry’s, and Hellmann’s, with a strong emphasis on sustainability. Nestlé holds a prominent place with coffee, snacks, and pet food staples, while Colgate-Palmolive maintains leadership in oral care. PepsiCo continues to command the snack and beverage space. These companies show that scale, trusted brands, and consistent innovation keep multinational CPG giants at the forefront, even as private labels and D2C challengers make inroads by addressing affordability, transparency, and convenience gaps.

Product Insights

Consumer packaged food accounted for a 43.06% revenue share of the CPG market in 2024, due to its consistent demand and essential role in daily life. Staples like snacks, dairy, and packaged meals are purchased frequently, creating high repeat consumption. Urbanization and busier lifestyles have further increased reliance on ready-to-eat and convenient food options. At the same time, innovation in healthier, fortified, and plant-based products has expanded appeal, while broad retail and e-commerce availability ensures easy access, collectively sustaining its dominant share in the market.

For instance, in August 2025, Fruitist introduced Snack Cups, a convenient, grab-and-go format featuring their premium blueberries, designed to make fresh fruit as effortless and craveable as packaged snacks. These cups cater to the fast-paced lifestyles of today’s consumers, offering a cleaner, more natural alternative to processed snacks.

Consumer packaged goods for health and wellness is anticipated to grow at a considerable CAGR from 2025 to 2033, driven by a combination of lifestyle changes, preventive health priorities, and demographic trends. Consumers are increasingly investing in supplements, functional foods, and fitness solutions to maintain long-term well-being. According to a survey cited by GFY Creative LLC, 78% of global consumers have purchased sports or wellness products in the past two years, with the same share intending to maintain or increase spending through 2025. Combining this with willingness to pay more for sustainability (~10%) and proven results (85%), roughly 70% of wellness shoppers are open to premium offerings across categories.

Distribution Channel Insights

Sales of consumer packaged goods through offline channels held a market share of 85.22%, as they remain the primary mode of purchase for most consumers, offering convenience, product inspection, and instant availability. Supermarkets, hypermarkets, and local grocery stores allow shoppers to see, touch, and compare products before buying, which is particularly important for perishable goods, personal care items, and household products. Additionally, promotional offers, in-store displays, and trusted retail relationships encourage repeat purchases.

Consumer Packaged Goods Market Share, by Distribution Channel, 2024 (%)

Sale of consumer packaged goods (CPG) through online channels is expected to grow at a CAGR of 5.9% from 2025 to 2033, as consumers increasingly value convenience, variety, and time savings. Busy lifestyles, urban living, and wider internet and smartphone access are encouraging shoppers to buy groceries, personal care items, and household goods online rather than visit stores. Promotions, subscription services, and doorstep delivery make online shopping attractive, while the pandemic accelerated comfort with digital purchases.

Regional Insights

The North America consumer packaged goods market accounted for a global revenue share of 34.68% in 2024. This can be attributed to strong consumer purchasing power, well-developed retail networks, and high brand penetration. Regular consumption of packaged foods, beverages, and personal care items, along with a preference for convenience and premium products, supports steady demand. Extensive supermarket, hypermarket, and e-commerce coverage ensures easy product availability, while marketing campaigns, promotions, and loyalty programs strengthen brand loyalty. According to a 2024 article by Baking Business, North America (including the U.S.) accounts for 29% of CPG product launches as genuinely new items.

U.S. Consumer Packaged Goods Market

The U.S. consumer packaged goods industry is anticipated to witness a CAGR of 3.5% from 2025 to 2033, due to steady consumer demand for everyday essentials like packaged foods, beverages, and personal care products. Growth is supported by rising interest in healthier and functional products, such as plant-based foods, fortified beverages, and clean-label personal care items.

Asia Pacific Consumer Packaged Goods Market Trends

The Asia Pacific CPG industry is projected to grow at a CAGR of 4.8% from 2025 to 2033. This growth can be primarily attributed to urban consumers in China, India, and Southeast Asia increasingly shifting from informal local markets to modern retail and e-commerce platforms. Rising middle-class incomes are driving demand for packaged foods, ready-to-drink beverages, and personal care products, while younger consumers favor convenience, premium options, and international brands. At the same time, companies are launching region-specific products, such as fortified noodles in India or functional teas in China, to meet local tastes, making growth more grounded in actual market behavior rather than generic trends.

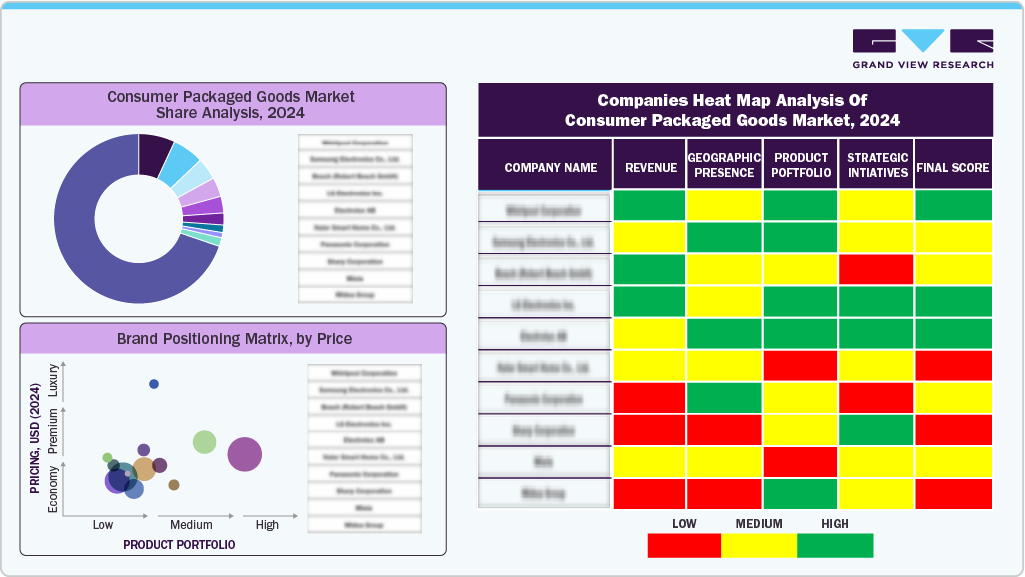

Key Consumer Packaged Goods Company Insights

The CPG market is dominated by a mix of global giants and strong regional players, with companies like Procter & Gamble, Unilever, Nestlé, PepsiCo, and Coca-Cola leading in terms of revenue and brand recognition. These companies leverage extensive product portfolios across food, beverages, personal care, and household segments, allowing them to capture significant market share while catering to diverse consumer preferences across regions. Brand loyalty, consistent quality, and frequent product innovation remain central to maintaining their competitive edge.

Market share dynamics are also shaped by the rise of niche and local brands, which are gaining traction through specialized offerings such as organic foods, plant-based products, clean-label personal care, and eco-friendly household items. These smaller players often appeal to younger and more health- or sustainability-conscious consumers, forcing established brands to adapt with targeted innovations, promotional campaigns, and localized product launches to retain market relevance.

Key Consumer Packaged Goods Companies:

The following are the leading companies in the CPG market. These companies collectively hold the largest market share and dictate industry trends.

- Procter & Gamble

- Unilever

- Nestlé

- PepsiCo

- The Coca-Cola Company

- Mondelez International

- Johnson & Johnson

- Colgate-Palmolive

- Kimberly-Clark

- Kraft Heinz

Recent Developments

-

In July 2025, Procter & Gamble (P&G) launched Gemz at Target, offering water-activated, single-dose hair care “gems” in five shampoos and five conditioners. These compact, travel-friendly, and TSA-approved products provide concentrated ingredients while cutting plastic waste, tapping into the trend for sustainable and convenient personal care CPG products.

-

In April 2025, Dove, a brand under Unilever, teamed up with Crumbl Cookies to launch a limited-edition body care line with cookie-inspired scents at Walmart. Leveraging TikTok and Instagram, the campaign generated 3.2 billion impressions and sold out quickly, showcasing Dove’s innovation and appeal to a younger, social-first audience. This collaboration highlights Dove’s focus on innovation, social media-driven engagement, and its ability to adapt to evolving consumer preferences in the competitive personal care CPG market.

-

In May 2025, Clean Cult launched its refillable cleaning system nationwide at Target, offering 17 sustainable products-including hand soap, dish soap, laundry detergent, and all-purpose cleaner-in paper-based cartons and aluminum bottles. Backed by a USD 5 million Series B extension from existing investors and celebrities like Zac Efron and Kevin Hart, the rollout in 1,800 stores and online aims to expand eco-friendly, low-waste home care solutions.

-

In August 2025, Bloom Nutrition launched Crisp Apple Sparkling Energy at Target for a limited time. It combines fresh apple flavor with 180mg of caffeine from green coffee bean extract, L-theanine, ginseng, and prebiotics for gut health. With 0g sugar and no artificial flavors, it targets consumers seeking energy and wellness benefits.

Consumer Packaged Goods Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5,664.34 billion

Revenue forecast in 2033

USD 7,799.43 billion

Growth rate

CAGR of 4.1% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Procter & Gamble; Unilever; Nestlé; PepsiCo; The Coca-Cola Company; Mondelez International; Johnson & Johnson; Colgate-Palmolive; Kimberly-Clark; Kraft Heinz

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Consumer Packaged Goods Market Report Segmentation

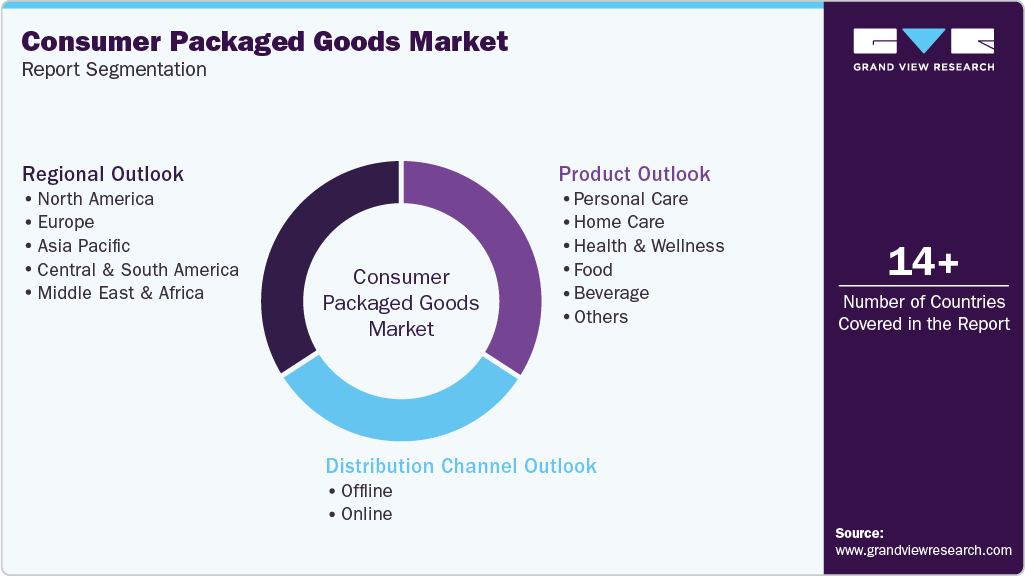

This report forecasts revenue growth at the global, regional, and country levels and analyzes the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global consumer packaged goods market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Personal Care

-

Skincare

-

Haircare

-

Cosmetics & Beauty

-

Oral Care and Personal Hygiene

-

-

Home Care

-

Laundry

-

Surface Cleaning

-

Dish Care

-

Air Care

-

-

Health & Wellness

-

OTC Medicines

-

Vitamins & Supplements

-

Functional Nutrition

-

-

Food

-

Staples & Pantry

-

Snacks & Confectionery

-

Bakery & Breakfast

-

Frozen & Convenience Foods

-

Dairy & Alternatives

-

Meat, Poultry & Seafood

-

-

Beverage

-

Non-alcoholic

-

Bottled Water

-

Soft Drinks & Juices

-

Others

-

-

Alcoholic

-

-

Others

-

-

Distribution Channel (Revenue, USD Billion, 2021 - 2033)

-

Offline

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Specialty Stores

-

Traditional Trade

-

-

Online

-

E-Commerce Platforms

-

D2C / Brand-Owned Websites

-

Social Commerce

-

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global consumer packaged goods market size was estimated at USD 5,467.51 billion in 2024 and is expected to reach USD 5,664.34 billion in 2025.

b. The global consumer packaged goods market is expected to grow at a compound annual growth rate (CAGR) of 4.1% from 2025 to 2033 to reach USD 7,799.43 billion by 2033.

b. Consumer packaged food accounted for 43.06% of the market in 2024, due to its consistent demand and essential role in daily life. Staples like snacks, dairy, and packaged meals are purchased frequently, creating high repeat consumption.

b. Some key players in the consumer packaged goods market include Procter & Gamble, Unilever, Nestlé, PepsiCo, The Coca-Cola Company, Mondelez International, Johnson & Johnson, Colgate-Palmolive, Kimberly-Clark, and Kraft Heinz.

b. The global consumer packaged goods (CPG) market’s growth is fueled by consumer demand, urbanization, and increasing disposable incomes worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.