- Home

- »

- Homecare & Decor

- »

-

Contract Furniture Market Size, Share, Industry Report, 2033GVR Report cover

![Contract Furniture Market Size, Share & Trends Report]()

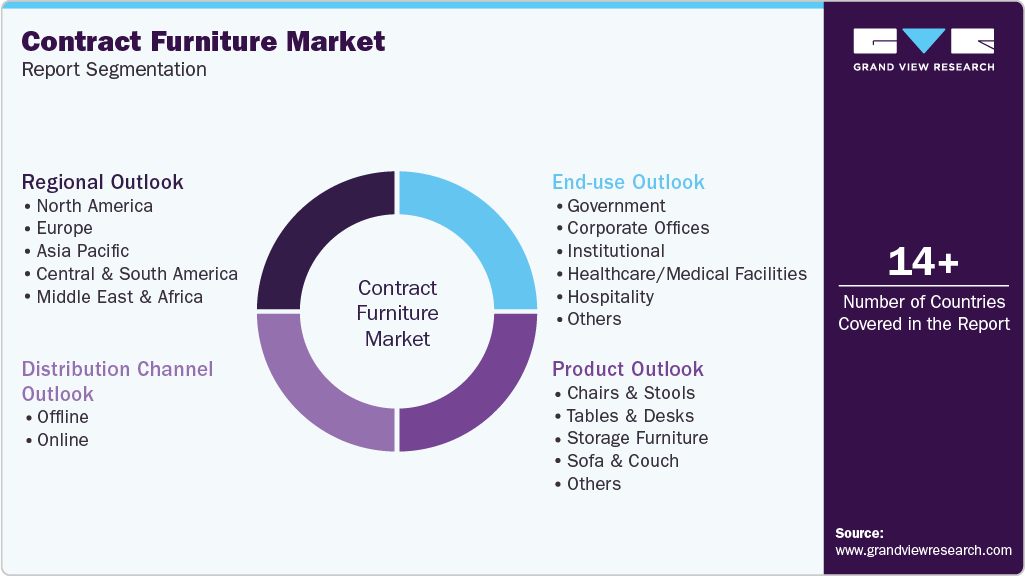

Contract Furniture Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Chairs & Stools, Tables & Desks, Storage Furniture, Sofa & Couch), By End-use, By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-025-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Contract Furniture Market Summary

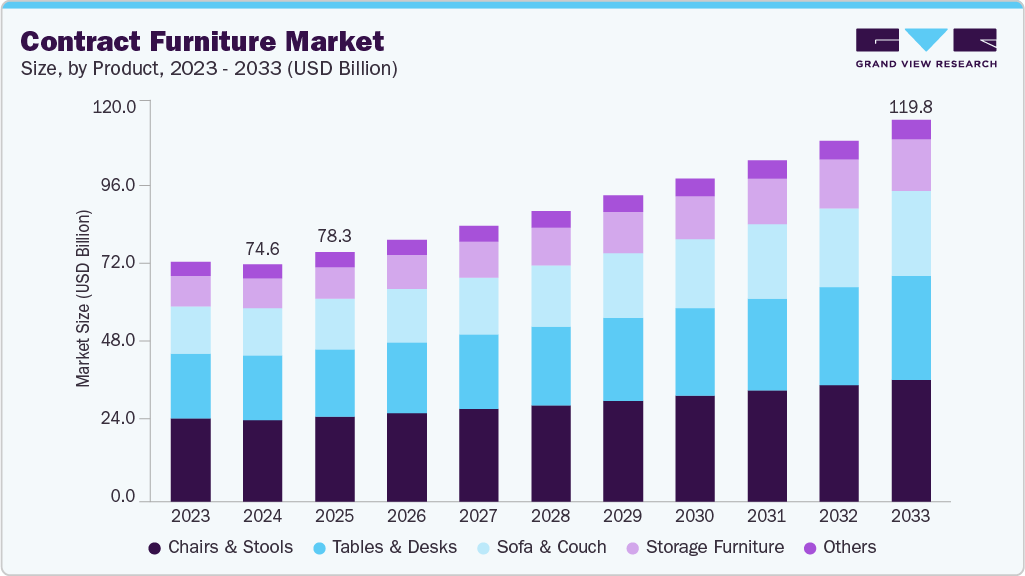

The global contract furniture market size was estimated at USD 74.55 billion in 2024 and is projected to reach USD 119.75 billion by 2033, growing at a CAGR of 5.5% from 2025 to 2033. The growth of the market is primarily attributed to factors such as increasing disposable incomes, growth of hospitality and housing sectors, developments in the commercial construction industry, and the growing demand for premium and luxury furniture globally.

Key Market Trends & Insights

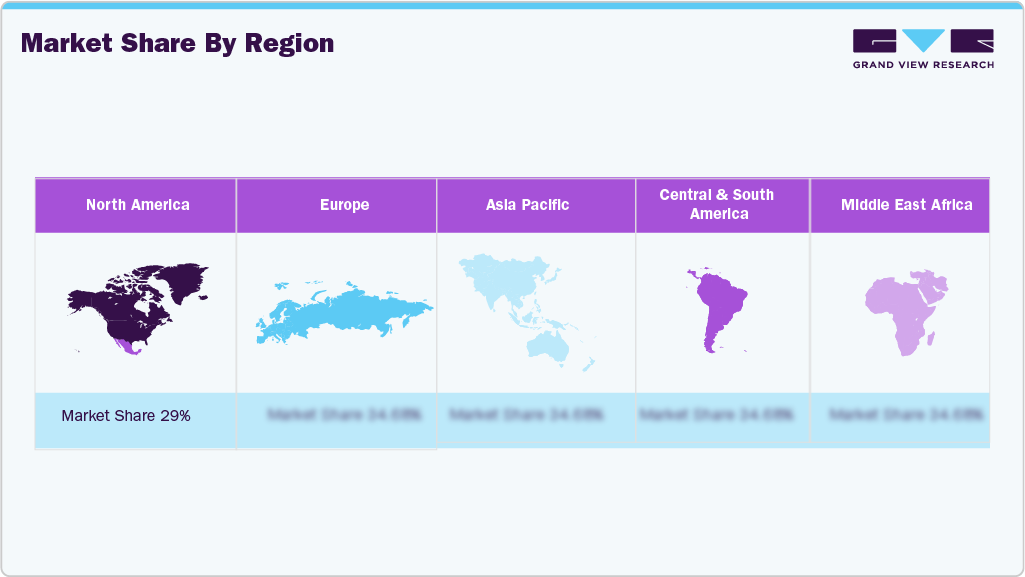

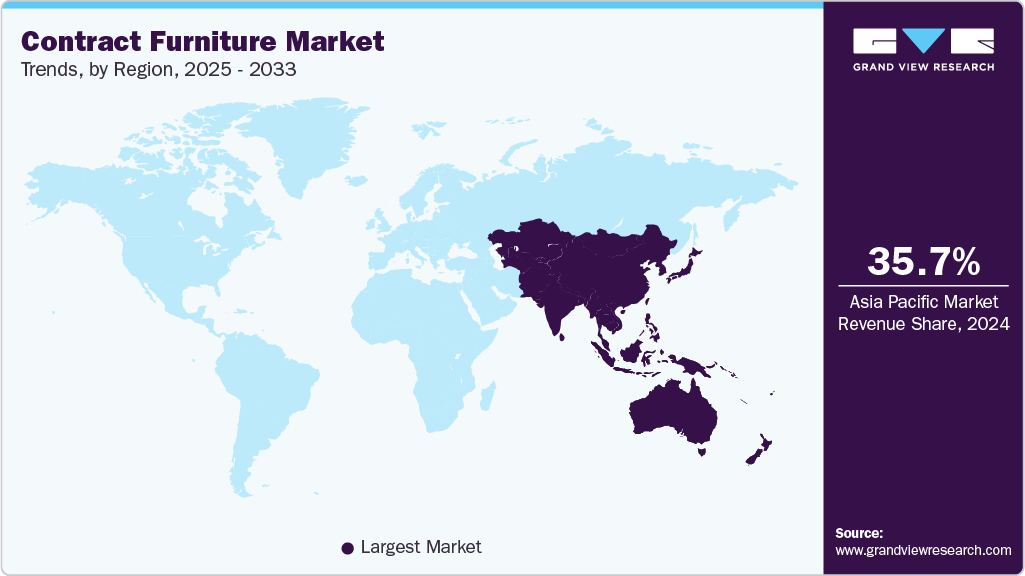

- By region, Asia Pacific led the global market with a share of 35.7% in 2024.

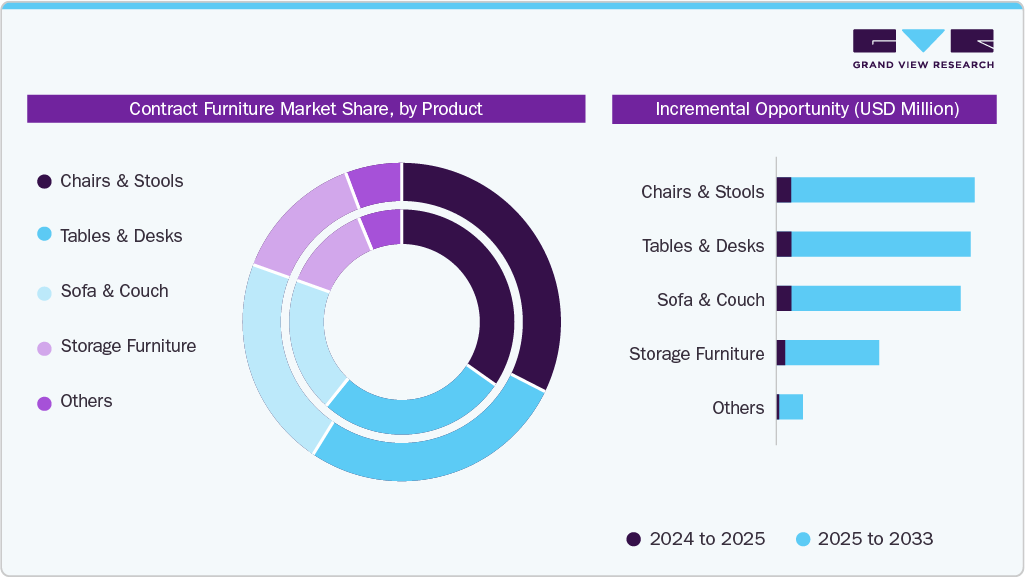

- By product, the chairs & stools led the market and accounted for a share of 34.4% in 2024.

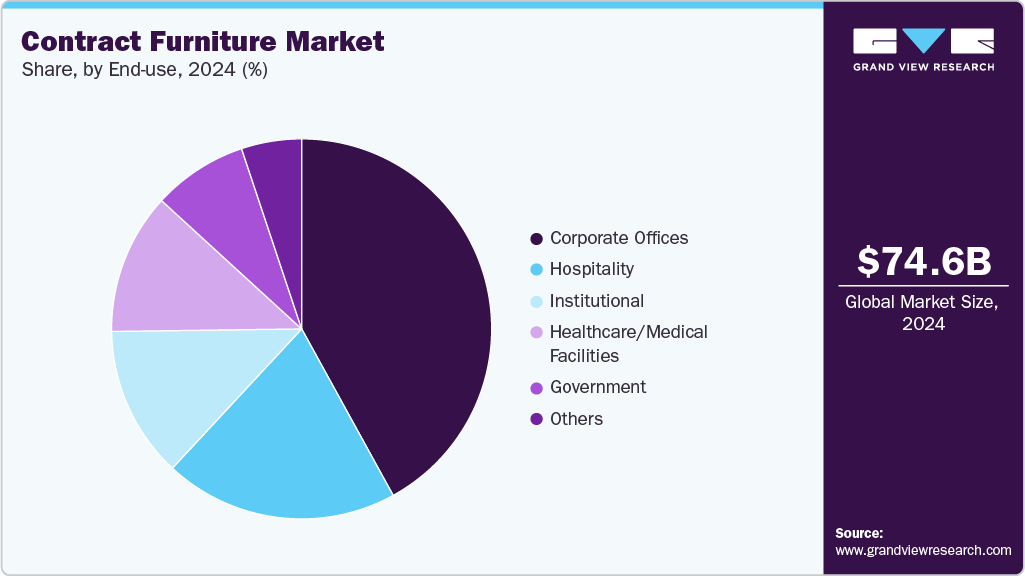

- By end use, the corporate offices led the market and accounted for a share of 42.0% in 2024.

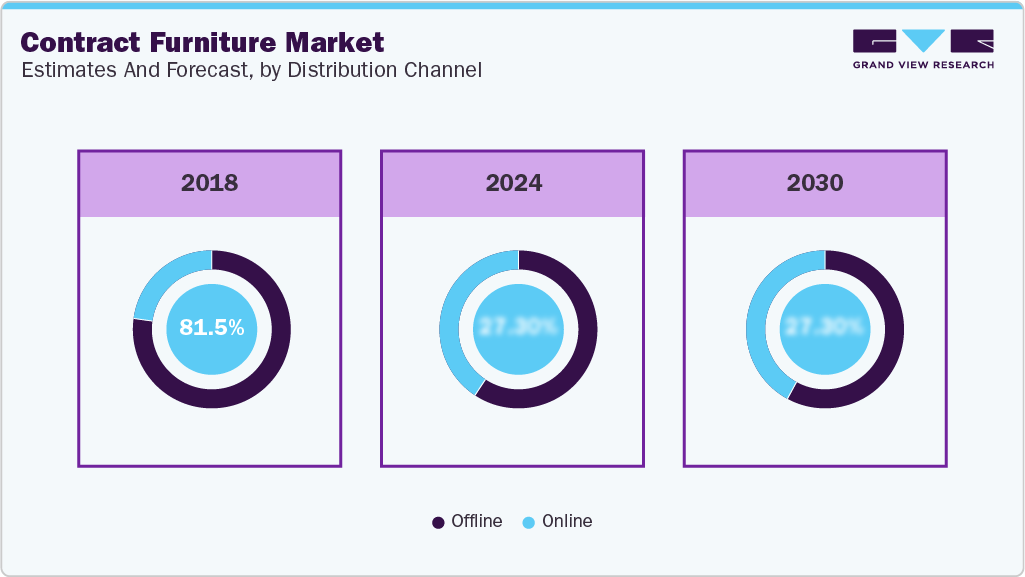

- By distribution channel, the offline segment led the market and accounted for a share of 76.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 74.55 Billion

- 2033 Projected Market Size: USD 119.75 Billion

- CAGR (2025-2033): 5.5%

- Asia Pacific: Largest market in 2024

Moreover, the increasing capital investments in office infrastructure, primarily driven by the development of Information Technology (IT) hubs in various countries, are expected to prompt the need for office furniture during the forecast period.According to the Economic Impact Study commissioned by the Building Owners and Managers Association International (BOMA), the establishment of business offices in the U.S. is increasing. Moreover, government initiatives focusing on the development of the real estate industry will consequently drive the demand for furniture. According to Saudi Arabia’s National Transformation Plan, the country will build more than 555,000 residential units, more than 275,000 hotel keys, over 4.3 million sq m of retail space, and over 6.1 million sq m of new office space by 2030.

As technology continues to evolve, it has enabled furniture manufacturers to design and produce innovative products that cater to the changing needs of modern workplaces. For example, the integration of smart technologies in furniture, such as adjustable desks with built-in charging stations and sensors for monitoring usage, has become increasingly popular. In addition, advancements in materials science and manufacturing processes have enabled the creation of more durable, sustainable, and aesthetically pleasing furniture designs.

In addition, the growing emphasis on sustainability and green building practices is creating substantial opportunities in the global contract furniture industry. Corporate buyers and real estate developers are increasingly prioritizing products that align with environmental, social, and governance (ESG) objectives and green certification standards such as LEED, BREEAM, and WELL Building. Manufacturers offering FSC-certified wood, recycled materials, and low-emission finishes are gaining a competitive edge in tenders for commercial, hospitality, and institutional projects.

Parallel to this, the rising focus on circular design and product longevity is reshaping the contract furniture value proposition. The transition toward a circular economy emphasizes repairable, modular, and take-back-ready products, enabling manufacturers to offer furniture-as-a-service (FaaS) or refurbishment programs. European design leaders such as Herman Miller, Steelcase, and Teknion have introduced circular design frameworks that extend product lifecycles while reducing waste, in line with the Ellen MacArthur Foundation’s circular business model principles (2024). This evolution positions contract furniture not just as a capital expenditure, but as a service-driven investment aligned with corporate sustainability goals.

Buyer Insights

The expansion of the global hospitality sector serves as a major growth catalyst for the market for contract furniture, as the continuous development of hotels, restaurants, resorts, and mixed-use hospitality spaces necessitates large-scale interior and exterior furnishing solutions. Modern hospitality projects increasingly focus on delivering immersive guest experiences through design-rich interiors that balance aesthetics, functionality, and comfort. This shift has accelerated demand for high-quality contract furniture, including guestroom case goods, lobby seating, dining tables and chairs, modular sofas, and workspace furnishings that align with brand identity and performance standards.

In addition, the recovery in the global tourism sector is further fueling investments in the construction and renovation of resorts, hotels, restaurants, and recreational facilities, thereby generating consistent demand for contract furniture. For instance, global international tourist arrivals reached 1.4 billion in 2024, an approximate 11% increase over 2023, underlining the rebound of resort and hospitality infrastructure worldwide. As tourism operators and property developers compete to attract and retain guests, they are investing in modern, design-driven contract furniture solutions for guestrooms, lobbies, restaurants, lounges, and meeting areas that enhance both comfort and brand identity. This growing emphasis on aesthetic cohesion, durability, and functionality across hospitality spaces continues to strengthen the global demand for contract furniture.

As organizations increasingly embrace hybrid working models and flexible workspace concepts, the demand for furniture that supports multiple postures, movement, and workflow modes has surged. Modern office design now emphasizes ergonomics, wellness, and adaptability factors, which are pivotal in commercial-grade furniture procurement. According to trend analyses, ergonomic seating and sit-stand desks are central features of workspace design in 2025.

For the market for contract furniture, this translates into strong growth potential in products designed with ergonomic adjustability (for example, sit-stand desks, height-adjustable tables, multi-adjustable chairs) and flexible layout systems (modular workstations, reconfigurable lounge furniture, mobile partitions) that enable rapid transitions between individual focus work, collaboration, and team-based modes.

Contract furniture suppliers are likely to experience a corresponding surge in demand as businesses seek to create dynamic and engaging workspaces to support their growing operations. As stated in a December 2023 news article, ‘Commercial Realty's Strong Performance In 2023 Sets The Pathway For Prosperity In 2024’, published on financialexpress.com, the office space leasing activity experienced strong demand and growth, with a notable 33% increase in gross office space leasing across the top 9 metro cities in India during Q3 2023.

Product Insights

Chairs & Stools held the largest revenue share in the market of 34.4% in 2024. Contract furniture manufacturers have been thoughtfully creating multipurpose and ergonomic seating options that increase comfort during long workdays, maximize space, and encourage effective employee collaboration to boost productivity. Office interior layouts have changed considerably in recent years, driving the demand for appropriate seating furniture, like chairs and stools.

Sofa & couch are anticipated to witness a CAGR of 6.8% from 2025 to 2033. Sofas are designed to provide comfortable seating for employees, clients, patients, students, and visitors in a more relaxed and informal setting. Sofas are typically larger and more cushioned than traditional chairs, letting individuals sit or recline comfortably and casually. Sofas ought to enhance the overall feel and appearance of a professional space, encouraging a more pleasant and collaborative work environment. In corporate offices, hotels, and other places, the sofas/couches often feature upholstered cushions. They are available in a variety of styles and patterns to match the general aesthetic of the workplace environment.

Distribution Channel Insights

Sales of contract furniture through offline channels held the largest share, accounting for around 76.9% in 2024. The sales of contract furniture through offline sales channels include direct sales, distributors/wholesalers, and contractors. Several businesses prefer direct sales for purchasing contract furniture, as these allow for direct communication and negotiation with the manufacturer or supplier, ensuring a clear understanding of product specifications, customization options, and pricing.

Sales of contract furniture through online are anticipated to witness a CAGR of 6.3% from 2025 to 2033. Businesses have increasingly turned to online platforms to source contract furniture for B2B due to convenience, wider product selection, and reduced physical interactions. E-commerce offers a streamlined procurement process, enables remote browsing and purchasing, and provides opportunities for cost savings.

Market players in the B2B office furniture industry have responded to the e-commerce and digitalization shift by embracing online platforms, enhancing customer experience through customization and visualization tools, improving supply chain integration, and offering value-added services. This adaptability and focus on digital solutions have allowed them to meet the evolving needs of businesses and thrive in the increasingly digital landscape.

End-use Insights

Contract furniture used in corporate offices held the largest revenue share of 42.0% in 2024. Corporate offices of all sizes employ commercial office furniture for their workspaces, encompassing essential items such as desks, chairs, conference tables, filing cabinets, reception furniture, and ergonomic office accessories. According to Organisation for Economic Co‑operation and Development (OECD) data, the average annual hours actually worked per worker in the United States in 2023 was 1,799 hours. Whether working in a traditional office setting or remotely, people spend most of their time sitting, which can add immense stress to the spine.

Contract furniture used in hospitality is anticipated to witness a CAGR of 7.0% from 2025 to 2033. In the hospitality industry, contract furniture is used in various settings, including hotel rooms, lobbies, outdoor areas, restaurants, lounges, and conference rooms. This includes a variety of items such as table tops, beds, sofas, dining tables, chair units, and lounge chairs. Hotel furniture serves as a global and aesthetically significant aspect of hotels, setting high-end establishments apart from others to a considerable degree due to its customization and design standards.

The selection of materials and finishes is crucial in shaping the overall aesthetic of furniture. Using premium materials such as solid wood, leather, and steel can impart a luxurious and long-lasting appearance. Furthermore, finishes like lacquer, veneer, and high gloss can enhance the visual appeal of the furniture. These materials and finishes not only enhance the aesthetic appeal of the hotel but also determine the durability and maintenance needs of the furniture.

Regional Insights

The North American contract furniture industry accounted for a share of around 28.5% in 2024. The healthcare sector in North America is undergoing expansion and renovation to meet the needs of the aging population and evolving healthcare delivery models. As new hospitals, clinics, and medical offices are built or renovated, there is a demand for specialized healthcare furniture designed to enhance patient comfort, facilitate care delivery, and comply with regulatory standards, driving the growth of the market.

The new healthcare furniture line provided by GSA Global Supply in its 2024/2025 Supply Catalog is certified by Greenguard and ANSI-BIFMA Level certified, aligning with sustainability standards outlined in Executive Order 13693, Planning for Federal Sustainability.

U.S. Contract Furniture Market Trends

The U.S. contract furniture industry demand is rising as buyers increasingly seek localized insights to guide procurement, facility planning, and post-pandemic workspace investments. Regional variations in construction pipelines, commercial real estate activity, hybrid-work adoption, and public-sector spending are driving distinct demand patterns across the Northeast, Midwest, South, and West.

Europe Contract Furniture Market Trends

The contract furniture industry in Europe is expected to grow at a CAGR of 5.0% from 2025 to 2033. Schools and other educational institutions are in a constant state of evolution, blending interior design trends with ergonomic considerations and elements that enhance creativity and learning. In Europe, there is a growing inclination for flexible classrooms and furniture that encourages movement among children, thereby improving their potential for effective learning and collaboration.

There is a rising demand for furniture that accommodates individual learning processes, recognizing that some students may prefer reading on a soft sofa or rug rather than a traditional wooden chair, while others may benefit from sitting in different types of chairs or require specific seating arrangements.

Asia Pacific Contract Furniture Market Trends

The Asia Pacific contract furniture industry accounted for a share of around 35.7% in 2024. The Asia Pacific market for contract furniture is experiencing growth due to factors such as rapid urbanization, increasing commercial construction activities, and rising demand for high-quality furnishings in commercial spaces. Several companies are poised to capitalize on these opportunities. For instance, Warisan (Indonesia) is a globally recognized leader in high-end custom design furniture manufacturing for full-scope contract boutique hotel projects as well as home refurbishments. Its products are mainly represented in 5-star hotels and resorts globally.

Warisan sources raw materials such as hardwood and plywood from Indonesian plantations. The materials are FSC-certified. The company has also obtained the Sistem Verifikasi Legalitas Kayu (SVLK) certification, ensuring every stage of harvesting, transportation, processing, and sale of timber products originates from forests and plantations managed sustainably. This highlights a growing preference for eco-friendly contract furniture in the region.

Central & South America Contract Furniture Market Trends

The Central & South America contract furniture industry is expected to grow at a CAGR of 5.4% from 2025 to 2033. In Central & South America, there is an emerging trend where consumers are increasingly prioritizing renovations, resulting in higher spending on furniture. Unlike the traditional view of furniture and interiors as long-term investments, there is now a prevalent inclination to replace these items every few years. This shifting consumer behavior is anticipated to drive the growth of the market in the region.

Middle East & Africa Contract Furniture Market Trends

The contract furniture industry in the Middle East and Africa is expected to grow at a CAGR of 5.9% from 2025 to 2033. Key trends in the Middle East & Africa market include a growing demand for sustainable and eco-friendly products and an increasing focus on innovative and customizable designs to cater to diverse customer preferences.

Developments in Dubai's commercial real estate sector are driving the growth of the contract furniture industry. As new commercial buildings are constructed to meet the booming demand for office spaces in sought-after areas like Dubai Hills, there is an increasing need for high-quality and innovative furniture solutions to furnish these spaces.

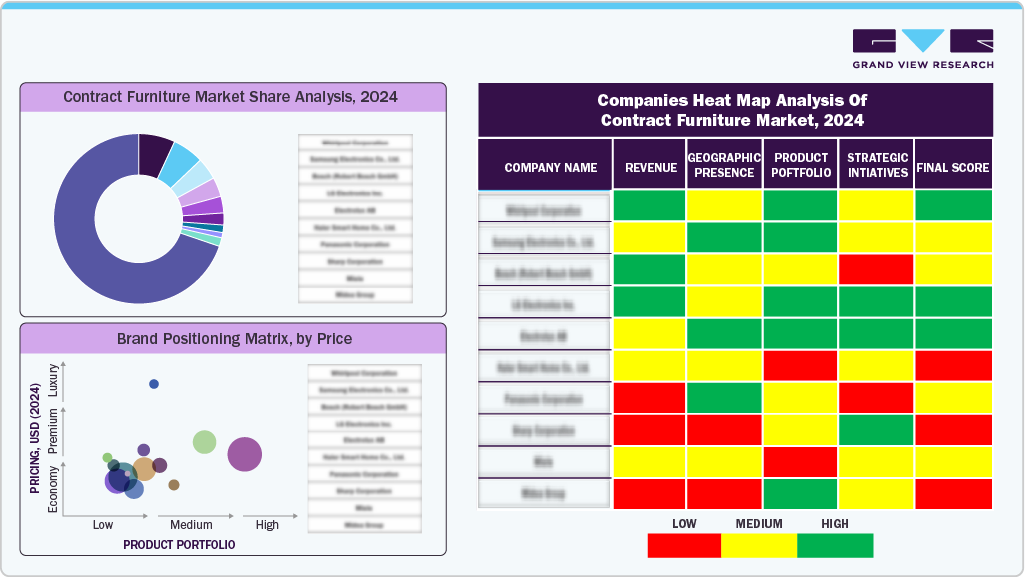

Key Contract Furniture Company Insights

Leading players in the contract furniture industry include MillerKnoll, Inc., Steelcase Inc., Haworth Inc., HNI Corporation, KI, Teknion, and others.

The market for contract furniture is highly competitive, with companies striving to strengthen their presence across both online and offline distribution channels. Leading brands are investing heavily in design innovation, modular functionality, and material advancements to cater to the evolving needs of commercial, hospitality, and institutional spaces. The growing emphasis on ergonomics, sustainability, and flexible workspace solutions is driving faster adoption, particularly in corporate and co-working environments. In addition, the rising demand for eco-friendly, durable, and customizable furniture, driven by environmental regulations and green-building standards, is shaping long-term growth opportunities for the sector.

Key Contract Furniture Companies:

The following are the leading companies in the contract furniture market. These companies collectively hold the largest market share and dictate industry trends.

- MillerKnoll, Inc.

- Steelcase Inc.

- Haworth Inc.

- HNI Corporation

- KI

- Teknion

- Global Furniture Group

- Kinnarps Group

- Sedus Stoll AG

- Martela

Recent Developments

-

In August 2025, One Bangkok teamed up with premium furniture retailer CHANINTR Living to launch Twenty & Above, the country’s first full office-furniture rental service. The service offers businesses a subscription-type model (starting at approximately USD 8 per square meter) that covers premium brands (such as Herman Miller and Knoll), as well as installation, maintenance, and replacement. It also emphasizes sustainability by refurbishing and re-deploying furniture.

-

In July 2025, Portica launched a new standalone label aimed specifically at the hospitality contract furniture industry, differentiating it from its previous SunVilla line. The new label features commercial-grade outdoor furniture, including sofas, lounge chairs, dining tables, chaise lounges, and fire tables, designed for both durability and aesthetic appeal in luxury residential and hospitality settings.

-

In October 2024, Visplay launched Omnio Office, a modular office-furniture system designed to support flexible, “agile” work environments by combining static units with mobile modules to enable rapid reconfiguration of workspace layouts. The system includes integrated power and data routing (including USB-C slots and optional 24 V electrification), acoustic panels made of recycled plastic, and plant-box modules, reflecting a focus on sustainability, adaptability, and long-term durability.

Contract Furniture Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 78.26 billion

Revenue Forecast in 2033

USD 119.75 billion

Growth rate

CAGR of 5.5% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

MillerKnoll, Inc.; Steelcase Inc.; Haworth Inc.; HNI Corporation; KI; Teknion; Global Furniture Group; Kinnarps Group; Sedus Stoll AG; Martela

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Contract Furniture Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends and opportunities in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global contract furniture market report by product, end-use, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Chairs & Stools

-

Tables & Desks

-

Storage Furniture

-

Sofa & Couch

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Government

-

Corporate Offices

-

Institutional

-

Healthcare/Medical Facilities

-

Hospitality

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the contract furniture market growth include the increasing demand for commercial furniture, the increasing housing & commercial construction, and rising demand for premium and luxury furniture.

b. The global contract furniture market was estimated at USD 74.55 billion in 2024 and is expected to reach USD 78.26 billion in 2025.

b. The global contract furniture market is expected to grow at a compound annual growth rate of 5.5% from 2025 to 2033 to reach USD 119.75 billion by 2033.

b. Chairs & Stools held the largest share in the contract furniture market, accounting for a share of 34.4% in 2024. Contract furniture manufacturers have been thoughtfully creating multipurpose and ergonomic seating options that increase comfort during long workdays, maximize space, and encourage effective employee collaboration to boost productivity.

b. Some key players operating in the contract furniture market include MillerKnoll, Inc., Steelcase Inc., Haworth Inc., HNI Corporation, KI, Teknion, Global Furniture Group, Kinnarps Group, and others

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.