- Home

- »

- Consumer F&B

- »

-

Convenience Stores Market Size & Analysis Report, 2028GVR Report cover

![Convenience Stores Market Size, Share & Trends Report]()

Convenience Stores Market (2022 - 2028) Size, Share & Trends Analysis Report By Type (Cigarettes & Tobacco, Foodservice, Packaged Beverages, Center Store, Low Alcoholic Beverages), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-929-0

- Number of Report Pages: 84

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2028

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Convenience Stores Market Summary

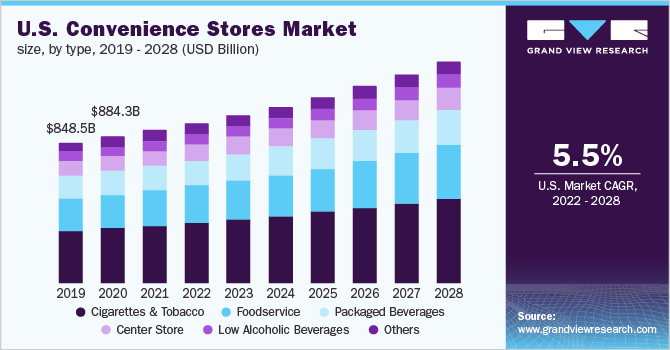

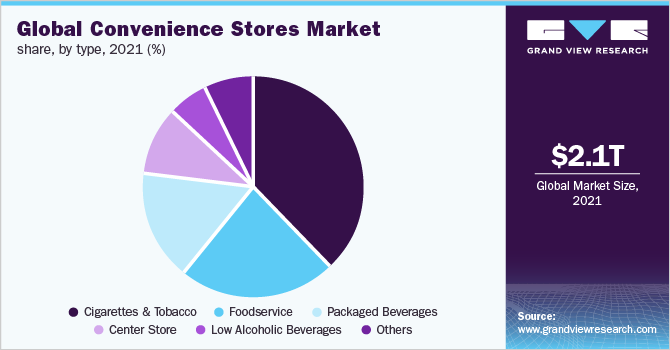

The global convenience stores market size was estimated at USD 2.12 trillion in 2021 and is projected to reach USD 3.12 trillion by 2028, growing at a CAGR of 5.6% from 2022 to 2028. Strong economic growth in emerging markets, increased population density in urban areas, expanding investments in the retail business in developing nations, and rising popularity of the franchising idea all contributed to the growth of the market.

Key Market Trends & Insights

- North America accounted for the largest market revenue share of over 47% in 2021.

- Asia Pacific is forecast to register the highest CAGR of 6.4% from 2022 to 2028.

- By type, the cigarettes & tobacco segment dominated the market and contributed a revenue share of around 39% in 2021.

Market Size & Forecast

- 2021 Market Size: USD 2.12 Trillion

- 2028 Projected Market Size: USD 3.12 Trillion

- CAGR (2022-2028): 5.6%

- North America: Largest market in 2021

- Asia Pacific: Fastest growing market

Convenience stores are gaining popularity as these stores contain each and every necessary item, benefitting customers to get the required items whenever needed in an emergency. Moreover, the market is surging due to long opening hours that provides customers with quick purchasing option of the necessary products when compared to other retail stores. The COVID-19 outbreak positively impacted the market. Convenience stores around the world have remained resilient to the pandemic, as customers visited convenience stores to avoid crowded places such as large stores or supermarkets.

A convenience store is a chain in the retail sector that offers a limited range of prepared and ready-to-eat food items, household groceries, packaged beverages, confectionery items, tobacco products, and periodicals. Convenience stores generally operate in small sizes and are open for extended hours as they operate 24/7 in some areas. These stores are often run till late at night, early in the morning, and also on holidays. Many customers rely on them for emergency purchases of products such as over-the-counter medicines, ice, milk, and eggs when regular stores are closed.

The convenience store has numerous benefits as they are mostly located in busy locations such as near railway stations or fuel stations so that customers can quickly grab their required items in a hurry which is one of the major factors for the market growth. Moreover, local corner stores are offering home deliveries by partnering with companies like Uber Eats which is again attracting consumers to demand their required items is the factor attributing to the growth of the market.

Additionally, the availability of ready-to-eat foods or prepared foods offered by corner stores is again attracting more customers to visit. Convenience stores can save much time for the customers by offering a large variety of items at the stores during their emergencies or in hurry. During the forecast period, the growing number of supermarkets that deliver goods online is likely to impede the expansion of the industry.

The COVID-19 pandemic has positively impacted the convenience store market. As per the survey by the National Association of Convenience Stores (NACS), total industry sales of in-stores have reported an increase of 1.5% during the coronavirus pandemic. Moreover, it was witnessed that the total basket size also surged by 18.5% in convenience stores. As customers were keen to reach small corner stores to avoid the supermarkets/hypermarkets. In addition, the convenience stores that offer food items and medicines during the pandemic have increased their overall sales during the coronavirus pandemic. Convenience stores typically have a smaller crowd as compared to other retail sectors which also helped them to make positive sales during the spread of disease all over the globe.

Type Insights

The cigarettes & tobacco segment dominated the market and contributed a revenue share of around 39% in 2021 and is forecast to grow at a CAGR of 5.8% from 2022 to 2028. The rising nicotine consumption across the globe is one of the primary factors driving the growth of the segment. In addition, the easy availability of tobacco products at every nearby convenience store is again accelerating the segment growth. In every country of the globe, tobacco consumption is comparatively higher than other items which are sold in convenience stores. Therefore, convenience stores are dominating in the revenue generation of the cigarettes & tobacco segment sales.

The foodservice segment is expected to witness the highest CAGR of 6.4% from 2022 to 2028. The foodservice segment is growing due to the easy availability of prepared food items in every convenience store. Moreover, the ready-to-eat food items and home delivery service offered by local convenience stores are again attributed to the growth of the foodservice segment. Convenience stores provide meals at all hours of the day so that consumers may obtain their things as soon as possible. As a result, throughout the forecast period, the foodservice segment is predicted to grow at the fastest CAGR.

Regional Insights

North America accounted for the largest market revenue share of over 47% in 2021. In the United States, the convenience stores count is considerably higher than other channels of trade which accounts for around 35% of brick-and-mortar retail stores. Moreover, the changing shopping conduct and the pandemic reformed the U.S retail sector, and the functioning of convenience stores has expanded beyond expectation. As the disease spread, customers were more likely to visit convenience stores due to less crowd as compared to supermarkets. Thus, increasing the overall sales of convenience stores in this region. Hence, the region is expected to grow at a significant CAGR during the forecast period.

Asia Pacific is forecast to register the highest CAGR of 6.4% from 2022 to 2028. The increase in purchasing power of the middle-class population in China and Vietnam is attributed to the surge in the demand for convenience stores. Additionally, Vietnam noticed the fastest growth in its convenience stores, especially in urban areas due to the lifestyle changes and consumers are living a fast-paced life. Additionally, with the development of infrastructure, the number of stores is increasing in popularity, and also the partnership agreements among the local companies are surging the overall market. Thus, the region is expected to grow at the fastest CAGR during the forecast period.

Key Companies & Market Share Insights

The market is characterized by the presence of established as well as new players. Major players operating in this market are offering various advantages such as partnership & acquisition. In October 2021, Reliance Retail announced its partnership with 7-Eleven, a giant convenience store to launch its store across India. The acquisition is made to increase its strong presence in the grocery segment. Some of the prominent players in the global convenience stores market include:

-

Casey's General Stores, Inc

-

Alimentation Couche-Tard Inc.

-

Murphy USA Inc.

-

Parkland Corporation

-

7-Eleven

-

Alibaba Group Holding Limited

-

Amazon.com, Inc.

-

FamilyMart

-

OXXO (FEMSA)

-

Lawson Inc.

Convenience Store Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 2.23 trillion

Revenue forecast in 2028

USD 3.12 trillion

Growth Rate

CAGR of 5.6% from 2022 to 2028

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2028

Quantitative units

Revenue in USD billion and CAGR from 2022 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; China; Vietnam; Japan; Brazil; Argentina; GCC; South Africa

Key companies profiled

Casey's General Stores, Inc.; Alimentation Couche-Tard Inc.; Murphy USA Inc.; Parkland Corporation; 7-Eleven; Alibaba Group Holding Limited; Amazon.com, Inc.; FamilyMart; OXXO (FEMSA); Lawson Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. Grand View Research has segmented the global convenience stores market report based on type and region:

-

Type Outlook (Revenue, USD Billion, 2017 - 2028)

-

Cigarettes & Tobacco

-

Foodservice

-

Packaged Beverages

-

Center Store

-

Low Alcoholic Beverages

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Vietnam

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

GCC

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global convenience store market size was estimated at USD 2.12 trillion in 2021 and is expected to reach USD 2.23 trillion in 2022.

b. The global convenience store market is expected to grow at a compound annual growth rate of 5.6% from 2022 to 2028 to reach USD 3.12 trillion by 2028.

b. North America dominated the convenience store market with a share of 47.1% in 2021. This is attributable to customers' high preference to visit convenience stores and rising sales by convenience stores.

b. Some key players operating in the convenience store market include Casey's General Stores, Inc.; Alimentation Couche-Tard Inc.; Murphy USA Inc.; Parkland Corporation; 7-Eleven; Alibaba Group Holding Limited; Amazon.com, Inc.; FamilyMart; OXXO (FEMSA); and Lawson Inc.

b. Key factors that are driving the convenience store market growth include expanding investments in the retail business in developing nations, and the rising popularity of the franchising idea.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.