- Home

- »

- Electronic & Electrical

- »

-

Digital Pen Market Size And Share, Industry Report, 2033GVR Report cover

![Digital Pen Market Size, Share & Trends Report]()

Digital Pen Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Scanning Pen, Handwriting Pen), By Usage (PC, Tablet), By End Use (Healthcare, Education), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-284-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Pen Market Summary

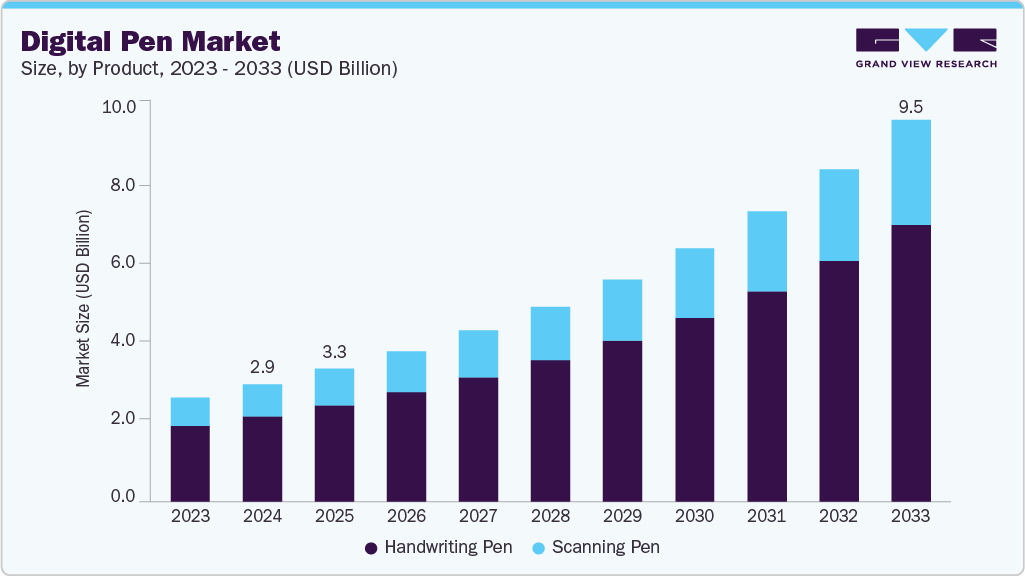

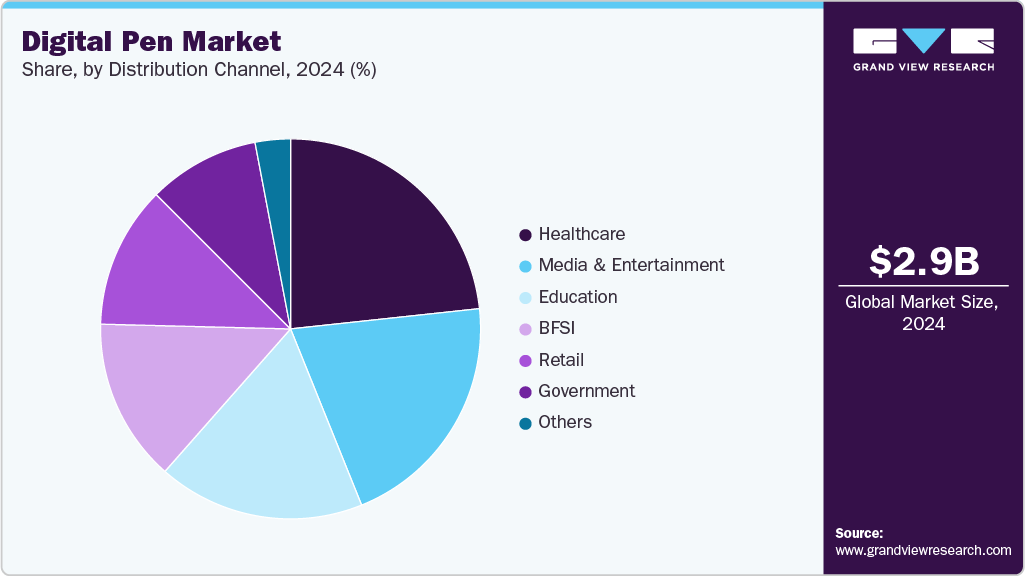

The global digital pen market size was estimated at USD 2.92 billion in 2024 and is projected to reach USD 9.48 billion by 2033, growing at a CAGR of 14.1% from 2025 to 2033, driven by the rising use in education, creative work, and professional settings, which is facilitated by precise input and seamless software integration. A key ongoing trend in the digital pen industry is the integration of AI-enabled features that enhance precision, productivity, and workflow automation.

Key Market Trends & Insights

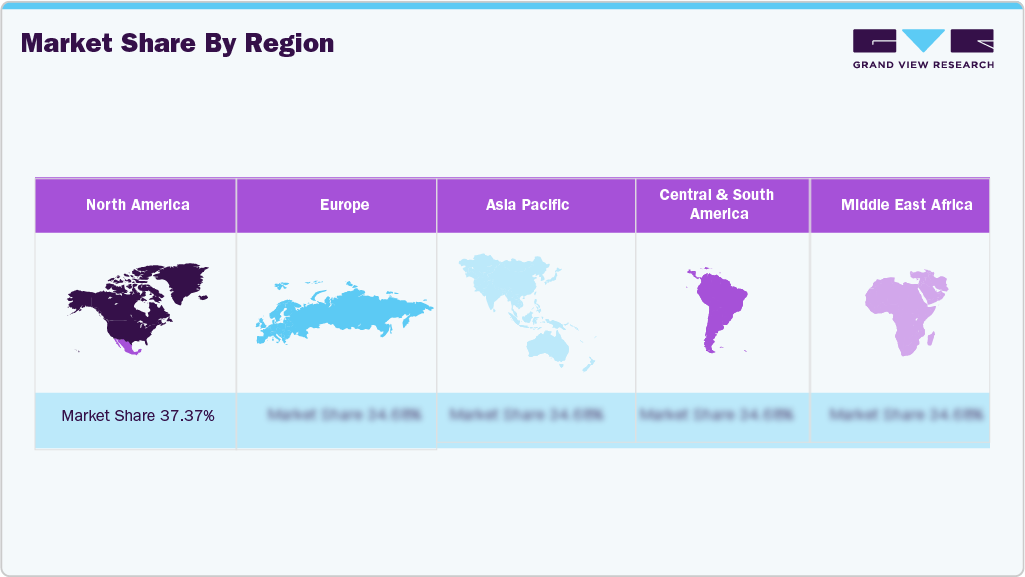

- North America dominated the global digital pen market with the largest revenue share of 37.37% in 2024.

- The digital pen market in the U.S. accounted for the largest market revenue share in North America in 2024.

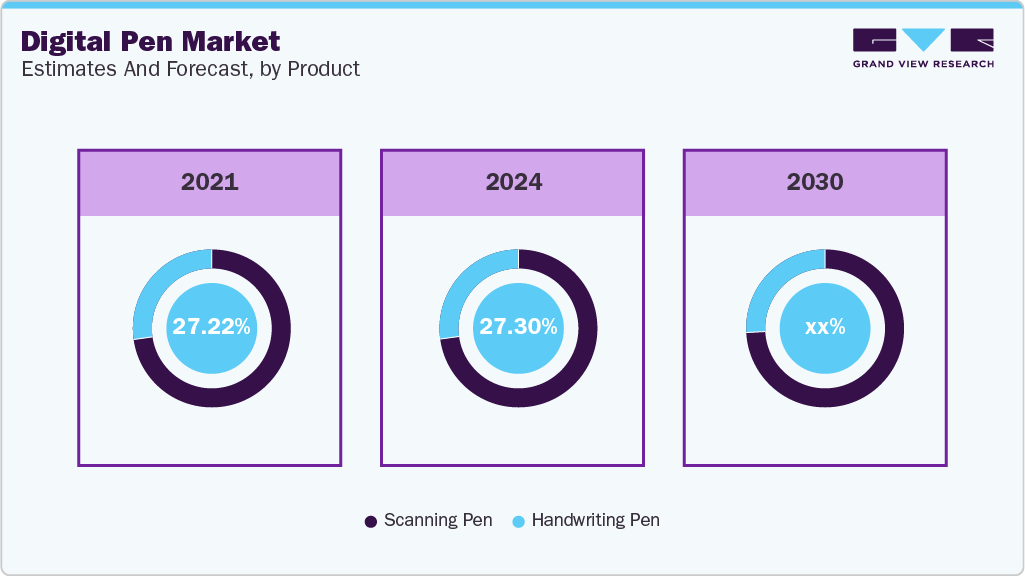

- By product, the handwriting pen segment led the market with the largest revenue share of 72.70% in 2024.

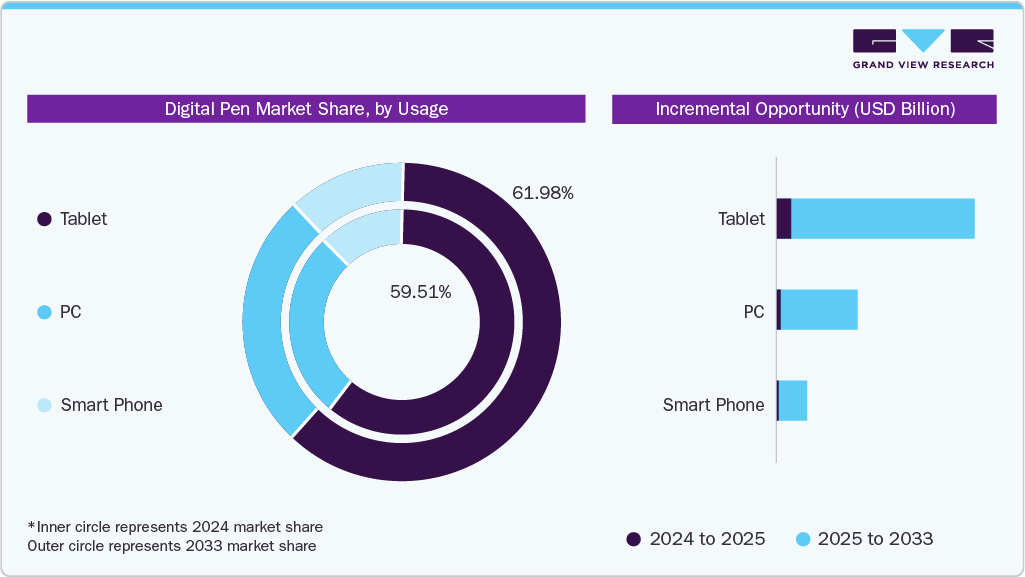

- By usage, the tablets segment led the market with the largest revenue share of 59.51% in 2024.

- By end use, the healthcare segment led the market with the largest revenue share of 23.26% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.92 Billion

- 2033 Projected Market Size: USD 9.48 Billion

- CAGR (2025-2033): 14.1%

- North America : Largest market in 2024

- Asia Pacific : Fastest growing market

Modern styluses increasingly incorporate intelligent handwriting recognition, gesture-based commands, and context-aware functionality, allowing users to convert handwritten notes into editable text, execute commands, and interact seamlessly with multiple applications.The growth of the digital pen industry is being driven by increasing adoption of stylus-compatible devices in education and corporate environments. In schools and universities, especially in North America and Asia Pacific, tablets and 2-in-1 devices are replacing traditional notebooks for note-taking and interactive learning, creating steady demand for digital pens. On the corporate side, hybrid work setups and digital collaboration tools are encouraging professionals to adopt stylus-enabled devices for document annotation, presentations, and remote teamwork, providing a tangible boost to sales.

According to a January 2023 article by Digital Stationary Consortium, 38% of digital pen users report using their pen on a daily basis, primarily for tasks like note‑taking, list‑making, and light editing.

Another key factor is the rapid expansion of creative and design industries that require precise input devices. Freelance designers, architects, and digital artists are increasingly relying on high-performance pens with low latency, pressure sensitivity, and tilt recognition for professional work. The rise of content creation for social media, digital illustration, and online design platforms has pushed demand for ecosystem-specific pens such as the Apple Pencil, Samsung S Pen, and Wacom styluses, creating a specialized segment within the market that drives both revenue and innovation.

In addition, regional affordability and online distribution channels are accelerating penetration in emerging markets. Brands such as Adonit, Lenovo, and XP-Pen offer cost-effective styluses that work across multiple devices, making them accessible to students and casual users in countries like India, China, and Southeast Asia. The proliferation of e-commerce platforms, combined with increasing awareness of digital learning and creative applications, has made digital pens more visible and affordable at the ground level, fueling adoption beyond premium device owners.

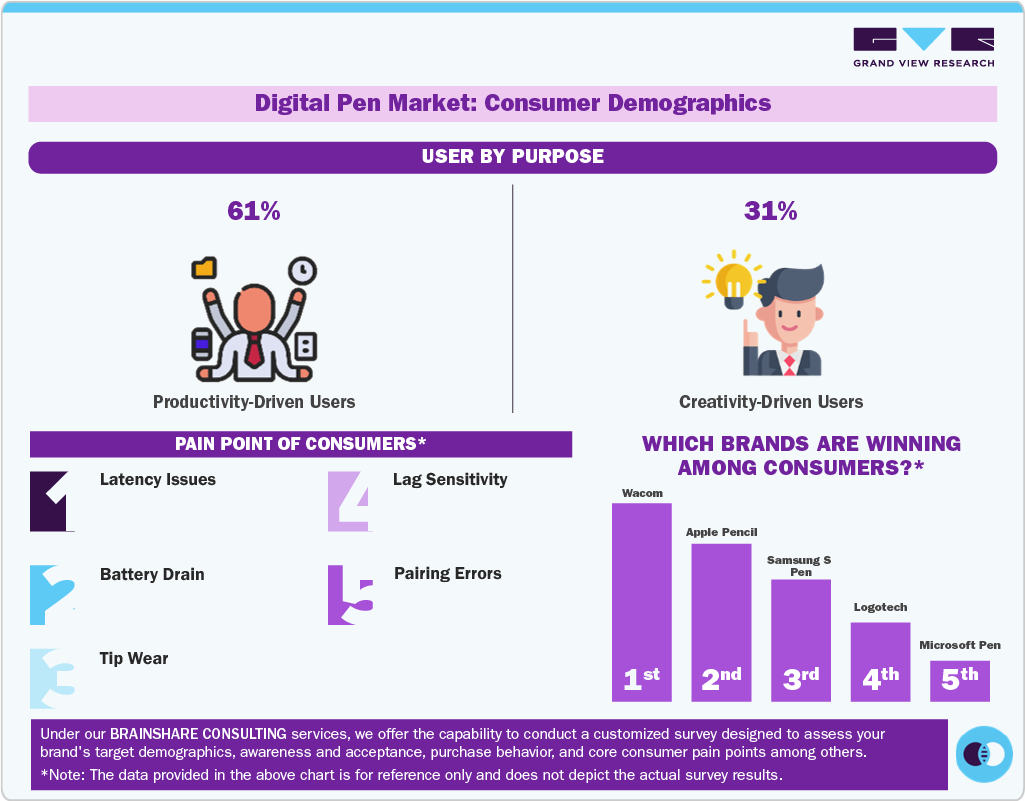

Consumer Insights

The global digital pen industry is primarily driven by productivity-focused users, who account for approximately 61% of the market. This group, including students, professionals, and remote workers, relies on digital pens for note-taking, document annotation, and efficient workflow management. Creativity-driven users, representing 39%, such as designers, architects, and digital artists, prioritize precision, pressure sensitivity, and software compatibility to support tasks like sketching, illustration, and digital design.

Consumers encounter recurring challenges that influence adoption and satisfaction. Common pain points include latency issues, battery drain, tip wear, lag sensitivity, and pairing errors, which can affect accuracy, responsiveness, and overall usability. Addressing these technical limitations is critical for brands seeking to maintain user trust and encourage continued engagement with stylus devices.

Leading companies have emerged by effectively tackling these challenges and offering high-quality, reliable solutions. Brands such as Wacom, Apple Pencil, Samsung S Pen, Logitech, and Microsoft Pen dominate the market, leveraging precise input, long battery life, and seamless integration with devices and software. Their focus on performance and compatibility appeals to both productivity-focused and creative users, reinforcing their competitive position globally.

Product Insights

The handwriting pen segment led the market with the largest revenue share of 72.70% in 2024, driven by user preference for natural writing experience, low-latency performance, and precision for note-taking, sketching, and annotations. High adoption in education, professional, and creative sectors is supported by ecosystem integration with devices like Apple iPads, Microsoft Surface tablets, and Wacom devices, making them the default choice for productivity and design applications.

The scanning pen segment is anticipated to witness at the fastest CAGR of 14.3 % from 2025 to 2033, fueled by increasing demand for text digitization, translation, and real-time data capture in offices, educational institutions, and libraries. Rising adoption of digital learning and remote work tools encourages users to convert printed or handwritten material into editable formats, with brands like C-Pen and IRISPen benefiting from this trend, which drives strong projected CAGR during the forecast period.

Usage Insights

The tablets segment led the market with the largest revenue share of 59.51% in 2024. Tablet-compatible digital pens dominate the industry as tablets are widely used for productivity, creative work, and education, offering larger screens and better stylus integration than smartphones. Professionals, students, and artists prefer tablets with styluses for precise input, note-taking, sketching, and digital design. Products like Apple Pencil for iPad, Microsoft Surface Pen, and Wacom Bamboo are popular due to their low latency, pressure sensitivity, and ecosystem compatibility, driving the high revenue share in this segment.

The smartphone segment is anticipated to grow at the fastest CAGR of 13.8 % from 2025 to 2033, as consumers increasingly use stylus-enabled devices for on-the-go note-taking, messaging, and creative tasks. Compact smartphones with integrated or compatible pens, such as Samsung Galaxy S series with S Pen and LG Stylo series, attract students, professionals, and creative users who value portability without sacrificing functionality. Rising smartphone adoption in emerging markets, coupled with increasing productivity and content-creation use cases, fuels the segment’s high projected CAGR during the forecast period.

End Use Insights

The healthcare segment led the market with the largest revenue share of 23.26% in 2024, as digital pens streamline record-keeping, prescription writing, and patient charting, reducing errors and improving workflow efficiency. Hospitals and clinics increasingly adopt stylus-enabled tablets and hybrid devices to digitize patient records and support telemedicine applications. Products like Wacom and Microsoft Surface pens are commonly integrated into EMR/EHR systems, enabling precise input and compliance with regulatory standards, which drives steady demand in this segment. According to an article published by PMC, a survey of 208 U.S. medical students reported that 59.7% preferred using a tablet over paper for note‑taking, citing benefits like ease of annotation and portability.

The education segment is anticipated to grow at the fastest CAGR of 5.9% from 2025 to 2033, as schools and universities shift toward digital learning, e-textbooks, and interactive classrooms. Stylus-compatible tablets and hybrid devices enhance note-taking, diagram drawing, and collaborative learning, particularly in K-12 and higher education. Observational studies in K-12 schools in South Korea and Singapore found that classroom adoption of tablets with pens increased student engagement scores by 15-20%, particularly for STEM and art subjects. Affordable digital pens from brands like Lenovo, Adonit, and XP-Pen, combined with government initiatives promoting e-learning in countries like India, China, and South Korea, are driving adoption and contributing to the segment’s steady CAGR during the forecast period.

Regional Insights

North America dominated the global digital pen market with the largest revenue share of 37.37% in 2024, primarily due to the high adoption of tablets, 2-in-1 laptops, and stylus-compatible devices in the professional, educational, and creative sectors. Growth is driven by productivity-focused users in enterprises, universities, and design studios, who demand precise, low-latency styluses for note-taking, digital sketching, and workflow integration. The U.S. contributes explicitly significantly, with strong uptake of Apple Pencil, Microsoft Surface Pen, and Wacom products, supported by wide retail availability, software ecosystem integration, and early technology adoption, leading to sustained revenue dominance.

U.S. Digital Pen Market Trends

The digital pen market in the U.S. accounted for the largest market revenue share in North America in 2024, fueled by increasing demand for stylus-enabled devices in remote work, online education, and creative industries. Rising adoption of digital learning tools in schools and higher education, combined with corporate investments in collaborative devices like the Surface Pro series and iPad Pro, drives higher penetration.

Asia Pacific Digital Pen Market Trends

The digital pen market in Asia Pacific is anticipated to witness at the fastest CAGR of 15.0% from 2025 to 2033, driven by a large student population, expanding creative industries, and rising smartphone and tablet penetration. Countries such as China, India, Japan, and South Korea are seeing increasing adoption of affordable digital pens for education, graphic design, and office productivity. The proliferation of e-learning, government initiatives for digital classrooms, and the expansion of affordable regional brands like Lenovo, Xiaomi, and Adonit further accelerate market growth in this region.

Key Digital Pen Company Insights

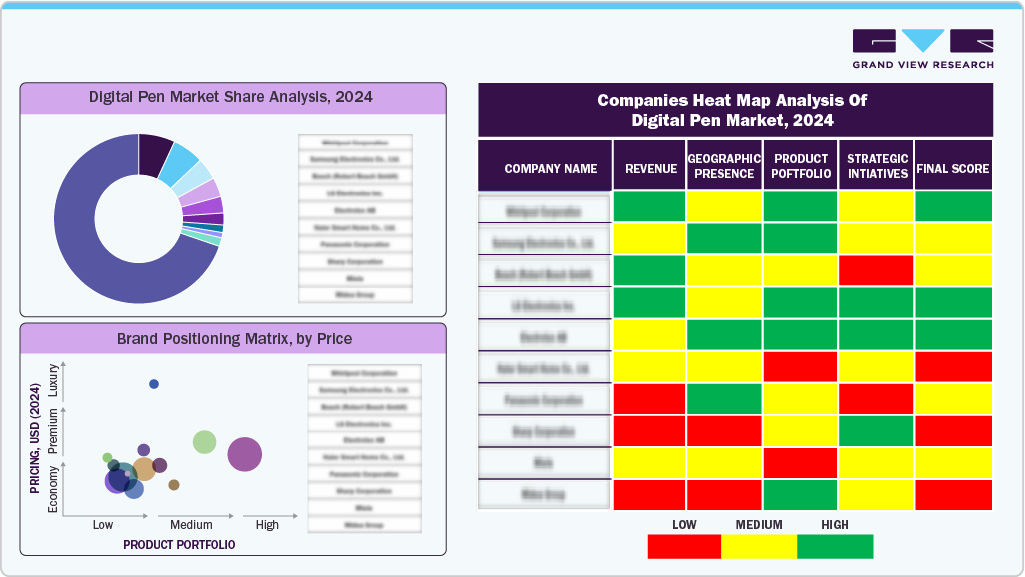

The global digital pen industry is led by established specialists, premium ecosystem brands, and emerging regional players that address productivity, education, and creative needs.

Wacom, Microsoft, Logitech, and HP dominate the mainstream and professional segments with reliable technology, broad device compatibility, and wide retail presence.

Premium brands such as Apple, Samsung, and Huawei focus on precision, low latency, and seamless software integration, appealing to digital artists and productivity-focused users.

Regional manufacturers such as Xiaomi, Lenovo, and Adonit are gaining traction in price-sensitive markets by providing affordable yet functional pens designed for mass-market tablets and hybrid devices. Their strong presence across online marketplaces and alignment with locally popular devices are strengthening their position, particularly in Asia Pacific. This multi-layered competitive structure, spanning entry-level universal styluses to premium ecosystem-bound pens, continues to define the global digital pen industry landscape.

Key Digital Pen Companies:

The following are the leading companies in the digital pen market. These companies collectively hold the largest Market share and dictate industry trends.

- Wacom

- Apple

- Microsoft

- Samsung

- Logitech

- Huawei

- Xiaomi

- HP

- Lenovo

- Adonit

- Graco Inc.

Recent Developments

-

In July 2025, UltraProlink launched the JOT Pencil, a universal stylus designed for iPads, tablets, and smartphones, offering a 1.5 mm precision tip, palm-rejection support in iPad mode, a lightweight aluminum build, and easy mode switching for broader device compatibility.

-

In April 2025, Motorola launched the Edge 60 Stylus, a mid-range smartphone equipped with a built-in stylus—bringing productivity features typically reserved for ultra-premium devices to a more affordable price point.

Digital Pen Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.30 billion

Revenue forecast in 2033

USD 9.48 billion

Growth rate

CAGR of 14.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product , usage, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia; South Korea; ; Brazil; South Africa

Key companies profiled

Wacom; Apple; Microsoft; Samsung; Logitech; Huawei; Xiaomi; HP; Lenovo; Adonit; Graco Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Pen Market Report Segmentation

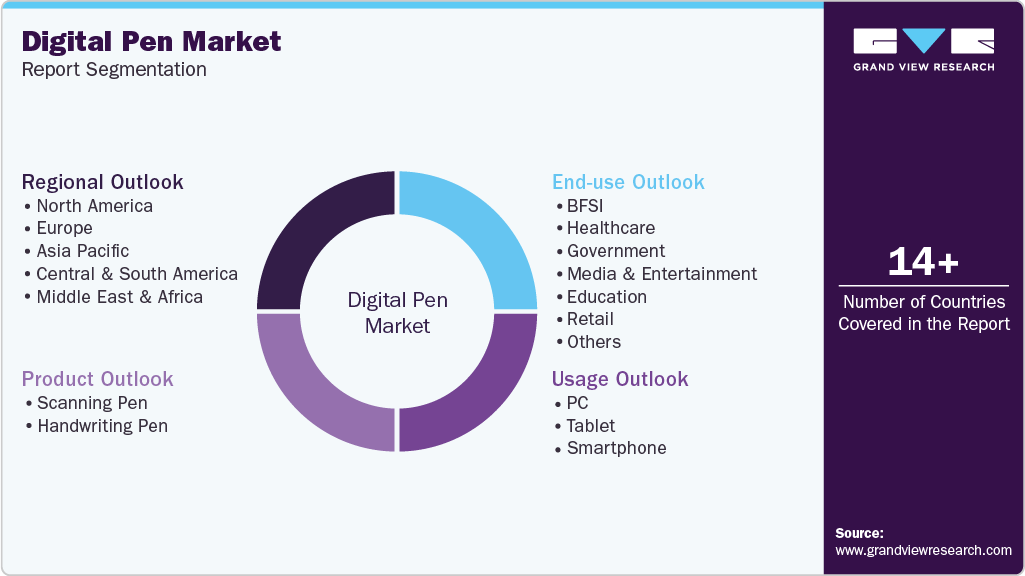

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global digital pen market report based on the product, usage, end use, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Scanning Pen

-

Handwriting Pen

-

Hybrid

-

Stylus

-

-

-

Usage Outlook (Revenue, USD Million, 2021 - 2033)

-

PC

-

Tablet

-

Smartphone

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

BFSI

-

Healthcare

-

Government

-

Media & Entertainment

-

Education

-

Retail

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global digital pen market size was estimated at USD 2.92 billion in 2024 and is expected to reach USD 3.30 billion in 2025.

b. The global digital pen market is expected to grow at a compound annual growth rate of 14.1% from 2025 to 2033 to reach USD 9.48 billion by 2033.

b. North America dominated the digital pen market with a share of 37.37% in 2024. This is attributable to the rapid adoption of the digital pen in the U.S. and Canada, as a result of the increased diffusion of digital technologies in several businesses.

b. Some key players operating in the digital pen market include IRIS S.A., Lucidia Inc., Kent Displays, Wacom Co., Ltd., ACECAD Digital Corp., NeoLAB Convergence Lab, Livescribe Inc., Moleskine S.p.A., Apple Inc., and Microsoft Inc.

b. Key factors that are driving the digital pen market growth include the growing need to digitize business in various sectors, including banking, healthcare, education, and retail, and the rising adoption of e-learning sites and apps among students of all ages.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.