- Home

- »

- Communication Services

- »

-

Digital Rights Management Market, Industry Report, 2033GVR Report cover

![Digital Rights Management Market Size, Share & Trends Report]()

Digital Rights Management Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Solution, Services), By Deployment, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-782-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Rights Management Market Summary

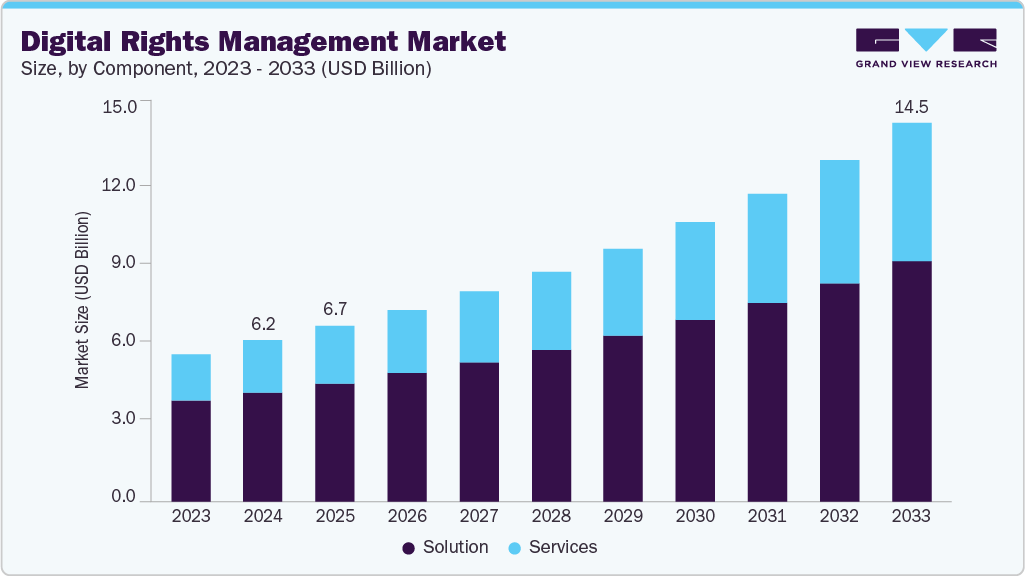

The global digital rights management market size was estimated at USD 6.16 billion in 2024 and is projected to reach USD 14.48 billion by 2033, growing at a CAGR of 10.1% from 2025 to 2033, due to the rising adoption of digital content across streaming platforms, e-books, gaming, and enterprise data sharing, which has increased the need to protect intellectual property from piracy and unauthorized access. As organizations increasingly rely on digital assets, such as videos, e-books, software, and confidential documents, there is a growing need to safeguard these assets from unauthorized access, piracy, and illegal distribution.

Key Market Trends & Insights

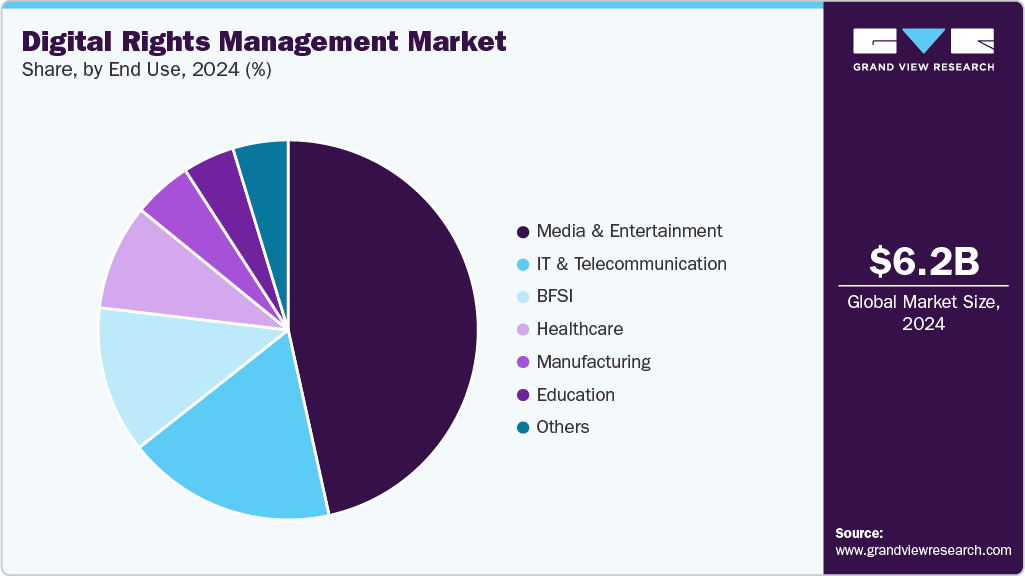

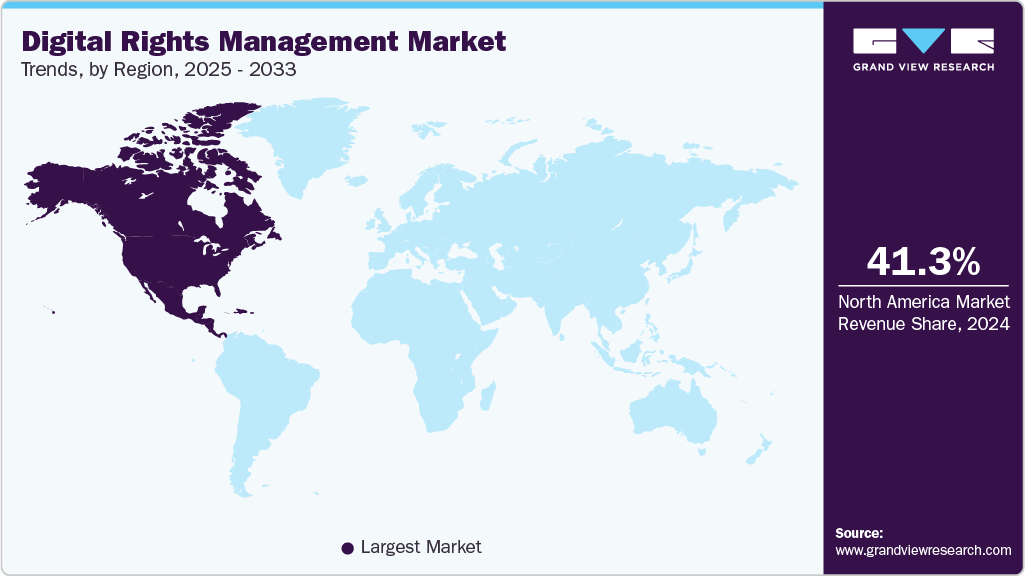

- North America dominated the digital rights management market with the largest revenue share of 41.3% in 2024.

- The digital rights management industry in the U.S. accounted for the largest market revenue share in North America in 2024.

- By component, the solution segment led the market with the largest revenue share of 68.0% in 2024.

- By deployment, the on-premises segment accounted for the largest market revenue share in 2024.

- By end use, the BFSI segment is expected to grow at the fastest CAGR from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 6.16 Billion

- 2033 Projected Market Size: USD 14.48 Billion

- CAGR (2025-2033): 10.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

As organizations increasingly rely on digital assets, such as videos, e-books, software, and confidential documents, there is a growing need to safeguard these assets from unauthorized access, piracy, and illegal distribution. Digital rights management (DRM) solutions provide encryption, license management, and secure access control, ensuring that intellectual property owners retain control over their digital content while enabling legitimate usage.The rapid expansion of online streaming platforms and digital media services also contributes to the growth of the digital rights management industry. With the proliferation of OTT platforms, music streaming apps, and e-learning portals, content creators and distributors are prioritizing robust DRM tools to protect premium content and ensure compliance with licensing agreements. The surge in digital consumption, especially in developing economies, is fueling the demand for scalable, cloud-based DRM systems that can secure content across multiple devices and formats.

In addition, stringent government regulations and compliance requirements are reinforcing the adoption of DRM solutions across industries. Laws such as the Digital Millennium Copyright Act (DMCA) and the General Data Protection Regulation (GDPR) emphasize data protection and intellectual property rights, encouraging enterprises to implement advanced DRM technologies. Furthermore, the increasing use of AI and blockchain technologies in DRM systems is enhancing authentication, tracking, and transparency in content usage, thereby driving innovation and market growth.

The rise in remote work and digital collaboration has amplified the importance of secure document sharing and enterprise-level data protection. Organizations are deploying DRM solutions to protect sensitive business files, intellectual property, and customer data from insider threats and external breaches, further contributing to market expansion. For instance, in February 2025, BuyDRM announced that Passes, a subscription platform for creators, adopted its KeyOS MultiKey Service to prevent unauthorized content access. The move reflects a growing trend of smaller creator platforms embracing advanced DRM solutions to protect digital assets and ensure secure content distribution.

Component Insights

The solution segment led the market with the largest revenue share of 68.0% in 2024, driven by the increasing integration of analytics and automation capabilities within DRM platforms. Modern DRM solutions now offer advanced features such as real-time content tracking, automated license renewals, and intelligent access management, enabling organizations to monitor and control digital assets more efficiently. Businesses are also adopting unified DRM solutions that support multiple content formats and distribution channels, reducing complexity and improving user experience.

Furthermore, the growing demand for interoperability between DRM systems and cloud-based infrastructure is encouraging vendors to offer flexible, scalable, and API-driven solutions that streamline deployment and enhance security across digital ecosystems.

The services segment is anticipated to grow at the fastest CAGR during the forecast period, due to the increasing need for expert implementation, customization, and ongoing management of DRM systems. As enterprises adopt complex digital ecosystems spanning multiple devices and platforms, they rely on professional and managed services to ensure seamless integration with existing IT infrastructure and compliance with content protection standards. Service providers offer specialized consulting, system configuration, and performance optimization to help organizations maximize the effectiveness of their DRM investments.

Deployment Insights

The on-premises segment accounted for the largest market revenue share in 2024, as organizations with stringent data security and regulatory requirements seek greater control over sensitive digital assets and encryption keys. Industries such as defense, finance, and healthcare prefer on-premises DRM solutions to maintain complete ownership of their infrastructure, minimize exposure to external threats, and comply with sector-specific data protection mandates. These solutions offer enhanced customization options, enabling enterprises to tailor content access policies and integrate DRM systems with their internal authentication frameworks.

The cloud segment is expected to grow at the fastest CAGR during the forecast period, due to the growing demand for scalable, flexible, and cost-effective content protection solutions. Cloud-based DRM enables organizations to manage licenses, distribute content, and enforce security policies across multiple platforms and geographies without heavy upfront infrastructure investments. The increasing adoption of subscription-based models, OTT platforms, and remote work environments makes cloud deployments particularly attractive, as they allow real-time updates, automatic scaling, and seamless integration with existing digital workflows.

Application Insights

The video content segment accounted for the largest market revenue share in 2024, fueled by the exponential demand for premium and on-demand video streaming across entertainment, education, and corporate sectors. Content providers are increasingly adopting DRM solutions to prevent piracy, unauthorized sharing, and illegal downloads of movies, TV shows, webinars, and training videos. The rapid expansion of OTT platforms, e-learning portals, and corporate video communications has heightened the need for secure, multi-device content delivery, ensuring that only authorized users can access premium video assets.

The mobile gaming & apps segment is expected to grow at the fastest CAGR during the forecast period, due to the expansion of mobile gaming, in-app purchases, and subscription-based applications. As mobile games and apps become increasingly monetized through digital content, developers are turning to DRM solutions to prevent unauthorized access, cheating, and piracy that can undermine revenue streams. The rise of global app stores and cross-platform gaming has intensified the need for secure license management and content protection across devices.

End Use Insights

The media & entertainment segment accounted for the largest market revenue share in 2024, driven by the increasing consumption of digital content across streaming platforms, social media, and digital publishing channels. Media companies are investing heavily in DRM solutions to protect movies, music, e-books, and other creative assets from piracy and unauthorized distribution, which helps preserve revenue and licensing agreements. The shift toward direct-to-consumer (DTC) models, personalized content delivery, and multi-device access has further amplified the need for robust content protection.

The BFSI segment is expected to grow at the fastest CAGR over the forecast period, owing to the rising need to secure sensitive financial data, proprietary software, and confidential client documents. Financial institutions are increasingly adopting DRM solutions to prevent unauthorized access, data leaks, and intellectual property theft, ensuring compliance with stringent regulations such as PCI DSS and local data protection laws. The shift toward digital banking, mobile financial applications, and online insurance services has further heightened the demand for robust content protection across multiple devices and platforms.

Regional Insights

North America dominated the global digital rights management market with the largest revenue share of 41.3% in 2024, driven bythe integration of AI and cloud-native technologies into DRM solutions. These advancements enable real-time content protection, automated license management, and enhanced scalability, catering to the needs of streaming services, e-learning platforms, and enterprise software providers.

U.S. Digital Rights Management Market Trends

The digital rights management market in the U.S. accounted for the largest market revenue share in 2024, due tothe expansion of the digital advertising sector, with companies like ByteDance, Alibaba, and Tencent increasing their share. This surge in digital advertising necessitates stronger content protection measures to safeguard intellectual property and ensure compliance with evolving data privacy regulations.

Europe Digital Rights Management Market Trends

The digital rights management market in Europe is anticipated to register at a considerable CAGR from 2025 to 2033, due to digital sovereignty influencing the DRM market. European nations are focusing on strengthening their digital infrastructure to reduce reliance on non-European technologies, leading to increased demand for locally developed DRM solutions that align with regional data protection standards.

The UK digital rights management market is expected to grow at a rapid CAGR during the forecast period, owing to the rapid digitalization across entertainment, media, and educational sectors, leading to a surge in digital content creation and distribution. This growth necessitates robust DRM solutions to protect intellectual property and ensure compliance with stringent copyright laws.

The digital rights management market in Germany held a substantial market share in 2024, due to the mature digital economy and high internet penetration, which have led to increased digital content consumption across various sectors. This trend necessitates advanced DRM solutions to protect digital assets and ensure secure content distribution.

Asia Pacific Digital Rights Management Market Trends

The digital rights management market in the Asia Pacific held a significant share in the global market in 2024, due to the rapid growth of digital content consumption across countries like India, South Korea, and Southeast Asia. This surge in digital media consumption drives the need for robust DRM solutions to protect intellectual property and ensure secure content distribution.

The Japan digital rights management market is expected to grow at a rapid CAGR during the forecast period, driven by the government's proactive cyber defense initiatives, such as the Active Cyberdefense Law, which aims to bolster national security against increasing cyber threats. These initiatives drive the adoption of advanced DRM solutions to protect digital assets and ensure compliance with national security regulations

The digital rights management market in China held a substantial market share in 2024, due to the rapid growth of digital platforms and AI-powered media technologies. As digital advertising and content consumption expand, companies increasingly require DRM solutions to prevent piracy, protect intellectual property, and ensure regulatory compliance.

Key Digital Rights Management Company Insights

Key players operating in the digital rights management industry are Adobe Inc., Google LLC (Widevine), Microsoft, Apple Inc., Oracle Corporation, and Irdeto. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key Digital Rights Management Companies:

The following are the leading companies in the digital rights management market. These companies collectively hold the largest market share and dictate industry trends.

- Adobe

- Amazon Web Services Inc.

- Apple Inc.

- Dell Inc.

- Fasoo Inc.

- Google LLC

- IBM Corporation

- Irdeto

- Locklizard Limited

- Microsoft

- OpenText Corporation

- Oracle Corporation

- SAP SE

- Seclore

- Vitrium Systems Inc.

Recent Development

-

In September 2025, Irdeto partnered with Ateme to integrate its TraceMark forensic watermarking technology into Ateme’s video delivery solutions. The collaboration strengthens content security by embedding imperceptible watermarks into video streams, enabling more effective piracy detection and prevention.

-

In October 2024, Adobe announced the launch of a new web application designed to enhance its Content Credentials system, enabling creators to sign and authenticate their works digitally. The tool provides transparency regarding the creation process, including any AI-driven modifications, and aims to strengthen trust and protection for digital content.

-

In October 2024, Seclore expanded its Enterprise Digital Rights Management (EDRM) platform to support neutral and interoperable CAD files, catering to industries that create, manage, and share intellectual property. This enhancement provides manufacturers with improved visibility into their design files, facilitating compliance reporting and auditing while strengthening the protection of sensitive intellectual property.

Digital Rights Management Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.72 billion

Revenue forecast in 2033

USD 14.48 billion

Growth rate

CAGR of 10.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; and South Africa

Key companies profiled

Adobe; Amazon Web Services Inc.; Apple Inc.; Dell Inc.; Fasoo Inc.; Google LLC; IBM Corporation; Irdeto; Locklizard Limited; Microsoft; OpenText Corporation; Oracle Corporation; SAP SE; Seclore; Vitrium Systems Inc.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Rights Management Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global digital rights management market report based on component, deployment, application, end use, and region.

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Solution

-

Services

-

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

On-premises

-

Cloud

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Audio Content

-

Images

-

Video Content

-

Mobile Gaming & Apps

-

eBook

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

BFSI

-

IT and Telecommunication

-

Media & Entertainment

-

Healthcare

-

Education

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Key factors driving the digital rights management market growth include the rising adoption of digital content across streaming platforms, e-books, gaming, and enterprise data sharing, which has increased the need to protect intellectual property from piracy and unauthorized access.

b. The global digital rights management market size was estimated at USD 6.16 billion in 2024 and is expected to reach USD 6.72 billion in 2025.

b. The global digital rights management market is expected to grow at a compound annual growth rate of 10.1% from 2025 to 2033 to reach USD 14.48 billion by 2033.

b. North America dominated the global market with the largest revenue share of 41.3% in 2024, driven by the integration of AI and cloud-native technologies into DRM solutions.

b. Some key players operating in the digital rights management market include Adobe, Amazon Web Services Inc., Apple Inc., Dell Inc., Fasoo Inc., Google LLC, IBM Corporation, Irdeto, Locklizard Limited, Microsoft, OpenText Corporation, Oracle Corporation, SAP SE, Seclore, Vitrium Systems Inc.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.