- Home

- »

- Electronic Devices

- »

-

Earphones And Headphones Market Size Report 2030GVR Report cover

![Earphones And Headphones Market Size, Share & Trends Report]()

Earphones And Headphones Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Price Band, By Technology, By Distribution Channel, By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-473-4

- Number of Report Pages: 274

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Earphones And Headphones Market Summary

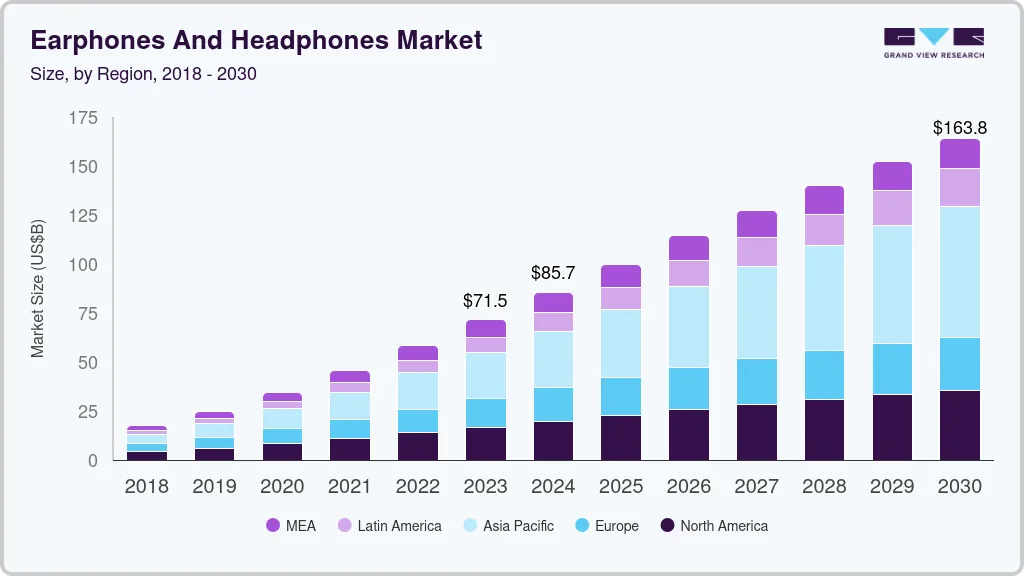

The global earphones and headphones market size was valued at USD 71,496.7 million in 2023 and is projected to reach USD 163,831.2 million by 2030, growing at a CAGR of 11.4% from 2024 to 2030. Increasing adoption of earphones and headphones during workouts is the major factor driving market growth.

Key Market Trends & Insights

- The demand for earphones and headphones was highest in the Asia Pacific region, accounting for around 32.6% of revenue share in 2023

- The earphones & headphones market in China is projected to grow at a CAGR of 14.6% from 2024 to 2030.

- Based on product, the market for the earphones segment accounted for around 55.1% of the overall share in 2023 and is anticipated to witness a CAGR of 12.6 % from 2024 to 2030.

- Based on price band, the USD 50-100 segment is expected to register healthy growth considering that several products of top brands fall under this category.

- By technology, the wired technology segment is expected to account for a revenue share of around 36.8% in 2023 and is expected to reach USD 51,299.3 Million in 2030.

Market Size & Forecast

- 2023 Revenue: USD 71,496.7 Million

- 2030 Projected Market Size: USD 163,831.2 Million

- CAGR (2024-2030): 11.4%

- Asia-Pacific: Largest Market in 2023

Gym-goers waste 30% of their workout time chatting, tangling earphones and headphones wires along with other workout distractions, and only 40 minutes of every hour is spent on exercise. More than 25% of the people spend 10 mins in untangling their headphones. This is also expected to be a primary reason why customers will prefer wireless earphones and headphones over the coming years. Moreover, the earphones and headphones market share in India is anticipated to grow due to the increased adoption of wireless technologies such as Wi-fi, Bluetooth, augmented reality (AR), and Virtual reality (VR) among others.

Manufacturers target fitness-conscious customers by offering innovative features, such as fitness monitoring and tracking capabilities, in their headphones. For instance, the BioSport Audio in-ear headphones, powered by Intel, offer health monitoring capabilities that require no exclusive batteries or chargers. BioSport relies on integrated sensors and proprietary software to operate as a heart monitor, pedometer, and other biometric devices. Besides, the earphones and headphones software is designed in a way through which a user can monitor, plan, and implement fitness movements via a mobile application. The rise in popularity of streaming music services, such as Spotify, Apple Music, and Amazon Music, has significantly contributed to the increase in demand for the global earphones and headphones market. As consumers widely adopt wireless headphones and earbuds, there has been a gradual shift towards conventional headphone jacks that support both wireless connectivity and Bluetooth, thereby fostering market growth.

With consumers progressively depending more on streaming platforms for accessing and enjoying music, there is an exponential increase in the demand for high-quality audio devices. Furthermore, the range of uses for headphones and earphones has increased due to the rise of podcasts, audiobooks, and other audio content, making them essential equipment for a variety of activities. The industry is experiencing constant growth and innovation due to the synergistic environment created by the seamless integration of audio streaming services and audio devices.

Top brands are investing a lot of money in designing their earbuds to cater to the fitness industry’s demands. Fitness products require enhanced durability as they are often subjected to wet and dusty environments. Companies such as GN Store Nord A/S (Jabra), Sony Corporation, and Jaybird are collaborating with athletes and health club owners to offer fitness-based features and enhanced ergonomics. The earbuds are offered with IPX ratings, making them sweat- and splash-proof to enhance life and quality, catering to the fitness industry. IP (Ingress Protection) or, in some cases, IPX rating, defines the level of protection that is being offered to the product against dust and water. Some of the safety ratings are IP 54, which offers resistance to dust and water splashes; IP55, which offers resistance to dust and low-pressure water jet spray; and IP 57, which offers a completely dust-tight unit that can survive high pressure and a heavy spray of water. The introduction of useful features and significant developments in product technology are expected to maintain demand for the product over the forecast period.

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of the market growth is accelerating. The growth of the market can be attributed to the increased spending on consumer electronics and the launch of innovative earphones and headphones. Additionally, the speculative growth in consumption of OTT platforms is expected to boost the expansion of the earphones and headphones market from 2024 to 2030.

The earphones and headphones competitive landscape is characterized by manufacturers' focus on global deployment, technology innovation, and product differentiation to sustain competition. They also aim to lower production costs by attaining economies of scale by leveraging the large customer base. Rapid product development cycles, enhanced customer service, research & development, and engineering & design operations are among the other focus areas that help OEMs add value to their products, which is prompting the competitive landscape of the earphones and headphones market.

The key companies also adopted inorganic growth strategies, such as the acquisition of other small-scale manufacturers. Additionally, the earphones and headphones market size in the United States emphasizes the need to update its training programs to incorporate technological and competitive shifts and changes. Mergers, acquisitions, and multiple partnerships are other growth strategies adopted by companies to expand their distribution platforms. Furthermore, companies invest significantly in building relationships with independent and direct sales forces globally as a part of their growth strategy. The earphones and headphones market, new to brands such as EVEN, 1MORE, Audeze LLC., and Nura, is investing significantly in conducting comprehensive training programs for their sales and marketing team as well as third-party distributors.

Product Insights

The market for earphones accounted for approximately 55.1% of the overall share in 2023 and is expected to witness a CAGR of 12.6% from 2024 to 2030. Increasing consumer demand for higher fidelity and style may favorably impact market growth. The growing popularity and adoption of smartphones, tablets, laptops, portable music players, and other mobile devices are expected to catapult the demand over the forecast period. Furthermore, a focus on compatibility with all those above portable electronic devices may spur demand for earphones in the market over the next few years.

The headphone market is projected to grow at a CAGR of 9.9% from 2024 to 2030. The growth is attributed to the rising demand for trendy headphones, as well as specialized headsets catering to various applications, such as gaming, audiophile, and fitness, which is expected to drive market growth.

Price Band Insights

The USD 50-100 segment is expected to register healthy growth considering that several products of top brands fall under this category. Meanwhile, the < USD 50 segment will witness steady growth due to several small brands introducing new products with advanced features at affordable prices. With the introduction of truly wireless earbuds, the < USD 100 segment has been boosted as the lookout of young consumers is towards trendy designs and advanced features, which are all on offer in the wireless earbuds. These products are normally priced high, and the consumers don’t mind spending money to buy such trending products.

Technology Insights

The wired technology segment is expected to account for a revenue share of approximately 36.8% in 2023 and is projected to reach USD 51,299.3 by 2030. Technological advancements have significantly shifted the headphones category from being a predominantly home audio accessory to being a premium portable AV accessory.

Technological advancements in the wireless products category, such as Bluetooth, SKAA, Artificial Intelligence, Augmented Reality, Virtual Reality, and Wi-Fi, are anticipated to increase the demand. Furthermore, the introduction of wireless earbuds has boosted the sales of wireless products and is one of the prime reasons for the growth of the wireless segment.

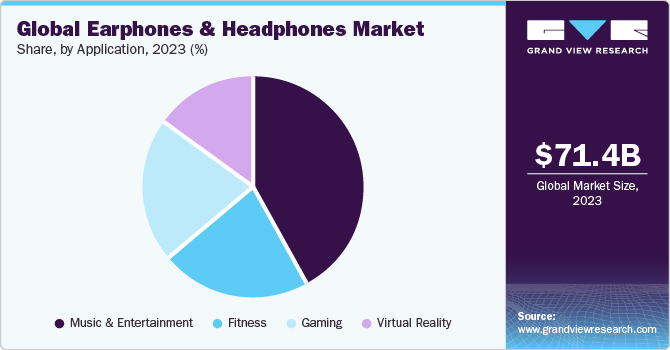

Application Insights

With improved internet penetration and the availability of several music subscription services, an increasing number of people are using music streaming services. Besides, the ongoing pandemic situation has boosted the entertainment industry; the OTT platforms are witnessing more subscriptions during lockdowns. This has significantly contributed to the growth of the music and entertainment segment.

The fitness segment is expected to witness high adoption of wireless earphones, with the inclusion of fitness trackers and heart rate monitoring in the earphones. The fitness trackers allow the athletes and individuals to monitor and plan their daily workout regime, diet, calories burned, and distance covered. The heart rate monitoring technology measures the heart rate through the ears and transmits the Beats Per Minute (BPM) data to the smartphone application, which can be used to plan the workout. Brands such as Bose Corporation, Jabra, Sony Corporation, and Samsung Electronics Co., Ltd. have introduced fitness tracking and heart rate monitoring features.

Regional Insights

Asia Pacific Earphones & Headphones Market Trends

The demand for earphones and headphones was highest in the Asia Pacific region, accounting for around 32.6% of revenue share in 2023. The growth of the region is attributed to the rising adoption of true wireless stereo earbuds and wireless headphones. Moreover, the increased adoption by the young generation is gaining traction in the Asia Pacific region.

China Earphones & Headphones Market Trends

The earphones & headphones market in China is projected to grow at a CAGR of 14.6% from 2024 to 2030. The availability of feature-equipped products is on the rise in the country. In addition to trendy designs and sound quality, the composition of earphones and headphones also plays a vital role in making the purchase decision. Thus, the aforementioned factors are collectively driving the growth of the Chinese earphones and headphones market.

Japan Earphones & Headphones Market Trends

The earphones & headphones market in Japan is projected to grow at a CAGR of 14.2% from 2024 to 2030. The high acceptance of Bluetooth wireless technology is expected to drive the growth of the Japan earphones & headphones market over the forecast period. Technology enables easy and secure connectivity for headphones and other audio devices. Bluetooth Smart technology creates new application opportunities for earphones\ headphones through an updatable platform and low power consumption.

India Earphones & Headphones Market Trends

The earphones & headphones market in India is projected to grow at a CAGR of 16.5% from 2024 to 2030. The India earphones & headphones market is emerging as a hot battlefield for wireless technology, with the emergence of new local vendors like boAt that have grabbed the attention of several consumers and competitors alike. The company is engaged in vigorous product research and has launched numerous TWS products in the Indian market.

North America Earphones & Headphones Market Trends

The earphones & headphones market in North America is projected to grow at a CAGR of 10.2% from 2024 to 2030. Customers in the region are increasingly using headphones at their workplaces to listen to music and other audio content on mobile devices, which is anticipated to fuel market demand for such devices. Furthermore, the availability of advanced features and a surge in the replacement market are expected the fuel demand for the North America earphones & headphones market from 2024 to 2030.

Europe Earphones & Headphones Market Trends

The earphones & headphones market in Europe is growing significantly at a CAGR of 8.3% from 2024 to 2030. The Europe earphones & headphones market is poised for growth owing to the short replacement cycle of earphones/headphones, attributed to the changing fashion, functionality, and damage or loss. The compatibility of earphones/headphones with tablets, laptops, desktops, cell phones, and other mobile devices may also contribute positively to the Europe earphones & headphones market growth.

U.K. Earphones & Headphones Market Trends

The earphones & headphones market in U.K. is growing significantly at a CAGR of 7.5% from 2024 to 2030. Entertainment on the move is a trend on the rise, which is primarily attributed to the proliferation of smartphones and tablets in the U.K. Moreover, earphones & headphones are largely used as complementary accessories to smartphones, tablets, music players, and laptops in the country.

Germany Earphones & Headphones Market Trends

The earphones & headphones market in Germany is growing significantly at a CAGR of 7.7% from 2024 to 2030. Earphone and headphone manufacturers in Germany are increasingly investing in producing environmentally friendly earphones and headphones to tackle the environmental hazards of plastic waste.

France Earphones & Headphones Market Trends

The earphones & headphones market in France is growing significantly at a CAGR of 8.5% from 2024 to 2030. Increasing consumer demand for higher fidelity and style may favorably impact market growth. The growing popularity and adoption of smartphones, tablets, laptops, portable music players, and other mobile devices is expected to catapult the demand over the forecast period. Furthermore, focusing on compatibility with all the aforementioned devices, portable electronic devices may spur demand for earphones in the market over the next few years.

Middle East & Africa Earphones & Headphones Market Trends

The Middle East & Africa earphones & headphones market is anticipated to witness a significant growth rate from 2024 to 2030. Decline in the price of wireless earphones in the region is anticipated to play a key role in the adoption of the earphones & headphones.

Saudi Arabia Earphones & Headphones Market Trends

The Saudi Arabia earphones & headphones market is anticipated to witness significant growth from 2024 to 2030, driven by the advent of feature-loaded earphones equipped with advanced noise-cancelling technologies.

Key Companies & Market Share Insights

Some of the key players operating in the market include Apple Inc., Harman International Industries, Incorporated, and Sony Corporation, among others.

-

Apple Inc is engaged in manufacturing and providing mobile communication & media devices along with personal computers. It also provides a range of software, services, accessories, and third-party digital content and applications. The products and services offerings include iPhone, iPad, Mac, wearables devices, and accessories.Earphones & headphones are provided under the company’s wearable, home, and accessories product portfolio. Apart from earphones & headphones, other offerings in the category include Beats products, iPod touch, Apple TV, HomePod, Apple Watch, and other accessories.

-

HARMAN International Industries, Incorporated is one of the wholly-owned subsidiaries of SAMSUNG Electronics Co Ltd. HARMAN International manufactures connected products and solutions that include connected car systems, audio and visual products, enterprise automation solutions, and connected services. It offers products and solutions to automotive applications, private consumers, and enterprises across the globe.

-

Sony Corporation is engaged in the design, development, and manufacturing of electronic devices and equipment such as television, cameras, headphones, and earphones among others. The company’s products are designed to cater to applications across professional, consumer, and industrial markets. It is also in the music recording business and is responsible for the production, distribution, management, and licensing of recorded music. Furthermore, the company also has a presence in motion pictures, television programming, digital networks, financial services, and non-life insurance businesses.

Logitech, Grado Labs, and Shure Incorporated are some of the emerging market participants in the business-to-business e-commerce market.

-

Logitech manufactures and markets cordless products. The company offers audio and video products, speakers, headsets, interactive gaming devices, mice, trackballs, keyboards, digital pens, lap desks, webcams, and universal remote controls.

- Grado Labs is a privately held, family-owned company engaged in manufacturing hand-built headphones and cartridges. The company also provides audio headphones, phono cartridges, amplifiers, and other accessories. Grado Labs operates through two divisions, namely headphones and cartridges. It offers a broad range of headphones, including the Wireless Series, Prestige Series, Statement Series, Professional Series, In-Ear Series, and other accessories.

Key Earphones and Headphones Companies:

- Alclair Audio, Inc.

- Apple, Inc.

- Bose Corporation

- Grado Labs

- JVC Kenwood Corporation

- Koninklijke Philips N.V. (Philips)

- Logitech, Inc. (Including Ultimate Ears, LLC.)

- Panasonic Corporation

- Plantronics, Inc. (Acquired by HP Inc.)

- Pioneer Corporation

- Sennheiser Electronic GmbH & Co. KG (Acquired by Sonova)

- SAMSUNG (Including Harman International Industries, Incorporated)

- Shure Incorporated

- Skullcandy, Inc. (Acquired by Mill Road Capital)

- Sony Corporation

- Zebronics India Pvt. Ltd.

Recent Developments

-

In September 2023, TP Vision and Kokoon introduced the Koninklijke Philips N.V. (Philips) N7808 sleep headphones, which combine TP Vision's design expertise with Kokoon's sleep science research. These ultra-thin (6mm) earbuds are designed for maximum comfort and feature smart functions, including audio fading, to help you sleep. Users who use the Kokoon App can track their sleep patterns and receive individualized coaching. A trial version of the software offers essential functionality, with a paid membership available for access to additional skills.

-

In September 2023, Bose Corporation introduced the latest additions to its QuietComfort line, the QuietComfort Ultra Headphones, Earbuds, and basic QuietComfort Headphones. These versions maintain the series for outstanding noise cancellation, high-quality music, and unparalleled comfort. Additionally, the QC Ultra variations feature a luxury design and innovative Bose Immersive Audio, further enhancing the audio experience.

-

In March 2023, Bose Corporation introduced the QuietComfort Ultra series, an upgraded version of its recognized wireless headphones and earbuds for music lovers worldwide. The new Ultra series offers advanced spatialized audio, enhanced immersion, improved noise cancellation, and a refined design made of premium materials.

-

In February 2022, Skullcandy, Inc. collaborated with Anheuser-Busch, a brewing company. The limited edition includes Skullcandy, Inc.'s Crusher Evo True Wireless Headphones and Sesh Evo, Dime, and Indy Evo true wireless earbuds, restyled in an appealing exclusive partnership. Both firms' Skullcandy x Budweiser limited-edition contributions are available globally, solely on Skullcandy.com.

Earphones and Headphones Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 71,496.7 million

Revenue forecast in 2030

USD 163,831.2 million

Growth Rate

CAGR of 12.6% from 2023 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, price band, technology, distribution channel, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, U.K., Germany, France, China, India, Japan, Australia, South Korea, Australia, Brazil, Mexico, UAE, Saudi Arabia, South Africa

Key companies profiled

Alclair Audio, Inc., Apple, Inc., Bose Corporation, Grado Labs, JVC Kenwood Corporation, Koninklijke Philips N.V. (Philips), Logitech, Inc. (Including Ultimate Ears, LLC.), Panasonic Corporation, Plantronics, Inc. (Acquired by HP Inc.), Pioneer Corporation, Sennheiser Electronic GmbH & Co. KG (Acquired by Sonova), SAMSUNG (Including Harman International Industries, Incorporated), Shure Incorporated

Skullcandy, Inc. (Acquired by Mill Road Capital), Sony Corporation, Zebronics India Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Earphones and Headphones Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global earphones and headphones market report based on product, price band, technology, distribution channel, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Earphones

-

Headphones

-

-

Price Band Outlook (Revenue, USD Million, 2018 - 2030)

-

<USD 50

-

USD 50-100

-

> USD 100

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Wired

-

ANC

-

Others

-

-

Wireless

-

ANC

-

Bluetooth

-

NFMI

-

Smart headphones

-

Others

-

-

-

Distribution Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Fitness

-

Gaming

-

Virtual Reality

-

Music & Entertainment

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global earphones and headphones market size was estimated at USD 71,496.7 million in 2023 and is expected to reach USD 71,496.7 million by 2024.

b. The global earphones and headphones market is expected to grow at a compound annual growth rate of 12.6% from 2024 to 2030 to reach USD 163,831.2 million by 2030.

b. Asia Pacific dominated the earphones and headphones market with a share of 33.0% in 2022. This is attributable to rising consumer disposable income and the rapidly growing music industry in the region.

b. Some of the key players operating in the earphones and headphones market include Apple, Inc., Bose Corporation, Alclair Audio, Inc., JVC Kenwood Corporation, Panasonic Corporation, Plantronics, Inc., Sennheiser Electronic GmbH & Co. KG (Sennheiser), Logitech, Inc. (Logitech International SA.), Skullcandy, Inc., and Sony Corporation.

b. Key factors that are driving the market growth include consumer preference for enhanced audio experience, rapidly growing music industry, rising internet penetration, and advancements in mobile technology.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.