- Home

- »

- Catalysts & Enzymes

- »

-

Environmental Catalysts Market Size, Industry Report, 2033GVR Report cover

![Environmental Catalysts Market Size, Share & Trends Report]()

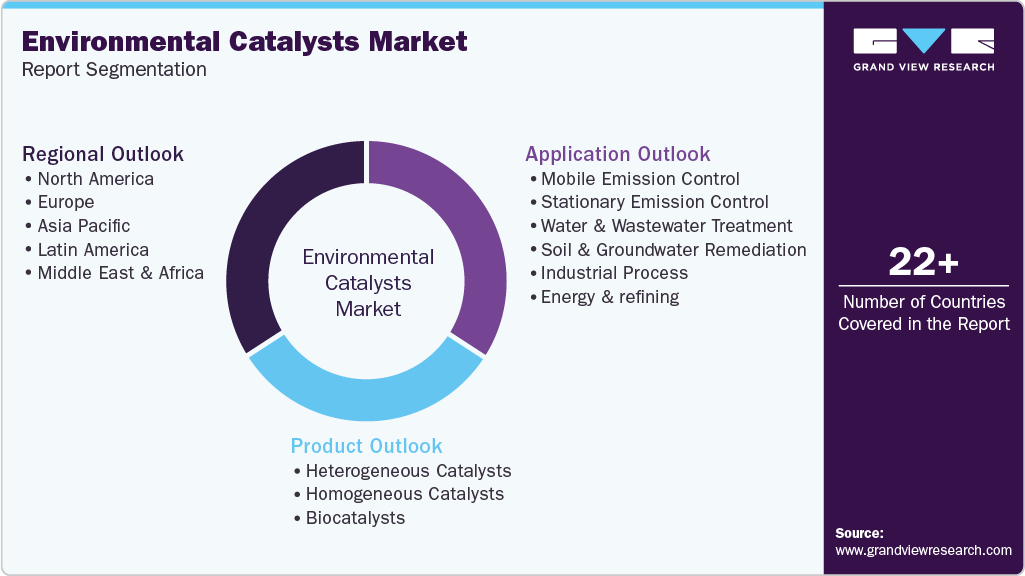

Environmental Catalysts Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Heterogeneous Catalysts, Homogeneous Catalysts, Biocatalysts), By Application (Mobile Emission Control, Stationary Emission Control, Water & Wastewater Treatment), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-818-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Environmental Catalysts Market Summary

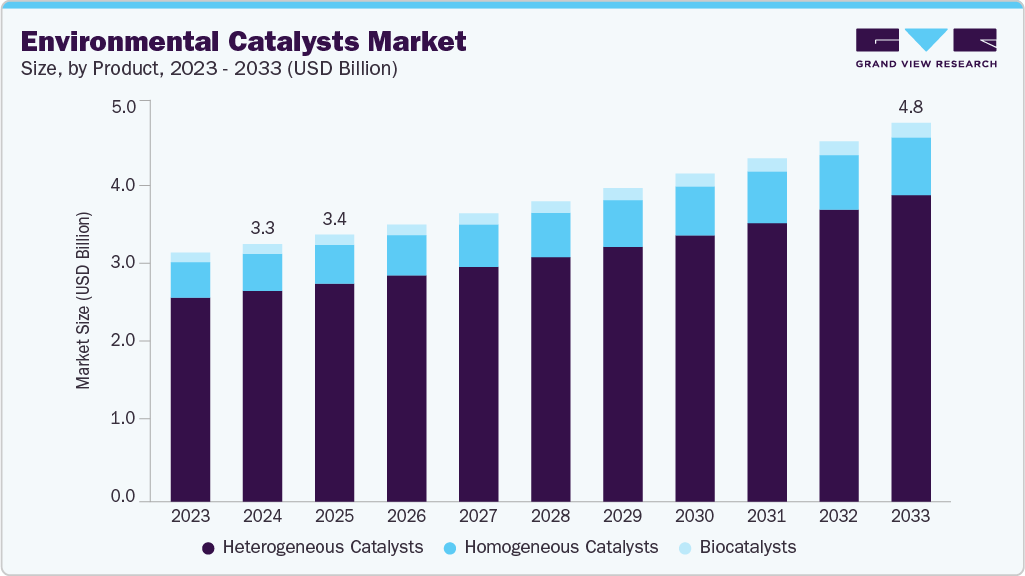

The global environmental catalysts market size was estimated at USD 3,274.6 million in 2024 and is projected to reach USD 4,817.5 million by 2033, growing at a CAGR of 4.5% from 2025 to 2033. Environmental catalysts are gaining strong relevance as industries face stricter emission limits, rising compliance costs, and growing pressure to reduce pollutants from combustion, manufacturing, and wastewater activities.

Key Market Trends & Insights

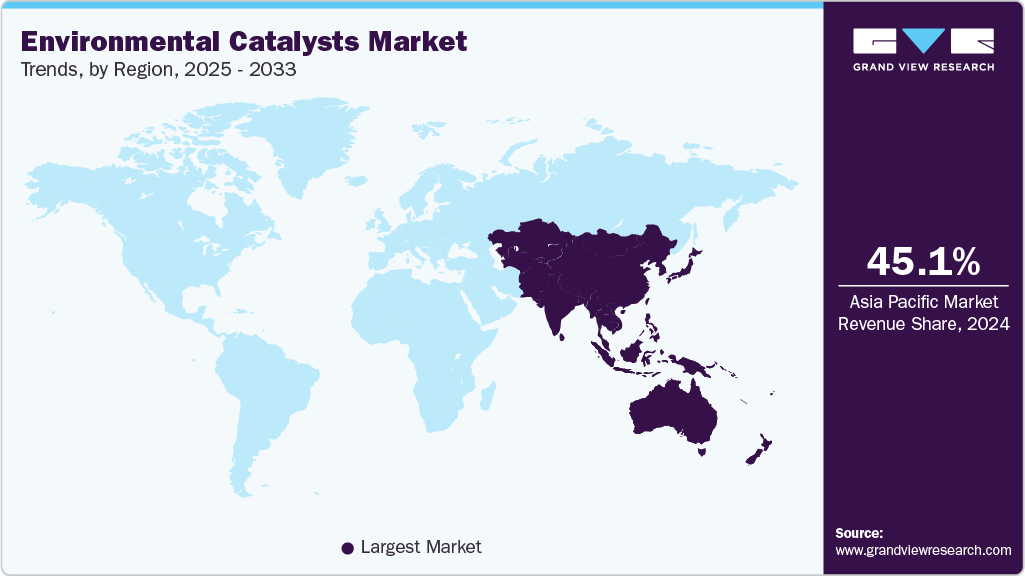

- Asia Pacific dominated the market and accounted for the largest revenue share of 45.1% in 2024.

- Heterogeneous catalysts segment dominated the market and accounted for the largest revenue share of 81.8% in 2024.

- Water & wastewater treatment segment is expected to grow fastest with a CAGR of 5.8% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 3,274.6 Million

- 2033 Projected Market Size: USD 4,817.5 Million

- CAGR (2025-2033): 4.5%

- Largest Region: Asia Pacific

Companies across transportation, chemicals, energy, and municipal services now depend on catalyst systems to maintain stable operations while keeping emissions within acceptable boundaries. A major influence on market growth is the shift toward measurable and enforceable regulatory standards. Facilities are regularly monitored for nitrogen oxides, carbon monoxide, volatile organics, and particulate levels. When readings approach or exceed limits, operators must upgrade or replace catalyst units to avoid fines or forced operational reductions. This creates consistent demand for systems that offer reliable conversion efficiency and longer operating life. In mobile emission control, new engine designs and higher exhaust temperatures require catalysts with stronger thermal durability, which encourages frequent adoption of advanced formulations. In stationary industries, fouling from sulfur, ash, or metals shortens service intervals and increases the need for professional regeneration services, forming a stable secondary segment in the market.

Performance requirements are also rising inside industrial plants. Many facilities are increasing throughput or changing feedstock compositions, which affects pollutant levels and catalyst behavior. As a result, manufacturers develop materials with improved porosity, metal distribution, and surface structure to maintain activity even under inconsistent operating conditions. Photocatalysts and electrocatalysts represent an important extension of this market. Photocatalysts support passive oxidation of pollutants in air and water systems, making them useful in surface coatings, filtration units, and decentralized treatment settings where maintenance must remain low. Electrocatalysts are becoming important due to the growth of hydrogen production, fuel cells, and electrochemical wastewater treatment. Their efficiency and durability directly influence the feasibility of these emerging technologies, linking environmental catalysts to future clean-energy systems.

Regional development patterns further shape the market. Asia Pacific continues to expand refining and chemical capacity, leading to strong demand for catalysts that can handle variable feed quality and high operating loads. Europe emphasizes environmental performance and materials recovery, which pushes companies to adopt catalysts compatible with recycling and long-term sustainability goals. North America concentrates on upgrading existing industrial assets and extending their operational life through catalyst refurbishment. Across all regions, companies are moving beyond simple regulatory compliance and are prioritizing solutions that support operational stability, controlled lifecycle costs, and measurable reductions in environmental impact. These shifts ensure that environmental catalysts remain fundamental to both current industrial processes and emerging clean-energy technologies.

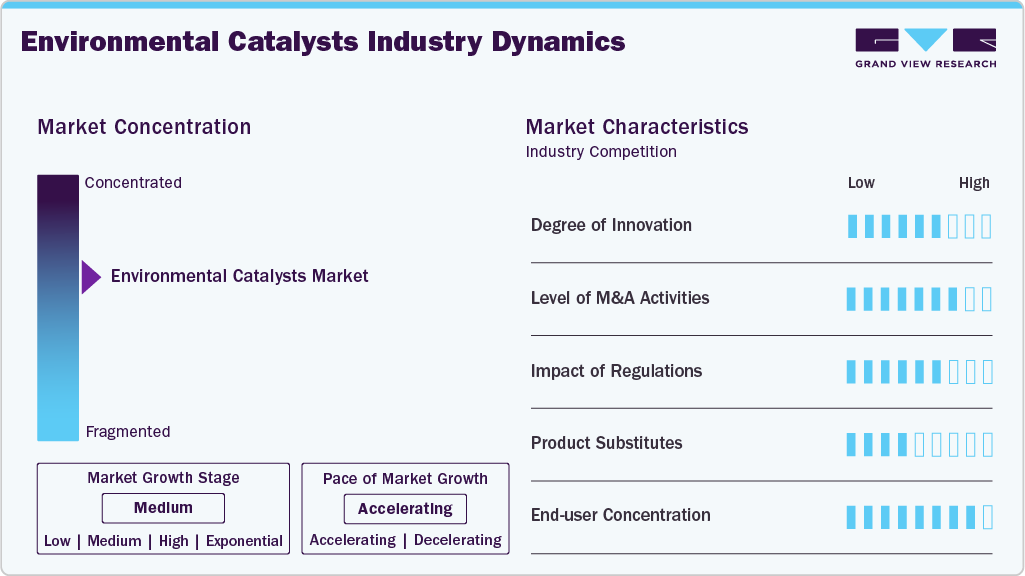

Market Concentration & Characteristics

Market concentration in environmental catalysts reflects the presence of several established manufacturers that hold long-standing relationships with refiners, automakers, chemical processors, and utility operators. These companies benefit from proprietary formulations, metal sourcing agreements, and integrated regeneration or recycling services, which make it difficult for newer entrants to compete on performance consistency and reliability. The need for proven activity, predictable lifetimes, and strict regulatory compliance also reinforces the position of experienced suppliers, as industrial customers rarely risk adopting untested technologies for critical emission-control functions.

The market is characterized by high technical complexity, long qualification cycles, and significant dependence on material science capability. Success depends on the ability to tailor catalysts for distinct operating environments, manage precious-metal usage efficiently, and provide support services that maintain system performance over time. Innovation often emerges through advances in surface engineering, structured supports, and catalytic coatings, while environmental priorities encourage solutions that reduce metal consumption and enable recyclability. Operational stability, durability, and integration with end-use processes remain core expectations across all applications.

Product Insights

The heterogeneous catalysts segment dominated the market and accounted for the largest revenue share of 81.8% in 2024. Heterogeneous catalysts held the largest share because industries that rely on large-scale emission control, refining, and chemical processing prefer solid catalysts with stable activity, easy separation, and long operational lifetimes. These systems can withstand temperature fluctuations, variable feed conditions, and heavy contaminants, making them the most practical choice for continuous industrial use. Their compatibility with structured supports, regeneration services, and recycling networks further strengthens adoption across mobile and stationary applications.

The homogeneous catalysts segment is expected to grow fastest with a CAGR of 5.1% from 2025 to 2033. Homogeneous catalysts are projected to grow fastest as specialized chemical and environmental processes increasingly require high selectivity and precise reaction control. Their ability to operate under milder conditions and enable cleaner conversion pathways supports adoption in advanced wastewater treatment, niche oxidation reactions, and emerging green-chemistry applications. Growth also benefits from research focused on reducing solvent impacts, improving catalyst recovery, and developing ligand systems that enhance efficiency, making them more viable for broader industrial deployment through 2033.

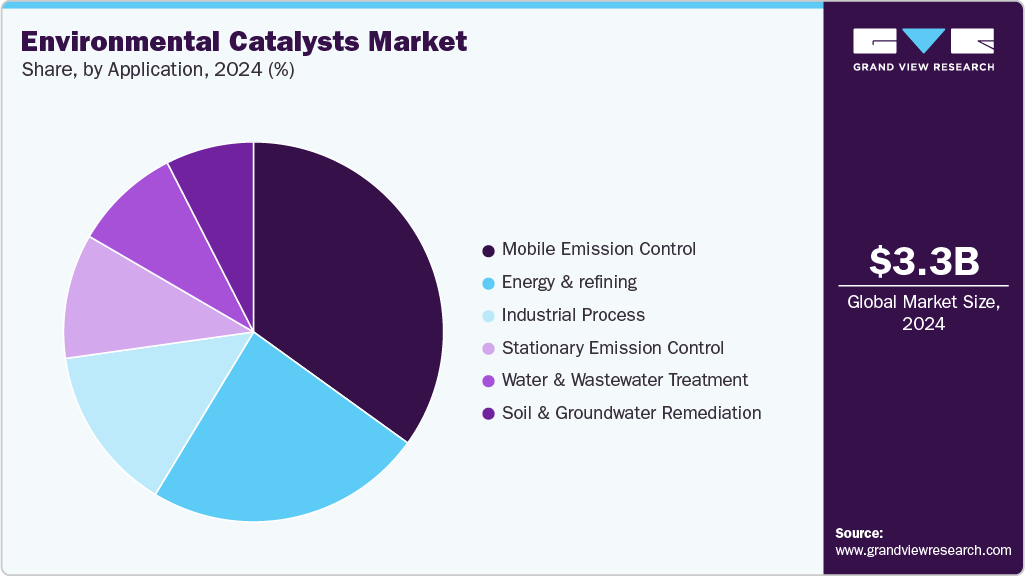

Application Insights

The mobile emission control segment dominated the market and accounted for the largest revenue share of 34.9% in 2024. The mobile emission control segment led the market because regulatory enforcement on vehicle exhaust standards has become increasingly strict across passenger cars, commercial fleets, and off-road machinery. Automakers rely on catalytic converters, diesel oxidation catalysts, SCR systems, and particulate filters to meet real-world driving emission requirements and certification tests. The replacement cycle for aging vehicles, along with the steady expansion of global vehicle fleets, supports continuous demand. Heavy-duty transportation also requires high-performance catalysts capable of functioning under variable loads, high temperatures, and diverse fuel qualities, reinforcing the segment’s dominant share.

The water & wastewater treatment segment is expected to grow fastest with a CAGR of 5.8% from 2025 to 2033. The water and wastewater treatment segment is positioned for the fastest growth as industries and municipalities face rising pressure to remove persistent pollutants, pharmaceuticals, dyes, and organic contaminants that conventional treatment methods cannot fully address. Catalysts used in advanced oxidation processes, electrochemical systems, and photocatalytic reactors offer more efficient degradation pathways and lower chemical consumption. Growing interest in decentralized treatment, zero-liquid-discharge strategies, and stricter discharge permits encourages the adoption of catalytic technologies. Continued progress in photocatalyst stability, electrocatalyst efficiency, and reactor design strengthens their commercial feasibility, supporting rapid expansion through 2033.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of 45.1% in 2024. Asia Pacific held the largest share due to its extensive refining, petrochemical, and manufacturing base, which demands continuous upgrades in emission control and process-efficiency technologies. The region’s dense urban centers and air-quality challenges have pushed governments to enforce stricter particulate, NOx, and VOC limits, prompting strong adoption of catalytic systems across vehicles, power plants, and industrial facilities. Rapid industrial expansion in China, India, and Southeast Asia also increases the need for catalysts capable of handling varied feedstock quality and high operating loads, reinforcing the region’s dominant position.

China held over 48.4% revenue share of the Asia Pacific environmental catalysts market. China’s market expansion is supported by strong national efforts to reduce urban air pollution and modernize manufacturing capacity. Large refining and petrochemical complexes require catalysts that tolerate variable feedstocks and high throughput, while ongoing initiatives such as “Blue Sky Protection” elevate standards for vehicles and industrial boilers. Growing wastewater treatment infrastructure and emerging hydrogen-related industries further increase demand for photocatalysts and electrocatalysts, reflecting China’s shift toward cleaner technologies in both heavy industry and energy systems.

North America Environmental Catalysts Market Trends

North America reflects a combination of regulatory stability and large-scale industrial activity. Refining, chemicals, mining, and metals processing facilities upgrade catalysts to maintain compliance and extend operational life of existing assets. Growth in natural gas power generation and expansion of low-carbon fuel production also influences adoption of specialized catalytic systems. The region’s strong presence in fuel-cell and electrolyzer development supports interest in electrocatalysts, while service-based models for regeneration and recycling remain an important competitive advantage.

U.S. Environmental Catalysts Market Trends

The U.S. market benefits from a mature regulatory framework with clear enforcement mechanisms that require catalytic systems in transportation, refining, chemicals, and power generation. Upgrades in large refineries, expansion of renewable diesel capacity, and stricter state-level air rules, especially in California, drive adoption of advanced catalysts. Industrial operators also prioritize solutions that reduce emissions while improving operational reliability, strengthening demand for both emission-control and process-oriented catalytic technologies across the country.

Europe Environmental Catalysts Market Trends

Europe is expected to grow fastest with a CAGR of 4.8% from 2025 to 2033. Europe is set to grow fastest as the region accelerates its transition toward low-emission industrial systems and circular material use. Environmental policies encourage the adoption of catalysts that support cleaner combustion, energy recovery, and advanced pollution-control processes in chemical manufacturing, waste treatment, and transportation sectors. The region’s strong focus on hydrogen technologies and electrochemical systems further stimulates demand for electrocatalysts and high-performance materials. Investments in sustainability-driven upgrades, combined with stringent compliance verification, create favorable conditions for steady catalyst deployment through 2033.

Latin America Environmental Catalysts Market Trends

Latin America’s catalyst demand is shaped by its energy and resource-driven economy. Major refining networks in Brazil and Mexico rely on catalysts to improve fuel quality and maintain output efficiency, especially as facilities undergo modernization. Urban air-quality concerns in large cities create the need for improved vehicular emission control. Industrial wastewater challenges in mining, pulp and paper, and food processing sectors encourage interest in catalytic oxidation and emerging photocatalytic treatment technologies, supporting gradual market expansion.

Middle East & Africa Environmental Catalysts Market Trends

The Middle East & Africa market is influenced by extensive oil and gas operations that require catalysts for refining, hydroprocessing, and gas treatment. As regional refiners shift toward higher-value products and cleaner fuels, advanced catalyst systems become essential. Air-quality initiatives in Gulf countries also increase demand for emission-control catalysts in industrial and transport applications. In Africa, growth is supported by expanding urban wastewater needs and development of new energy projects, including early-stage hydrogen and electrochemical applications.

Key Environmental Catalysts Company Insights

The two key dominant manufacturers in the market are BASF SE and Johnson Matthey.

-

BASF SE operates with a broad catalyst portfolio that supports emission control, refining, chemical synthesis, and emerging clean-energy applications. Its capabilities span advanced material design, catalytic coatings, and integration of precious-metal management, allowing it to address complex industrial requirements across global markets. BASF’s focus on innovation is reflected in the development of highly durable catalyst structures, improved reaction selectivity, and solutions that optimize fuel quality and process performance. The company continues to expand its role in photocatalytic and electrocatalytic technologies, aligning its strategy with growing demand for cleaner conversion pathways and low-carbon processes.

-

Johnson Matthey is widely known for its advanced emission-control systems and material-science capabilities, supporting automotive, industrial, and energy applications. Its work includes designing catalysts that perform under demanding thermal and chemical conditions while offering stable activity throughout long operating cycles. Johnson Matthey continues to strengthen its position in environmental and energy-transition sectors through research in high-efficiency catalytic coatings, fuel-cell components, and electrocatalysts for hydrogen technologies. Its approach focuses on enhancing performance durability, improving precious-metal utilization, and developing solutions that support cleaner industrial operations and evolving global regulatory standards.

Key Environmental Catalysts Companies:

The following are the leading companies in the environmental catalysts market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Johnson Matthey

- Clariant AG

- Umicore

- Topsoe

- Honeywell

- Albemarle

- Evonik Industries

- Solvay

- W. R. Grace & Co.

Recent Developments

-

In November 2025: BASF Environmental Catalyst and Metal Solutions opened a state-of-the-art Budenheim facility dedicated to producing green hydrogen and fuel cell components, marking a significant expansion of its clean energy manufacturing capabilities and supporting Europe’s growing hydrogen technology demand.

-

In August 2024: BASF introduced its Fourtiva™ FCC catalyst, featuring AIM and MFT technologies to boost butylene yields, enhance octane quality, reduce coke formation, and help refiners improve profitability, flexibility, and carbon efficiency across gasoil and mild-resid feedstock operations.

Environmental Catalysts Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3,394.2 million

Revenue forecast in 2033

USD 4,817.5 million

Growth rate

CAGR of 4.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Brazil; Argentina; Germany; UK; Italy; Spain; France; China; Japan; South Korea; Saudi Arabia; South Africa

Key companies profiled

BASF SE; Johnson Matthey; Clariant AG; Umicore; Topsoe; Honeywell; Albemarle; Evonik Industries; Solvay; W. R. Grace & Co.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Environmental Catalysts Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global environmental catalysts market report based on product, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Heterogeneous Catalysts

-

Homogeneous Catalysts

-

Biocatalysts

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Mobile Emission Control

-

Stationary Emission Control

-

Water & Wastewater Treatment

-

Soil & Groundwater Remediation

-

Industrial Process

-

Energy and refining

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Latin America

-

Brazil

-

Argentina

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global environmental catalysts market size was estimated at USD 3,274.6 million in 2024 and is expected to reach USD 3,394.2 million in 2025.

b. The environmental catalysts market is expected to grow at a compound annual growth rate of 4.5% from 2025 to 2033, reaching USD 4,817.5 million by 2033.

b. The heterogeneous catalysts segment accounted for the largest share, as industries rely on solid catalysts that offer strong durability, stable activity, and easier handling in high-temperature and high-throughput environments. Their widespread use in emission control, refining, and industrial processing supports their dominant position in the market.

b. Some of the key players operating in the environmental catalysts Market include BASF SE, Johnson Matthey, Clariant AG, Umicore, Topsoe, Honeywell, Albemarle, Evonik Industries, Solvay, W. R. Grace & Co.

b. Growth in the environmental catalysts market is driven by stricter emission regulations, rising demand for cleaner industrial processes, adoption of advanced treatment systems in water and air applications, expansion of refining capacity, and increasing use of photocatalysts and electrocatalysts in emerging clean-energy and pollution-control technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.