- Home

- »

- Next Generation Technologies

- »

-

Europe Military Drone Market Size, Industry Report, 2030GVR Report cover

![Europe Military Drone Market Size, Share & Trends Report]()

Europe Military Drone Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Fixed-wing, Rotary Blade, Hybrid), By Operation Mode, By Range, By Application, By Maximum Take-off Weight, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-822-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Military Drone Market Summary

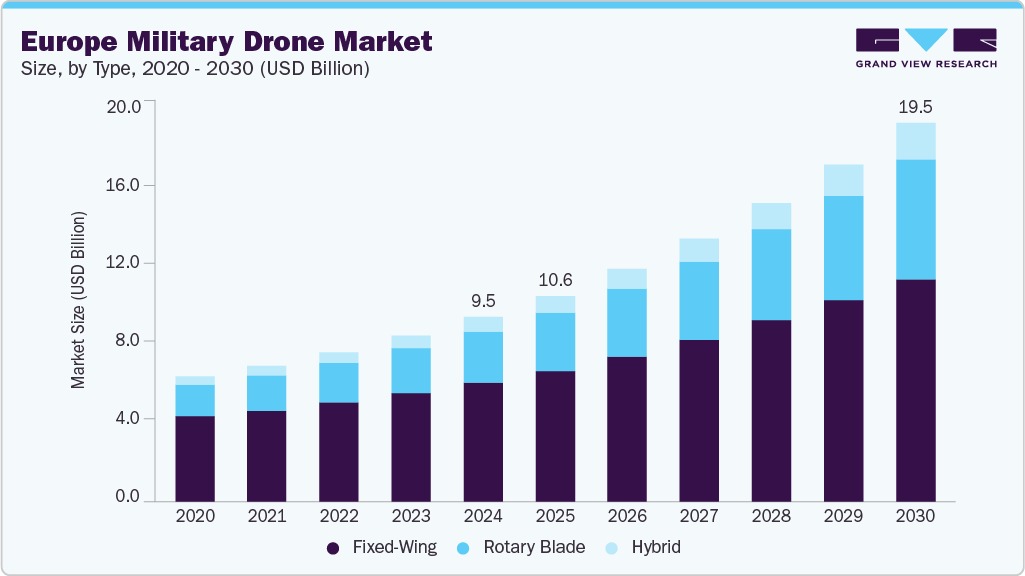

The Europe military drone market size was estimated at USD 9,468.7 million in 2024 and is projected to reach USD 19,462.2 million by 2030, growing at a CAGR of 12.9% from 2025 to 2030. Rising geopolitical tensions, defense modernization, and strong government investments across the region drive the market growth. The sustained funding and procurement for joint drone development, substantial grants for UAV research and innovation, streamlined defense procurement processes, and increased venture capital investment are key factors driving the growth of the Europe military drone industry.

Additionally, the heightened demand for advanced Intelligence, Surveillance, and Reconnaissance (ISR) capabilities against evolving security threats, as well as the growing need to reduce human risk in combat scenarios, through the use of autonomous systems. Technological advancements, such as enhanced imaging sensors, precision-guided munitions, and the integration of Artificial Intelligence (AI) in drone platforms, are significantly improving operational efficacy and market adoption. These combined factors create a dynamic and expanding market landscape for the Europe military drone industry.

Furthermore, the increasing deployment of drone swarms, hybrid drone technology combining fixed-wing and rotary capabilities for extended versatility, and integrated Counter-Unmanned Aerial Systems (C-UAS) to mitigate drone threats. Moreover, European forces are investing heavily in domestic drone manufacturing to enhance strategic autonomy from non-European suppliers, alongside boosted collaborations between defense entities and startups to accelerate innovation. Such factors are expected to drive the military drone industry in coming years.

Moreover, key players are supported by government funding, streamlined procurement, and venture capital inflows. Cross-national drone training centers and airspace integration trials contribute to improving interoperability and readiness, reinforcing Europe's expanding military drone capabilities into the coming years, thereby driving the Europe military drone industry expansion.

Type Insights

The fixed-wing segment dominated the Europe military drone market with a share of over 64.0% in 2024, driven by the demand for long-endurance and high-speed unmanned aerial vehicles capable of covering extensive operational areas. Owing to their aerodynamic efficiency, fixed-wing drones are preferred for intelligence, surveillance, and reconnaissance (ISR) missions and extended patrol operations. Their capability to carry substantial payloads and operate at higher altitudes suits strategic military applications, including cross-border monitoring and maritime surveillance, primarily serving air force and naval operations requiring persistent situational awareness and rapid response.

The hybrid segment is expected to register the fastest CAGR of over 17.0% from 2025 to 2030, owing to its operational versatility, which includes both vertical takeoff and landing (VTOL) and long-range flight capabilities. These drones can operate in complex terrain or confined spaces otherwise inaccessible to conventional fixed-wing designs, supporting diverse tactical missions such as close-range ISR, logistics, and supply. The hybrid design meets demand from air forces and naval units for drones capable of rapid deployment and flexibility in multi-domain operations, enhancing operational reach while maintaining portability and endurance.

Operation Mode Insights

The remotely piloted segment dominated the Europe military drone industry in 2024, driven by mature command-and-control infrastructure and human-in-the-loop engagement requirements essential for high-stakes military operations. Due to stringent regulatory environments and the need for reliable real-time decision-making capabilities, remotely piloted UAVs are particularly suited for ISR and precision strike missions under direct human supervision. This segment supports both air force and naval operations with demonstrated reliability, particularly in scenarios that require complex coordination and validated engagement protocols.

The fully autonomous segment is expected to register the fastest CAGR from 2025 to 2030, propelled by advancements in AI, machine learning, and sensor fusion technologies. Due to growing confidence in autonomous navigation and decision-making, military forces are increasingly employing these systems for beyond visual line of sight (BVLOS) and extended visual line of sight (EVLOS) operations, which exceed the limits of direct human control. Fully autonomous drones enable scalable swarm tactics, persistent ISR, and logistics missions in contested environments, reducing personnel risk and expanding operational tempo across air force and naval theaters.

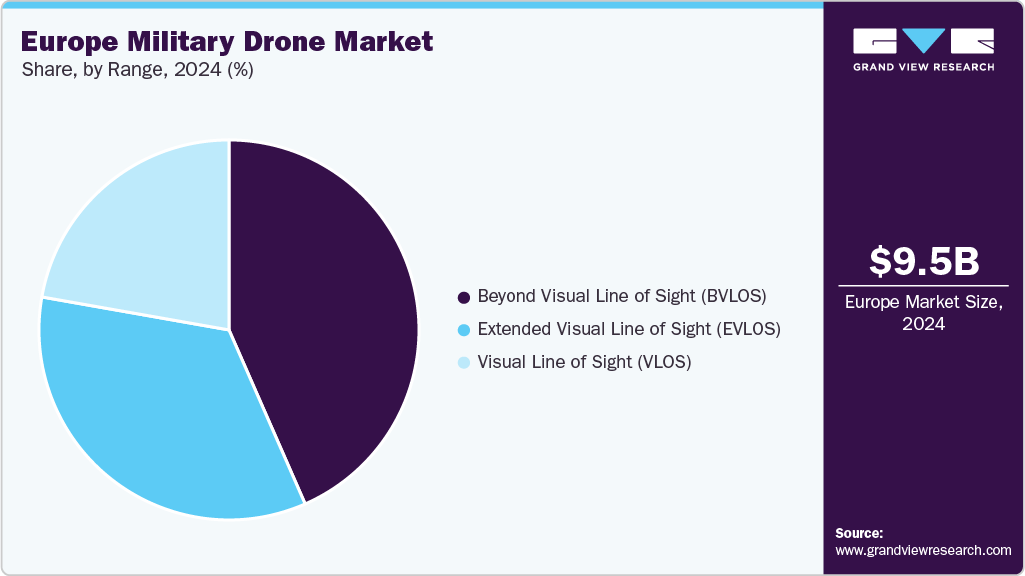

Range Insights

The beyond visual line of sight (BVLOS) segment dominated the market in 2024, driven by the increasing demand for deep-penetration reconnaissance missions, long-endurance surveillance over hostile terrains, and precision strike capabilities that extend beyond the operator’s visual range. Advancements in SATCOM, encrypted data links, and autonomous flight control systems are enabling drones to maintain secure, uninterrupted operations across vast distances. Defense modernization programs are further emphasizing BVLOS capabilities to support real-time intelligence gathering, electronic warfare, and resupply missions in denied environments.

The extended visual line of sight (EVLOS) segment is expected to register a significant CAGR from 2025 to 2030. The growing need for enhanced operational safety and situational awareness, enabling pilots to control drones over extended distances via trained observers, is critical for frontline ISR and tactical logistics, driving the market. Further impetus comes from the integration of real-time video feeds and AI-powered detect-and-avoid systems, which extend effective control ranges, alongside the rising adoption of drone swarming and coordinated missions where maintaining visual links remains essential. The launch of EVLOS operations marks a significant step toward broader regulatory acceptance of extended-range visual line-of-sight drone operations, thereby expanding commercial and industrial use cases in the market.

Application Insights

The intelligence, surveillance, and reconnaissance (ISR) segment dominated the Europe military drone market in 2024, driven by the necessity for comprehensive battlefield awareness and real-time intelligence integration to support tactical and strategic decisions. Due to evolving security threats, ISR drones equipped with advanced sensors provide enhanced situational awareness to air force and naval commanders.

The logistics & supply segment is expected to register the fastest CAGR from 2025 to 2030, propelled by the use of drones to transport critical materials and equipment in contested or remote areas, minimizing supply chain vulnerabilities and supporting expeditionary forces and naval operations. Defense modernization programs in Europe are also accelerating the adoption of autonomous aerial cargo systems.

Maximum Take-off Weight Insights

The 150-1000 kg dominated the market in 2024, driven by demand for tactical UAVs capable of versatile mission profiles offering a balance between payload capacity, endurance, and portability. Due to their mid-sized payload capabilities, these drones are favored by air forces and navies for multi-role intelligence, surveillance, and reconnaissance (ISR) missions, target acquisition, and light strike operations. Their operational flexibility allows deployment in a wide array of tactical scenarios, including battlefield surveillance, artillery spotting, and coastal monitoring, making them essential assets in modern military arsenals.

The >1000 kg segment is expected to register the fastest CAGR from 2025 to 2030, supported by a clear shift toward heavier, mission-capable UAVs for long-range logistics, extended surveillance, and armed reconnaissance. Defense agencies are increasingly prioritizing large drones for endurance-heavy missions, higher payload delivery, and seamless integration within manned-unmanned teaming frameworks. This transition toward heavier, more interoperable platforms is emerging as a key modernization trend across air and naval forces.

End Use Insights

The air force segment dominated the market in 2024, driven by a strategic emphasis on modernizing aerial combat and reconnaissance capabilities through the use of drones. This is due to the increasing demand for autonomous and remotely piloted systems to extend operational reach and reduce pilot risk in contested airspaces. Advanced ISR (intelligence, surveillance, and reconnaissance) capabilities, combined with the integration of AI for enhanced decision-making and precision targeting, have accelerated the adoption of these capabilities among the air forces of leading European countries.

The navy segment is expected to register the fastest CAGR from 2025 to 2030, owing to the rising need for maritime domain awareness, anti-submarine warfare support, and logistical resupply missions using drones to enhance fleet capabilities and operational flexibility. Additionally, they enable logistical resupply missions to naval fleets, particularly in disputed or remote maritime zones. This growth is fueled by increasing naval modernization budgets and strategic focus on protecting sea lanes and national waters, driving demand for UAVs that enhance fleet capabilities and operational flexibility in dynamic maritime environments.

Regional Insights

The UK military drone market dominated the market with a share of over 23.0% in 2024, driven by the government’s strategic focus on autonomous defense technologies and the modernization of its armed forces with advanced UAVs. Increasing investment in AI-driven drone systems and indigenous defense capabilities is boosting domestic development. The emphasis on real-time battlefield intelligence and enhanced situational awareness fuels demand for high-performance drones.

The military drone market in Germany is expected to grow at a significant CAGR from 2025 to 2030, driven by the government’s strategic focus on autonomous defense technologies and modernizing armed forces with advanced UAVs. Increasing investment in AI-driven drone systems and indigenous defense capabilities is boosting domestic development. The emphasis on real-time battlefield intelligence and enhanced situational awareness fuels demand for high-performance drones.

The France military drone market is expected to grow at the fastest CAGR of around 14.0% from 2025 to 2030, driven by increasing defense modernization programs and a growing emphasis on autonomous and surveillance technologies. This rapid growth is driven by the country's strategic focus on enhancing intelligence, surveillance, and reconnaissance (ISR) capabilities amidst heightened geopolitical tensions and security challenges.

Key Europe Military Drone Company Insights

Some of the key players operating in the market include BAE Systems PLC and Thales Group.

-

BAE Systems PLC offers a broad portfolio of unmanned air systems, including high-altitude platforms like FalconWorks’ PHASA-35 for long-endurance ISR and communications relay missions. BAE Systems is recognized for its expertise in autonomous systems and low-observable stealth drones, exemplified by the Taranis UCAV demonstrator, which focuses on integrating autonomous missions.

-

Thales Group is a multinational defense company, at the forefront of intelligent drone systems innovation in Europe. The company develops a wide range of drone technologies, from ISR mini-drones with advanced electronic warfare payloads to the Toutatis family of AI-augmented loitering munitions capable of precision strikes with minimal collateral damage. The company is pioneering scalable, interoperable drone swarms equipped with secure communications and cyber-resilient architectures, suitable for multinational coalition deployments including NATO and EU missions.

Turkish Aerospace Industries and Baykar are some of the emerging participants in the Europe military drone market.

-

Turkish Aerospace Industries (TAI) is Turkey’s premier aerospace and defense technology company, which specializes in the design, development, modernization, manufacturing, and integration of aerospace systems, including fixed-wing and rotary aircraft, unmanned aerial vehicles (UAVs), satellites, and space systems. With a modern production facility spanning 150,000 square meters, TAI is involved in several advanced projects, including the KAAN fifth-generation stealth fighter, the Anka-3 jet-powered stealth UCAV, and the Hürjet advanced jet trainer.

-

Baykar is a leading Turkish defense and aerospace company specializing in the design, development, and production of unmanned aerial vehicles (UAVs) and autonomous systems, contributing significantly to Turkey’s drone capabilities. Known for its flagship Bayraktar TB2 tactical UAV, which has seen widespread operational use and export success, Baykar continues to innovate with advanced combat drones and swarm technologies.

Key Europe Military Drone Companies:

- BAE Systems plc

- Thales Group

- Leonardo S.p.A.

- Baykar

- Airbus SE

- Israel Aerospace Industries Ltd.

- Elbit Systems Ltd.

- Turkish Aerospace Industries

- Saab AB

- Parrot Drones SAS

Recent Developments

-

In November 2025, BAE Systems PLC signed a Memorandum of Understanding (MoU) with Turkish Aerospace Industries (TAI) to explore the joint development of advanced uncrewed air systems (UAS). The goal is to merge UK combat air integration expertise with Turkish drone manufacturing for next-generation joint drones for NATO and other allied fleets.

-

In November 2025, Thales Group showcased its advanced intelligent drone systems at the Dubai Airshow, highlighting significant innovations in both military and civil domains. Thales’ latest offerings range from ISR mini-drones equipped with high-performance optronic and electronic warfare payloads to the Toutatis family of loitering munitions, powered by trusted AI, which enables rapid engagement of time-sensitive targets with one-meter precision while keeping human operators in control of engagement decisions.

-

In October 2025, Israel Aerospace Industries (IAI) announced a new generation Counter-Unmanned Aerial Systems (C-UAS) Swarm solution designed to detect, identify, disrupt, and intercept swarms of drones.

Europe Military Drone Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10,587.7 million

Revenue forecast in 2030

USD 19,462.2 million

Growth rate

CAGR of 12.9% from 2025 to 2030

Base Year of estimation

2024

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, operation mode, range, application, maximum take-off weight, end use, and region

Regional scope

Europe

Country scope

Germany; UK; France

Key companies profiled

BAE Systems plc; Thales Group; Leonardo S.p.A.; Baykar; Airbus SE; Israel Aerospace Industries Ltd.; Elbit Systems Ltd.; Turkish Aerospace Industries; Saab AB; Parrot Drones SAS

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Europe Military Drone Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe military drone market report based on type, operation mode, range, application, maximum take-off weight, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Fixed-Wing

-

Rotary Blade

-

Hybrid

-

-

Operation Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Remotely Piloted

-

Partially Autonomous

-

Fully Autonomous

-

-

Range Outlook (Revenue, USD Million, 2018 - 2030)

-

Visual Line of Sight (VLOS)

-

Extended Visual Line of Sight (EVLOS)

-

Beyond Visual Line of Sight (BVLOS)

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Intelligence, Surveillance and Reconnaissance (ISR)

-

Logistics & Supply

-

Others

-

-

Maximum Take-off Weight Outlook (Revenue, USD Million, 2018 - 2030)

-

<150 Kg

-

150-1000 Kg

-

>1000 Kg

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Air Force

-

Army

-

Navy

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Germany

-

UK

-

France

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.