- Home

- »

- Consumer F&B

- »

-

Europe Snacks Vending Machine Market Size Report, 2033GVR Report cover

![Europe Snacks Vending Machine Market Size, Share & Trends Report]()

Europe Snacks Vending Machine Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Frozen & Refrigerated, Fruit Snacks), By Type (Smart Vending Machine, Traditional Vending Machine), By Application, By Payment Mode, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-815-8

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Snacks Vending Machine Market Summary

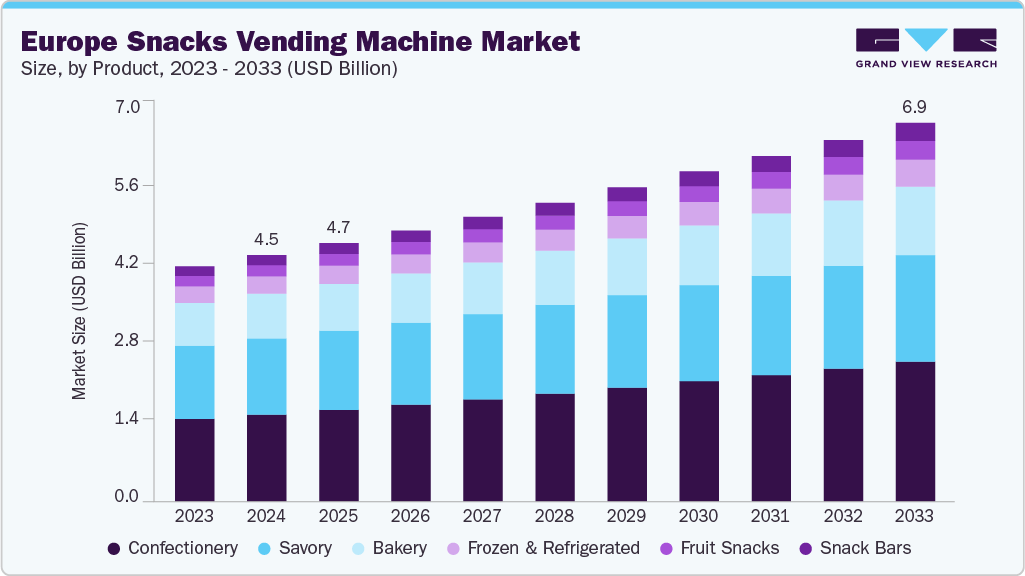

The Europe snacks vending machine market size was estimated at USD 4.53 billion in 2024 and is expected reach USD 6.97 billion by 2033, growing at a CAGR of 4.9% from 2025 to 2033. The growth can be attributed to rising demand for on-the-go snacks, rising health awareness, technological advancements in vending machines, a growing variety of snack options, and the expansion of vending machine networks in public and private spaces.

Key Market Trends & Insights

- Germany held the largest share of the Europe snacks vending machine market in 2024, accounting for 24.95%.

- The Italy snacks vending machine market is experiencing significant growth, projecting a CAGR of 6.8% from 2025 to 2033.

- By product, the confectionery snacks vending machine held the largest share of 36.26% in 2024.

- By type, the smart snacks vending machine is experiencing significant growth, projecting a CAGR of 6.4% from 2025 to 2033.

- By application, the offices segment held the largest market share of 42.19% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.53 Billion

- 2033 Projected Market Size: USD 6.97 Billion

- CAGR (2025-2033): 4.9%

- Germany: Largest Market in 2024

- Italy: Fastest Growing Market

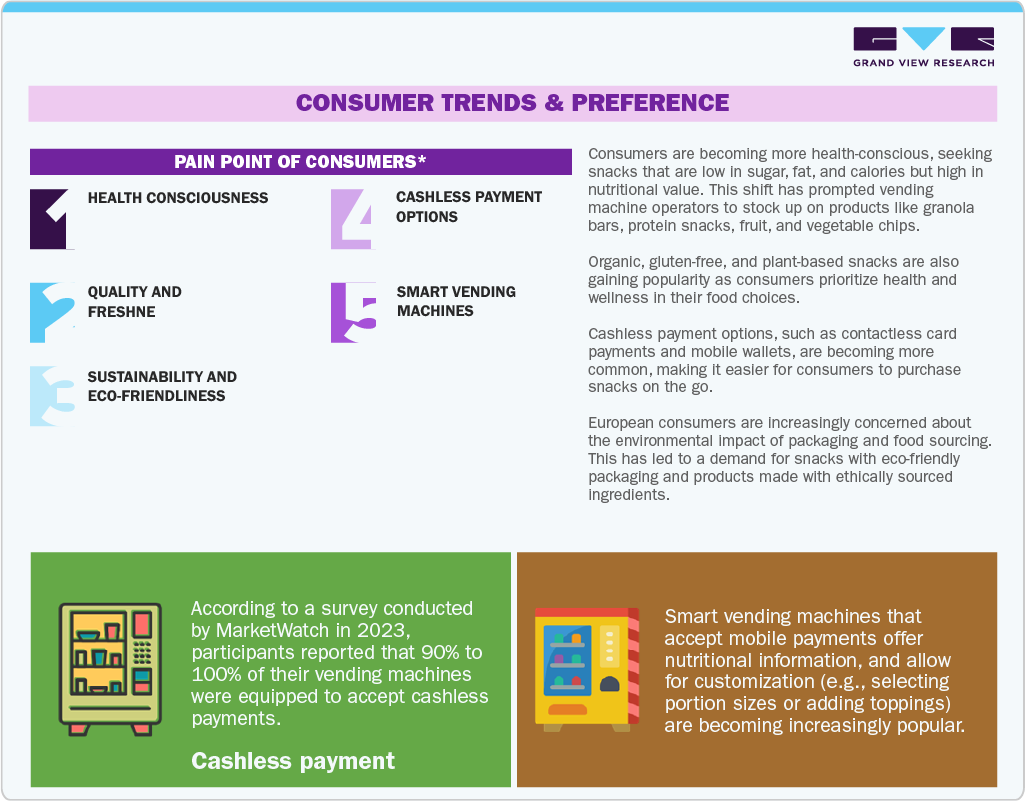

Advancements in vending machine technology are significantly reshaping the landscape of the Europe snacks vending machine industry, particularly through the integration of smart features that enhance both consumer experience and operational efficiency. One of the most notable developments is the widespread adoption of cashless payment systems. For example, machines like those from Cantaloupe Systems enable customers to make purchases using debit cards, credit cards, mobile wallets such as Apple Pay and Google Pay, as well as other non-cash payment methods.This streamlines the transaction process and caters to the growing preference for contactless payments. As a result, vending machines equipped with these technologies are not only more appealing to consumers but also more profitable for operators. The convenience of cashless transactions eliminates the need for physical cash, making it easier for consumers to quickly purchase snacks without any hassle.

The trend toward healthier snacking is reshaping the Europe snack vending machine market. As consumers become increasingly health-conscious, they are shifting away from traditional, high-calorie, and processed snack options, such as chips and candy bars, in favor of healthier alternatives that align with their wellness goals. This shift has prompted vending machine operators to diversify their offerings, introducing a range of healthier alternatives that cater to the demands of modern, health-conscious consumers.

One of the key changes is the inclusion of organic and natural snacks. Organic fruit bars, whole-grain crackers, and nut-based snacks are gaining popularity as they cater to consumers seeking minimally processed foods free from artificial additives. Brands like Nakd and Eat Natural, for example, offer fruit and nut bars that are both satisfying and nutritious. These products appeal to consumers who prioritize clean labels and prefer snacks that are free from preservatives, artificial colors, and genetically modified ingredients.

Consumer Insights for Europe Snacks Vending Machine

Product Insights

Confectionery snacks led the Europe snacks vending machine industry, accounting for the largest revenue share of 35.26% in 2024. Confectionery snacks remain a key driver in the European vending machine market, largely due to their indulgent nature. The desire for sweet treats, particularly during breaks or leisure moments, fuels the demand for chocolate bars, gummies, and other sugary delights. Seasonal promotions and limited-edition flavors also create excitement and encourage impulse purchases, making confectionery items a popular choice in vending environments.

The snack bars segment is projected to grow at the fastest CAGR of 6.8% from 2025 to 2033. The snack bars are rapidly gaining popularity in the European vending machine market, driven by the demand for convenient, on-the-go nutrition. As consumers increasingly seek healthier alternatives, protein bars, granola bars, and meal replacement bars have become essential vending machine staples. The emphasis on fitness and wellness has led to an explosion of innovative snack bars that cater to various dietary preferences, including vegan, gluten-free, and low-carb options, thereby enhancing their appeal.

Type Insights

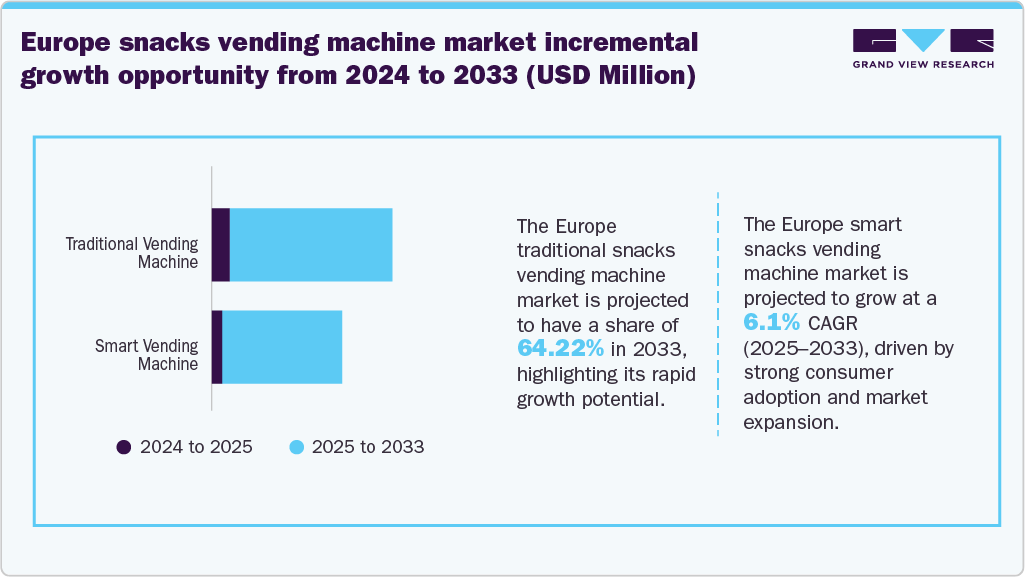

Traditional snack vending machines led the Europe snack vending machine market, accounting for the largest revenue share of 67.81% in 2024. A notable factor driving their demand is the established familiarity and reliability associated with these machines. Many consumers are accustomed to the straightforward process of selecting items and making cash or card payments, which appeals to those who prefer simplicity and speed. Traditional machines are often viewed as cost-effective solutions for operators, as they require less upfront investment compared to their high-tech counterparts.

The smart snacks vending machine segment is projected to grow at the fastest CAGR of 6.1% from 2025 to 2033. The demand for smart vending machines in Europe is significantly fueled by technological advancements that enhance consumer experience. These machines, equipped with touch screens, cashless payment systems, and real-time inventory tracking, cater to the growing preference for convenience and efficiency among consumers. Shoppers appreciate the ability to make quick transactions using mobile wallets or contactless cards, which aligns with the broader trend of digital payment solutions gaining traction in everyday purchases.

Application Insights

Snacks vending machines in offices accounted for the largest revenue share of 42.19% in 2024. In offices, the demand for snack vending machines is primarily driven by the need for convenient snacking solutions during work hours. Employees often seek quick, easy access to refreshments without taking extended breaks, making vending machines a practical option. Offering a variety of snacks, ranging from healthy choices like nuts and granola bars to traditional treats like chips and candy, helps cater to different dietary preferences and boosts employee morale.

The snack vending machine market in commercial places is projected to grow at the fastest CAGR of 4.9% from 2025 to 2033. In commercial spaces, the demand for snack vending machines is significantly driven by the need for convenience and quick access to food options for employees and customers alike. With busy schedules and fast-paced environments, individuals appreciate the convenience of being able to grab snacks or beverages on the go without having to leave the premises. This convenience can enhance overall productivity and satisfaction, making vending machines an attractive addition to retail stores, shopping malls, and entertainment venues.

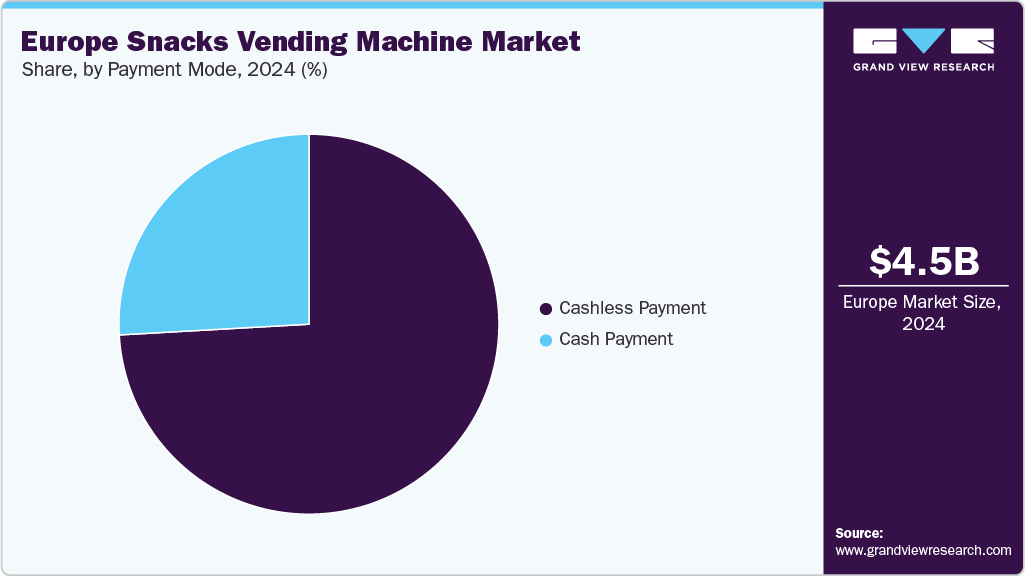

Payment mode Insights

Cashless payment for snacks vending machines led the Europe snacks vending machine industry with the largest revenue share of 74.08% in 2024. The rise of cashless payment options is significantly transforming the snacks vending machine market in Europe. The increasing prevalence of mobile wallets, contactless cards, and digital payment platforms reflects a broader trend towards cashless transactions among consumers. European shoppers are increasingly appreciating the convenience of quickly paying for snacks without needing to carry cash, making cashless payment options highly desirable in vending machines.

Cash payment for snack vending machines is projected to grow at a significant CAGR of 2.2% from 2025 to 2033. The demand for snack vending machines that accept cash payments remains significant in Europe, particularly among certain consumer demographics and in specific locations. Many people, especially older generations and those in rural areas, still prefer using cash for transactions due to its familiarity and perceived security. Vending machines that accept cash cater to these consumers, ensuring they have access to snacks without the need for electronic payment methods.

Country Insights

Germany led the Europe snacks vending machine market in 2024, holding the largest revenue share of 24.95%. The snacks vending machine market in Germany is driven by factors such as high urbanization, a strong focus on workplace convenience, and a culture that values efficient, self-service solutions. With a growing number of office spaces, educational institutions, and public areas adopting vending machines, the demand for snack vending machines has steadily increased. German consumers appreciate the accessibility of snacks during work breaks and commutes, making vending machines a common sight in transportation hubs, office buildings, and universities.

The Italy snacks vending machine market is projected to expand at the fastest CAGR of 6.8% from 2025 to 2033. Italy's market is shaped by a strong café culture and a high consumption of quick snacks, especially coffee and pastries. Italians often grab snacks during work or on the go, making vending machines a convenient option, particularly in offices, train stations, and shopping centers. Vending machines offering snacks and beverages have gained traction as they cater to the fast-paced lifestyle of professionals and travelers.

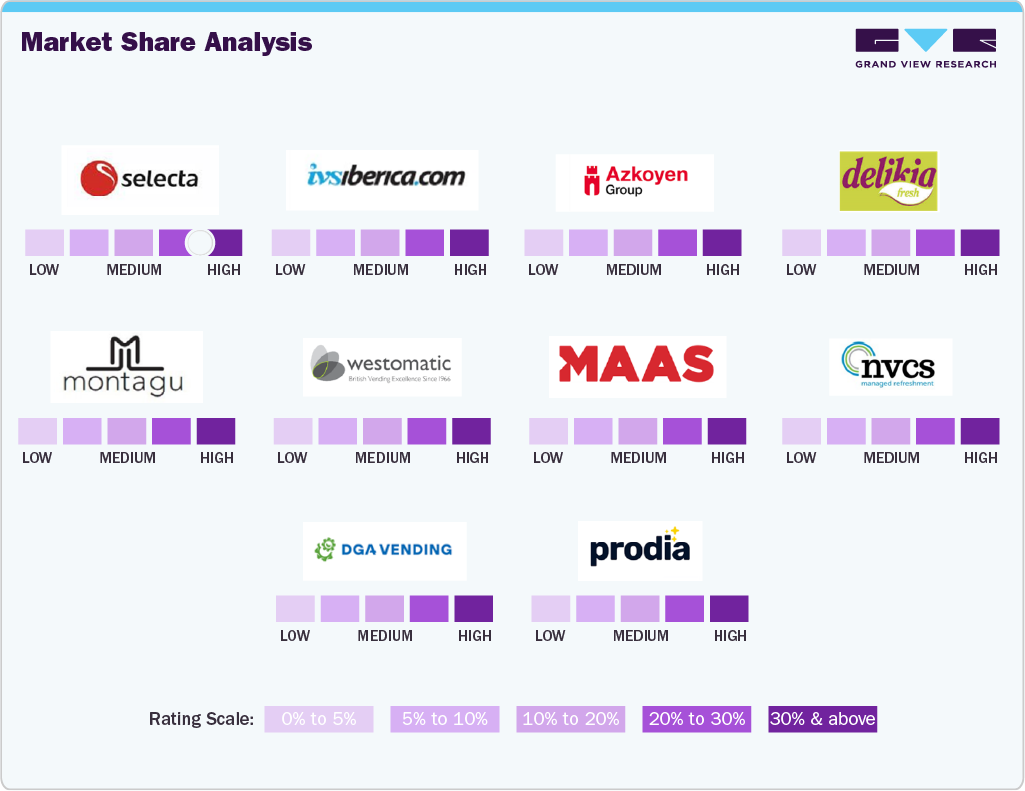

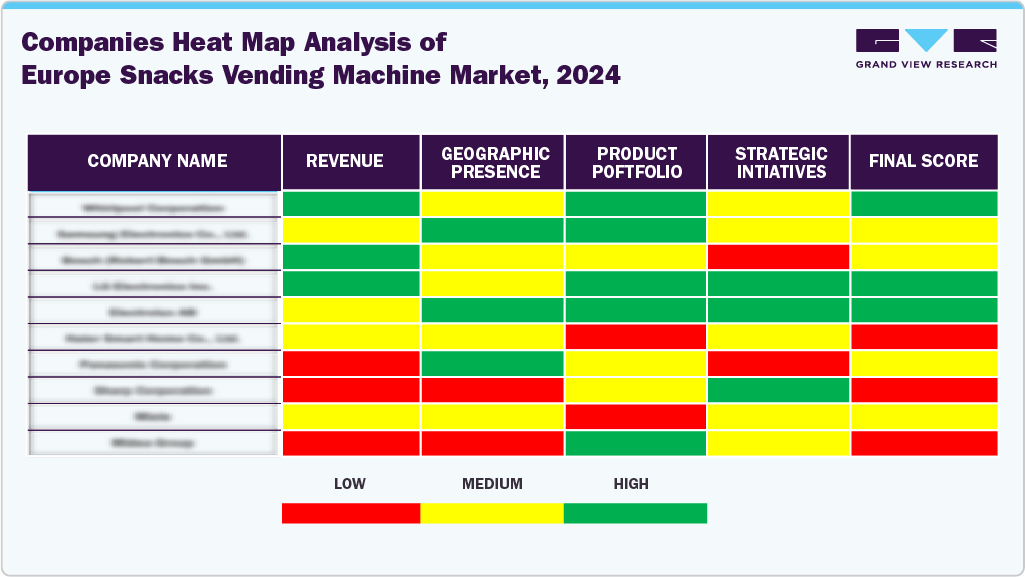

Key Europe Snacks Vending Machine Company Insights

The competitive landscape of the Europe snacks vending machine market is characterized by consolidation among large operators, rapid product innovation by equipment manufacturers, and intensifying competition on digital capabilities and route-to-market partnerships. Market leadership has been consolidated by European operators that combine fleet scale with service contracts, which have been used to secure hospitality and workplace channels, achieving distribution density that smaller operators struggle to replicate. Manufacturers and OEMs have been differentiated through R&D, product modularity, and value-added features such as temperature control and cashless/IoT integrations.

Key Europe Snacks Vending Machine Companies:

- Selecta Group

- IVS Iberica

- Azkoyen Group

- Delikia Fresh

- Montagu Group Limited (The Vending People)

- Westomatic Vending Services Ltd.

- Maas

- NVCS Ltd

- DGA Vending GmbH

- Prodia+

Recent Developments

-

In March 2024, Selecta Group announced a strategic partnership with TINE to develop food and beverage solutions in Norway. The long-term partnership aims to develop a sustainable development model in the vending market.

-

In November 2023, Selecta Group introduced crypto payments to food vending machines throughout Europe through integration with Solana Pay, a blockchain payment solution. The company aims to offer a high level of user experience through modern blockchain-based payment.

Europe Snacks Vending Machine Market Report Scope

Report Attribute

Details

Market value size in 2025

USD 4.75 billion

Revenue forecast in 2033

USD 6.97 billion

Growth rate

CAGR of 4.9% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, application, payment mode, country

Regional Scope

Europe

Country scope

Germany; UK; France; Italy; Switzerland; Poland; Portugal; Netherlands; Spain; Romania; Russia; Belgium

Key companies profiled

Selecta Group; IVS Iberica; Azkoyen Group; Delikia Fresh; Montagu Group Limited (The Vending People); Westomatic Vending Services Ltd.; Maas; NVCS Ltd; DGA Vending GmbH; Prodia+

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Snacks Vending Machine Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Europe snacks vending machine market report based on product, type, application, distribution channel, and country:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Frozen & Refrigerated

-

Fruit Snacks

-

Bakery

-

Savory

-

Confectionery

-

Snack Bars

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Smart Vending Machine

-

Traditional Vending Machine

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial Places

-

Offices

-

Public places

-

Others

-

-

Payment Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

Cash Payment

-

Cashless Payment

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Germany

-

UK

-

France

-

Italy

-

Switzerland

-

Poland

-

Portugal

-

Netherlands

-

Spain

-

Romania

-

Russia

-

Belgium

-

Frequently Asked Questions About This Report

b. The Europe snacks vending machine market size was estimated at USD 4.53 billion in 2024 and is expected to reach USD 4.75 billion in 2025.

b. The Europe snacks vending machine market is expected to grow at a compound annual growth rate of 4.9% from 2025 to 2033 to reach USD 6.97 billion by 2033.

b. Confectionery snacks led the Europe snacks vending machine industry, accounting for the largest revenue share of 35.26% in 2024. Confectionery snacks remain a key driver in the European vending machine market, largely due to their indulgent nature.

b. Selecta Group; IVS Iberica; Azkoyen Group; Delikia Fresh; Montagu Group Limited (The Vending People); Westomatic Vending Services Ltd.; Maas; NVCS Ltd; DGA Vending GmbH; Prodia+

b. The growth can be attributed to rising demand for on-the-go snacks, rising health awareness, technological advancements in vending machines, a growing variety of snack options, and the expansion of vending machine networks in public and private spaces.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.