- Home

- »

- Beauty & Personal Care

- »

-

Facial Serum Market Size And Share, Industry Report, 2030GVR Report cover

![Facial Serum Market Size, Share & Trends Report]()

Facial Serum Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Anti-Aging Serums, Skin Brightening Serums, Acne Fighting Serums), By Form (Water Based Serum, Oil Serum), By Distribution Channel, By Price Point, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-188-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Facial Serum Market Size & Trends

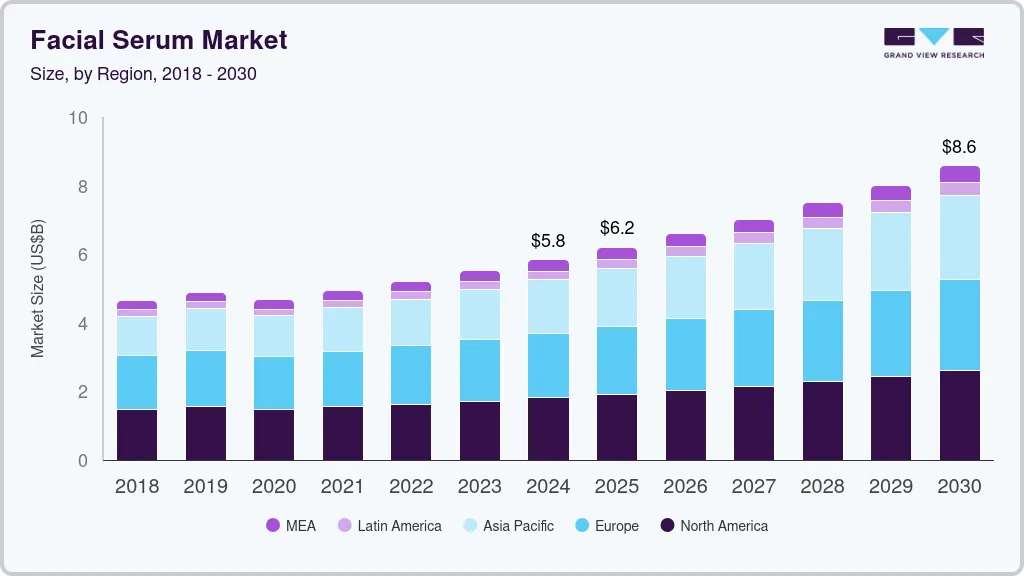

The global facial serum market size was estimated at USD 5.84 billion in 2024 and is expected to grow at a CAGR of 6.7% from 2025 to 2030. Factors boosting the use of facial serum include the aging population globally and rising awareness about the importance of protecting and maintaining healthy skin.

Key Market Highlights:

- Anti-aging serums accounted for a revenue of USD 1,864.7 million in 2024.

- Skin Brightening Serums is the most lucrative type segment registering the fastest growth during the forecast period.

- The sales through supermarkets & hypermarkets captured a market share of 29.53% in 2024.

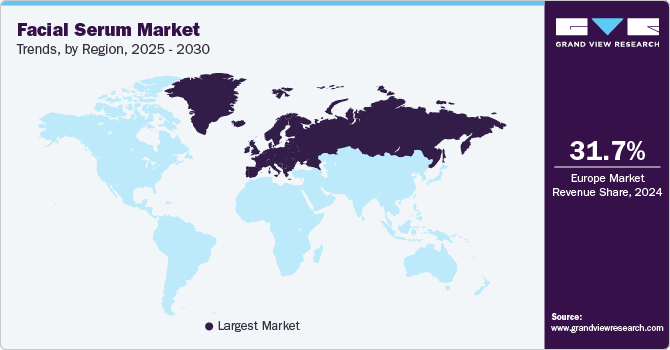

- In terms of region, Europe was the largest revenue generating market in 2024.

- Country-wise, Germany is expected to register the highest CAGR from 2025 to 2030

Facial serums contain a high concentration of powerful ingredients such as retinol, hyaluronic acid, and vitamin C, among others, which offer targeted solutions for various skin-related concerns. According to a 2021 survey conducted by the European Academy of Dermatology and Venerology (EADV), almost half (47.9%) of the European population over 18 years of age experienced at least one dermatological condition over the preceding 12 months. The most common skin condition reported was a fungal skin infection (9.07%), followed by atopic dermatitis (AD) (5.34%), alopecia (5.22%), and acne (5.49%). As a result of this, the demand for facial serums containing active ingredients is expected to grow significantly over the forecast

Advancements in skincare technology have led to the development of innovative serums with ethically sourced ingredients, technologies, sustainable packaging, and unique delivery systems. Encapsulation technology, for example, protects active ingredients from degradation and ensures targeted delivery for optimal efficacy. Manufacturers are investing heavily in research and development activities to create innovative, affordable, and eco-friendly clean-label skincare products that are highly effective in maintaining skin health. Consumers are increasingly seeking out skincare solutions tailored to their specific needs and concerns.

Facial serums offer a targeted approach, with concentrated formulas that can address a range of concerns, from wrinkles and acne to hyperpigmentation and dryness. For example, in February 2021, Swissforce Pharma AG launched a new face serum that specifically targets fine lines and wrinkles. This newly launched serum contains a unique combination of 2% low molecular weight hyaluronic acid, collagen booster, retinol, collagen, and sweet iris stem cells. The serum helps to reduce the appearance of wrinkles and fine lines and restore skin resilience by re-densifying and firming the skin. Such product launches help cosmetics companies redefine their product strategy and help them cater to consumers looking for skincare routines tailored to specific skin concerns and aspirations.

For instance, in October 2023, Plum Goodness, an Indian 100% vegan and cruelty-free beauty brand, launched a new product line that includes hair care and beauty items such as face serums, creams, sunscreens, moisturizers, lipsticks, mists, and monsoon hair care products. It's 2% Encapsulated Salicylic Acid Face Serum contains pear extracts that are rich in amino acids and powerful antioxidants, which help boost skin elasticity and fortify the skin barrier.

Consumers are increasingly becoming conscious of the potentially harmful effects of synthetic ingredients and are opting for serums formulated with natural alternatives. With an increase in disposable incomes, especially in emerging economies, consumers can invest in high-quality skincare products such as facial serums. This growth in disposable income has created new markets and opportunities for natural and organic skincare products.

For example, in June 2023, Bee Rx launched a new line of clean-label and natural cosmetic skincare products in Canada through Taro Pharmaceuticals Inc., a Canadian manufacturer and supplier of prescription and topical over-the-counter and dermatology products. Bee Rx's skincare lineup includes anti-aging facial serums, lip-pumping serums, and anti-aging eye lift serums. The company uses 100% natural ingredients, including high-strength, Kanuka honey sourced from New Zealand, and natural bee venom.

The men's grooming industry is experiencing a significant surge, and facial serums have become a crucial component in men's skincare routines. Brands are catering to this segment with serums specifically formulated for men's skin concerns. The e-commerce boom has made facial serums more accessible to consumers worldwide. Moreover, endorsements and recommendations through online platforms drive consumer interest and demand. Skincare influencers and celebrities frequently promote the use of serums, which further fuels consumer interest.

For example, notable American singers such as Camila Cabello and Alicia Keys have stated that they utilize Osmosis Skincare face serums in their routines. Additionally, popular Hollywood actresses Viola Davis and Jane Fonda have endorsed L'Oréal's anti-wrinkle serum in their nighttime routine. This trend highlights a growing consumer preference for unique and authentic products and the influence of popular figures in the marketing of cosmetic products.

Consumer Insights

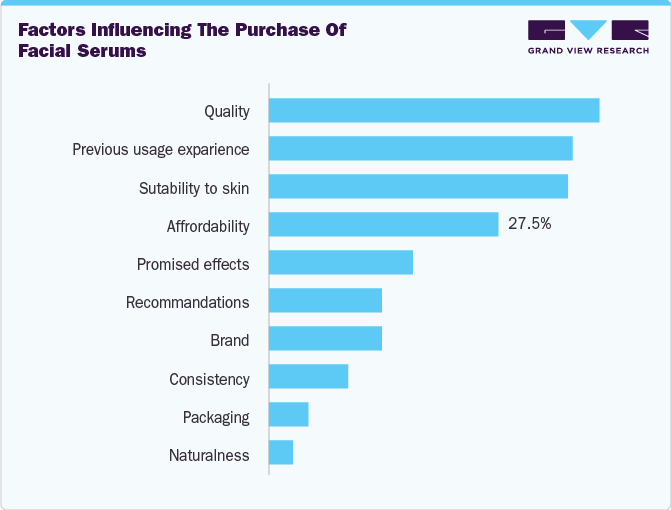

According to the survey conducted by Grand View Research of over 500 women aged between 20-35, the findings show that quality, previous experience, and suitability stand out as the most influential factors, which show that familiarity with a product and compatibility with individual skin types are key drivers in choosing a serum. Collectively, these factors highlight that consumers are largely motivated by trust, personal effectiveness, and tangible benefits.

Affordability also plays a notable role, influencing 27.5% of buyers. This suggests that while consumers are willing to invest in quality skincare, they are also conscious of cost and value for money. Mid-level factors like promised effects, recommendations, and brand reflect a moderate reliance on brand reputation and third-party opinions, though not as heavily as firsthand results and product performance.

Consumers increasingly gravitate toward personalized, multifunctional facial serums that combine quality with convenience, eliminating the need for complex routines. This shift is evident in the rising demand for at-home beauty treatments, particularly serums equipped with built-in applicators that deliver spa-like results effortlessly. Adding to this trend is the growing appeal of "pre-tweakments" - non-invasive, quick-fix solutions that noticeably enhance skin appearance.

At the same time, minimalist skincare is on the rise. Serums that offer multiple benefits, such as hydration, anti-aging, and protection against environmental stressors, are becoming essential for busy individuals seeking effective yet time-saving solutions. In parallel, the clean beauty movement, emphasizing non-toxic and natural ingredients, is gaining momentum and significantly influencing consumer purchasing choices.

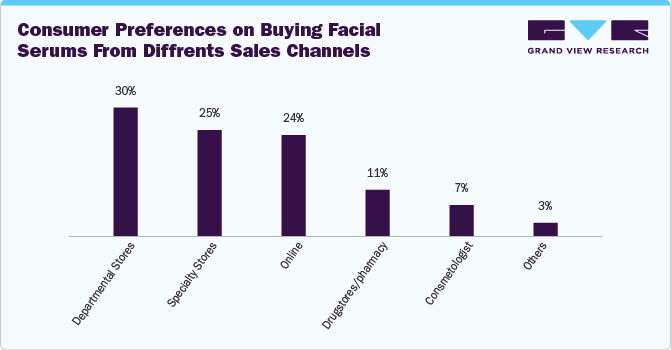

According to the survey conducted by Grand View Research of over 500 women aged between 20-35, it reveals that most consumers still favor traditional retail channels when purchasing facial serums. Many buyers prefer physically inspecting products and benefiting from in-store promotions or guidance from sales representatives. Specialty stores and online platforms follow closely, showing a strong inclination toward stores that offer expert curation and convenience, respectively. The minimal difference between these two suggests that while physical presence remains important, digital shopping is nearly equally preferred for its accessibility and variety.

Drugstores/pharmacies hold a modest share, likely driven by their association with trust, availability of dermatologist-recommended products, and ease of access. Cosmetologists account for a smaller percentage, suggesting that while professional advice is valued, it’s less common for everyday serum purchases. Other sources make up the least preferred option, indicating a relatively low reliance on unconventional or less formal purchasing channels.

Trump Tariffs Insights

President Donald Trump's recent tariff policies have significantly impacted the beauty and personal care industry, introducing steep import taxes on products from several key countries. As of May 2025, the United States has imposed a 145% tariff on most imports from China, marking a significant escalation in trade tensions between the two nations. This steep increase stems from President Donald Trump's "Liberation Day" tariff policy, announced on April 2, 2025, which introduced a baseline 10% tariff on imports from most countries and additional country-specific tariffs for nations with significant trade imbalances with the U.S. For China, this meant an extra 34% tariff on top of an existing 20% levy, culminating in a 54% tariff. Subsequent measures have raised the total tariff on Chinese goods to 145%. Meanwhile, imports from South Korea, Taiwan, and Vietnam are taxed at 25%, 32%, and 46%, respectively. Additionally, a 20% tariff has been imposed on goods from the European Union, affecting luxury and niche beauty brands from countries like France and Italy. These tariffs are part of a broader strategy to reduce reliance on foreign manufacturing and promote domestic production. However, the beauty industry, which heavily depends on global supply chains for products and ingredients, is now experiencing rising production costs. These costs are often passed on to consumers, resulting in noticeable price increases across the market. Even brands labeled “Made in the USA” are affected due to their reliance on imported components. As a result, companies are forced to reconsider sourcing strategies and pricing models, while consumers may shift their preferences in response to higher product prices.

According to an article published in January 2025 by Vogue, over 25,000 products sold in the U.S. beauty market are primarily imported from China, and these tariffs could lead to significant price hikes. Common products like skincare, shampoo, makeup, and hair care are mainly sourced from China, with key supply areas including cities like Guangzhou, Shanghai, and Beijing, according to Examine China.

To navigate the financial strain of increased U.S. tariffs, beauty and personal care manufacturers are strategically diversifying their supply chains. This involves relocating production facilities and sourcing materials from countries that either have lower tariff exposure or more favorable trade relations with the United States.

Manufacturers that previously relied heavily on China are now shifting production to nations like India, Indonesia, or certain African countries where labor and operational costs remain competitive, and U.S. tariffs are comparatively lower or nonexistent. Additionally, by sourcing packaging, raw ingredients, or formulation components from alternative markets with established trade agreements with the U.S., companies can reduce their overall cost burden. This move will not only help in maintaining competitive pricing in the American market but also offer a buffer against future geopolitical or trade policy shifts. Furthermore, this diversification will improve supply chain resilience by reducing dependency on a single country or region, allowing manufacturers to respond more flexibly to regulatory changes, shipping disruptions, or global economic fluctuations.

Type Insights

Anti-aging serums accounted for a revenue share of 31.92% in 2024. A growing aging population in many countries has resulted in an ever-growing interest in anti-aging products such as serums and creams. Consumers have become increasingly aware of the importance of preventive skincare and proactive measures against aging. Additionally, celebrity endorsements and social media trends have influenced consumer behavior, driving demand for anti-aging serums.

In August 2023, Natura launched the Chronos Intensive Antioxidant Serum for anti-aging concerns. The product is manufactured with antioxidant extracts from the Amazon, including açaí berry, cocoa, and ingá. These ingredients work together to stimulate antioxidant mechanisms in deep layers of the skin to protect it against oxidation and prevent the appearance of early signs of aging. Such initiatives allow companies to cater to diverse consumer needs, maintain competitiveness, and capitalize on market shifts, ensuring long-term success and customer loyalty.

Skin brightening serums are anticipated to register a CAGR of 7.5% from 2025 to 2030. There is a growing concern about hyperpigmentation caused by sun exposure, acne scars, and hormonal changes. As a result, people are looking for effective solutions to address uneven skin tone, dark spots, and hyperpigmentation. Skin brightening serums are gaining popularity because they offer targeted action. Skin brightening serums formulated with botanical extracts and gentle ingredients like vitamin C and Niacinamide are becoming more popular as consumers have started preferring natural and organic skincare products.

In October 2022, Galderma S.A. launched A-LUMINATE BRIGHTENING SERUM under its brand Alastin Skincare. The newly launched product is a clinically proven serum designed to reduce the appearance of surface hyperpigmentation and contains a multifaceted blend of antioxidants, peptides, and targeted ingredients. The product also helps the skin to appear brighter and creates a more even-toned, luminous complexion over time.

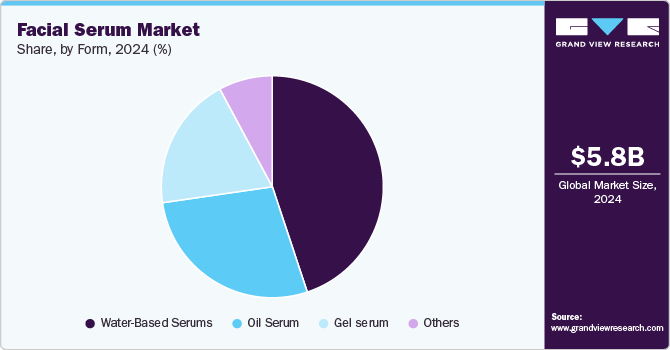

Form Insights

Water-based facial serums dominated the market with a revenue share of 44.90% in 2024. Water-based serums are formulated with humectants such as hyaluronic acid and glycerin, which are known to attract and retain moisture, leaving the skin plump and hydrated. Their lightweight texture and oil-free nature make them perfect for maintaining a balanced complexion, and they can be easily layered with other skincare products like moisturizers and sunscreen without causing pilling or discomfort. Additionally, many skincare brands are creating water-based serums that target multiple concerns such as brightening, firming, and pore-minimizing.

Demand for oil-based facial serums is set to expand at a CAGR of 7.6% from 2025 to 2030. The demand for natural and plant-based skincare solutions is on the rise, and this trend aligns perfectly with oil-based serums. These serums are often made with pure botanical oils such as jojoba, rosehip, and squalane. Oil-based serums offer versatility, acting as moisturizers, makeup primers, or even massage oils. This appeals to consumers who are looking for streamlined routines and multi-purpose products.

In addition, transparent communication about the specific oils used, their benefits, and potential sensitivities helps build trust with consumers and enables them to make informed purchase decisions. In March 2020, Erwachen launched their Black Bee Honey and Alpine Rose Magical Facial Oil Serum, prepared using essential oils such as Rosa alba, luxurious Rosa damascena, carrot seed oil, and patchouli leaf oil. The addition of essential oils helps to maintain the elasticity and firmness of the skin and delay the effects of aging. Also, growing consumer preference for high-quality facial serums has led to an increase in willingness to spend on premium products.

Distribution Channel Insights

The sales through supermarkets & hypermarkets captured a market share of 29.53% in 2024. Supermarkets and hypermarkets have a vast network of stores located in convenient locations, making it easy for a wide range of consumers to access their products. This is particularly beneficial for those who prefer physical shopping or are impulsive buyers. Moreover, facial serums can benefit from promotional campaigns and being placed on shelves alongside complementary products like moisturizers and cleansers. This increases their visibility and drives sales. For instance, in September 2022, Derma E launched their dermatologist-recommended Vitamin C line at Walmart stores, which includes their top-selling vitamin C concentrated serum line. This strategy would allow the company to reach new customers all across the U.S. and enhance its overall share in the facial serum industry.

Demand from online retailers is expected to advance at the highest CAGR of 7.7% from 2025 to 2030. E-commerce platforms offer a wider variety of serums than brick-and-mortar stores. They cater to diverse needs and preferences with ease and offer lower prices due to reduced overhead costs. This attracts budget-conscious consumers and drives price competition. Online shopping provides 24/7 access to a vast array of serums from global brands, exceeding the limitations of geographical location and physical store availability. The increased influence of social media and preference for online shopping due to the COVID-19 pandemic has enhanced segment growth.

Price Point Insights

The mass-market facial serums accounted for a revenue share of 49.95% in 2024. Mass-market serums are accessible to a wider audience, driven by competitive pricing and larger product volumes. This attracts budget-conscious consumers or those seeking to experiment with serums before investing in luxury options. Mass-market brands are increasingly incorporating innovative ingredients and technologies, like encapsulated retinol or plant-derived alternatives, to bridge the gap with luxury serums while maintaining affordability. Moreover, younger demographics, value-conscious consumers, and individuals new to serums are most likely to gravitate toward mass-market options, resulting in high demand for such skin serums.

Demand for luxury facial serums is set to expand at a strong CAGR of 7.5% by 2030. Luxury serums claim to have advanced ingredients such as plant-derived stem cells, marine collagen, and biocompatible peptides in higher concentrations compared to mass-market products, ensuring better results. Luxury brands are increasingly adopting sustainable practices, ethically sourced ingredients, and using environmentally-friendly packaging, appealing to eco-conscious consumers.

Moreover, social media and influencer marketing are significant factors in raising awareness and influencing purchase decisions based on product claims and influencer recommendations. For example, the famous Spanish actress Penélope Cruz used Lancôme Advanced Genifique anti-aging face serum to prep her skin for the 2022 Oscars. This product minimizes fine lines, plumps skin, and evens skin tone in just one week. Celebrity fans are always inclined to purchase products associated with their favorite stars, contributing to the demand for products endorsed by well-known personalities.

Regional Insights

The Europe facial serum market dominated the global industry with a revenue share of 31.65% in 2024. Germany, France, and the UK are significant players, driven by high disposable incomes and established beauty routines. The willingness of consumers in this region to pay more for premium and luxury beauty products is driving demand for facial serums prepared from natural and organic ingredients. Moreover, increasing skin care concerns and growth in the geriatric population have led to increasing investments in proactive skincare products, with serums being seen as targeted solutions for concerns like aging, acne, and hyperpigmentation.

Asia Pacific Facial Serum Market Trends

The Asia Pacific facial serum market is set to expand at the highest CAGR of 7.9% from 2025 to 2030. The middle-class population in the Asia Pacific region is growing, leading to an increase in demand for premium facial care products. The region comprises a diverse range of ethnicities and skin types, resulting in various skin concerns. Sun damage and hyperpigmentation are prevalent in Southeast Asia, while dryness and aging are common in Japan and South Korea. As a result, there is a growing demand for multifunctional face care serums that address these concerns.

Leading manufacturers are developing effective products to cater to this demand. For example, in September 2022, Entod International Group launched "Vasuki," a facial gel serum, in India. This serum contains synthetic tripeptide snake venom neurotoxin, which is a clinically proven venom developed by Entod Research Cell UK's advanced skincare laboratories. The product is effective in reducing and preventing both dynamic and static lines in early-aging skin around the eyes, neck, hands, forehead, and lips.

Key Facial Serum Company Insights

Some key players operating in the market include L'Oréal S.A., Amorepacific Group Inc., Unilever, Estée Lauder Inc., and KOSÉ Corporation.

-

L'Oréal SA is a French personal care company engaged in the manufacture and sale of beauty and hair care products. The company was founded in 1909 and operates through 4 complementary divisions, including the Professional Products Division, the Consumer Products Division, L’Oréal Luxe, and the Dermatological Beauty Division.

-

Estée Lauder Inc. is an American multinational cosmetics company engaged in the manufacturing and distribution of skincare, makeup, fragrance, and hair care products. The company was founded in 1946. Its products are sold in more than 135 countries and territories across the globe. In the U.S., its products are available in department stores, specialty stores, and online at esteelauder.com.

-

Shiseido Company Limited is a cosmetics products manufacturer and distributor headquartered in Tokyo, Japan. The company was founded in Tokyo, Japan, in 1872. The company has around 39,000 employees globally and operates in around 120 countries and regions around the world. The company’s diverse product portfolio includes body care products, skincare products, fragrances, shampoo and hair care products, hair color products, styling products, perm products, and cosmetics.

-

Revlon, Inc. is an American multinational company founded in 1932 and deals in cosmetics, skincare, perfume, and personal care. The company's diversified portfolio of brands is sold in approximately 150 countries around the world.

Key Facial Serum Companies:

The following are the leading companies in the facial serum market. These companies collectively hold the largest market share and dictate industry trends.

- L'Oréal S.A.

- Galderma S.A.

- Amorepacific Group Inc

- KOSÉ Corporation

- Clarins Inc.

- Unilever plc.

- Shiseido Company Limited

- Beiersdorf AG

- Estée Lauder Companies Inc.

- Revlon Inc.

Recent Developments

-

In March 2023, Shiseido Asia Pacific entered into a distribution partnership agreement with Global SS Beauty Brands Limited, a subsidiary of Shoppers Stop, India's prominent fashion and beauty destination. The collaboration is aimed at enhancing Shiseido's presence in India by expanding its brand reach. As part of the agreement, the Shiseido Group will introduce its renowned make-up brand, NARS Cosmetics, in the latter half of 2023, focusing on major cities in India.

-

In January 2023, Kosé Corporation announced a strategic partnership with Aman Group SARL, a multinational hospitality company headquartered in Switzerland, to produce a new skincare line under an OEM contract. The line will include five products, including replenishing face serum, and will be available online in 20 countries, including Japan. It will also be used in treatments at Aman Tokyo and other Aman Spas around the world.

-

In October 2022, L'Oréal USA invested USD 140 million in a new research and innovation (R&I) center in New Jersey, USA. The center will focus on beauty innovation across skin, hair, and makeup categories using green science and beauty technology. The R&I center is spread across 250,000 square feet and will bring together over 550 employees from the company's North American research and innovation division, including advanced product development and research & evaluation.

Facial Serum Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.20 billion

Revenue forecast in 2030

USD 8.58 billion

Growth rate

CAGR of 6.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, form, distribution channel, price point, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

L'Oréal S.A.; Galderma S.A.; Amorepacific Group Inc; KOSÉ Corporation; Clarins Inc; Unilever Plc; Shiseido Company Limited; Beiersdorf AG; Estée Lauder Companies Inc; Revlon

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Facial Serum Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global facial serum market report based on the type, form, distribution channel, price point, and region.

-

Type Outlook (USD Million, 2018 - 2030)

-

Anti-Aging Serums

-

Skin Brightening Serums

-

Acne Fighting Serums

-

Hydrating Face Serums

-

Exfoliating Face Serums

-

Others

-

-

Form Outlook (USD Million, 2018 - 2030)

-

Oil based

-

Gel based

-

Water based

-

Others

-

-

Distribution Channel Outlook (USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Drugstores & Pharmacies

-

Specialty Beauty Stores

-

Online Retailers

-

Others

-

-

Price Point Outlook (USD Million, 2018 - 2030)

-

Mass-Market

-

Premium

-

Luxury

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global facial serum market was estimated at USD 5.84 billion in 2024 and is expected to reach USD 6.20 billion in 2025.

b. The global facial serum market is expected to grow at a compound annual growth rate of 6.7% from 2025 to 2030 to reach USD 8.58 billion by 2030.

b. Europe dominated the facial serum market with a share of 31.65% in 2024. The growth of the regional market is driven by high disposable incomes, established beauty routines, and the willingness of consumers in the region to pay more for premium and luxury beauty products.

b. Some of the key players operating in the facial serum market include L'Oréal S.A.; Galderma S.A.; Amorepacific Group Inc; KOSÉ Corporation; Clarins Inc.; Unilever Plc.; Shiseido Company Limited; Beiersdorf AG; Estée Lauder Companies Inc; and Revlon Inc.

b. Key factors that are driving the facial serum market growth include growing consumer concerns related to dark circles, acne, hyperpigmentation, & age spots, the importance of preventative skincare, and protecting and maintaining healthy skin.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.