- Home

- »

- HVAC & Construction

- »

-

Farm Implements Market Size & Share, Industry Report 2033GVR Report cover

![Farm Implements Market Size, Share & Trends Report]()

Farm Implements Market (2025 - 2033) Size, Share & Trends Analysis Report By Component, By Product Type, By Power Source, By Enterprise Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-787-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Farm Implements Market Summary

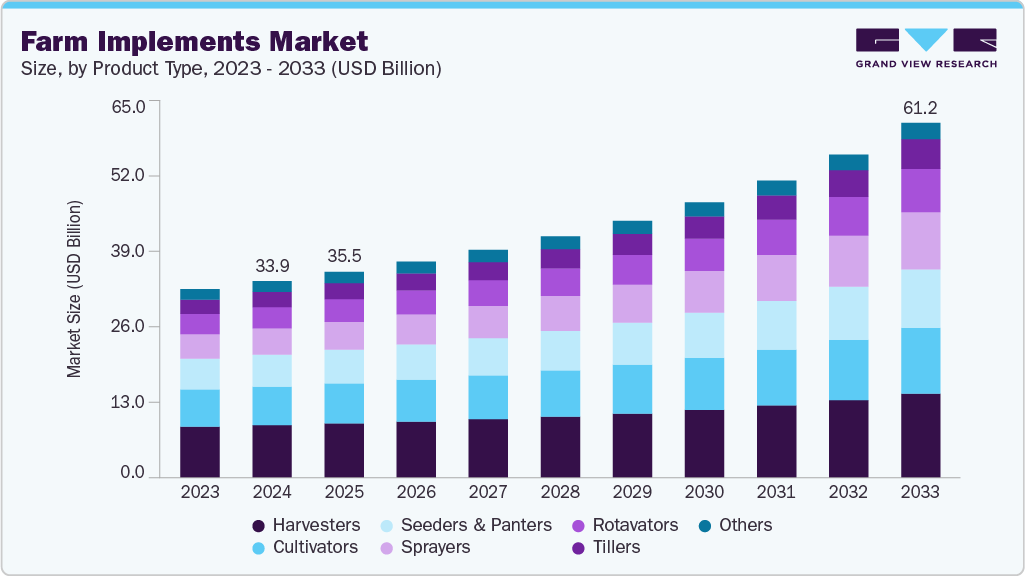

The global farm implements market size was estimated at USD 33.91 billion in 2024 and is projected to reach USD 61.18 billion by 2033, growing at a CAGR of 7.1% from 2025 to 2033. The growing focus on improving crop yield and soil health through precision and sustainable farming methods is driving demand for farm implements market

Key Market Trends & Insights

- Asia Pacific held 36.7% revenue share of the global farm implements market in 2024.

- In China, the integration of smart technologies such as IoT-enabled monitoring, and automation systems in is accelerating the demand for farm implements market.

- By security power source, management & orchestration segment held the largest revenue share of 29.6% in 2024.

- By power source, public cloud segment held the largest revenue share in 2024.

- By enterprise size, large enterprises segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 33.91 Billion

- 2033 Projected Market Size: USD 61.18 Billion

- CAGR (2025-2033): 7.1%

- Asia Pacific: Largest market in 2024

- Europe: Fastest growing market in 2024

The trend toward commercial and large-scale farming drives the farm implements market growth. As agricultural enterprises expand their cultivated areas and diversify crop types, the demand for specialized and heavy-duty equipment rises. Implements designed for high-volume operations, such as large seed drills, combine harvesters, and mechanized irrigation systems, are witnessing strong adoption. The pursuit of higher efficiency, reduced turnaround time, and scalability in farming operations is pushing both individual farmers and agribusinesses to invest in advanced implements, ensuring sustained growth of the global farm implements market.The rapid growth of tractor sales has also had a direct positive impact on the farm implements market. Tractors serve as the primary power source for a variety of implements, including seeders, cultivators, and sprayers. As tractor penetration increases across global agricultural regions, the demand for compatible and efficient implements rises in parallel. Manufacturers are responding by developing multi-purpose and easily attachable implements that cater to diverse field conditions and cropping systems, further boosting market adoption.

The growing influence of agricultural cooperatives and contract farming models is contributing to market expansion. These models encourage collective investment in modern implements, enabling small and marginal farmers to access machinery that would otherwise be unaffordable. Cooperatives often pool financial resources to purchase high-performance equipment such as threshers, planters, or power tillers, which can be shared among members based on seasonal demand. In addition, the rise of agricultural service providers who rent out implements and machinery on a pay-per-use basis is making mechanized farming more accessible to smaller landholders, further fueling demand across both developing and developed regions.

In addition, globalization and the expansion of agricultural trade are driving the demand for advanced farm implements. As farmers aim to meet international quality standards for exports, there is a growing emphasis on uniformity, hygiene, and post-harvest efficiency. Implements that assist in precision harvesting, cleaning, grading, and packaging are becoming increasingly essential. The modernization of post-harvest operations, combined with the need to reduce crop spoilage and maintain consistent quality, is pushing the adoption of technologically sophisticated implements that streamline the entire value chain from field to market.

Product Type Insights

The harvesters segment dominated the farm implements market in 2024 with a revenue share of 26.7%. The expanding cultivation of high-value and large-scale crops such as wheat, maize, rice, and soybeans has also contributed significantly to the demand for specialized harvesters. Each of these crops requires customized harvesting solutions that ensure efficient processing and minimal crop damage. Manufacturers are responding to this demand by designing harvesters suited for specific crop types, terrains, and climatic conditions. The availability of multi-crop and modular harvesters that can handle diverse crops across seasons enhances equipment utilization rates, improving return on investment for farmers.

The sprayers segment is projected to be the fastest-growing segment from 2025 to 2033. The expansion of contract farming and custom hiring services has accelerated the use of sprayers across small and medium-sized farms. These service models enable farmers who cannot afford to own high-cost equipment to access modern spraying technologies through rental or pay-per-use systems. Agricultural input companies and cooperatives are increasingly offering mechanized spraying services as part of integrated crop management solutions. This accessibility is contributing to widespread adoption, even in developing regions. The combined effect of rising pest pressures, technological innovation, sustainability goals, and service-based farming models is ensuring strong and sustained growth of the sprayers segment within the global farm implements market.

Power Source Insights

The tractor-mounted implements segment dominated the farm implements market with a market share of over 55.3% in 2024. The growing trend toward mechanized and precision farming practices drives segment growth. Farmers are adopting tractor-mounted implements that enable more accurate and uniform field operations, improving overall productivity. Modern implements now integrate advanced technologies such as GPS, sensors, and automated depth or rate control systems, allowing for precision tillage, seeding, and fertilizer application. These innovations help reduce input wastage and optimize soil and nutrient management. The combination of tractors and precision implements enables farmers to perform multiple functions with high accuracy, thereby reducing operational time and costs. This efficiency-driven approach is particularly appealing to large and medium-scale farmers looking to maximize yield output from limited arable land.

The self-propelled implements segment is projected to be the fastest-growing segment from 2025 to 2033. The emergence of climate-resilient and adaptive farming practices is also driving the adoption of self-propelled implements. Extreme weather events, irregular rainfall, and fluctuating temperatures are affecting planting and harvesting schedules globally. Self-propelled machines provide the flexibility to operate under diverse and challenging field conditions, including wet, uneven, or hilly terrain. Their robust design and enhanced traction allow farmers to continue critical operations without significant delays, thereby mitigating the risks associated with climate variability. This reliability in unpredictable environmental conditions makes self-propelled implements particularly valuable for farmers seeking to safeguard yields and reduce losses.

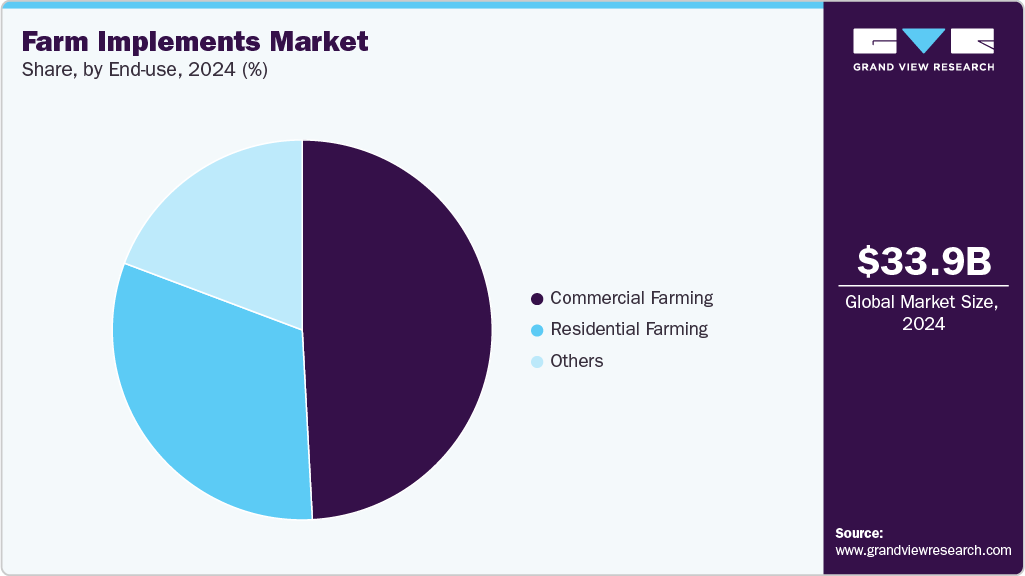

End Use Insights

The commercial farming segment dominated the market in 2024. The integration of automation and robotics in commercial farming is driving segment growth. Commercial farms are increasingly exploring robotic planters, autonomous harvesters, and AI-assisted sprayers that reduce reliance on human intervention and improve operational accuracy. These technologies allow commercial farms to optimize input use, monitor crop health in real time, and perform complex field operations with minimal supervision. The combination of robotics and mechanization enhances efficiency and profitability, making commercial farmers more likely to invest in modern, high-tech farm implements.

The residential farming segment is projected to be the fastest-growing segment from 2025 to 2033. The increasing interest in urban and peri-urban agriculture is driving the residential farming segment. As urban populations expand, individuals and households are turning to small-scale farming to grow vegetables, fruits, and ornamental plants for personal consumption, recreation, or supplementary income. This trend has created demand for compact, easy-to-use, and efficient farm implements that suit limited spaces such as home gardens, terraces, and small plots. Lightweight hand tools, mini tillers, garden tractors, and portable irrigation systems are increasingly adopted by residential farmers to manage soil preparation, planting, and maintenance with minimal effort and space utilization. The convenience and accessibility of these implements make them essential for urban residents seeking to engage in farming activities without extensive labor or technical expertise.

Regional Insights

Asia Pacific dominated the farm implements market with a market share of 36.7% in 2024. The increasing commercialization and intensification of farming operations are fueling the market in the Asia Pacific. Farmers are shifting from subsistence farming to commercial-oriented agriculture to capitalize on the rising demand for food, horticulture products, and cash crops. Large-scale farming operations require high-capacity and versatile implements capable of performing multiple tasks efficiently across diverse crops and terrains. Manufacturers are responding by introducing multi-functional and durable implements tailored to the region’s crop diversity, which further encourages adoption among commercial farmers seeking higher productivity and profitability.

China Farm Implements Market Trends

The China farm implements industry is projected to grow during the forecast period. The expansion of e-commerce and digital agriculture platforms in China is boosting the demand for farm implements. Online marketplaces, equipment rental platforms, and precision agriculture software provide farmers with easier access to modern machinery, leasing options, and technical support. These platforms reduce entry barriers for smallholders and commercial farmers alike, making it more convenient to acquire and utilize advanced implements. Digital agriculture solutions also enable better tracking of implement performance, maintenance schedules, and crop outcomes, reinforcing the value of mechanized equipment in improving operational efficiency.

Europe Farm Implements Market Trends

Europe farm implements industry is expected to be the fastest growing segment, with a CAGR of 6.9% over the forecast period. The growing emphasis on organic farming and residue-free crop production is stimulating market growth. European consumers are increasingly demanding high-quality, chemical-free produce, which requires specialized implements to maintain soil health and optimize organic inputs. Equipment designed for precise organic fertilization, mechanical weed control, and reduced soil disturbance supports these practices. The adoption of such specialized implements ensures compliance with organic certification standards while maintaining productivity, driving demand among farmers transitioning to or expanding organic operations.

The farm implements industry in UK is projected to grow during the forecast period. The growth of agritourism and educational farming initiatives is also influencing demand in the UK Agricultural enterprises that host farm tours, workshops, or community-supported agriculture programs require efficient and safe farm operations to manage visitor activities alongside production. Implements that streamline planting, harvesting, and maintenance help ensure operational efficiency while maintaining aesthetic appeal and safety standards. The need to combine productivity with public engagement has created a niche demand for user-friendly, compact, and visually appealing implements that cater to these multifunctional farm setups.

North America Farm Implements Market Trends

The farm implements industry in North America is expected to grow during the forecast period. Integration of renewable energy and sustainable farming practices is another factor boosting the market. North American farmers are increasingly incorporating solar-powered irrigation systems, wind energy installations, and bioenergy crops into their operations. Implementers that are compatible with energy-efficient or low-emission farming systems, such as electric tractors or hybrid machinery, are in higher demand. These implements help farmers reduce fuel costs, lower carbon footprints, and comply with regulatory and market-driven sustainability standards, making environmentally friendly mechanization an attractive option.

The farm implements industry in the U.S. is grow during the forecast period. The integration of digital agriculture platforms and connected machinery is influencing the market. Implements linked to farm management software provide real-time insights into operational performance, predictive maintenance schedules, and field-specific input recommendations. This data-driven approach enhances efficiency, reduces downtime, and supports informed decision-making. U.S. farmers are increasingly adopting connected and smart implements to improve productivity, optimize resources, and maintain competitiveness, further driving demand for modern farm machinery in the country.

Key Farm Implements Company Insights

Some of the key companies operating in the market, include AGCO Corporation and VMware, among others are some of the leading participants in the farm implements market.

-

AGCO Corporation is a global manufacturer and distributor of agricultural equipment. AGCO’s product portfolio in the farm implements market includes tractors, combines, hay and forage equipment, sprayers, tillage and seeding machinery, and application equipment. The company is known for its flagship brands such as Massey Ferguson, Fendt, Valtra, and Challenger, each providing specialized solutions for various scales of farming operations. Tractors form a core part of AGCO’s offerings, available in multiple configurations and power ranges, designed to handle everything from heavy-duty tillage to precision farming tasks.

-

Deere & Company is a global agricultural, construction, and forestry equipment company. The company offers a comprehensive portfolio of farm implements designed to cover the entire spectrum of agricultural operations. Deere & Company manufactures tractors ranging from compact utility models to high-horsepower machines for large-scale farming, engineered for durability, fuel efficiency, and integration with advanced precision farming systems. Its combine harvesters and threshers are designed to optimize crop harvesting efficiency, minimize losses, and deliver high-quality yields, while incorporating automation, sensors, and monitoring technologies for enhanced operational control.

Remlinger Manufacturing, and Gcore are some of the emerging market participants in the farm implements market.

-

Remlinger Manufacturing is a U.S.-based company specializing in the design, production, and distribution of farm implements and agricultural machinery. The company’s product portfolio includes a variety of tillage equipment, seeders, planters, cultivators, and other essential farm implements. Its tillage tools are engineered to prepare soil effectively, ensuring proper aeration and nutrient distribution, which are critical for optimal crop growth. The seeders and planters produced by Remlinger Manufacturing are designed to provide precise seed placement and spacing, allowing farmers to achieve uniform germination and maximize yield potential.

-

Great Plains Ag, officially known as Great Plains Manufacturing, Inc., is a U.S.-based company recognized for its comprehensive range of agricultural equipment and farm implements. The company’s product portfolio spans several key categories, including tillage equipment, planting and seeding machinery, fertilizer applicators, and crop care implements. Great Plains Ag’s planters and seeders are designed for precision and uniformity, allowing farmers to maximize germination rates and planting efficiency. These implements often feature adjustable row spacing, depth control, and durable components to ensure long-term reliability in the field.

Key Farm Implements Companies:

The following are the leading companies in the farm implements market. These companies collectively hold the largest market share and dictate industry trends.

- AGCO Corporation

- Agius Agricultural Trading Ltd.

- Airtec Sprayers, Inc.

- Bomet Sp. z o.o. Sp. K

- CLAAS KGaA mbH

- Deere & Company

- Great Plains Ag

- Hagie Manufacturing Company, LLC

- Hiniker Company

- Kinze Manufacturing

- KUBOTA Corporation

- KUHN Group

- Landoll Company, LLC

- Monosem

- PBZ LLC

- Remlinger Manufacturing

Recent Developments

-

In 2025, Deere & Company launched its all-new F8 and F9 series of self-propelled forage harvesters. These high-performance machines are engineered to provide a greatly enhanced driving experience, integrating advanced automation and precision farming technologies while further improving silage quality. The F8 and F9 harvesters feature user-friendly controls for both machine operation and harvesting settings, enhancing overall usability. In addition, machine settings can be saved under different driver profiles, enabling a seamless start to harvesting without needing to readjust settings with each change of operator.

-

In August 2024,Kinperium Industries Inc. acquired Hiniker Company, marking a strategic step toward future growth and reinforcing its dedication to delivering exceptional solutions across its portfolio. Kinperium has successfully strengthened and expanded each of its three existing portfolio companies and plans to apply the same approach to Hiniker, leveraging its current strengths while investing in initiatives to secure the company’s long-term success.

-

In July 2024, Kinze Manufacturing is broadening its sales and service presence in Romania through a new partnership with K-Planter. Under this agreement, Kinze product sales will be coordinated through the existing Kinze distributor in the country. Meanwhile, SC Agro Interbrands SRL will manage the sales and servicing of Kinze agricultural equipment in Romania's northeastern region.

Farm Implements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 35.47 billion

Revenue forecast in 2033

USD 61.18 billion

Growth rate

CAGR of 7.1% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

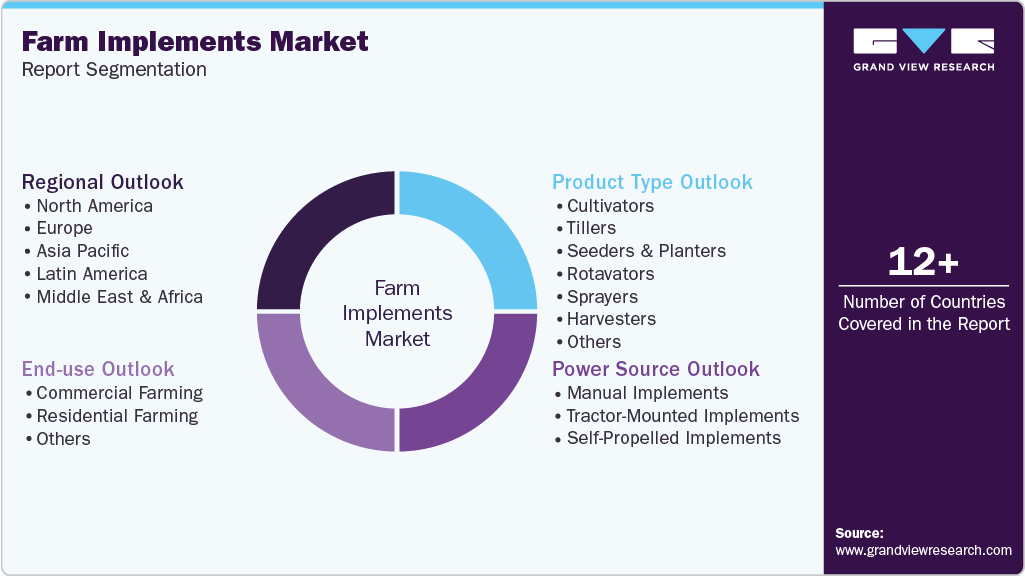

Segments covered

Product type, power source, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

AGCO Corporation; Agius Agricultural Trading Ltd.; Airtec Sprayers, Inc.; Bomet Sp. z o.o. Sp. K; CLAAS KGaA mbH; Deere & Company; Great Plains Ag; Hagie Manufacturing Company, LLC; Hiniker Company; Kinze Manufacturing; KUBOTA Corporation; KUHN Group; Landoll Company, LLC; Monosem; Remlinger Manufacturing

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Farm Implements Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global farm implements market report based on product type, power source, end use, and region:

-

Product Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Cultivators

-

Tillers

-

Seeders & Planters

-

Rotavators

-

Sprayers

-

Harvesters

-

Others

-

-

Power Source Outlook (Revenue, USD Billion, 2021 - 2033)

-

Manual Implements

-

Tractor-Mounted Implements

-

Self-Propelled Implements

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Commercial Farming

-

Residential Farming

-

Others

-

-

Farm Implements Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global farm implements market size was estimated at USD 33.91 billion in 2024 and is expected to reach USD 35.47 billion in 2025.

b. The global farm implements market is expected to grow at a compound annual growth rate of 7.1% from 2025 to 2033, reaching USD 61.18 billion by 2033.

b. The harvesters segment dominated the farm implements market in 2024 with a revenue share of 26.7%. The expanding cultivation of high-value and large-scale crops such as wheat, maize, rice, and soybeans has also contributed significantly to the demand for specialized harvesters.

b. Some key players operating in the market include AGCO Corporation, Agius Agricultural Trading Ltd., Airtec Sprayers, Inc., Bomet Sp. z o.o. Sp. K, CLAAS KGaA mbH, Deere & Company, Great Plains Ag, Hagie Manufacturing Company, LLC, Hiniker Company, Kinze Manufacturing, KUBOTA Corporation, KUHN Group, Landoll Company, LLC, Monosem, Remlinger Manufacturing

b. Factors such as the growing focus on improving crop yield and soil health through precision and sustainable farming methods and the integration of smart technologies such as IoT-enabled monitoring, and automation systems are the key factors driving the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.