- Home

- »

- Beauty & Personal Care

- »

-

France Sun Care Cosmetics Market, Industry Report, 2033GVR Report cover

![France Sun Care Cosmetics Market Size, Share & Trends Report]()

France Sun Care Cosmetics Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Tinted Moisturizers, SPF Foundation, SPF Sunscreen), By Type (Conventional, Organic), By Distribution Channel (Specialty Stores, E-Commerce), And Segment Forecasts

- Report ID: GVR-4-68040-661-4

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

France Sun Care Cosmetics Market Trends

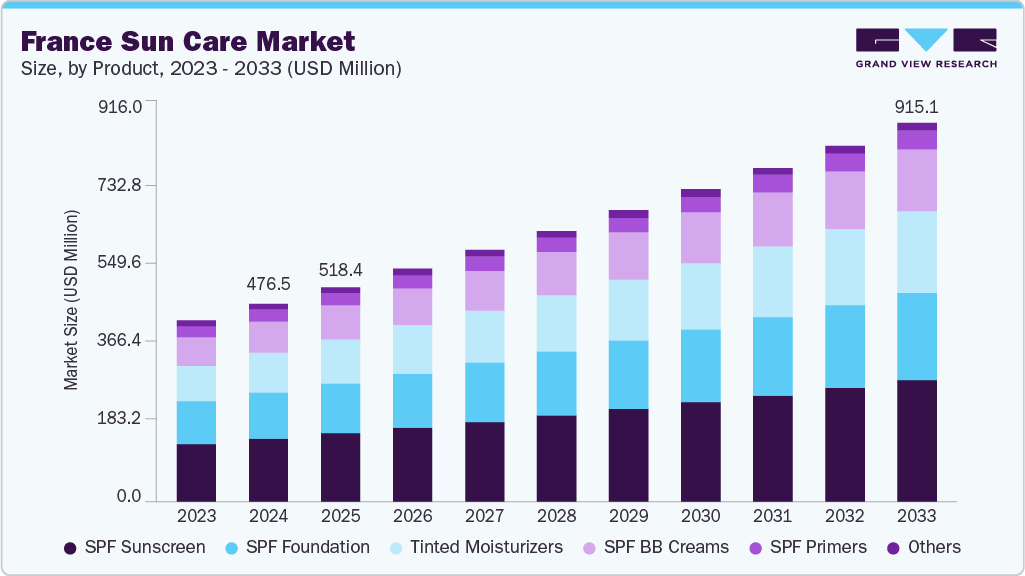

The France sun care cosmetics market size was estimated at USD 476.5 million in 2024 and is expected to grow at a CAGR of 7.4% from 2025 to 2033. The sun care cosmetics industry in France is shaped by evolving consumer preferences and a strong emphasis on product efficacy and formulation transparency. French consumers are increasingly drawn to multi-functional sun care products that combine sun protection with skincare benefits, such as anti-aging serums, hydrating creams, and tinted moisturizers with SPF. High SPF (30+) and broad-spectrum protection against UVA and UVB rays are especially valued for facial products.

Moreover, there is growing interest in mineral and reef-safe formulations and products with clean, natural, or organic ingredients, reflecting the country's broader commitment to health, wellness, and environmental responsibility. The market is driven by increasing skin health awareness and the risks of sun exposure, including premature aging and skin cancer. Rising demand for high-SPF and broad-spectrum protection products fuels innovation in formulations. Consumers also seek multi-functional sun care that combines skincare or cosmetic benefits.

Furthermore, preferences for clean, natural, and eco-friendly ingredients support the shift toward sustainable and mineral-based sun protection solutions. The sun care cosmetics industry in France is also driven by growing dermatological recommendations and public health campaigns promoting daily sun protection. Increased tourism and outdoor leisure activities further boost seasonal and year-round product demand. Technological advancements in texture and finish appeal to consumers seeking lightweight, non-greasy formulas.

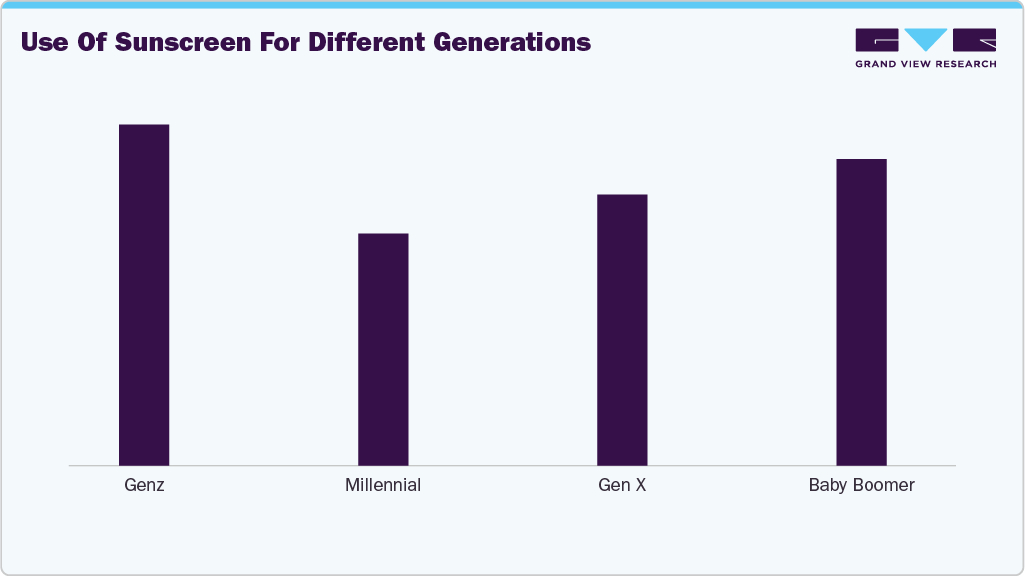

Moreover, the influence of beauty trends from social media encourages the adoption of sun care as a key step in everyday skincare routines. According to the YouGov survey published in October 2024, about 34% of French consumers use sunscreen regularly in their skin routine.

Consumer Insights & Surveys

French women are increasingly incorporating sunscreen and sun care products into their daily skincare routines during summer and year-round. There is a strong emphasis on facial sun protection, often through products such as SPF-infused moisturizers, foundations, and serums. Awareness of sun damage, aging, and skin health drives consistent use, especially among women over 30. In addition, French women tend to favor elegant, lightweight textures that blend seamlessly with skincare and makeup.

Product Insights

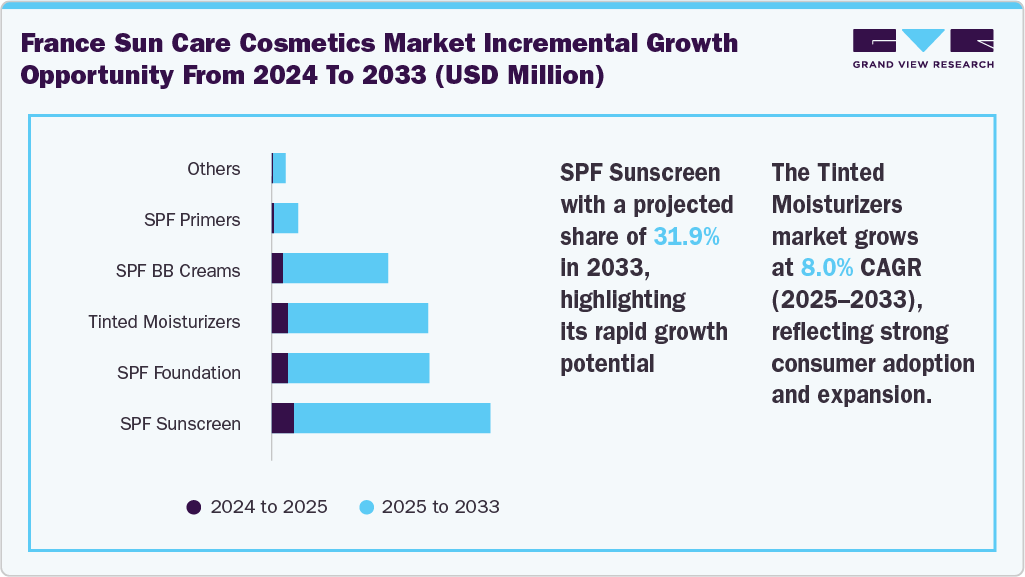

SPF sunscreen accounted for the largest share of about 31.6% in 2024. SPF sunscreen demand in France is driven by heightened awareness of the harmful effects of UV radiation, including premature aging and skin cancer. Dermatologist endorsements and public health initiatives reinforce the importance of daily SPF use. Consumers seek high-SPF products that offer broad-spectrum protection while maintaining a pleasant, non-greasy feel. Integrating SPF into everyday beauty products such as moisturizers and makeup also supports its widespread adoption. Companies are innovating new formulations, such as L’Oréal’s Anthelios product line, which utilizes Netlock technology, a microencapsulation system that forms a uniform, invisible film on the skin.

Demand for tinted moisturizers is projected to rise at a CAGR of 8.0% from 2025 to 2033. Tinted moisturizers are gaining popularity in France’s market because they combine hydration, sun protection, and light coverage in one product. French consumers appreciate these products' natural, effortless beauty look, aligning with minimalist skincare trends. Their multifunctionality appeals to busy lifestyles, reducing the need for multiple products. Furthermore, the demand for skin-friendly formulas with SPF and subtle tint supports their continued growth. The tinted moisturizers available in the market include Laura Mercier, Clarins, and Jowaé's Tinted Moisturizing Cream.

Type Insights

Conventional sun care cosmetics accounted for the largest share of 82.1% in 2024. The conventional market in France is driven by strong consumer trust in well-established brands and clinically tested formulations. Many French consumers prioritize proven efficacy and dermatological safety, especially for sensitive skin. Seasonal demand spikes during holidays and summer months continue to sustain sales of traditional sunscreen. In addition, wide availability in pharmacies and supermarkets ensures consistent consumer access and loyalty to conventional sun care products.

The demand for organic sun care cosmetics is estimated to grow with the fastest CAGR of 7.9% over the forecast period. Demand for organic sun care cosmetics in France is fueled by rising consumer concerns over synthetic ingredients and their potential health impacts, leading to a preference for natural, plant-based formulations. Eco-conscious shoppers are also attracted to products with environmentally responsible packaging and sustainably sourced ingredients. Influencers and wellness-focused content highlight the benefits of organic sun care, reinforcing its appeal. Finally, French regulatory standards and organic certifications such as COSMOS and Ecocert boost consumer confidence and adoption. The COSMOS-certified organic products are available across 82 countries, while approximately 12,500 raw materials carry the certified signature.

Distribution Channel Insights

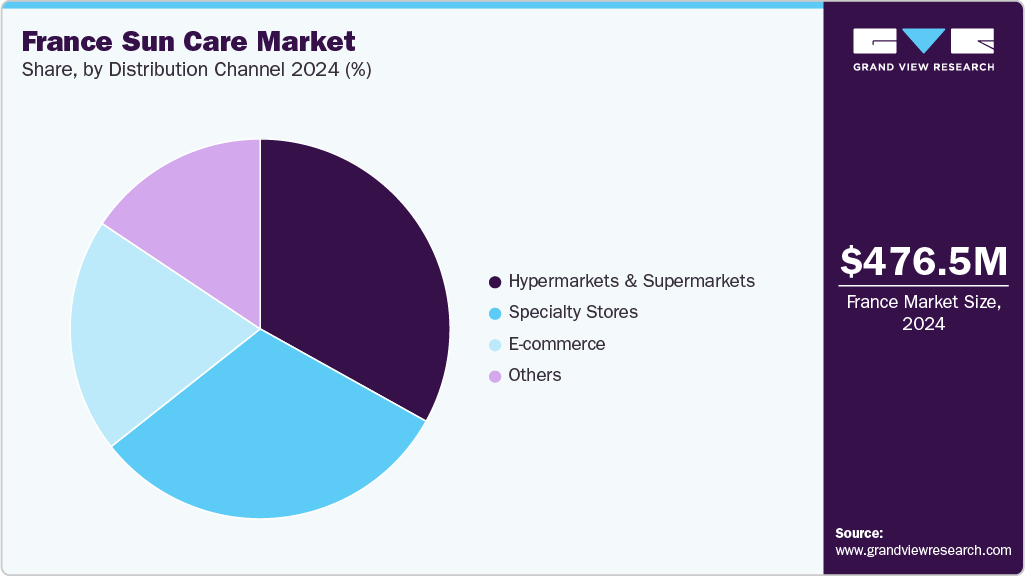

Hypermarkets and supermarkets accounted for a revenue share of about 37.1% in 2024. Hypermarkets and supermarkets in France play a pivotal role in the sun care cosmetics industry by offering a wide product variety at competitive prices, driving accessibility for everyday shoppers. Promotional campaigns, in‑store displays, and seasonal discounts boost impulse purchases, especially during spring and summer. According to the YouGov survey published in October 2024, about 27% of consumers in the country learn about skin care products such as sunscreen through hypermarkets and mall stalls. These channels also make it easy for mass-market and private-label sun care brands to gain shelf visibility and consumer loyalty. Moreover, the convenience of one‑stop shopping encourages consumers to purchase sun care alongside other daily essentials.

E-commerce is expected to grow at the fastest CAGR of 8.2% from 2025 to 2033. The e‑commerce channel for sun care cosmetics in France is propelled by increasing consumer demand for convenience, wide product variety, and seamless online shopping experiences. Brands leverage targeted digital marketing and social media, such as shoppable content on Instagram and TikTok, to enhance product discovery and drive impulse buys.

According to the YouGov survey published in October 2024, about 41% of consumers in the country discover skin care products through the Instagram online platform. The rise of direct-to-consumer models allows brands to offer personalized, subscriber-based purchases, bypassing traditional retail to control pricing and customer relationships. Mobile-optimized platforms and flexible payment/checkout options fuel online orders, especially during peak seasons. In addition, ease of access to customer reviews and authentic brand communications instills trust, incentivizing consumers to buy sun care products online.

Key France Sun Care Cosmetics Company Insights

The market comprises both well-established companies and new entrants. Leading players actively respond to evolving sun care cosmetics trends and broaden their services to sustain and enhance their market share.

-

L’Oréal Group is a leading market player headquartered in Clichy, France, with a diverse portfolio of globally recognized beauty and skincare brands. Operating through divisions like Consumer Products, L’Oréal Luxe, and Active Cosmetics, the company offers sun protection solutions across all price points and skin types. Brands such as Garnier, La Roche-Posay, Vichy, and L’Oréal Paris provide a wide range of SPF products, including sunscreens, tinted moisturizers, and facial care. L’Oréal’s strong focus on dermatological research, innovation, and sustainability continues to drive its leadership in the French sun care segment.

-

Pierre Fabre Group is a key French player in the dermo-cosmetic and pharmaceutical industries, known for its skincare and sun protection expertise. Headquartered in Castres, France, the company operates a portfolio of trusted brands, such as Avène, A-Derma, and Ducray, which cater to sensitive skin and dermatological needs. Within the sun care segment, Eau Thermale Avène leads with a range of high-SPF and broad-spectrum products, emphasizing skin tolerance and environmental safety. Pierre Fabre’s commitment to dermatological innovation and eco-conscious formulations strengthens its position in the market.

Key France Sun Care Cosmetics Companies:

- L’Oréal S.A.

- Pierre Fabre Laboratories

- Beiersdorf AG

- NAOS INC

- Clarins

- LVMH

- Groupe rocher

- Sisley

- Laboratoires SVR

- PATYKA

Recent Developments

-

In June 2025, La Roche-Posay introduced a new addition to its Anthelios summer range: a lightweight SPF 50+ fluid designed to protect the skin while targeting dark spots. The product features Melasyl, a patented ingredient developed over 18 years, which helps prevent excess pigmentation by regulating melanin production.

-

In March 2021, Pierre Fabre Laboratories launched TRIASORB, an organic, non-nano sun filter integrated into the Eau Thermale Avène Intense Protect 50+ sunscreen. It offers ultra‑broad protection (UVB, UVA, blue light) while being non-toxic to coral, phytoplankton, and zooplankton.

France Sun Care Cosmetics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 518.4 million

Revenue forecast in 2033

USD 915.1 million

Growth rate (revenue)

CAGR of 7.4% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, distribution channel

Country scope

France

Key companies profiled

L’Oréal S.A.; Pierre Fabre Laboratories; Beiersdorf AG; NAOS INC; Clarins; LVMH; Groupe rocher; Sisley; Laboratoires SVR; PATYKA

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

France Sun Care Cosmetics Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the France sun care cosmetics market report by product, type and distribution channel:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Tinted Moisturizers

-

SPF Foundation

-

SPF BB Creams

-

SPF Primers

-

SPF Sunscreen

-

Others

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Conventional

-

Organic

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Hypermarkets & Supermarkets

-

Specialty Stores

-

E-Commerce

-

Others

-

Frequently Asked Questions About This Report

b. The France sun care cosmetics market size was estimated at USD 476.5 million in 2024 and is expected to reach USD 518.4 million in 2025.

b. The France sun care cosmetics market is expected to grow at a compound annual growth rate (CAGR) of 7.4 % from 2025 to 2033 to reach USD 915.1 million by 2033.

b. SPF sunscreen accounted for a revenue share of 31.6% in 2024, driven by heightened awareness of the harmful effects of UV radiation, including premature aging and skin cancer.

b. Some key players operating in the France sun care cosmetics market include L’Oréal S.A., Pierre Fabre Laboratories, Beiersdorf AG, NAOS, Clarins, and LVMH

b. Key factors driving market growth in the France sun care cosmetics market include increasing awareness of skin protection against UV radiation, a rising preference for premium and natural skincare products, and a growing emphasis on personal grooming and wellness. The popularity of outdoor and beach-related activities further contributes to the market’s expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.