- Home

- »

- Catalysts & Enzymes

- »

-

Fuel Cell Catalyst Market Size & Share, Industry Report 2033GVR Report cover

![Fuel Cell Catalyst Market Size, Share & Trends Report]()

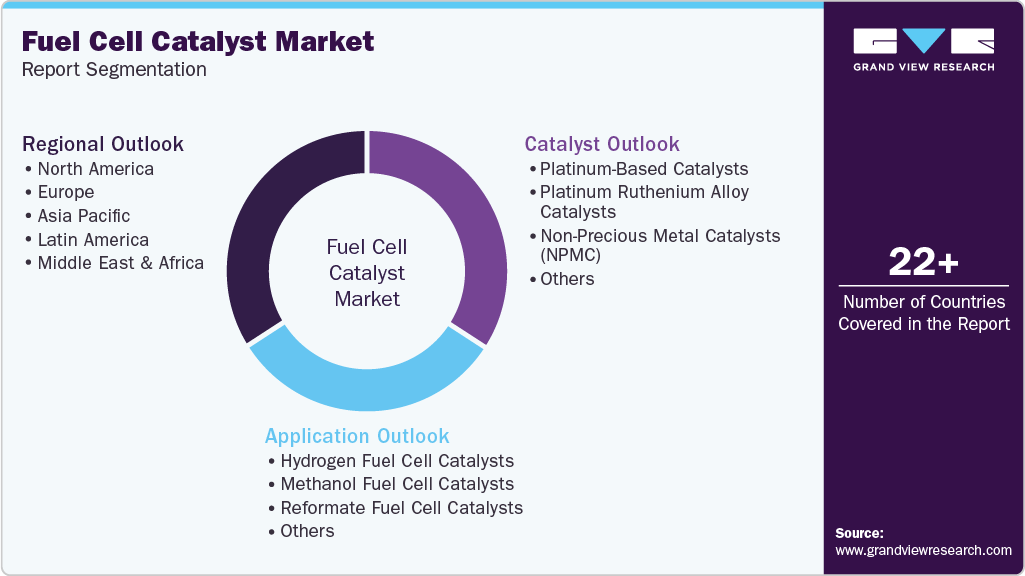

Fuel Cell Catalyst Market (2025 - 2033) Size, Share & Trends Analysis Report By Catalyst (Platinum-Based Catalysts, Platinum Ruthenium Alloy Catalysts, Non-Precious Metal Catalysts), By Application (Hydrogen, Methanol), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-779-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fuel Cell Catalyst Market Summary

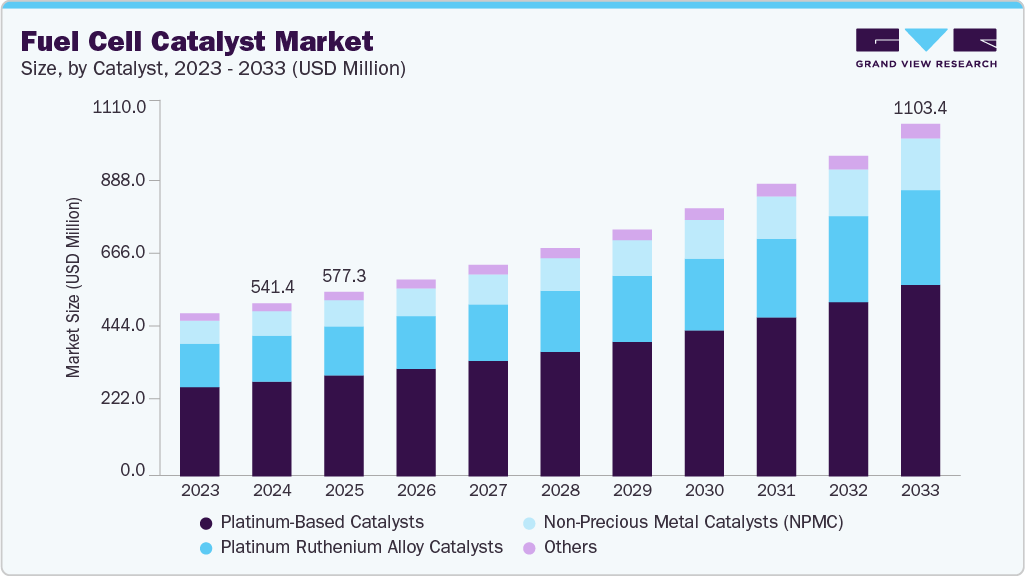

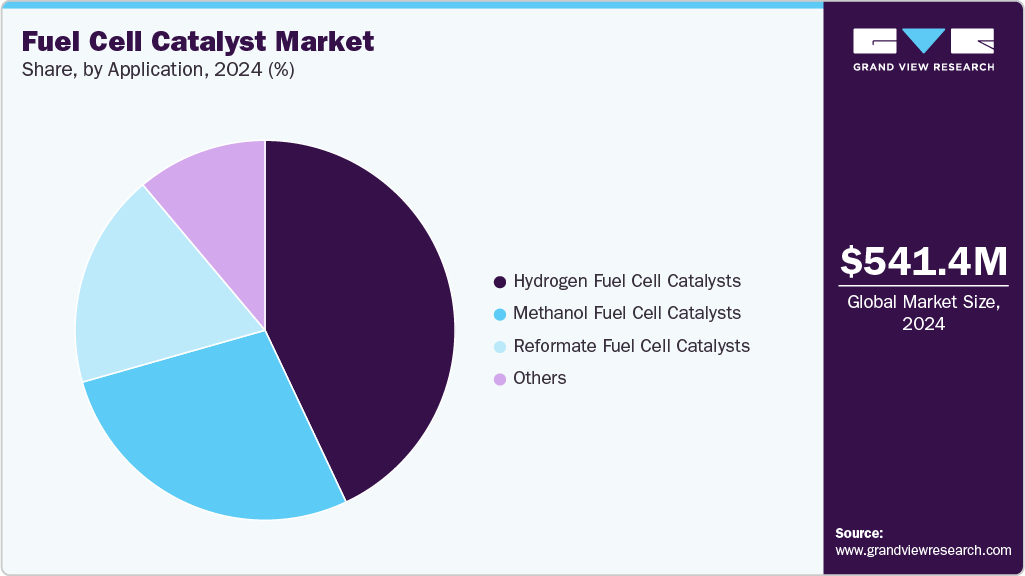

The global fuel cell catalyst market size was estimated at USD 541.38 million in 2024 and is projected to reach USD 1,103.39 million by 2033, growing at a CAGR of 8.4% from 2025 to 2033. The growth is primarily driven by the rising adoption of hydrogen fuel cells, which serve as a clean and efficient energy solution.

Key Market Trends & Insights

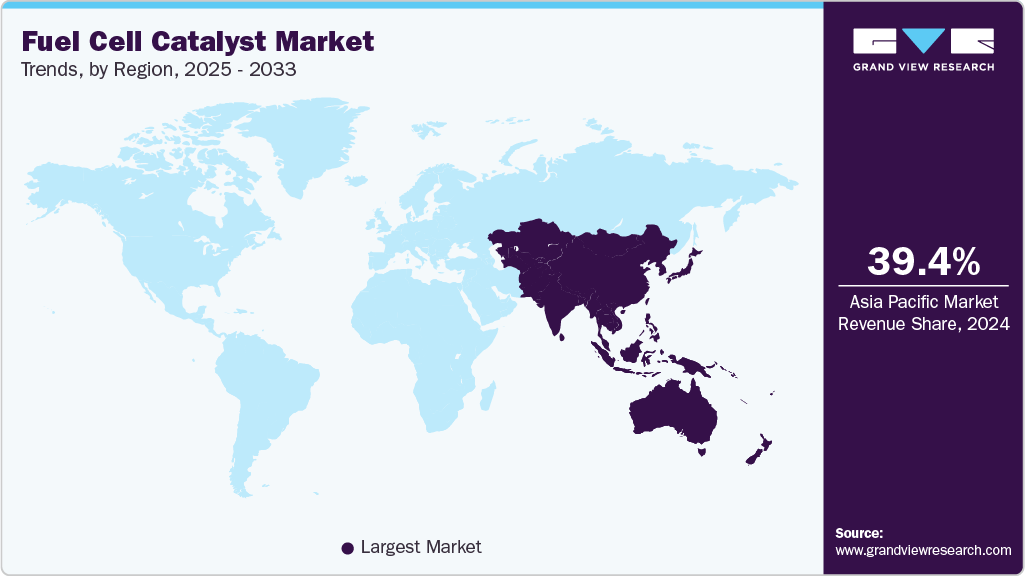

- Asia Pacific fuel cell catalyst market dominated with the largest revenue share of 39.42% in 2024.

- China is expected to register the highest CAGR of 8.9% during the forecast period.

- Based on catalysts, the platinum-based catalysts segment dominated the market and accounted for the largest revenue share of 54.77% in 2024.

- Based on application, the methanol fuel cell catalysts segment is expected to grow at the fastest CAGR of 9.0% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 541.38 Million

- 2033 Projected Market Size: USD 1,103.39 Million

- CAGR (2025-2033): 8.4%

- Asia Pacific: Largest market in 2024

This technology relies on catalysts to accelerate chemical reactions, enabling higher energy output with minimal emissions. As global efforts to achieve carbon neutrality intensify, industries are increasingly investing in hydrogen-based systems. The need for durable and high-performance catalysts has therefore become critical, driving continuous innovation and market expansion.One of the key drivers of growth is the accelerating global transition toward clean and sustainable energy, which is driving the adoption of hydrogen fuel cells across automotive, industrial, and power sectors. Growing concerns over carbon emissions and rising energy demand have encouraged governments and private players to invest in hydrogen infrastructure. Fuel cell catalysts, being essential components that enable efficient electrochemical reactions, are witnessing higher demand as industries shift toward low-emission technologies. Moreover, supportive policies, public-private partnerships, and large-scale R&D funding are further strengthening market growth.

Another major driver is the ongoing advancement in catalyst materials aimed at improving performance and reducing production costs. Conventional catalysts rely heavily on platinum, which raises overall system costs and limits large-scale commercialization. To overcome this challenge, manufacturers are focusing on low-platinum and non-precious metal alternatives that offer comparable efficiency and durability. These innovations are making fuel cell systems more affordable and scalable, encouraging wider adoption across transportation and stationary power applications, and thus sustaining long-term market expansion.

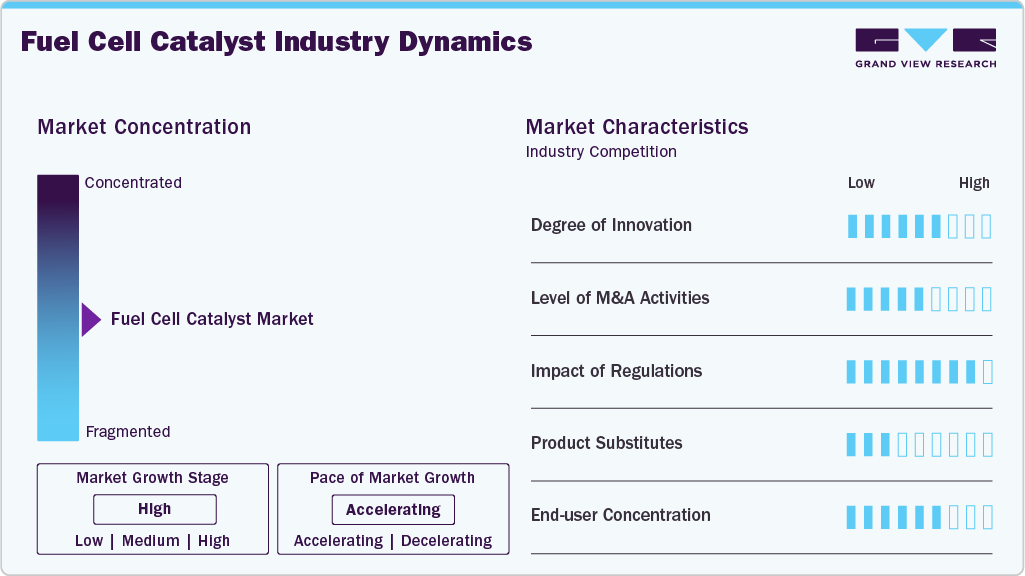

Market Concentration & Characteristics

The industry is moderately concentrated, with a few major players dominating global production through strong technological expertise and extensive R&D capabilities. Companies focus on developing advanced catalyst formulations with improved durability and lower platinum content to gain a competitive edge. Strategic partnerships, government collaborations, and expansion into emerging hydrogen economies are common characteristics shaping the market landscape.

In terms of characteristics, the industry is highly innovation-oriented and capital-intensive, requiring advanced manufacturing capabilities and strong material science expertise. Entry barriers are significant due to high R&D costs, complex production processes, and the need for proprietary catalyst technologies. The market also exhibits strong collaboration between catalyst developers, fuel cell manufacturers, and automotive OEMs to accelerate commercialization. Additionally, regional supply chain dependencies for precious metals such as platinum and palladium influence pricing dynamics and overall market stability.

Catalyst Insights

The platinum-based catalyst segment led the market and accounted for the largest revenue share of 54.77% in 2024. Platinum-based catalysts dominate the market due to their superior catalytic efficiency, high stability, and proven performance in hydrogen fuel cells. They are widely used across automotive and stationary applications where high power output and durability are essential.

The Non-Precious Metal Catalysts (NPMC) segment is the fastest-growing segment with a CAGR of 8.9% during the forecast period. This growth is driven by the rising demand for cost-effective alternatives to platinum-based catalysts, coupled with advancements in material engineering that enhance catalytic performance and durability. NPMCs are gaining traction in both automotive and stationary fuel cell applications as industries focus on reducing system costs and improving long-term sustainability.

Application Insights

The hydrogen fuel cell catalyst segment dominated the industry with a revenue share of 42.98% in 2024, due to its extensive use in transportation, power generation, and industrial applications, driven by large-scale investments in hydrogen infrastructure. Their high energy efficiency, quick refueling capability, and strong government support for zero-emission mobility further reinforce their market leadership.

The methanol fuel cell catalysts segment is the fastest-growing segment with a CAGR of 9.0% during the forecast period. This growth is driven by the increasing demand for compact and portable power solutions across electronics and remote energy systems. Methanol fuel cells offer advantages such as easy fuel storage, lower operating temperatures, and cost-efficient operation, making them ideal for small-scale and off-grid applications.

Regional Insights

Asia Pacific fuel cell catalyst market dominated with the largest revenue share of 39.42% in 2024. The growth is fueled by rapid industrialization, strong government support for clean energy projects, and increasing investments in hydrogen infrastructure. Countries such as China, Japan, and South Korea are leading in fuel cell adoption, supported by national hydrogen strategies, large-scale pilot projects, and growing demand for zero-emission vehicles. Expanding manufacturing capacity and local supply chain development for catalyst materials further strengthens the region’s leadership position.

China Fuel Cell Catalyst Market Trends

The fuel cell catalyst market in Chinadominated the region with a revenue share of 51.57% in 2024, driven by aggressive government policies promoting hydrogen energy and fuel cell vehicles. Strong investments in hydrogen refueling networks and domestic catalyst manufacturing are accelerating commercialization. The country’s emphasis on technological self-sufficiency and cost reduction has encouraged partnerships between research institutions and catalyst producers to develop high-performance, low-platinum solutions.

North America Fuel Cell Catalyst Market Trends

The fuel cell catalyst market in North America is driven by robust R&D capabilities, supportive regulatory frameworks, and rising adoption of hydrogen fuel cells in transport and stationary power. The region benefits from the strong participation of leading automotive manufacturers and fuel cell developers focusing on scaling up production. Ongoing public-private collaborations and clean energy funding programs are propelling innovation in catalyst performance and durability.

The fuel cell catalyst market in the U.S. is characterized by a well-developed hydrogen ecosystem, advanced material research, and growing adoption of fuel cell electric vehicles (FCEVs). Federal initiatives such as the Hydrogen Shot and incentives for zero-emission mobility are stimulating domestic catalyst demand. U.S. companies are focusing on optimizing catalyst efficiency and expanding pilot-scale fuel cell installations for heavy-duty transportation and distributed power applications.

Europe Fuel Cell Catalyst Market Trends

The fuel cell catalyst market in Europe is a mature and policy-driven market, where stringent emission standards and the EU’s Green Deal goals are accelerating the deployment of fuel cells across industries. The region’s focus on energy transition and green hydrogen production supports continuous demand for high-efficiency catalysts. Extensive collaboration between automakers, energy firms, and research institutions is fostering technological advancement and commercial scalability.

Germany fuel cell catalyst marketrepresents one of the most advanced and innovation-focused markets in Europe, backed by strong government funding and industrial participation in hydrogen technologies. The country’s emphasis on renewable integration and sustainable transportation has encouraged local production of fuel cell systems and catalyst materials. German manufacturers are prioritizing R&D on next-generation catalysts with reduced platinum content to meet both cost and performance goals.

Latin America Fuel Cell Catalyst Market Trends

The fuel cell catalyst market in Latin America is witnessing gradual growth, supported by the region’s rising interest in clean energy diversification and hydrogen pilot projects. Countries such as Brazil and Chile are leading initiatives to explore green hydrogen potential, creating early opportunities for catalyst adoption. Increasing collaboration with international energy firms and research partnerships is expected to drive regional technology transfer and market expansion.

Middle East & Africa Fuel Cell Catalyst Market Trends

The fuel cell catalyst market in the Middle East & Africa is still emerging but shows growing potential, driven by government investments in hydrogen economy development and renewable integration. Countries like the UAE and Saudi Arabia are launching hydrogen megaprojects to diversify their energy mix and reduce carbon intensity. Rising interest in exporting green hydrogen and establishing local fuel cell assembly capabilities is expected to support future catalyst demand in the region.

Key Fuel Cell Catalyst Companies Insights

Key players operating in the fuel cell catalyst market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth. Some of the key players operating in the market include Umicore, Johnson Matthey, 3M, Heraeus Precious Metals, TANAKA PRECIOUS METAL GROUP Co., Ltd., Clariant, Fuel Cells Etc., De Nora, BASF, and Pajarito Powder.

-

Umicore is a materials technology company specializing in sustainable metallurgy and advanced catalyst solutions. It provides a wide range of fuel cell catalysts designed for proton exchange membrane (PEM) and hydrogen applications. The company’s strong R&D capabilities and focus on low-platinum and platinum-free technologies position it as a leader in promoting clean mobility and green hydrogen solutions across global markets.

-

Johnson Matthey is a multinational specializing in sustainable technologies and catalyst innovation. The company produces high-performance catalysts for hydrogen fuel cells and focuses on developing durable, efficient materials for automotive and stationary power applications. Johnson Matthey’s expertise in precious metal chemistry and strong collaboration with fuel cell manufacturers have solidified its position as a global leader in the clean hydrogen economy.

Key Fuel Cell Catalyst Companies:

The following are the leading companies in the fuel cell catalyst market. These companies collectively hold the largest market share and dictate industry trends.

- Umicore

- Johnson Matthey

- 3M

- Heraeus Precious Metals

- TANAKA PRECIOUS METAL GROUP Co., Ltd.

- Clariant

- Fuel Cells Etc.

- De Nora

- BASF

- Pajarito Powder

Recent Developments

- In February 2025, Johnson Matthey and Bosch announced a long-term collaboration to jointly develop and manufacture catalyst coated membranes (CCMs) for zero-emission hydrogen fuel cell stacks.

Fuel Cell Catalyst Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 577.34 million

Revenue forecast in 2033

USD 1,103.39 million

Growth rate

CAGR of 8.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Catalyst, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Umicore; Johnson Matthey; 3M; Heraeus Precious Metals; TANAKA PRECIOUS METAL GROUP Co., Ltd.; Clariant; Fuel Cells Etc.; De Nora; BASF; Pajarito Powder

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fuel Cell Catalyst Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global fuel cell catalyst market report based on product, application, and region

-

Catalyst Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Platinum-Based Catalysts

-

Platinum Ruthenium Alloy Catalysts

-

Non-Precious Metal Catalysts (NPMC)

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Hydrogen Fuel Cell Catalysts

-

Methanol Fuel Cell Catalysts

-

Reformate Fuel Cell Catalysts

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fuel cell catalyst market size was estimated at USD 541.4 million in 2024 and is expected to reach USD 577.3 million in 2025.

b. The global fuel cell catalyst market is expected to grow at a compound annual growth rate of 8.4% from 2025 to 2033 to reach USD 1,103.4 million by 2033.

b. Asia Pacific dominated the fuel cell catalyst market with a share of 39.4% in 2019. The market growth is fueled by rapid industrialization, strong government support for clean energy projects, and increasing investments in hydrogen infrastructure.

b. Some key players operating in the fuel cell catalyst market include Umicore, Johnson Matthey, 3M, Heraeus Precious Metals, TANAKA PRECIOUS METAL GROUP Co., Ltd., Clariant, Fuel Cells Etc., De Nora, BASF, and Pajarito Powder.

b. Key factors that are driving the market growth include rising adoption of hydrogen fuel cells, which serve as a clean and efficient energy solution. This technology relies on catalysts to accelerate chemical reactions, enabling higher energy output with minimal emissions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.