- Home

- »

- Homecare & Decor

- »

-

Furniture, Fixtures And Equipment Market Size Report, 2033GVR Report cover

![Furniture, Fixtures, And Equipment Market Size, Share & Trends Report]()

Furniture, Fixtures, And Equipment Market (2025 - 2033) Size, Share & Trends Analysis By Product (Furniture, Fixtures, Equipment), By End Use (Hotels & Hospitality, Retail Spaces), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-478-2

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Furniture, Fixtures, And Equipment Market Summary

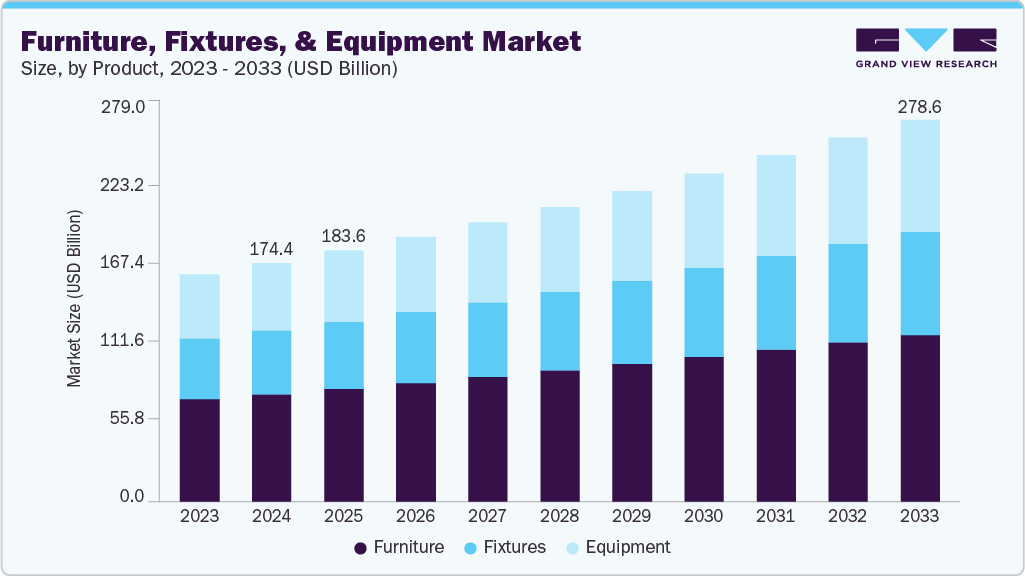

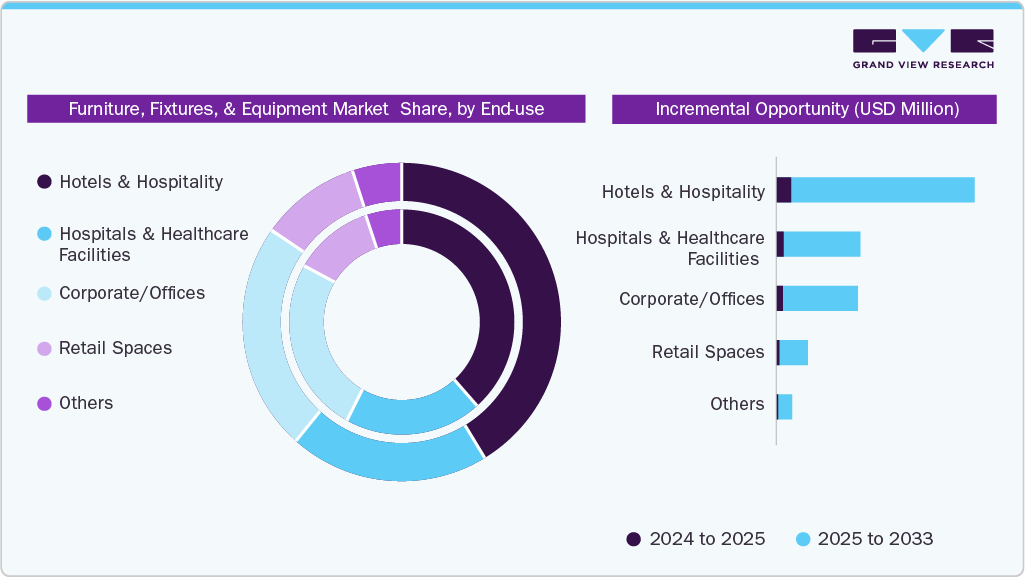

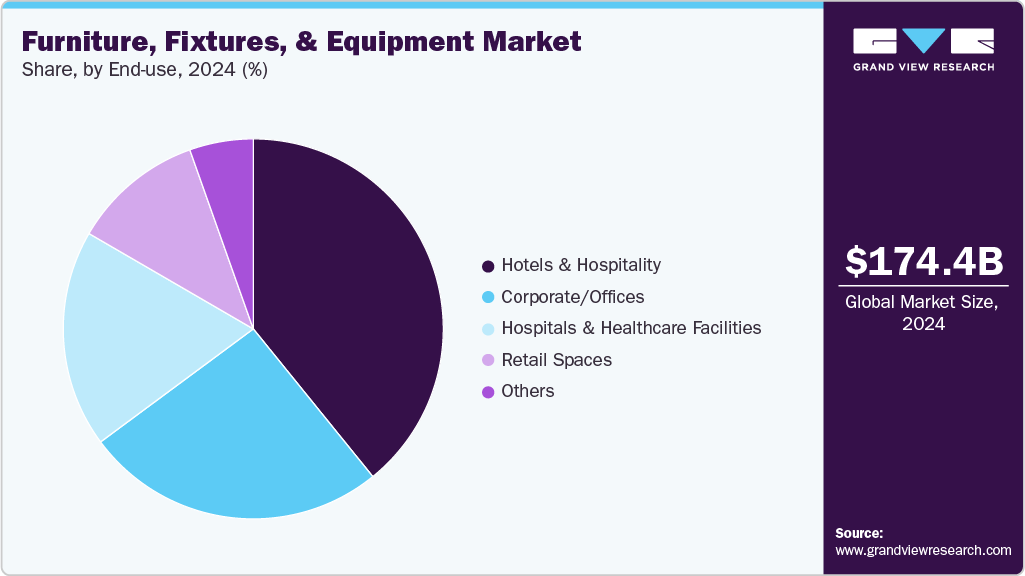

The global furniture, fixtures, and equipment market size was estimated at USD 174.44 billion in 2024 and is expected to reach USD 278.55 billion by 2033, growing at a CAGR of 5.4% from 2025 to 2033. The market is experiencing robust growth, driven by expanding commercial construction, rising hospitality investments, and increased corporate spending on workplace modernization.

Key Market Trends & Insights

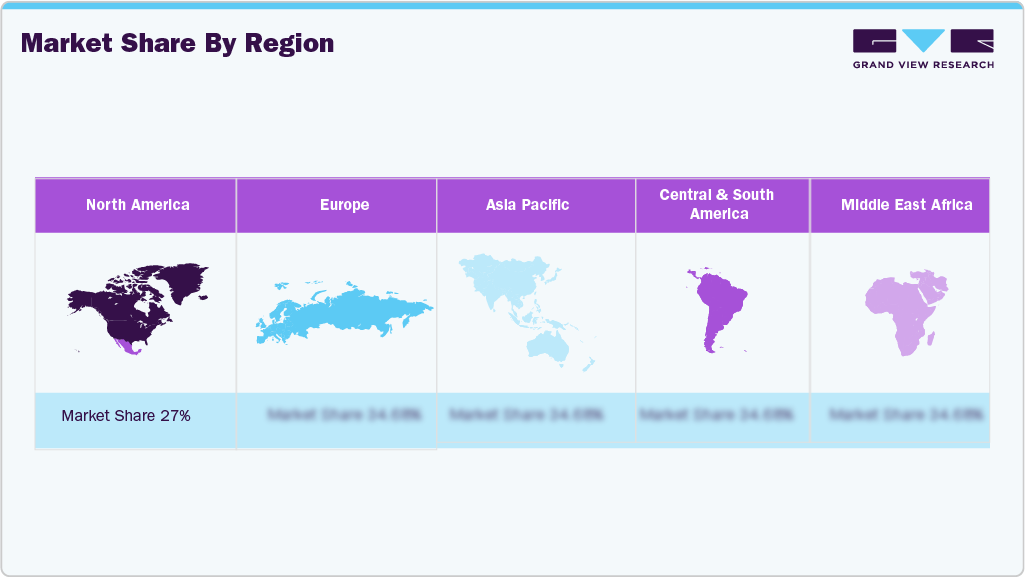

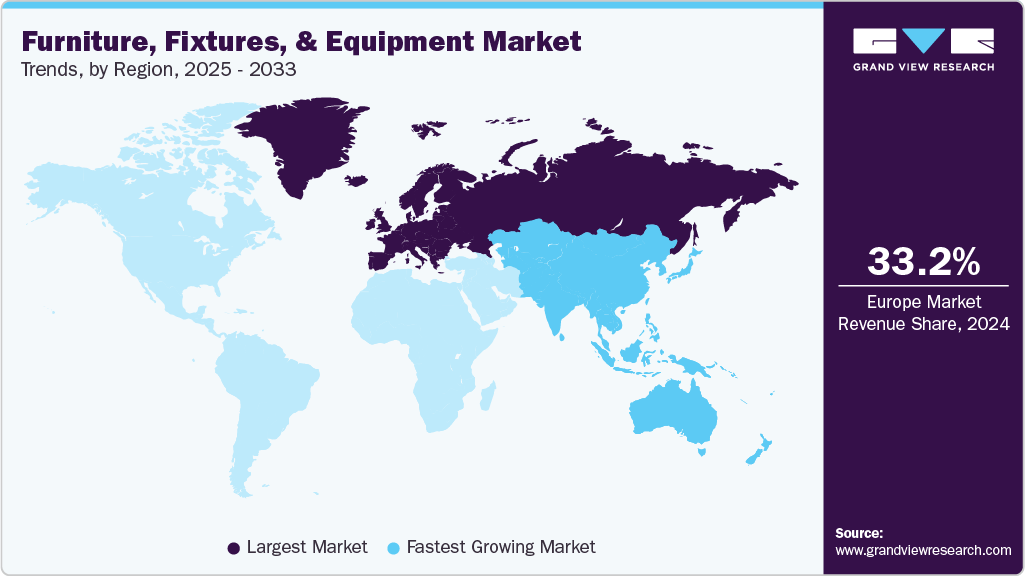

- By region, Europe led the market with a share of 33.2% in 2024.

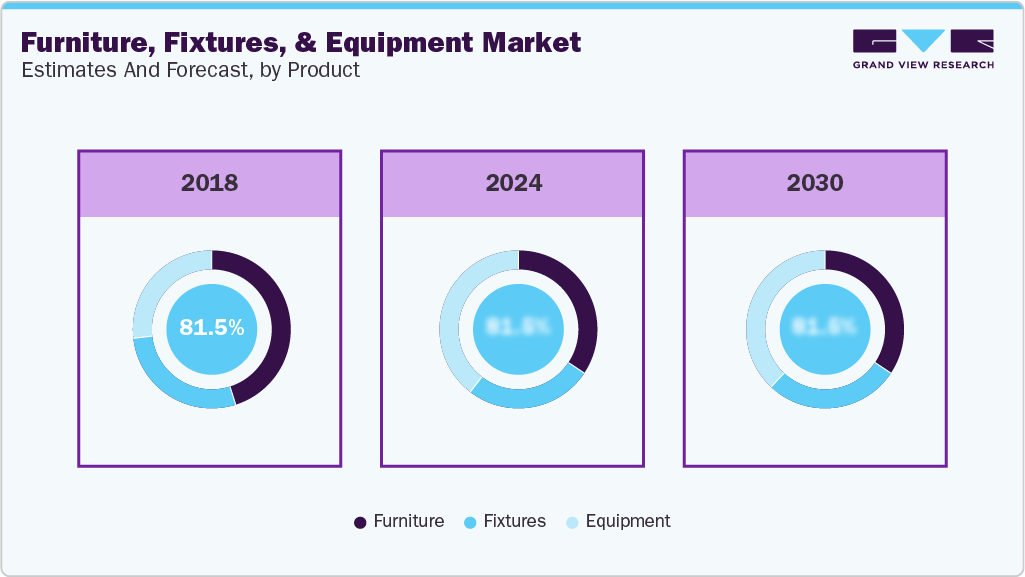

- By product, furniture led the market and accounted for a share of 45.1% in 2024.

- By end use, the hotels & hospitality segment led the market and accounted for a share of 39.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 174.44 Billion

- 2033 Projected Market Size: USD 278.55 Billion

- CAGR (2025-2033): 5.4%

- Europe: Largest market in 2024

- Asia Pacific : Fastest growing market

The growing focus on infrastructure development across emerging and developed economies, particularly in hospitality, healthcare, and corporate sectors, is propelling the demand for integrated furniture, fixtures, and equipment (FF&E) solutions. Governments and private developers are actively investing in large-scale projects such as hotels, hospitals, offices, and retail outlets, all of which require coordinated FF&E installations to meet aesthetic, functional, and operational needs. For instance, according to Saudi Arabia’s National Transformation Plan, the country will build more than 555,000 residential units, more than 275,000 hotel keys, over 4.3 million sq m of retail space, and over 6.1 million sq m of new office space by 2030. Saudi Arabia’s Vision 2030 and other national transformation programs worldwide are promoting large real estate developments, thereby strengthening demand for FF&E products globally.

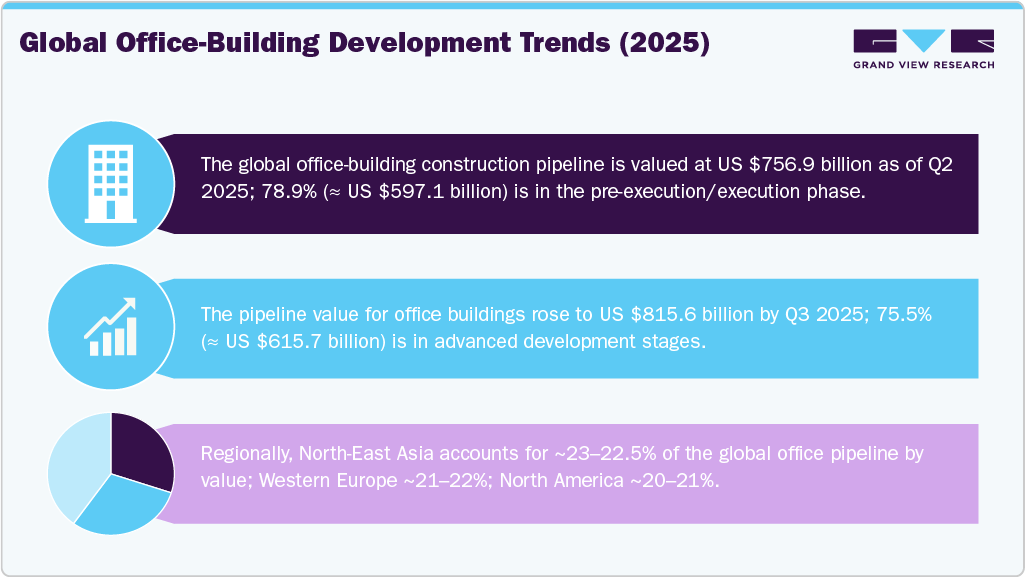

Moreover, the increasing capital investments in office infrastructure, primarily driven by the development of Information Technology (IT) hubs in various countries, are expected to prompt the need for office furniture, fixtures, and equipment during the forecast period. According to the Economic Impact Study commissioned by the Building Owners and Managers Association International (BOMA), the establishment of business offices in the U.S. is increasing. Moreover, government initiatives focusing on the development of the real estate industry will consequently drive the demand for furniture. According to Saudi Arabia’s National Transformation Plan, the country will build more than 555,000 residential units, more than 275,000 hotel keys, over 4.3 million sq m of retail space, and over 6.1 million sq m of new office space by 2030.

The market is witnessing a clear shift toward customized, ergonomic, and sustainable FF&E solutions that cater to diverse end-use sectors such as corporate offices, hospitality, healthcare, and educational institutions. With continuous investments in real estate and infrastructure projects globally, the demand for high-quality products is anticipated to remain strong, positioning the market for steady growth over the coming years. According to a Resume Builder survey of 1,000 company leaders, 90% of companies planned to implement return-to-office policies by the end of 2024. This will increase the demand for furniture solutions that accommodate the needs of modern office environments.

FF&E suppliers are likely to experience a corresponding surge in demand as businesses seek to create dynamic and engaging workspaces to support their growing operations. As stated in a December 2023 news article, ‘Commercial Realty's Strong Performance In 2023 Sets The Pathway For Prosperity In 2024’, published on financialexpress.com, the office space leasing activity experienced strong demand and growth, with a notable 33% increase in gross office space leasing across the top 9 metro cities in India during Q3 2023.

Buyer Insights

Buyers across hospitality, corporate, and residential segments increasingly prioritize FF&E solutions that use responsibly sourced and low-impact materials. This includes furniture made from FSC-certified wood, water-based finishes, recycled fabrics, and traceable metal supply chains. The expansion of the global hospitality sector serves as a major market growth catalyst, as the continuous development of hotels, restaurants, resorts, and mixed-use hospitality spaces necessitates large-scale interior and exterior solutions. Modern hospitality projects are increasingly focused on delivering immersive guest experiences through design-rich interiors that strike a balance between aesthetics, functionality, and comfort. This shift has accelerated demand for high-quality furniture, fixtures, and equipment.

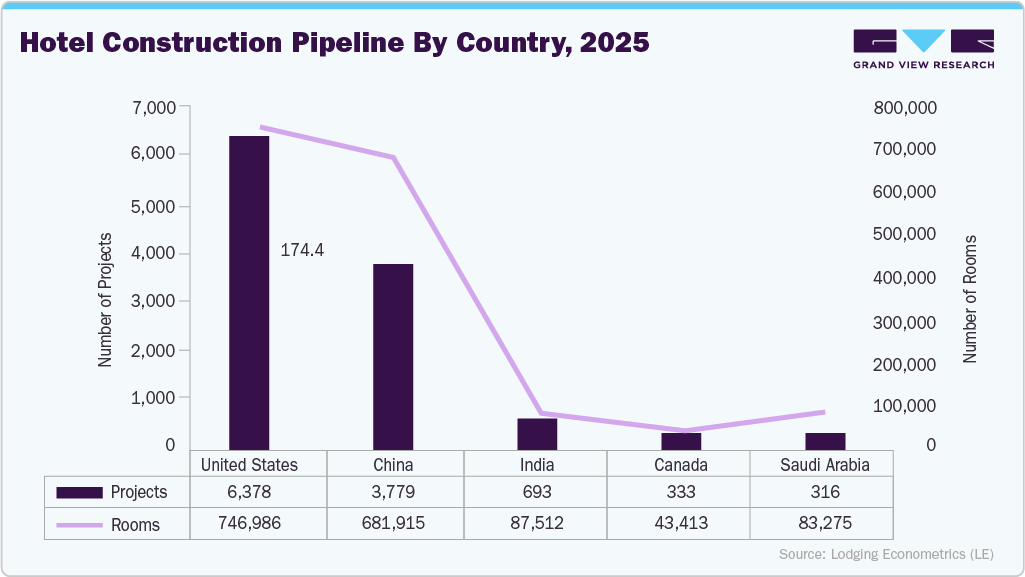

The global hotel construction pipeline (a key subset of commercial construction) reached 15,820 projects representing 2,438,189 rooms in Q4 2024, marking a 4% increase in project count and a 3% increase in rooms year-on-year. In Q2 2025, the pipeline rose further to 15,871 projects/2,436,225 rooms, up 3% by projects and 2% by rooms YoY. These robust growth rates illustrate how commercial building starts are on an upward trajectory, which will drive demand for FF&E in the hospitality sector.

In addition, the recovery in the global tourism sector is further fueling investments in the construction and renovation of resorts, hotels, restaurants, and recreational facilities, thereby generating consistent demand for FF&E. For instance, global international tourist arrivals reached 1.4 billion in 2024, an approximate 11% increase over 2023, underlining the rebound of resort and hospitality infrastructure worldwide.

Moreover, flexible furniture systems are being widely adopted to accommodate evolving usage patterns, especially in corporate and hospitality environments where space configurations shift frequently. Buyers prefer modular seating systems, adaptive workstations, expandable conference setups, and stackable fixtures that can be reconfigured without requiring specialized labor. This supports multi-purpose usage, reduces the need for replacements during functional changes, and improves cost efficiency over the asset lifecycle. FF&E suppliers are expected to provide configuration guidelines and 3D layout planning support to demonstrate flexibility in real project contexts.

Product Insights

Furniture dominated the market, accounting for a share of 45.1% in 2024. This segment is being driven by sustainability imperatives, digital commerce evolution, and lifestyle shifts post-pandemic. Consumers and large retailers are increasingly demanding recycled materials, take-back programs, and lower lifecycle carbon footprints; as a result, product development and sourcing strategies are being re-aligned to circular models. Consumers are prioritizing sustainable sourcing, recyclability, and durability, prompting manufacturers such as IKEA, Steelcase, and Herman Miller to expand circular design and resale programs.

Equipment is anticipated to witness a CAGR of 5.8% from 2025 to 2033. The equipment sub-category within FF&E (commercial kitchen appliances, hospitality appliances, office equipment, medical equipment, HVAC/filtration, etc) is being redefined by energy-efficiency mandates, digitalization, and total-cost-of-ownership thinking. Procurement is being driven away from one-off purchases toward connected, serviceable assets that deliver measured energy and water savings, predictable uptime, and lower lifecycle cost; as a result, vendors are prioritizing heat-pump drying, water-recycling, IoT telemetry, and modular designs in new product roadmaps.

For instance, RATIONAL introduces a new appliance category and digital solutions. A new cooking-system category (and incremental innovations to the iCombi/iVario lines) was previewed and rolled out as part of RATIONAL’s push on digitalisation and integrated cleaning/digital services. This is being positioned to increase productivity and reduce energy use in commercial kitchens.

End Use Insights

Sales of furniture, fixtures, and equipment (FF&E) in hotels & hospitality held the largest share, accounting for around 39.2% in 2024. This segment is experiencing robust growth, driven largely by the global expansion of the hospitality sector and an increasing emphasis on enhancing guest experiences. Hotel furniture encompasses a wide range of products, from beds, seating, and case goods to decorative items and outdoor furniture. As travelers prioritize comfort and ambiance, hotels are investing in high-quality, aesthetically pleasing, and functional furniture to elevate their brand and attract clientele. This trend is especially prominent in luxury and boutique hotels, which are adopting bespoke furniture solutions to offer unique, immersive experiences.

Hospitals & healthcare facilities is anticipated to witness a CAGR of 5.6% from 2025 to 2033. The furniture for hospitals and healthcare facilities is vital for creating functional, sterile, and aesthetically pleasing environments. Key furniture items, such as patient beds, exam stools, waiting room chairs, and over-bed tables, enhance comfort and accessibility for patients while supporting healthcare staff's workflow. The market's focus is on durability, chemical resistance, and adherence to cleanliness standards. In addition, the furniture must meet ADA (Americans with Disabilities Act Standards for Accessible Design) accessibility requirements, ensuring inclusivity for all patients. Healthcare facilities regularly update their furniture to maintain a professional and welcoming atmosphere, recognizing the significant role physical environments play in improving patient outcomes and staff efficiency.

Regional Insights

The North America furniture, fixtures, and equipment (FF&E) market is expected to grow at a CAGR of 4.5% from 2025 to 2033. The market encompasses a wide range of products, including beds, chairs, tables, lighting, and bathroom fixtures, as well as specialized equipment such as kitchen appliances and smart systems designed to enhance consumer experience. As technology evolves, furniture manufacturers are increasingly integrating smart solutions into office designs, reflecting the changing needs of modern workplaces. Gebesa, a North American office furniture manufacturer (headquartered in Mexico and catering to the U.S. & Canadian markets), is increasingly integrating smart solutions into workplace furniture, such as adjustable desks, modularized displays, and AV equipment, to enhance comfort, efficiency, and collaboration.

Europe Furniture, Fixtures, And Equipment Market Trends

The furniture, fixtures, and equipment (FF&E) market in Europe accounted for a share of around 33.2% in 2024. In Europe, furniture purchasing and omnichannel retailing are being driven by accelerated digitalization: online sales, AR/virtual showrooms, and platform-led distribution are expanding addressable markets and shortening purchase cycles. In the UK and across Europe, online furniture penetration has been reported to grow strongly (IKEA reported online sales representing ~26% of FY24 sales, and industry forecasts show fast growth in the online furniture segment). Retailers and pure-play brands have been investing in AR tools, marketplace listings, and last-mile logistics to capture consumers researching online but buying high-value items digitally.

Asia Pacific Furniture, Fixtures, And Equipment Market Trends

The furniture, fixtures, and equipment (FF&E) market in the Asia Pacific accounted for a share of around 28.5% in 2024. In the Asia Pacific region, demand for furniture and fitted equipment in China & India is being driven by continued urbanization and rising household incomes, which together are enlarging the addressable residential market and upgrading purchase preferences toward branded and higher-margin product lines. This growth has also been fueled by the expansion of omnichannel retailing and large e-commerce platforms that shorten time-to-purchase and enable mass customization and modular product launches; manufacturers and retailers have been observed to prioritize online-to-offline fulfilment and digital showrooms to capture this traffic. Product development focused on multifunctional and small-space solutions is being monetized as population movement to lower- and mid-tier cities increases renovation and furnishing cycles.

Central & South America Furniture, Fixtures, And Equipment Market Trends

The furniture, fixtures, and equipment (FF&E) market in the CSA is expected to grow at a CAGR of 6.0% from 2025 to 2033. Brazil’s large housing deficit and ongoing public and private housing activity have been creating steady, volume-driven demand for basic furniture and fitted equipment. Government initiatives and subsidised housing programmes (such as the long-running Minha Casa Minha Vida framework and its successors) have been credited with stimulating construction and furnishing cycles for low- and middle-income segments, which in turn have supported OEM and retail volume. In addition, replacement and first-time-buyer furnishing cycles in growing metropolitan peripheries have been reported as material contributors to market expansion.

Middle East & Africa Furniture, Fixtures, And Equipment Market Trends

The furniture, fixtures, and equipment (FF&E) market in the MEA is expected to grow at a CAGR of 6.3% from 2025 to 2033. A large housing backlog, ongoing public housing delivery, and persistent refurbishment activity are underpinning demand for basic and mid-market FF&E. South Africa’s human settlements programmes and the sizable backlog of subsidised housing (estimated in recent analyses at ~2.4 million units) are being cited as steady sources of first-time and replacement furnishing demand; constrained fiscal envelopes and a focus on integrated human settlements are shaping the type and price bands of furniture procured. Online channels and omni-marketplaces are widening distribution and lowering search friction for bulky home goods, enabling both national reach and quicker product assortment expansion. Local platforms and pure-play retailers (Takealot, Mr Price Home, Zando) plus international entrants are being observed to scale furniture and home-decor categories, which is accelerating category frequency and SKU proliferation.

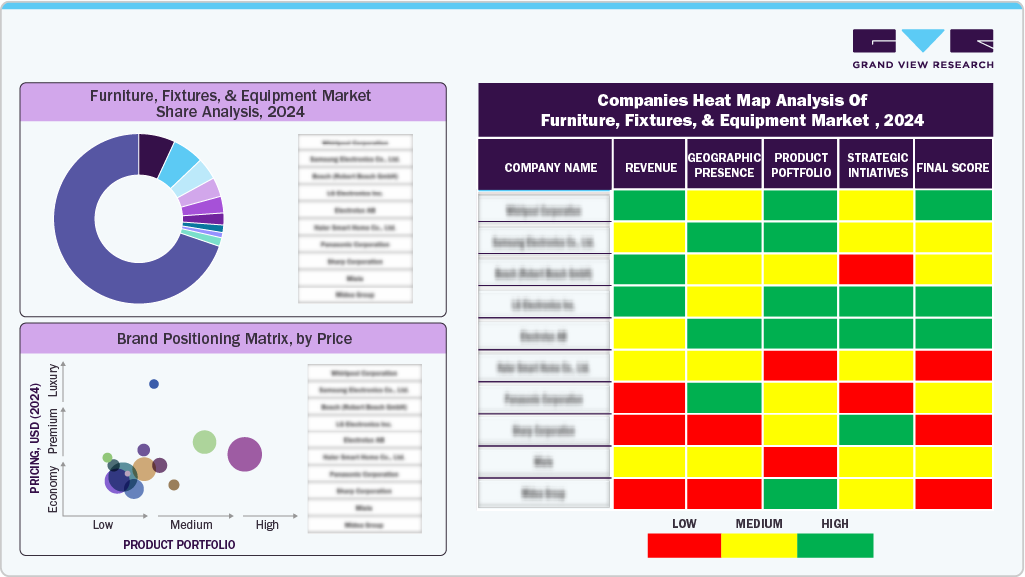

Key Furniture, Fixtures, And Equipment Company Insights

Leading market players include Herman Miller Inc., Haworth Inc., Stryker Corporation, Ashley Furniture Industries, Inc., Inter IKEA Systems B.V., and others. Companies in the market are increasingly investing in advanced material engineering, ergonomic design innovation, and modular construction technologies to enhance product durability, sustainability, and adaptability across commercial and residential settings. The growing emphasis on smart, multifunctional furniture integrated with IoT and energy-efficient systems is further driving market advancement.

Rising consumer awareness regarding sustainable sourcing, eco-friendly materials, and circular design principles is fostering strong demand for products made from recycled or renewable resources. In addition, the ongoing shift toward flexible workspaces, hospitality refurbishments, and luxury home interiors is reinforcing long-term growth prospects for the FF&E sector, positioning it as a key enabler of both aesthetic and functional transformation in modern infrastructure and living environments.

Key Furniture, Fixtures, And Equipment Companies:

The following are the leading companies in the furniture, fixtures, and equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Kimball International Inc.

- Global Furniture Group

- Steelcase Inc.

- Herman Miller Inc.

- Haworth Inc.

- Stryker Corporation

- Ashley Furniture Industries, Inc.

- Inter IKEA Systems B.V.

- Häfele

- Kinnarps Group

Recent Developments

-

In November 2025, Häfele launched a series of innovations at SICAM 2025, showcasing its commitment to connected and invisible design. The highlights included the new OneCable 24 V lighting system, the ultra-slim Free Slim 8 mm opening system, and the Ixconnect UC 16/64 connector, all designed to integrate seamlessly into modern furniture solutions. These launches emphasize Häfele’s focus on functionality, aesthetics, and smart connectivity for next-generation living spaces.

-

In June 2025, Herman Miller launched its new Fulton Market showroom in Chicago alongside an interactive Seating Lab during Design Days 2025. The refreshed space spotlights the brand’s commercial innovations and invites visitors to explore and test ergonomic seating solutions firsthand. This move underscores Herman Miller’s commitment to immersive design experiences and performance-driven workplace environments.

-

In July 2025, Haworth’s Luxury Living Group acquired 100% of Fashion Furniture Design S.p.A. (FFD), gaining full control over the Fendi Casa home furniture license. This acquisition strengthens Haworth’s position in the high-end furniture market, combining its design and manufacturing expertise with Fendi Casa’s luxury home furnishings legacy.

-

In April 2024, Global Furniture Group launched its new Include seating series at NeoCon 2025, featuring a kinetic synchro-tilter mechanism that automatically adjusts to a person’s weight and an ergonomic articulating lumbar support for enhanced comfort. The collection is ideal for boardrooms, meeting rooms, and executive offices, and is available in mid- and high-back models with a range of finish options.

Furniture, Fixtures, And Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 183.55 billion

Revenue forecast in 2033

USD 278.55 billion

Growth rate

CAGR of 5.4% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; CSA; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Kimball International Inc.; Global Furniture Group; Steelcase Inc.; Herman Miller Inc.; Haworth Inc.; Stryker Corporation; Ashley Furniture Industries, Inc.; Inter IKEA Systems B.V.; Häfele, Kinnarps Group

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Furniture, Fixtures, And Equipment Market Report Segmentation

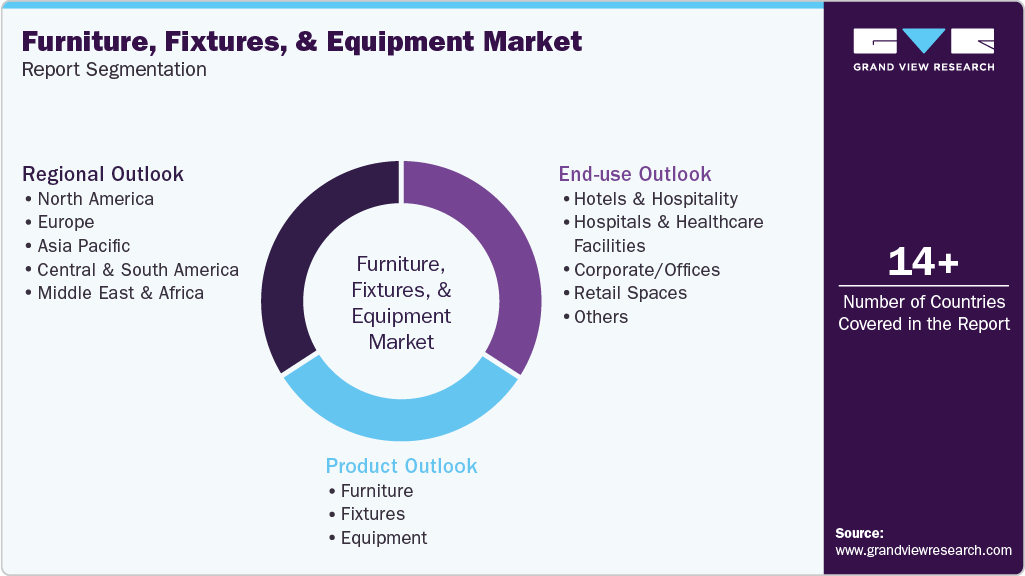

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends and opportunities in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the furniture, fixtures, and equipment (FF&E) market based on product, end use, and region:

-

Product Outlook (Revenue: USD Million, 2021 - 2033)

-

Furniture

-

Fixtures

-

Equipment

-

-

End Use Outlook (Revenue: USD Million, 2021 - 2033)

-

Hotels & Hospitality

-

Hospitals & Healthcare Facilities

-

Corporate/Offices

-

Retail Spaces

-

Others

-

-

Regional Outlook (Revenue: USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global furniture, fixtures, and equipment market was estimated at USD 174.44 billion in 2024 and is expected to reach USD 193.30 billion in 2025.

b. The global furniture, fixtures, and equipment market is expected to grow at a compound annual growth rate of 5.4% from 2025 to 2030 to reach USD 278.55 billion by 2033.

b. Furniture held the largest share in the furniture, fixtures, and equipment (FF&E) market, accounting for a share of 45.1% in 2024. The furniture segment within the global furniture, fixtures, and equipment (FF&E) market is being driven by sustainability imperatives, digital commerce evolution, and lifestyle shifts post-pandemic. Consumers and large retailers are increasingly demanding recycled materials, take-back programs, and lower lifecycle carbon footprints; as a result, product development and sourcing strategies are being re-aligned to circular models.

b. Some of the key players operating in the furniture, fixtures, and equipment (FF&E) market include Kimball International Inc., Global Furniture Group, Steelcase Inc., Herman Miller, Inc., Stryker Medical, Ashley Furniture Industries, Inc., Inter IKEA Systems B.V., Century Furniture LLC., Haworth International, Ltd, and Teknion.

b. Growth of the global furniture, fixtures, and equipment market is majorly driven on account of increasing demand from the hospitality, healthcare, education, and residential sectors. As these industries expand and evolve, there is a growing demand for high-quality and customized FF&E solutions that meet the unique requirements of diverse projects.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.