- Home

- »

- Biotechnology

- »

-

Genetic Toxicology Testing Market Size, Industry Report 2033GVR Report cover

![Genetic Toxicology Testing Market Size, Share & Trends Report]()

Genetic Toxicology Testing Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (In Vitro, In Vivo), By Product (Reagents & Consumables, Assay Kit, Services), By Assay (Comet Assay, Micronucleus Assay, Chromosomal Aberration Test), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-981-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Genetic Toxicology Testing Market Summary

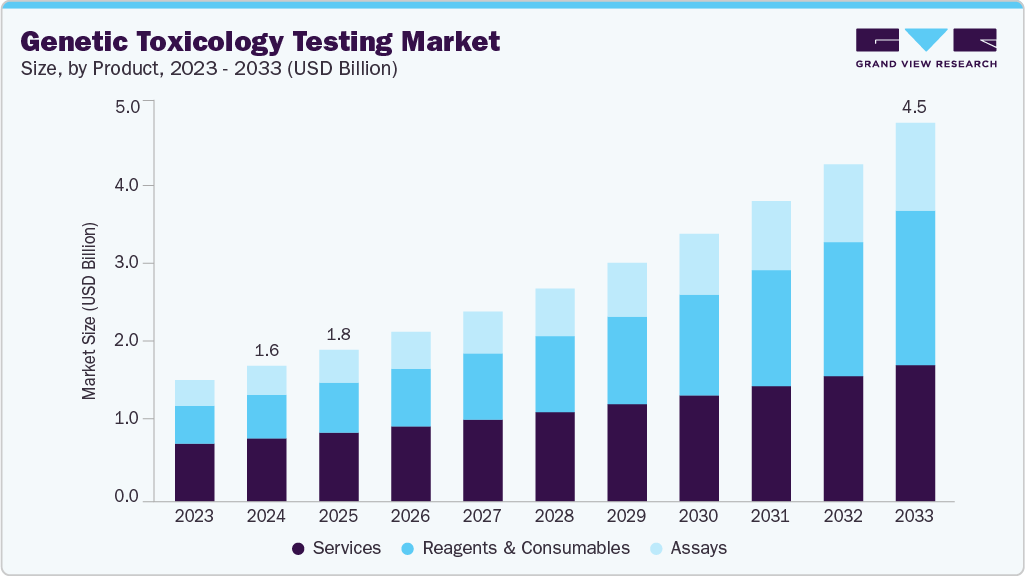

The global genetic toxicology testing market size was valued at USD 1.62 billion in 2024 and is projected to reach USD 4.53 billion by 2033, expanding at a CAGR of 12.13% from 2025 to 2033. The industry is increasing due to several factors, including the growing prevalence of cancer, breakthroughs in genomics technology, research and development in the chemical, pharmaceutical, and biotechnology industries, the shift toward precision and personalized medicine, and increasing public awareness of the health risks associated with exposure to genotoxic agents.

Key Market Trends & Insights

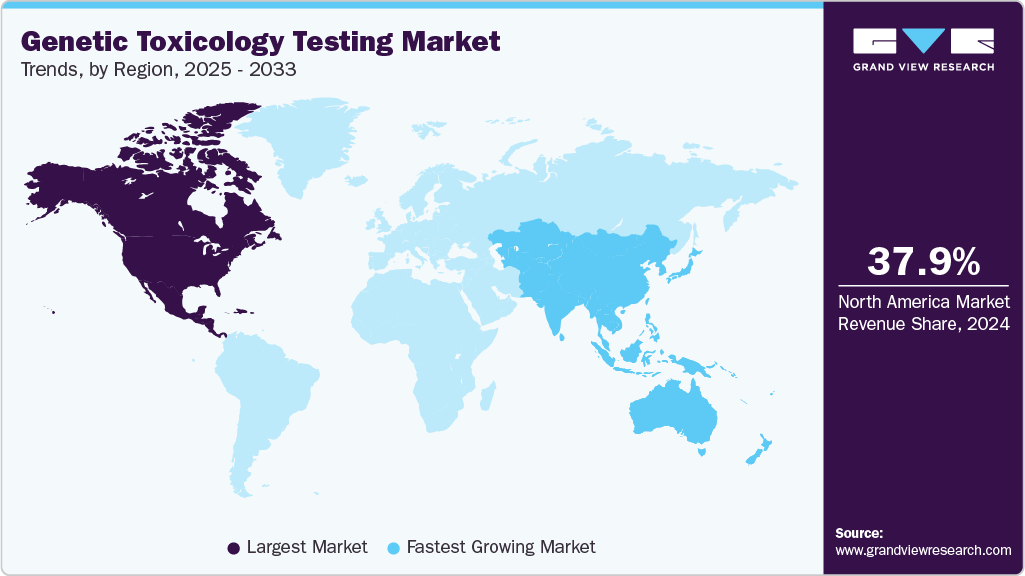

- The North America genetic toxicology testing market held the largest share of 37.87% of the global market in 2024.

- The genetic toxicology testing industry in the U.S. is expected to grow significantly over the forecast period.

- By product, the service segment held the highest market share of 46.53% in 2024.

- Based on type, the in vitro segment held the highest market share in 2024.

- By assay, the comet assay segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.62 Billion

- 2033 Projected Market Size: USD 4.53 Billion

- CAGR (2025-2033): 12.13%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Technological AdvancementsThe market for genetic toxicology testing is driven largely by technological advancements, which are transforming conventional testing paradigms and enhancing the precision, speed, and predictive value of genotoxic evaluations. By allowing for the simultaneous testing of thousands of samples, the integration of high-throughput screening (HTS) platforms has greatly accelerated compound evaluation, cutting costs and development timelines.

Moreover, the market's potential for growth has been further enhanced by the integration of artificial intelligence (AI) and machine learning (ML) into toxicology testing. In addition to increasing testing efficiency, this shift toward data-driven, computational toxicology is also aligned with international regulatory efforts that support non-animal, in silico, and in vitro testing methods.

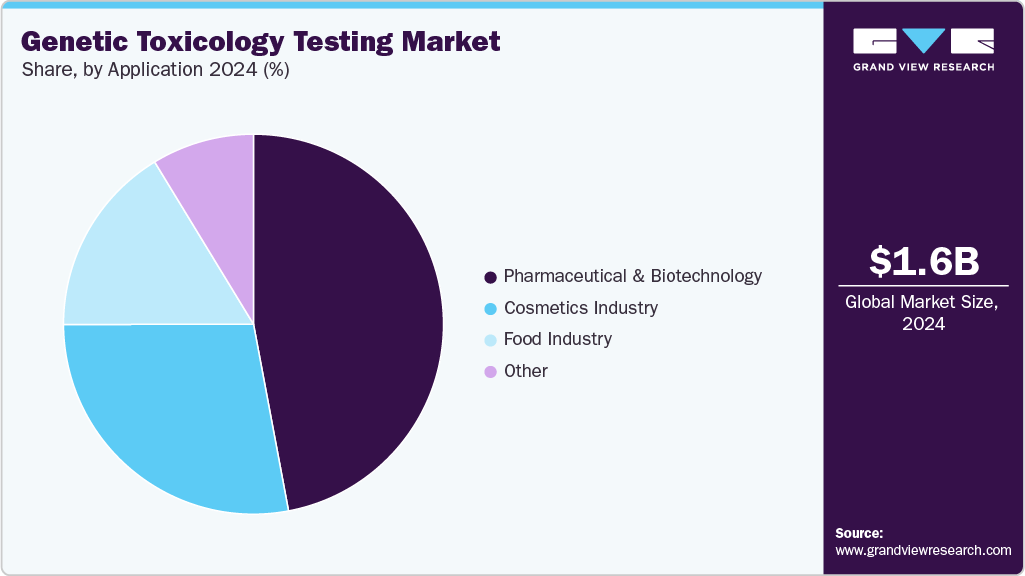

Cosmetic and Chemical Safety Assessment

As consumers and regulatory bodies place a greater emphasis on product safety and sustainability, the growing demand for genetic toxicology testing is largely driven by the expanding sectors of cosmetics, agrochemicals, and industrial chemicals. The need to assess the potential mutagenic and carcinogenic effects of chemicals and cosmetic ingredients on human health and the environment is increasing as their production expands globally.

Moreover, manufacturers are being compelled to invest in thorough genotoxicity evaluations due to growing consumer awareness of product safety and the growing demand for "clean," non-toxic, and environmentally friendly formulations. To evaluate DNA damage, chromosomal abnormalities, and mutagenic potential in complex formulations, businesses utilize sophisticated cell-based assays, 3D tissue models, and microfluidic systems.

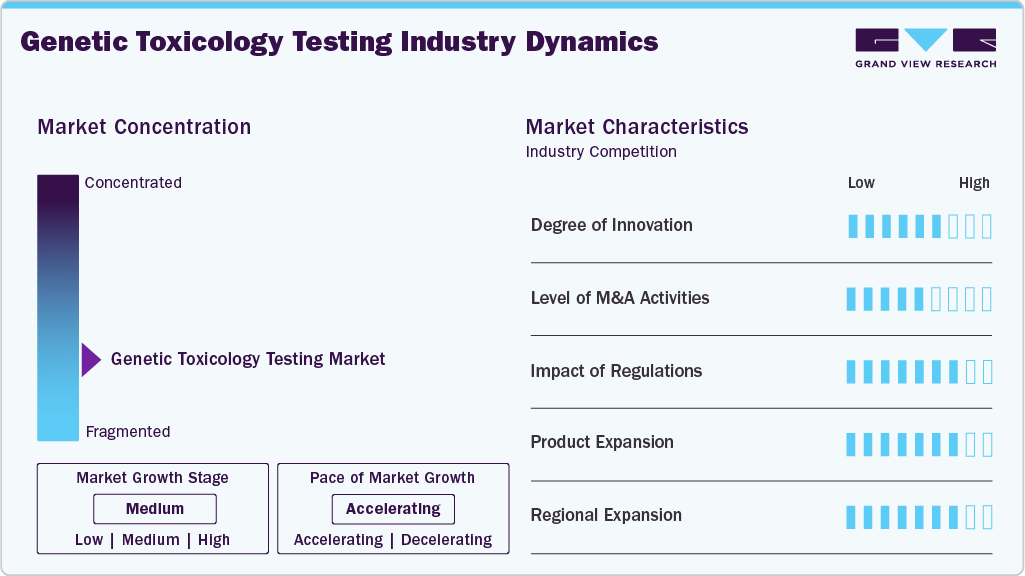

Market Concentration & Characteristics

The industry shows strong innovation through NGS, HTS, AI-driven analysis, and advanced 3D or organ-on-chip models, enhancing accuracy and efficiency while reducing animal use. These advances enable faster, more ethical, and cost-effective assessments of genotoxicity.

The industry for the genetic toxicology industry is experiencing a moderate amount of M&A activity, as businesses buy specialized labs and CROs to increase their capabilities, incorporate AI and in vitro technologies, and fortify their global presence. To boost competitiveness and spur growth, these agreements emphasize innovation, consolidation, and expansion of services. For instance, in January 2022, Inotiv, Inc. acquired Integrated Laboratory Systems, LLC to extend Inotiv's capabilities into genomics, bioinformatics, and computational toxicology. The acquisition also aimed to add significant expertise in pathology and toxicology.

Regulations strongly drive the industry, with agencies like the FDA, EMA, and OECD mandating genotoxicity studies for safety compliance. Evolving rules that promote in vitro and in silico methods, as well as reducing animal testing, are prompting companies to adopt advanced, validated technologies.

Product expansion in the genetic toxicology testing industry is driven by advancements in in vitro assays, AI-based tools, and 3D or organ-on-chip models, which enhance testing accuracy, speed, and ethical compliance across various industries.

Companies expanding their presence in emerging markets, such as the Asia-Pacific and Latin America, where R&D investments and regulatory frameworks are rapidly evolving, are driving regional expansion in the genetic toxicology testing industry. This expansion helps meet the growing demand for sophisticated, affordable, and compliant testing services in the chemical and pharmaceutical industries.

Product Insights

The service segment captured the largest revenue share of 46.53% in 2024. This is attributed to several factors, such as the increasing demand for outsourced services, the complexity of testing procedures, and the need for specialized expertise. Service providers offer a range of genetic toxicology testing services, including in vitro and in vivo testing, genotoxicity assays, and regulatory consulting services. This segment’s dominance can be attributed to its ability to provide comprehensive solutions to clients, ensuring compliance with regulatory requirements and delivering accurate and reliable results.

The reagents & consumables segment is expected to grow at the fastest CAGR over the forecast period. Several factors have contributed to this growth, including the growing demand for genetic toxicology testing, technological advancements that have produced increasingly complex reagents and consumables, and the increasing emphasis on genetic toxicology research and development activities.

Type Insights

The in vitro segment held the largest revenue share in 2024 and is estimated to show the fastest CAGR during the forecast period. This is driven by advantages such as cost-effectiveness, more rapid results, reduced animal use, ethical compliance, regulatory support, and growing awareness of the benefits of genetic toxicology testing. Advances in cell culture, high-throughput screening, and computational modeling have further improved the reliability and appeal of in vitro methods.

The in vivo segment is expected to experience significant growth throughout the forecast period, driven by the increasing demand for precise and reliable testing techniques, technological advancements, and the growing recognition of the value of genetic toxicology in assessing potential hazards associated with chemicals and medications. The demand for in vivo testing services is being driven by regulatory bodies' emphasis on the significance of genetic toxicology testing in pharmaceuticals and other products.

Assay Insights

The comet assay segment dominated the market in 2024 with the largest share of 38.82%. The comet assay, also known as single-cell gel electrophoresis, is widely used for assessing DNA damage. It can detect a broad range of DNA damage, including single-strand breaks, double-strand breaks, and incomplete repair sites. It is a relatively simple and versatile technique, making it adaptable to various types of samples and testing methods. Also, its adoption has increased due to its cost-effectiveness in genetic toxicology testing.

The genetic mutation test is expected to witness rapid growth with the fastest CAGR during the forecast period. The increase is due to factors including awareness of genetic disorders, demand for personalized medicine, advancement in genomics and biotechnology, regulatory compliance, and the growing prevalence of diseases such as cancer and genetic disorders. Moreover, the increasing use of gene testing in various sectors, including pharmaceuticals, agriculture, and the environment, contributes to market growth.

Application Insights

In 2024, the pharmaceutical and biotechnology segment held the largest revenue share of 47.00% and is expected to grow at the fastest rate throughout the forecast period. The biotechnology and pharmaceutical sectors are highly regulated. The regulatory environment drives the need for genetic toxicology testing services in these industries. It is expected that the extensive use of gene toxicology testing in drug development and discovery will aid the expansion.

The food industry segment is expected to grow with the significant CAGR during the forecast period. This growth can be attributed to several factors, including increasing consumer awareness about food safety, the expansion of the global food supply chain, stringent regulations governing food quality and safety, advancements in genetic toxicology testing technologies, and the rising demand for genetically modified organisms in the food industry.

Regional Insights

The North America genetic toxicology testing market dominated the global market with a revenue share of 37.87% in 2024. Regional dominance can be attributed to increasing drug development with strong investments in pipelines. In addition, the existence of key players in the region eases the accessibility of genetic toxicology testing for pharma and biotech companies in the region.

U.S Genetic Toxicology Testing Market Trends

The genetic toxicology testing industry in the U.S. dominated the North American region in 2024. The stringent regulatory environment in the U.S., particularly from agencies such as the Food and Drug Administration, plays a crucial role in driving the demand for genetic toxicology testing. Regulatory bodies require toxicology assessment before approving a new drug, food ingredients, cosmetics, and other products for human use, such as lotions, nose drops, eye drops, and many more.

Europe Genetic Toxicology Testing Market Trends

The genetic toxicology testing market in Europe is expanding due to strict regulations, ethical testing policies, and advanced in vitro and AI-based methods. Strong R&D investments and active CRO involvement further strengthen the region’s leadership in innovative and compliant toxicology testing.

The UK genetic toxicology testing market is expanding due to strict MHRA regulations, rising R&D activity, and the adoption of in vitro and AI-based methods. Advances in high-throughput and 3D cell models, combined with a strong biopharma and CRO presence, are driving innovation and growth.

The genetic toxicology testing market in Germany is expanding with strict regulations. Supported by its robust pharma, biotech, and chemical sectors, the country remains a leader in ethical, advanced toxicology testing.

Asia Pacific Genetic Toxicology Testing Market Trends

The genetic toxicology testing market in Asia Pacific is projected to expand at the fastest CAGR of 13.50% over the forecast period, due to developments by countries such as Japan and India in tightening the regulations on testing of novel food and drug development. For instance, in March 2025, India’s Syngene International acquired a U.S.-based biologics facility in Baltimore for USD 36.5 million, expanding its biomanufacturing capacity and supporting rising global demand for genetic toxicology and biologics safety testing services.

China genetic toxicology testing industry is expected to experience significant growth in the coming years, driven by increasing research and development activities within the pharmaceutical and biotechnology sectors.

The genetic toxicology testing market in Japan is expected to grow significantly in the coming years due to increased research and development activities on early toxicity detection, augmented funding by governments in the life sciences research field.

Middle East & Africa Genetic Toxicology Testing Market Trends

The genetic toxicology testing industry in the Middle East & Africa is expanding gradually due to increased healthcare spending, heightened consumer awareness of product safety, and strengthened regulatory frameworks. Countries such as South Africa, Saudi Arabia, and the United Arab Emirates are progressively implementing in vitro and advanced toxicology techniques to compete with the international competition.

Kuwait genetic toxicology testing market is growing due to advancements in healthcare infrastructure, regulatory updates, and rising pharmaceutical R&D. The increasing adoption of in vitro and computational methods supports demand for reliable safety testing.

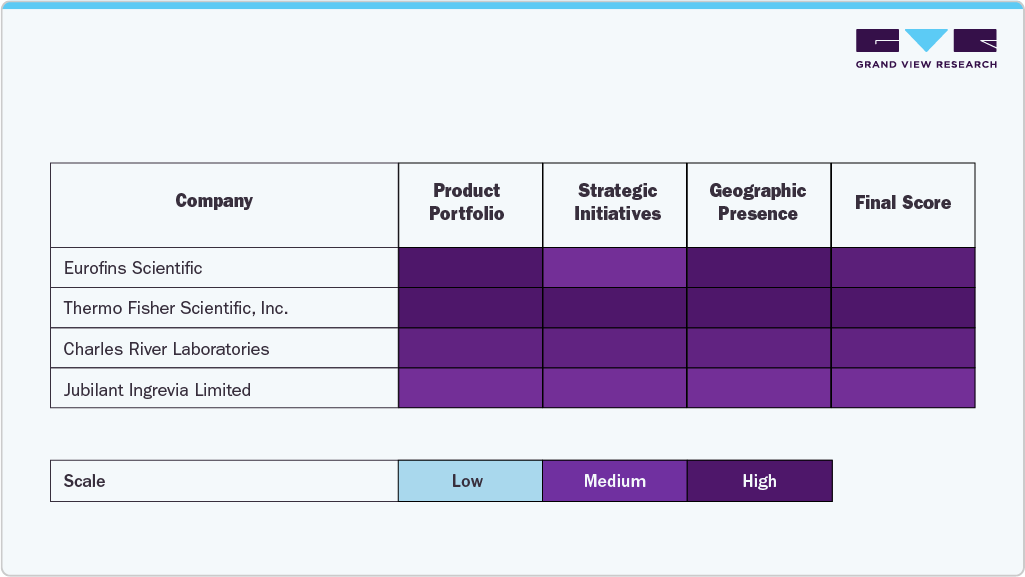

Key Genetic Toxicology Testing Companies Insights

Key players operating in the genetic toxicology testing market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

By providing specialized toxicology studies, AI-assisted predictive testing, and customized assay development tailored to the evolving needs of the pharmaceutical, biotechnology, chemical, and cosmetic industries, emerging companies such as Jubilant Ingrevia Limited, Syngene International Limited, Gentronix, Inotiv, Creative Bioarray, and MB Research Laboratories are expanding their presence.

Key Genetic Toxicology Testing Companies:

The following are the leading companies in the genetic toxicology testing market. These companies collectively hold the largest market share and dictate industry trends.

- Laboratory Corporation of America Holdings

- Eurofins Scientific

- Thermo Fisher Scientific, Inc.

- Charles River Laboratories

- Jubilant Ingrevia Limited

- Syngene International Limited

- Gentronix

- Inotiv

- Creative Bioarray

- MB Research Laboratories.

Recent Developments

-

In July 2025, U.S.-based Thermo Fisher Scientific received FDA approval for its Oncomine Dx Express Test, enhancing rapid genomic profiling and driving demand for genetic toxicology testing through advanced next-generation sequencing solutions.

-

In September 2024, Denmark’s Scantox Group acquired UK-based Gentronix Ltd, expanding its genetic toxicology portfolio and strengthening global demand for comprehensive preclinical and genotoxicity testing services across pharmaceutical and biotech sectors.

-

In May 2023, Thermo Fisher Scientific, Inc. partnered with Pfizer to enhance local access to next-generation sequencing for lung and breast cancer. This collaboration aims to provide faster, more precise testing, leading to tailored treatments and improved patient outcomes in regions where such advanced diagnostics were previously limited.

Genetic Toxicology Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.81 billion

Revenue forecast in 2033

USD 4.53 billion

Growth rate

CAGR of 12.13% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, application, assay, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Thermo Fisher Scientific; Inc.; Charles River Laboratories; Laboratory Corporation of America Holdings; Eurofins Scientific; Jubilant Ingrevia Limited; Syngene International Limited; Gentronix; Inotiv; Creative Bioarray; MB Research Laboratories.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Genetic Toxicology Testing Market Report Segmentation

This report forecasts revenue growth at the global, regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global genetic toxicology testing market report on the basis of product, type, assay, application, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Reagents & Consumables

-

Assays Kit

-

Services

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

In Vitro

-

In Vivo

-

-

Assay Outlook (Revenue, USD Million, 2021 - 2033)

-

Comet Assay

-

Micronucleus Assay

-

Chromosomal Aberration Test

-

Genetic Mutation Test

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical & Biotechnology

-

Food Industry

-

Cosmetics Industry

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global genetic toxicology testing market size was estimated at USD 1.62 billion in 2024 and is expected to reach USD 1.81 billion in 2025.

b. The global genetic toxicology testing market is expected to grow at a compound annual growth rate of 12.13% from 2025 to 2033 to reach USD 4.53 billion by 2033.

b. North America dominated the genetic toxicology testing market with a share of 37.87% in 2024. This is attributable to increasing drug development with strong investment in the pipelines

b. Some key players operating in the genetic toxicology testing market include Thermo Fisher Scientific, Inc; Charles River Laboratories International; Laboratory Corp of America Holdings; Eurofins Scientific; Jubilant Life Sciences Limited; Syngene International Limited; Gentronix Ltd.; Inotiv Inc.; Creative Bioarray; and MB Research Laboratories

b. Key factors that are driving the market growth include increasing drug development and discovery, along with the rising use of pharmacogenomics in the market, is anticipated to boost the demand for genetic toxicology market

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.