- Home

- »

- Plastics, Polymers & Resins

- »

-

Graphene-Enhanced Conductive Polymers Market, 2033GVR Report cover

![Graphene-Enhanced Conductive Polymers Market Size, Share & Trends Report]()

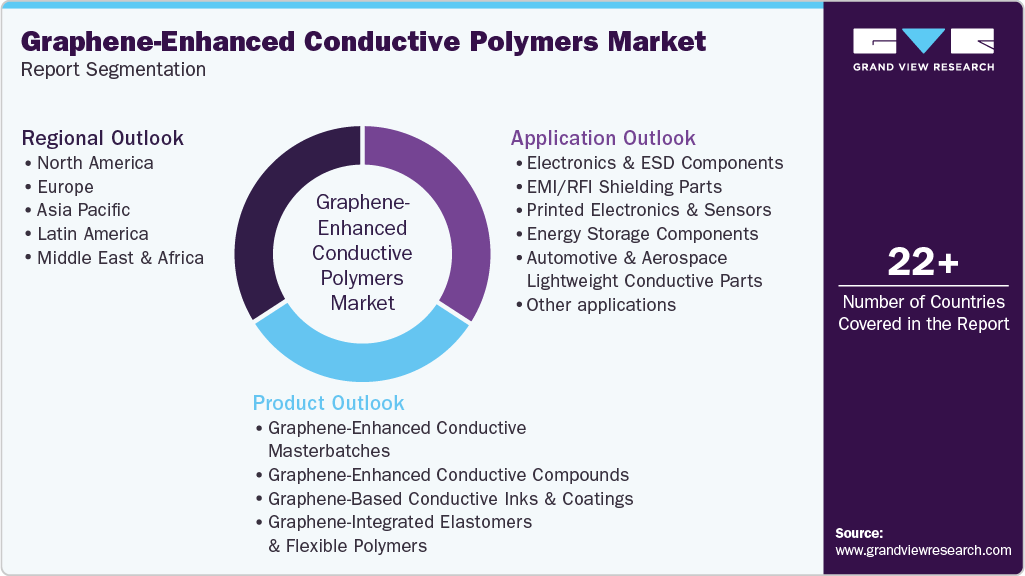

Graphene-Enhanced Conductive Polymers Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Graphene-Enhanced Conductive Masterbatches, Graphene-Enhanced Conductive Compounds), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-825-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Graphene-Enhanced Conductive Polymers Market Summary

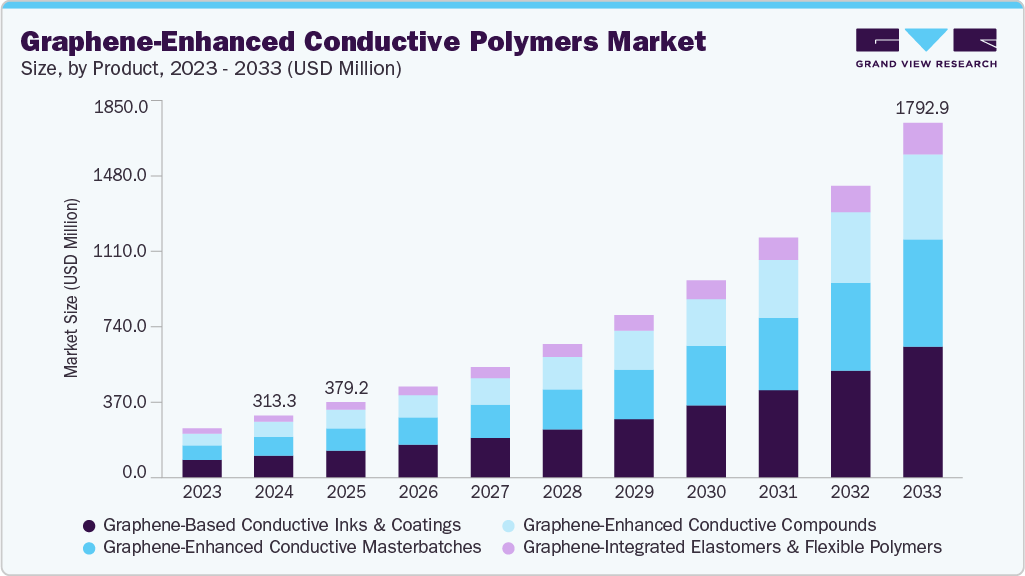

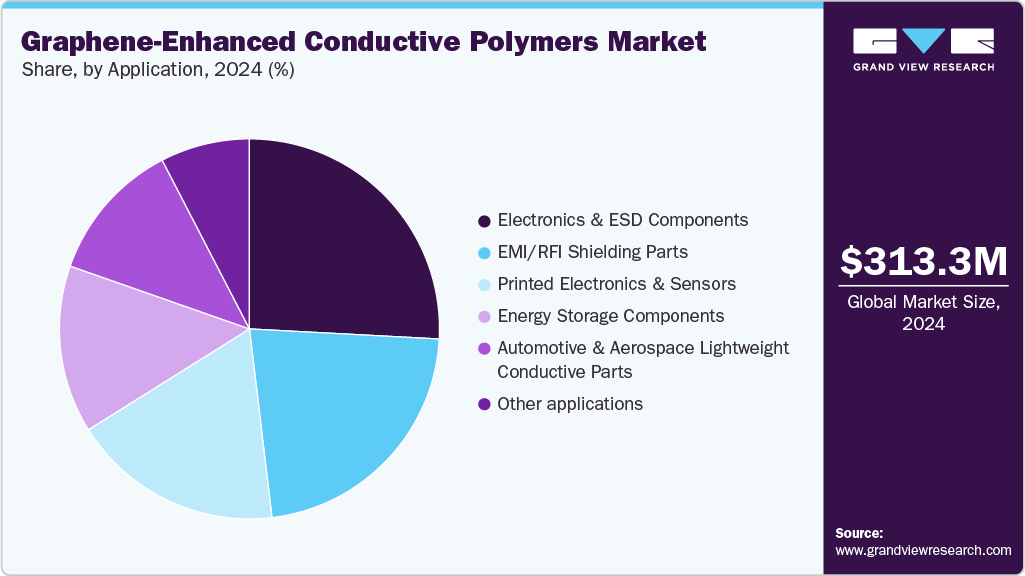

The global graphene-enhanced conductive polymers market size was estimated at USD 313.3 million in 2024 and is projected to reach USD 1,792.9 million by 2033, growing at a CAGR of 21.4% from 2025 to 2033. A growing driver is the shift toward miniaturized electronic components that require materials with higher conductivity at smaller thicknesses.

Key Market Trends & Insights

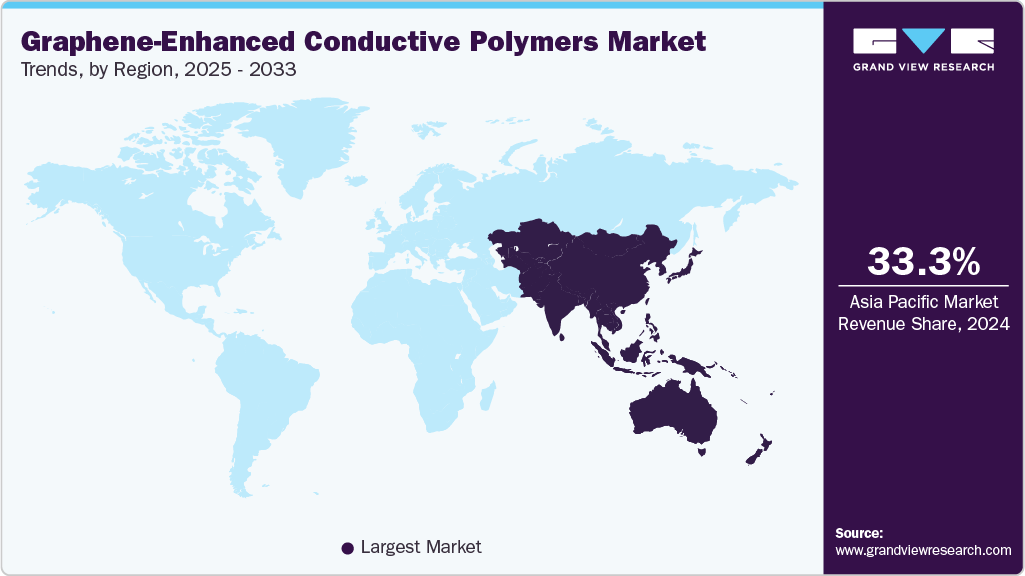

- Asia Pacific dominated the graphene-enhanced conductive polymers market with the largest revenue share of 33.29% in 2024.

- The graphene-enhanced conductive polymers market in India is expected to grow at a substantial CAGR of 23.5% from 2025 to 2033.

- By product, the graphene-based conductive inks & coatings segment is expected to grow at a considerable CAGR of 21.9% from 2025 to 2033 in terms of revenue.

- By application, the energy storage segment is expected to grow at a considerable CAGR of 22.0% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 313.3 million

- 2033 Projected Market Size: USD 1,792.9 million

- CAGR (2025 – 2033): 21.4%

- Asia Pacific: Largest market in 2024

Graphene-enhanced polymers meet this need by delivering strong electrical performance while keeping devices lighter and more compact. The industry is shifting from single-function fillers to multifunctional graphene-polymer systems that combine electrical conductivity with mechanical reinforcement and thermal management. Adoption is rising across automotive, aerospace and electronics where lightweighting and miniaturization are priorities.

Manufacturers are increasingly specifying graphene additions at low loadings to achieve targeted conductivity without compromising processability. Market forecasts show strong compound annual growth driven by these cross-sector use cases.

Drivers, Opportunities & Restraints

Demand for higher performance in flexible and high-frequency electronics is the primary commercial driver. Graphene delivers high intrinsic conductivity, exceptional strength, and thermal conductivity at low weight, enabling thinner, lighter conductive layers than traditional fillers. This technical edge is being leveraged for EMI shielding, heat dissipation, and stretchable interconnects in 5G, wearables, and electric vehicles. End-user performance requirements are therefore accelerating uptake.

Printable and functional inks, adhesives, and coatings present a clear route to scale adoption. Graphene-enhanced conductive polymers can be formulated for inkjet and roll-to-roll processes, unlocking printed sensors, flexible antennas, and integrated energy devices. Suppliers that solve dispersion and ink formulation will capture value across IoT, smart packaging, and next-gen battery electrodes. Licensing chemistry and co-development with OEMs offers rapid commercial pathways.

Commercial deployment is constrained by inconsistent graphene quality, dispersion difficulty, and high upstream costs. Achieving uniform percolation networks in polymer matrices requires controlled functionalization and processing, which adds steps and expense. The capacity for large, low-cost, high-quality graphene remains limited and standards are still immature. These factors raise total system cost and slow specification by conservative industrial buyers.

Market Concentration & Characteristics

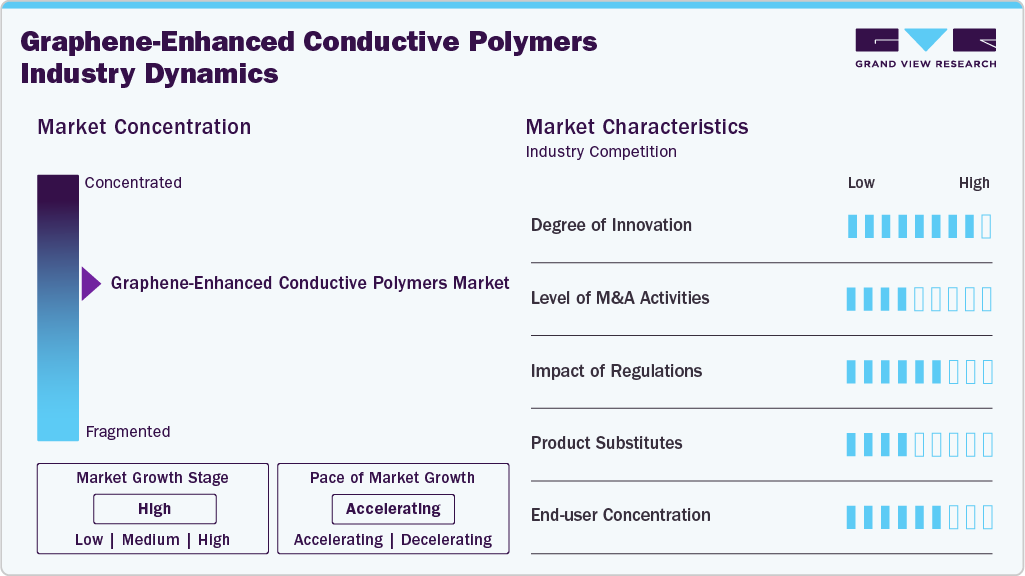

The growth stage of the industry is exponential, and the pace is accelerating. The market exhibits consolidation, with key players dominating the industry landscape. Major companies like BLACKLEAF, Black Swan Graphene, Directa Plus, Cabot Corporation, First Graphene, The Sixth Element, Graphenest, and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet evolving industry demands.

Innovation is concentrated on functional chemistry and scalable processing rather than on graphene as a raw material. Developers now focus on tailored functionalization, hybrid graphene-polymer architectures, and low-loading formulations that deliver conductivity, mechanical reinforcement, and thermal management in one package. Printable, low-temperature ink systems and 3D-printable, metal-free formulations are moving lab demonstrations toward manufacturable products. Progress in dispersion technologies and standardized quality metrics will determine how quickly pilot successes translate to high-volume adoption.

Silver-based inks remain the benchmark for peak conductivity, so they are the primary substitute where electrical performance is critical. Carbon nanotubes, silver nanowires, and conductive carbon blacks offer alternative tradeoffs between conductivity, flexibility, transparency, and cost. Choice of substitute is application-driven: silver for the highest performance, CNTs or AgNWs for stretchable/transparent layers, and carbon blacks/graphite where cost and bulk conductivity matter. Market uptake of graphene solutions therefore depends on narrowing the performance-to-cost gap versus these established fillers.

Product Insights

Graphene-based conductive inks & coatings dominated the market, accounting for a revenue share of 35.48% in 2024, and is forecasted to grow at a 21.9% CAGR from 2025 to 2033. A major commercial driver is the substitution of expensive metallic inks with low-loading graphene formulations for printed electronics. Manufacturers can cut silver usage while keeping conductivity and adding flexibility for roll-to-roll and inkjet processes. Improvements in graphene dispersion and formulation are lowering cure temperatures and expanding use in smart packaging and wearable sensors. Market interest is rising as printable electronics volumes grow.

The graphene-enhanced conductive masterbatches segment is anticipated to grow at a substantial CAGR of 21.5% through the forecast period. The key driver here is seamless integration into existing polymer processing lines through concentrated masterbatches. Suppliers provide pre-dispersed graphene concentrates that simplify dosing, improve process consistency, and reduce downstream compounding steps. This lowers manufacturing risk for OEMs and accelerates adoption in antistatic films, EMI components, and structural parts. Recent product launches validate near-term commercial traction.

Application Insights

Energy storage dominated the market, accounting for a revenue share of 25.85% in 2024, and is forecasted to grow at a 22.0% CAGR from 2025 to 2033. Performance demands for fast charging and high power density are pushing graphene into electrodes and conductive binders. Graphene’s high surface area and conductivity enable supercapacitors with superior power response and composite electrodes with improved rate capability. Advances in scalable synthesis and functionalized graphene chemistries are making commercial prototypes more viable. Continued progress in manufacturing cost and electrode integration will determine the pace of industrial uptake.

The electronics & electricals segment is expected to expand at a substantial CAGR of 21.8% through the forecast period. Rising 5G rollouts and vehicle electrification are driving demand for thin, effective EMI shielding and thermally conductive materials. Graphene-enhanced polymers deliver shielding across wide frequency bands while keeping weight and thickness down. This suits antenna substrates, flexible PCBs and EV electronic housings where space and thermal management are critical. Buyers are prioritizing validated performance and supply stability when specifying new materials.

Regional Insights & Trends

North America graphene-enhanced conductive polymers market held a revenue share of 31.53% in 2024, and is expected to grow at a CAGR of 21.5% over the forecast period. Government and defense procurement is a powerful regional driver. Large defense budgets and active R&D programs fund smart uniform and protective-gear pilots that need advanced polymers and integrated electronics. These contracts de-risk supplier scale-up and create pull-through for commercial uses. The region’s strong institutional testing infrastructure speeds qualification for industrial buyers.

U.S. Graphene-Enhanced Conductive Polymers Market Trends

Domestic manufacturing resurgence and targeted public grants are supporting near-term capacity expansion. Federal and state programs now fund textile retooling and advanced-materials fabs, reducing supply-chain risk for smart textile producers. This reshoring trend encourages OEMs to qualify local suppliers and invest in higher-value polymer formulations. The result is a faster time to market for pilot projects.

Europe Graphene-Enhanced Conductive Polymers Market Trends

Policy and public funding focused on sustainable and high-performance textiles drives innovation in Europe. The European Commission and partnership programmes are directing capital to collaborative R&D, prototyping and SME acceleration in smart textiles. Grants and accelerator networks lower technology risk for manufacturers and encourage eco-design principles in polymer selection. End users value certified, circular solutions when specifying new fabrics.

Asia Pacific Graphene-Enhanced Conductive Polymers Market Trends

Scale manufacturing and integrated electronics supply chains make the region a volume driver. Large textile clusters in China, India, Japan and South Korea offer low-cost production plus local electronics and sportswear OEMs that pull smart textile innovations into mass markets.

Suppliers benefit from rapid iteration cycles and competitive pricing structures. Local demand for wearable consumer tech and performance sports apparel sustains growth.

Key Graphene-Enhanced Conductive Polymers Companies Insights

Key players operating in the graphene-enhanced conductive polymers market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Graphene-Enhanced Conductive Polymers Companies:

The following are the leading companies in the graphene-enhanced conductive polymers market. These companies collectively hold the largest Market share and dictate industry trends.

- BLACKLEAF

- Black Swan Graphene

- Directa Plus

- Cabot Corporation

- First Graphene

- The Sixth Element

- Graphenest

Recent Developments

-

In May 2025, Black Swan Graphene announced a preferred compounder agreement with Modern Dispersions to scale its Graphene Enhanced Masterbatch (GEM) products. The collaboration targets commercial compounding and faster market qualification of GEM concentrates for polymer manufacturers.

-

In March 2025, BLACKLEAF launched a new range of graphene-based conductive inks aimed at printed electronics and smart packaging. The product line is marketed for improved printability and lower cure temperatures to support roll-to-roll and inkjet processes.

Graphene-Enhanced Conductive Polymers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 379.2 million

Revenue forecast in 2033

USD 1,792.9 million

Growth rate

CAGR of 21.4% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in tons; revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, and trends

Segment covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Spain; Italy; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

BLACKLEAF; Black Swan Graphene; Directa Plus; Cabot Corporation; First Graphene; The Sixth Element; Graphenest

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Graphene-Enhanced Conductive Polymers Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global graphene-enhanced conductive polymers market report on the basis of product, application, and region:

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Graphene-Enhanced Conductive Masterbatches

-

Graphene-Enhanced Conductive Compounds

-

Graphene-Based Conductive Inks & Coatings

-

Graphene-Integrated Elastomers & Flexible Polymers

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Electronics & ESD Components

-

EMI/RFI Shielding Parts

-

Printed Electronics & Sensors

-

Energy Storage Components

-

Automotive & Aerospace Lightweight Conductive Parts

-

Other applications

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.