- Home

- »

- Beauty & Personal Care

- »

-

Hand Care Market Size And Share, Industry Report, 2033GVR Report cover

![Hand Care Market Size, Share & Trends Report]()

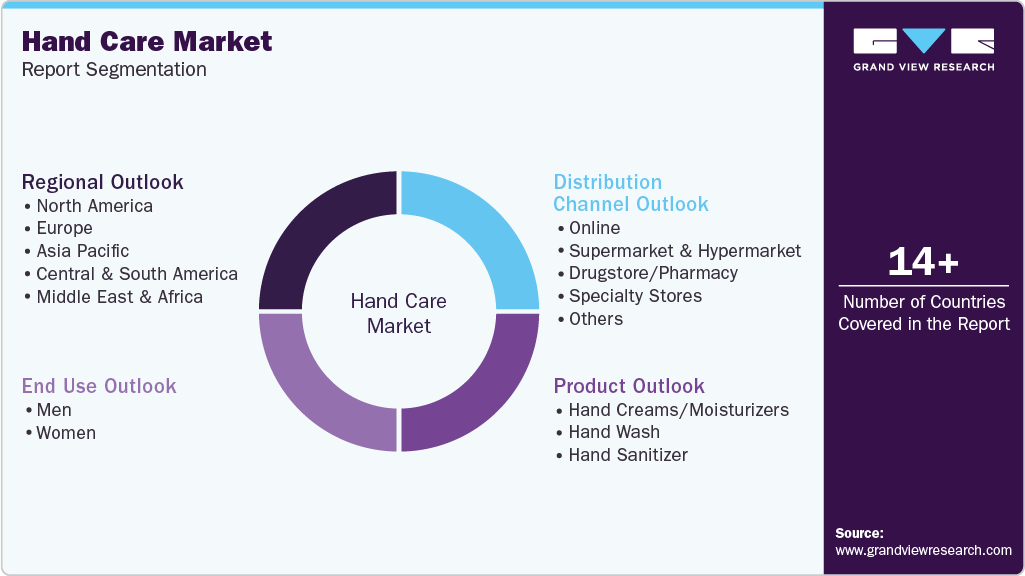

Hand Care Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Hand Creams/ Moisturizers, Hand Wash, Hand Sanitizer), By End Use (Men, Women), By Distribution Channel (Online, Supermarket & Hypermarket), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-085-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hand Care Market Summary

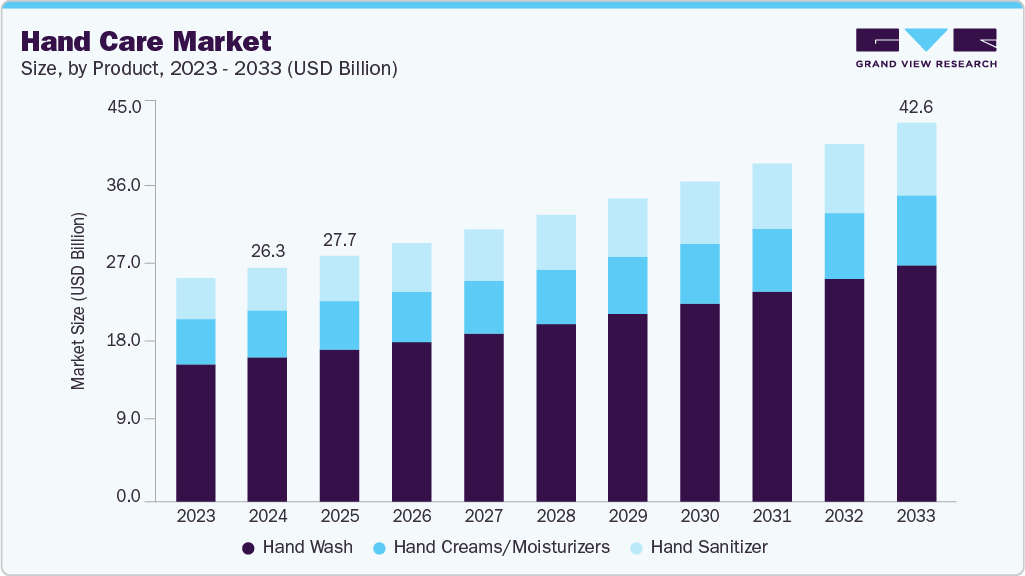

The global hand care market size was estimated at USD 26.35 billion in 2024 and is projected to reach USD 42.59 billion by 2033, growing at a CAGR of 5.5% from 2025 to 2033. The global market for hand care forms a vital segment of the broader beauty and personal care industry, which continues to evolve with changing consumer lifestyles and hygiene habits.

Key Market Trends & Insights

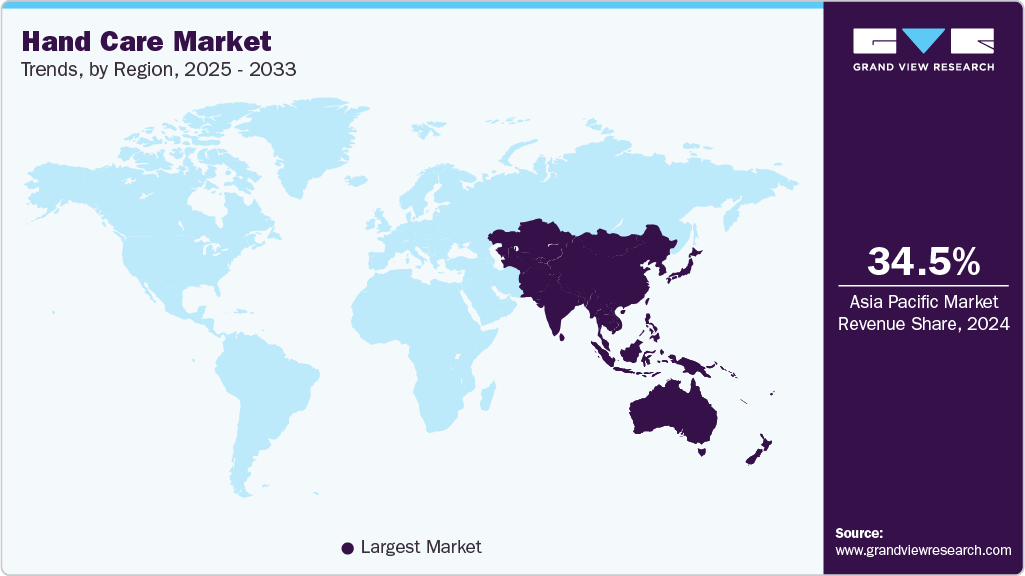

- Asia Pacific hand care industry held a major share of 34.55% of the global hand care market in 2024.

- The hand care industry in India is expected to grow significantly over the forecast period.

- By product, the hand wash segment held the largest market share of 61.8% in 2024.

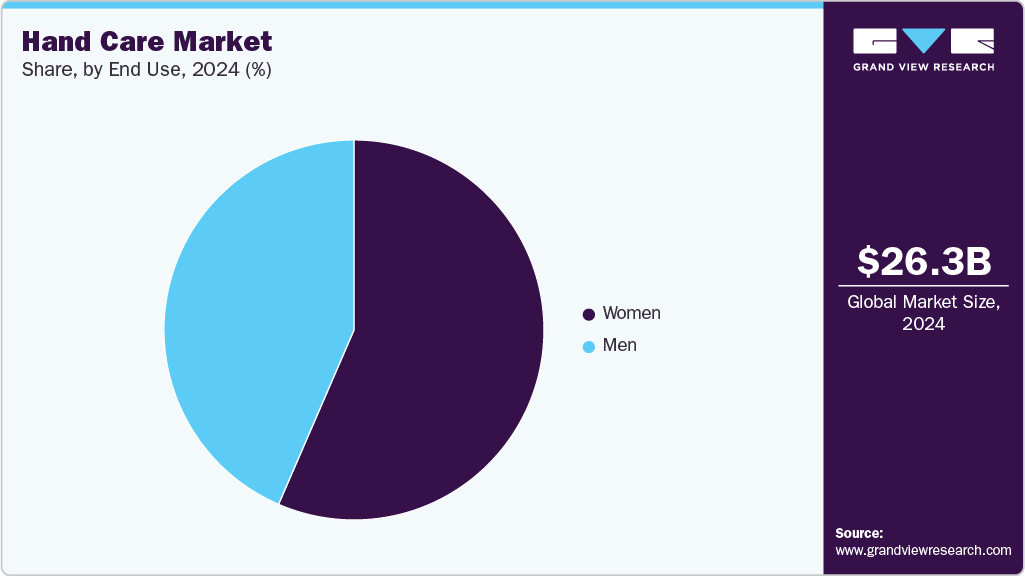

- Based on end use, the women segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 26.35 Billion

- 2033 Projected Market Size: USD 42.59 Billion

- CAGR (2025-2033): 5.5%

- Asia Pacific: Largest market in 2024

As part of this expansive sector, hand care has gained heightened relevance, especially post-pandemic, as personal hygiene and self-care have become everyday priorities. Consumers increasingly recognize the need for hand moisturization and protection, especially due to frequent handwashing and sanitizer use, which can cause dryness, irritation, and skin sensitivity. These factors, combined with the rising awareness of skin health, are driving sustained growth in the global hand care industry.A major trend shaping the global hand care industry is the rising demand for natural, organic, and clean-label hand care products. Consumers are looking for plant-based formulations enriched with ingredients such as shea butter, aloe vera, coconut oil, and essential oils that offer hydration without harsh chemicals.

In addition, there is a growing interest in multifunctional products that deliver anti-aging, sun protection, and antibacterial benefits. Sustainability is also influencing purchasing behavior, with eco-friendly packaging, refill options, and biodegradable materials becoming standard among leading brands. These innovations cater to a health-conscious and environmentally aware consumer base.

Moreover, the global hand care industry has experienced a lasting boost from the heightened hygiene consciousness that emerged during the COVID-19 pandemic. Handwashing became a critical preventive measure recommended by health authorities worldwide, and its impact continues to shape consumer behavior.

According to the National Foundation of Infectious Diseases (NFID), around 80% of infectious diseases are spread by dirty hands, highlighting the essential role of regular and proper hand hygiene. Public health campaigns emphasizing the importance of washing hands for at least 20 seconds have significantly raised awareness. Diseases like flu, COVID-19, and norovirus can be effectively prevented through such basic practices, underlining the ongoing demand for hand care products that both cleanse and protect.

Consumer Surveys & Insights

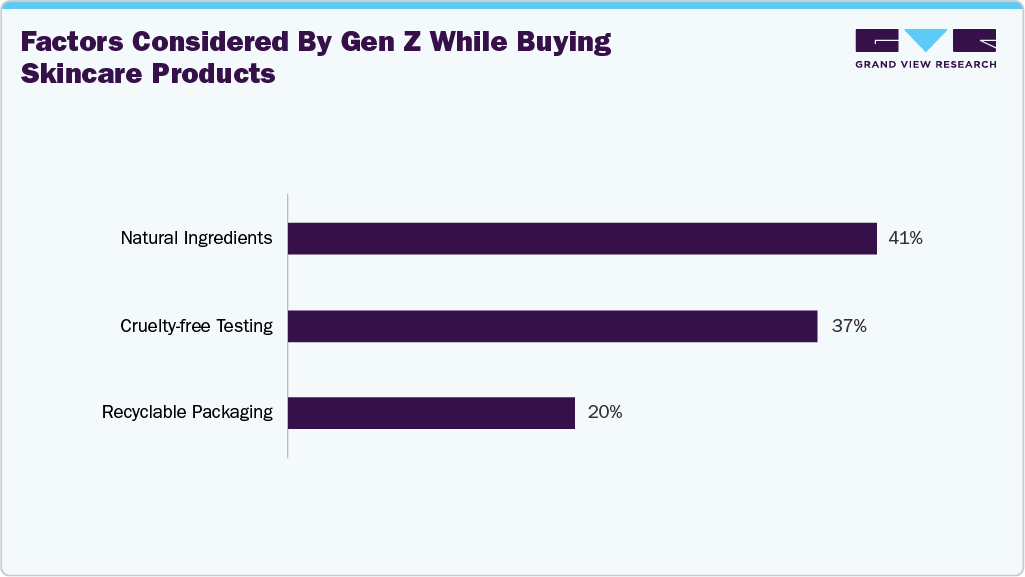

According to the World Economic Forum, as of 2023, Generation Z, born between 1997 and 2009, represents the largest age group globally, comprising close to 30% of the population. With growing spending power, Gen Z has emerged as one of the most pivotal and influential consumer groups in the beauty and personal care industry. Their impact is especially evident in the hand care category, where they actively seek functional, ethical, and aesthetically appealing products across formats like hand washes, sanitizers, lotions, and creams.

Gen Z demonstrates a unique consumer behavior by starting to purchase beauty and personal care products at an early age. A 2024 article on Dermalogica NZ’s blog reveals that 60% of Gen Zers purchase skincare products before the age of 14, marking a clear shift toward early consumer behavior. This opens opportunities for brands to build loyalty through education and science-backed hand care options, whether barrier-repair lotions or gentle, skin-safe sanitizers.

They often seek clinically proven ingredients such as peptides, retinol, and collagen boosters to address dryness and skin damage, especially from frequent handwashing or sanitizer use. With 33% of consumers (YouGov) considering vitamin C-infused products and 29% favoring hyaluronic acid in 2025, Gen Z aligns with Gen X in valuing effective, evidence-based hand care.

Millennials and Gen Z also prioritize ethics, clean beauty, and sustainability. According to YouGov, 34% of consumers aged 18-29 plan to explore Korean skincare in 2025, highlighting global trend adoption. Ethical values drive their hand care choices: 41% prefer natural ingredients, 37% seek cruelty-free products, and 20% want recyclable packaging.

Trump Tariff Impact

The imposition of tariffs during the Trump administration significantly altered trade flows and cost structures across various consumer goods industries, including the global hand care industry. Tariffs on imported raw materials such as packaging components, chemical ingredients, and plastic containers increased the production costs for manufacturers operating in the United States. For instance, tariffs on Chinese goods under Section 301 trade measures affected a wide range of personal care inputs, including polyethylene and polypropylene resins, which are commonly used in bottles, dispensers, and caps for hand sanitizers and liquid soaps.

These higher input costs forced many companies to either absorb the additional expenses, which reduced margins, or pass them on to consumers, making hand care products relatively more expensive in the U.S. hand care industry compared to other regions. This dynamic influenced global supply chain strategies, with several firms seeking to diversify sourcing away from China and exploring manufacturing hubs in Southeast Asia, Mexico, and Eastern Europe.

These disruptions also accelerated mergers, acquisitions, and local capacity expansions in the U.S. hand care industry as firms aimed to reduce tariff exposure. In the long term, tariffs under Trump highlighted the vulnerabilities of overreliance on single-country sourcing and reinforced the industry’s shift toward supply chain resilience, regional manufacturing hubs, and greater investment in automation to offset higher costs.

Product Insights

The hand wash product segment accounted for a revenue share of 61.8% of the market in 2024. Consumers seek multi-functional cleansing products that go beyond basic hygiene, offering a blend of efficacy, skin nourishment, and sensorial experience. Daily hand washing, once a routine act, has become a point of focus for personal care, especially as heightened awareness around germs and surface hygiene continues to influence consumer behavior. As a result, brands are rethinking formulation strategies to deliver both antimicrobial efficacy and skin-friendly performance.

The hand sanitizer product segment is expected to grow at a CAGR of 6.0% from 2025 to 2033. Recent developments in the hand sanitizer and disinfectant category reflect a strategic shift by leading companies towards improving both functional performance and user experience. Product innovation is now centered on formulations that balance high antimicrobial efficacy with skin compatibility, packaging sustainability, and format-specific use cases. Companies such as GOJO Industries, Reckitt Benckiser, and Unilever have introduced new launches aimed at addressing the evolving hygiene needs of consumers and institutional users.

Distribution Channel Insights

Distribution through supermarket & hypermarket channel accounted for a revenue share of 33.6% in 2024. Hypermarkets and supermarkets are widely preferred for hand care purchases due to their accessibility, affordability, and extensive product assortments. These high-traffic retail environments offer convenience, enabling consumers to pick up hand washes, moisturizers, or sanitizers alongside routine grocery or household purchases. From budget-friendly brands to premium formulations, the category spans a wide price range, making it easy for shoppers to compare and select hand care items that suit their needs.

Distribution through online channel is expected to grow at a CAGR of 8.2% from 2025 to 2033. Online channels are critical in the market, providing consumers with easy access to both essential hygiene products and premium skincare treatments. Digital platforms offer broad product assortments, transparent ingredient and usage information, and convenience, all of which appeal to busy, skincare-aware consumers. These features support both research-driven and impulse hand care purchases.

End Use Insights

Women end users accounted for a revenue share of 56.5% in 2024. Women’s hand care category remains largely shaped by conventional formulations, which prioritize familiarity, fragrance, and affordability. Historically, these products have focused on mass appeal through accessible pricing, synthetic ingredients, and sensory attributes designed to attract wide female consumer bases. However, evolving expectations around texture, aesthetics, and skin-friendly ingredients are prompting legacy and prestige brands alike to recalibrate their offerings, blending the reliability of traditional formats with an elevated user experience and formulation transparency.

The men segment is expected to grow at a CAGR of 7.3% from 2025 to 2033. Men’s participation in the hand care category is growing, albeit from a relatively low base. The segment, traditionally underpenetrated, is undergoing a shift as awareness around skin health and hygiene increases among male consumers. However, their purchasing behavior continues to reflect distinct priorities, functionality, simplicity, and sensory discretion.

Regional Insights

The Asia Pacific hand care industry held the largest market share of 34.55% in 2024 in global hand care industry. In recent years, consumer awareness around skin health has grown significantly across the region, especially in high-density urban environments where pollution, frequent sanitization, and temperature fluctuations are common. This has led to increased demand for hand care products that go beyond basic hydration and instead offer targeted solutions for barrier repair, inflammation, and hyperpigmentation.

The emphasis on safe and functional formulations has driven companies to pivot toward dermatologically tested, fragrance-free, and clean-label hand creams. Multinational and regional players are now incorporating ceramides, niacinamide, glycerin, and plant-based actives into hand moisturizers and soaps to address specific concerns such as dryness, irritation, and dullness.

India Hand Care Market Trends

India hand care industry is the leading consumer of hand care in the Asia Pacific market. Growing affluence and evolving consumer lifestyles in India are reshaping engagement with daily personal care routines, including hand care. Traditionally viewed as a basic hygiene necessity, hand care is now positioned as a sensorial and design-led experience. Urban professionals and younger consumers increasingly seek products that combine advanced hydration or barrier repair with refined fragrance profiles and aesthetically packaged formats.

As brands align offerings with these preferences, introducing portable tubes, seasonal editions, and wellness-inspired scent collections, parallel efforts in public health communication continue to reinforce hand hygiene behavior at the population level. These dual shifts, toward both premiumization and habitual reinforcement, are collectively expanding the addressable market for hand care products across income segments and usage occasions.

Europe Hand Care Market Trends

The Europe hand care industry is anticipated to grow at a significant CAGR from 2025 to 2033. As consumers seek products that protect and restore the skin barrier after repeated washing and exposure to external irritants, hand care is evolving into a daily necessity rather than a seasonal indulgence. Cultural attitudes linking personal grooming with professionalism and self-respect are further reinforcing the role of hand care in everyday routines.

Functional benefits, ethical formulations, and brand transparency are the defining factors influencing buyer choices. Consumers demand high-performing hand creams and soaps made with proven ingredients like glycerin, shea butter, niacinamide, and ceramides. Consumers are increasingly focused on product manufacturing practices; cruelty-free claims, eco-friendly packaging, and clean-label formulations significantly drive customer loyalty and influence purchasing decisions.

North America Hand Care Market Trends

The North America hand care industry is anticipated to grow at a lucrative CAGR from 2025 to 2033. Consumers in the U.S. and Canada are demonstrating long-term behavioral shifts toward hand hygiene and care, influenced by the legacy of the COVID-19 pandemic. What began as a public health necessity has evolved into a sustained wellness priority. This shift is now influencing product development, purchase behavior, and consumer expectations across genders and age groups.

Notably, three out of four respondents believe proper hand hygiene is one of the most critical factors for public health and safety, emphasizing a growing culture of shared responsibility. According to the National Foundation for Infectious Diseases’ (NFID) 2025 Handwashing Report, there remains a notable gap between hygiene awareness and actual consumer behavior in North America.

The U.S. hand care industry held the largest market share in the North American market, driven by heightened consumer awareness of hygiene and skin health. Major drivers include rising demand for antibacterial and moisturizing formulations, increasing preference for premium and natural ingredient-based products, and growing workplace and travel-related hygiene practices. Key trends shaping the U.S. market involve sustainability-focused innovations, such as eco-friendly packaging and vegan formulations, alongside digital retail expansion and subscription-based product offerings.

The competitive landscape for the U.S. market is highly fragmented, with global personal care leaders like Procter & Gamble, Unilever, and Johnson & Johnson competing alongside niche brands that emphasize organic, dermatologically tested, and cruelty-free products. This dynamic environment has pushed players to invest in product diversification and targeted marketing to capture evolving consumer segments.

Key Hand Care Company Insights

The hand care industry structure is best characterized as moderately consolidated and segmented across personal care (hand creams, lotions), hygiene (hand washes, sanitizers), and professional/industrial channels. Large multinational consumer-goods firms have been observed to retain their dominant share positions through extensive brand portfolios, broad distribution networks, and scale economics, while specialist suppliers and regional players compete on formulation, price, and channel focus.

-

The Clorox Company is a leading multinational manufacturer and marketer of consumer and professional products. It is widely recognized for its portfolio of trusted brands such as Clorox, Burt’s Bees, Brita, Hidden Valley, Glad, and Pine-Sol. Operating across four core segments, Health & Wellness, Household, Lifestyle, and International, the company delivers a wide range of products from cleaning supplies and water filtration to natural personal care and condiments.

-

Unilever PLC is a global consumer goods company with a wide-ranging portfolio spanning food and beverages, personal care, beauty, and home care products. Its world-renowned brands include Lifebuoy, Dove, Knorr, Sunsilk, Hellmann’s, Magnum, Vaseline, and Surf. Unilever operates in over 190 countries, serving 3.4 billion people daily with products that enhance hygiene, nutrition, and wellbeing.

Key Hand Care Companies:

The following are the leading companies in the hand care market. These companies collectively hold the largest market share and dictate industry trends.

- The Clorox Company

- Colgate-Palmolive Company

- Diversey Holdings, Ltd. (Solenis Group)

- Unilever PLC

- Bath & Body Works, Inc.

- The Procter & Gamble Company

- Reckitt Benckiser Group plc

- Kimberly-Clark Corporation

- Henkel AG & Co. KGaA

- GOJO Industries, Inc.

Recent Developments

-

In July 2025, Noshinku launched its Nourishing Travel Hand Sanitizing Wipes, debuting a skincare-forward version of sanitizing wipes designed for on-the-go use. Formulated to kill 99.9% of germs, they are enriched with aloe, green tea, and oat extracts for soothing hydration. The wipes use pharma-grade sugar cane alcohol, exclude parabens, synthetic fragrances, dyes, and benzalkonium chloride, and feature 100% natural essential oil scents: Eucalyptus, Bergamot, Lavandula, or a mixed Discovery Pack.

-

In May 2025, Touchland launched a limited‑edition Disney Mickey Mouse Power Mist Hand Sanitizer set. The formula is dermatologist-tested, vegan, cruelty‑free, dye-free, and enriched with hydrating ingredients like aloe vera and radish root ferment filtrate, delivering a fast-drying, skincare-forward hand sanitizer experience.

Hand Care Market Report Scope

Report Attribute

Details

Market revenue in 2025

USD 27.67 billion

Revenue forecast in 2033

USD 42.59 billion

Growth rate (Revenue)

CAGR of 5.5% from 2025 to 2033

Actuals

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Japan; China; India; South Korea; Australia; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

The Clorox Company; Colgate-Palmolive Company; Diversey Holdings, Ltd. (Solenis Group); Unilever PLC; Bath & Body Works, Inc.; The Procter & Gamble Company; Reckitt Benckiser Group plc; Kimberly-Clark Corporation; Henkel AG & Co. KGaA; GOJO Industries, Inc.

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hand Care Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global hand care market report based on product, end use, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hand Creams/Moisturizers

-

Hand Wash

-

Hand Sanitizer

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Men

-

Women

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2021 - 2033)

-

Online

-

Supermarket & Hypermarket

-

Drugstore/Pharmacy

-

Specialty Stores

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global hand care market was estimated at USD 26.35 billion in 2024 and is expected to reach USD 27.67 billion in 2025.

b. The global hand care market is expected to grow at a compound annual growth rate of 5.5% from 2025 to 2033 to reach USD 42.59 billion by 2033.

b. The hand wash product type accounted for the largest share of 61.8% of the hand care market in 2024. Consumers seek multi-functional cleansing products that go beyond basic hygiene, offering a blend of efficacy, skin nourishment, and sensorial experience.

b. Key players in the hand care market are The Clorox Company, Colgate-Palmolive Company, Diversey Holdings, Ltd. (Solenis Group), Unilever PLC, Bath & Body Works, Inc., The Procter & Gamble Company, Reckitt Benckiser Group plc, Kimberly-Clark Corporation, Henkel AG & Co. KGaA, and GOJO Industries, Inc., among others.

b. Key factors driving the hand care market growth include changing consumer lifestyles and hygiene habits, need for hand moisturization and protection, combined with the rising awareness of skin health.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.