- Home

- »

- Healthcare IT

- »

-

Healthcare Business Banking Solutions And Services Market 2033GVR Report cover

![Healthcare Business Banking Solutions And Services Market Size, Share & Trends Report]()

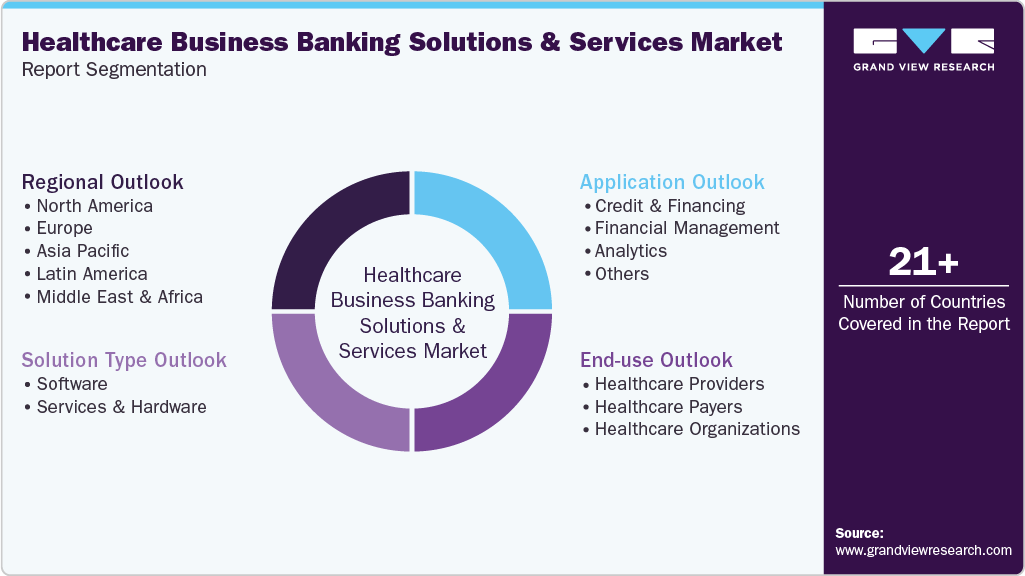

Healthcare Business Banking Solutions And Services Market (2025 - 2033) Size, Share & Trends Analysis Report By Solution Type (Services, Software & Hardware), By Application (Credit & Financing, Financial Management), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-817-4

- Number of Report Pages: 190

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Healthcare Business Banking Solutions And Services Market Summary

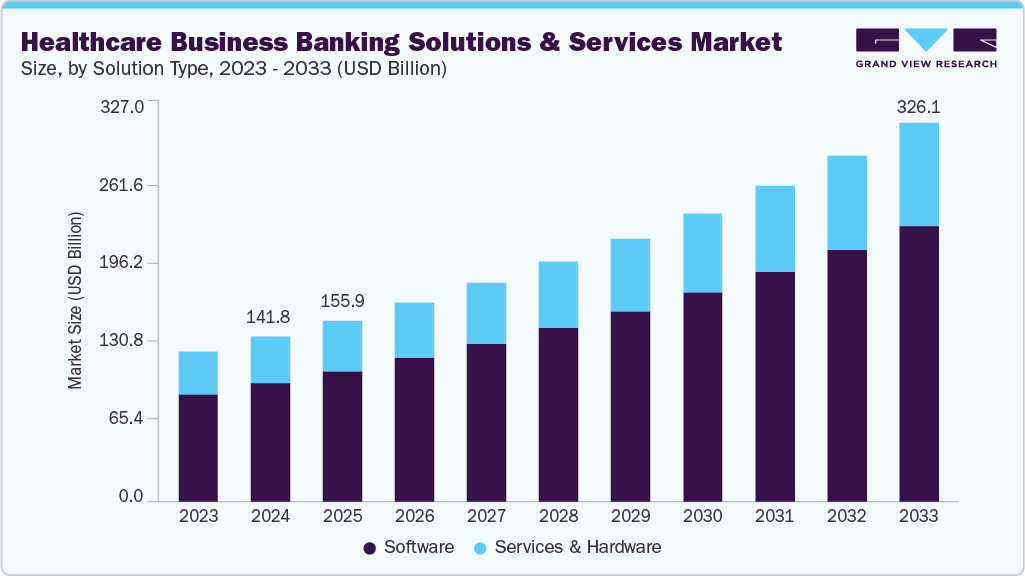

The global healthcare business banking solutions and services market size was estimated at USD 141.8 billion in 2024 and is projected to reach USD 326.1 billion by 2033, growing at a CAGR of 9.7% from 2025 to 2033. This growth is attributed to rising healthcare digitalization and electronic payments adoption, increasing financial complexity of healthcare providers and systems, and the adoption of mobile and cloud-based corporate banking platforms.

Key Market Trends & Insights

- North America dominated the healthcare business banking solutions & services market with a revenue share of 39.4% in 2024.

- The U.S. healthcare business banking solutions & services industry is witnessing robust growth.

- By solution type, the services segment held the largest market share of 79.1% in 2024.

- By application, the financial management held the dominant market share in 2024.

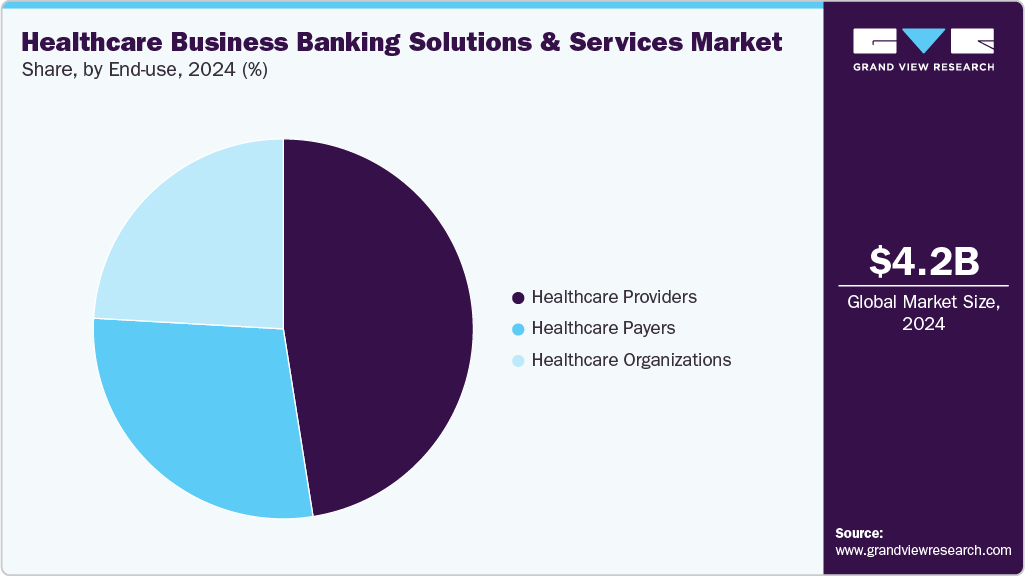

- By end-use, the healthcare providers segment held the largest revenue share of 47.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 141.8 Billion

- 2033 Projected Market Size: USD 326.1 Billion

- CAGR (2025-2033): 9.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The growth of healthcare business banking solutions is driven by increased digitalization and the widespread adoption of electronic payments. According to the 2025 TrustCommerce survey, nearly 80% of U.S. healthcare consumers are comfortable or open to using digital payment methods for healthcare expenses, and among those aged 60 and older, close to 60% share this confidence. The survey also showed that around 62.5% of respondents have paid for doctor or specialist visits digitally, and about 59.5% have used digital channels to pay for prescriptions. This shift toward digital transactions highlights the move to technology-driven financial processes in healthcare. As providers, pharmacies, and clinics implement online billing and contactless payment systems, banks and fintech companies are developing specialized solutions, including payment gateways, merchant services, and automated revenue management tools, to support this transformation.

The growing complexity of healthcare billing, insurance claims, and reimbursements is driving strong demand for automated revenue cycle and cash flow management tools. Hospitals, clinics, and healthcare networks face delays and administrative burdens in managing payments from patients, insurers, and government programs. Automated solutions integrated with banking platforms help streamline these processes. They enable real-time payment tracking, faster claims reconciliation, and predictive cash-flow forecasting. As healthcare organizations increasingly adopt digital billing and analytics systems, they require banking partners to offer seamless connectivity between financial accounts, EHR systems, and payment gateways. This push toward automation reduces revenue leakage and manual errors. It enhances financial efficiency and drives the adoption of specialized healthcare business banking solutions.

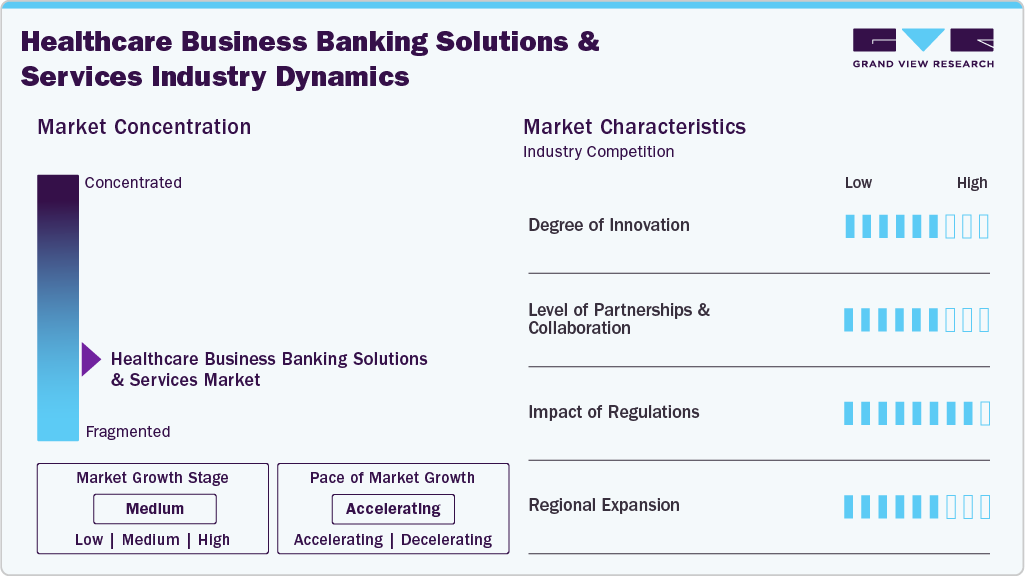

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, characteristics, and participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, the impact of regulations, the level of partnership and collaboration activities, the degree of innovation, and regional expansion.

The degree of innovation in the healthcare business banking solutions & services market is high, fueled by the growing need to optimize financial operations, improve liquidity, and enhance payment efficiency across healthcare organizations. Vendors are introducing AI-driven banking and treasury platforms that automate cash-flow forecasting, claims reconciliation, and payment processing, enabling providers to reduce administrative burdens, minimize revenue leakage, and accelerate reimbursements.

The level of partnerships and collaboration activities in the healthcare business banking solutions & services industry is steadily increasing, as banks and healthcare institutions join forces to enhance financial accessibility and operational efficiency. For instance, in December 2024, Bali International Hospital and Bank Mandiri signed a strategic partnership to enhance access to premium healthcare services in Bali by offering integrated financial solutions, including flexible payment plans, exclusive offers, and health finance education.

The healthcare business banking solutions & services market is significant, as both the financial and healthcare sectors are heavily governed by compliance frameworks. Strict regulations such as HIPAA, GDPR, and PCI DSS influence how patient and payment data are handled within banking platforms, driving vendors to adopt advanced security, encryption, and audit systems. Additionally, government policies promoting digital health, cashless payments, and financial transparency are accelerating the adoption of compliant banking technologies.

The regional expansion in the market for healthcare business banking solutions & services is gaining momentum as banks and fintech providers broaden their presence across emerging healthcare economies. Leading financial institutions are expanding their specialized healthcare banking services, including provider financing, digital payment gateways, and treasury management, into high-growth regions such as the Asia Pacific, the Middle East, and Latin America, where healthcare infrastructure and private investments are rapidly increasing.

Solution Type Insights

The services segment dominated the healthcare business banking solutions & services industry, with the largest revenue share of 79.1% in 2024, and is anticipated to witness the fastest CAGR of 9.8% over the forecast period. The growth is attributed to increasing reliance on outsourced financial services to reduce operational costs and improve efficiency. Services like consultancy, financial advisory, and outsourcing of financial processes are widely adopted due to their flexibility and ability to address specific needs. Moreover, banks offer specialized services that may exceed the expertise of in-house teams. All these factors are anticipated to fuel the segment growth over the forecast period.

Moreover, the software and hardware devices segment is also expected to grow significantly over the forecast period, owing to the increasing investment in technology to streamline financial operations by healthcare providers and payers. Furthermore, increasing integration of advanced software solutions for automation, data analytics, and cybersecurity is also driving the demand for technologically advanced software and hardware.

For instance, in August 2021, Commerce Bancshares, Inc. announced the optimization of patient financing options by integrating Health Services Financing (HSF) with Epic MyChart. This integration aims to expedite patient enrollment in HSF, thereby enhancing the patient experience and saving the provider's valuable time. Through the HSF Patient Enrollment app available in the Epic App Orchard, healthcare providers can seamlessly offer the HSF program via patients' MyChart accounts. The patient enrollment process is now entirely self-service, facilitating smoother transactions for all parties involved.

Application Insights

The financial management segment dominated the healthcare business banking solutions & services market in 2024, with the largest revenue share. The adoption rate of financial management solutions is high among healthcare organizations due to the need to manage complex financial operations. These solutions integrate various financial functions such as budgeting, accounting, and financial reporting, providing a comprehensive view of an organization's financial health. The trend is shifting towards the use of holistic financial management platforms that streamline these processes, thereby enhancing efficiency and accuracy.

Moreover, these platforms help in compliance with regulatory requirements and reduce the risk of financial discrepancies. For instance, in September 2022, Commerce Bancshares, Inc. partnered with FISPAN, a fintech company, to offer embedded commerce financing solutions. The new platform offers improved banking and treasury functionalities, including streamlined features such as account reconciliation, payment initiation, & remittance advice. It is compatible with leading accounting platforms, such as QuickBooks Online and Sage Intacct, which enhances overall financial management capabilities.

However, the analytics segment is anticipated to showcase the fastest growth at a CAGR of 12.9% from 2025 to 2033. Advanced analytics and AI solutions provide actionable insights, predictive financial modeling, and risk management, enabling organizations to anticipate trends and mitigate risks proactively. Thus, the increasing demand for improved financial planning, efficiency, and strategic decision-making is fueling the demand for analytics solutions among healthcare payers and providers.

End-use Insights

The healthcare providers segment dominated the market with the largest revenue share of 47.5% in 2024. Healthcare providers increasingly adopt banking solutions to manage their extensive financial operations more efficiently. High adoption rates are driven by the need for robust revenue cycle management, encompassing billing, payment, and reimbursement processes. Integrated financial management platforms provide providers with a holistic view of their financial health, enabling better resource allocation and informed strategic planning. Thus, market players are launching solutions that cater to this rising demand. For instance, in May 2021, J.P. Morgan Chase launched Morgan Health, a business unit that enhances the quality, efficiency, and equity of employer-sponsored healthcare. Morgan Health will collaborate with various healthcare experts and partners, including provider groups, employers, and organizations dedicated to improving the healthcare system.

The healthcare payers segment is anticipated to witness the fastest growth from 2025 to 2033. The growth of this segment can be attributed to the ability of these solutions to streamline claims processing, reducing turnaround times, and enhancing customer satisfaction. Advanced analytics and automation tools provide critical insights for efficient financial management and risk assessment, helping payers mitigate potential financial risks.

Regional Insights

North America dominated the healthcare business banking solutions and services market with a revenue share of 39.4% in 2024. The North America healthcare business banking solutions & services market is expanding rapidly as healthcare providers increasingly seek digitized treasury, payment, and revenue-cycle platforms to manage the region’s complex reimbursement and payer mix. Major U.S. banks, including JPMorgan Chase, Wells Fargo, and Bank of America, are launching specialized healthcare banking divisions that integrate digital payment gateways, automated claims reconciliation tools, and liquidity optimization systems.

U.S. Healthcare Business Banking Solutions And Services Market Trend

The U.S. healthcare business banking solutions and services industry is witnessing robust growth as providers increasingly seek integrated financial platforms to manage complex billing cycles, reimbursements, and liquidity needs. Major financial institutions are responding with specialized initiatives targeting healthcare clients. For instance, in September 2023, U.S. Bank launched an initiative to serve small- to mid-size healthcare practices with annual revenues of up to USD 25 million, offering specialized banking, payments, and wealth management solutions through dedicated healthcare relationship managers. The program aims to simplify finances and improve patient payment experiences for medical, dental, and veterinary practices nationwide.

Europe Healthcare Business Banking Solutions And Services Market Trend

In Europe, the healthcare business banking solutions and services industry is advancing as financial institutions and policymakers prioritize the modernization of healthcare funding and payment infrastructures. For instance, in September 2024, the WHO and European development banks launched the USD 1.73 billion (Euro 1.5 billion) Health Impact Investment Platform to strengthen primary healthcare in 15 low- and middle-income countries, focusing on pandemic resilience and climate crisis response. The platform mobilizes concessional loans and grants to support national health strategies and improve access to equitable, cost-effective primary care services. This reflects Europe’s broader commitment to innovative healthcare financing models and cross-border financial collaboration that continue to drive the adoption of specialized banking solutions and sustainable healthcare investment frameworks across the region.

The UK healthcare business banking solutions and services market is expanding as healthcare providers and private practices increasingly adopt specialized financial services to manage complex reimbursement flows, digital payments, and operational financing. Some of the leading players, such as Barclays, HSBC, and Lloyds Bank, offer dedicated healthcare banking divisions providing cash-flow management, practice financing, and payment automation solutions, contributing to the growth of the market.

The healthcare business banking solutions and services market in Germany is expanding. Healthcare providers and institutions are seeking streamlined financial operations as investment in digital health and hospital modernization increases. The adoption of cashless transactions, centralized treasury management, and infrastructure financing supported by initiatives such as the Hospital Future Act is increasing the demand for customized banking ecosystems. These systems enhance financial efficiency, transparency, and sustainability across the market.

Asia Pacific Healthcare Business Banking Solutions And Services Market Trend

The Asia Pacific healthcare business banking solutions and services industry is expanding rapidly, driven by growing private healthcare investments, digital payment penetration, and government-led financial modernization initiatives. For instance, in April 2025, Kerala (India) launched a digital payment system across 313 government hospitals, allowing patients to pay using cards and UPI platforms such as Google Pay and PhonePe, with plans to extend the system to all hospitals. The initiative also includes online OP ticket booking and M-Health apps that integrate payment and patient record access, reflecting the region’s broader shift toward seamless, cashless healthcare ecosystems. Such efforts, along with public-private collaborations and cross-border financial interoperability, are accelerating the adoption of specialized banking and payment solutions across the region’s healthcare landscape.

The healthcare business banking solutions and services market in Japan is advancing as the country’s aging population and growing healthcare expenditures drive demand for efficient financial management systems across hospitals and medical institutions. The government’s push for digital transformation in healthcare and wider adoption of cashless payment systems are encouraging providers to integrate automated payment and treasury solutions into their operations.

China’s healthcare business banking solutions and services market is growing rapidly, driven by increasing hospital investments and healthcare infrastructure expansion to meet rising patient demand. The government’s focus on tiered healthcare system reforms and promotion of digital hospital payments has led many hospitals to adopt centralized billing and automated payment solutions, reducing delays in reimbursements.

Latin America Healthcare Business Banking Solutions And Services Market Trend

The healthcare business banking solutions & services industry in Latin America is expanding as providers seek streamlined financial operations, digital payment integration, and efficient cash-flow management to support hospitals, clinics, and multi-location healthcare networks. Growing demand for specialized banking solutions reflects the region’s focus on improving operational efficiency and financial transparency within the healthcare sector.

Middle East & Africa Healthcare Business Banking Solutions And Services Market Trend

The Middle East & Africa healthcare business banking solutions & services industry is expanding as healthcare providers and insurers increasingly adopt digital payment systems, treasury management, and cash-flow optimization tools. In 2024, the fintech firm SingleView partnered with Bupa Arabia to deliver its innovative financial‑services platform, enhancing payments and banking capabilities within Saudi Arabia’s healthcare sector. This highlights the region’s broader push toward digitally enabled, provider-focused banking solutions, driven by rising patient volumes, growing insurance adoption, and the modernization of healthcare infrastructure.

Key Healthcare Business Banking Solutions And Services Company Insights

The companies operating in this market are focusing on strategic partnerships, collaborations with other organizations, and innovative solutions. Furthermore, the market players are undertaking strategies such as acquisitions, new product launches, joint ventures and agreements, and expansion in other regions to increase their market outreach

Key Healthcare Business Banking Solutions And Services Companies:

The following are the leading companies in the healthcare business banking solutions and services market. These companies collectively hold the largest market share and dictate industry trends.

- Bank of America Corporation

- JPMorgan Chase & Co.

- Standard Chartered

- HSBC Innovation Bank Limited

- Citigroup Inc.

- Barclays Investment Solutions Limited

- Deutsche Bank AG, Frankfurt am Main

- Goldman Sachs

- UBS

- BNP Paribas

- PNC Bank

- KeyBank

- Fifth Third Bank

- Regions Bank

- Comerica Bank

Recent Developments

- In July 2025, Wells Fargo & Company announced that it had expanded its Commercial Banking Healthcare team by more than 30% year‑to‑date, adding dedicated industry bankers across key U.S. regions and sectors, including healthcare services, MedTech, and biopharma.

“Healthcare Banking is a priority sector for Wells Fargo. We will continue strengthening our team to bring our full capabilities to clients so they can deliver better outcomes and drive efficiencies in this essential U.S. industry,”

- Mary Katherine DuBose

- In May 2023, DNB Bank ASA and Back Bay Life Science Advisors announced a strategic partnership to provide integrated advisory and financing services to healthcare and life‑science companies globally, combining DNB’s capital markets and investment‑banking capabilities with Back Bay’s expertise in strategy, commercialization, and transactions.

As companies advancing healthcare assets are met with scientific, business and funding challenges, our Partnership’s integration of strategy and transaction execution excellence across investment and corporate banking functions becomes critical to furthering improvements in global healthcare. The boards and managements of healthcare companies will now be able to choose one dedicated partner for commercial development and corporate finance guidance and execution.

-Jonathan P. Gertler, CEO of Back Bay Life Science Advisors.

-

In May 2023, Fifth Third Bancorp announced the acquisition of Big Data LLC, a technology solutions provider specializing in healthcare payments and remittances. This acquisition enhances Fifth Third's national healthcare revenue cycle capabilities, addressing clients' complex needs in this sector and aligning with the bank's vision of digital innovation & focus on healthcare.

-

In January 2023, Citizens Financial Group, Inc.’s Citizens M&A Advisory acted as the sole financial advisor for Springboard Healthcare Staffing and Education during its acquisition by Ingenovis Health, supported by Trilantic North America and Cornell Capital.

-

In June 2022, Bank of America announced a USD 40 million investment to expand access to primary healthcare. This financing initiative extended the reach of the company’s Signature Health Initiative, supporting the establishment and growth of primary care facilities.

-

In January 2021, PNC Bank N.A. acquired Tempus Technologies, Inc., a prominent payment gateway provider specializing in secure and innovative payment-processing solutions for businesses. This acquisition was expected to enhance PNC Treasury Management's comprehensive payments platform, offering corporate clients streamlined management of payables and receivables across various payment channels.

“This acquisition demonstrates our ongoing commitment to investing in our Treasury Management products and solutions by further expanding our payments capabilities, Leveraging Tempus Technologies patented solutions and our existing industry-leading Treasury Management platform, we will provide our clients with convenient, immediate and secure payments options based upon their business' individual needs.”

-Executive Vice President and Head of PNC Corporate & Institutional Banking.

Healthcare Business Banking Solutions And Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 155.9 billion

Revenue forecast in 2033

USD 326.1 billion

Growth rate

CAGR of 9.7% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Market value in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Bank of America Corporation, JPMorgan Chase & Co.; Standard Chartered; HSBC Innovation Bank Limited; Citigroup Inc.; Barclays Investment Solutions Limited; Deutsche Bank AG; Frankfurt am Main; Goldman Sachs; UBS; BNP Paribas; PNC Bank; KeyBank; Fifth Third Bank; Regions Bank; Comerica Bank

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Healthcare Business Banking Solutions And Services Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global healthcare business banking solutions & services market report based on solution type, application, end-use, and region:

-

Solution Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Software

-

Services and Hardware

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Credit & Financing

-

Financial Management

-

Analytics

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Healthcare Providers

-

Healthcare Payers

-

Healthcare Organizations

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global healthcare business banking solutions & services market size was estimated at USD 141.8 billion in 2024 and is expected to reach USD 155.9 billion in 2025.

b. The global healthcare business banking solutions & services market is expected to grow at a compound annual growth rate of 9.7% from 2025 to 2033 to reach USD 326.1 billion by 2033.

b. North America dominated the healthcare business banking solutions & services market with a share of 39.4 % in 2024. The market is expanding rapidly as healthcare providers increasingly seek digitized treasury, payment, and revenue-cycle platforms to manage the region’s complex reimbursement and payer mix.

b. Some key players operating in the healthcare business banking solutions & services market include Bank of America Corporation, JPMorgan Chase & Co.; Standard Chartered; HSBC Innovation Bank Limited; Citigroup Inc.; Barclays Investment Solutions Limited; Deutsche Bank AG; Frankfurt am Main; Goldman Sachs; UBS; BNP Paribas; PNC Bank; KeyBank; Fifth Third Bank; Regions Bank; Comerica Bank

b. Key factors that are driving the market growth include rising healthcare digitalization and electronic payments adoption, increasing financial complexity of healthcare providers and systems, and the adoption of mobile and cloud-based corporate banking platforms. In addition, the need for robust revenue cycle management, encompassing billing, payment, and reimbursement processes in healthcare organizations, is further contributing to the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.