- Home

- »

- Advanced Interior Materials

- »

-

High Density Fiberboard Market Size, Industry Report, 2033GVR Report cover

![High Density Fiberboard Market Size, Share & Trends Report]()

High Density Fiberboard Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Raw HDF, Laminated HDF), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-820-1

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

High Density Fiberboard Market Summary

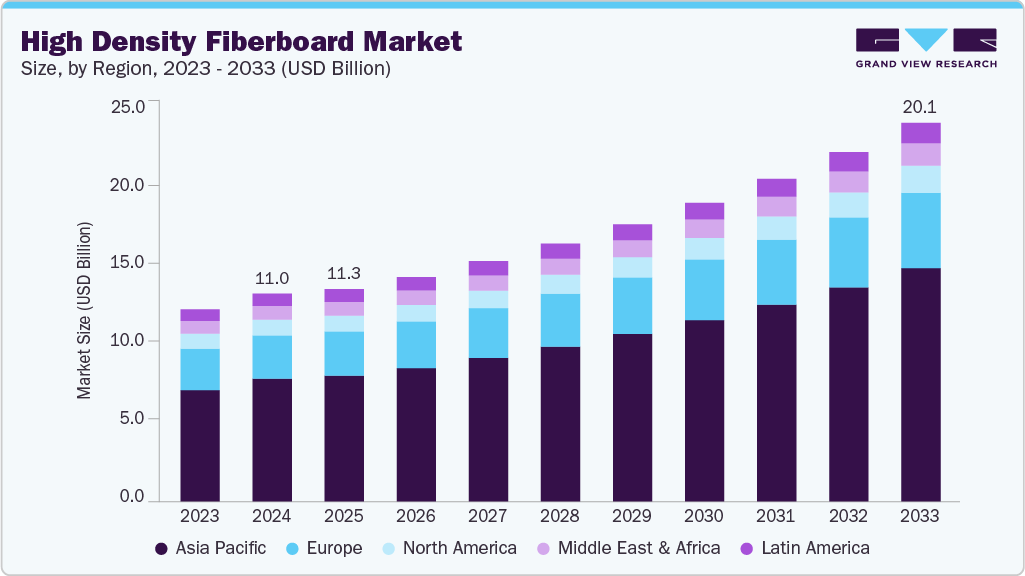

The global high density fiberboard market size was estimated at USD 11.04 billion in 2024 and is projected to reach USD 20.12 billion by 2033, growing at a CAGR of 7.5% from 2025 to 2033. The demand for high-density fiberboard is expanding steadily as urban development, residential upgrades, and commercial interior projects continue to accelerate worldwide.

Key Market Trends & Insights

- Asia Pacific dominated the high density fiberboard market with the largest revenue share of 59.1% in 2024.

- China dominated the Asia Pacific high density fiberboard market with the highest revenue share of 83.2% in 2024.

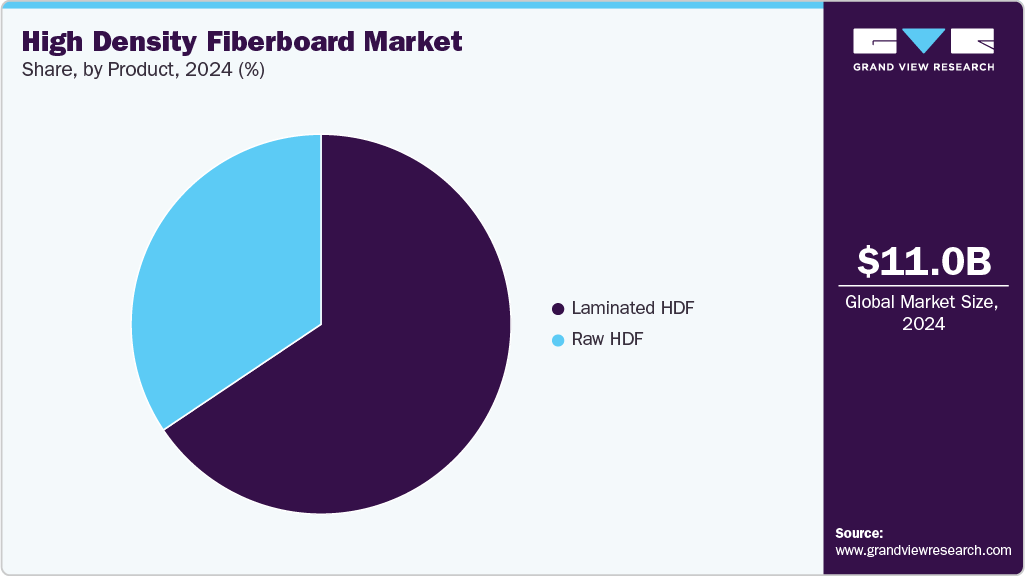

- By product, the laminated HDF segment led the market with the largest revenue share of 65.6% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 11.04 Billion

- 2033 Projected Market Size: USD 20.12 Billion

- CAGR (2025-2033): 7.5%

- Asia Pacific: Largest market in 2024

Builders and designers are gravitating toward HDF because it delivers a uniform structure, high strength, and excellent compatibility with laminates and coatings. The rising popularity of modular, space-efficient furniture is further strengthening its position as a core engineered wood product. In advanced markets, sustained renovation cycles and aesthetic enhancement trends are increasing panel consumption across flooring, wall systems, and cabinetry. Eco-conscious consumers and manufacturers are now increasingly preferring materials with recycled fiber content, which aligns well with HDF production processes.

The furniture manufacturing ecosystem remains a dominant growth engine, as HDF offers reliability, clean machining, and consistent density that support the production of precision components. Advances in resin chemistry, pressing technology, and decorative surface treatments are enabling producers to supply higher-performance and moisture-resistant grades. Regulatory momentum toward low-emission building materials is accelerating the use of compliant HDF in residential and institutional projects. Large-scale production capabilities in the Asia-Pacific are also lowering global costs and enhancing export competitiveness. Growing consumer interest in modern, textured, and pre-finished interior surfaces is expanding the decorative HDF segment. Rising timber prices and sustainability pressures are prompting industries to shift away from solid wood and adopt engineered alternatives.

The high density fiberboard industry is witnessing a shift toward enhanced surface technologies, including textured finishes, synchronized embossing, and digitally printed designs. Manufacturers are developing moisture-resistant, high-strength, and lightweight variants to expand usage in kitchens, bathrooms, and premium furniture. Growing interest in bio-based adhesives and low-formaldehyde resins is reshaping product development priorities. Automation and real-time process monitoring in production lines are improving consistency and reducing operational costs. Decorative panel innovation is driving demand for high-quality substrates that can support premium laminates and coatings. E-commerce-driven DIY culture is increasing the consumption of pre-cut, ready-to-install HDF components.

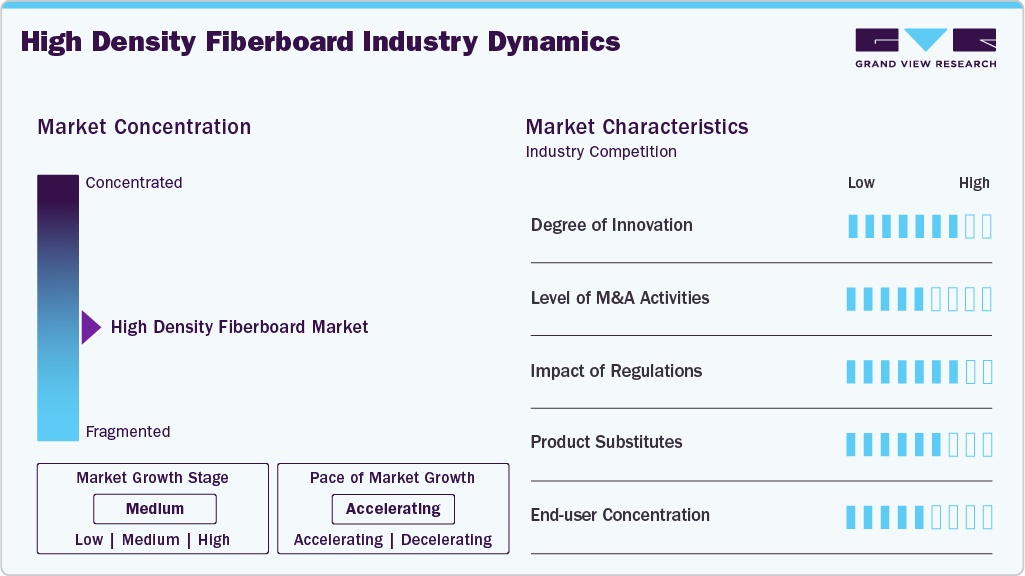

Market Concentration & Characteristics

The high density fiberboard industry remains moderately concentrated, with a mix of large multinational panel producers and regionally dominant manufacturers shaping supply dynamics. Major players operate integrated facilities with strong control over raw materials, resin systems, and downstream decorative capabilities, which gives them a competitive advantage. Smaller producers mainly compete on price and local distribution strength, particularly in emerging markets. Capacity expansion in the Asia-Pacific region is gradually shifting global supply leadership toward the area. Despite consolidation among key players, market entry remains accessible due to the availability of mature production technologies. Trade barriers, resin costs, and fiber availability influence geographic concentration patterns.

HDF competes primarily with MDF, particleboard, plywood, and certain plastic or PVC-based interior materials, creating moderate substitution pressure. While MDF is a close structural substitute, HDF’s higher density and superior surface quality give it an advantage in premium applications. Plywood offers higher moisture resistance but is more expensive, prompting budget-conscious buyers to opt for HDF. The growing use of wood-plastic composites (WPC) in specific segments poses a niche threat, particularly in wet-area cabinetry. Solid wood continues to serve high-end markets but faces cost and sustainability constraints. Decorative laminates and metal panels are occasionally used in design-driven applications, albeit at a higher price point.

Product Insights

The laminated HDF segment led the market with the largest revenue share of 65.6% in 2024, owing to its widespread use in furniture, interior panels, flooring substrates, and decorative applications that require a smooth, durable, and aesthetically enhanced surface. Its superior compatibility with veneers, decorative papers, and high-pressure laminates makes it the preferred choice for premium cabinetry, wall cladding, and modular furniture production. Growing consumer preference for contemporary interiors, along with the expansion of organized retail and home improvement channels, has further boosted the adoption of laminated HDF.

The raw HDF segment is expected to grow at the fastest CAGR of 7.1% over the forecast period, due to rising demand from manufacturers who prefer unprocessed boards for custom fabrication and downstream finishing. Its cost-effectiveness, machining flexibility, and suitability for a variety of laminates, coatings, and value-added processes make it attractive for mass-production environments. The growth of small and mid-sized furniture workshops, especially in developing regions, is driving demand for raw HDF that can be tailored to specific design or performance requirements. Increased availability of moisture-resistant and low-emission raw boards is also expanding their application scope in kitchens, wardrobes, and interior infrastructure.

Regional Insights

The high density fiberboard market in North America benefits from a stable housing sector, strong renovation demand, and advanced furniture manufacturing clusters. Consumers favor engineered panel products for their durability and compatibility with high-end laminates and finishes. Regulatory frameworks that emphasize formaldehyde reduction and indoor air quality support the use of certified HDF panels. U.S. and Canadian producers focus on higher-value grades, including moisture-resistant and specialty decorative substrates. Import dependence remains moderate, with Asia supplying cost-competitive products to the region. A preference for modern, minimalist interiors is boosting decorative HDF penetration in retail channels.

U.S. High Density Fiberboard Market Trends

The high density fiberboard market in the U.S. is shaped by steady home improvement spending, commercial retrofits, and increasing adoption of modular interiors. Builders and OEMs prefer HDF for its strength, uniformity, and compatibility with advanced laminates and coatings. Strict CARB and TSCA Title VI regulations reinforce the shift toward low-emission HDF grades. Domestic production focuses on value-added surface-finished panels, while imports fill price-sensitive segments. Kitchen and bath remodeling is creating strong demand for moisture-resistant HDF variants. Retail and DIY channels continue to expand the customer base for decorative and pre-cut HDF components.

Asia Pacific High Density Fiberboard Market Trends

Asia Pacific dominated the global high density fiberboard market with the largest revenue share of 59.1% in 2024 and is projected to grow at the fastest CAGR during the forecast period, owing to extensive furniture manufacturing, rapid construction growth, and increasing urban population density. The region benefits from abundant raw materials, cost-efficient labor, and large-scale production capacities, which enhance its international competitiveness. The expansion of residential projects and rising middle-class consumption are driving the increased use of engineered wood panels in interiors. Governments across the region are promoting sustainable building materials, boosting adoption of compliant HDF grades. Export-oriented manufacturing clusters in China, Vietnam, and India strengthen regional influence. Demand for decorative panels is rising as consumer preferences shift toward contemporary interiors.

The high density fiberboard market in China remains the world’s largest producer and consumer of HDF, supported by an advanced panel manufacturing ecosystem and strong domestic demand for furniture and interior products. Continuous investment in new production lines and resin technologies is enhancing product quality and expanding the application range. The country’s large urban housing stock drives recurring interior renovation cycles that sustain panel consumption. Export competitiveness remains strong due to cost efficiencies and broad supplier networks. Policies promoting resource efficiency and low-emission materials are reshaping the industry toward greener variants. Decorative HDF panels are gaining popularity in retail and commercial renovations.

Europe High Density Fiberboard Market Trends

The high density fiberboard market in Europe demonstrates steady HDF demand supported by sustainability-led construction rules, high-quality furniture production, and renovation cycles. Strong regulatory frameworks drive the adoption of low-formaldehyde and eco-certified HDF products. European manufacturers lead in decorative surfaces, embossing technology, and engineered panel innovations. The demand for premium interiors, particularly in hospitality and retail environments, supports high-value HDF grades. Rising energy and resin costs have heightened price sensitivity, leading to regional sourcing shifts. The region also benefits from strong circular economy policies that encourage the use of recycled fibers.

The Germany high density fiberboard market is a key hub for engineered wood innovation, with strong demand stemming from high-end furniture, laminate flooring, and interior systems. The country’s strict environmental regulations drive the development of advanced, low-emission HDF products. German manufacturers emphasize precision, sustainability, and premium surface technologies, positioning the country as a quality benchmark. Renovation activity in residential spaces remains robust, stimulating recurrent panel usage. The demand for decorative surfaces is increasing as contemporary interior design preferences evolve. Strong export linkages support stable production volumes.

Latin America High Density Fiberboard Market Trends

The high density fiberboard market in Latin America is growing due to rising housing needs, expanding modular furniture industries, and urbanization-led interior spending. Countries such as Brazil and Mexico host significant furniture manufacturing clusters that rely heavily on engineered panels. Economic improvements and the expansion of the middle class are supporting DIY home-improvement trends. Local manufacturers are increasing capacity to reduce dependence on imports and improve cost competitiveness. Decorative HDF products are gaining traction in retail and residential sectors. Construction recovery in key countries is boosting demand for panel-based applications.

Middle East & Africa High Density Fiberboard Market Trends

The high density fiberboard market in the Middle East & Africa region is experiencing growing demand for HDF driven by rising commercial development, hospitality expansion, and urban housing projects. Imported decorative and moisture-resistant grades dominate due to limited domestic panel manufacturing. Interior design preferences are shifting toward contemporary, laminate-based finishes, increasing reliance on engineered wood substrates. Government-led infrastructure development supports broader usage of panel-based interior solutions. Hot climate conditions are encouraging demand for more stable, engineered materials over natural wood. Retail modernization is improving access to HDF-based furniture and interior products.

Key High Density Fiberboard Company Insights

Some of the key players operating in the market include ARAUCO and Pfleiderer Group.

-

ARAUCO provides manufacturing, distribution, and service to customers in construction, casework, fixture, fabrication, commercial design, and paper making.

-

Pfleiderer offers a complete range of products and services with a focus on furniture making, the timber trade, interior fitout and timber construction and pools the Duropal and Thermopal product ranges under the Pfleiderer umbrella brand and is a partner of industry, commerce, installers, designers and architects.

Weyerhaeuser and SWISS KRONO GROUP are some of the emerging market participants in the high density fiberboard industry.

-

Founded in 1900 by Frederick Weyerhaeuser, Weyerhaeuser has become one of the largest sustainable forest products companies in the world.

-

The SWISS KRONO Group, headquartered in Lucerne, Switzerland, is a leading supplier of wood-based materials. The company offers a wide range of products in the fields of interior design, flooring and building materials.

Key High Density Fiberboard Companies:

The following are the leading companies in the high density fiberboard market. These companies collectively hold the largest market share and dictate industry trends.

- ARAUCO

- Kronospan

- Weyerhaeuser

- Pfleiderer Group

- Woodeco Group

- Greenpanel Industries Limited

- SWISS KRONO GROUP

- Rushil Decor Ltd

- Homanit

- Dare Wood-Based Panels Group

Recent Developments

-

In October 2025, Pfleiderer announced the establishment of its direct presence in Singapore and Greater China to provide enhanced local support, faster access to samples and technical expertise, and seamless collaboration on regional projects.

High Density Fiberboard Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.28 billion

Revenue forecast in 2033

USD 20.12 billion

Growth rate

CAGR of 7.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; China; Japan; India; South Korea; Saudi Arabia; UAE; Egypt; Kuwait; Qatar

Key companies profiled

ARAUCO; Kronospan; Weyerhaeuser; Pfleiderer Group; Woodeco Group; Greenpanel Industries Limited; SWISS KRONO GROUP; Rushil Decor Ltd; Homanit; Dare Wood-Based Panels Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global High Density Fiberboard Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global high density fiberboard market report based on the product, and region:

-

Product Outlook (Volume, Thousand Cubic Meters; Revenue, USD Million, 2021 - 2033)

-

Raw HDF

-

Raw HDF, By Grade

-

E0

-

E1

-

E2

-

-

Raw HDF, By Application

-

Fire Resistant

-

Moisture Resistant

-

Others

-

-

-

Laminated HDF

-

Laminated HDF, By Grade

-

E0

-

E1

-

E2

-

-

Laminated HDF, By Surface Type

-

Melamine

-

PVC

-

PET

-

Flooring

-

Others

-

-

Laminated HDF, By Application

-

Fire Resistant

-

Moisture Resistant

-

Others

-

-

-

-

Regional Outlook (Volume, Thousand Cubic Meters; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Egypt

-

Qatar

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global high density fiberboard market size was estimated at USD 11.04 billion in 2024 and is expected to reach USD 11.28 billion in 2025.

b. The global high density fiberboard market is expected to grow at a compound annual growth rate of 7.5% from 2025 to 2033 to reach USD 20.12 billion by 2033.

b. The laminated HDF segment held the highest revenue market share of 65.6% in 2024, owing to its widespread use in furniture, interior panels, flooring substrates, and decorative applications that require a smooth, durable, and aesthetically enhanced surface.

b. Some of the key players operating in the high density fiberboard market include ARAUCO, Kronospan, Weyerhaeuser, Pfleiderer Group, Woodeco Group, Greenpanel Industries Limited, SWISS KRONO GROUP, Rushil Decor Ltd, Dare Wood-Based Panels Group, and Homanit.

b. Sustainability-led construction demand, growth in modular furniture, technological advances in panel production, and stricter low-emission regulations are the key factors driving the high-density fiberboard market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.