- Home

- »

- Electronic & Electrical

- »

-

Home Water Filtration Unit Market, Industry Report, 2033GVR Report cover

![Home Water Filtration Unit Market Size, Share & Trends Report]()

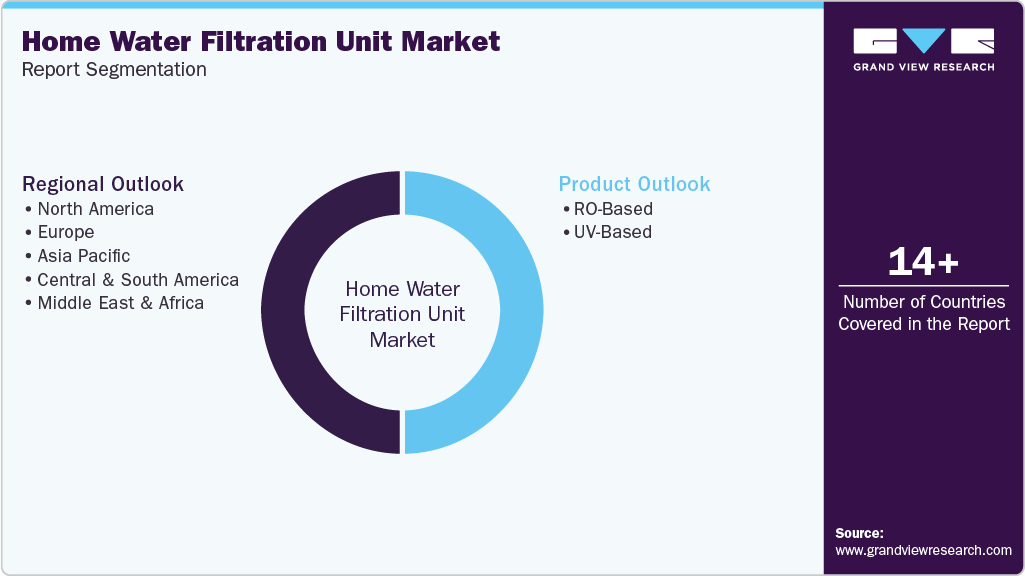

Home Water Filtration Unit Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (RO-Based, UV-Based), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-317-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Home Water Filtration Unit Market Summary

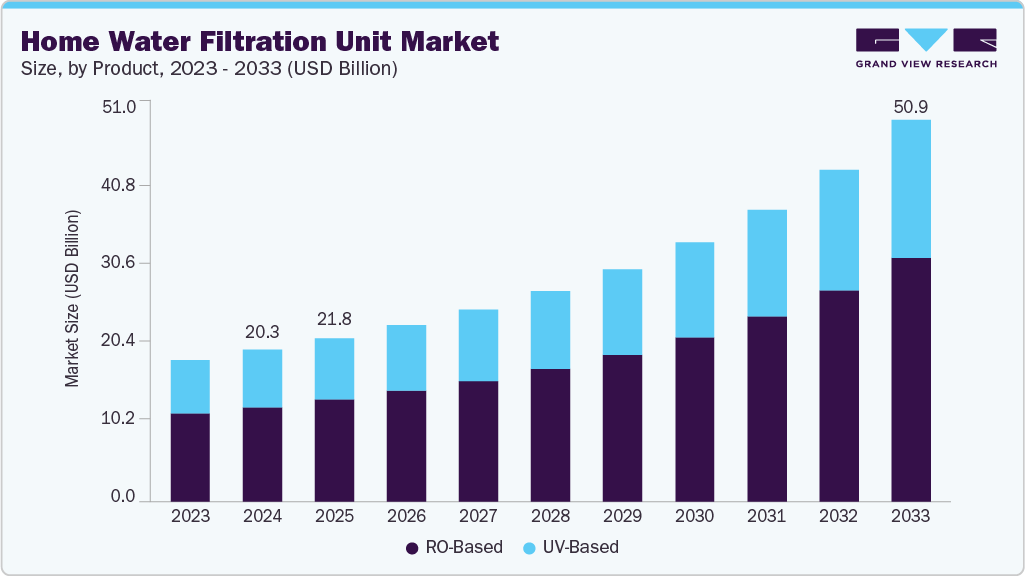

The global home water filtration unit market size was estimated at USD 20.26 billion in 2024 and is projected to reach USD 50.89 billion by 2033, growing at a CAGR of 11.2% from 2025 to 2033. This can be attributed to increasing concerns over water safety and the rising shift toward household purification systems. Expanding urban adoption of RO, UV, and multi-stage units further strengthens demand.

Key Market Trends & Insights

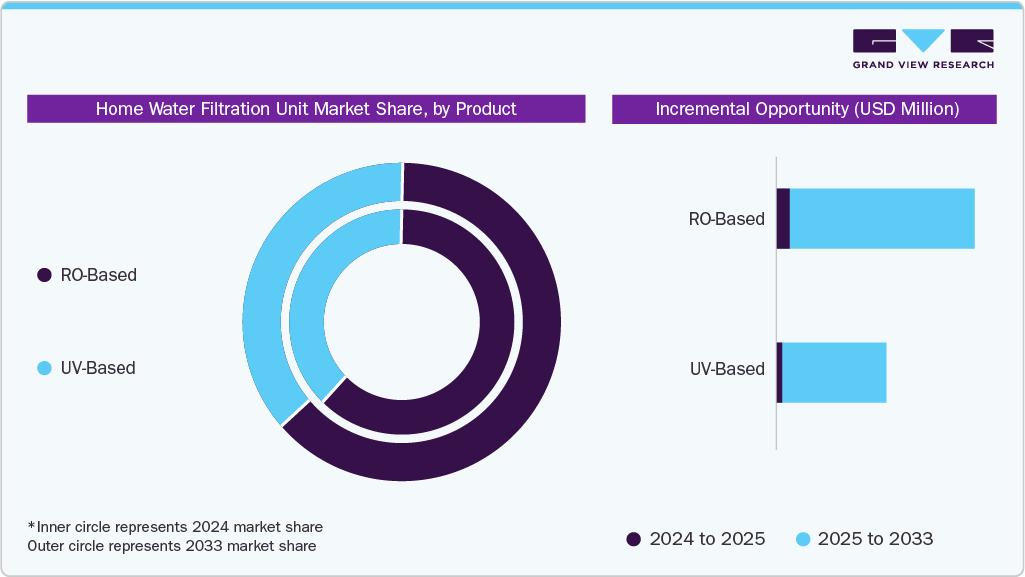

- By product, the RO-based home water filtration unit led the market with a share of 62.23% in 2024.

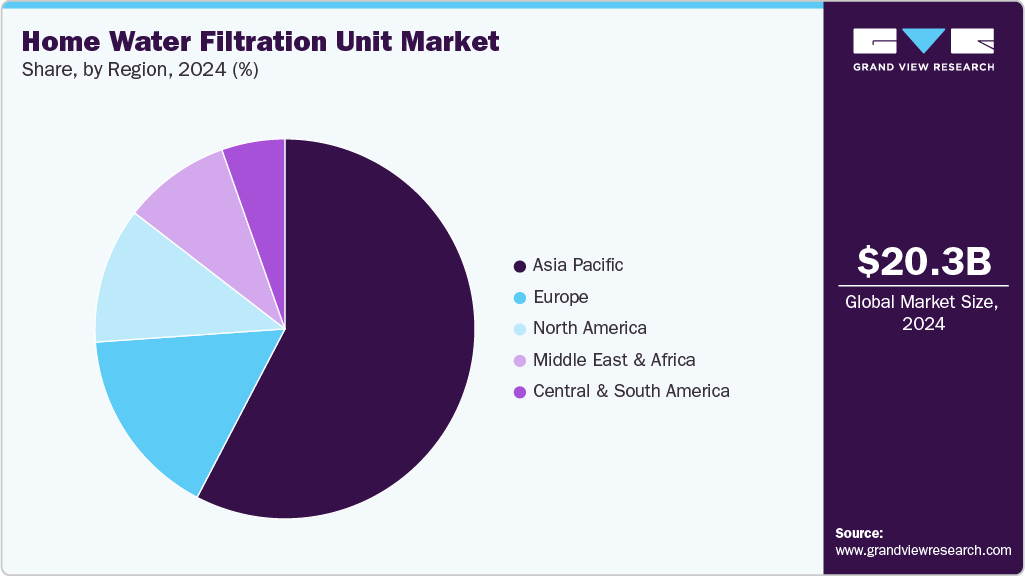

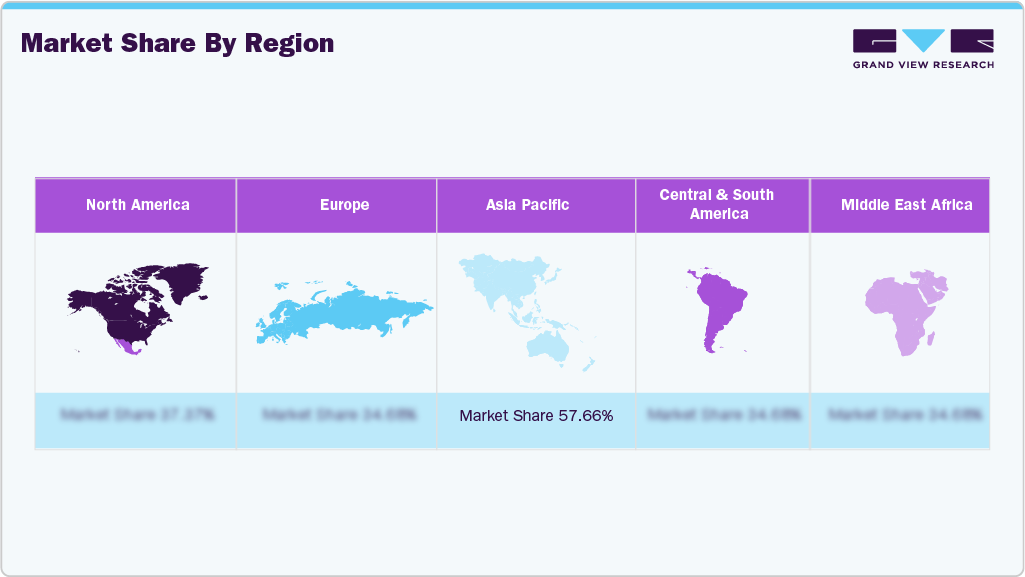

- By region, Asia Pacific held a market share of 57.66% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 20.26 Billion

- 2033 Projected Market Size: USD 50.89 Billion

- CAGR (2025-2033): 11.2%

A key ongoing global trend is the rapid adoption of multi-stage, high-efficiency filtration systems, such as RO-UV-UF combinations, driven by rising awareness of contamination and stricter water quality norms across both developed and emerging regions. Consumers are increasingly replacing basic filters with advanced units that can handle heavy metals, microplastics, and chemical pollutants, reflecting a global shift toward more comprehensive and reliable household purification solutions.Global demand is primarily driven by rising concerns over water contamination, with an increasing number of households seeking reliable purification as incidents involving heavy metals, microplastics, and industrial pollutants become more widely reported. For example, growing awareness of lead-related cases in regions like the U.S. and chemical runoff issues in parts of Southeast Asia has prompted consumers to opt for certified multi-stage RO and UV systems, which ensure safer drinking water.

Another key driver is the expansion of urban middle-class populations, particularly in the Asia Pacific, where rapid urbanization puts a strain on municipal water infrastructure. Cities in India, China, and Indonesia are increasingly turning to home filtration units as everyday essentials, rather than discretionary purchases. This shift boosts sales of affordable under-sink RO units, compact countertop purifiers, and UV-based systems designed for densely populated residential environments.

The market is also propelled by technology upgrades and convenience-led innovation, with manufacturers introducing smart filters that track real-time TDS levels, send filter-replacement alerts, and optimize purification cycles. Brands offering IoT-enabled purifiers in markets such as Japan, South Korea, and the U.S. demonstrate how digital features enhance user trust and reduce maintenance friction, thereby accelerating adoption across both premium and mid-range segments. Examples include Xiaomi’s smart RO purifiers in China, Coway’s IoT-enabled models in South Korea, and Brita and A.O. Smith’s connected systems in the U.S., all of which offer filter-life tracking, real-time TDS monitoring, and automated alerts-making purification more reliable and maintenance-friendly.

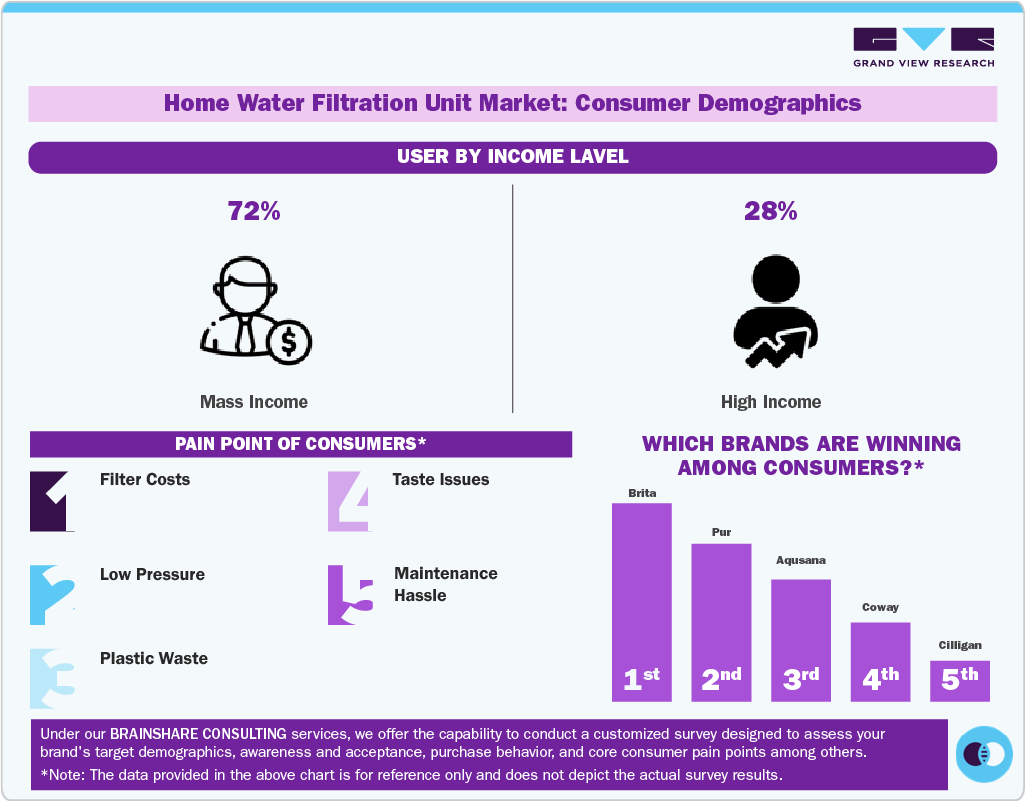

Consumer Insights

The income split shows that mass-income households (72%) make up the largest user base, as they prioritize affordable and practical solutions for safer water. These consumers generally opt for compact pitcher filters, faucet attachments, or basic under-sink units due to their lower upfront cost and wide retail availability.

The pain points reflect the most common frustrations across markets. Filter costs and maintenance hassle highlight the ongoing burden of replacement cycles. Issues such as low pressure and taste problems are tied to inconsistent municipal supplies, while plastic waste concerns are rising as consumers seek more sustainable cartridge systems.

Global leaders such as Brita, Pur, Aquasana, Coway, and Culligan are winning because they address these pain points directly-offering subscription filter models, longer-life cartridges, eco-friendly materials, and higher-efficiency purification technologies. Their strong retail distribution, trust built over time, and consistent product reliability keep them ahead in consumer adoption.

Product Insights

RO-based water filtration units held a market share of 62.23% in 2024, as they address high TDS levels, heavy metal contamination, and deteriorating groundwater quality across major markets. Regions such as India, China, and parts of the Middle East rely on RO due to brackish or mineral-heavy water, while increased public awareness of long-term health risks and the availability of cost-efficient multi-stage RO models further reinforce their dominance. Brands such as Kent, Aquaguard, and Culligan popularize RO units through strong distribution and multi-stage purification features that appeal to safety-conscious households.

UV-based water filtration units are expected to witness a CAGR of 10.6% from 2025 to 2033, driven by urbanization, the shift toward treated municipal water supply, and preference for low-maintenance, chemical-free purification. Cities in Japan, South Korea, Singapore, and Western Europe are increasingly adopting UV systems due to their low maintenance requirements, compact design, and chemical-free purification, which is supported by brands introducing smart and energy-efficient UV technologies that appeal to modern urban consumers.

Regional Insights

The Asia Pacific Home Water Filtration Unit industry held a revenue share of 57.66% in 2024. The region dominates due to the scale and severity of its water contamination issues, which are structurally different from Western markets. High TDS levels in India, heavy metal contamination in China’s industrial zones, and frequent microbial outbreaks in Southeast Asia create a strong dependency on household filtration as a primary water-safety tool, not just a quality enhancer. This makes filtration units a necessity rather than a convenience.

Moreover, it has the world’s largest base of first-time filtration buyers, supported by aggressive local manufacturing from brands such as Kent, AO Smith, Xiaomi, Midea, and Coway, which produce affordable models suited for region-specific contaminants.

North America Home Water Filtration Unit Market Trends

The Home Water Filtration Unit industry in North America is anticipated to witness a CAGR of 9.7% from 2025 to 2033. North America’s growth is driven by infrastructure-driven risks, not widespread contamination. Aging pipelines, especially in older U.S. and Canadian cities, lead to sporadic issues such as lead leaching, which prompts consumers to opt for under-sink and whole-house systems.

The rising demand for PFAS removal, unique to the U.S. regulatory climate, has triggered rapid product innovation from Aquasana and Culligan. The higher adoption of smart filtration units also shapes the market. This segment is more mature here than in APAC, with app-connected usage tracking and auto-delivery filter replacement services gaining traction.

U.S. Home Water Filtration Unit Market Trends

The U.S. Home Water Filtration Unit industry is expected to witness a CAGR of 9.4 % from 2025 to 2033. The U.S. is experiencing accelerated adoption due to regulatory tightening by the EPA on PFAS, chromium-6, and disinfection byproducts, prompting households to upgrade to NSF-certified multi-stage systems.

Growth is further pushed by the rising popularity of whole-home filtration in newly constructed suburban homes, where developers increasingly offer built-in systems as upgrades. High consumer willingness to pay for premium units from brands such as Brita Elite, Pelican, and GE Home Water differentiates the U.S. trajectory from Canada and Mexico, making its growth path distinct within North America.

Key Home Water Filtration Unit Company Insights

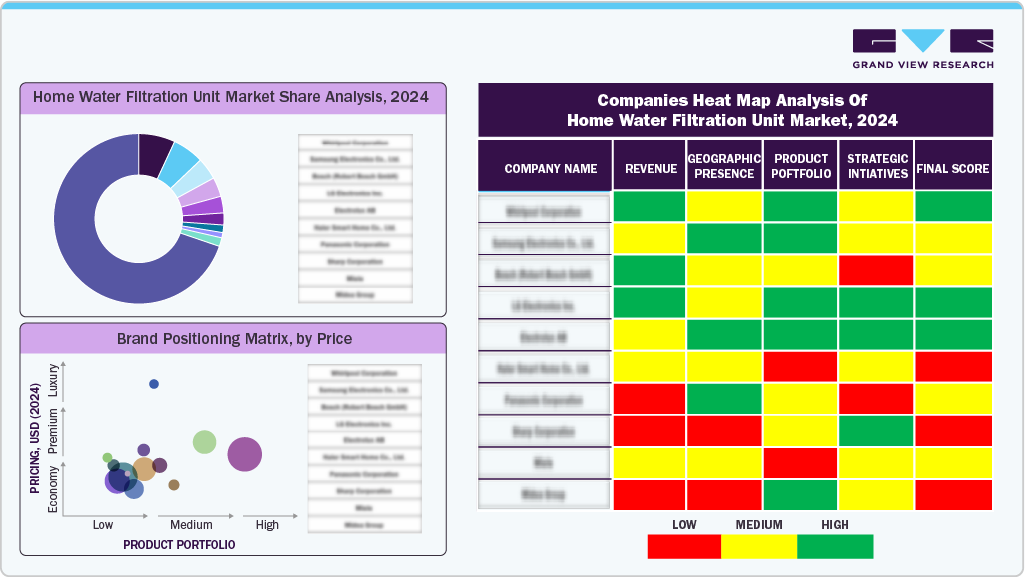

The global Home Water Filtration Unit Market is shaped by a mix of long-established purification specialists, premium innovation-driven brands, and fast-growing regional manufacturers serving different household needs.

Established players such as Brita, Pur, Culligan, and Aquasana lead the mainstream segment through strong certification standards, reliable multi-stage technologies, and widespread availability across retail and online channels. Premium brands, including Coway, Kent, and AO Smith, attract urban and health-focused consumers by offering smart connected systems, compact designs, and advanced RO and UV combinations.

Regional companies such as Midea, Xiaomi, Livpure, and Pureit are expanding rapidly in the Asia Pacific, the Middle East, and Latin America by providing affordable products tailored to local water issues, including high TDS levels and inconsistent municipal water supplies.

Their strong presence on major e-commerce platforms and ability to customize features for local conditions have increased competitive intensity. This structure, which combines mass-market accessibility with technology-led premium offerings and region-specific value brands, continues to define the global competitive landscape.

Their strong presence on major e-commerce platforms and ability to customize features for local conditions have increased competitive intensity. This structure, which combines mass-market accessibility with technology-led premium offerings and region-specific value brands, continues to define the global competitive landscape.Key Home Water Filtration Unit Companies:

The following are the leading companies in the home water filtration unit market. These companies collectively hold the largest market share and dictate industry trends.

- Brita

- Pur

- Culligan

- Aquasana

- Coway

- Kent

- AO Smith

- Pureit (Hindustan Unilever)

- 3M Water Filtration

- Pentair

Recent Developments

-

In October 2025, Xiaomi launched the Mijia Desktop Water Purifier Ice-Making Edition, a compact smart purifier that combines six-stage RO filtration with UV sterilisation, instant hot-water dispensing, and a variable-frequency ice maker. It offers app-based control, dual water tanks, and the ability to produce different ice sizes while delivering purified hot or cold water for everyday household use.

-

In October 2025, Elista entered the home water-purifier market with two new alkaline models-Amrit and Shuddh. The Amrit features a nine-stage purification process, with copper infusion, mineral restoration, instant hot-water dispensing, and a digital display; the Shuddh offers a seven-stage system in a compact design tailored for urban households.

-

In April 2025, Tappwater introduced three sustainable household filtration products in Sweden through Onlinefilter: the EcoPro Compact faucet filter with five-stage purification and significantly reduced plastic use, the ShowerPro shower filter that removes over 80 contaminants and minimizes limescale, and the PitcherPro glass jug filter that eliminates major pollutants while adding magnesium for better taste and alkalinity.

Home Water Filtration Unit Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 21.81 billion

Revenue forecast in 2033

USD 50.89 billion

Growth rate (Revenue)

CAGR of 11.2 % from 2025 to 2033

Actual rata

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD Million/ Billion, Volume in Thousand Units, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand ; South Korea; Brazil; South Africa

Key companies profiled

Brita; Pur; Culligan; Aquasana; Coway; Kent; AO Smith; Pureit (Hindustan Unilever); 3M Water Filtration; Pentair

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Home Water Filtration Unit Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global Home Water Filtration Unit Market report on the basis of product and region.

-

Product Outlook (Volume, Thousand Units; Revenue, USD Million, 2021 - 2033)

-

RO-Based

-

UV-Based

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global home water filtration unit market size was estimated at USD 20.26 billion in 2024 and is expected to reach USD 21.81 billion in 2025.

b. The global home water filtration unit market is expected to grow at a compound annual growth rate of 11.2% from 2025 to 2033 to reach USD 50.89 billion by 2033.

b. Asia Pacific dominated the home water filtration unit market with a share of 57.66% in 2024. This is attributable to increasing product demand among middle-income households and large-scale investments for R&D and new product development by manufacturers.

b. Some key players operating in the home water filtration unit market include Best Water Technology Group; Kent RO System Ltd.; Brita Gmbh; Eureka Forbes Limited; Tata Chemicals; HaloSource Inc.; Panasonic; Amway Corporation; Aquasana; GE Water & Process Technologies Inc.; and Eureka Forbes Limited.

b. Key factors that are driving the market growth include changing consumer lifestyles, most notably in urban areas; growing awareness about the ill effects of contaminated surface water; and declining levels of potable water worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.