- Home

- »

- Water & Sludge Treatment

- »

-

Hydrazine Market Size, Share & Trends, Industry Report 2033GVR Report cover

![Hydrazine Market Size, Share & Trends Report]()

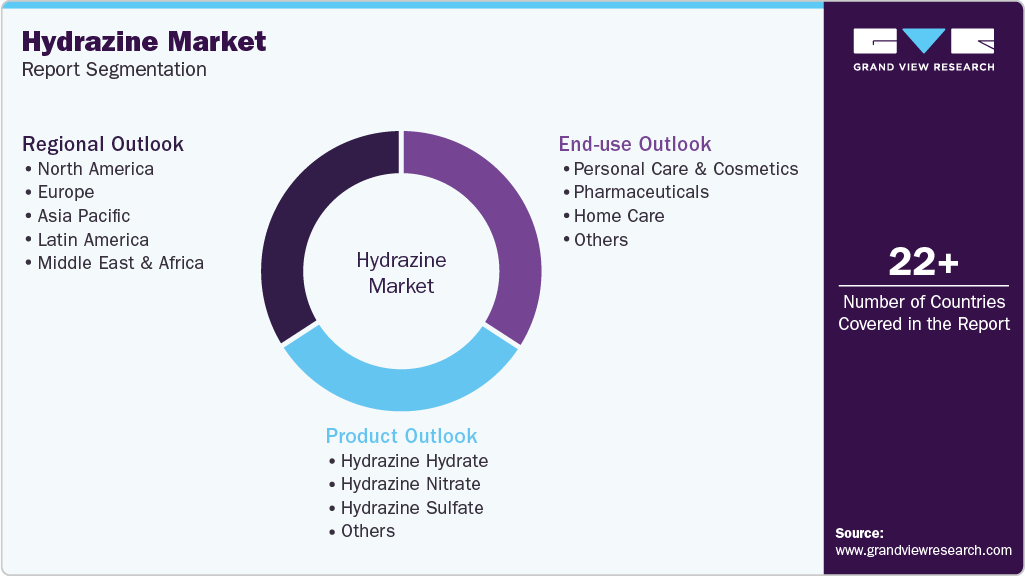

Hydrazine Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Hydrazine Hydrate, Hydrazine Nitrate), By End Use (Personal Care & Cosmetics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-811-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hydrazine Market Summary

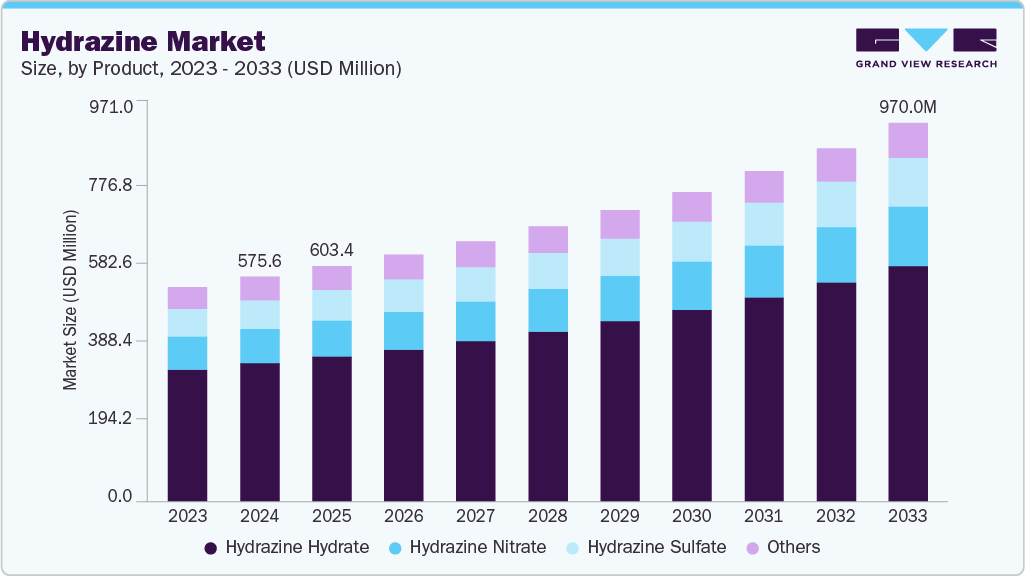

The global hydrazine market size was estimated at USD 575.6 million in 2024 and is projected to reach USD 970.0 million by 2033, growing at a CAGR of 6.1% from 2025 to 2033. The market is growing steadily, driven by rising demand for polymer foaming agents used in plastics and rubber manufacturing.

Key Market Trends & Insights

- Asia Pacific is expected to grow fastest with a CAGR of 6.3% from 2025 to 2033.

- Hydrazine Hydrate segment dominated the market and accounted for the largest revenue share of 61.6% in 2024.

- Pharmaceuticals segment is expected to grow fastest with a CAGR of 6.6% from 2025 to 2033

Market Size & Forecast

- 2024 Market Size: USD 575.6 Million

- 2033 Projected Market Size: USD 970.0 Million

- CAGR (2025-2033): 8.09%

- CAGR (2025-2033): 6.1%

- Asia Pacific: Largest market in 2024

These agents help produce lightweight and durable materials used across packaging, construction, and automotive industries. As global industrial activity expands, the need for foamed polymers continues to rise, strengthening hydrazine consumption and supporting overall market growth. Growing demand from the pharmaceutical industry is another key driver for the hydrazine market. Hydrazine is used as an intermediate in the synthesis of various drugs and active pharmaceutical ingredients. The expansion of pharmaceutical production, especially in the Asia Pacific, is boosting its consumption. Increasing investments in drug development and specialty chemicals further support market growth.

The shift toward cleaner energy sources offers new opportunities for hydrazine as a potential fuel and in fuel cell applications. Its strong reducing properties make it suitable for energy storage and propulsion systems. As industries explore low-emission technologies, demand for hydrazine-based solutions could increase. This trend may open new avenues beyond traditional industrial uses.

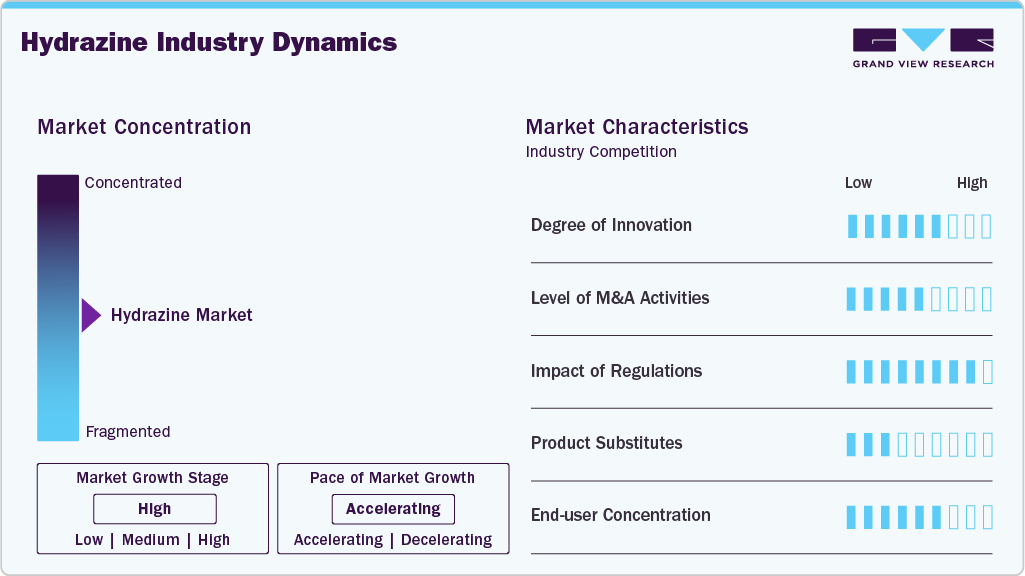

Market Concentration & Characteristics

The hydrazine market is moderately concentrated, with a few major players dominating global production. Companies such as Arkema, Lonza, Otsuka Chemical, and Lanxess control a significant share of the supply due to their advanced manufacturing technologies and established distribution networks. High entry barriers, including strict safety regulations and complex production processes, limit the number of new entrants.

The market is characterized by strong regional specialization, with Asia-Pacific leading in production and consumption. Demand patterns are closely tied to industrial growth in polymers, water treatment, and pharmaceuticals. Ongoing innovations to improve process efficiency and reduce environmental impact are shaping competition, while regulatory compliance remains a key factor influencing market dynamics.

Product Insights

The hydrazine hydrate segment led the market and accounted for the largest revenue share of 61.6% in 2024, due to its critical role in water treatment applications. It efficiently removes oxygen from boiler systems, preventing corrosion and improving operational reliability. Strong demand from the power and manufacturing sectors continues to sustain its market leadership.

Hydrazine nitrate segment is the fastest-growing segment with a CAGR of 6.6%, driven by its use in aerospace propulsion systems. It delivers high energy efficiency in rocket fuels, supporting expanding satellite and space programs. Rising investment in aerospace applications is accelerating its market growth.

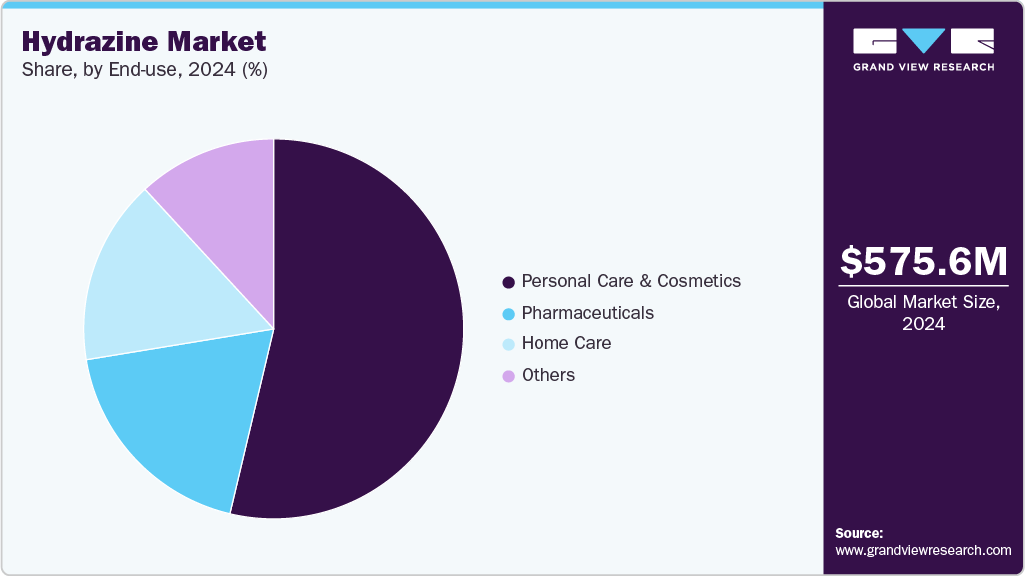

End Use Insights

The personal care and cosmetics segment dominated the end use segment with a revenue share of 53.7% in 2024, due to the widespread use of hydrazine derivatives in product formulations. These compounds are used in manufacturing active ingredients, foaming agents, and preservatives. Continuous demand for skincare and grooming products supports stable consumption. Strong growth in the beauty and wellness industry further reinforces its leading position.

The pharmaceutical segment is the fastest-growing segment with a CAGR of 6.6% during the forecast period, driven by the increasing use of hydrazine derivatives in drug synthesis. Hydrazine serves as a key intermediate in producing anti-tuberculosis and anti-cancer medicines. Expanding R&D activities and rising healthcare investments are fueling product adoption. This growing medical application base positions pharmaceuticals as the fastest-growing end-use segment.

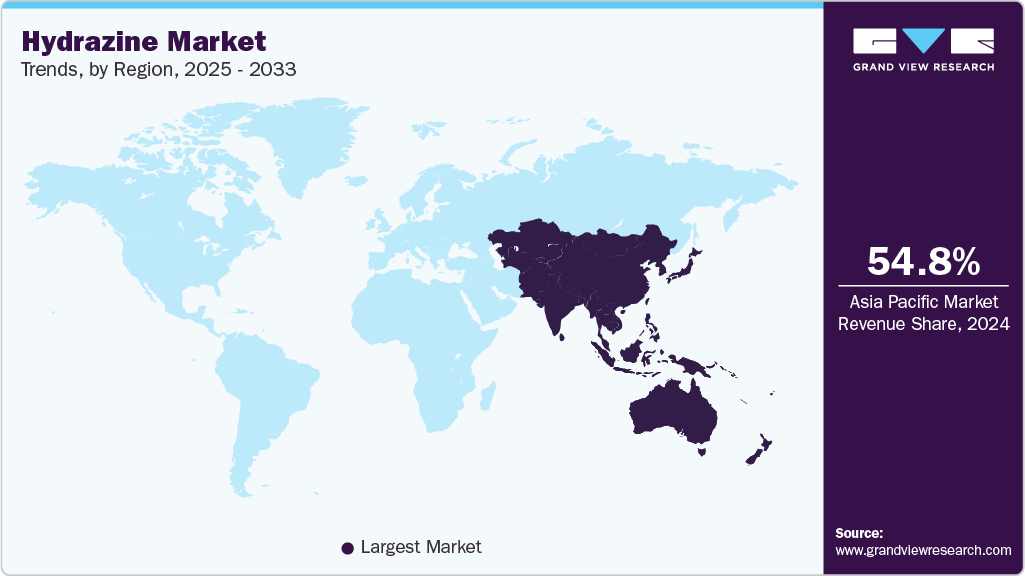

Regional Insights

Asia Pacific dominated the market with largest revenue share of 54.8% in 2024, driven by rapid industrialization and expanding manufacturing capacity. Growing production of polymers, agrochemicals, and pharmaceuticals is fueling regional consumption. Rising demand for lightweight plastics in packaging and construction also supports steady growth. This strong industrial base continues to make Asia-Pacific the fastest-growing market globally.

China Hydrazine Market Trends

China registered highest CAGR of 5.7% during the review period. China dominated the market with a revenue share of 43.7%, due to its expanding agrochemical sector. Increasing demand for crop protection chemicals and fertilizers is boosting hydrazine use as a key intermediate. The country’s large-scale agricultural modernization is further stimulating domestic production. This strong link to the farming industry ensures consistent growth in hydrazine demand.

North America Hydrazine Market Trends

North America holds a significant CAFR of 6.1%, driven by technological innovation in chemical manufacturing. Advanced production methods are improving purity, safety, and environmental compliance. Continuous R&D investments by major producers are enhancing process efficiency. This innovation-led approach supports stable growth and competitiveness in the regional market.

The U.S. hydrazine market dominated the North America Market with revenue share of 89.9%. The main driver for hydrazine demand is its growing application in water treatment systems. Hydrazine’s ability to prevent corrosion in boilers and power plants enhances operational efficiency. The country’s large energy and manufacturing sectors rely heavily on such treatment chemicals. This focus on plant maintenance and performance sustains steady market demand.

Europe Hydrazine Market Trends

Europe’s push toward sustainable and regulated chemical production driving the market. Strict environmental standards are encouraging cleaner, more efficient hydrazine manufacturing processes. Companies are investing in green chemistry to meet compliance and reduce emissions. This regulatory-driven modernization supports steady but responsible market growth.

The Germany hydrazine market growth is driven by its robust pharmaceutical and specialty chemical industries. Hydrazine serves as an essential intermediate in the synthesis of high-value compounds. The country’s strong R&D infrastructure supports the development of advanced chemical formulations. This innovation-driven demand keeps Germany a key European consumer of hydrazine.

Latin America Hydrazine Market Trends

In Latin America, agricultural expansion is the primary driver of hydrazine market growth. The compound’s use in producing pesticides and fertilizers supports higher crop yields. Rising food demand and government support for farming modernization are boosting agrochemical output. This agricultural growth directly translates into stronger hydrazine consumption.

Middle East & Africa Hydrazine Market Trends

The hydrazine market in the Middle East and Africa is growing due to increase in investment of power generation and industrial infrastructure. Hydrazine is widely used in boiler water treatment to prevent corrosion and improve efficiency. Ongoing construction of new energy facilities is creating consistent demand for such chemicals. This infrastructure-driven growth is steadily expanding regional market potential.

Key Hydrazine Company Insights

Some of the key players operating in the market include Arkema S.A., LANXESS, Otsuka Chemical Co., Ltd., Yibin Tianyuan Group, Nippon Carbide Industries Co., Inc., Hunan Zhuzhou Chemical Industry Group Co., Ltd., bovine trade chongqing co., LTD. , Palm Commodities International, Inc., RX Chemicals, and Acuro Organics Limited.

-

Arkema S.A. holds a leading position in the global hydrazine market owing to its advanced production technologies and strong international footprint. The company’s extensive product range, including hydrazine hydrate and derivatives, serves key sectors such as polymerization, pharmaceuticals, and water treatment. Its focus on sustainable and efficient manufacturing processes enhances its competitive edge. With a well-established global distribution network, Arkema continues to strengthen its market dominance through innovation and capacity expansion.

-

Otsuka Chemical Co., Ltd. is a major force in the hydrazine market, recognized for its high-purity products and technological expertise. The company benefits from its strategic manufacturing partnerships and strong customer base across Asia and global markets. Its hydrazine solutions cater to diverse industrial applications, from chemical synthesis to electronics. Continuous investment in R&D and operational excellence enables Otsuka Chemical to maintain leadership in product quality and reliability.

Key Hydrazine Companies:

The following are the leading companies in the hydrazine market. These companies collectively hold the largest market share and dictate industry trends.

- Arkema S.A.

- LANXESS

- Otsuka Chemical Co., Ltd.

- Yibin Tianyuan Group

- Nippon Carbide Industries Co., Inc.

- Hunan Zhuzhou Chemical Industry Group Co., Ltd.

- bovine trade chongqing co., LTD.

- Palm Commodities International, Inc.

- RX Chemicals

- Acuro Organics Limited

Recent Developments

-

05 Apr 2023, SS Blow Chem Pvt. Ltd. (India) announced the expansion of its hydrazine hydrate production capacity at the Hanumangarh Industrial Area in Rajasthan, increasing output from 1,200 TPA to 2,800 TPA. The project is scheduled for completion by Q2 FY2024, strengthening the company’s position in the domestic specialty chemicals segment.

Global Hydrazine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 603.4 million

Revenue forecast in 2033

USD 970.0 million

Growth rate

CAGR of 6.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons, Revenue in USD million, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Arkema S.A.; LANXESS; Otsuka Chemical Co., Ltd.; Yibin Tianyuan Group; Nippon Carbide Industries Co., Inc.; Hunan Zhuzhou Chemical Industry Group Co., Ltd.; bovine trade chongqing co., LTD.; Palm Commodities International, Inc.; RX Chemicals; Acuro Organics Limited

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hydrazine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global hydrazine market report based on product, end use, and region

-

Product Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2033)

-

Hydrazine Hydrate

-

Hydrazine Nitrate

-

Hydrazine Sulfate

-

Others

-

-

End Use Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2033)

-

Personal Care & Cosmetics

-

Pharmaceuticals

-

Home Care

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Latin America

-

Brazil

-

Argentina

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global hydrazine market size was estimated at USD 575.6 million in 2024 and is expected to reach USD 603.4 million in 2025.

b. The global hydrazine market is expected to grow at a compound annual growth rate of 6.1% from 2025 to 2033 to reach USD 970.0 million by 2033.

b. Asia Pacific dominated the market with largest revenue share of 54.8% in 2024, driven by rapid industrialization and expanding manufacturing capacity.

b. Some key players operating in the hydrazine market include Arkema S.A., LANXESS, Otsuka Chemical Co., Ltd., Yibin Tianyuan Group, Nippon Carbide Industries Co., Inc., Hunan Zhuzhou Chemical Industry Group Co., Ltd., bovine trade chongqing co., LTD. , Palm Commodities International, Inc., RX Chemicals, Acuro Organics Limited

b. The market is growing steadily, driven by rising demand for polymer foaming agents used in plastics and rubber manufacturing. These agents help produce lightweight and durable materials used across packaging, construction, and automotive industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.