- Home

- »

- Digital Media

- »

-

In-app Advertising Market Size & Share, Industry Report 2033GVR Report cover

![In-app Advertising Market Size, Share & Trends Report]()

In-app Advertising Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Entertainment, Gaming, Social, Online Shopping, Payment & Ticketing, News), By Type (Banner Ads, Interstitial Ads), By Platform, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-408-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

In-app Advertising Market Summary

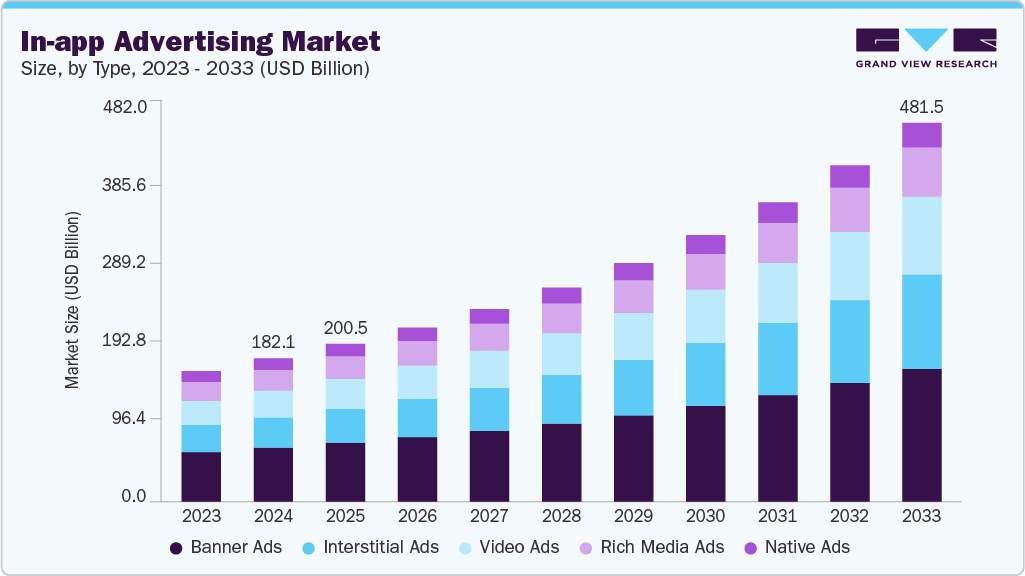

The global in-app advertising market size was estimated at USD 182.06 billion in 2024 and is expected to reach USD 481.47 billion by 2033, growing at a CAGR of 12.1% from 2025 to 2033. This growth is primarily driven by increasing mobile app usage, enhanced targeting capabilities through data analytics, and rising demand for personalized and engaging ad experiences.

Key Market Trends & Insights

- Asia Pacific dominated the global in-app advertising market with the largest revenue share of 35.18% in 2024.

- The in-app advertising market in China led the Asia Pacific market and held the largest revenue share in 2024.

- By type, banner Ads segment led the market and held the largest revenue share of 37.6% in 2024.

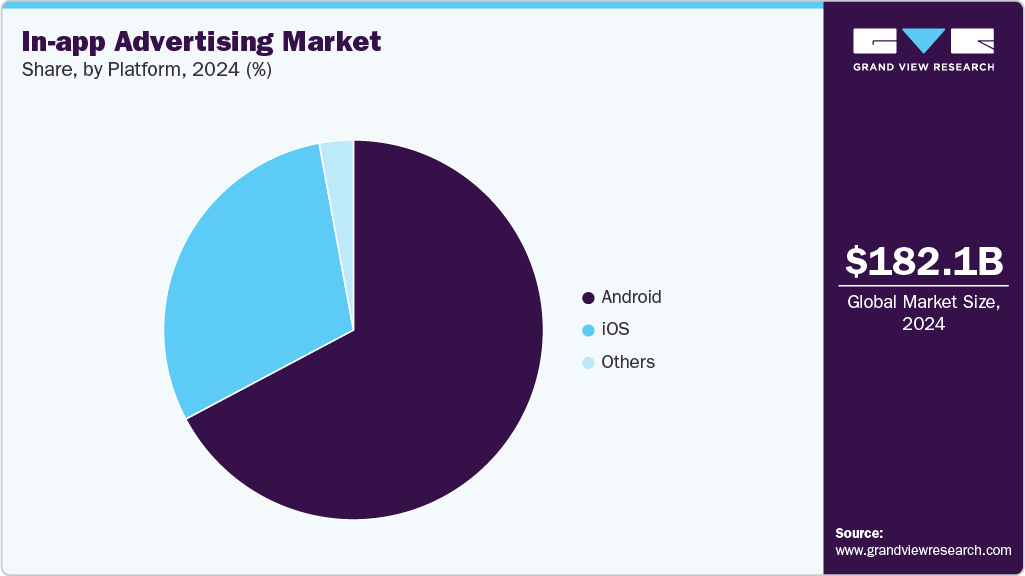

- By platform, the android segment led the market and held the largest revenue share of 67.3% in 2024.

- By application, the gaming segment held the dominant position in the market and accounted for the leading revenue share of 28.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 182.06 Billion

- 2033 Projected Market Size: USD 481.47 Billion

- CAGR (2025-2033): 12.1%

- Asia Pacific: Largest market in 2024

The market is largely driven by the rapid proliferation of smartphones and increased mobile internet penetration. Growing digital engagement, especially among younger demographics, has prompted advertisers to shift budgets from traditional media to mobile platforms to reach consumers more effectively. There is a rising demand for personalized and data-driven advertising experiences from key sectors such as e-commerce, gaming, and entertainment. The emphasis on user engagement and maximizing return on ad spend (ROAS) further motivates companies to adopt an innovative in-app advertising industry. Together, these factors contribute to steady market growth globally.

A notable trend in the market is the widespread adoption of programmatic advertising and real-time bidding (RTB), enabling advertisers to reach highly targeted audiences with greater efficiency. Advances in artificial intelligence (AI) and machine learning (ML) are enhancing ad personalization, allowing for the dynamic delivery of content based on user behavior, preferences, and engagement patterns. There is also a growing emphasis on privacy-first advertising due to stricter data regulations, which is prompting the use of contextual advertising and consent-based data strategies.

Furthermore, the rise of mobile gaming, video streaming, and social media platforms is creating more immersive and engaging ad formats such as rewarded ads, playable ads, and interactive video. These trends highlight the market’s pivot towards user-centric and performance-driven solutions.

Leading companies in the in-app advertising industry are actively investing in advanced analytics platforms and data management technologies to optimize ad performance and ROI. Strategic collaborations with app developers, publishers, and data providers are becoming increasingly important to expand inventory and gain deeper consumer insights. Firms are also focusing on global expansion by entering emerging markets where smartphone penetration and mobile app usage are rapidly increasing.

Additionally, there is a strong push toward sustainable advertising practices, including carbon-conscious digital ad delivery and reduced energy consumption of ad servers. These efforts are positioning companies to stay competitive while aligning with the evolving demands of the in-app advertising industry.

Type Insights

The banner ads segment accounted for the largest market share of over 37.6% in 2024. The growth is attributed to various benefits, such as being affordable, easy to implement, and supporting all types of applications and mobile devices. Banner Ads help marketers increase traffic, brand awareness, and product sales. The banner ads offer high returns on investments, resulting in numerous growth opportunities for the banner ads segment over the forecast period.

The interstitial ads segment is projected to experience the highest CAGR of 14.1% from 2023 to 2033. Interstitial ads are particularly effective during natural transition points within mobile apps, which enhances user engagement without causing excessive disruption. Advancements in creative optimization and dynamic ad rendering have made interstitials more visually appealing and contextually relevant. The growing emphasis on monetization strategies among mobile app developers is encouraging the adoption of interstitial formats to maximize ad revenue. Interstitial ads are becoming an essential component of in-app advertising strategies.

Application Insights

The gaming segment accounted for the largest revenue share in 2024. In-app advertising within gaming apps offers advertisers extended user interaction time, high click-through rates, and advanced targeting capabilities. The rise of free-to-play models has driven game developers to rely heavily on ad monetization, integrating rewarded ads, interstitials, and playable ad formats that enhance user engagement rather than disrupt gameplay. Advancements in AI-based ad personalization and real-time bidding platforms allow advertisers to deliver contextually relevant ads to gamers, significantly improving conversion rates. These factors make the gaming segment the most lucrative and dominant application area in the in-app advertising market.

The online shopping segment is anticipated to grow at the highest CAGR from 2023 to 2033. The rapid surge in mobile commerce, along with the increasing penetration of smartphones and user-friendly e-commerce apps, has significantly boosted in-app ad placements within shopping applications. Retailers and marketplaces are leveraging in-app advertising to personalize user experiences, promote flash sales, and drive product discovery. The growing trend of social commerce and integration of payment gateways within apps also enhances ad conversion rates, making online shopping apps a key driver of in-app advertising industry growth during the forecast period.

Platform Insights

The Android segment accounted for the largest market share in 2024. Android is an open-source operating system that allows different devices to run on the Android platform, unlike iOS, which runs only on Apple devices. The advertisers usually target high-end Android devices based on device models to target high quality users. The increasing focus on data privacy and developing enhanced advertising solutions is offering numerous growth opportunities for the Android platform segment in the future. As a result, Android remains a fundamental component of the industry.

The iOS segment is expected to experience the fastest growth from 2023 to 2033. This growth is driven by the high spending power of iOS users, making the platform highly attractive. Apple's tightly controlled app ecosystem ensures higher user engagement and app retention, which boosts ad viewability and performance. The widespread adoption of in-app purchases and subscription models on iOS apps creates opportunities for native advertising and monetization strategies that are less intrusive yet highly effective. These factors are expected to significantly increase the demand for in-app advertising on the iOS platform across global markets.

Regional Insights

North America in-app advertising market accounted for a share of over 31% in 2024. The growth is attributed to the large number of smartphone users coupled with the rising popularity of mobile streaming services such as Hulu, Amazon Prime, Netflix, and other popular video streaming services have increased the potential for in-app advertising industry in the region. The rapidly growing gaming market and substantial growth in mobile shopping, owing to its ability to offer a better shopping experience, are expected to fuel the growth of in-app advertising industry in North America.

U.S. In-app Advertising Market Trends

The in-app advertising market in the U.S. is experiencing growth with the largest market share of over 89% in 2024, driven by the widespread adoption of mobile apps across sectors such as e-commerce and finance. The increasing digital screen time among consumers and the proliferation of smartphones have created a robust ecosystem for advertisers to deliver personalized content directly within apps. U.S. advertisers are leveraging AI and machine learning technologies to enable real-time bidding and hyper-targeted ad placements. The presence of major tech companies and ad tech platforms in the region has accelerated innovation in immersive ad formats like interactive video and augmented reality ads, further fueling market growth.

Europe In-app Advertising Market Trends

The in-app advertising market in Europe is expected to grow at a CAGR of over 10%, due to increasing mobile penetration and strict data privacy regulations. The implementation of the General Data Protection Regulation (GDPR) has led to greater transparency and accountability in data usage, encouraging advertisers to adopt consent-based advertising strategies. The expansion of 5G networks across major European economies is improving app performance and enabling richer, real-time ad formats such as interactive video and augmented reality ads. These trends are collectively driving the growth of the in-app advertising market across Europe.

The UK in-app advertising market is experiencing steady growth, driven by the country’s high smartphone penetration and increasing mobile app usage. UK advertisers are rapidly shifting budgets from traditional media to mobile platforms to better engage a tech-savvy, on-the-go population. The rise of mobile commerce and digital banking is also fueling demand for personalized, in-app advertising experiences. Leading players in the UK market, including Google and Meta are investing in AI-powered ad delivery and advanced analytics to optimize ad performance. These factors collectively contribute to the continued expansion of the in-app advertising industry.

The in-app advertising market in Germany is driven by the country’s strong digital infrastructure and a tech-savvy population. The rising popularity of mobile commerce and digital banking apps in Germany is encouraging brands to invest in performance-driven ad formats like native and video ads. Germany’s stringent data privacy regulations under the GDPR are accelerating the adoption of contextual and consent-based advertising models. With a growing emphasis on user experience and transparency, the German in-app advertising market remains highly competitive and poised for continued expansion.

Asia-Pacific In-app Advertising Market Trends

The in-app advertising market in Asia Pacific is expected to grow at the fastest CAGR of 14.3% from 2025 to 2033, driven by rising smartphone penetration and a surge in digital content consumption. Localized advertising strategies and culturally relevant content are enabling brands to better connect with diverse audiences across the region. The rapid growth of e-commerce platforms and mobile gaming apps is providing new and scalable advertising inventories for marketers. The in-app advertising market in the Asia Pacific is expanding rapidly, with advertisers and publishers focusing heavily on mobile-first strategies to tap into this digitally dynamic region.

China in-app advertising market is driven by its massive mobile user base and the dominance of domestic super apps. Government initiatives promoting the digital economy and innovation have further encouraged businesses to shift marketing budgets toward mobile channels. Local advertisers are increasingly leveraging rich media formats, influencer collaborations, and mini-program ads to capture consumer attention. These drivers collectively support China’s dynamic and rapidly expanding in-app advertising industry.

The in-app advertising market in India is also experiencing rapid growth, propelled by the country’s booming digital ecosystem and widespread smartphone adoption. The availability of affordable mobile data plans and increased time spent on mobile apps have further accelerated in-app advertising. Government initiatives promoting digital inclusion, such as Digital India, are also contributing to the expansion of mobile usage and app-based engagement. Due to these trends, India’s in-app advertising market is growing at a fast pace and is expected to continue its upward trajectory in the coming years.

Key In-app Advertising Companies Insights

Key players operating in the in-app advertising market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key In-app Advertising Companies:

The following are the leading companies in the in-app advertising market. These companies collectively hold the largest market share and dictate industry trends.

- Google LLC

- Meta

- Apple Inc.

- Unity Technologies

- AppLovin.

- InMobi

- Chartboost, Inc.

- Liftoff, Inc.

- Smaato, Inc.

- Digital Turbine, Inc.

Recent Developments

-

In June 2025, Unity Technologies launched the Unity Audience Hub, a privacy-first advertising solution that combines federated insights from Unity’s ad ecosystem with trusted third-party data to deliver highly relevant audiences for brand campaigns across mobile and connected TV (CTV). Initial beta testing showed over 100% increase in engagement rates, demonstrating improved ad performance for developers and marketers.

-

In April 2025, Meta Platforms announced the global rollout of in-app advertising on its Threads platform, making ads available to all eligible advertisers in over 30 countries, including the United States. According to the company, this phased expansion aims to balance user experience with advertiser effectiveness, marking a significant step in Meta’s efforts to monetize its emerging social media app. Ads will appear natively within user feeds, labeled as “Sponsored” posts, and are part of Meta’s broader strategy to expand its in-app advertising ecosystem beyond Facebook and Instagram.

-

In February 2025, Apple enhanced its Search Ads platform by introducing deep linking capabilities, enabling advertisers to direct users to specific in-app destinations within iOS 18-supported apps. This update applies to ad placements on the Today tab, Search tab, and search results, allowing for more personalized and context-driven ad experiences. By integrating deep links into custom product pages, advertisers can significantly improve user engagement and conversion rates. As iOS 18 adoption increases, developers and marketers are encouraged to update their strategies to take full advantage of this advanced targeting feature.

In-app Advertising Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 200.46 billion

Revenue forecast in 2033

USD 481.47 billion

Growth rate

CAGR of 12.1% from 2025 - 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, platform, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Russia; Netherlands; China; Japan; India; South Korea; Australia; Brazil; Mexico; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Google LLC; Meta; Apple Inc.; Unity Technologies; AppLovin.; InMobi; Chartboost, Inc.; Liftoff, Inc.; Smaato, Inc.; Digital Turbine, Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global In-app Advertising Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global in-app advertising market report based on type, platform, application, and region:

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Banner Ads

-

Interstitial Ads

-

Rich Media Ads

-

Video Ads

-

Native Ads

-

-

Platform Outlook (Revenue, USD Billion, 2021 - 2033)

-

Android

-

iOS

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Entertainment

-

Gaming

-

Social

-

Online Shopping

-

Payment & Ticketing

-

News

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global in-app advertising market was estimated at USD 182.06 billion in 2024 and is expected to reach USD 200.46 billion in 2025.

b. The global in-app advertising market is expected to grow at a compound annual growth rate of 12.1% from 2025 to 2033 to reach USD 481.47 billion by 2033.

b. The key players in the Google LLC, Meta, Apple Inc., Unity Technologies, AppLovin., InMobi, Chartboost, Inc., Liftoff, Inc., Smaato, Inc. , Digital Turbine, Inc.

b. Key factors that are driving the in-app advertising market growth include growing smartphone usage, increased time spent on mobile apps, rising adoption of social media and gaming platforms, and advancements in AI-based targeting and programmatic advertising.

b. Asia Pacific dominated the in-app advertising market with a share of over 35% in 2024, driven by the rapid growth of smartphone users, increasing mobile internet penetration, and the rising adoption of mobile gaming and e-commerce apps across countries like China, India, and Southeast Asia.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.