- Home

- »

- Semiconductors

- »

-

In-Mold Electronics Market Size, Share, Industry Report, 2033GVR Report cover

![In-Mold Electronics Market Size, Share & Trends Report]()

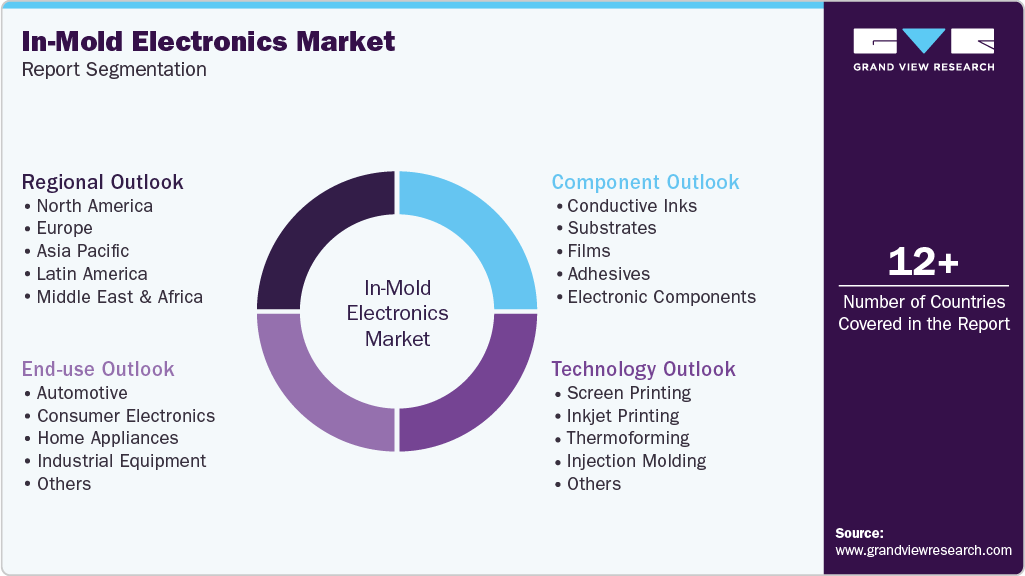

In-Mold Electronics Market (2025 - 2033) Size, Share & Trends Analysis Report By Component, By Technology (Screen Printing, Inkjet Printing, Thermoforming, Injection Molding), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-679-7

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

In-Mold Electronics Market Summary

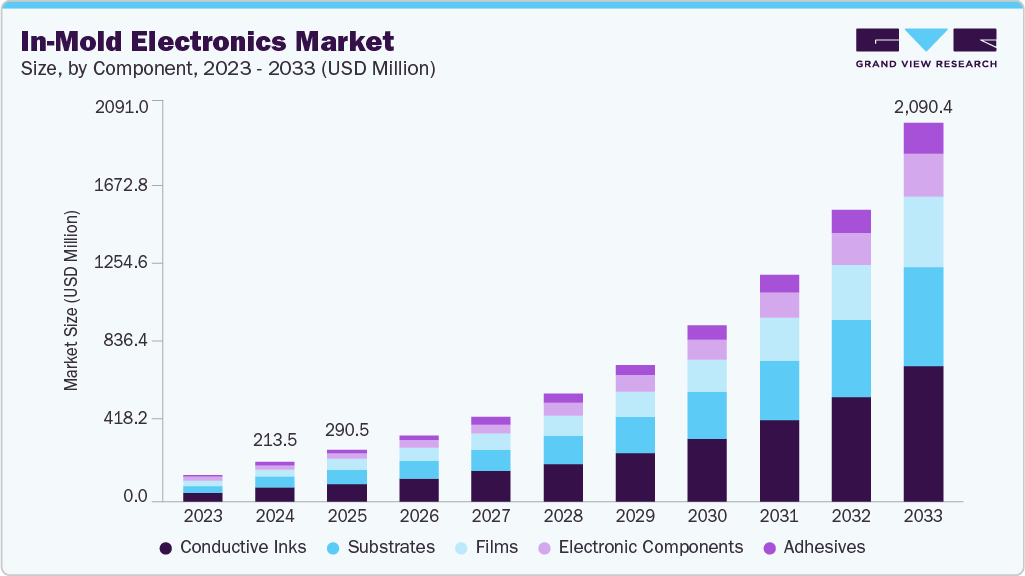

The global in-mold electronics market size was estimated at USD 213.50 million in 2024, and is projected to reach USD 2,090.42 million by 2033, growing at a CAGR of 27.9% from 2025 to 2033, driven by the increasing demand for lightweight, compact, and cost-effective electronic components integrated directly into molded surfaces.

Key Market Trends & Insights

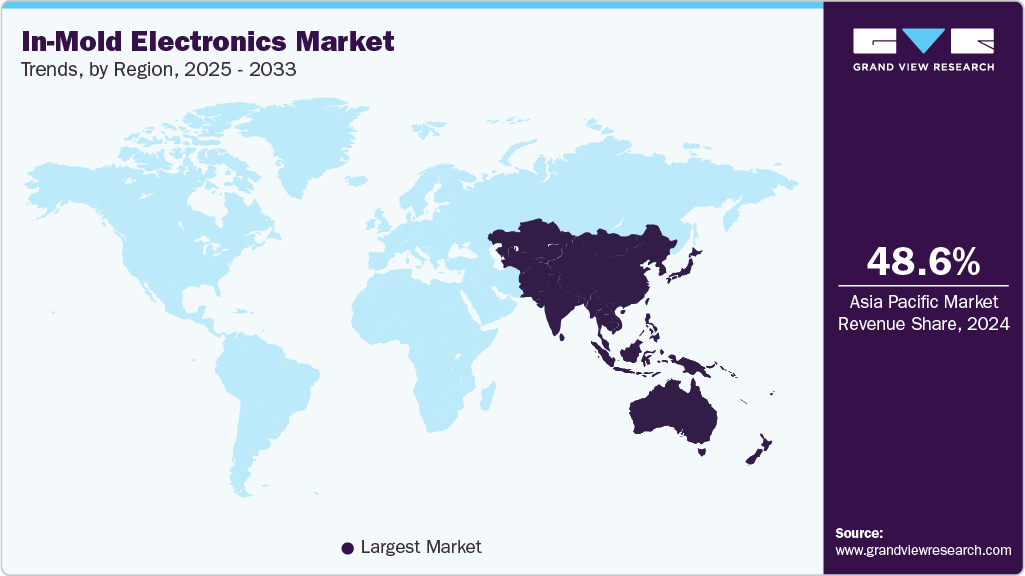

- The Asia Pacific in-mold electronics market accounted for a 48.6% share of the overall market in 2024.

- The In-Mold electronics market in China held a dominant position in 2024.

- By component, the conductive Inks segment accounted for the largest share of 35.2% in 2024.

- By technology, the screen printing segment held the largest market share in 2024.

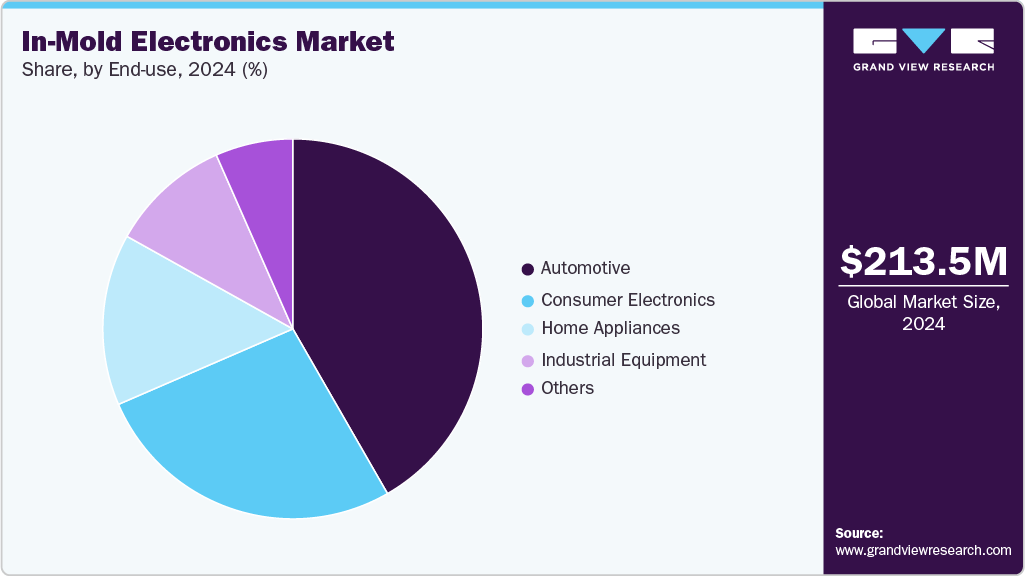

- By end use, the automotive segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 213.50 Million

- 2033 Projected Market Size: USD 2,090.42 Million

- CAGR (2025-2033): 27.9%

- Asia Pacific: Largest market in 2024

The rising adoption of smart surfaces in automotive interiors, consumer electronics, and industrial applications, combined with advances in printed electronics, capacitive touch sensors, and decorative-functional integration, is significantly accelerating market growth across developed and emerging regions. The growing shift toward electric vehicles and intelligent automotive interiors is significantly boosting the market for In-Mold electronics. Automakers are under continuous pressure to reduce vehicle weight and enhance energy efficiency while maintaining high-performance standards. IME allows the integration of printed circuitry, lighting, and sensors into 3D-molded plastic parts, replacing bulky wiring harnesses and mechanical buttons. This results in a sleeker, lighter, and more energy-efficient design. As OEMs push for innovation in human-machine interfaces (HMIs), steering consoles, and infotainment systems, the need for compact, multifunctional components is propelling the market growth of IME within the global automotive industry.

The rising consumer demand for aesthetically pleasing and durable interfaces in products like smart home appliances, smartphones, and wearable electronics is propelling the market growth of IME technology. In-Mold Electronics enables the embedding of capacitive touch sensors and LEDs into curved or contoured surfaces, allowing for next-generation product designs. Its resistance to abrasion, moisture, and chemical exposure makes it ideal for household and portable electronics that require high reliability in daily use. As device miniaturization and multifunctionality become essential, manufacturers are increasingly shifting toward IME-enabled solutions to meet modern consumer expectations, thereby boosting the market.

Government-backed research and development in printed electronics and hybrid systems is further boosting the market for In-Mold Electronics. Multiple national programs and innovation consortia have been launched to support the advancement of flexible, formable, and printed electronics, which are foundational to IME technology. These initiatives are not only fostering innovation in conductive inks and flexible substrates but are also accelerating commercialization pathways for IME applications across sectors. As collaborative ecosystems between public institutions and industrial players strengthen, the resulting technological breakthroughs are enhancing manufacturing capabilities and propelling the market growth for IME on a global scale.

The global emphasis on sustainable electronics and eco-friendly manufacturing is strongly encouraging the adoption of IME over traditional circuit-based systems. IME structures use fewer materials, reduce the need for hazardous substances, and simplify recycling at end-of-life. These advantages align well with environmental regulations and circular economy models adopted by many governments and industries. As companies move toward greener product development and regulatory compliance, IME is emerging as a preferred technology due to its sustainable attributes. This focus on environmental responsibility is propelling the market growth of IME, particularly in consumer electronics, appliances, and automotive interiors.

Component Insights

The Conductive Inks segment accounted for the largest share of 35.2% in 2024. The adoption of conductive inks is playing a pivotal role in propelling the market growth of In-Mold Electronics. These inks serve as the foundation for creating flexible and stretchable circuitry, enabling electronics to be embedded within 3D-formed plastic parts. As industries push for thinner, lighter, and more integrated designs, the demand for silver-based and carbon-based conductive inks is accelerating. Enhanced conductivity, printability, and thermal stability make these inks indispensable in forming complex circuit patterns in curved IME surfaces. Moreover, ongoing innovation in nano-particle inks and printable dielectric materials is further boosting the market by enabling high-performance electronic integration at scale.

The Electronic Components segment is projected to grow at a significant CAGR over the forecast period. The increasing functionality of In-Mold Electronics is supported by advancements in electronic components such as sensors, LEDs, and capacitors. These components are now being developed in ultra-thin formats, enabling seamless integration within molded structures. The growing need for capacitive touch sensing, embedded lighting, and wireless interfaces in automotive and consumer electronics is driving demand for these components. Their compact size and compatibility with flexible substrates are essential for next-generation IME applications. As industries continue to prioritize space-saving solutions with multifunctionality, the innovation in embedded components is directly boosting the market for IME-based systems.

Technology Insights

The Screen Printing segment held the largest market share in 2024. Screen printing technology remains the most widely adopted technique in IME manufacturing due to its scalability, affordability, and reliability. Its ability to deposit conductive inks uniformly over large and complex surfaces makes it ideal for automotive panels, control interfaces, and home appliances. This technology supports mass production with consistent quality, which is critical for OEMs seeking to deploy IME solutions at scale. The simplicity of the screen printing process, coupled with its ability to support multilayer printing, is boosting the market by enabling cost-effective prototyping and commercial rollouts across industries.

The Inkjet Printing segment is projected to grow at the fastest CAGR over the forecast period. Inkjet printing is emerging as a high-potential technology in IME due to its capability for precise, digitally controlled deposition of inks without physical masks or stencils. This method allows for rapid design iteration and customization, making it attractive for low-to-mid volume applications in wearables, medical devices, and luxury automotive interiors. As brands increasingly seek differentiation through personalized interfaces and unique form factors, inkjet printing is propelling the market growth by offering unparalleled design freedom and material efficiency. Technological advancements in printhead accuracy and ink formulation are also contributing to its growing relevance in IME production lines.

End Use Insights

The Automotive segment dominated the market in 2024 and is projected to grow at a significant CAGR over the forecast period. The automotive sector is a key driver of In-Mold Electronics adoption, with demand soaring for integrated control panels, ambient lighting, and capacitive touch features in vehicle interiors. IME provides a sleek, space-saving alternative to traditional mechanical switches and wire-heavy systems. With electric vehicle manufacturers placing a premium on lightweight and energy-efficient components, IME is being increasingly deployed to enhance both aesthetics and functionality. In addition, the integration of haptic feedback and gesture control via IME interfaces is transforming the driver experience, thereby boosting the market in the automotive domain.

The Consumer Electronics segment is projected to grow at the fastest CAGR over the forecast period. In the consumer electronics segment, the miniaturization trend and the need for durable, user-friendly interfaces are driving the adoption of IME technology. Wearables, smart appliances, and connected home products increasingly rely on embedded interfaces that are thin, resilient, and visually appealing. IME allows brands to incorporate LEDs, sensors, and touch functions into compact, curved surfaces ideal for modern product designs. This demand for highly integrated and design-flexible components is propelling market growth, especially as manufacturers prioritize differentiating their offerings in a competitive landscape.

Regional Insights

The North America in-mold electronics market accounted for 23.1% share of the overall market in 2024. The in-mold electronics market in North America is gaining momentum, driven by strong government support for advanced manufacturing and increasing demand from the automotive and aerospace sectors. The region is witnessing high investment in flexible hybrid electronics, which form the backbone of IME technology. As manufacturers aim to embed electronics into lighter, more durable substrates, North America’s innovation ecosystem is enabling mass-scale application of IME in steering interfaces, control panels, and next-generation avionics. This blend of R&D funding and OEM readiness is significantly boosting the market across the region.

U.S. In-Mold Electronics Market Trends

The U.S. in-mold electronics market held a dominant position in 2024.In the U.S., the transition to electric and autonomous vehicles is creating strong demand for lightweight and multifunctional interior components. IME solutions are increasingly used to replace mechanical switches with seamless, touch-sensitive surfaces in dashboards and control consoles. This shift toward integrated interfaces is not only enhancing user experience but also helping reduce vehicle weight, an essential factor in improving EV range. Federal support for smart manufacturing technologies is further propelling market growth by encouraging the adoption of advanced materials and embedded electronics.

Europe In-Mold Electronics Market Trends

The European market is being driven by a strong policy focus on circular electronics, eco-design, and environmental responsibility. IME technology aligns well with these goals by enabling a reduction in material waste, eliminating soldering processes, and improving end-of-life recyclability. Industries across automotive, home appliances, and consumer electronics are increasingly adopting IME to meet evolving EU sustainability standards. This push for greener manufacturing and compliance with lifecycle design requirements is boosting the market for In-Mold Electronics in the region.

Germany in-mold electronics market is significantly growing. As a global hub for automotive production and engineering, Germany is actively expanding its use of IME in vehicle interior design. The technology is being applied in creating smart dashboards, ambient lighting systems, and integrated control panels that contribute to a cleaner, sleeker cabin experience. National efforts to advance Industry 4.0 are enabling the integration of functional printing and embedded electronics into manufacturing workflows, further boosting the market by driving digital transformation in automotive supply chains.

The UK in-mold electronics market is emerging as a significant contributor through its strong investment in printed and flexible electronics. Companies and research institutions are collaborating to bring customized, high-performance IME solutions to market, especially for smart packaging, consumer electronics, and aerospace applications. The ability to rapidly prototype and manufacture curved, multifunctional interfaces is attracting growing interest from OEMs. This innovation-driven approach is propelling market growth and positioning the UK as a competitive player in this technology space.

Asia Pacific In-Mold Electronics Market Trends

The Asia Pacific in-mold electronics market dominated the global market and is expected to grow at the fastest CAGR from 2025 to 2030. The Asia Pacific region is witnessing rapid expansion in the IME market, supported by a strong manufacturing base, rising consumer demand, and government-led industrial digitization. Regional electronics manufacturers are increasingly adopting IME for high-volume production of smart appliances, mobile devices, and automotive interiors. The ability to integrate touch sensors, lighting, and circuitry into curved surfaces at a lower cost is encouraging broader adoption across both consumer and industrial applications. This combination of scale, cost-efficiency, and innovation is significantly boosting the market across APAC.

China in-mold electronics market is growing significantly due to focus on smart manufacturing and electronics localization. The country’s large-scale automotive and consumer electronics sectors are incorporating IME to enhance product design, reduce assembly complexity, and integrate advanced user interfaces. As China continues to scale up electric vehicle production and invest in automated manufacturing technologies, the use of lightweight, embedded electronics is becoming more prevalent. These advancements are collectively driving strong momentum in the IME market.

Japan in-mold electronics market is growing as the nation is leveraging its deep expertise in material science and precision manufacturing to drive innovation. Domestic manufacturers are developing advanced conductive inks, thermoplastics, and printing techniques tailored for IME applications. The automotive industry, in particular, is adopting IME for control panels and infotainment systems to deliver more intuitive and compact user interfaces. As design flexibility and miniaturization become essential, Japan’s focus on high-quality manufacturing is boosting the IME market significantly.

India’s expanding electronics manufacturing sector, supported by national initiatives, is creating fertile ground for the adoption of in-mold electronics. Programs encouraging domestic production and R&D in printed electronics are helping local companies explore IME applications in cost-sensitive industries such as appliances, automotive interiors, and medical devices. The drive to reduce imports and develop indigenous technology solutions is propelling market entry for IME and encouraging startups and OEMs to adopt this integrated electronics approach.

Key In-Mold Electronics Company Insights

Some of the major players in the In-Mold Electronics market include Butler Technologies, CERADROP, DuPont, Eastprint Incorporated, GenesInk, among others. These companies contribute significantly to the market by offering a comprehensive range of capabilities, including high-performance conductive inks, precision printing technologies, and scalable manufacturing solutions. Their focus on combining design flexibility with durability supports the development of lightweight, multi-functional components across automotive, medical, and consumer electronics sectors. In addition, their active involvement in research collaborations, rapid prototyping, and the commercialization of 3D formable electronics further strengthens their leadership in this evolving field.

-

DuPont is a globally recognized leader in science, innovation, and specialty materials, with a strong footprint across industries such as electronics, automotive, healthcare, and packaging. In the context of the In-Mold Electronics (IME) market, DuPont plays a foundational role through its expertise in conductive inks, flexible substrates, dielectric materials, and barrier films, core components that enable reliable and high-performance IME systems. Its extensive research capabilities and long-standing experience in material science allow DuPont to support complex printed electronics applications, contributing to the evolution of smarter, thinner, and more integrated electronic components. The company's strong commitment to quality, innovation, and material compatibility positions it as a key enabler of IME technology worldwide.

-

TactoTek is a Finland-based technology company that specializes in In-Mold Structural Electronics (IMSE), a subdomain of in-mold electronics. The company is renowned for its ability to merge electronics, decorative surfaces, and 3D injection molding into single, seamless components. TactoTek’s proprietary IMSE technology simplifies electronic product design by reducing weight, assembly steps, and component count while enhancing durability and aesthetic appeal. Focused on sustainability and design freedom, TactoTek enables manufacturers to produce intuitive, user-friendly interfaces in curved and compact form factors. Its licensing-based business model empowers partners across automotive, industrial, and consumer electronics sectors to implement IME solutions globally, making the company a key innovator in the structural electronics landscape.

Key In-Mold Electronics Companies:

The following are the leading companies in the in-mold electronics market. These companies collectively hold the largest market share and dictate industry trends.

- Butler Technologies

- CERADROP

- DuPont

- Eastprint Incorporated

- GenesInk

- Golden Valley Products

- InMold Solution

- Nissha Co., Ltd.

- TACTOTEK

- TEKRA, LLC.

- YOMURA TECHNOLOGIES, INC.

Recent Developments

-

In August 2023, DuPont completed the acquisition of Spectrum Plastics Group to strengthen its capabilities in the healthcare and wearable electronics sectors. This move expanded DuPont’s In-Mold Electronics offerings by enhancing access to medical-grade substrates and specialty materials, thereby boosting its role in flexible and printed electronics manufacturing.

-

In December 2023, TactoTek partnered with Yanfeng to co-develop integrated human-machine interfaces for next-generation vehicle interiors. The collaboration focuses on embedding touch, lighting, and functional electronics into single 3D-molded components, thereby accelerating IME adoption in the global automotive sector.

In-Mold Electronics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 290.50 million

Revenue forecast in 2033

USD 2,090.42 million

Growth rate

CAGR of 27.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Butler Technologies; CERADROP; DuPont; Eastprint Incorporated; GenesInk; Golden Valley Products; InMold Solution; Nissha Co., Ltd.; TACTOTEK; TEKRA, LLC.; YOMURA TECHNOLOGIES, INC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global In-Mold Electronics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global in-mold electronics market report based on component, technology, end use, and region.

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Conductive Inks

-

Silver-based

-

Carbon-based

-

Copper-based

-

-

Substrates

-

Films

-

Adhesives

-

Electronic Components

-

Sensors

-

LEDs

-

Capacitors

-

Antennas

-

Others

-

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Screen Printing

-

Inkjet Printing

-

Thermoforming

-

Injection Molding

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Automotive

-

Consumer Electronics

-

Home Appliances

-

Industrial Equipment

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global in-mold electronics market size was estimated at USD 0.21 billion in 2024 and is expected to reach USD 0.29 billion in 2025.

b. The global in-mold electronics market size is expected to grow at a significant CAGR of 27.9% to reach USD 2.09 billion in 2033.

b. Asia Pacific held the largest market share of 48.6% in 2024. The Asia-Pacific region is witnessing rapid expansion in the In-Mold Electronics market, supported by a strong manufacturing base, rising consumer demand, and government-led industrial digitization. Regional electronics manufacturers are increasingly adopting In-Mold Electronics for high-volume production of smart appliances, mobile devices, and automotive interiors.

b. Some of the players in the in-mold electronics market are Butler Technologies, CERADROP, DuPont, Eastprint Incorporated, GenesInk, Golden Valley Products, InMold Solution, Nissha Co., Ltd., TACTOTEK, TEKRA, LLC., and YOMURA TECHNOLOGIES, INC.

b. The key driving trend in the in-mold electronics (IME) market is the growing demand for lightweight, compact, and seamlessly integrated electronic interfaces across industries such as automotive and consumer electronics, which is spurring the adoption of IME technology.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.