- Home

- »

- Display Technologies

- »

-

In-Store Digital Advertising Display Market Size Report, 2033GVR Report cover

![In-Store Digital Advertising Display Market Size, Share & Trends Report]()

In-Store Digital Advertising Display Market (2025 - 2033) Size, Share & Trends Analysis Report By Component, By Product Type, By Technology, By Resolution, By Screen Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-786-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

In-Store Digital Advertising Display Market Summary

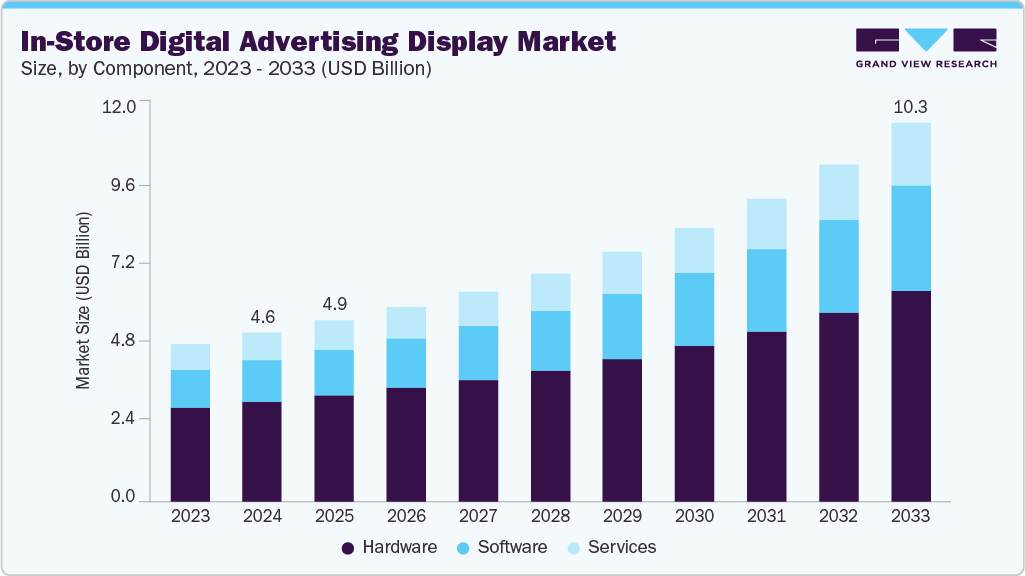

The global in-store digital advertising display market size was estimated at USD 4.59 billion in 2024 and is projected to reach USD 10.28 billion by 2033, growing at a CAGR of 9.7% from 2025 to 2033. The rising adoption of connected retail ecosystems is driving the market growth.

Key Market Trends & Insights

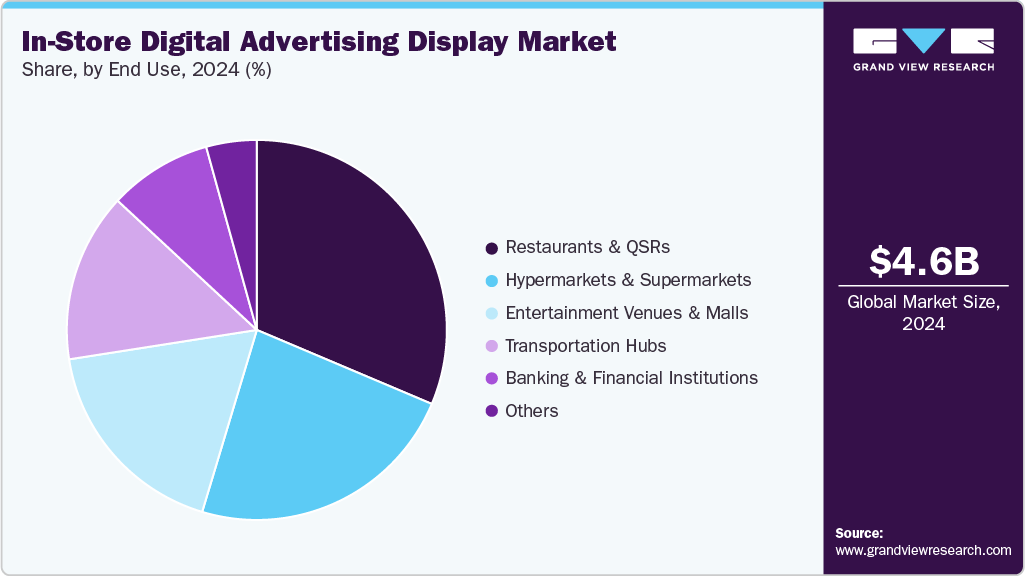

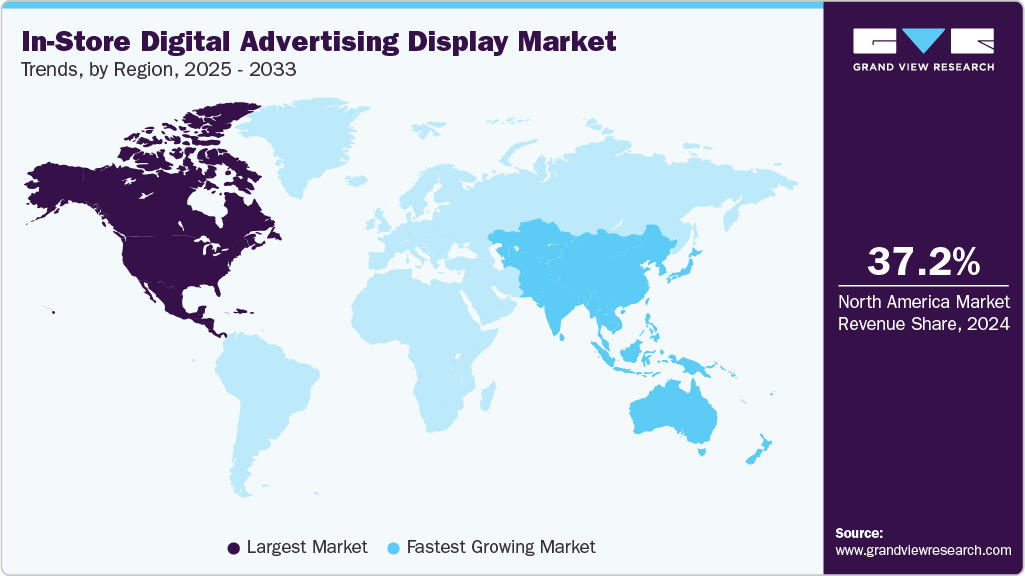

- North America held a 37.2% revenue share of the global in-store digital advertising display market in 2024.

- In the U.S., increasing integration of retail analytics with advertising content management is accelerating the demand for in-store digital advertising display systems.

- By component, the hardware segment held the largest revenue share of 59.2% in 2024.

- By product type, the digital posters segment held the largest revenue share in 2024.

- By technology, the LED segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.59 Billion

- 2033 Projected Market Size: USD 10.28 Billion

- CAGR (2025-2033): 9.7%

- North America: Largest Market in 2024

- Asia Pacific: Fastest Growing Market in 2024

The rapid urbanization and modernization of retail infrastructure are driving the growth of the in-store digital advertising display industry. As cities expand and consumer spending power rises, shopping malls, supermarkets, and lifestyle stores are investing heavily in digital transformation to attract tech-savvy urban shoppers. These modern retail formats demand visually engaging and technologically advanced advertising solutions that enhance store ambiance and encourage impulse purchases. In-store digital displays offer the flexibility to deliver high-impact visuals and promotional content in real time, creating dynamic shopping environments that align with modern urban lifestyles. In markets like Brazil, India, and Southeast Asia, where organized retail is expanding rapidly, this modernization of physical spaces is directly contributing to the widespread installation of in-store digital advertising display systems.

The growing adoption of 5G and improved connectivity infrastructure, which is enabling faster data transmission and real-time content updates across multiple store locations, is driving market growth. Retailers can now manage and synchronize hundreds of displays simultaneously using cloud-based platforms, ensuring consistent messaging and seamless updates without manual intervention. This connectivity also allows for integration with IoT sensors and AI algorithms that adjust advertisements based on environmental conditions, such as temperature, time of day, or foot traffic density. As 5G networks continue to roll out globally, the ability to stream high-definition, interactive content on in-store displays is becoming more efficient and cost-effective, fueling further adoption of connected digital signage solutions.

The growing influence of experiential retail drives in-store digital advertising display market growth. Consumers today are not just shopping for products; they are seeking immersive experiences that connect them emotionally to brands. Retailers and brands are using digital displays to create storytelling zones, interactive product showcases, and augmented reality experiences that engage customers beyond traditional advertising. For instance, fashion retailers use large LED walls to showcase runway videos, while automotive showrooms employ interactive touchscreens for virtual test drives. These experiences strengthen brand identity, increase dwell time, and encourage higher spending, positioning digital displays as essential tools in crafting immersive, experience-oriented retail environments.

Furthermore, the expanding use of programmatic advertising in physical retail environments is reshaping how in-store display advertising is managed and monetized. Retailers are adopting software platforms that allow real-time bidding and automated purchasing of screen time on digital displays, similar to online advertising models. This enables brands to deploy campaigns dynamically across retail networks based on inventory levels, audience demographics, or local events. Programmatic in-store advertising brings scalability and precision to physical retail marketing, making it more flexible and data-driven. The convergence of retail media networks with digital out-of-home (DOOH) advertising technologies is thus opening new growth opportunities for display manufacturers, content management providers, and advertisers alike, further propelling the market growth globally.

Component Insights

The hardware segment dominated the in-store digital advertising display industry with a revenue share of 59.2% in 2024. The integration of hardware with Internet of Things (IoT) and cloud technologies is propelling the hardware segment. Retailers are deploying connected display systems that can communicate with sensors, cameras, and management platforms to deliver personalized and adaptive content. For instance, IoT-enabled hardware can adjust display brightness based on ambient light conditions or change advertisements depending on audience demographics captured by in-store cameras. Cloud-based connectivity allows centralized control and synchronization of multiple displays across different store locations, ensuring consistent branding and real-time campaign updates. The convergence of hardware and connectivity solutions enhances operational efficiency, scalability, and the ability to execute targeted advertising at scale.

The software segment is projected to grow significantly during the forecast period. The growing focus on personalization and data analytics is driving the software segment. Retailers and brands are increasingly using artificial intelligence (AI) and machine learning (ML)-powered software to analyze consumer behavior, purchasing patterns, and demographic data to deliver targeted and context-aware advertising. These intelligent software systems can automatically adjust content based on variables such as time of day, customer demographics, or inventory levels. This data-centric and adaptive approach allows retailers to maximize advertising relevance and return on investment, making software the key enabler of smart and personalized in-store marketing.

Product Type Insights

The digital posters segment dominated the in-store digital advertising display market in 2024. The growing integration of digital posters with content management systems (CMS) and analytics software is fueling market growth. These systems allow retailers to manage and schedule content remotely across multiple locations, ensuring consistency and efficiency in marketing campaigns. Furthermore, the use of data analytics helps brands tailor content to specific customer demographics, store locations, or peak shopping hours. This ability to deliver targeted and time-sensitive content enhances the effectiveness of in-store advertising. It strengthens brand-customer interaction, positioning digital posters as a valuable marketing tool in the retail ecosystem.

The kiosks segment is projected to be the fastest-growing segment from 2025 to 2033. The rise of omnichannel retailing is driving the adoption of kiosks in physical stores. As consumers increasingly expect seamless integration between online and offline shopping, kiosks serve as a bridge between digital and physical channels. Customers can use kiosks to order products not available in-store for home delivery or to check inventory across multiple locations, ensuring convenience and access to a wider product range. In emerging markets, where e-commerce penetration is growing rapidly, kiosks provide a critical touchpoint that links in-store experiences with online shopping platforms, supporting retailers in meeting the expectations of tech-savvy consumers and enhancing their competitive advantage.

Technology Insights

The LED segment dominated the in-store digital advertising display market in 2024. The growing integration of LED displays with content management systems and digital marketing software is another driver supporting this segment. Cloud-based platforms and centralized software allow retailers to remotely manage and update content across multiple LED screens in real time. Retailers can schedule promotions, adapt content to different store locations, and personalize advertisements based on customer demographics or shopping behavior. This level of control enhances the effectiveness of marketing campaigns and ensures that displays remain relevant and engaging, making LED technology an essential component of modern, data-driven retail strategies.

The OLED segment is projected to grow at the fastest CAGR from 2025 to 2033. The rising importance of brand differentiation and luxury retail experiences is driving the adoption of OLED displays. In markets where consumer expectations for store aesthetics and immersive shopping experiences are high, retailers are leveraging OLED technology to create visually stunning, high-resolution advertisements that convey a sense of premium quality. Luxury fashion, electronics, and automotive brands, in particular, use OLED displays to showcase product details, highlight craftsmanship, and deliver cinematic experiences that reinforce brand identity.

Resolution Insights

The FHD segment dominated the in-store digital advertising display industry in 2024. The rising trend of multi-screen and video wall installations in stores is further driving FHD display demand. Retailers are increasingly deploying clusters of FHD screens to create cohesive video walls that deliver large-format visuals and immersive experiences without the cost and complexity of 4K installations. These video walls can display synchronized content across multiple screens, enhancing storytelling capabilities and capturing shopper attention more effectively. FHD displays offer an ideal balance between resolution, cost, and operational efficiency, making them the preferred choice for creating high-impact, scalable visual experiences in retail stores.

The 8K segment is projected to grow at a significant CAGR from 2025 to 2033. The trend toward large-format digital signage and flagship store differentiation is supporting the adoption of 8K technology. Retailers are using expansive 8K screens to create striking visual statements that reinforce brand identity and attract foot traffic, particularly in competitive urban shopping districts. These displays can serve as centerpieces for store entrances, interactive experience zones, or video walls that combine multiple panels into a seamless visual canvas. The ability of 8K displays to deliver breathtaking visual clarity at scale enables retailers to leave a lasting impression on consumers, driving both engagement and sales.

Screen Size Insights

The 32-52 inches segment dominated the in-store digital advertising display market in 2024. The increasing integration of social media and live content into in-store displays is also fueling demand for 32-52 inch screens. Retailers are leveraging mid-sized displays to showcase live social media feeds, user-generated content, or real-time promotions, creating an interactive and engaging shopping environment. The ability to merge social engagement with in-store advertising allows retailers to build stronger connections with their audience while enhancing the overall shopping experience.

The above 52 inches segment is projected to grow at the fastest CAGR from 2025 to 2033. The rise of flagship stores and urban retail environments is fueling demand for displays above 52 inches. Retailers are increasingly using these large-format screens to establish a strong visual presence and create high-profile brand showcases that attract foot traffic. In competitive shopping districts and high-visibility locations, such displays act as a statement piece, reinforcing brand identity while delivering marketing messages at scale. The combination of visibility, immersive experience potential, and content versatility ensures that large-format displays are a critical driver in the market growth, particularly for premium and high-traffic retail formats.

End Use Insights

The restaurants & QSRs segment dominated the market in 2024. The shift toward digital menus in restaurants and QSRs is driving the in-store digital advertising display market growth. For instance, digital displays make it easier to comply with changing food labeling laws that require the display of calorie counts or allergen information, as updates can be implemented instantly across all screens. Additionally, they help reduce printing costs and environmental impact associated with paper menus and posters. In an era where speed, efficiency, and customer engagement are key competitive differentiators, iIn-store digital advertising displays have become an indispensable tool for restaurants and QSRs to attract attention, streamline operations, and drive repeat visits.

The transportation hubs segment is projected to grow at the fastest CAGR from 2025 to 2033, driven by the high and diverse foot traffic in locations such as airports, train stations, bus terminals, and metro stations, which makes them prime venues for impactful advertising. These environments offer advertisers the opportunity to reach a broad audience that includes both daily commuters and travelers from various demographics. Digital displays in transportation hubs are strategically positioned in waiting areas, ticket counters, boarding gates, and concourses to ensure maximum visibility. The dynamic nature of these screens allows advertisers to deliver rotating, real-time content that captures attention even in fast-paced settings, where static posters often fail to make an impression.

Regional Insights

North America dominated the in-store digital advertising display market with a revenue share of 37.2% in 2024, driven by a combination of advanced retail infrastructure, high adoption of digital technologies, and a strong focus on enhancing customer engagement at the point of sale. Retailers across the U.S. and Canada are increasingly turning to digital signage, interactive kiosks, and video walls to create immersive shopping experiences that differentiate them from competitors. This region’s mature retail ecosystem, which includes large-format stores, shopping malls, supermarkets, and specialty outlets, provides an ideal environment for deploying these technologies at scale. Brands are leveraging in-store digital advertising displays to influence consumer purchasing decisions directly in the buying environment, using dynamic, data-driven content to promote products, upsell complementary items, and highlight time-sensitive offers.

U.S. In-Store Digital Advertising Display Market Trends

The U.S. in-store digital advertising display industry is projected to grow during the forecast period. The competitive pressure from e-commerce giants has further intensified the role of in-store digital advertising displays in the U.S. market. Physical retailers are leveraging these technologies as a way to boost immediate sales and to reinforce brand loyalty by delivering experiences that online channels cannot replicate. Interactive product demos, immersive video content, and augmented reality features available through in-store displays create a tactile and engaging environment that encourages shoppers to spend more time in stores. This experiential approach is particularly impactful in categories like consumer electronics, home improvement, and luxury goods, where hands-on interaction is a key factor in purchase decisions.

Asia Pacific In-Store Digital Advertising Display Market Trends

The Asia Pacific in-store digital advertising display industry is expected to be the fastest growing segment, with a CAGR of 10.4% over the forecast period. Urbanization and the rapid expansion of organized retail networks in the Asia Pacific are major accelerators of market growth. Large-scale retail chains and mall developers are adopting high-resolution LED, LCD, and OLED displays to create immersive advertising experiences that stand out in highly competitive retail environments. In emerging markets like India and Southeast Asia, the entry of international retail brands and the growth of domestic players are driving demand for cost-effective yet impactful display solutions. Meanwhile, in more mature markets like Japan, South Korea, and Singapore, there is a greater emphasis on advanced features such as AI-powered content personalization, integration with mobile apps, and interactive touch-enabled kiosks to cater to digitally sophisticated shoppers.

The in-store digital advertising display market in China is projected to grow during the forecast period. The deep integration of in-store digital advertising displays with mobile commerce platforms and digital payment ecosystems drives the market growth. With mobile payment penetration exceeding 80% in many urban areas, displays are increasingly being used as gateways for consumers to access promotions, scan QR codes, receive personalized discounts, and make instant purchases via apps like Alipay and WeChat Pay. This convergence of physical displays and mobile engagement creates a highly interactive retail environment, where brands can track consumer behavior, adjust campaigns in real time, and build stronger customer relationships. The popularity of livestreaming and social commerce also plays a role, as in-store displays are sometimes used to broadcast live product demos or influencer-led promotions, bridging the gap between entertainment and shopping.

Europe In-Store Digital Advertising Display Trends

The in-store digital advertising display industry in Europe is expected to grow during the forecast period. Seasonal shopping events and tourism-related retail also play an important role in driving demand for in-store displays. Retailers in cities such as Paris, Milan, and London often invest heavily in high-end digital signage to create luxury brand experiences, communicate in multiple languages, and adjust campaigns instantly to match changing foot traffic patterns. Additionally, European retail sectors such as fashion, cosmetics, and luxury goods place strong emphasis on brand storytelling, and in-store digital advertising displays have become a vital medium for delivering these narratives in a visually compelling way that reinforces brand identity.

The in-store digital advertising display industry in the UK is grow during the forecast period. The rise of omnichannel and click-and-collect shopping is driving the market growth. In-store digital advertising displays are being integrated with online platforms and mobile apps to ensure seamless, consistent messaging across touchpoints. For example, displays in UK supermarkets and department stores often promote online-exclusive offers, showcase products available for next-day pickup, or direct customers to specific aisles. The ability to adapt content quickly to reflect changing inventory, weather conditions, or trending products is particularly valuable in a fast-moving retail environment. Moreover, the widespread use of contactless payments and mobile engagement tools in the UK complements interactive display features like QR code scanning, NFC-triggered promotions, and augmented reality-based product visualization.

Key In-Store Digital Advertising Display Company Insights

Some of the key companies operating in the market, include Samsung Electronics Co., Ltd., and LG Electronics, among others are some of the leading participants in the in-store digital advertising display market.

-

Samsung Electronics Co., Ltd. is a multinational electronics company engaged in providing consumer electronic products and solutions and Information Technology (IT) solutions, and mobile communication worldwide. The company offers various products, including phones, tablets, wearables, computing & SSD, digital signage and video walls, TVs, printers & copiers, networking & voice, medical devices, and air conditioning. The company distributes its products online and through dedicated franchise stores. The company’s services include Samsung ProCare and Samsung business services. The company has a geographical presence spanning Europe, Asia Pacific, the Middle East, and Africa, among other regions.

-

LG Electronics provides electronic products and technology solutions. LG Electronics offers various products, such as OLED displays, digital signage, video walls, outdoor displays, display TVs, display monitors, and IT products. The company provides accessories like wall mounts, monitor stands, and other TV accessories. The company has a global presence and operates through more than 70 subsidiaries. It has corporate offices, sales offices, and dealers across North America, South America, Central America, Europe, Asia Pacific, Russia & CIS, and the Middle East & Africa.

Scala, and Barco are some of the emerging market participants in the in-store digital advertising display market.

-

Scala is a digital signage software solution. The company serves government agencies, corporate enterprises, and the incumbents of various industries and industry verticals. It also provides solutions for various screen sizes, such as digital menu boards, kiosks, wayfinding, emergency messaging, assistive selling tools, vending, point-of-sale, advertising networks, financial terminals, and mobile and social networking in both public and private environments.

-

Barco is a Belgian technology company, and it operates across three primary sectors: Transportation Hubs, Enterprise, and Healthcare, offering cutting-edge products such as projectors, display monitors, video walls, connectivity platforms, image processing tools, and interactive software. Its V-series indoor LED displays, which include V4i and V6i models with 4 mm and 6 mm pixel pitches, combine the company’s signature image quality with excellent contrast, reliability for 24/7 operation, and cost-effectiveness for environments like fashion stores, automotive showrooms, banks, and transit hubs.

Key In-Store Digital Advertising Display Companies:

The following are the leading companies in the in-store digital advertising display market. These companies collectively hold the largest market share and dictate industry trends.

- Daktronics Dr.

- BrightSign, LLC

- LG Electronics

- Panasonic Corporation

- Samsung Electronics Co., Ltd.

- Scala

- Barco

- Lamar Advertising Company

- Leyard Group

- STRATACACHE

- MenuPro Signage

- Hanshow Technology

- Navori SA

- Mvix

- Displaydata Ltd.

Recent Developments

-

In February 2025, Samsung partnered with Cielo to revolutionize retail advertising and franchise management. The collaboration integrates Samsung’s VXT display technology with Cielo’s AI-powered platform, delivering advanced tools that enhance digital marketing and streamline operations. As part of this partnership, Cielo is launching SmartSigns, a Digital Signage as a Service (DaaS) solution built on Samsung’s VXT technology, designed to deliver the right message to the right audience at the right time. By incorporating CieloVision’s KYAI for real-time analytics and AI-driven advertising, businesses can access valuable insights into consumer behavior and engagement.

-

In January 2025, LG Electronics USA partnered with BrightSign LLC to launch a new line of ultra-high-definition digital signage displays featuring BrightSignOS. The UV5N series utilizes LG’s advanced embedded system-on-a-chip multi-core processor to deliver cutting-edge content performance. Designed for seamless integration with a wide range of BrightSign-compatible content management systems, these displays are ideal for diverse screen sizes across industries.

-

In March 2024, Hanshow Technology partnered with Pagoda to integrate its advanced electronic shelf labels and comprehensive in-store marketing solutions into Pagoda’s store operations, setting a new standard for retail digitalization. The two companies plan to strengthen their strategic collaboration further, focusing on technological innovation and service excellence to expand screen size scenarios, exchange industry knowledge, and jointly develop a roadmap for high-quality growth. This partnership aims to create a new benchmark for digital transformation in the fruit retail sector.

In-Store Digital Advertising Display Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.92 billion

Revenue forecast in 2033

USD 10.28 billion

Growth rate

CAGR of 9.7% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, product type, technology, resolution, screen size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Daktronics Dr.; BrightSign, LLC; LG Electronics; Panasonic Corporation; Samsung Electronics Co., Ltd.; Scala; Barco; Lamar Advertising Company; Leyard Group; MenuPro Signage; Hanshow Technology; Navori SA; STRATACACHE; Mvix; Displaydata Ltd.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global In-Store Digital Advertising Display Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the in-store digital advertising display market report based on component, product type, technology, resolution, screen size, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hardware

-

Software

-

Services

-

-

Product Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Digital Menu Boards

-

Video Walls

-

Digital Posters

-

Kiosks

-

Digital Shelf Displays

-

Others

-

-

Technology Outlook (Revenue, USD Billion, 2021 - 2033)

-

LCD

-

LED

-

OLED

-

Projection

-

-

Resolution Outlook (Revenue, USD Billion, 2021 - 2033)

-

8K

-

4K

-

FHD

-

HD

-

Lower than HD

-

-

Screen Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Below 32 Inches

-

32-52 Inches

-

Above 52 Inches

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hypermarkets & Supermarkets

-

Restaurants & QSRs

-

Transportation Hubs

-

Entertainment Venues & Malls

-

Banking & Financial Institutions

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global in-store digital advertising display market size was estimated at USD 4.59 billion in 2024 and is expected to reach USD 4.92 billion in 2025.

b. The global in-store digital advertising display market is expected to grow at a compound annual growth rate of 9.7% from 2025 to 2033 to reach USD 10.28 million by 2033.

b. The FHD segment dominated the in-store digital advertising display market in 2024. The rising trend of multi-screen and video wall installations in stores is further driving FHD display demand. Retailers are increasingly deploying clusters of FHD screens to create cohesive video walls that deliver large-format visuals and immersive experiences without the cost and complexity of 4K installations.

b. Some key players operating in the market include Daktronics Dr., BrightSign, LLC, LG Electronics, Panasonic Corporation, Samsung Electronics Co., Ltd., Scala, Barco, Lamar Advertising Company, Leyard Group, MenuPro Signage, Hanshow Technology, Navori SA, STRATACACHE, Mvix, Displaydata Ltd., and Others.

b. Factors such as increasing adoption of energy-efficient technologies, such as rapid urbanization and modernization of retail infrastructure are driving the in-store digital advertising display market. As cities expand and consumer spending power rises, shopping malls, supermarkets, and lifestyle stores are investing heavily in digital transformation to attract tech-savvy urban shoppers plays a key role in accelerating the in-store digital advertising display market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.