- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Indonesia Nutraceuticals Market Size, Industry Report, 2033GVR Report cover

![Indonesia Nutraceuticals Market Size, Share & Trends Report]()

Indonesia Nutraceuticals Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Dietary Supplements, Functional Food), By Application (Diabetes, Eye Health), By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-801-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Indonesia Nutraceuticals Market Summary

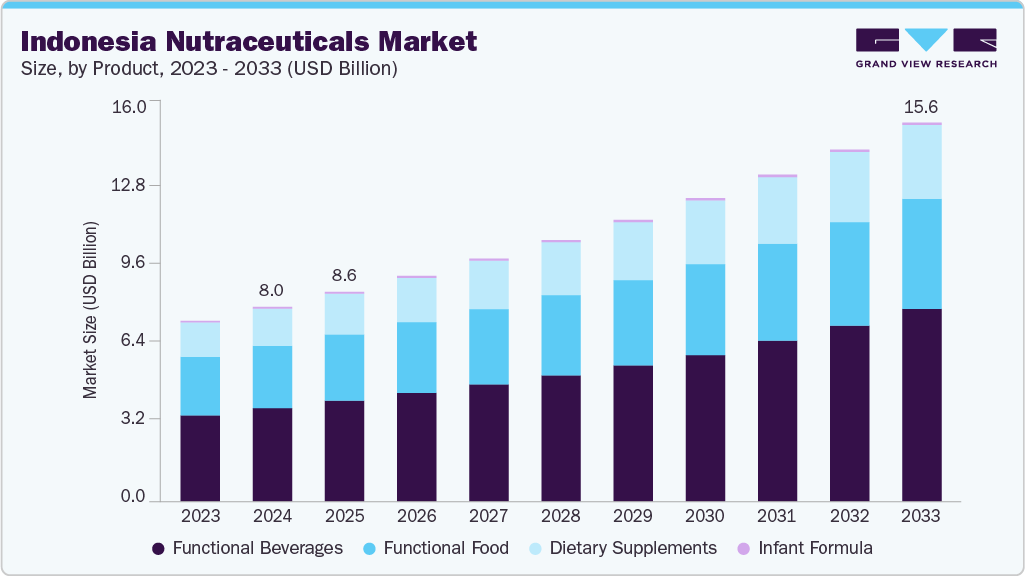

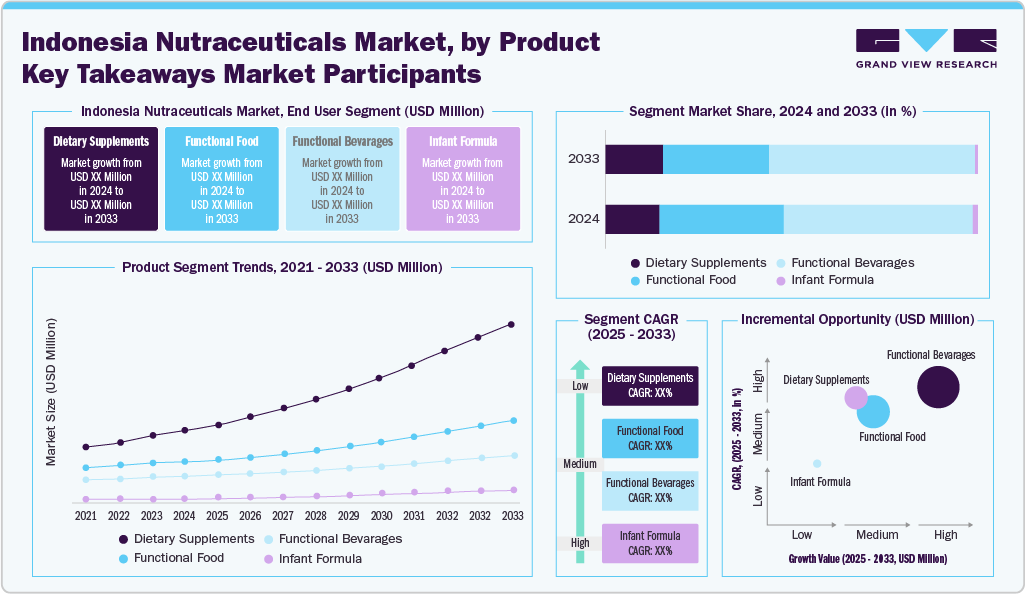

The Indonesia nutraceuticals market size was estimated at USD 8.01 billion in 2024 and is projected to reach USD 15.60 billion by 2033, growing at a CAGR of 7.7% from 2025 to 2033. The market is propelled by increasing health awareness, evolving demographic trends, and the development of innovative nutraceutical products.

Key Market Trends & Insights

- By product, the functional beverages segment held the highest market share of 47.9% in 2024.

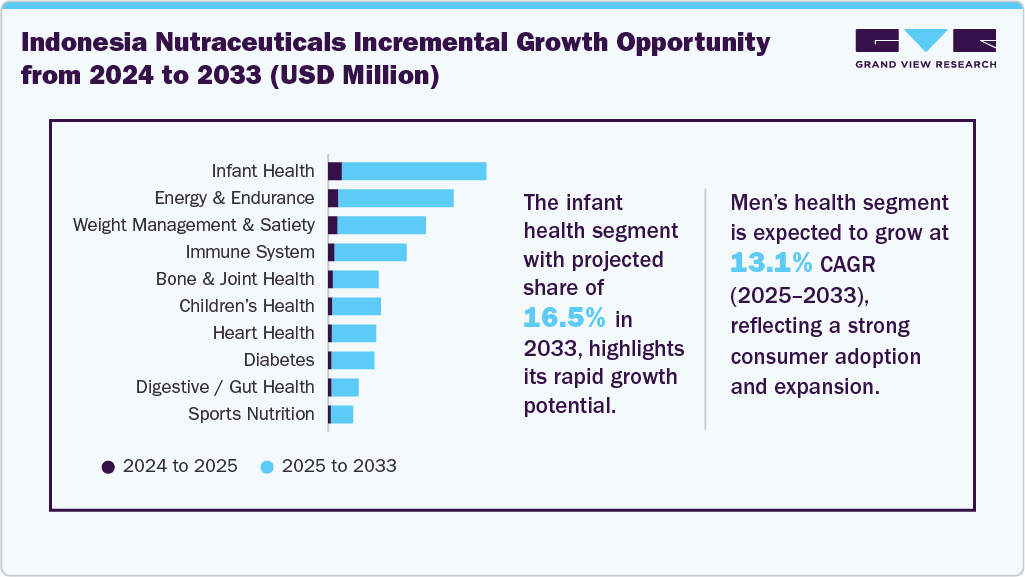

- Based on application, the weight management & satiety segment held the highest market share in 2024.

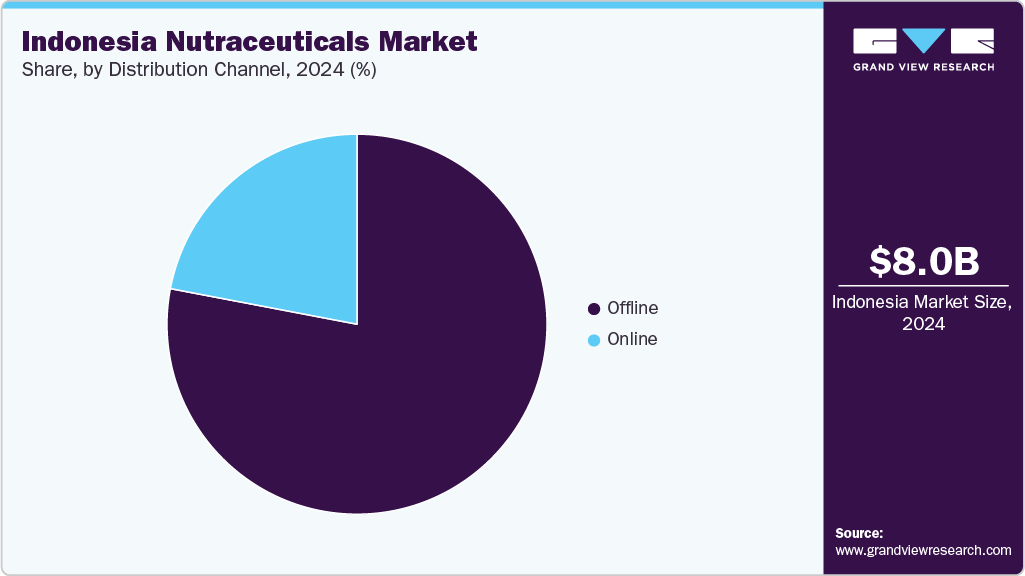

- By distribution channel, the offline segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.01 Billion

- 2033 Projected Market Size: USD 15.60 Billion

- CAGR (2025-2033): 7.7%

In addition, improved accessibility to these products further supports market growth. These factors create a favorable environment for sustained expansion driven by consumer demand and product innovation. According to World Bank Data, in 2024, Indonesia’s GDP reached USD 1.4 trillion, and its population reached 283,487,931. Rising urban consumer preferences and evolving lifestyles are fueling increased demand for nutraceuticals. These economic growth and demographic shifts significantly expand Indonesia’s nutraceutical market in the coming years.Robust administrative backing and government initiatives are expected to drive market growth. For instance, Global Alliance for Improved Nutrition launched initiatives in Indonesia to address malnutrition. The programs implemented were Adolescent Nutrition, Food System Dashboard. These initiatives supported government policies, promoted nutritious food access, and implemented training programs.

Innovation driven by R&D and investments propel industry growth, with novel ingredient discovery central to nutraceuticals’ potential. The discovery and availability of novel ingredients play a pivotal role in the growth potential of nutraceuticals. In October 2022, Wipro Consumer Care Ventures invested in startup Youvit, marking its first direct Southeast Asia investment. The funds supported product expansion and branding, as the company aimed to strengthen its distribution across Indonesia, Malaysia, and Southeast Asia.

Consumer Insights

As Indonesia faces a growing incidence of non-communicable diseases, including cardiovascular disorders, diabetes, and obesity, public awareness of health and wellness is steadily increasing. According to the Health Survey Indonesia 2023, the prevalence of overweight and obesity among adults in Indonesia, as measured by body mass index, is 37.8%. Thus, nutraceuticals are gaining recognition for their ability to fill nutritional gaps and enhance overall wellness, helping to address dietary deficiencies. In Indonesia, consumer behavior towards nutraceuticals indicates a proactive approach to health management. People increasingly choose fortified foods, herbal supplements, and vitamins to address dietary inadequacies. This trend is driven by their desire for convenience, perceived safety, and effectiveness.

Consumers now prioritize health supplements and functional foods as integral components of their daily diet. Moreover, a growing aging population and increasing prevalence of lifestyle-related health issues have increased the need for targeted nutritional interventions, positioning nutraceuticals as a strategic component in comprehensive healthcare approaches.

Product Insights

The functional beverages segment dominated the market with a revenue share of 47.9% in 2024 and is expected to grow at the fastest CAGR of 7.7% over the forecast period. The functional beverage market is fueled by factors such as consumer willingness to pay a premium, increasing awareness regarding health and wellness, and the strategic expansion of nutraceutical product portfolios by industry players.In July 2025, Nestlé launched Milo Pro, a high‑protein beverage targeting Indonesia's active teens and young adults. It is available in ready-to-drink format to make it convenient for young adults to get the right amount of protein each day. Furthermore, local and international brands actively innovate, developing new flavors and formulations tailored to Indonesian consumers' preferences and regional health requirements.

The dietary supplements segment is projected to grow at a CAGR of 7.7% from 2025 to 2033. The market for dietary supplements is experiencing substantial growth, fueled by increasing consumer focus on preventative healthcare and overall wellness. This trend is driven by individuals proactively addressing nutritional deficiencies and aiming to improve their general health. The increasing global aging population further fuels this demand. In 2023, the World Bank reported that people over 65 reached 19,819,797. Furthermore, expanding personalized nutrition significantly contributes to market growth.

Application Insights

The weight management & satiety segment held the largest market share of the Indonesia nutraceuticals market in 2024. This growth is driven by the rising prevalence of obesity, increased consumption of packaged foods, and the integration of digital health solutions alongside personalized nutraceutical regimens. Moreover, government initiatives promoting healthy eating habits significantly expand the market, particularly among adolescents. For instance, in February 2022, the World Food Programme launched a digital campaign to encourage healthy eating among Indonesian youth in partnership with the Ministry of Health. This initiative emphasizes the importance of balanced diets, nutrition awareness, and multi-stakeholder collaboration to support youth development and overall well-being. These combined factors underscore a strategic shift towards preventive health and personalized nutrition solutions within the Indonesian market.

The men's health segment is projected to experience the fastest CAGR from 2025 to 2033. This is attributed to increasing health-related challenges among men. The increasing incidence of such conditions has directly fueled consumer awareness of supplements intended to support men's health. The demand for tailored nutritional interventions surges as men become more proactive in addressing their health concerns and seeking preventative measures.

Distribution Channel Insights

The offline distribution segment dominated the Indonesian nutraceuticals market in 2024. The market is driven by consumers’ trust and the perception of product authenticity. In addition, reference groups and social norms continue to influence purchasing decisions. Consumers value recommendations from family, friends, and healthcare professionals, significantly impacting offline purchase behavior. Price sensitivity also plays a role, as offline channels often offer promotional discounts and opportunities for direct negotiation, all of which appeal to cost-conscious buyers.

The online segment is projected to experience the fastest CAGR from 2025 to 2033. The market is growing owing to increasing consumer health consciousness. This trend is driven by a strong belief in nutraceuticals' ability to boost immunity and enhance overall well-being, complementing a broader societal shift towards healthier lifestyles, including regular exercise and balanced diets. In November 2022, Indonesia's SOEs Holding, led by Bio Farma, launched Medbiz, an e-commerce B2B platform for health products. Furthermore, BRI collaborated with Medbiz to enhance digital health service access across the country.

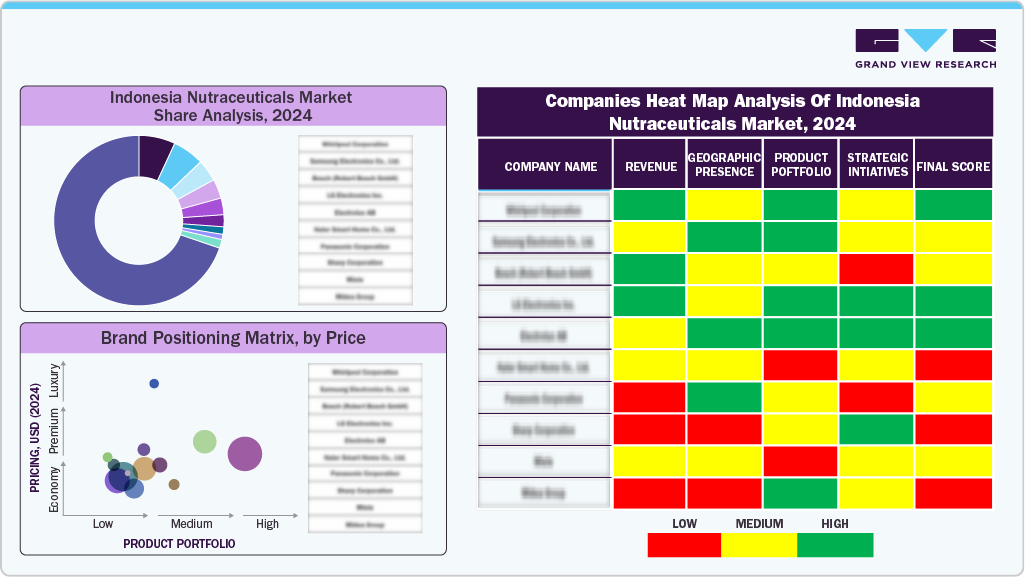

Key Indonesia Nutraceuticals Company Insights

Some of the key players in the Indonesia nutraceuticals market include Kalbe, Sidomuncul, PT INDOFOOD SUKSES MAKMUR Tbk, and others.

-

P.T. Yakult Indonesia Persada. is a health-focused company promoting wellness through its probiotic products. The company emphasizes a healthy lifestyle, offering informative content on health benefits, science, and lifestyle tips. It continues innovating and expanding its reach, providing consumers with trusted probiotic solutions for better health and well-being.

Key Indonesia Nutraceuticals Companies:

- P.T. Yakult Indonesia Persada.

- Nestlé Indonesia

- Kalbe, Sidomuncul

- PT INDOFOOD SUKSES MAKMUR Tbk,

Recent Developments

-

In June 2025, PT Ionaya Optima Natura introduced Vitera. This premium daily powder blends Nutrileads' precision prebiotic Benicaros with microalgae extract and is designed to support gut and immune health.

-

In June 2024, Duopharma Biotech Berhad, through its subsidiary PT Duopharma Healthcare Indonesia, successfully launched its Flavettes Glow Vitamin C brand in Indonesia.

Indonesia Nutraceuticals Market Report Scope

Report Attribute

Details

Revenue forecast in 2033

USD 15.60 billion

Growth rate

CAGR of 7.7% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, distribution channel

Key companies profiled

P.T. Yakult Indonesia Persada., Nestlé Indonesia, Kalbe, Sidomuncul, PT INDOFOOD SUKSES MAKMUR Tbk,

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Indonesia Nutraceuticals Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Indonesia nutraceuticals market report based on product, application, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Dietary Supplements

-

Tablets

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Capsules

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Soft Gels

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Powders

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Gummies

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Liquid

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Others

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

-

Functional Food

-

Vegetable and Seed Oil

-

Sweet Biscuits, Snack Bars and Fruit Snacks

-

Dairy

-

Baby Food

-

Breakfast Cereals

-

Others

-

-

Functional Beverages

-

Energy drink

-

Sports drink

-

Others (Functional dairy based beverages, kombucha, kefir, probiotic drinks, and functional water)

-

-

Infant Formula

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Allergy & Intolerance

-

Healthy Ageing

-

Bone & Joint health

-

Cancer Prevention

-

Children's Health

-

Cognitive Health

-

Diabetes

-

Digestive / Gut Health

-

Energy & Endurance

-

Eye Health

-

Heart Health

-

Immune System

-

Infant Health

-

Inflammation

-

Maternal Health

-

Men's Health

-

Nutricosmetics

-

Oral care

-

Personalized Nutrition

-

Post Pregnancy Health

-

Sexual Health

-

Skin Health

-

Sports Nutrition

-

Weight Management & Satiety

-

Women's Health

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Supermarkets & Hypermarkets

-

Pharmacies

-

Specialty Stores

-

Practitioner

-

Grocery Stores

-

Others

-

-

Online

-

Amazon

-

Other Online Retail Stores

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.