- Home

- »

- Petrochemicals

- »

-

Industrial Lubricants Market Size, Industry Report, 2033GVR Report cover

![Industrial Lubricants Market Size, Share & Trends Report]()

Industrial Lubricants Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Process Oils, General Industrial Oils, Metalworking Fluids, Industrial Engine Oils), By Application, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-180-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Lubricants Market Summary

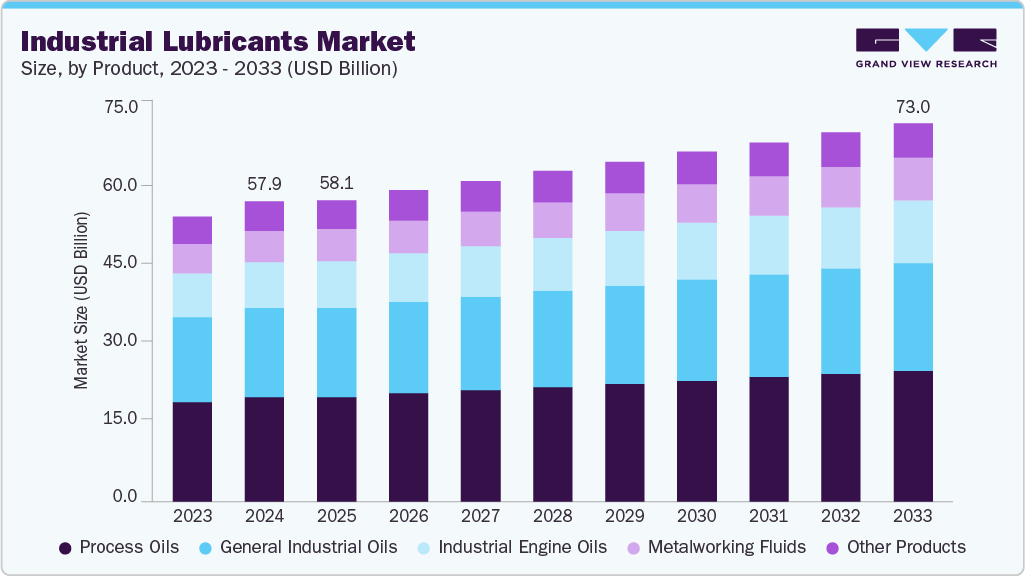

The global industrial lubricants market size was estimated at USD 57,886.3 million in 2024 and is projected to reach USD 73,011.3 million by 2033, growing at a CAGR of 2.9% from 2025 to 2033. Rapid industrialization across developing nations and increasing global trade activities are driving the demand for industrial lubricants.

Key Market Trends & Insights

- Asia Pacific dominated the industrial lubricants market with the largest revenue share of 34.3% in 2024.

- The industrial lubricants market in China held a substantial share of the APAC market in 2024.

- By product, process oils segment dominated the market and accounted for the largest revenue share of 34.9% in 2024.

- By product, process oil by product dominated the market with a revenue share of 34.9% in 2024.

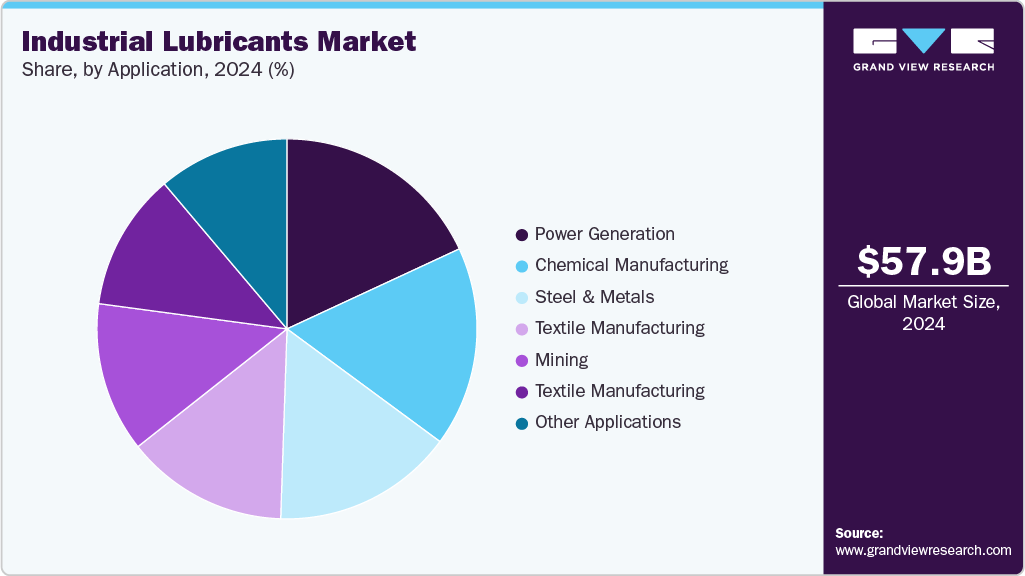

- By application, power generation segment dominated the market and accounted for the largest revenue share of 26.5% in 2024.

Market Size & Forecasts

- 2024 Market Size: USD 57,886.3 Million

- 2033 Projected Market Size: USD 73,011.3 Million

- CAGR (2025-2033): 2.9%

- Asia Pacific: Largest market in 2024

Moreover, increased investments in research and development, combined with well-planned expansion strategies, are driving the growth of leading market players. Industries such as unconventional Food Processing, chemicals, and mining are projected to expand significantly, boosting the use of industrial lubricants in equipment such as compressors, centrifuges, engines, and bearings.

Over the last ten years, countries such as India, Indonesia, South Africa, China, and Brazil have experienced substantial growth in their industrial sectors. Industries involved in manufacturing foundry products, plastics, metal goods, consumer appliances, and the mining sector have seen increased prominence, leading to a greater need for high-performance industrial lubricants. Furthermore, rapid industrial development in BRICS nations, especially China, India, Brazil, Russia, and South Africa, has contributed to market growth. These nations have shown robust expansion in manufacturing domains such as machinery, chemical production, food processing, and metal processing, driven by favorable investment climates and an abundant skilled workforce. The growing industrial landscape in these regions continues to push demand for industrial lubricants used in large-scale operations.

This growing industrial activity has contributed to the rising consumption of lubricants, including process oils, Metalworking Fluids, industrial oils, and engine oils. Consistent industrial output across these regions is anticipated to sustain the demand for such lubricants. In India, process oils account for a substantial portion of the industrial lubricant market, representing more than half of the total demand. In addition, the fast-paced expansion in power generation and distribution sectors has significantly boosted the need for transformer oils.

The increasing demand for various finished products and the need to enhance production capacity have driven manufacturers to adopt machinery for automating production and processing operations. Key growth drivers over the forecast period include evolving emission regulations, advancements in engine technologies, and the implementation of carbon footprint reduction measures, particularly in emerging markets such as China and India.

Changing consumer lifestyles and the growing influence of Western living habits have led to increased demand for processed and frozen foods. The integration of automation in packaging lines and the adoption of robotics for high-pressure operations are expected to drive growth in the processed food sector. The expanding significance of agro-processing is also likely to spur further industry advancements. In addition, rising urbanization, evolving dietary preferences, and the surge in industrial food production, especially in the Asia Pacific and Latin America, are intensifying the need for industrial lubricants used in food-grade equipment. Technological innovations and automation in Textile Manufacturing, along with the expansion of manufacturing facilities by global food and beverage companies, are contributing to higher lubricant demand to maintain hygiene standards, improve efficiency, and extend equipment life in fast-paced, large-scale production settings.

However, growing environmental concerns and strict regulations surrounding contamination and pollution caused by synthetic lubricants present significant challenges. One of the key issues is the disposal of used lubricants, as many of the additives involved are derived from petrochemicals and pose serious risks to water quality. As a result, increasing awareness and regulatory scrutiny related to the use, recycling, and disposal of lubricants are acting as restraints on market growth.

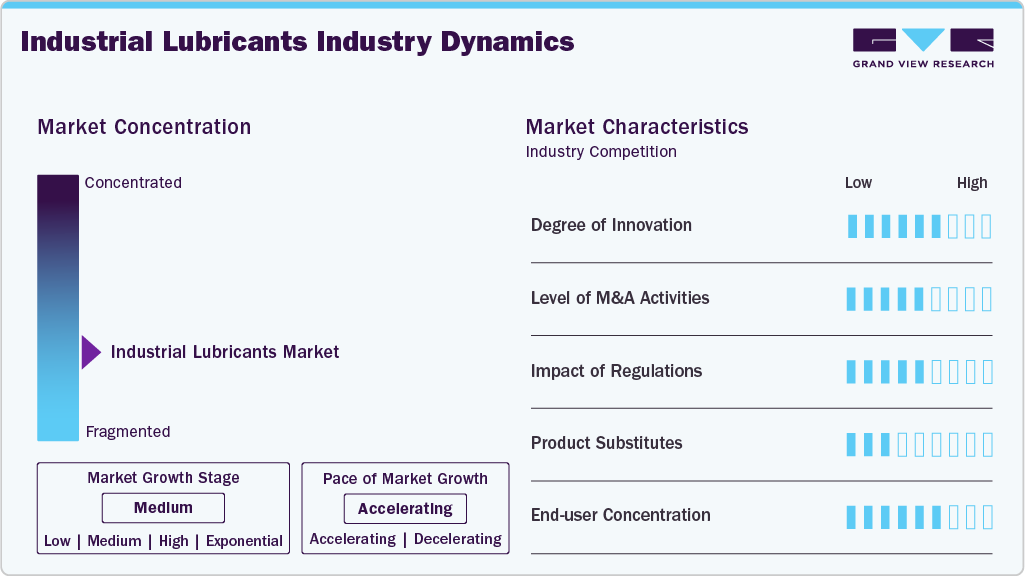

Market Concentration & Characteristics

The industrial lubricants market is moderately fragmented, with dominance by a few large, vertically integrated players. These leading companies capitalize on economies of scale, backward integration into base oil production, and extensive global distribution networks to secure strong market positions. Their integration across the lubricant value chain, from crude oil refining or synthetic base stock production to additive formulation and blending, enables cost efficiency, consistent product performance, and dependable supply. This vertical integration supports their ability to serve a wide range of end-use industries, including automotive, manufacturing, Food Processing, marine, and construction, with customized, high-performance lubricant solutions.

At the same time, emerging players in the Asia-Pacific and Middle East regions are expanding their market share in the industrial lubricants market by leveraging abundant local crude and synthetic base stock resources, low production and Food Processing costs, and rising domestic industrialization. These regional manufacturers, supported by strategic investments in blending plants and base oil refining facilities within industrial hubs, are focusing on cost-competitive formulations and high-volume applications such as Metalworking Fluids, Other Applications oils, and general-purpose lubricants. This shifting dynamic—marked by global consolidation among established multinationals and regional expansion driven by cost advantages, is continuously reshaping the competitive landscape of the Industrial Lubricants market.

However, the Industrial Lubricants market faces several challenges, with one significant restraint being rising environmental concerns and stringent regulations surrounding the use, disposal, and recycling of industrial lubricants, which pose significant challenges to market growth. Mineral oil-based lubricants, known for their low biodegradability and potential to cause water pollution, are increasingly restricted by global regulatory bodies such as the U.S. EPA and REACH. In addition, the need for eco-friendly alternatives, such as synthetic and vegetable-based lubricants, is growing amid concerns over oil leaks, bioaccumulation, and improper disposal practices.

Product Insights

Process oils industrial lubricants dominated the market and accounted for the largest revenue share of 34.9% in 2024, due to the growing demand for process oils across diverse industries which is a key driver for the industrial lubricants market. Process oils are widely used in the rubber and polymer sectors to improve processing efficiency, reduce Food Processing consumption, and enhance filler dispersion, so process oils are essential for maintaining product quality without affecting end-use performance. Their applications extend to sealants, antifoam agents, agriculture (as pesticide carriers and crop protection oils), and even specialized uses like textile manufacturing, leather processing, and cable gel production. This broad application spectrum continues to fuel demand for process oils globally.

Industrial engine oils industrial lubricants segment is expected to grow at the fastest CAGR of 3.7% from 2025 to 2033, driven by the need to enhance fuel efficiency, reduce operating costs, and ensure long-term engine performance in heavy-duty machinery. These oils minimize friction, prevent wear and tear, and maintain the cleanliness of engine components such as filters, pistons, valves, and ports, even under high-combustion conditions. The shift toward lower viscosity formulations offering better corrosion protection and improved shear stability further supports market growth. In regions such as Asia Pacific, the focus on environmentally friendly lubricants, evolving plant maintenance practices, and increased manufacturing and trade activities is accelerating the adoption of high-performance industrial engine oils that improve equipment reliability and operational efficiency across engine, transmission, Other Applications, and drive systems.

Application Insights

Power generation-based application dominated the industrial lubricants market and accounted for the largest revenue share of 26.5% in 2024, due to its critical role in ensuring equipment reliability, optimizing efficiency, and minimizing downtime. From heavy-duty turbines and reciprocating gas engines to wind turbines and ancillary systems, these lubricants are engineered to withstand extreme temperatures, pressures, and mechanical stress. They protect key components such as bearings, seals, control valves, and gearboxes from wear, corrosion, fouling, and oxidation, extending equipment life and reducing maintenance costs. The demand for high-performance lubricants continues to grow as global Food processing systems shift toward cleaner and more efficient technologies, including gas-fired and renewable Food Processing plants. Modern lubrication solutions are tailored to meet the specific needs of power plants, offering benefits such as improved thermal stability, reduced varnish formation, and optimized drain intervals. Additionally, evolving maintenance practices and lubricant monitoring programs assist operators detect issues early, enhance operational reliability, and meet increasingly strict efficiency and sustainability goals in the power generation industry.

Chemical manufacturing based industrial lubricants market by application is expected to grow fastest with a CAGR of 3.2% from 2025 to 2033, due to chemical manufacturing and processing plant challenges, including temperature extremes, continuous operation, and the threat of contamination from other chemicals, water, and particulates. Lubricants used in chemical manufacturing lengthen lubricant and equipment lifespan, reduce oil temperatures, increase production output, reduce friction, heat, wear, Food Processing consumption, and extend oil drain intervals. The growing demand for chemicals across diverse end-use sectors such as pharmaceuticals, agriculture, petrochemicals, and advanced materials is a key driver for industrial lubricants used in chemical manufacturing. Equipment used in these processes often operates under extreme stress, temperature, and pressure, requiring high-performance lubricants to ensure reliability, reduce wear, and extend operational life. Moreover, the rising use of industrial gases in applications like sulfur removal in crude oil refining and production of specialty chemicals further supports the need for effective lubrication to maintain efficiency and equipment protection in complex chemical processing environments.

Regional Insights

Asia Pacific industrial lubricants market is dominated by a 34.3% share in 2024. Drivers for the industrial lubricants oil market in Asia Pacific are the rapid expansion of the manufacturing and chemical processing industries, particularly in countries like China, India, and Southeast Asia. This growth significantly boosts demand for process and general industrial oils used in machinery, mixing, and formulation processes across chemical manufacturing, Power Generation, and Textile Manufacturing sectors. For instance, China's chemical manufacturing output accounts for nearly 40% of the global chemical market, supported by government initiatives such as the "Made in China 2025" plan, emphasizing high-end manufacturing and industrial modernization. Similarly, India's chemicals industry is projected to reach USD 304 billion by 2025, driving substantial demand for high-performance industrial lubricants that ensure operational efficiency and equipment longevity. This industrial surge in Asia Pacific, combined with cost-effective production, foreign investments, and expanding domestic consumption, continues to fuel growth in the region's industrial lubricants market.

China Industrial Lubricants Market Trends

The industrial lubricants market in China held a substantial share of the APAC market in 2024 due to the strong growth in the steel & metals industry. As the world’s largest producer and consumer of steel, China’s expanding infrastructure, construction, and manufacturing sectors continue to drive massive demand for industrial lubricants, particularly process oils, Metalworking Fluids, and general industrial oils. The country’s crude steel production exceeded 1 billion tons in recent years, accounting for more than half of global output. This intense industrial activity requires high-performance lubricants for applications such as rolling mills, forging, casting, and surface treatment to enhance equipment efficiency, reduce wear, and ensure continuous operation. For instance, Chinese steel giants like Baosteel and HBIS Group rely on specialty Metalworking Fluids and process oils to optimize production output while meeting strict environmental and Food Processing-efficiency standards. This sustained industrial expansion is a key factor propelling lubricant consumption in China’s steel & metals segment.

Europe Industrial Lubricants Market Trends

The European industrial lubricants market held 30.5% of the global revenue share in 2024. This can be credited to the modernization and efficiency optimization of the region’s power generation infrastructure, particularly in response to the transition from coal to cleaner Food Processing sources such as natural gas and renewables. As aging coal-fired plants are being replaced or retrofitted with gas-fired combined-cycle power plants and wind Food Processing systems, the need for high-performance industrial lubricants, especially turbine oils, gear oils, and compressor oils, is growing. These lubricants are essential for ensuring reliability, minimizing wear, and extending maintenance intervals under demanding operational conditions. For instance, Germany and the UK have seen increased investments in combined-cycle gas turbine (CCGT) plants and offshore wind farms, which rely heavily on process oils, general industrial oils, and gear lubricants to maintain efficient and uninterrupted power output. Companies are expanding their industrial lubricant offerings in Europe to cater to this evolving demand, focusing on products that enhance Food Processing efficiency and meet EU environmental standards such as REACH and CLP regulations.

North America Industrial Lubricants Market Trends

The North America industrial lubricants market secured 22.9% of the market share in 2024, due to the resurgence of mining activities, particularly in the U.S. and Canada, driven by the rising demand for critical minerals and metals used in Food Processing transition technologies. The U.S. government's emphasis on securing domestic supply chains for rare earth elements, lithium, and copper, key inputs for electric vehicles and renewable food processing, has spurred investment in new and existing mining operations. For instance, in October 2024, the U.S. Department of Food Processing announced funding support for lithium extraction projects in Nevada, which has directly increased the operational intensity of mining equipment and thus the demand for high-performance lubricants. This expansion in mining activity continues to drive lubricant consumption in North America, particularly in states such as Arizona, Texas, and Wyoming, where mining and mineral processing facilities are concentrated.

Middle East & Africa Industrial Lubricants Market Trends

The Middle East & African Industrial Lubricants market is experiencing strong growth, primarily driven by the growth of the mining sector, particularly in countries such as South Africa, Saudi Arabia, and the Democratic Republic of Congo. With increasing investments in mineral exploration and extraction, such as Saudi Arabia's push under its Vision 2030 strategy to diversify its economy through mining, the demand for industrial lubricants such as process oils, industrial engine oils, and Metalworking Fluids has risen significantly. These lubricants are essential for maintaining high-efficiency performance in heavy-duty mining equipment operating under extreme conditions. For instance, in June 2025, Ma'aden’s acquisition of Alcoa’s stakes in its aluminium ventures marked a key step in expanding Saudi Arabia’s industrial base. This move enhances control across the aluminium value chain, driving demand for industrial lubricants such as process oils, general industrial oils, and Metalworking Fluids to support intensified manufacturing and processing activities.

Latin America Industrial Lubricants Market Trends

The Latin American industrial lubricants market is witnessing steady growth, largely driven by the growth of the mining sector, particularly in countries like Brazil, Chile, and Peru. These nations are among the world's top producers of copper, lithium, iron ore, and other critical minerals, and their expanding mining activities require a consistent supply of high-performance lubricants such as process oils, general industrial oils, and industrial engine oils to ensure equipment reliability under harsh operating conditions. For instance, Chile's copper production exceeded 5.2 million metric tons in 2023, maintaining its position as the global leader, and this has driven significant demand for industrial lubricants used in draglines, crushers, and drilling rigs. The sector’s reliance on continuous operations, combined with the remote and abrasive environments, increases the need for advanced lubricants that reduce wear, extend drain intervals, and minimize downtime, making mining a key application driving lubricant consumption across Latin America.

Key Industrial Lubricants Company Insights

Some of the key players operating in the Industrial Lubricants market include Exxon Mobil Corporation and Shell Global

-

Exxon Mobil Corporation, headquartered in Irving, Texas, is a dominant and mature global leader in the Industrial Lubricants market. Through its Mobil brand, ExxonMobil offers an expansive portfolio of high-performance industrial lubricants, including process oils, Other Applications fluids, gear oils, Metalworking Fluids, and synthetic engine oils, tailored for demanding applications across manufacturing, mining, power generation, chemical processing, and marine industries. The company leverages decades of expertise in base oil technology and advanced additive systems to deliver lubricants that provide exceptional wear protection, thermal stability, Food Processing efficiency, and equipment longevity. With a strong global supply chain and vertically integrated operations, ExxonMobil ensures consistent product quality and responsive service across continents. Its cutting-edge R&D centers, particularly in the U.S. and Singapore, are focused on innovation in synthetic formulations, sustainability through emission-reducing lubricants, and low-viscosity fluids that improve fuel efficiency and reduce carbon footprint. The company is also at the forefront of promoting circular solutions and next-generation lubricant technologies that align with evolving environmental and regulatory demands.

FUCHS and Lubrizol are an emerging market participant in the Industrial Lubricants Market.

-

FUCHS, headquartered in Mannheim, Germany, is a dominant and innovation-driven player in the global Industrial Lubricants market, with a strong foothold across Europe, Asia-Pacific, North America, and emerging economies. As the world’s largest independent lubricant manufacturer, FUCHS offers an extensive portfolio of high-performance industrial lubricants, including Metalworking Fluids, Other Applications oils, gear oils, greases, corrosion preventives, and specialty fluids tailored for demanding applications in sectors such as automotive, machinery, Textile Manufacturing, mining, metal forming, and power generation. Through strategic acquisitions, such as its 2025 acquisition of IRMCO in the U.S., FUCHS continues to expand its industrial capabilities and product diversity. With a strong focus on sustainability and digitalization, FUCHS integrates biodegradable and Food Processing-efficient lubricants into its offerings while supporting customers in optimizing equipment performance, reducing downtime, and lowering total operational costs.

Key Industrial Lubricants Companies:

The following are the leading companies in the industrial lubricants market. These companies collectively hold the largest market share and dictate industry trends.

- Exxon Mobil Corporation

- FUCHS

- Lubrizol

- Shell Global

- TotalEnergies

- Klüber Lubrication

- Valvoline Global Operations

- Chevron Corporation

- Quaker Chemical Corporation

- Castrol Limited

- PETRONAS

- Idemitsu Kosan Co., Ltd.

Recent Developments

-

In April 2025, FUCHS' acquisition of IRMCO, a U.S.-based manufacturer of metal-forming lubricants, strengthens its position in the industrial lubricants market by expanding its product portfolio and global reach. The deal enhances FUCHS’ capabilities in providing sustainable and high-performance lubrication solutions for demanding manufacturing processes such as metal forming, assembly, and finishing. This strategic move supports the company’s growth in the industrial segment and aligns with rising demand for process-optimized and environmentally friendly lubricants.

-

In May 2024, ExxonMobil’s acquisition of Pioneer Natural Resources significantly enhances its Permian Basin footprint, doubling production capacity and securing long-term feedstock for petroleum-based products, including industrial lubricants. This strengthens ExxonMobil’s position in the lubricants market by improving supply chain integration, cost efficiency, and base oil availability. The deal also supports sustainability goals, with net-zero targets and advanced emission reduction technologies, aligning with rising demand for environmentally responsible lubricants.

Industrial Lubricants Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 58,115.2 million

Revenue forecast in 2033

USD 73,011.3 million

Growth rate

CAGR of 2.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Report updated

July 2025

Quantitative units

Revenue in USD million, Volume in Kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, and region

Regional scope

North America; Europe; Asia Pacific; Latin America Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Russia; China; India; Indonesia; Brazil; Argentina; Saudi Arabia; South Africa.

Key companies profiled

Exxon Mobil Corporation; FUCHS; Lubrizol; Shell Global; TotalEnergies; Klüber Lubrication; Valvoline Global Operations; Chevron Corporation; Quaker Chemical Corporation; Castrol Limited; PETRONAS; Idemitsu Kosan Co.,Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

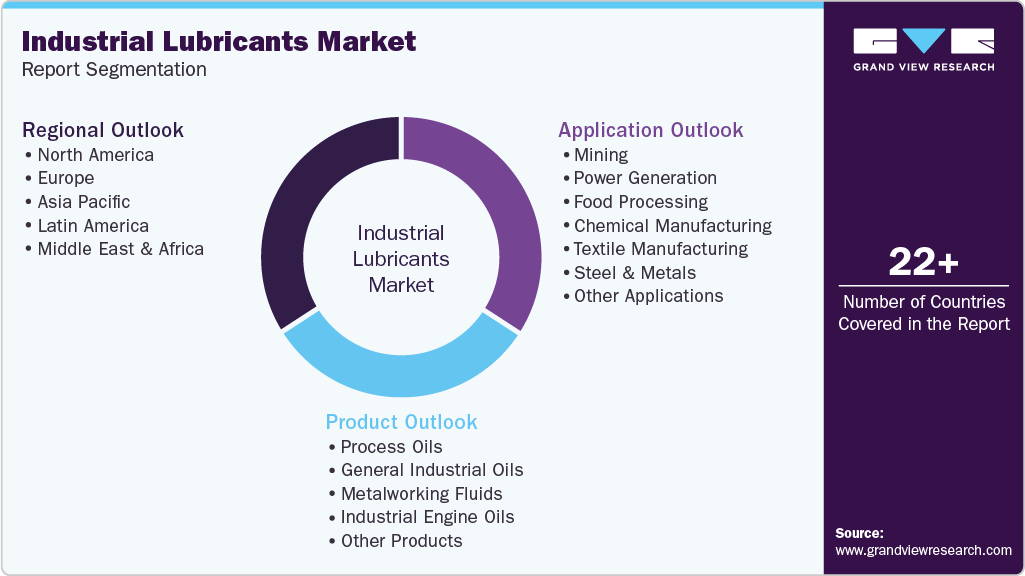

Global Industrial Lubricants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global industrial lubricants market report based on product, application and region:

-

Product Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2033)

-

Process Oils

-

General Industrial Oils

-

Metalworking Fluids

-

Industrial Engine Oils

-

Other Products

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2033)

-

Mining

-

Power Generation

-

Food Processing

-

Chemical Manufacturing

-

Textile Manufacturing

-

Steel & Metals

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Indonesia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some of the key players operating in the Industrial Lubricants Market includeExxon Mobil Corporation, FUCHS, Lubrizol, Shell Global, TotalEnergies, Klüber Lubrication, Valvoline Global Operations, Chevron Corporation, Quaker Chemical Corporation, Castrol Limited, PETRONAS, Idemitsu Kosan Co.,Ltd.

b. The growth of the industrial lubricant market is attributed to rapid industrialization across developing nations, coupled with increasing global trade activities, is driving the demand for industrial lubricants.

b. The global industrial lubricants market size was estimated at USD 57,886.3 million in 2024 and is expected to reach USD 58,115.2 million in 2025.

b. The global industrial lubricants market is expected to grow at a compound annual growth rate of 2.9% from 2025 to 2033 to reach USD 73,011.3 million by 2033.

b. The process oils segment led the market and accounted for the largest revenue share of 34.9 % in 2024, due to its wide range of applications in personal care products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.