- Home

- »

- Plastics, Polymers & Resins

- »

-

Ion-Conductive Polymers Market Size, Industry Report, 2033GVR Report cover

![Ion-Conductive Polymers Market Size, Share & Trends Report]()

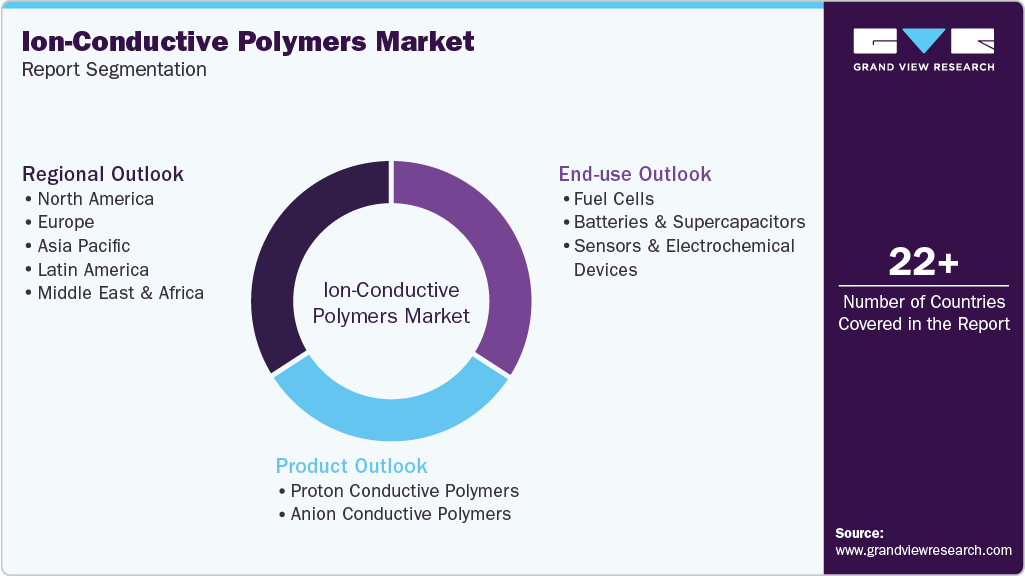

Ion-Conductive Polymers Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Proton Conductive Polymers, Anion Conductive Polymers), By End Use, By Region And Segment Forecasts

- Report ID: GVR-4-68040-818-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ion-Conductive Polymers Market Summary

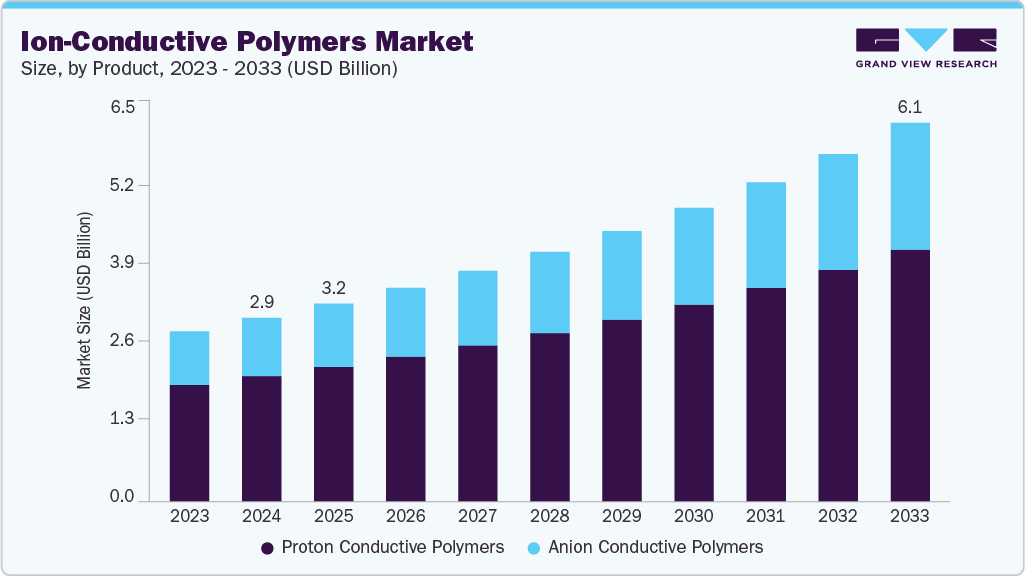

The global ion-conductive polymers market size was estimated at USD 2.96 billion in 2024 and is projected to reach USD 6.11 billion by 2033, growing at a CAGR of 8.5% from 2025 to 2033. Rising demand for flexible and wearable electronics is driving the use of ion-conductive polymers, as they enable lightweight, stretchable, and safe energy storage systems.

Key Market Trends & Insights

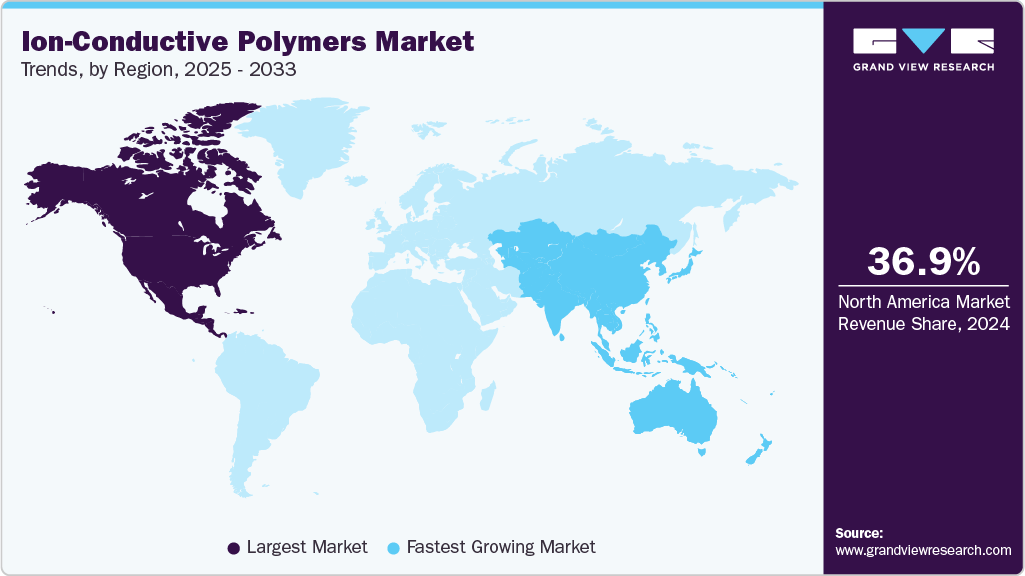

- North America dominated the global ion-conductive polymers market with the largest revenue share of 36.90% in 2024.

- The ion-conductive polymers market in Canada is expected to grow at the fastest CAGR of 9.7% from 2025 to 2033.

- By product, the anion conductive polymers segment is expected to grow at the fastest CAGR of 9.1% from 2025 to 2033.

- By end use, the batteries & supercapacitors segment is expected to grow at the fastest CAGR of 9.3% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 2.96 billion

- 2033 Projected Market Size: USD 6.11 billion

- CAGR (2025 - 2033): 8.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Their ability to maintain conductivity under mechanical stress makes them ideal for next-generation smart devices and sensors.Market maturation and targeted differentiation. Investment and R&D are shifting the ion-conductive polymer space from chemistry-driven novelty to application-led product lines.

Suppliers now prioritize the development of tailored electrolytes and ionomers for specific applications, such as solid-state batteries, proton exchange membranes, and flexible electronics. This is producing faster commercialization cycles and clearer product segmentation across energy and industrial end-markets.

Drivers, Opportunities & Restraints

Electrification and battery architecture change. Automotive and large-format energy storage programs are actively pursuing solid-state and gel-polymer designs to improve energy density and safety. That demand prompts OEMs and battery makers to adopt advanced ion-conductive polymers that strike a balance between ionic transport and mechanical compliance. Corporate demonstrators and pilot lines make this transition commercially plausible in the near term.

Decarbonizing power and transport creates adjacent markets. Growth in proton exchange membrane fuel cells, green hydrogen systems, and next-generation flexible electronics opens large, higher-margin niches for specialized ionomers and polymer electrolytes. Firms that can couple material performance with scalable, low-cost processing will capture long-term supply contracts and licensing deals across mobility, stationary power, and industrial hydrogen.

Performance versus manufacturability and cost. High ionic conductivity in lab formulations often conflicts with mechanical strength, thermal stability, and scalable processing. Solving these trade-offs requires complex chemistries and new equipment, which raises capital expenditures (capex) and lengthens qualification cycles for conservative buyers. Regulatory approval, long validation timelines, and price sensitivity in battery and fuel-cell supply chains further slow adoption.

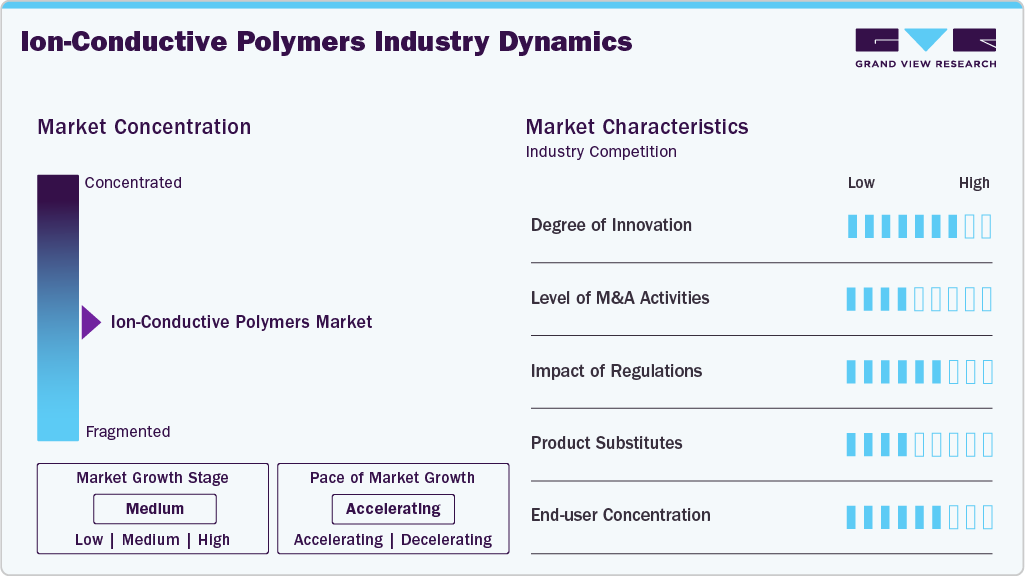

Market Concentration & Characteristics

The market growth stage of the ion-conductive polymers industry is medium, and the pace is accelerating. The market exhibits slight fragmentation, with key players dominating the industry landscape. Major companies like Heraeus Holding GmbH, Agfa-Gevaert N.V., Merck KGaA, Solvay S.A., Ormecon Pvt Ltd, The Lubrizol Corporation, Henkel AG & Co. KGaA, 3M Company, NTK (Nagase ChemteX Corporation), Suzhou Ruihong Electronic Chemical Co., Ltd., and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet evolving industry demands.

The ion-conductive polymers industry is in an intensive innovation phase driven by the need for performance and integration. Researchers focus on developing new polymer architectures that enhance room-temperature ionic conductivity while maintaining mechanical strength. Research on composite strategies, single-ion conductors, and responsive additives aims to address the interfacial and stability gaps observed in early solid-state cells. Patent filings and lab-to-pilot demonstrations demonstrate rapid iteration; however, commercial readiness still relies on repeatable scale-up data.

Several established and emerging electrolyte classes compete directly with ion-conductive polymers. Liquid electrolytes remain the baseline due to their low cost and high conductivity, but they fall short in terms of safety and packaging complexity. Ceramic and glassy solid electrolytes offer superior ionic mobility and thermal stability but struggle with brittleness and interface resistance. Gel and composite polymer electrolytes sit between these extremes, offering a pragmatic trade-off of safety, processability, and near-term manufacturability.

Product Insights

The proton conductive polymers segment led the market with the largest revenue share of 68.31% in 2024. The demand for proton-conductive polymers is driven by the rapid expansion of PEM fuel cells and electrolyzers, where durability under humid, oxidative conditions is crucial. Buyers now require membranes that combine high proton conductivity with lower platinum-group metal loadings to reduce system cost. This is pushing suppliers toward reinforced, hydrocarbon-based ionomers that extend stack life while easing supply-chain pressure on fluorinated chemistries. Successful materials will be those validated in long-duration, real-world demonstrations.

The anion-conductive polymers segment is anticipated to grow at the fastest CAGR of 9.1% during the forecast period. Anion-conductive polymers gain traction because they enable lower-cost electrolyser designs and reduce reliance on scarce acidic catalyst systems. Improvements in AEM durability and chemical stability are unlocking opportunities for decentralized green-hydrogen projects and industrial electrolysis applications. Manufacturers that commercialize robust, low-cost AEMs will accelerate electrolyser adoption by lowering the total cost of ownership. Investors are closely monitoring scale-up metrics and stack lifetime data.

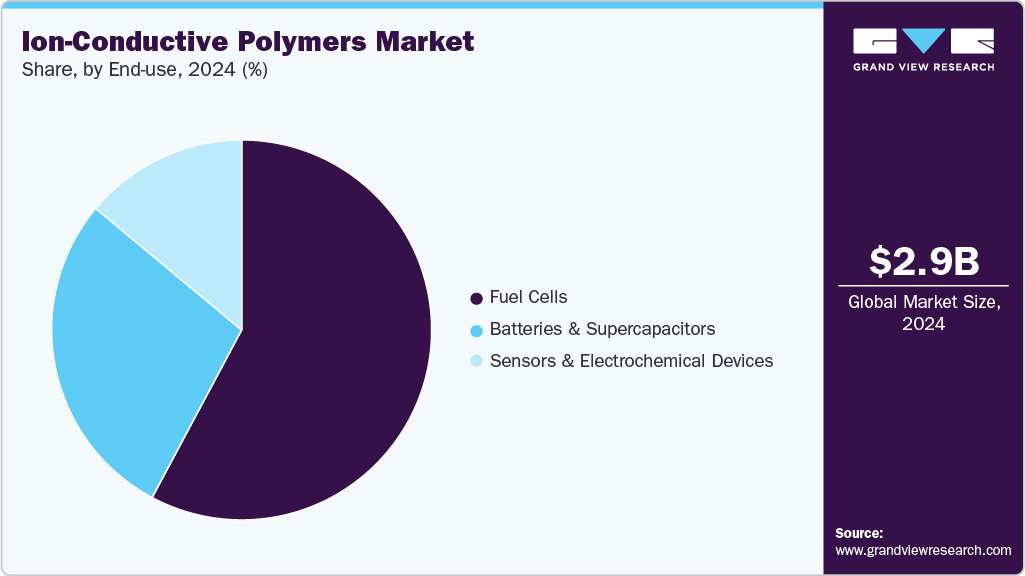

End Use Insights

The fuel cell segment led the market with the largest revenue share of 57.81% in 2024. Fuel cell demand is being driven by strategic industrial investments in hydrogen mobility and stationary backup power, where long run-times and rapid refueling are required. Automotive and heavy-duty OEMs are committing to pilot fleets and factory capacity, which creates predictable procurement windows for membrane and ionomer suppliers. Regions building hydrogen infrastructure, accelerate off-take and de-risk capital-intensive manufacturing lines for specialty polymers. Policy support remains a decisive enabler.

The batteries & supercapacitors segment is expected to expand at the fastest CAGR of 9.3% through the forecast period. Advances in solid-state and polymer electrolyte batteries drive demand for ion-conductive polymers that deliver both safety and energy density gains. Developers are prioritizing chemistries that suppress dendrite growth while supporting scalable, roll-to-roll processing for thin-film cells. For supercapacitors, polymer electrolytes that enable higher operating voltages with stable cycle life open up premium applications in fast-charging transport and grid buffering. Commercial winners will marry performance with manufacturability.

Regional Insights

North America dominated the ion-conductive polymers market with the largest revenue share of 36.90% in 2024. Large investments in pilot lines and materials R&D are concentrating in North America as battery makers pursue safer, higher-energy cells. This increases the demand for ion-conductive polymers that are suitable for roll-to-roll processing and automotive qualification. Public and private funding is shortening the tech-validation gap and making regional supply chains more attractive to OEMs.

U.S. Ion-Conductive Polymers Market Trends

The ion-conductive polymers market in the U.S. accounted for the largest market revenue share in North America in 2024. The Inflation Reduction Act and DOE programs have triggered reshoring across the battery and hydrogen value chain. This creates steady offtake pathways for ion-conductive polymers used in solid-state cells and electrolysers. Companies that meet U.S. regulatory and quality standards will capture the bulk of federally subsidized builds.

Europe Ion-Conductive Polymers Market Trends

The ion-conductive polymers market in Europe is anticipated to grow at a substantial CAGR during the forecast period. EU policy packages and REPowerEU commitments are directing capital to electrolysis and fuel-cell projects. This raises the need for durable proton and anion exchange membranes in industrial and transport applications. However, uneven infrastructure rollout and tough cost targets mean suppliers must demonstrate lifecycle economics to win tenders.

Asia Pacific Ion-Conductive Polymers Market Trends

The ion-conductive polymers market in the Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period. Asia Pacific remains the largest battery cell production hub and continues expanding capacity across China, Japan, and Korea. Regional OEMs are piloting polymer-based solid-state and polymer electrolyte cells, which fuels demand for specialised ionomers. Scale advantages and local supply integration favour suppliers who can quickly validate performance at the cell level.

Key Ion-Conductive Polymers Company Insights

The ion-conductive polymers industry is highly competitive, with several key players dominating the landscape. Major companies include Heraeus Holding GmbH, Agfa-Gevaert N.V., Merck KGaA, Solvay S.A., Ormecon Pvt Ltd, The Lubrizol Corporation, Henkel AG & Co. KGaA, 3M Company, NTK (Nagase ChemteX Corporation), and Suzhou Ruihong Electronic Chemical Co., Ltd. The ion-conductive polymers industry is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key Ion-Conductive Polymers Companies:

The following are the leading companies in the ion-conductive polymers market. These companies collectively hold the largest Market share and dictate industry trends.

- Heraeus Holding GmbH

- Agfa‑Gevaert N.V.

- Merck KGaA

- Solvay S.A.

- Ormecon Pvt Ltd

- The Lubrizol Corporation

- Henkel AG & Co. KGaA

- 3M Company

- NTK (Nagase ChemteX Corporation)

- Suzhou Ruihong Electronic Chemical Co., Ltd.

Recent Developments

-

In October 2025, Solid Power, Inc. announced a strategic collaboration with Samsung SDI and BMW Group to develop all-solid‐state batteries in which Solid Power will supply sulfide‐based solid electrolyte materials.

-

In July 2025, ProLogium Technology Co., Ltd. unveiled its fourth-generation “Superfluidized Inorganic Solid‐State Electrolyte”, which delivers high ionic conductivity (~57 mS/cm) and improved manufacturability, positioning it as a new benchmark for solid-electrolyte materials.

Ion-Conductive Polymers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.19 billion

Revenue forecast in 2033

USD 6.11 billion

Growth rate

CAGR of 8.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, Volume in Tons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segment covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Spain; Italy; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Heraeus Holding GmbH; Agfa-Gevaert N.V.; Merck KGaA; Solvay S.A.; Ormecon Pvt Ltd; The Lubrizol Corporation; Henkel AG & Co. KGaA; 3M Company; NTK (Nagase ChemteX Corporation); Suzhou Ruihong Electronic Chemical Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ion-Conductive Polymers Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the ion-conductive polymers market report based on the Product, end use, and region:

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Proton Conductive Polymers

-

Anion Conductive Polymers

-

-

End Use Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Fuel Cells

-

Batteries & Supercapacitors

-

Sensors & Electrochemical Devices

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global ion-conductive polymers market size was estimated at USD 2.96 billion in 2024 and is expected to reach USD 3.19 billion in 2025.

b. The global ion-conductive polymers market is expected to grow at a compound annual growth rate of 8.5% from 2025 to 2033 to reach USD 6.11 billion by 2033.

b. Fuel cells dominated the ion-conductive polymers market across the application segmentation in terms of revenue, accounting for a market share of 57.81% in 2024, and are forecasted to grow at an 8.2% CAGR from 2025 to 2033.

b. Some key players operating in the ion-conductive polymers market include Heraeus Holding GmbH, Agfa-Gevaert N.V., Merck KGaA, Solvay S.A., Ormecon Pvt Ltd, The Lubrizol Corporation, Henkel AG & Co. KGaA, 3M Company, NTK (Nagase ChemteX Corporation), and Suzhou Ruihong Electronic Chemical Co., Ltd.

b. Rising demand for flexible and wearable electronics is driving the use of ion-conductive polymers, as they enable lightweight, stretchable, and safe energy storage systems. Their ability to maintain conductivity under mechanical stress makes them ideal for next-generation smart devices and sensors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.