- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Italy Liquid Dietary Supplements Market Size Report, 2030GVR Report cover

![Italy Liquid Dietary Supplements Market Size, Share & Trends Report]()

Italy Liquid Dietary Supplements Market (2025 - 2030) Size, Share & Trends Analysis Report By Ingredients (Vitamins, Botanicals, Minerals), By Type, By Application, By End-user (Adults, Geriatric, Children, Infants), By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-802-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

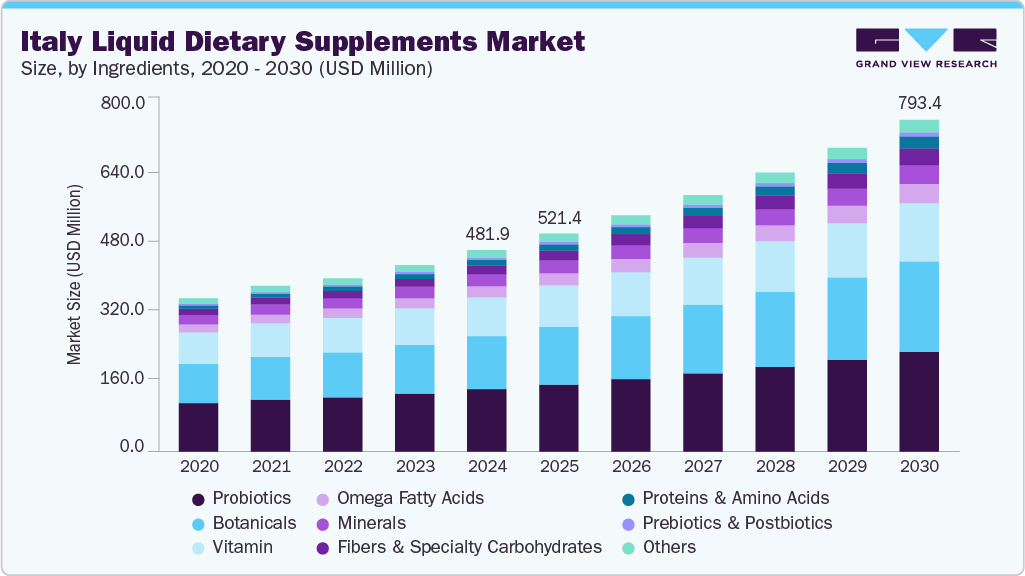

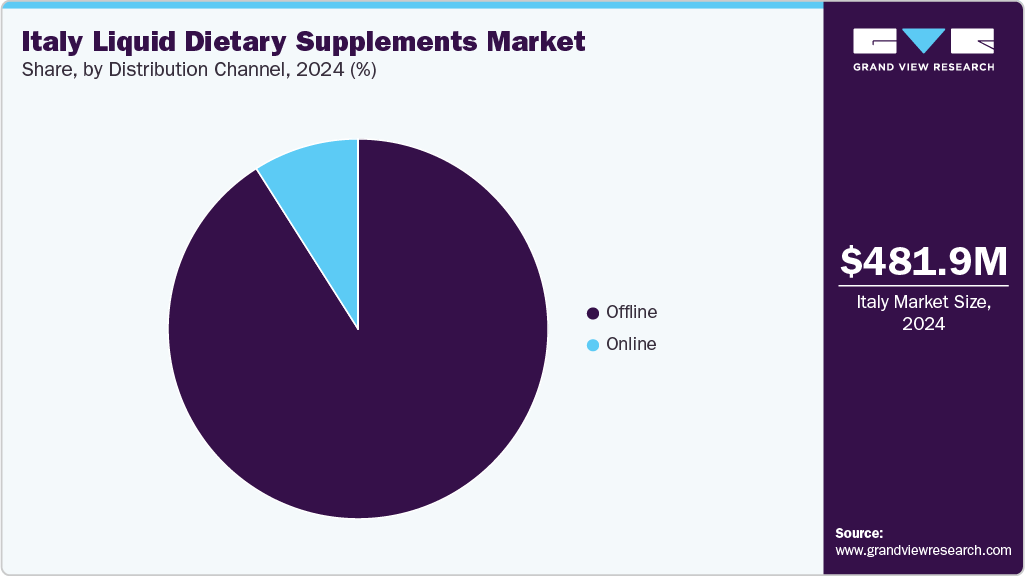

The Italy liquid dietary supplements market size was estimated at USD 481.9 million in 2024 and is projected to grow at a CAGR of 8.8% from 2025 to 2030. The rising aging population, along with the rising awareness of nutritional deficiencies, is boosting demand for easy-to-consume liquid supplements. Sedentary lifestyles and busy routines are promoting the shift towards convenient health solutions. Italy's strong pharmaceutical and nutraceutical manufacturing infrastructure supports innovation and product development in this sector. Moreover, the retail chains and pharmacies in urban areas are rising, leading to improved product accessibility. The presence of global nutraceutical brands and supportive EU regulations is contributing to the expansion of the liquid dietary supplements market.

The Italy liquid dietary supplements market has experienced significant growth. Sedentary lifestyle, including remote and hybrid work models, has significantly transformed consumer behavior, creating demand for home-use dietary supplements. As employees and students trying to maintain a balance between work and health, they are looking for setups that can be adjusted for different purposes. In response to it, brands have introduced flavored, ready-to-drink formats for daily use. This shift has led to the emergence of subscription-based models and personalized supplement plans for an individual’s health goals. Doorstep delivery and effective digital marketing campaigns have positioned liquid supplements as a preferred wellness solution.

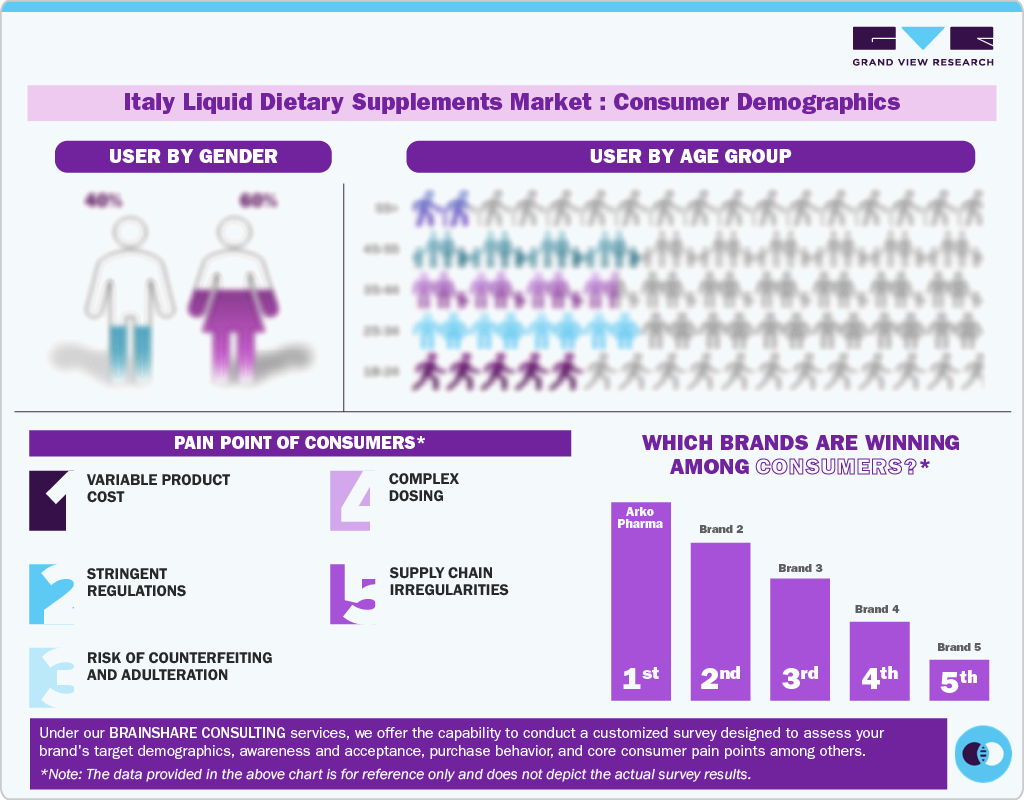

Consumer Insights

Italian consumers are becoming proactive about their health, strongly emphasizing preventive care and daily wellness routines. Liquid supplements are easy to consume and quickly absorbed, gaining popularity among adults and elderly consumers. Trust in pharmacies and prescriptions by health professionals continues to influence purchasing behavior. Moreover, rising preference for personalized healthcare and nutritional awareness solutions is further propelling the demand for the Italy liquid dietary supplements market. Italy’s finance department raised concerns over the country’s “merciless demographic crisis,” pointing to a record low of approximately 370,000 births in 2024 and a fertility rate of just1.18-well below the EU average and far from replacement levels. This demographic shift signals a rapidly aging population, which is expected to place increasing pressure on the healthcare system, pensions, and long-term care services. Thus, the demand for Italy’s liquid dietary supplements is expected to rise significantly, particularly among adults who require liquid supplements to fuel their daily nutritional needs.

Consumer Demographics

A rise in chronic health conditions and age-related deficiencies has created more awareness around the need for consistent nutritional intake. Liquid dietary supplements are appealing as they come in palatable flavors and customized dosages. Ease of digestion and faster absorption make them suitable for adults and elderly users. Targeted formulas are available for bone health, immunity and energy, further enhancing demand. Integration of these supplements into daily routines can solve problems for consumers and can be an important proactive step for long-term health maintenance, especially for those living in urban busy lifestyles.

Ingredient Insights

Probiotics dominated the market and accounted for a share of 30.9% in 2024. The growth of probiotic liquid dietary supplements in Italy is driven by an increasing consumer awareness of gut health and its connection to overall well-being. As digestive issues become more common due to changing diets and stress-related lifestyles, many Italians are turning to probiotics as a natural solution. Liquid formats are gaining popularity because they are easy to use, ensure fast absorption, and offer higher bioavailability, particularly for seniors and children. Pharmacies and healthcare professionals actively promote these products, especially after antibiotic treatments. Furthermore, the rising demand for clean-label, plant-based, and dairy-free options is attracting health-conscious consumers, further fueling market expansion.

Proteins and amino acids are projected to grow at the fastest CAGR of 13.9% over the forecast period, driven by increasing health consciousness and the adoption of an active lifestyle. Preference for convenient, fast-absorbing nutritional alternatives serves different purposes for different individuals. Liquid formats particularly appeal to athletes, fitness enthusiasts, and older adults. This trend reflects a broader shift toward preventive health and performance-focused nutrition across various age groups.

Type Insights

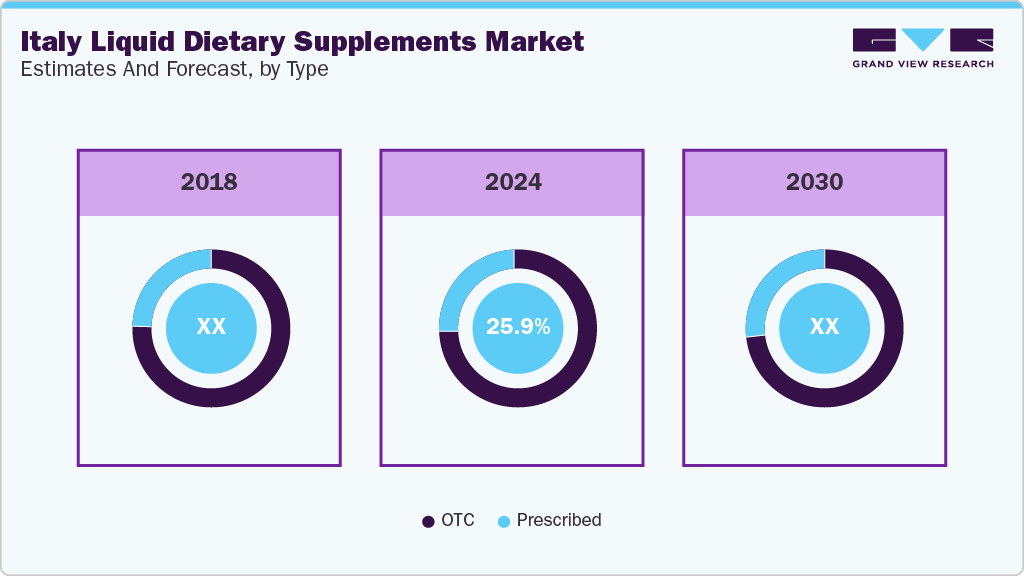

The OTC (over the counter) segment dominated the market in 2024. An increasing consumer interest in self-care and preventive health drives the market. Italy is experiencing a demographic shift, with 24% of its population aged 65 or older, creating strong demand for liquid dietary supplements. Therefore, Pharmacies and e-commerce platforms have made OTC liquid supplements popular for immune, energy, health, and digestion support. Liquid formats are gaining popularity due to their ease of administration and easy-to-use format, particularly for children, the elderly, and individuals who have difficulty swallowing pills. This demonstrates how pharmacies and e-commerce platforms make these products, especially OTC liquid supplements, more accessible and widely used for immune, energy, digestive, and general health support.

The prescribed segment accounted for the highest CAGR during the forecast period. Physicians recommend liquid dietary supplements for pediatric, geriatric, and post-operative patients due to their ease of administration and higher bioavailability. Additionally, Italy's aging population, the growing prevalence of chronic diseases, and the increasing use of supplements in hospitals and institutions are generating demand. Moreover, advancements in liquid formulation technologies are enabling more targeted, clinically effective products tailored to patient-specific needs.

Application Insights

The bone and joint health segment accounted for a significant share in 2024, driven by the aging population's growing focus on mobility and quality of life. As consumers over 60 increasingly seek convenient ways to manage osteoarthritis and osteoporosis, liquid formats are gaining popularity due to their easier absorption compared to tablets. This format is particularly appealing to elderly consumers who may find it challenging to swallow pills. Furthermore, Italian consumers increasingly favor natural ingredients such as collagen, glucosamine, and vitamin D in liquid form. Health practitioners are also recommending liquid supplements for their quicker effectiveness. Together, these trends contribute to significant market growth in this segment.

The prenatal health segment is projected to grow at the fastest CAGR over the forecast period. Healthcare providers often recommend prenatal vitamins to support a baby’s healthy development. Key nutrients include folic acid, iron, calcium, vitamin D, and iodine, which help prevent birth defects and support bone, brain, and immune health. Liquid prenatal supplements-formulated for pregnancy support-are gaining traction in Italy, driven by a growing preference for easy-to-consume, quick-absorption formats among expectant mothers. Italian expectant mothers increasingly prefer these formats for precise nutrient intake. Higher doses-such as folic acid-may be prescribed in certain cases based on medical history.

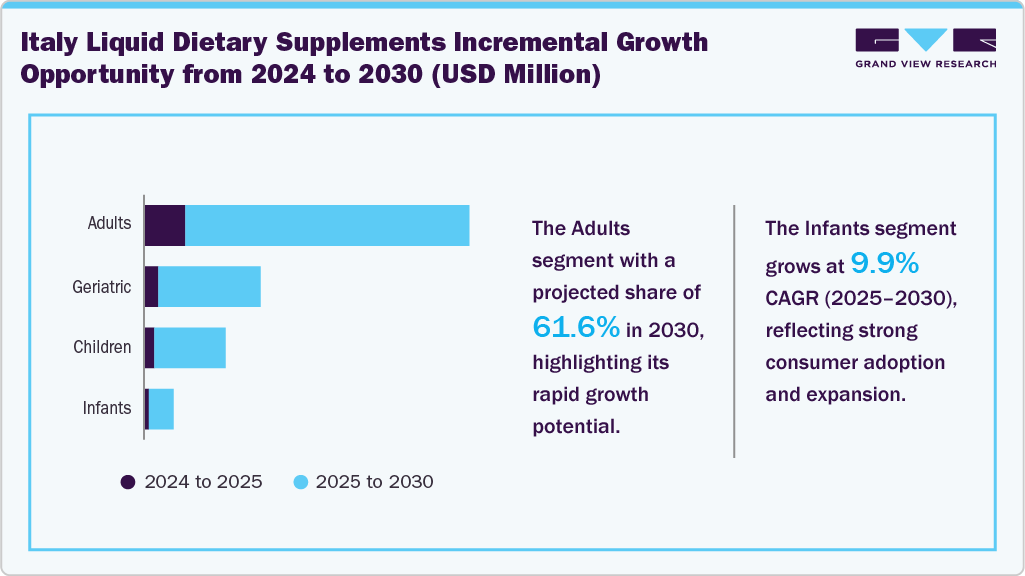

End-user Insights

The adult segment dominated the Italy liquid dietary supplements market in 2024. The demand for liquid nutritional supplements is rising steadily, as awareness of preventive health, stress management, and nutritional balance grows. Consequently, the need for liquid formats supporting immunity, energy, and digestive health is rising. Adults, in particular, are seeking fast-acting, easy-to-consume solutions that fit into their busy lifestyles, making liquid supplements a preferred choice over traditional pills or capsules.

The infants segment is projected to grow at the fastest CAGR over the forecast period. The growing awareness among parents regarding child nutrition is a significant driver of growth in the infant liquid dietary supplements market. Modern Italian parents are more proactive in addressing nutritional gaps, especially for vitamins like D and iron. Liquid formats are favored for infants due to ease of administration and better palatability. Pediatricians recommend these supplements to encourage growth and enhance the immune system. Additionally, rising birth rates in certain regions and government-sponsored health initiatives contribute to increased demand. Together, these factors are driving the growth of this market segment.

Distribution Channel Insights

Offline distribution channels accounted for the largest market share in 2024. The offline channel for liquid dietary supplements is backed by strong support in retail pharmacy stores. Many adults prefer in-person consultations with pharmacists when choosing supplements, valuing expert advice and physical verification of products. Pharmacies dominate offline sales, especially for supplements targeting immunity, digestion, and joint health. Additionally, in-store displays and pharmacist recommendations are key drivers in influencing purchasing decisions.

Online distribution channels are expected to grow at the fastest CAGR over the forecast period. The segment’s growth is attributed to health awareness and the convenience of e-commerce platforms. Young consumers prefer purchasing supplements online due to the wide options and availability of home delivery. Post-pandemic, the shift towards online shopping was accelerated. Influencer marketing and social media played a key role in promoting liquid formats as modern and lifestyle-friendly. Additionally, brands offering subscription services and personalized wellness plans fuel this digital growth trend.

Key Italy Liquid Dietary Supplements Company Insights

Some key companies operating in the market include Amway, Nestlé Italiana SpA, Abbott, and Pfizer srl

-

Abbott is a global healthcare company headquartered in the U.S., operating in over 160 countries. The company specializes in diagnostics, medical devices, branded generic pharmaceuticals, and nutritional products. In Italy, Abbott has a strong and longstanding presence, operating through its diagnostics, medical nutrition, and adult/pediatric health divisions. The company serves the clinical and consumer markets and collaborates with Italian healthcare providers, pharmacies, and institutions.

-

Pfizer srl is a leading global biopharmaceutical company headquartered in the U.S. It develops, manufactures, and markets medicines, vaccines, biotechnology products, and consumer health items. In Italy, Pfizer srl has a strong presence with administrative and commercial offices, including Rome and Milan, Ascoli Piceno and Catania manufacturing plants, and a consumer health division focused on supplements and OTC products.

Key Italy Italy Liquid Dietary Supplements Companies:

- Amway

- Nestlé Italiana SpA

- Abbott

- Pfizer srl

- BASF

- Bayer AG

- Arkopharma

Italy Liquid Dietary Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 521.4 million

Revenue forecast in 2030

USD 793.4 million

Growth rate

CAGR of 8.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Ingredients, type, application, end-user, distribution channel

Key companies profiled

Amway; Nestlé Italiana SpA; Abbott; Pfizer srl; BASF; Bayer AG; Arkopharma

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Italy Liquid Dietary Supplements Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Italy liquid dietary supplements market report based on ingredients, type, application, end-use, and distribution channel:

-

Ingredients Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (Selenium, Chromium, Copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

OTC

-

Prescribed

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Boomers

-

Male

-

Female

-

-

-

Geriatric

-

Children

-

Infants

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Hypermarkets/Supermarkets

-

Pharmacies

-

Specialty Stores

-

Practioner

-

Others (Direct to Consumer, MLM)

-

-

Online

-

Amazon

-

Other Online Retail Stores

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.