- Home

- »

- Next Generation Technologies

- »

-

Japan Legal Services Market Size, Industry Report, 2030GVR Report cover

![Japan Legal Services Market Size, Share & Trends Report]()

Japan Legal Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Service, By Firm Size (Large Firms, Medium Firms, Small Firms), By Provider, And Segment Forecasts

- Report ID: GVR-4-68040-805-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Japan Legal Services Market Size & Trends

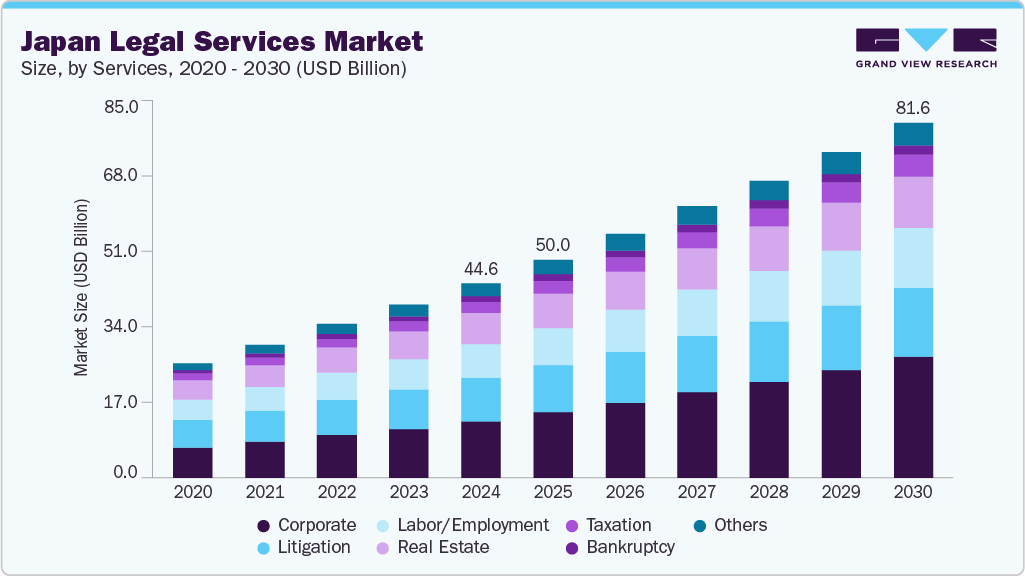

The Japan legal services market size was estimated at USD 44.64 billion in 2024 and is expected to reach USD 81.58 billion by 2030, registering a CAGR of 10.3% from 2025 to 2030. The growing demand for specialized legal expertise primarily drives the market growth. Japanese companies and foreign firms operating in Japan look for specialized services in areas such as intellectual property protection, data privacy, antitrust, and labor law. This evolving landscape, driven by economic reforms and the country's growing role in trade and investment, continually increases the demand for high-quality legal counsel to navigate complex legal environments, thereby accelerating the Japan legal services industry.

Japan is at the forefront of integrating generative AI (GenAI) into legal services, leveraging AI-driven tools to automate routine tasks such as contract review, document drafting, and legal research. These technologies save firms a significant amount of time, estimated at around five hours per week per professional, thereby boosting productivity and allowing lawyers to focus on complex tasks that require human judgment. Japan’s balanced regulatory approach encourages AI innovation while mandating human oversight, ensuring GenAI complements rather than replaces legal expertise.

Additionally, the growing integration of legal tech, including artificial intelligence (AI), automation, and cloud-based solutions, which enables law firms to improve operational efficiency, streamline document review, contract analysis, and research, and enhance client services, is a key factor driving the market growth. Rising concerns over cybersecurity, data protection, and digital business transformation have further boosted the need for legal services specializing in technology-driven fields, making digital expertise a key differentiator among market players.

Furthermore, demographic and societal changes also play an influential role in expanding Japan's legal services market. Japan’s aging population is driving increased demand for estate planning, elder law, and healthcare-related legal services. Additionally, there’s increased attention on environmental, social, and governance (ESG) legal guidance, workplace rights, and social justice issues. The dynamic start-up ecosystem and the growing number of small and medium-sized enterprises (SMEs) require legal assistance for structuring, compliance, and intellectual property, as well as diversifying market opportunities to ensure further sustained growth across both corporate and individual client segments. These factors position the Japan legal services industry for continued growth and transformation in the coming years.

Moreover, the growth of Alternative Legal Service Providers (ALSPs) in Japan reflects a broader trend toward cost-effective, technology-enabled legal solutions. ALSPs offer specialized services such as document review, contract lifecycle management, e-discovery, and regulatory compliance by leveraging legal technology, including AI and automation, that traditional law firms may not fully utilize. These providers enhance operational efficiency and deliver scalable, flexible legal support, making them attractive to corporate legal departments that face budget constraints and an increasing demand for sophisticated legal assistance amid regulatory complexities. These factors are expected to drive the Japan legal services industry in the coming years.

Service Insights

The corporate segment led the Japan legal services market, with the largest share of over 29.0% in 2024, driven by the rise in high-stakes lawsuits in areas like intellectual property disputes, product liability, and class-action cases. The increasing complexity of regulatory environments and the need for specialized legal representation in areas such as labor and employment law further bolster demand. Additionally, individual plaintiffs and corporations are seeking experienced litigators to navigate complex courtroom procedures, contributing to the dominance of this segment.

The taxation segment is expected to witness a significant CAGR of over 11.0% from 2025 to 2030. This growth can be attributed to the complexity of Japan’s tax regime, which including evolving consumption tax rules, international transfer pricing, and cross-border corporate tax issues, continuing to drive demand for specialized tax legal services. Many Japanese corporations are increasing their spending on outside counsel to navigate these layers, especially as they expand operations overseas and face multi-jurisdictional tax exposure.

Firm Size Insights

The large firms segment accounted for the largest share of the Japan legal services market in 2024, driven by their capacity to manage complex, high-value legal matters involving cross-border mergers and acquisitions, private equity transactions, and regulatory compliance. These firms are often able to invest in legal-tech, talent acquisition, and international offices to serve multinational clients. Large firms also face pressure to scale efficiently and deliver value, leading them to adopt AI and automation, reflecting the broader trend of technology adoption in Japan’s legal market.

The small firms segment is expected to register the fastest CAGR from 2025 to 2030, driven by their focus on serving local clients, niche practice areas, and cost-effective solutions that appeal to startups, small and medium-sized enterprises (SMEs), and individual clients. These firms capitalize on personalized client relationships, agility in adapting to evolving legal needs, and an increasing adoption of technology and AI tools to enhance operational efficiency.

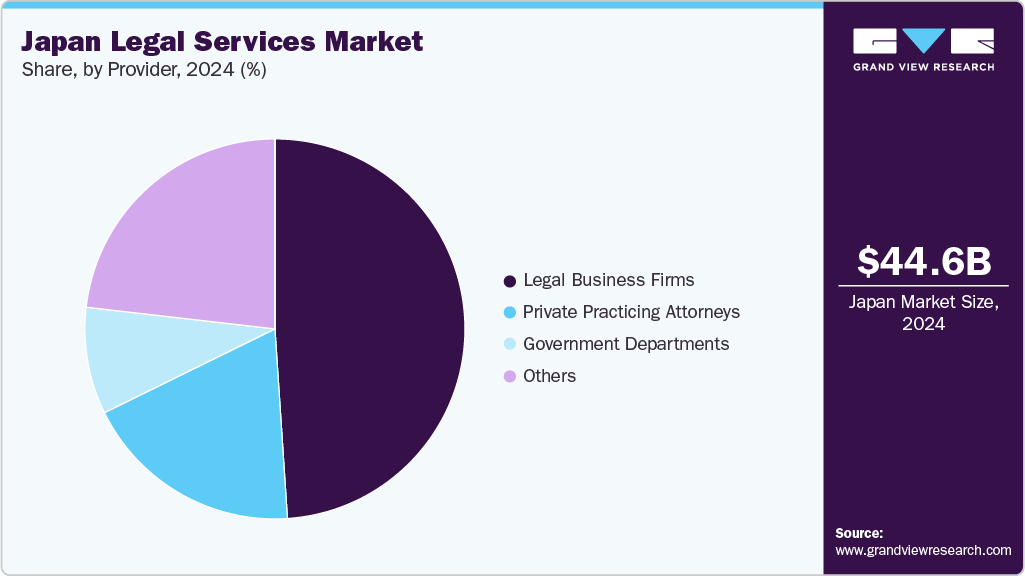

Provider Insights

The legal business firms segment dominated the Japan legal services industry in 2024, driven primarily by the increasing complexity of Japan's regulatory environment and the rising demand for integrated legal solutions that cover cross-border transactions, mergers and acquisitions (M&A), joint ventures, and compliance advisory. Legal business firms in Japan are also benefiting from the country's emphasis on digital transformation, with many firms leveraging AI and LegalTech to enhance operational efficiency and client service.

The private practicing attorneys segment is expected to register the fastest CAGR from 2025 to 2030, owing to the growing demand for personalized legal services among startups, SMEs, and individual clients. The increasing complexities of regulatory compliance, rising cross-border transactions, and the adoption of digital and AI tools to streamline legal workflows are fueling the rapid expansion of this segment. Furthermore, a heightened focus on specialized areas, such as intellectual property, labor law, data privacy, and dispute resolution, is driving private practitioners to cater to evolving client needs, thereby contributing to robust market growth.

Key Japan Legal Services Company Insights

Some of the key players operating in the market include Nishimura & Asahi and Anderson Mori & Tomotsune.

-

Nishimura & Asahi is a law firm that provides comprehensive legal services to various industries, including automotive, aerospace, energy, pharmaceuticals, telecommunications, financial services, real estate, media, technology, and more. The firm is recognized for its in-depth industry knowledge and global presence, with offices worldwide. It handles major deals and disputes for significant brands, offering expertise in M&A, tax, IP, antitrust, labor, banking, and aerospace sectors.

-

Anderson Mori & Tomotsune is a law firm serving corporate clients domestically and internationally. Its practice spans M&A, finance, insurance, energy, real estate, telecommunications, technology, FinTech, labor, competition law, dispute resolution, corporate governance, and more. The firm advises clients across various sectors, including banking, securities, insurance, infrastructure, hospitality, education, and digital transformation.

Nagashima Ohno & Tsunematsu and Atsumi & Sakai are among the emerging participants in the Japanese legal services market.

-

Nagashima Ohno & Tsunematsu has legal teams in Japan, offering high-quality services in corporate law, finance, dispute resolution, competition law, sports and entertainment, export controls, and international transactions. It supports clients across diverse industries, including infrastructure, manufacturing, technology, and sports. The firm maintains a strong international presence, with offices abroad and extensive global networks.

-

Atsumi & Sakai offers corporate, finance, real estate, intellectual property, labor, technology, healthcare, and international legal services. It supports clients from various sectors, including pharmaceuticals, technology, manufacturing, and finance, with a focus on M&A, regulatory compliance, and dispute resolution.

Key Japan Legal Services Companies:

- Nishimura & Asahi

- Anderson Mori & Tomotsune

- Mori Hamada & Matsumoto

- Nagashima Ohno & Tsunematsu

- TMI Associates

- CITY-YUWA PARTNERS

- Atsumi & Sakai

- OH-EBASHI LPC & PARTNERS

- Baker McKenzie

- ABE,IKUBO,KATAYAMA

Recent Developments

-

In October 2025, Anderson Mori & Tomotsune launched a PoC joint project for Japan’s first multi-agent collaboration in the legal field with Bengo4.com, Inc. and Mirai Translate, Inc., focusing on AI and multi-agent technology to improve legal service delivery.

-

In September 2025, Mori Hamada & Matsumoto collaborated with Harvey, a key player in generative-AI legal solutions, aiming to integrate cutting-edge AI tools in legal service delivery. This partnership includes ongoing product development, lawyer training, and thought leadership to enhance client value by adopting AI technology.

-

In April 2025, Baker McKenzie announced its role as AURELIUS's legal advisor in acquiring Teijin Automotive Technologies North America (TAT-NA) from Teijin Limited. TAT-NA is a leading provider of advanced composite technologies for the automotive, heavy truck, marine, and recreational vehicle sectors.

Japan Legal Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 50.03 billion

Revenue forecast in 2030

USD 81.58 billion

Growth rate

CAGR of 10.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2025 to 2030

Report service

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, firm size, provider

Country Scope

Japan

Key companies profiled

Nishimura & Asahi; Anderson Mori & Tomotsune; Mori Hamada & Matsumoto; Nagashima Ohno & Tsunematsu; TMI Associates; CITY-YUWA PARTNERS; Atsumi & Sakai; OH-EBASHI LPC & PARTNERS; Baker McKenzie; ABE, IKUBO, KATAYAMA

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Japan Legal Services Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest technology trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Japan legal services market report based on service, firm size, and provider:

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Taxation

-

Real Estate

-

Litigation

-

Bankruptcy

-

Labor/Employment

-

Corporate

-

Others

-

-

Firm Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Firms

-

Medium Firms

-

Small Firms

-

-

Provider Outlook (Revenue, USD Billion, 2018 - 2030)

-

Private Practicing Attorneys

-

Legal Business Firms

-

Government Departments

-

Others

-

Frequently Asked Questions About This Report

b. The Japan legal services market size was estimated at USD 44.64 billion in 2024 and is expected to reach USD 50.03 billion in 2025.

b. The Japan legal services market is expected to grow at a compound annual growth rate of 10.3% from 2025 to 2030 to reach USD 81.58 billion by 2030.

b. The corporate segment accounted for the largest market share of over 29% in 2024, driven by the rise in high-stakes lawsuits in areas like intellectual property disputes, product liability, and class-action cases.

b. Key players operating in the Japan legal services market include Nishimura & Asahi, Anderson Mori & Tomotsune, Mori Hamada & Matsumoto, Nagashima Ohno & Tsunematsu, TMI Associates, CITY-YUWA PARTNERS, Atsumi & Sakai, OH-EBASHI LPC & PARTNERS, Baker McKenzie, and ABE, IKUBO, KATAYAMA.

b. Key factors that are driving the Japan legal services market include growing demand for specialized legal expertise, the growing integration of legal tech, including artificial intelligence (AI), automation, and cloud-based solutions, and the growth of Alternative Legal Service Providers (ALSPs) in Japan.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.